Efficient management and juggling your business’s Accounts Payable (AP) is one of those accounting tasks that goes unnoticed by most – until there’s a problem. But effective AP management is key for a business’s financial health, helping balance cash flow with maintaining positive vendor or supplier relationships.

Likewise, there’s more to the term “AP processes” than meets the eye; it encompasses the complete cycle from invoice receipt to payment processing, ensuring that all obligations are met in a timely manner.

At the end of the day, efficient AP management directly impacts cash flow, supplier relationships, and overall financial stability. Dynamics 365 (D365) Business Central is one of many comprehensive AP solutions, offering a range of tools to streamline AP operations. The modern ERP system enhances efficiency, reduces errors, and provides real-time insights, making it an indispensable asset for businesses aiming for optimal financial management.

Understanding AP Invoice Processing for Business Central

In D365 Business Central, AP invoice processing workflows are both efficient and intuitive. The workflow begins with the receipt of an invoice, which is then matched against purchase orders and receipts to ensure accuracy. Once verified, an assigned or designated approver approves the invoice, it’s posted, and ultimately paid electronically or via traditional methods. It is then assigned a relevant G/L code to be captured in the general ledger. Caution is observed to avoid common mistakes like, incorrect credit-debit recording, incorrect amounts captured, incorrect vendors, etc. The streamlined process helps ensure that invoices are processed promptly and accurately, reducing the risk of errors and delays.

Step-by-Step Guide to Processing Invoices in Business Central

Processing invoices in Business Central involves several key steps:

Invoice Receipt: Capture the invoice data through manual entry or automated import (though manual entry tends to introduce risk factors around human error, especially if you have a particularly voluminous AP backlog).

- Go to 'Purchase Invoices' to start the process

- Click on 'New' and Fill in the necessary details like invoice date, vendor number

- Add invoice lines like item details and shipping costs, etc.

Approval: Route the invoice for necessary approvals using predefined workflows.

Posting: Post the invoice to update the ledger and prepare for payment once approved.

- Upon approval, you can click on the Post button to update the ledger

- After you enter all the invoice journal lines, click the Post button to post the invoice journal. To access the Invoice register page, navigate to Accounts payable > Invoices > Invoice register.

- You can also print the invoice or save it as a PDF

Payment: Execute payment through various supported methods, such as bank transfers or checks.

- You can search and navigate to Payment Journal and click on 'New'

- Fill in details like vendor payment amount and post the payment

- This will update the general ledger with payment information

Each step is (generally) seamless, leveraging Business Central's integrated features to ensure a smooth and error-free process.

Benefits of Using Business Central for AP Invoice Processing

Using D365 Business Central for AP invoice processing offers numerous benefits.

- It enhances accuracy by automating data entry and matching and reduces processing time through streamlined workflows

- Provides real-time visibility into the status of invoices and payments.

- Additionally, it improves compliance with audit trails and supports better cash flow management with detailed reporting and analytics.

Overall, Business Central helps businesses manage their AP processes more effectively, leading to improved financial control and operational efficiency.

Leveraging AP Automation for Business Central

AP automation leverages advanced tech, including machine learning and artificial intelligence, to streamline and automate the accounts payable processes while reducing the need for manual intervention. Adapting AP to today’s tech is a big step forward, as it enhances accuracy, speeds up processing times, and reduces operational costs. AP automation fosters a more efficient and reliable financial management system by minimizing human errors and accelerating invoice approval and payment.

How AP Automation Enhances Efficiency in Business Central

In D365 Business Central, AP automation optimizes efficiency by automating repetitive tasks such as data entry, invoice matching, and approval workflows.

This leads to quicker turnaround times and ensures compliance with organizational policies.

The integration of machine learning and AI further improves accuracy and decision-making, allowing businesses to process higher volumes of invoices with greater precision and fewer resources.

Implementing AP Automation Solutions in Business Central

Implementing AP automation in Business Central involves integrating automation tools that capture and process invoice data, match invoices with purchase orders, and manage approvals electronically. Businesses can configure automated workflows to handle routine tasks, set up alerts for discrepancies, and ensure compliance with regulatory requirements. The implementation process requires careful planning and alignment with business needs to maximize the benefits of automation.

Exploring AP Solutions on AppSource for Business Central

AppSource offers a range of AP automation solutions tailored for Business Central. These solutions provide enhanced functionalities such as OCR (Optical Character Recognition) for invoice data capture, AI-driven matching algorithms, and customizable workflows. By exploring and integrating these third-party applications, businesses can further enhance their AP processes, ensuring a seamless and efficient accounts payable system. The diverse offerings on AppSource enable businesses to choose solutions that best fit their specific needs and operational requirements.

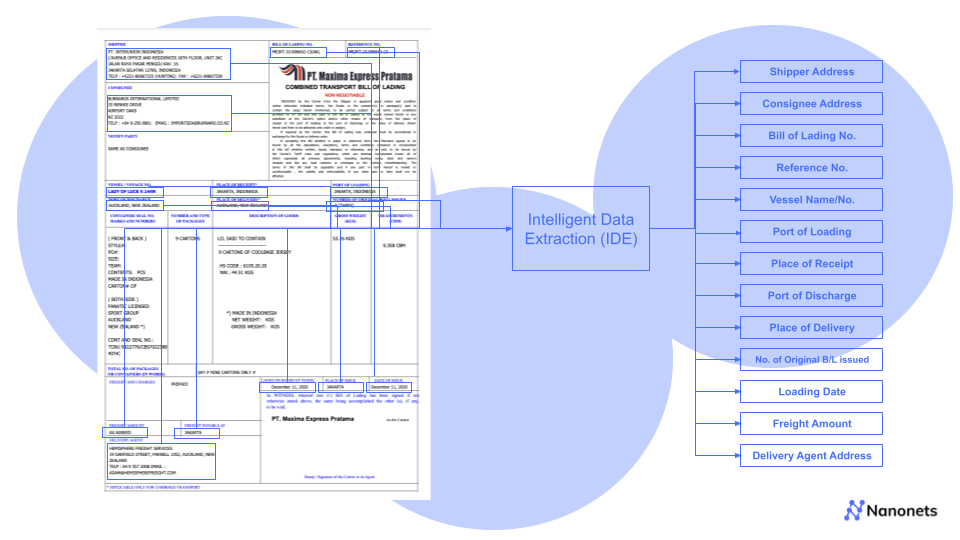

Nanonets for AP Automation

Nanonets is a powerful tool for AP automation that offers several key benefits beyond D365’s basic offerings. By leveraging advanced AI and machine learning algorithms, Nanonets accurately extracts and processes invoice data, reducing manual entry errors and speeding up the invoice processing time.

It provides seamless integration with D365 Business Central, enhancing the overall efficiency of the AP workflow. Nanonets also supports customizable workflows, enabling businesses to tailor the automation process to their specific needs. Additionally, its robust data validation features ensure compliance and accuracy, ultimately leading to improved financial management and operational efficiency.

Conclusion

Efficient management of Accounts Payable (AP) processes is essential for the financial stability and growth of businesses. Dynamics 365 Business Central offers a robust solution to streamline these processes, enhancing accuracy and efficiency. By leveraging AP automation, businesses can further improve their AP workflows, reducing manual tasks and increasing productivity. Nanonets, as an AP automation tool, integrates seamlessly with Business Central, providing advanced AI-driven capabilities to optimize invoice processing. Embracing these technologies empowers businesses to achieve greater financial control, operational efficiency, and overall success in a competitive market.