In the world of lending, risk management is crucial to success. But with a growing number of loan applications and an increasing number of delinquencies, how can lenders effectively manage risk without sacrificing efficiency?

The answer lies in automating steps in the lending process.

Automation enables lenders to conduct more stringent credit checks, income verification, and other critical verifications to ensure that only qualified borrowers are approved. By using automation, lenders can also improve their loan processing times and reduce human error, ensuring regulatory compliance.

This article will explore the benefits of using automation to filter customers early on in the lending process, including how it can help lenders minimize risk, improve efficiency, and increase profitability. As the lending environment continues to change, lenders that embrace automation will be better equipped to navigate the challenges ahead.

Why is it important to filter customers in the lending process?

Loan provision is a risky business, with lenders constantly walking a fine line between providing access to credit to customers while minimising their risk of default.

Even in the most favourable economic conditions, borrowers with low credit scores have historically been more likely to fall behind on their payments for car loans, personal loans, and credit cards.

In the United States, for example, subprime borrowers are increasingly struggling to keep up with their payments. In mid-2022, the rising delinquencies on subprime credit cards and personal loans, which are at least 60 days late, increased faster than normal, nearing their pre-pandemic levels.

This trend is a worrying signal for lenders who must carefully evaluate borrowers before approving loans. While access to credit is crucial for many people and companies, lenders must also protect themselves from the risk of default and ensure that they can remain financially solvent in the long run.

Filtering customers is an essential part of the lending process. It helps lenders evaluate borrowers' creditworthiness, assess the risk of default, and ensure that only qualified applicants are approved for loans.

Without proper filtering, lenders run the risk of approving high-risk borrowers, which can lead to increased loan defaults and losses. Effective filtering methods also help lenders comply with regulatory requirements and prevent fraudulent activities, which can have severe consequences for lenders.

In short, filtering customers is critical for lenders to manage risk, ensure loan performance, and maintain a profitable lending business.

Automate your mortgage processing, underwriting, fraud detection, bank reconciliations or accounting processes with a ready-to-use custom workflow.

Benefits of filtering customers in the lending process

The benefits of customer filtering include:

- Time and money savings by avoiding investments in prospective borrowers with little chance of qualifying for a mortgage.

- Avoiding bad-fit customers can prevent the cost of retaining poor-fit customers, which can be higher than acquiring good-fit customers.

- Breaking up with bad customers before they have the chance to default on loans can prevent expensive problems down the road.

- Proactively ending relationships on your own terms can be more beneficial than waiting for customers to leave.

- Customer filtering can help recognise borrowers who may become a poor fit, even in the mortgage lending process where it can be difficult to identify such borrowers.

- Traditional underwriting processes may not assess creditworthiness accurately for a borrower who derives income from non-traditional sources.

- Filtering customers based on income and savings, in addition to credit scores, can be a stronger predictor of mortgage risk.

Automated customer filtering

Filtering customers manually is an onerous and challenging task due to the overwhelming number of loan applications received by lending companies.

Credit risk managers, credit policymakers, and legal resources may have the expertise, but reviewing documents and assessing creditworthiness can still be tedious and error-prone.

Despite having a team of experts, making accurate lending decisions while minimizing risk remains a challenge. This is where automation can be a game-changer!

The use of a loan automation system simplifies the traditionally long and complex process of checking customer credibility and approving loan applications, which has been a major inconvenience for years.

According to the "How Finance Leadership Pays Off" survey conducted by Oxford Economics, 73% of financial executives acknowledge that automation improves their company's finance function's efficiency.

Credit process automation eliminates manual tasks and helps overcome traditional lending challenges. The analytical tools of the system enable lenders to offer a better customer experience and improve efficiency and loan performance in the long run. The presence of automation at the loan origination stage results in several benefits, including full compliance with lending regulations, a reduction in loan approval time by several days, elimination of manual loan processes, faster and more accurate automated loan underwriting, better customer relationship management, fraud detection, and reduced risks of data compromise.

Benefits of automated customer filtering

Some of the specific benefits of automated customer filtering include:

- Faster approvals for applicants - automation can speed up workflows and review more borrowers' files in much less time, resulting in faster approvals.

- More efficient workflows - automation can reduce the time and resources needed for manual customer filtering processes.

- Increased accuracy - automation can eliminate the risk of human errors in data entry and processing, resulting in more accurate customer filtering.

- Better risk assessment - automation can provide lenders with more detailed financial information on potential borrowers, enabling them to make better risk assessments.

- Improved access to cash flow analytics - automation can provide lenders with a more holistic view of a potential borrower's financial health, helping them identify good fit customers earlier in the process.

- Reduced expenses - by filtering out bad customers earlier in the process, lenders can reduce the expenses of unqualified borrowers and maintain profitability.

- Expanded customer base - automation and cash flow analysis before underwriting can capture new customers not serviced by traditional lenders relying solely on credit-bureau data.

Not surprisingly, McKinsey reported in 2022 that over 60 percent of financial institutions surveyed increased their utilization of new forms of data and advanced analytical techniques such as machine learning for credit portfolio management in the last two years. An even greater percentage, more than 75 percent, anticipated these trends to continue for the next two years.

Automate your mortgage processing, underwriting, fraud detection, bank reconciliations or accounting processes with a ready-to-use custom workflow.

How to automate customer filtering for lending?

By leveraging advanced technologies such as AI and machine learning, lenders can automate several key steps in the customer filtering process, such as borrower onboarding, data extraction, borrower pre-qualification, credit risk assessment, and collateral valuation.

These automation tools help lenders to streamline their operations, reduce the time and costs associated with manual processing, and ultimately make better lending decisions. With automation, lenders can also customize borrower eligibility requirements and categorize borrowers based on predefined parameters, such as loan type, geographical location, and borrower type.

Additionally, automation allows lenders to assign loan processing tasks to relevant staff members based on their availability and location, improving efficiency and reducing errors.

There are several steps that can be automated in the customer filtering process:

- Use configurable registration forms for borrower onboarding.

- Set borrower eligibility requirements based on internal lending policies.

- Automate data extraction and validation from borrower-provided documents.

- AI-enabled borrower pre-qualification against pre-set requirements.

- Automate borrower categorization by user-defined parameters.

- Verify KYC/AML based on geography.

- Automate processing of borrower credit documentation in various formats.

- Automate assessment of borrower credit risk based on user-defined criteria.

- Automate scoring of business credit risk based on default probability and loss given default models.

- Automate loan processing tasks and communication with borrowers.

How can Nanonets help automate customer filtering?

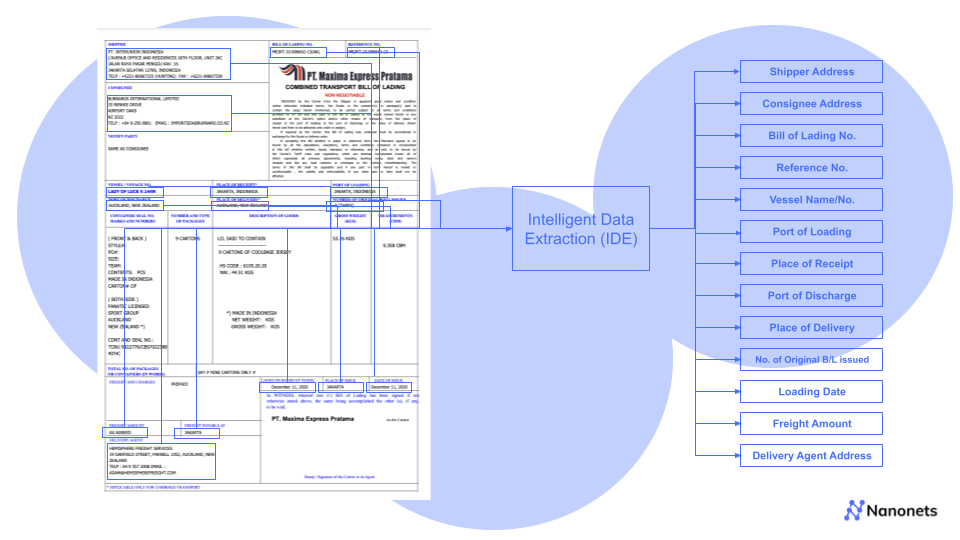

Nanonets is an AI-enabled data extraction OCR tool that can ease customer evaluation in the loan process by automating the extraction of data from various documents provided by the customer. This technology can capture important financial information from bank statements, tax documents, pay stubs, and other sources with a high degree of accuracy, reducing the risk of errors and inaccuracies that can occur with manual data entry.

By using Nanonets, lenders can streamline the loan application process, saving time and reducing the workload for loan officers. This also allows lenders to process a larger volume of loan applications, resulting in faster turnaround times for loan approvals.

In addition, Nanonets can enable lenders to perform more comprehensive and accurate analysis of potential borrowers' financial status, helping them to identify good fit customers and avoid unqualified borrowers. Lenders can also use the extracted data to perform income analysis, risk modeling, and cash flow analysis, which can provide a more complete picture of the borrower's financial health beyond traditional credit bureau data alone.

Automate your mortgage processing, underwriting, fraud detection, bank reconciliations or accounting processes with a ready-to-use custom workflow.

Take away

By implementing automation in the early stages of the lending process, lenders can enjoy several benefits, such as the ability to identify suitable customers and filter out unqualified borrowers.

With technology like Nanonets' document capture technology, lenders can analyze cash flow data from multiple sources, enabling them to obtain a comprehensive understanding of a borrower's financial status beyond just credit bureau data. This automation can also help lenders reduce costs associated with unqualified borrowers, improve profitability, and broaden the range of acceptable credit risks at the top-of-the-funnel, potentially attracting new customers that may not be serviced by traditional lenders that rely solely on credit-bureau data.