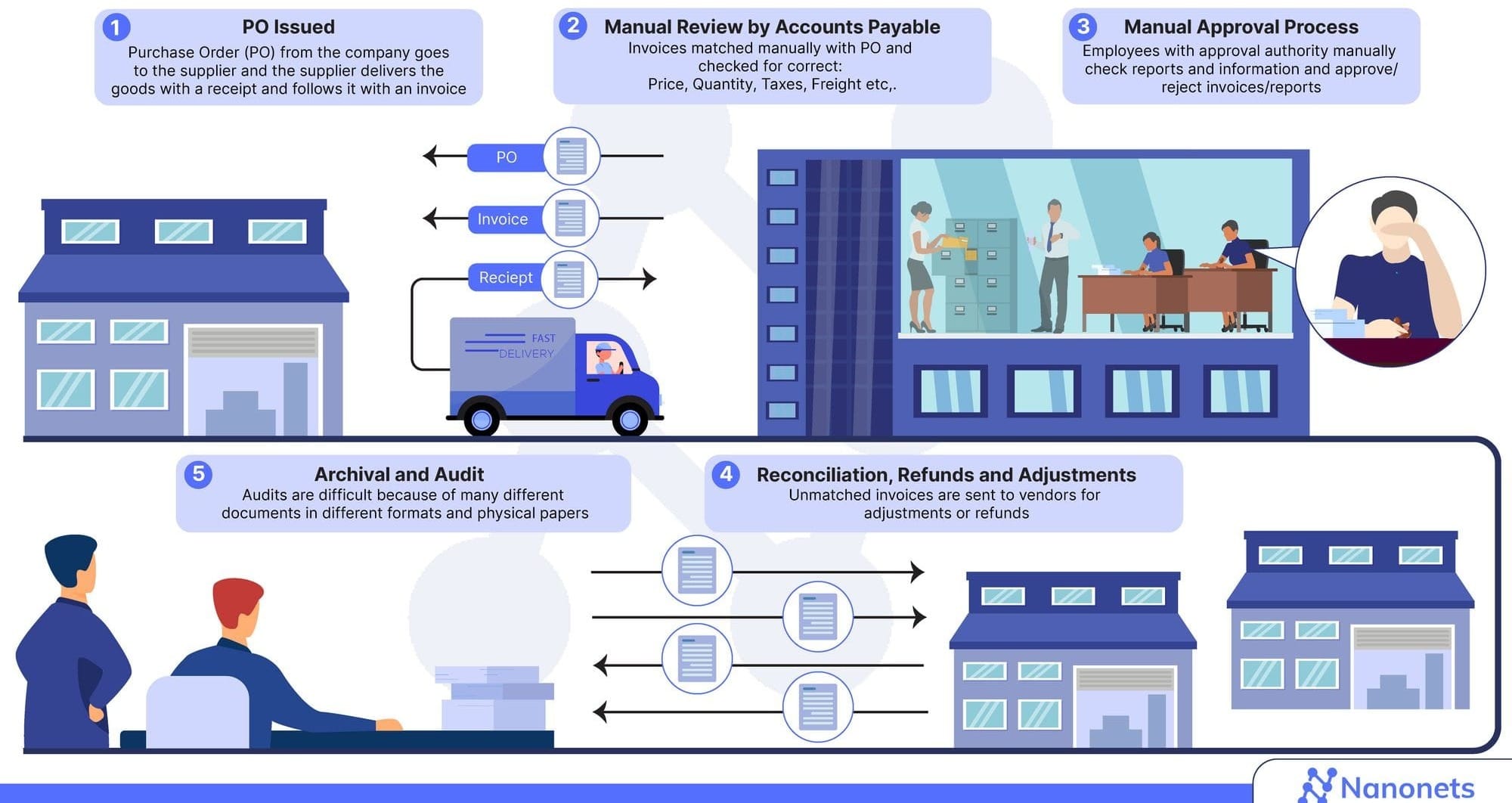

The last time you manually matched an invoice with a purchase order, you overlooked a mismatch in quantities, resulting in overpayment and a headache-inducing reconciliation process. So, this time, you're determined to get it right. You're squinting at the screen, comparing every line item, making sure everything matches perfectly.

If this sounds all too familiar, you're not alone. Manual invoice matching is a pain point for many accounts payable (AP) professionals. It's time-consuming, error-prone, leading to delayed payments, strained vendor relationships, and increased processing costs.

But what if there was a better way? Automating invoice matching can help reduce manual work, minimize errors, and streamline your AP process. In this guide, we'll explore the different types of matching, the challenges involved, and how automation can transform your invoice processing workflow.

Understanding invoice matching

Invoice matching is the process of comparing an invoice received from a supplier with the corresponding purchase order (PO) and, in some cases, the goods receipt (GR) or other supporting documents.

The purpose of invoice matching is to ensure that the details on the invoice, such as item descriptions, quantities, and prices, match the information on the PO and that the goods or services have been received as expected. This process helps prevent errors, fraud, and overpayments while ensuring timely and accurate payment to suppliers.

This underlines the importance of efficient invoice-matching processes in achieving superior AP performance.

Now let's take a closer look at some key terms you'll encounter in this process:

- Deviations: During the invoice matching process, discrepancies may arise between the invoice and supporting documents. These discrepancies are called deviations and can be related to price, quantity, or other factors.

- Tolerance: To manage these deviations, organizations set tolerance levels. These are the acceptable range of variance between the invoice and supporting documents. For instance, say the invoice amount is $100, but the PO shows $99. In this case, the invoice may be approved for payment despite the mismatch. This is because the difference falls within the company's accepted tolerance level. It is a small margin of error they're okay with.

- Holds: If the deviation exceeds the tolerance level, the invoice is put on hold pending further investigation. Say the company in the earlier example has a tolerance level of $1. If the invoice amount is $105, but the PO shows $100, the invoice will be put on hold and flagged for review. Holds ensure that only valid invoices are processed for payment, reducing the risk of errors and overpayments.

How does invoice matching work?

The process involves comparing key data points from the invoice with the corresponding data on the PO and other supporting documents. These data points typically include item descriptions, quantities, unit prices, total amounts, taxes and other charges, and delivery dates and terms.

Let’s breakdown the invoice matching process into steps:

- Invoice Receipt: An invoice is received from the vendor detailing the goods or services provided. It could received as a paper document, email attachments of scanned PDFs, or in structured, digital format, such as XML.

- PO comparison: The invoice is matched against the purchase order to confirm that the details—like quantity and price—align with the initial agreement. Any deviations between the invoice and PO are identified at this stage.

- Receiving report verification: The invoice is checked against the receiving report to ensure the goods or services were delivered as stated. Deviations in quantity or quality may be detected during this step.

- Discrepancy identification: Any differences between the invoice, PO, and receiving report are flagged for review. These deviations can relate to price, quantity, or other factors.

- Tolerance check: Minor discrepancies within set limits are accepted automatically while larger issues are flagged and held for investigated.

- Resolution and payment: Issues are resolved, and once verified, the invoice is approved for payment.

- Record keeping: Processed invoices are archived for accurate financial records and audits.

This streamlined approach ensures payments are accurate and aligned with your agreements, minimizing errors and fraud.

Types of invoice matching and when to use them

There are three main types of invoice matching: 2-way matching, 3-way matching, and 4-way matching. Each type has its own unique process, benefits, and ideal use cases.

Here's a breakdown of each type:

2-way matching

The simplest form of invoice matching. It involves comparing the invoice with the corresponding purchase order to ensure the details match up. This type of matching is best suited for straightforward purchases with minimal risk of discrepancies.

When to use 2-way matching:

- For low-value, high-volume purchases

- When dealing with trusted, long-term suppliers

- For services or intangible goods that don't require a physical receipt

The processing times are faster naturally due to the fewer documents to verify. The complexity is also lower, making it easier to automate. You can implement it when working with reliable suppliers because of the lower risk of errors and discrepancies. However, 2-way matching offers less protection against errors or fraud than more comprehensive matching methods.

3-way matching

It takes the process a step further by comparing the invoice, purchase order, and goods receipt or packing slip. This type of matching ensures that the details match up and that the goods or services have been received in the correct quantity and condition.

When to use 3-way matching:

- For high-value, low-volume purchases

- When dealing with new or less-established suppliers

- For physical goods that require proof of delivery and inspection

3-way matching provides enhanced accuracy and control, reducing the risk of paying for goods not received or services not rendered. It's handy for better compliance with internal policies and external regulations. However, it requires more time and resources to process invoices than 2-way matching.

4-way matching

The most comprehensive type of invoice matching. In addition to comparing the invoice, purchase order, and goods receipt, it also involves verifying the inspection report or quality control report. This type of matching is typically used in industries with strict quality requirements or complex supply chains.

When to use 4-way matching:

- For critical purchases with high-quality standards

- In industries such as aerospace, automotive, or pharmaceuticals

- When dealing with suppliers located in different countries or subject to international trade regulations

It offers the highest level of control and accuracy, ensuring that all aspects of the purchase, from ordering to quality inspection, are thoroughly verified. This approach minimizes the risk of paying for substandard goods or services. It also enables better tracking and traceability of materials and components throughout the supply chain.

However, it's also the most time-consuming and resource-intensive method, potentially leading to longer processing times and increased costs.

Here's a quick overview of the documents required for each type of invoice matching:

| Matching Type | Documents Required | Key Fields to Match |

|---|---|---|

| 2-Way | 1. Purchase Order 2. Invoice |

- Billed Quantity: Invoice quantity ≤ PO quantity - Invoice Price: Invoice price ≤ PO price |

| 3-Way | 1. Purchase Order 2. Goods Receipt 3. Invoice |

- Billed Quantity: Invoice quantity ≤ GR quantity - Invoice Price: Invoice price = PO price - Received Quantity: GR quantity ≥ Billed quantity |

| 4-Way | 1. Purchase Order 2. Goods Receipt 3. Inspection Report 4. Invoice |

- Billed Quantity: Invoice quantity ≤ PO quantity and Accepted quantity - Invoice Price: Invoice price = PO price - Received Quantity: GR quantity ≥ Billed quantity - Accepted Quantity: Accepted quantity ≥ Billed quantity |

Choosing the right matching type depends on your organization's needs, risk tolerance, and resource availability. Many organizations even combine matching types, applying more rigorous checks to high-value or critical purchases.

Identify common challenges in the invoice-matching workflow

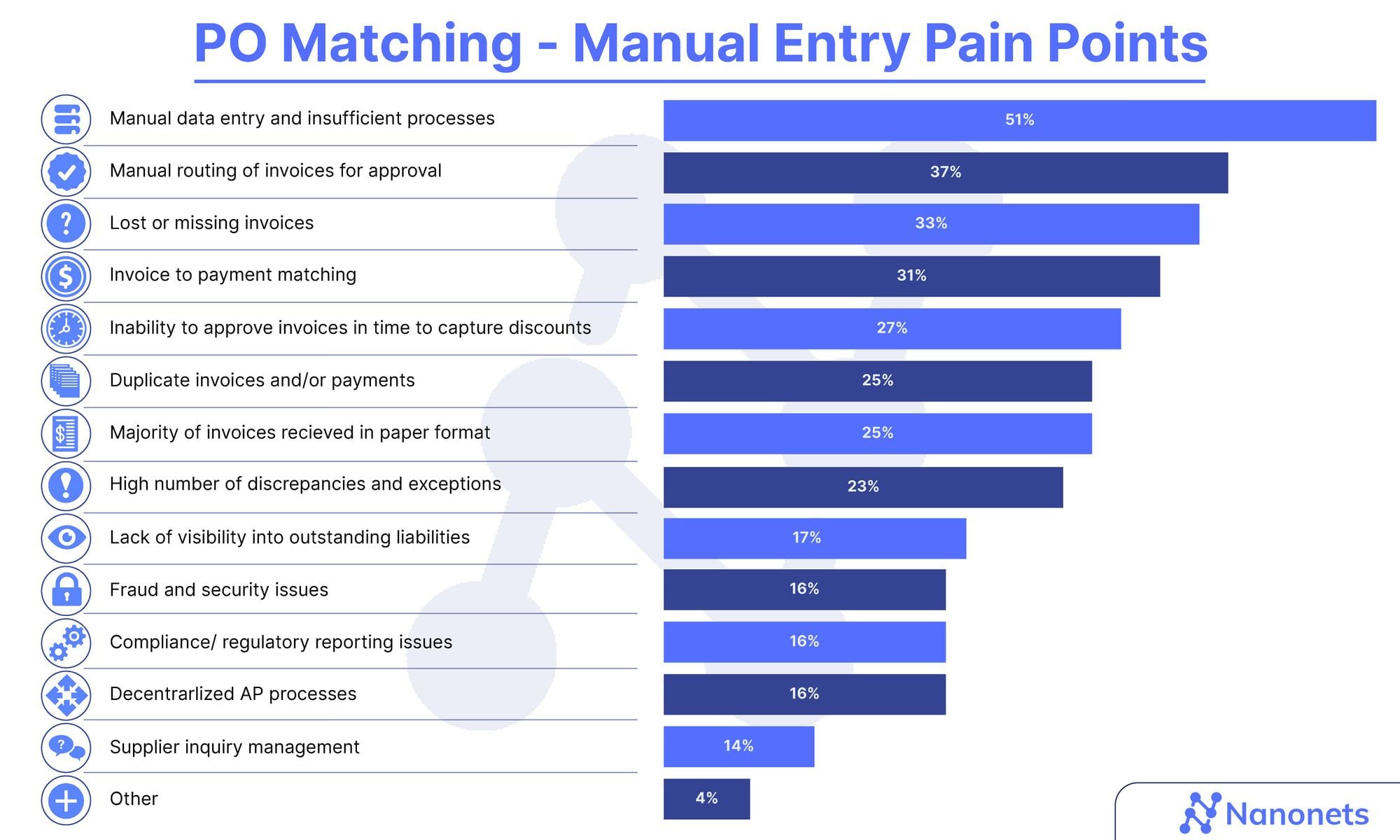

AP teams are always under pressure to process invoices quickly and accurately. With their performance being evaluated on metrics like the cost to process a single invoice, time to process a single invoice, invoice exception rate, and early payment discount capture rate, it's crucial to identify what is hindering their ability to keep up with the growing workload.

This stark difference highlights the challenges AP teams face when dealing with manual invoice-matching processes.

Let's explore some of these challenges in more detail:

1. Difficulty in accessing and comparing data across multiple documents

When you’re trying you match invoice data, the last thing you want is to waste time searching for documents across multiple systems. It can be a real pain. For instance, the invoice might be a scanned PDF, the purchase order could be in an Excel spreadsheet, and the goods receipt might be in your NetSuite inventory system.

AP Manager: "Did you check the Google Drive shared folder? I think I saw some POs there the other day."

AP Specialist: "Seriously? Okay, I'll take a look, but this is so frustrating. Why can't we just have everything in one place?"

This fragmented approach makes data comparing error-prone. Amidst all the tab-switching, typos and wrong decimal placements can easily slip through, leading to mismatches and delays. Moreover, the lack of a centralized system makes it challenging to maintain version control and ensure everyone is working with the most up-to-date information.

2. Inconsistent data formats and units of measurement

This issue arises because different suppliers, departments, and systems may use varying formats for dates, currencies, and units of measure. Some may use MM/DD/YYYY for dates, while another uses DD/MM/YYYY. Similarly, some may use metric units, while others use imperial units.

Such inconsistencies may force you to hold invoices even when there are no real issues, causing unnecessary delays and frustration for both parties. The worst part is that if these slip through, it could lead to further confusion. For example, a date inconsistency could cause you to pay an invoice before the due date, impacting your cash flow.

3. High volume of invoices

As businesses grow, the volume of invoices that need to be matched and processed increases exponentially. However, the accounts payable team often remains the same size, leading to a disproportionate workload for the existing members.

When AP teams are forced to cut corners or simplify their matching process, it may increase the risk of errors. It could damage your bottom line and strain supplier relationships. The increased workload can also lead to decreased employee morale, higher stress levels, and burnout, resulting in higher turnover rates and additional spending on hiring and training new staff.

4. Inconsistent or inaccurate data across systems

When your ERP and accouting software are not properly integrated or synchronized, it can lead to data discrepancies. Sometimes, it might be due to manual data entry errors or delays in updating information across systems.

This lack of real-time sync can lead to delays in the invoice-matching process. Your AP staff would end up spending more time reconciling data and resolving discrepancies. This can result in late payments, missed early payment discounts, and strained supplier relationships.

5. Lack of visibility and guidance for handling exceptions

Exceptions and disputes often arise during matching due to discrepancies. To resolve them, you need the AP team, suppliers, and internal departments to collaborate with each other. If there are information silos and lack of standardized workflows for handling exceptions, the process can become chaotic and time-consuming.

Tom [AP Specialist]: @Sarah, I found a quantity mismatch on that invoice two weeks ago. I followed our process and flagged it for purchasing to review on the Shared Drive. But get this -- I checked with their manager, and apparently, they don't even use that folder anymore! They've got a new email inbox for exceptions. I've sent the details to the right email now and asked for an urgent response.

This lack of a standardized process for handling exceptions leads to miscommunication and delays when collaborating with purchasing or receiving departments. It can strain relationships with suppliers, who may become frustrated with the lack of transparency and timely communication. The end result would be missed deadlines, late fees, and damage to the your reputation.

6. Managing multiple invoice formats

You may receive invoices from various suppliers in different formats, such as PDFs, scanned images, spreadsheets, and XML. This lack of standardization occurs because each supplier has their own invoicing system and preferences. Your AP team ends up having to manually process and consolidate the data.

If you don't handle this issue effectively, it can lead to increased error rates, delays in processing, and potential overpayments or duplicate payments. Furthermore, your team will lose a ton of time on manual file conversions or copy-pasting data. This means less time for supplier relationship management and financial analysis.

7. Fraud and theft risks

You may fall for fake invoices that closely resemble legitimate ones but with modified payment details. Or the same invoice could be submitted multiple times, often with slight variations. These fraudulent schemes can slip through manual invoice matching because when you rely solely on human oversight, it's easy to miss subtle discrepancies or duplicates.

The consequences of fraud include direct financial losses, reputational damage, and the time and resources required to investigate and resolve the issue. It can also have a significant psychological impact on AP staff, leading to increased stress and reduced morale. Audits and legal proceedings may further strain your resources.

How to improve your invoice-matching workflow

According to The State of ePayables 2024 report, best-in-class performers who adopted automation and AI spend an average of $2.78 and 3.1 days to process a single invoice, compared to $12.88 and 17.4 days for those relying on manual processes. Automating your invoice-matching workflow can significantly reduce costs, minimize errors, and improve efficiency.

Let’s explore the different ways you can optimize your invoice-matching process:

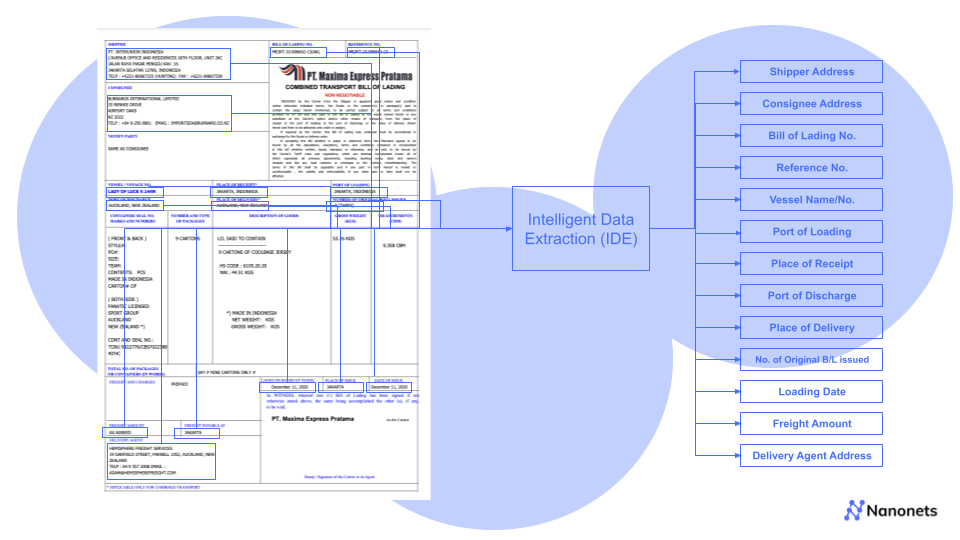

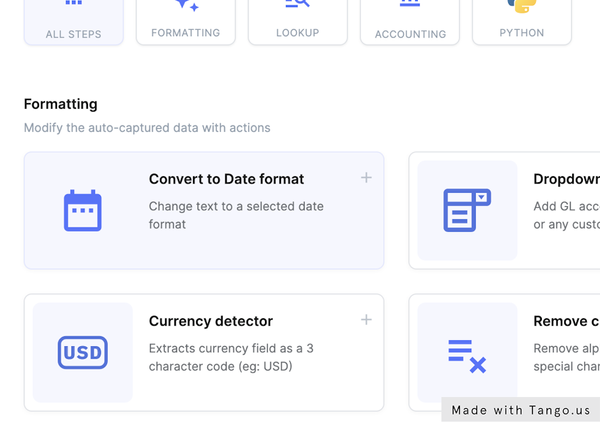

1. Automate data capture and extraction

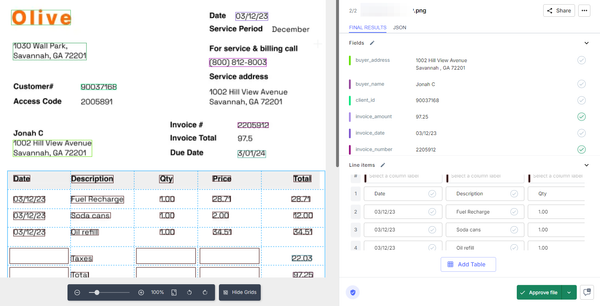

Imagine being able to automatically grab important information from your invoices, purchase orders, and receipts. Intelligent Document Processing tools use advanced OCR (optical character recognition) and AI to accurately pull out key details like invoice numbers, dates, line items, quantities, prices, and totals — even from unstructured data like scanned PDFs or images.

The system can handle everything from standard invoice templates to international formats and even handwritten notes. The AI also learns from corrections and adapts to different layouts, so it gets smarter over time.

With manual data capture reduced, exceptions and discrepancies will also be easier to spot. Moreover, comparing data will involve less tab-switching or copy-pasting between systems. Everything is automatically extracted and consolidated in a centralized system — whether it is on your email inbox, ERP, or a shared drive. This streamlined data capture process saves your team hours of manual work and reduces the risk of errors.

2. Use AI to automate invoice matching

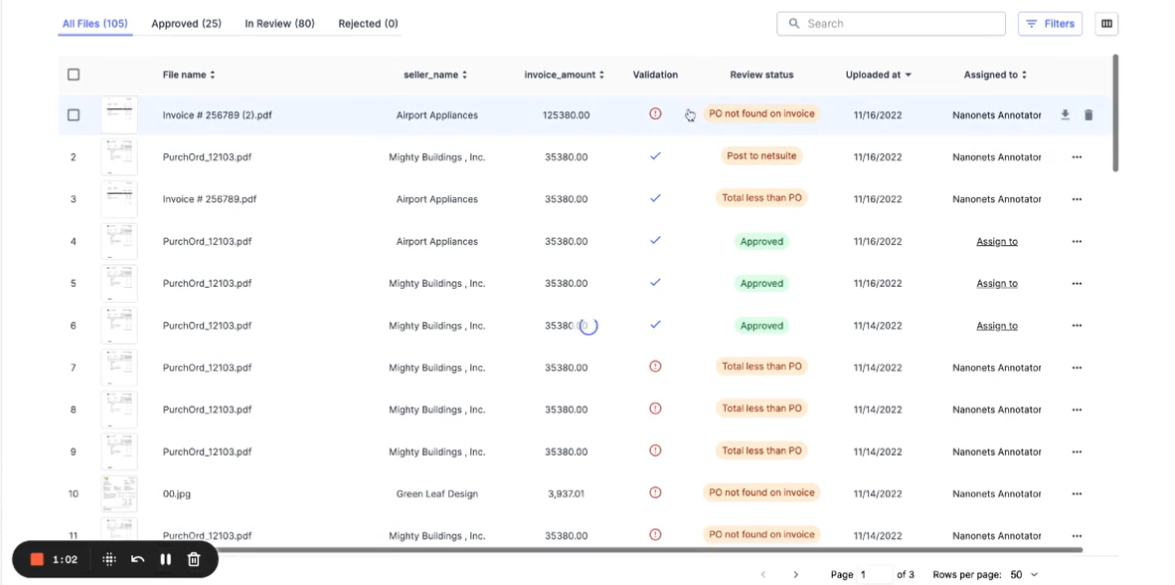

IDP tools can automatically compare invoices with purchase orders (2-way matching), purchase orders and receiving documents (3-way matching), or purchase orders, receiving documents, and inspection reports (4-way matching).

The system uses compares key details like item descriptions, quantities, prices, and totals across all your documents. If everything matches up, the invoice can be automatically approved for payment. If there are any differences, like a price discrepancy or a missing receipt, the system will flag them for review and show you exactly where the mismatch is.

With AI-powered matching, you have the flexibility to choose the level of matching that makes sense for your business. If you're dealing with low-value, low-risk invoices, 2-way matching might be sufficient. But for high-value, high-risk invoices, you might want the added security of 3-way or even 4-way matching.

In addition to header-level matching, IDPs can perform line-item matching. This granular matching compares the line-item details from invoices against the corresponding line items in POs, helping identify discrepancies at the item level and preventing overbilling.

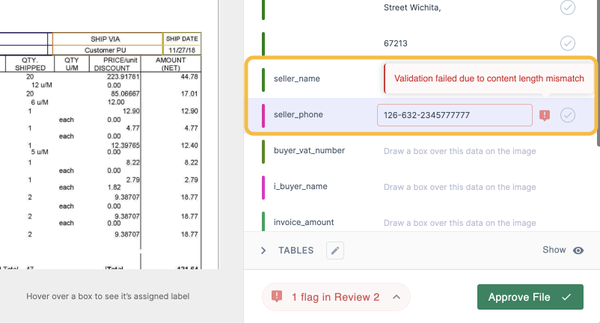

3. Set up automated validation rules and tolerances

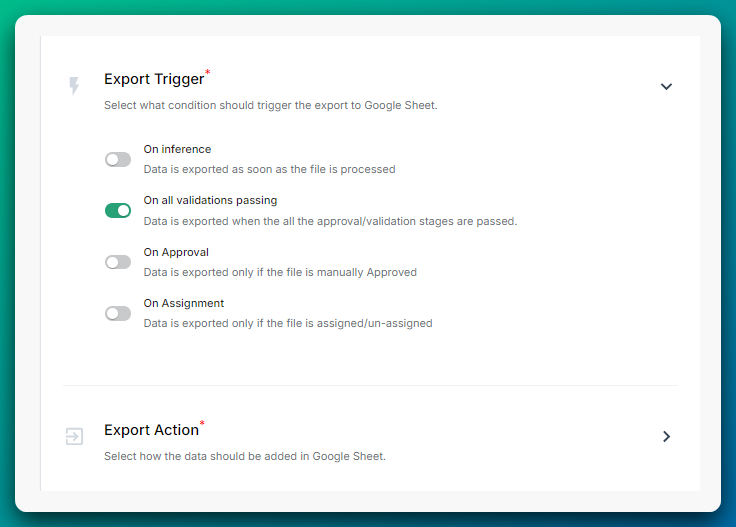

Sometimes, invoices might have small differences from purchase orders or receipts, like slightly different prices or quantities. Instead of flagging every little difference for review, you can set up automated validation rules and tolerances in your AI-powered system.

For example, you can create a rule that says if the price on an invoice is within a certain percentage (like 5%) of the price on the purchase order, it's close enough and can be automatically approved. Or if the quantity is off by less than a certain number of units (like 10).

By setting up these rules and tolerances, you can cut down on the number of exceptions your team has to review manually. The system will only flag invoices with bigger discrepancies that need a closer look, based on your predefined criteria.

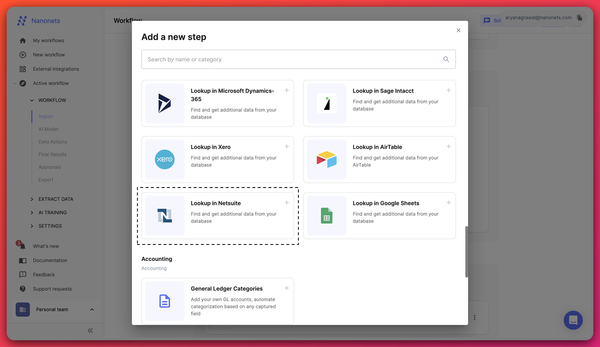

4. Ensure smooth data flow and collaboration

To really smoothen your invoice matching workflow, it's important to connect your AI-powered system with your other business tools, like your ERP and accounting software. This way, information can flow smoothly between all your systems, and everyone can work together more easily.

When you integrate your systems, you can automatically send matched invoices to accounting software like QuickBooks, Xero, or NetSuite for payment processing. You can also pull in purchase order and receipt data from ERP systems like SAP, Oracle, or Microsoft Dynamics to make matching even faster.

Plus, with everything connected, your whole team can see the status of invoices and work together to resolve any issues. No more digging through emails or chasing down paper trails. Real-time syncing data between systems also ensures that everyone is working with the most up-to-date information.

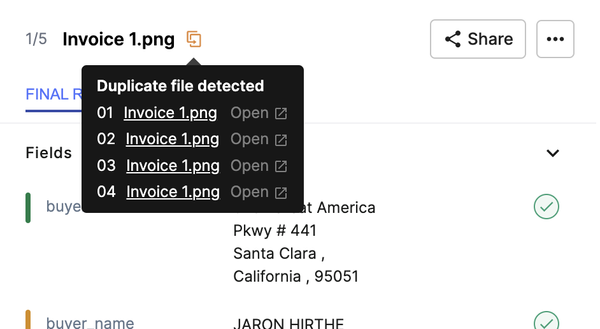

5. Use AI to detect duplicate invoices and potential fraud

Sometimes, vendors might accidentally (or not so accidentally) submit the same invoice more than once. Or, in rare cases, someone might try to sneak in a fake invoice. AI can help catch these duplicate and potentially fraudulent invoices before they slip through the cracks.

AI-powered tools can compare file names and metadata to identify invoices that have already been processed. They can also scan your invoices and compare them to past ones, looking for matches or suspiciously similar details. The system can flag any potential duplicates or fraud for review, so you can catch them early and avoid paying twice or paying for something you didn't actually order.

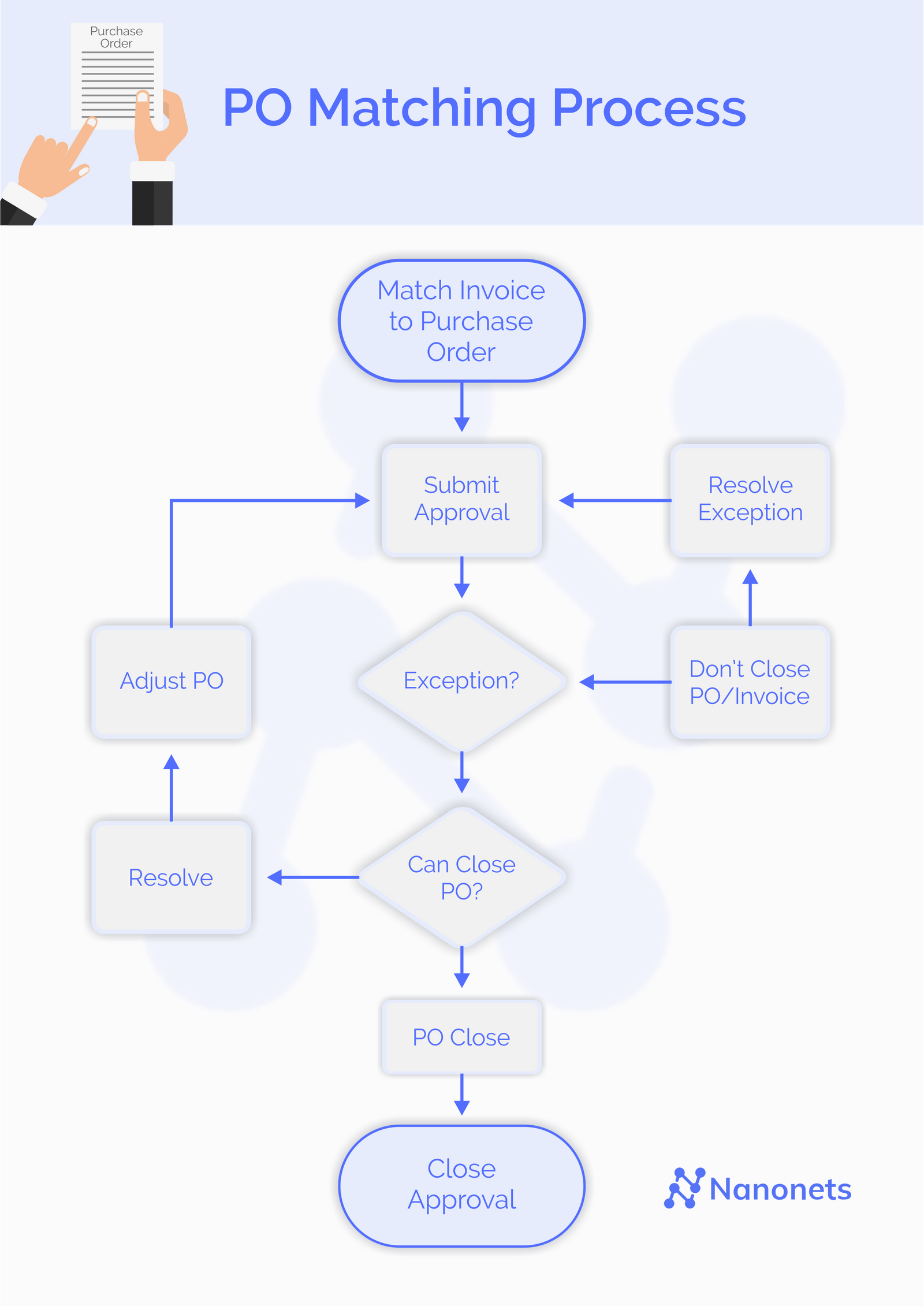

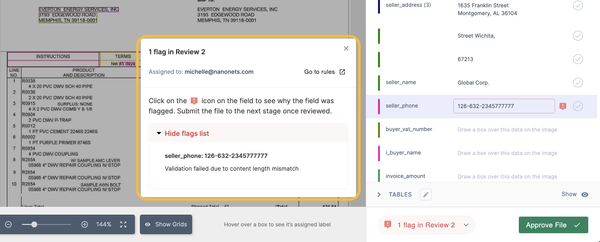

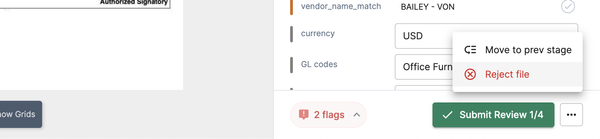

6. Create exception handling workflows

There will always be some invoices that don't match up perfectly with purchase orders or receipts. That's where exception handling workflows come in.

With these workflows, you can automatically route mismatched invoices to the right people for review, based on the type of discrepancy. For example, if the price is off, it might go to the purchasing team. If the quantity doesn't match the receipt, it might go to the warehouse team.

By setting up these automated workflows in your IDP system, you can make sure exceptions get resolved quickly, by the people who are best equipped to handle them. No more invoices getting lost in the shuffle or sitting in someone's inbox for weeks.

7. Add missing invoice data from external sources

Sometimes, invoices might be missing important information, like a vendor address or a product code. Rather than chasing down that information manually, AI-powered tools can automatically fill in the gaps by pulling data from external sources.

For example, the system can check the vendor's name against your vendor database in your ERP system (like SAP or Oracle) and add in their full address and contact information. Or it can match a product description to your product catalog in your inventory management system and fill in the correct product code and price.

This makes matching even easier and more accurate, since the system has all the information it needs right from the start. Plus, it saves your team the time and hassle of manually looking up and entering that data.

8. Support global invoice matching

If your company works with international vendors, you know how tricky it can be to match invoices in different languages and currencies. But with IDPs that support multi-language and multi-currency processing, it doesn't have to be a headache.

These tools can automatically detect the language of an invoice and extract the relevant information, no matter what format it's in. They can also convert currencies to your standard currency, like USD or EUR, for easy matching and reporting.

Plus, data standardization and conditional formatting features can help ensure that all your invoice data is in a consistent format, regardless of where it came from. You can also apply country-specific validation rules, like VAT calculations for European invoices or GST for Indian invoices, to make sure your global invoices are compliant with local regulations.

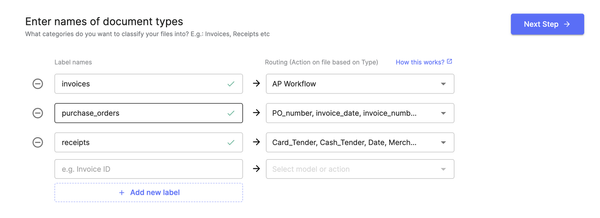

9. Sort incoming documents for faster processing

AI-based document classification can automatically categorize incoming documents into types like invoices, purchase orders, receipts, credit notes, etc. This ensures that only relevant documents are processed for matching, reducing errors and saving time.

By accurately classifying documents upfront, you can ensure that only relevant documents are pushed forward for matching. This saves your AP team valuable time that would otherwise be spent manually sorting through a mix of documents to find the invoices or POs that need to be matched.

Moreover, the IDP gets smarter over time. As it processes more documents, it learns to recognize different invoice formats and styles. This means that even as your business grows and you start receiving invoices from new suppliers, you can maintain high classification accuracy, keeping your invoice matching process efficient and error-free.

Now, if you are on the look out for an IDP solution that can help you implement these best practices, consider Nanonets. It is an AI-based platform that offers intelligent document processing capabilities to automate your invoice processing workflow end-to-end.

You can check out the following resources to learn more about how Nanonets can help streamline your invoice matching process:

2-Way Matching by integrating with NetSuite

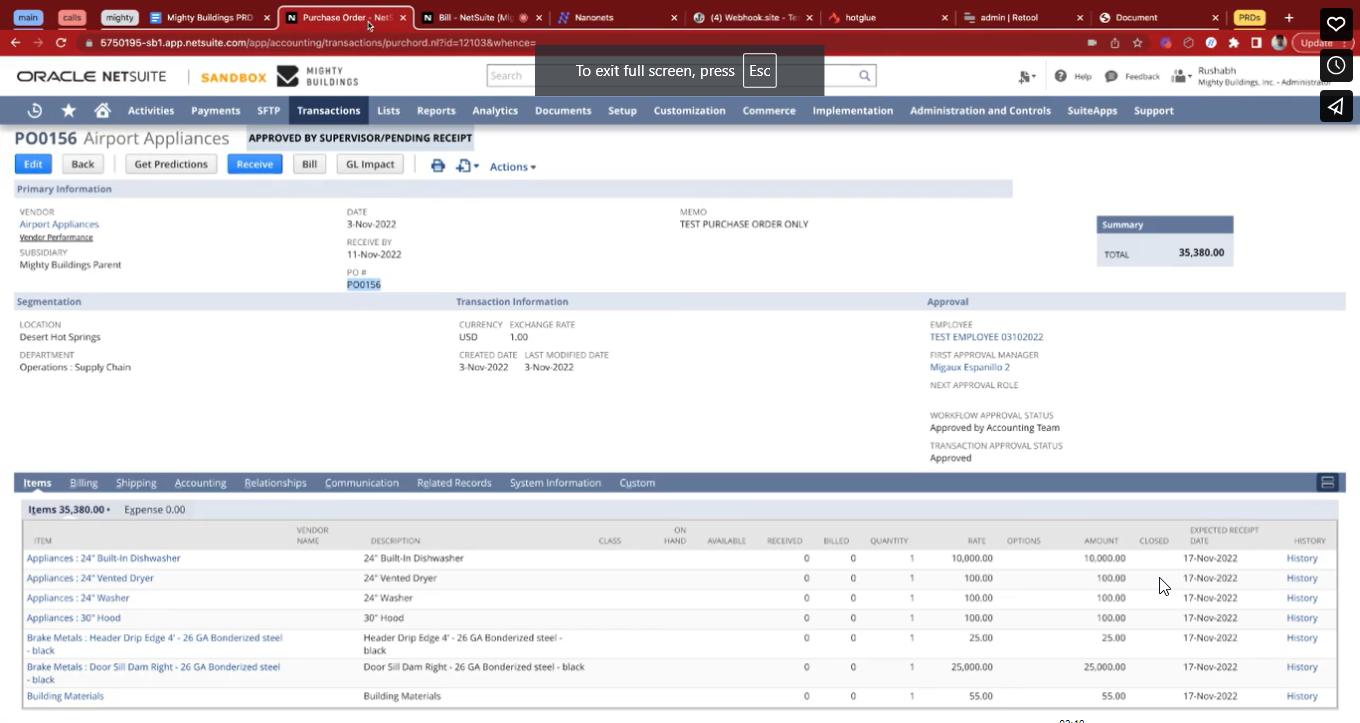

The demo showcases the creation of a purchase order in NetSuite, followed by the vendor sending the invoice and delivering the goods. Nanonets automatically extracts invoice data and compares it against the purchase order, checking for matching PO numbers, seller names, and totals.

You can see how Nanonets flags discrepancies, allows for corrections, and ultimately posts the matched invoice data to NetSuite, creating a corresponding bill with all the relevant information accurately associated.

2-Way Matching by integrating with NetSuite

3-Way Matching

By uploading three invoices and extracting key information such as PO numbers, DO numbers, and grand total amounts, Nanonets validates the data against corresponding records in MySQL databases.

The system flags any mismatches in grand totals between the invoice, purchase order, and delivery order, providing a clear view of discrepancies.

3-way matching demo video