Best Reconciliation Software 2024

Best Reconciliation Software Tools

Reconciliation software is a tool specifically designed to compare financial data from different sources such as invoices, bank statements, general ledgers, and other financial records. Financial teams often face challenges while performing reconciliations internally, as it involves a significant amount of manual work. To address this issue, organizations prefer using reconciliation software, which can automate the heavy lifting and monotonous tasks while ensuring accuracy and timeliness during the monthly book-closing period.

In this article we will cover the following sections:

- Best Reconciliation software quick comparison

- Why is account reconciliation important? Why do you need to do it?

- Types of Reconciliations financial teams come across

- What is account reconciliation software?

- Top 5 account reconciliation software

- Benefits of using Automated Reconciliation Software

- Why Your Organisation Needs an Automated Reconciliation Software

Best Reconciliation software quick comparison

Need a TL;DR? With automation taking over the world and time being more critical than ever, we've selected the top reconciliation software solutions. These are ranked based on features such as pricing, user-friendly interface, workflow automation, automated data extraction, transaction matching, exception handling capabilities, and their ability to integrate with other accounting tools

- Best Automated Reconciliation Software: Nanonets

- Most Popular Reconciliation Software: Quickbooks

- Best Account Reconciliation Software: Xero

- Best Financial Close Reconciliation Software: Blackline

- Best Enterprise Reconciliation Software: Netsuite

Choosing the best reconciliation software depends on your organisational needs and goals.

Want automated data extraction capabilities once you upload your documents (meaning no data entry or creating templates) and transaction matching powered by ML algorithms (meaning AI matching) across documents you either upload, receive from an email or provide connection to the database ?

We have developed Nanonets Reconciliation AI tool just for you!

Are you a spreadsheet wizard who won't back down against the most daunting and time consuming transaction tasks? Use CubeSoftware. If Pricing is an issue you may try to use Power Query to reconcile in excel.

If you already are using Quickbooks as an accounting platform and don't want to look anywhere else for the added features and functionality - Quickbooks Statement Reconciliation is the way to go.

Xero is tailored for small and medium business who like to keep their records paperless and human error free. Quickbooks users may use Xero if they are not quite satisfied with the abilities of the former.

Blackline is generally sought out to be one of the top account reconciliation software. With ability to integrate across different accounting tools and importing documents into predefined templates it happens be a steep learning curve with great functionality. There are several tutorials available online to help you get started.

Netsuite Reconciliation is suitable for organizations that need to automate core financial matching by offering highly scalable and robust account reconciliation features.

Why is Account Reconciliation Important?

Keeping your accounts spick and span can help you to get out of financial jiffy. Poor financial book keeping leads to misinterpretation of your company's financial health which may lead to frauds and errors going undetected. Timely completion of the financial close process helps stakeholders in decision making and reporting. Maintaining an accurate audit trail is crucial for your company to avoid potential penalties which auditors may flag. With regular reconciliations finance teams are able to avoid cash flow discrepancies, timing differences, and missing transactions so that the entire company remain compliant with mandatory regulatory requirements.

Types of Reconciliations Software

Software tools for Bank Account Reconciliation

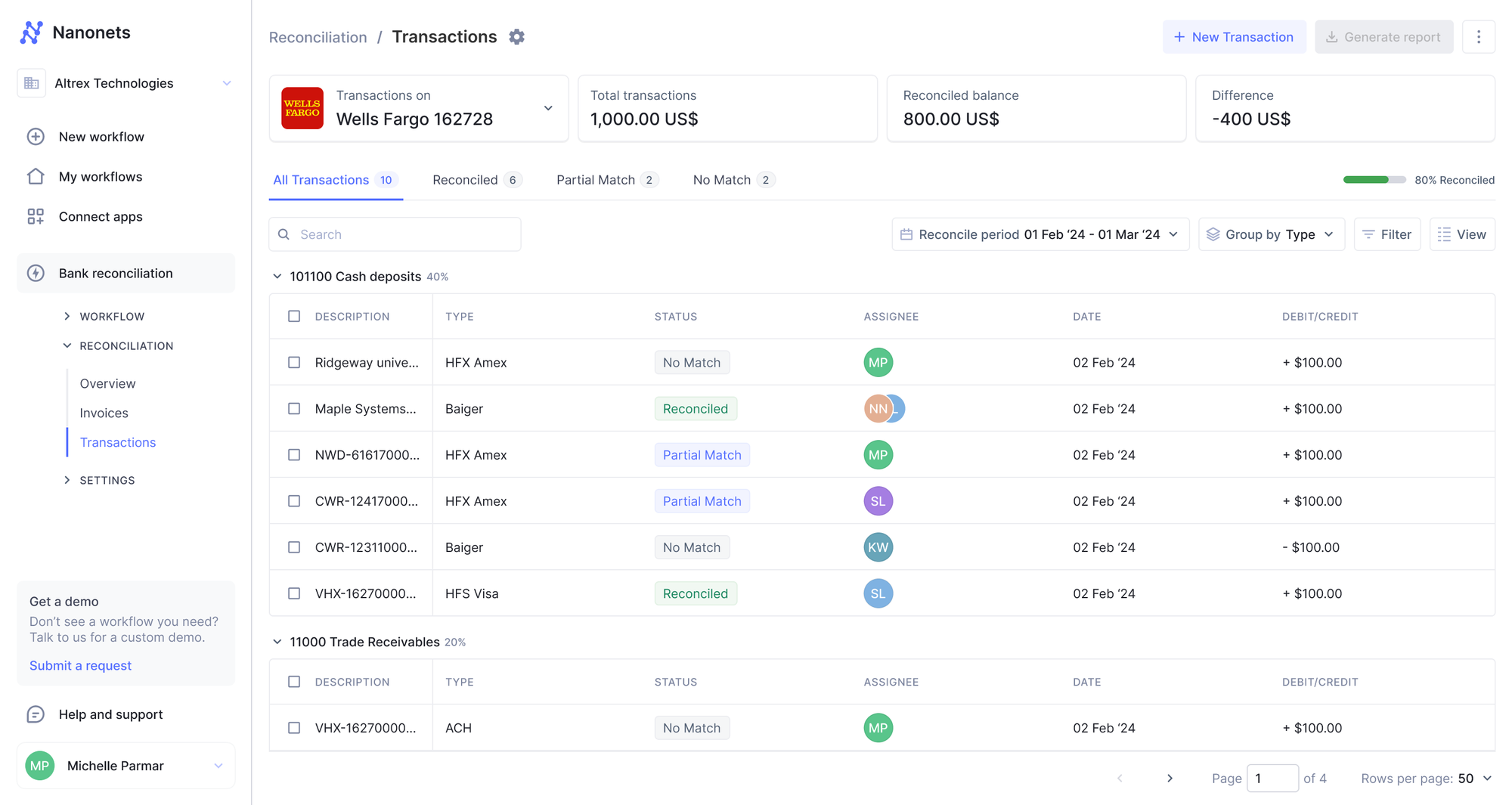

Bank reconciliation is the process of matching bank statements to internal book records in order to ensure financial accuracy. A Bank Reconciliation Software aims in matching company's internal transactions with the ones recorded by the bank. It helps generate reports regarding cash flow, outstanding checks and reconciled amount. Bank reconciliation softwares typically have integrations to directly pull company's data and match transactions to generate reports for better financial reporting.

Account Reconciliation Software

Account Reconciliation ensures that the company's general ledgers align perfectly with other financial records. These mean matching across ledgers, bank statements and other Third Party financial statements. A software like Nanonets which can extract data automatically across multiple templates proves to be the best choice here. Account Reconciliation Softwares should centralised data repository to store, access and review company wide financial statements.

Balance Sheet Reconciliation Software

Balance Sheet Reconciliation Software aims at reconciling balance sheet accounts with the supporting financial documentation. Financial data is generally stored between different account tools and spreadsheets, often making it difficult to reconcile. A great balance sheet reconciliation software should be easily be integrated into existing tools.

What is an Account Reconciliation Software?

A great account Reconciliation software should adhere to the following features and functionalities to help you maintain a great financial reporting management system by bridging the gap between your internal book keeping and external reports. Verifying and aligning transactions to ensure correctness and accuracy are of the upmost importance.

- Automated Matching:

Reconciliation softwares should match transactions between both the data sets (in this case your ledger and statements) with utmost accuracy. Different reconciliation tools try to do an exact match my noting down the time, amount and other details from the transactions. Nanonets AI trains the label names using NLP techniques which help in predicting the best match for the subsequent transaction entries. - Centralised Data:

The ability to generate reports and dashboards on financial data is crucial for finance teams to keep track of the status of the company's financial health. By identifying which transactions have matched, to manually assign team members to un-matched entries can help in timely bookkeeping and ensure financial regulatory compliance. - Audit Trails:

Maintain a detail record of reconciliations in the past, ensuring transparency into the health of your financial processes. Access to store and anonymise your important financial data is key is maintaining privacy and health of your book keeping system. - Integrations:

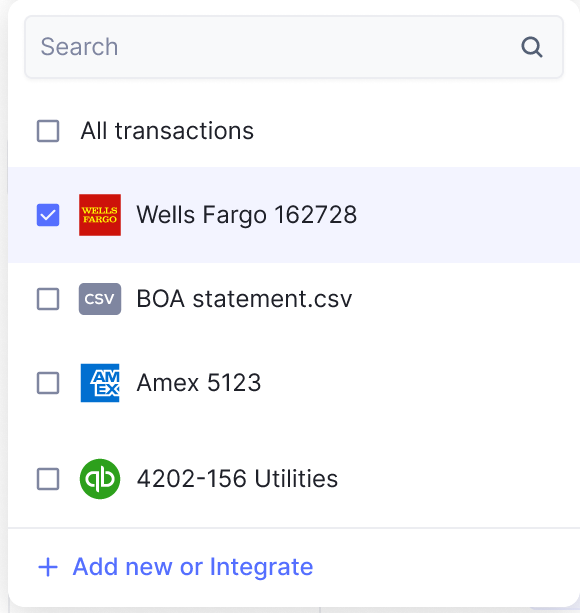

Since account reconciliation involve multiple third party systems to compare your financial data on, it should be able to access your data stored within these systems through user friendly integrations. Ability to load the data inside the software, comparing transactions, triggering alert workflows are key should haves involving any reconciliation software.

Top 5 Reconciliation Software

1. Nanonets

Nanonets is an AI-powered solution that can greatly simplify and streamline the account reconciliation process. It automates various steps, reduces manual effort, and increases efficiency.

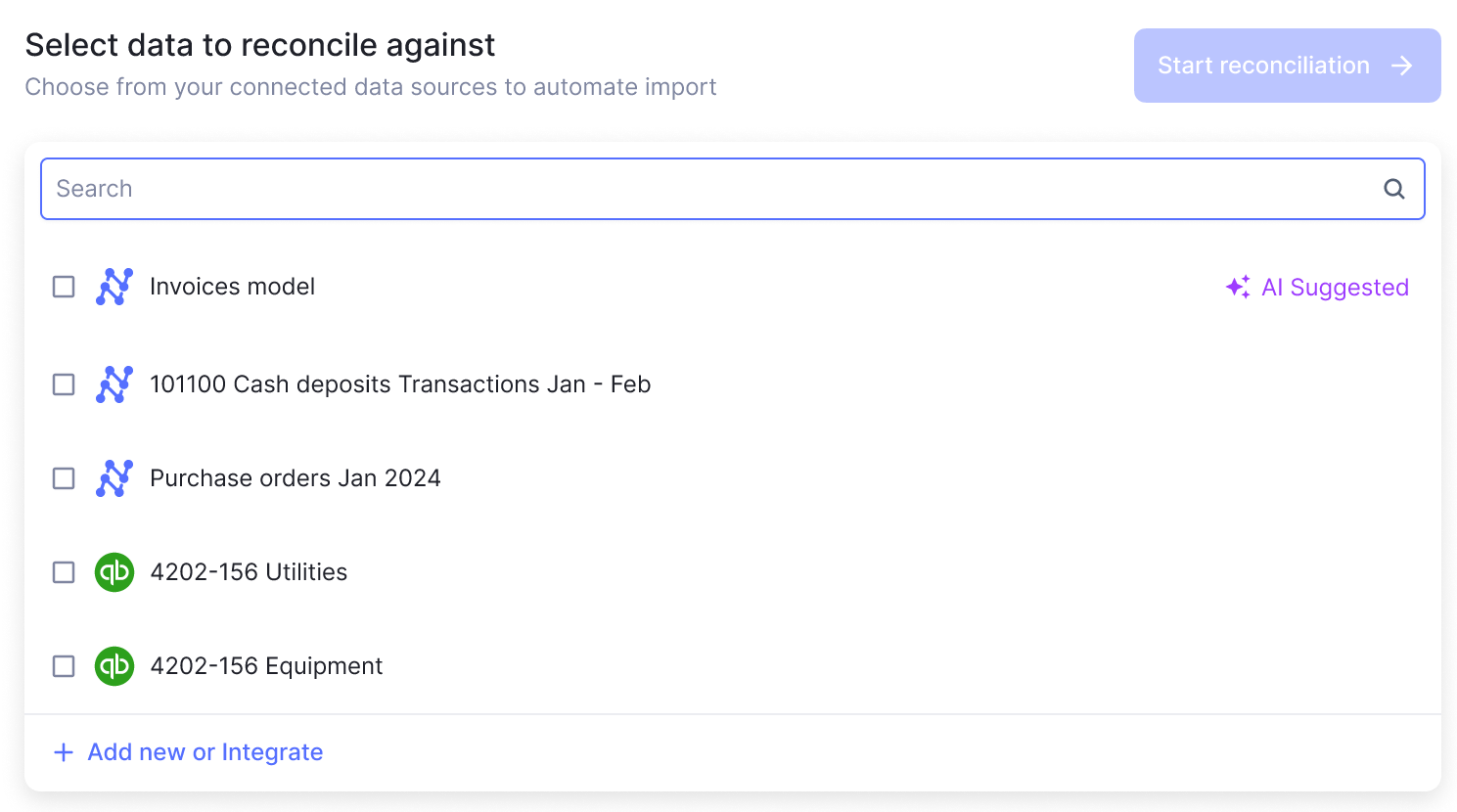

Nanonets integrates data from multiple financial sources, extracts relevant data from documents, and matches data across different sources. It also facilitates automated review and approval workflows and provides a central repository for supporting documentation.

Here are some of the key features of Nanonets that make it a valuable tool for account reconciliation:

- Automated document processing: Nanonets can automatically process documents from multiple sources, such as bank statements, invoices, and receipts. This eliminates the need for manual data entry, which can save time and reduce errors.

- Data extraction: Nanonets uses optical character recognition (OCR) to extract relevant data from documents. This data can then be used to match transactions across different systems.

- Data matching: Nanonets uses rule-based matching to identify and reconcile transactions across different systems. This helps ensure that all transactions are accounted for, and there are no errors.

- Workflow automation: Nanonets can automate the account reconciliation process, from data entry to approval. This can free up time for accountants to focus on other tasks.

- Centralized repository: Nanonets provides a central repository for supporting documentation. This makes it easy to find and access documents when needed.

If Nanonets meets your business requirements, you can get in touch for a

customized quote.

2. Xero

Xero is a cloud-based accounting software for small businesses, startups, and growing companies. It offers a variety of features, including bookkeeping, accounting, invoicing, and inventory management.

Xero can be extended through third-party integrations for additional functionalities. It is a scalable solution that can grow with your business.

Here are some of the key features of Xero:

- Cloud-based: Xero is a cloud-based software, which means you can access it from anywhere with an internet connection.

- Scalable: Xero can be scaled to meet the needs of your business, whether you're just starting out or have hundreds of employees.

- User-friendly: Xero is easy to use, even if you don't have any accounting experience.

- Secure: Xero is secure, with data encryption and two-factor authentication.

Pricing: Plans start at $13 per month.

3. QuickBooks

QuickBooks is a widely recognized accounting software that caters to businesses of all sizes. Known for its user-friendly interface, comprehensive feature set, and seamless integration with third-party applications, QuickBooks simplifies financial management tasks and is especially suitable for SMEs looking for a simple, seamless solution for their financial accounting needs.

- Widely recognized accounting software

- User-friendly interface

- Comprehensive feature set

- Seamless integration with third-party applications

- Affordable pricing and extensive support ecosystem

- Pricing: Plans start at $25 per month.

4. BlackLine

BlackLine is a cloud-based software platform that automates and streamlines the financial close process. It can help businesses save time and money, reduce errors, and improve compliance.

Here are some of its key features:

- Reduce errors: BlackLine can help to reduce errors by automating the reconciliation of accounts and preparing financial statements.

- Improve compliance: BlackLine can help businesses ensure compliance with accounting standards and regulations by providing visibility and control over the entire financial close process.

- Improve visibility and control: BlackLine can help businesses track progress, collaborate with teams, and ensure compliance with accounting standards and regulations.

- Streamline processes: BlackLine can help businesses streamline their financial close process by automating manual tasks and providing visibility and control.

Pricing: Available on custom quote.

5. Oracle Netsuite

Oracle Netsuite offers a cloud-based suite of financial management solutions designed to streamline accounting processes and drive business growth. With features like real-time financial reporting, automated billing, and customizable dashboards, Netsuite provides businesses with the tools they need to manage their finances effectively.

Its integration capabilities, scalability, and industry-specific solutions make it a compelling option for businesses across various sectors.

- Cloud-based suite of financial management solutions

- Real-time financial reporting

- Automated billing processes

- Customizable dashboards

- Industry-specific solutions

- Pricing: Customized pricing based on business requirements.

Benefits of Account Reconciliation software

Utilizing account reconciliation software offers numerous advantages for businesses aiming to enhance their financial processes and decision-making capabilities. Here are some of the key benefits:

- Enhanced Efficiency through Automation: These tools significantly reduce the need for manual intervention by automating the reconciliation process, thereby streamlining tasks that are repetitive and time-consuming. This not only saves valuable time but also increases the overall efficiency of financial operations.

- Empowered Strategic Planning: By freeing finance and financial planning & analysis (FP&A) teams from the clutches of manual processes, account reconciliation software enables them to concentrate on more critical tasks. This focus on strategic initiatives rather than routine data entry helps in driving the company's financial strategy forward.

- Increased Reporting Accuracy: The software ensures the accuracy and reliability of financial reports by providing a detailed and comprehensive view of all transactions. This precision aids in quickly identifying and rectifying any account discrepancies, thereby maintaining the integrity of financial records.

- Real-Time Financial Insights: One of the standout features of account reconciliation software is its ability to deliver real-time insights into a company’s cash flow. This capability allows business owners and financial managers to make informed decisions based on current financial data, enhancing the agility and responsiveness of the business to changing financial landscapes.

Why Your Organisation Needs an Automated Reconciliation Software

Automated reconciliation software like Nanonets can help businesses save time, reduce errors, and improve compliance. Here are some reasons why you should consider using automated reconciliation software:

- Automated Transaction Matching:

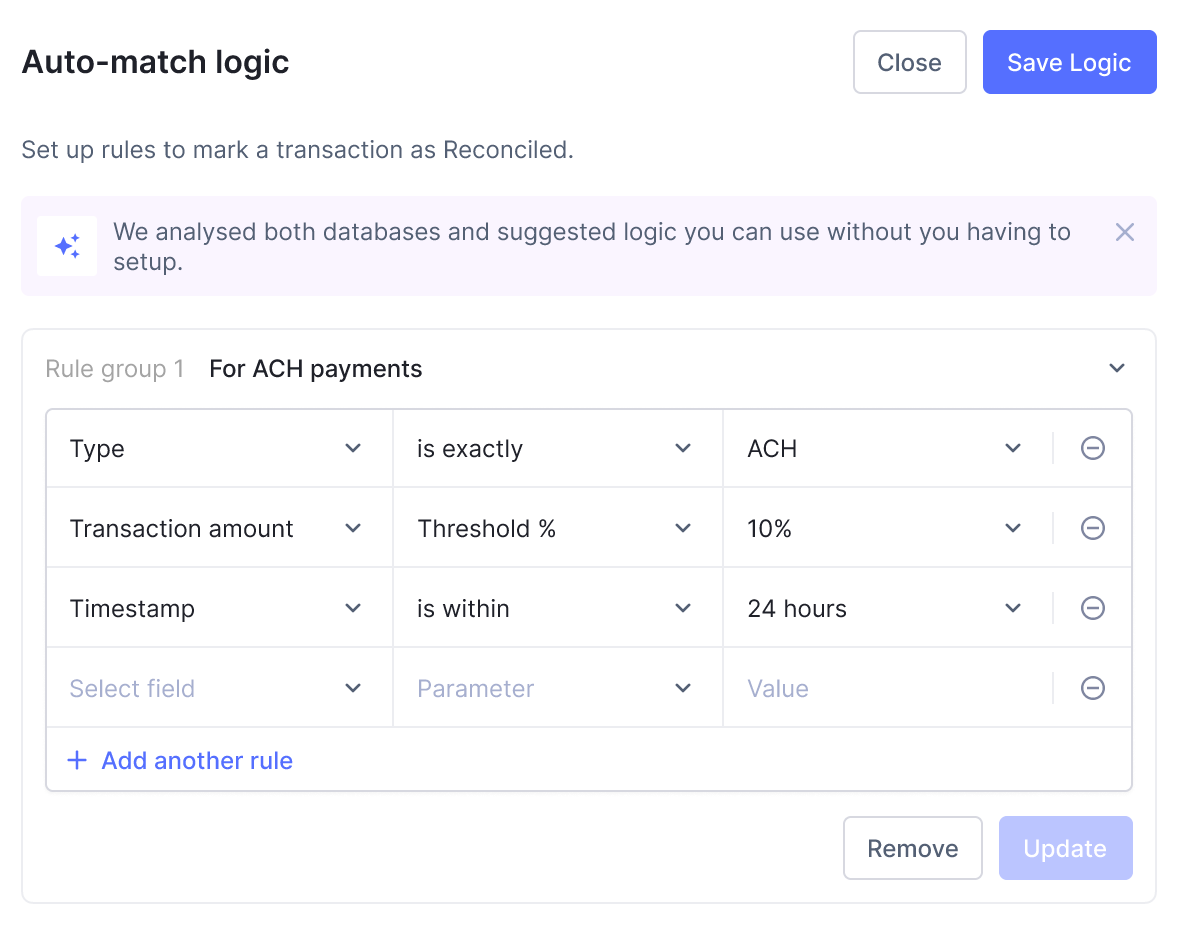

On Nanonets, you can leverage Nanonets' Intelligent Document Processing trained on 1M+ documents to leverage automated matching of transaction entries. This mean those transactions are identified as the best match based on column names, date, amount etc ensuring 95% accuracy. When these algorithms fail Nanonets tries to make a match using fuzzy matching capabilities as a failsafe. You can always setup custom rules as matching logic.

- Data Ingestion and Management:

Once your ledger entries are extracted with 99% accuracy using zero shot data extraction models you will be able to chose between multiple financial sources to reconcile from. These integrations are possible since Nanonets positions itself as a workflow automation platform specialising in financial data managements.

- Intelligent Matching Rules:

You can set up your own custom matching logic based on specific rules in order to manage specific use cases effectively. These act as failsafes so as to reduce the number no match transaction entries. Nanonets AI uses transferred learning to continuously learn from these custom rules defined to automate matching with higher accuracy over time.

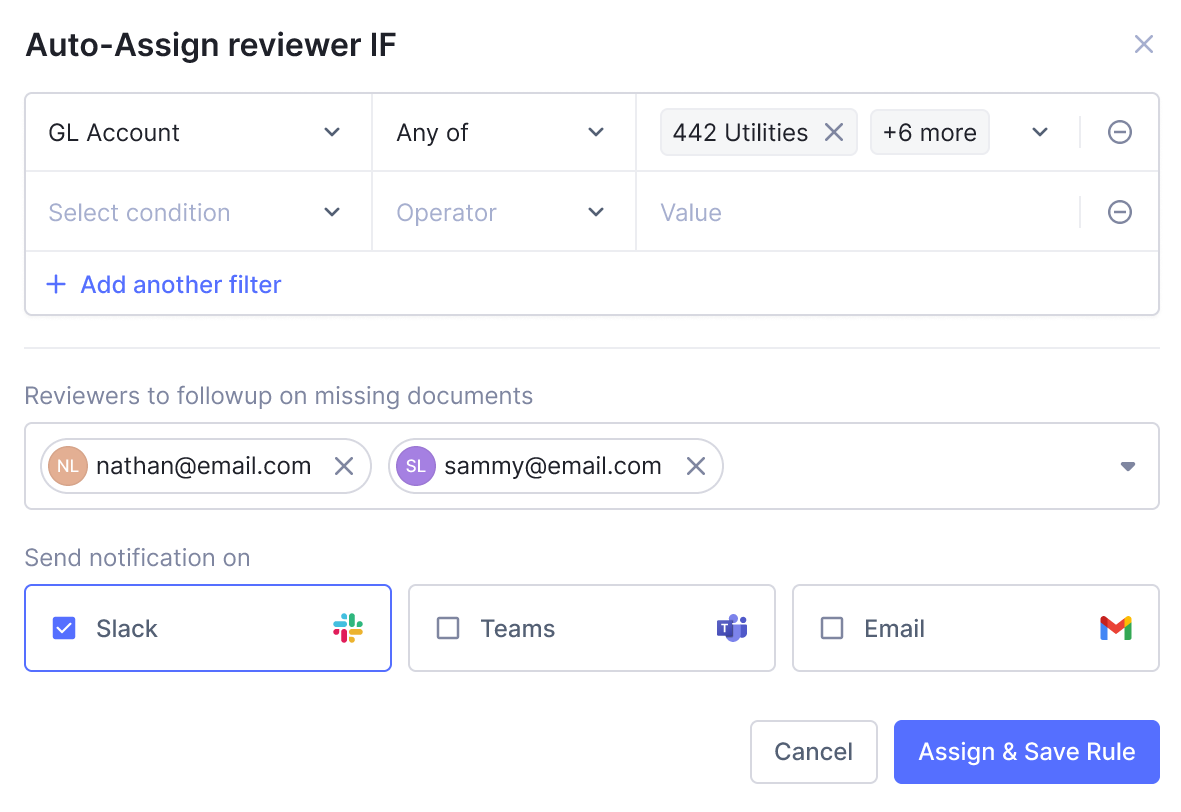

- Exception Management:

Using Nanonets Workflow Automation capabilities to alert exceptions during your automated transaction matching process can help result in faster and timely reconciliations. This is achieved by alerting the relevant stakeholders in taking prompt actions and recording audit trails throughout the journey.

- Integration with Accounting Systems:

Leverage streamlining your data flows and avoid manual entry by integrating Nanonets with all your accounting tools. By automating the reconciliation process end-to-end, automated reconciliation software like Nanonets improves accuracy, reduces errors, and provides valuable insights into a company's financial health

FAQs for Reconciliation software

What is account reconciliation software?

Account reconciliation software is a tool that automates the process of comparing and verifying financial records from different sources, such as bank statements, general ledgers, and accounting systems. It helps identify and correct discrepancies to ensure the accuracy and integrity of financial data

How does account reconciliation software work?

Account reconciliation software works by automatically matching transactions between internal financial records and external statements. It can import data from various sources, apply customizable matching rules, highlight exceptions, and generate detailed reports.

When should a business consider investing in account reconciliation software?

Businesses should consider investing in account reconciliation software when they experience growing transaction volumes, multiple bank accounts, or complex reconciliation needs. As a business scales, manual reconciliation becomes increasingly challenging and error-prone, making software a valuable tool for maintaining financial accuracy and efficiency