What is a Bank Reconciliation Statement

Bank reconciliation is the process in which the entries in a bank statement are compared with the entries in various in-house financial documents (e.g. general ledger) of a company. This process ensures that all the transactions performed by the company are accounted for (pun unintended) and that there are no unexplained financial activities for the period for which the reconciliation has been performed. The bank reconciliation statement is the record of the reconciliation process that has been performed and has details of the entries, any discrepancies detected ruling the reconciliation process, and their mitigation.

Looking for Reconciliation Software?

Check out Nanonets Reconciliation where you can easily integrate Nanonets with your existing tools to instantly match your books and identify discrepancies.

This article discusses the importance of bank reconciliation statements and the benefits of automation in generating them.

The Importance of Bank Reconciliation Statements

The bank reconciliation statement is a record of the periodic bank reconciliation operations performed by any organization. It offers the following benefits to the organization:

- Ensures accuracy of transactions: The process of comparing the bank statement with other financial statements ensures that the numbers in all these records can be accounted for. This ensures the integrity of financial data and helps in keeping an eye on the financial health of the organization.

- Detects errors, omissions, and irregularities: By analyzing and comparing every entry in the bank statement and general ledger (or other financial documents used in the reconciliation statement), any errors, discrepancies, or omissions can be caught in time. These can prevent inaccuracies from snowballing into significant financial misstatements.

- Safeguards against fraud and unauthorized activities: Bank reconciliation is a frontline defense against fraudulent activities such as unauthorized withdrawals and embezzlement. Discrepancies uncovered during the reconciliation process can raise red flags, prompting further investigation and measures to prevent financial losses and uphold the organization's security protocols.

- Regulatory compliance: Regular and accurate bank reconciliation helps the company comply with the rules and laws of the country. This in turn reflects on the integrity of the company and its legitimacy. This fosters trust among stakeholders and regulatory authorities.

- Financial transparency: Accurate bank reconciliation statements instil confidence among all stakeholders because of the financial transparency it offers. This facilitates better stakeholder relationship, which in turn provides access to capital and business opportunities.

- Informed Decision Making: Any decision taken by an organization hinges on the financial health of the organization. The bank reconciliation statement provides a blueprint on the financial health of the company in real time, and can help with strategic decision making for sustainable growth and long-term profitability.

What are the Components of the Bank Reconciliation Statement

The bank reconciliation statement is a record of the bank reconciliation process. Therefore it would contain the data that are typically present in the bank statement. These include:

- Opening Balance: The bank statement usually starts off with the opening balance. This is the closing balance from the prior month’s bank statement.

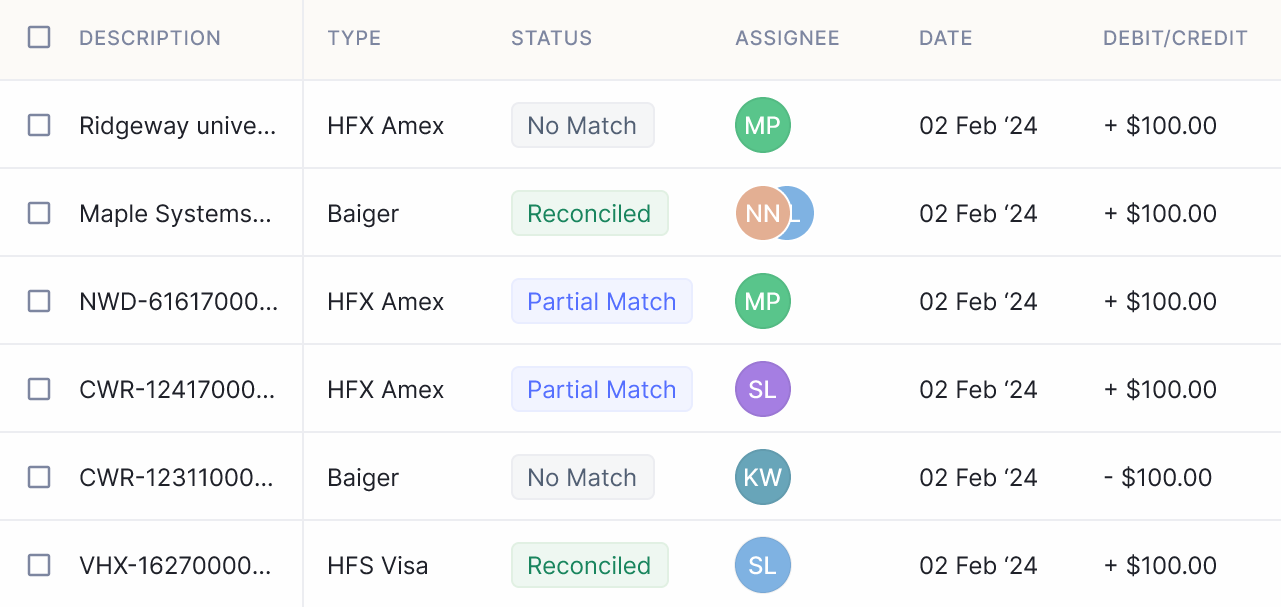

- All Transactions: These include the credit and debit details from the bank statement. All deposits, withdrawals, checks, e-transfers, fees, fines, and interests are part of this list.

- Transactions from the Internal Records: Some transactions (e.g. cash transactions or credit card transactions) may not be reflected in the bank statement. These must be considered and acocunted for in the reconciliation.

- Adjusted Internal Balance: Like the adjusted bank balance, this is the balance calculated by adjusting the opening balance with the total of all internal transactions recorded by the company.

- Reconcilled Items: The items that don’t match between the bank statement and the internal records must be explained and included. These include items like deposits and credits in transit, bank errors, timing and currency mismatches etc.

- Adjusted or Reconciled Bank Balance: This is the bank balance that is calculated after accounting for all the transactions and incorporating them in the starting bank balance (i.e.) starting balance minus the debit items (reconciled) plus the credit items(reconciled). This represents the true balance of the company's bank account at the end of the reconciliation period.

How to prepare a Bank Reconciliation Statement

The bank reconciliation statement is performed in tandem with the reconciliation process. Thus, the steps outlined for the reconciliation process holds good for the statement preparation process as well.

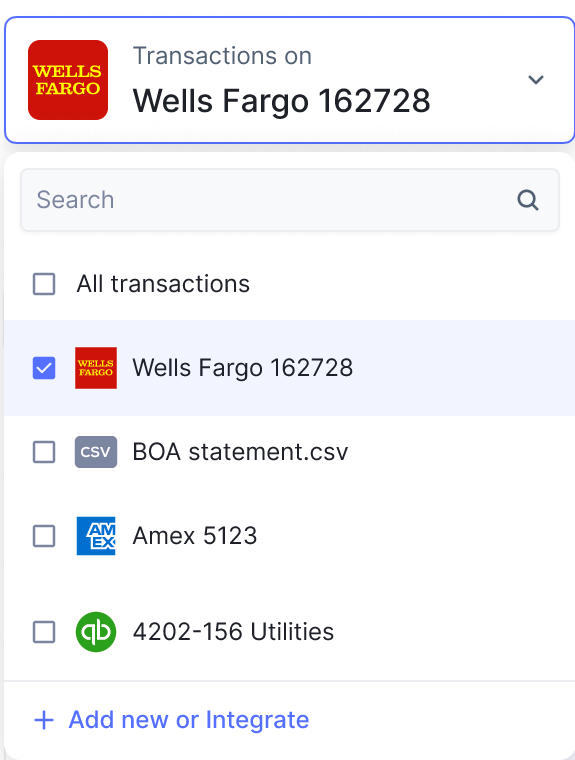

- Source consolidation: The first step is to gather all the documents associated with the financial operations of the company. Since bank reconciliation involves comparing bank documents to other financial documents of the company, the updated bank statement must first be obtained from the bank. Other documents may include the general ledger, cash receipt log, invoice log, credit card statement, payroll statement, etc. These may be physical documents or digital documents like spreadsheets.

- Identify the starting point: Usually this would be the starting balance in the bank statement if the previous month (or period) reconciliation has been performed accurately. Otherwise, the most recent instance where the balance in your business records matched that of your bank account is chosen as the starting point of the reconciliation process.

- Review credits: All the credit items in the bank statement are matched against credit entries in the internal records like the grand ledger. For any mismatch, like missing deposits, the reason is investigated. A missing deposit in the bank statement may be due to a check that has not yet been cleared or a payment in process.

- Review debits: All the debit items in the bank statement are matched against debit entries in the internal records like the grand ledger. For any mismatch, like missing payments made, the reason is investigated. Discrepancies may be due to uncleared payments or transactions made using alternative methods, or unexpected fees/fines/charges levied by the bank.

- Calculate end balance: This is done by adding all the adjusted credits and subtracting the adjusted debits from the starting balance.

Reconciliation discrepancies may be caused by time zone differences, currency differences, data entry errors, calculation mistakes, unexpected fees/fines by the bank and outstanding credits or debits. In dire cases, they may arise due to fraud or mismanagement. All of these are accurately recorded in the reconciliation statement to serve as a reference for later reconciliation operations.

Importance of Automation in Generating Bank Reconciliation Statements

Bank reconciliation statements are complex documents, especially for large companies with numerous daily transactions of various forms. Keeping track of these transactions becomes a problem because multiple people/departments are involved in these operations and bank reconciliation at the end of the month becomes a huge problem. Here are some compelling reasons to use software for the generation of bank reconciliation statements.

- Time-savings: The generation of reconciliation statements manually involves comparing every entry in the bank statement with every entry in the supporting internal financial record. This is a tiresome process and challenges the human focus to the extreme. While the process in itself is time-consuming, any mistake during comparison will lead to further time setbacks and associated frustrations.

- Error-prevention: Any number-intensive task like reconciliation carries with it the risk of human error. The error can be due to human fatigue or incompetence. Any mistake can have a long tail of detection and correction, which can tax the process and operator enough to lead to further errors.

- Enhanced Scalability: Although there are no limits to human intelligence, imagination, and wonder (said Abraham Lincoln), there are limits to the efficiency of human effort in mundane repetitive tasks. Manual bank reconciliation statement generation, by its sheer tediousness, can prevent a company from growing. Automation can ease this process and help rechannel human competence into scale-up operations.

- Reliable record keeping: Tracking changes can be easier with automated tools. Modifications and adjustments can be recorded in digital logs for posterity.

- Strategic decision-making support: Automation can ease the generation of bank reconciliation statements, thereby affording a real-time view of the financial health of the organization. This in turn helps with strategic decision-making.

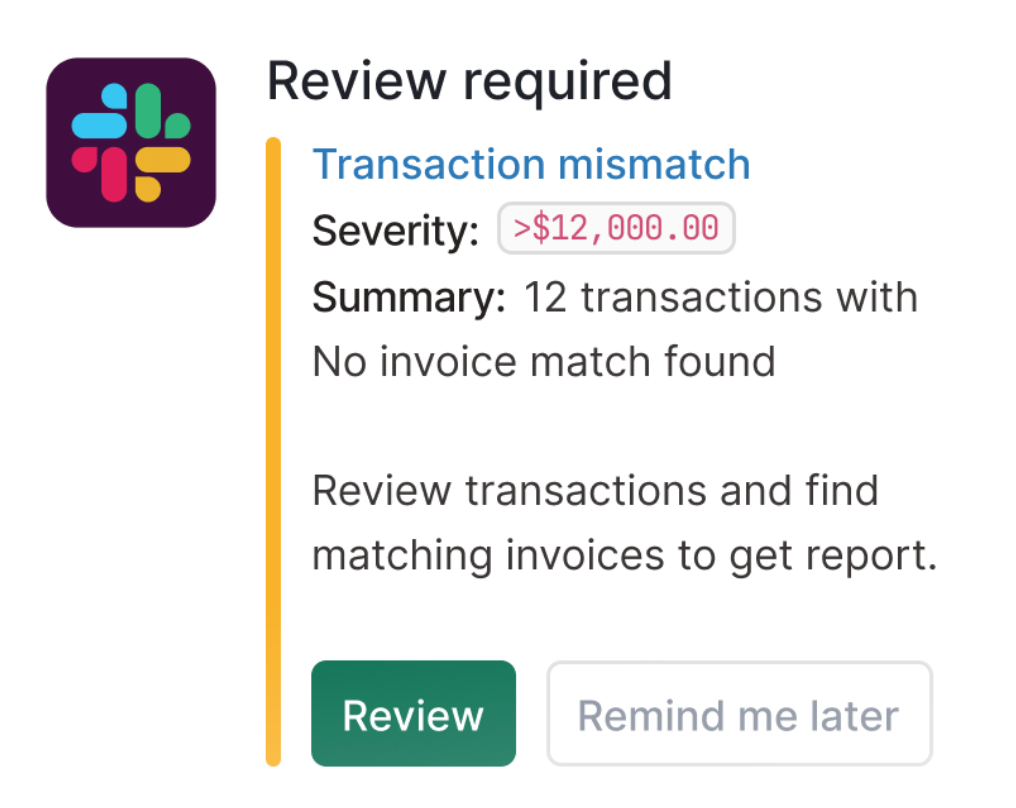

- Fraud detection: While it is admirable to trust humanity, Corruption, embezzlement, and fraud are all characteristics that, as Greenspan said, exist everywhere. It is not only harder to detect fraud during manual reconciliation processes, but it is also possible that manual reconciliation itself can be a fertile field for fraud to grow. Automated solutions can prevent fraud and/or detect fraud early so that corrective actions may be taken.

- Audit Ease: Timely reconciliation statements enabled by automation can help in year-end audits or financial reviews. Auditors may have difficulty verifying the accuracy and completeness of manual reconciliations, potentially leading to audit findings or discrepancies.

Nanonets for Bank Reconciliation Statements

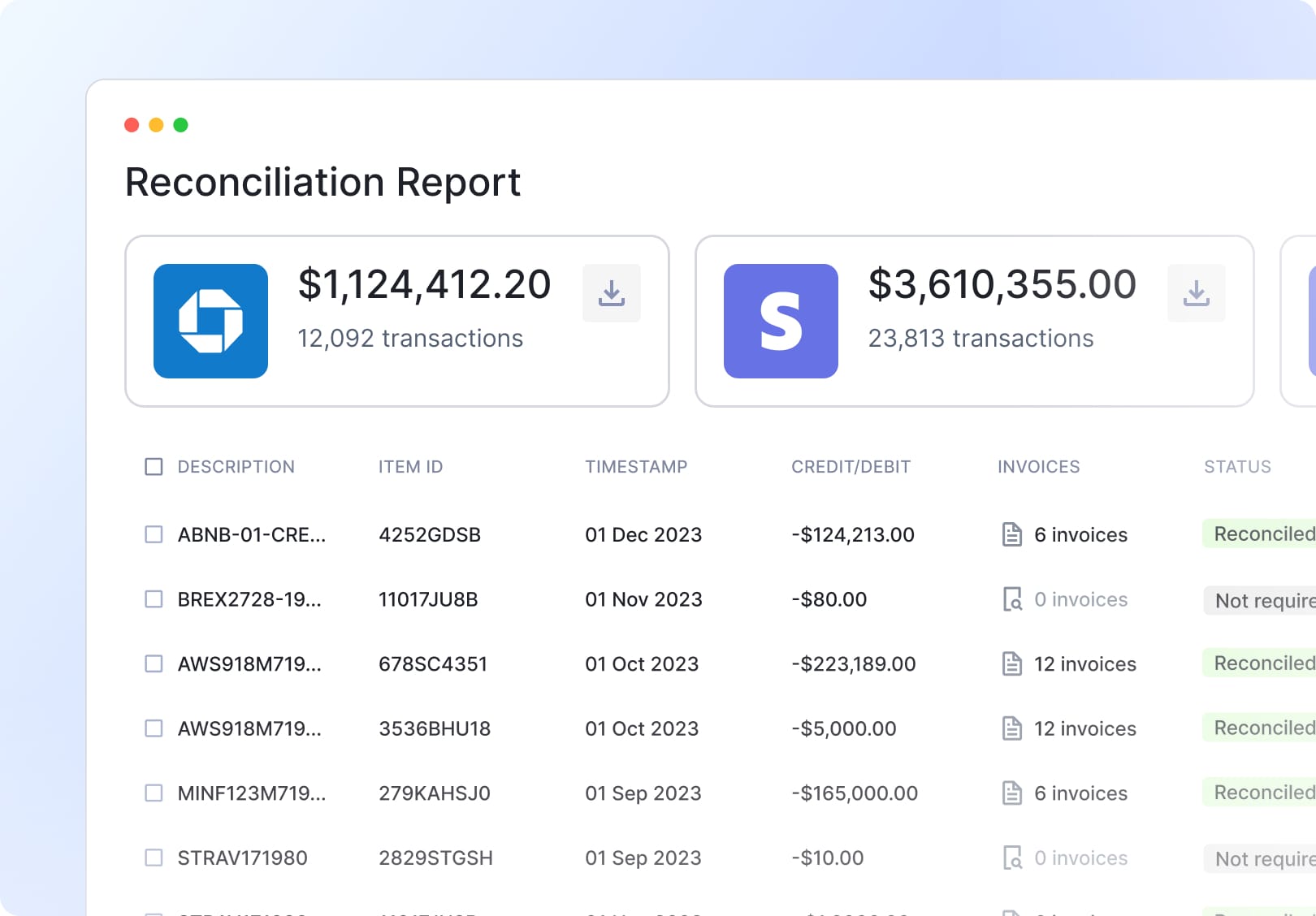

The generation of bank reconciliation statements can be eased through the use of automation tools like Nanonets. Nanonets can help in extracting data accurately from various sources such as bank statements, credit card statements, and invoices thereby saving time and human energy.

Some specific features of nanonets that help with bank reconciliation statements are:

Automated data extraction: Simplifying Financial Record Management

- Extraction of accurate data from a variety of financial documents, both digital and paper-based

Advanced AI Engine: Precise Data Extraction

AI-powered data extraction ensures accuracy without the need for predefined templates, adapting to various document formats.

Flexible Configuration: Tailor to Your Needs

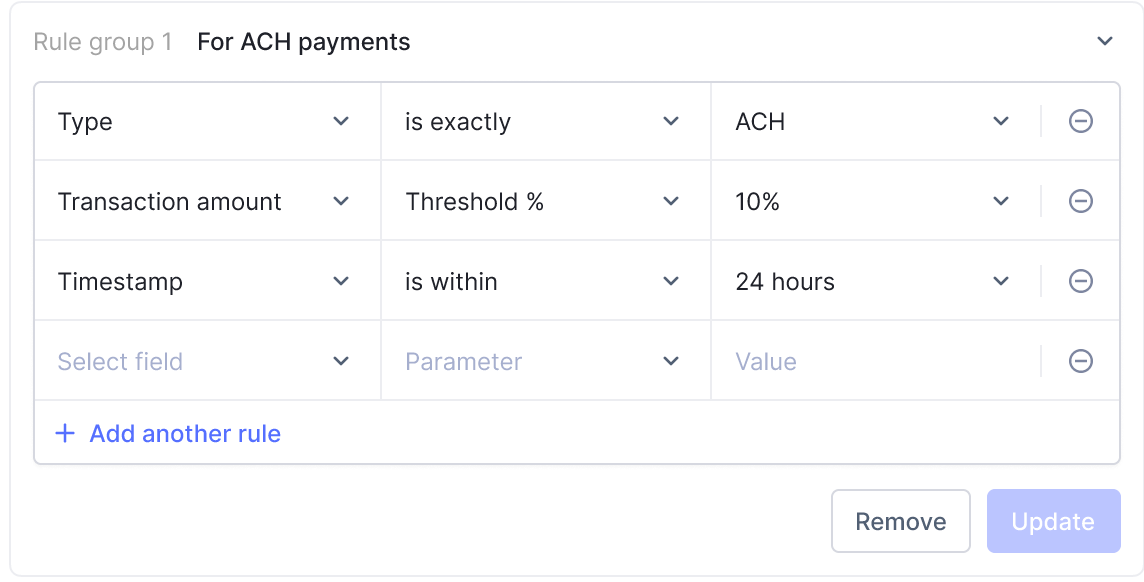

Customize data extraction settings to align with your unique business rules and requirements for optimal results.

Seamless Integration: Consolidate Financial Processes

Easily integrate with existing tools and leverage custom API capabilities for a unified financial workflow.

Enhanced Accuracy: Improve Reconciliation

Boost the precision of your reconciliation processes with automated data extraction, minimizing errors and discrepancies.

Real-Time Fraud Detection: Protect Your Finances

Identify duplicate entries, missing payments, outliers, and unauthorized transactions in real-time, safeguarding against financial fraud.

No-Code Blocks: Simplify Reconciliation and Verification

Perform in-app reconciliation and verification using no-code blocks, eliminating the need for complex spreadsheets and multiple tools.

Take Away

Bank reconciliation statements are a vital set of documents that help maintain the financial integrity and safety of organizations. They offer a real-time look at the financial state of the enterprise and serve as a safety rail against fraud and financial mismanagement. Bank reconciliation statements are also useful in auditing operations and in ensuring regulatory compliance. Software like Nanonets can help in automating the process of bank reconciliation and report generation through accurate data extraction, algorithmic categorization of data, and prompt discrepancy flagging. Nanonets can be an asset to any enterprise in all operations of financial and accounts management.