Argus Modeling: Driving Data-Based Real Estate Decisions

As a commercial real estate investor or lender, accurate property valuation and potential return analyses are crucial to making profitable investments. However, with many factors to consider, such as property location, market conditions, tenant occupancy, and financing options, it can be challenging to know where to begin. This is where Argus modeling can help.

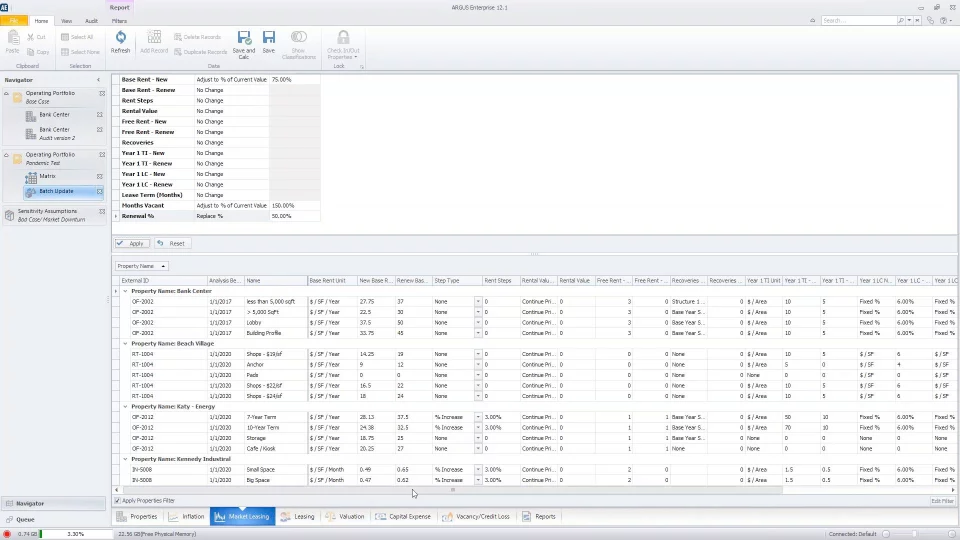

Argus modeling is a complex financial analysis tool that allows real estate investors and lenders to forecast a property's financial performance, evaluate various investment scenarios, and identify potential risks and opportunities. It is named after the Argus software platform, which is widely used in the real estate industry to perform financial analyses.

Improve your Argus models by extracting data from construction documents on the go. Try Nanonets OCR software to extract data and feed data to your Argus models.

What is Argus modeling?

At its core, Argus modeling is a tool for analyzing the financial performance of commercial real estate properties. It allows investors and lenders to project a property's income and expenses over time. It makes accurate projections by considering factors such as rent escalation, lease expirations, and operating expenses.

The process begins with inputting various property details into the Argus software platform, such as rental rates, occupancy rates, lease terms, and operating expenses. From there, the software creates a detailed financial model that considers these factors' impact over time.

Using Argus modeling, investors and lenders can also test different investment scenarios, such as adding or subtracting tenant spaces, renegotiating lease terms, or changing the financing structure. This allows them to evaluate different investment strategies' potential risks and rewards and make more informed decisions.

In addition to analyzing individual properties, Argus modeling can also be used to analyze entire portfolios of properties. By inputting multiple properties into the software platform, investors and lenders can gain a holistic view of their real estate holdings and better understand the potential risks and opportunities across their portfolios.

Why opt for Argus modeling in underwriting?

For underwriting commercial real estate investments, Argus modeling provides exceptional value. Argus modeling gives investors and lenders a more realistic financial forecast by accurately projecting a property's future income and expenses. It can account for a wide variety of risks and scenarios.

Moreover, Argus modeling helps identify potential issues that may affect a property's performance. This allows investors and lenders to adjust their investment strategy accordingly and minimize potential losses.

On top of all this, Argus modeling also streamlines the underwriting process. It automates complex financial analysis and calculations, saving time and reducing the risk of errors.

Improve your Argus models by extracting data from construction documents on the go. Try Nanonets OCR software to extract data and feed data to your Argus models.

What are the benefits of using Argus modeling?

As a powerful tool for creating projections, Argus modeling offers a wide variety of benefits including:

- Accurate and realistic financial forecasting: By using detailed market data and property-specific information, investors and lenders can accurately project a property's future income and expenses, accounting for various scenarios and risks.

- Evaluation of different investment scenarios: Investors and lenders can use Argus modeling to evaluate different investment scenarios, such as lease expirations, rent escalations, or changes in tenant occupancy. This helps them make informed decisions about investment strategies and optimize returns.

- A comprehensive view of property portfolios: With Argus modeling, investors and lenders can view an entire property portfolio in one place, allowing them to evaluate performance, identify areas for improvement, and make data-driven decisions.

- Streamlined due diligence processes: Argus modeling saves time and reduces the risk of errors by automating complex financial analyses and calculations. This streamlines the due diligence process for investors and lenders.

Who uses Argus modeling?

Argus modeling is used by a variety of professionals in the commercial real estate industry, including investors, lenders, brokers, appraisers, and asset managers.

Investors and lenders can use Argus modeling to evaluate the financial feasibility of a property investment. They can also use it to forecast cash flows over time and make informed decisions about the risks and rewards of an investment. Essentially, it allows investors and lenders to fully evaluate different investment scenarios to make strategic decisions based on data.

Brokers also use Argus modeling to provide clients with detailed financial analyses of a property, including cash flows, net operating income, and internal rate of return. These analyses can help their clients make informed decisions about a property purchase or sale, lease negotiation, or other real estate transactions.

Appraisers can accurately assess the value of a property with Argus modeling. It can provide detailed reports that consider current market trends and property-specific information. Similarly, Asset managers use Argus modeling to evaluate the performance of a property portfolio. It can even show asset managers potential ways they can improve the property.

Improve your Argus models by extracting data from construction documents on the go. Try Nanonets OCR software to extract data and feed data to your Argus models.

What can you do with Argus modeling?

In the commercial real estate industry, Argus modeling can help with a wide range of tasks, including:

- Analyze and evaluate properties: Argus modeling enables you to analyze the financial performance of a property, including cash flows, net operating income, and internal rate of return. This allows you to evaluate the feasibility of a property investment, identify potential risks and opportunities, and make informed decisions.

- Forecast future performance: Argus modeling can accurately project a property's future income and expenses using detailed market data and property-specific information, accounting for various scenarios and risks. This enables you to make informed decisions about a property's financial performance over time.

- Evaluate investment scenarios: By evaluating different investment scenarios, such as lease expirations, rent escalations, or changes in tenant occupancy, Argus modeling helps you make informed decisions about investment strategies and optimize returns.

- Assess property value: With Argus modeling, you can assess the value of a property accurately and reliably, considering current market trends and property-specific information.

- Manage property portfolios: Argus modeling provides a comprehensive view of an entire property portfolio, allowing you to evaluate performance, identify areas for improvement, and make data-driven decisions about investment strategies.

What’s next?

Argus modeling depends on the input which needs to be taken from the lease & other financial documents. Using an OCR software like Nanonets can help you gain an edge over other real estate professionals by boosting processing times and ensuring you never lose out on a good deal.

If you’re using Argus modeling, check out Nanonets OCR software to automate underwriting easily.

Summing it all up

Argus modeling is a powerful tool for real estate investors, lenders, and underwriters. It provides accurate financial forecasting, helps evaluate different investment scenarios, assesses property value, and provides a comprehensive view of property performance. With streamlined due diligence processes and the ability to make informed data-driven decisions, Argus modeling has become essential in the real estate industry.

Improve your Argus models by extracting data from construction documents on the go. Try Nanonets OCR software to extract data and feed data to your Argus models.