If you've ever spent hours chasing down missing invoices, manually entering data, or chasing colleagues for approvals, you know the pain of inefficient accounts payable (AP) processes. They can be a headache for your team and a bottleneck for your business.

Luckily, AP automation solutions like Nanonets and Tipalti can help. These powerful tools streamline your workflows, reduce errors, and give you back valuable time and resources. But with both platforms offering compelling features, which one is the right fit for your needs?

In this head-to-head comparison, we'll test Nanonets and Tipalti. We'll also explore their key capabilities, pricing, user reviews, and more to help you determine which solution best suits you.

Nanonets vs. Tipalti at a glance

On the surface, Nanonets and Tipalti may seem like similar AP automation solutions. Both offer features like invoice processing, approval workflows, payment execution, and integrations with popular accounting software. However, when you dig deeper, some key differences emerge.

Nanonets is a better fit for businesses prioritizing ease of use, flexibility, and affordability. It offers a user-friendly interface, customizable workflows, and pricing that scales with your usage.

Tipalti, on the other hand, is geared towards larger enterprises with more complex AP needs. It provides advanced features like multi-entity support, global tax compliance, and supplier onboarding but has a higher price tag and longer implementation times.

Here's a quick comparison of Nanonets and Tipalti across critical AP parameters:

| Feature | Nanonets Rating | Tipalti Rating |

|---|---|---|

| Invoice capture and data extraction | 5 | 4.5 |

| Data management | 5 | 4 |

| Multi-language and multi-format processing | 5 | 4 |

| Supplier payment data validation | 4 | 5 |

| Compliance capabilities | 3 | 5 |

| Payment processing | 3 | 5 |

| Matching and approvals | 4 | 4.5 |

| Automated workflows | 4.5 | 4 |

| Integrations | 5 | 4 |

| Ease of use | 5 | 3.5 |

| GL Coding | 4 | 4 |

| Reporting and analytics | 4 | 4 |

Read About: Tipalti vs. Stampli

What is Nanonets?

Nanonets is a comprehensive workflow automation solution designed to streamline and simplify manual processes in businesses of all sizes. With advanced OCR and AI-powered data extraction, Nanonets enables enterprises to capture data from documents accurately, regardless of the format.

Nanonets Flow is our comprehensive AP automation platform designed to streamline and simplify the entire invoice processing workflow. It utilizes OCR technology, AI-powered data extraction, customizable approval workflows, ERP integrations, and real-time reporting.

The platform provides a user-friendly interface and guided onboarding to help businesses optimize their AP processes, save time, reduce errors, and improve financial control.

What is Tipalti?

Tipalti is an automation platform that provides a comprehensive suite of solutions to help businesses streamline their financial operations. Tipalti offers a range of tools for managing various aspects of the payables process, such as mass payments, procurement, and expense management.

The platform enables companies to manage their entire payables process, from invoice capture and approval to payment execution and reconciliation. Tipalti's AP automation solution includes multi-entity support, tax compliance, and fraud detection, allowing businesses to simplify and evolve their AP processes while focusing on growth and success.

Although Nanonets and Tipalti provide a wide range of business solutions, this article will focus solely on comparing their AP automation capabilities. In the subsequent sections, we'll delve deeper into each platform's unique strengths and potential limitations within the AP automation domain.

Nanonets: Advantages for AP teams

When comparing Nanonets vs. Tipalti, you must carefully consider each tool's pros and cons to make an informed decision. Nanonets stand out with the following key features:

- The AI-powered OCR technology accurately captures invoice data from any format, reducing manual data entry by up to 95%. This frees up your AP team to focus on more strategic tasks.

- The end-to-automation enables businesses to streamline their entire AP process, from invoice capture to payment processing, without manual intervention. This helps to save time, minimize errors, and enhance overall efficiency.

- Customizable approval workflows ensure invoices are routed to the correct approvers based on your organization's unique policies and hierarchy. This streamlines the approval process and reduces cycle times.

- Seamless integration with popular ERPs and accounting systems like NetSuite, QuickBooks, and Xero allows for automatic synchronization of invoice data. This eliminates the need for manual data entry and reduces the risk of errors.

- Automatically uses your bank statements and general ledger data to perform an automated reconciliation of your financial transactions. This will allow you to match your books and identify discrepancies faster, reducing the time required to close your books at month-end.

- Automated 3-way matching and discrepancy detection help identify potential issues early in the process, preventing overpayments and fraud.

- AI-powered GL coding predicts the correct GL codes for invoices based on historical data, reducing your AP team's time on this task while ensuring accuracy and consistency.

Tipalti: Advantages for AP teams

Tipalti brings a lot to the table when it comes to AP automation. Here are some of its key strengths:

- Support for payments to 196 countries in 120 currencies, making it easy to manage global transactions. Tipalti automates the entire international payment process, including tax compliance and regulatory reporting.

- A self-service multi-lingual supplier portal that simplifies onboarding and management for vendors worldwide. Suppliers can submit their information, including tax forms and payment details, automatically validated by the platform.

- Multi-entity and multi-subsidiary support that allows you to manage and reconcile payments across different business units and geographies. This provides a centralized view of your AP operations.

- Automated tax compliance and regulatory reporting for global payments, ensuring your business stays compliant with changing regulations across different countries and jurisdictions.

- Fraud detection and risk management features that identify suspicious transactions and supplier behavior, alerting your team to potential risks.

- Tipalti’s virtual credit or debit card allows users to easily manage and control business spending, reduce costs, and improve profitability. You can create cards on-demand with the proper controls and approvals, centralize spend, improve visibility, and reduce fraud risk.

Nanonets: Potential drawbacks

While Nanonets has a lot to offer, there are some areas where it could improve. If you're considering Nanonets for your AP automation needs, keep these potential drawbacks in mind:

- While Nanonets' AI-powered OCR technology is impressive, it requires some training to capture data from their specific invoice formats accurately. This may require some upfront time investment to ensure smooth processing.

- The UI could be more intuitive, especially for users new to AP automation. There may be a learning curve as users navigate the various features and settings.

- While Nanonets offers a range of features, the platform lacks certain advanced functionalities, such as extensive vendor management tools. This may be a limitation for businesses with complex vendor relationships or requiring more granular control over vendor interactions.

Tipalti: Potential drawbacks

Tipalti has been a go-to AP solution for over a decade, and for good reason. However, it could be better. Here are a few of its weaknesses:

- Tipalti's interface may become slow and clunky, especially during busy times like month-end close, which is frustrating when time is critical.

- The implementation and onboarding process can be lengthy and complex, especially for larger organizations with multiple entities or complex approval workflows. Properly setting up and configuring the system may require significant time and resources.

- Some users have reported that Tipalti's AP reporting capabilities are lacking, making it difficult to gain valuable insights and take action to improve financial results. This may require exporting data to other tools for more advanced analysis.

- Integrating with popular ERPs like NetSuite presents challenges, including data synchronization issues and limited customization options. These limitations may lead to manual reconciliation, which is time-consuming and prone to errors.

- Despite the automation capabilities, manual interventions may be required in certain situations. The OCR for invoice processing, post-approval editing, and GL code upload features may not always function as intuitively as you’d like.

What do users say about Nanonets?

According to G2 Crowd, the popular software review platform, Nanonets has received an outstanding rating of 4.8 out of 5 stars. Users have praised it for its robust features and exceptional user experience. The tool is known for its accuracy and efficiency in processing various document types, which saves a significant amount of time that would otherwise be spent on manual data entry.

The platform's flexibility and adaptability to different use cases are frequently commended, with users appreciating the ability to configure models for their needs.

The platform's user-friendly interface, ease of use, end-to-end automation capabilities, seamless integrations, and customizable workflows are frequently praised. Users also appreciate the responsive and knowledgeable customer support team.

While some users mention that complex use cases may require initial training, they note that the effort pays off with significant efficiency gains. A few users suggest more flexible pricing options for single users or infrequent usage.

Overall, users are thrilled with Nanonets' ability to streamline AP processes and automate data extraction processes, combined with its flexibility and scalability. These advantages make it a top choice for businesses looking to transform their finance operations.

What do users say about Tipalti?

Tipalti is rated at an overall rating of 4.5 out of 5 stars based on over 210 reviews on G2Crowd. It is currently ranked in the top 10 in the Accounts Payable Automation Software category.

Tipalti is lauded for its streamlined accounts payable processes and robust features. Users appreciate the self-service vendor portal, automated tax compliance, and multi-currency support for global payments. The efficient payment processing, excellent customer support, and straightforward navigation make it easy to use, saving time and reducing manual effort.

Some users have experienced difficulties while using Tipalti, such as integration issues with ERPs, high fees for foreign currency payments, and challenges in editing invoice data entered earlier. There have also been reports of occasional system glitches or lags, and a steep learning curve for some users.

Despite these issues, Tipalti still remains a popular choice for businesses that want to automate and streamline their accounts payable processes, particularly those with complex global payment requirements.

Pricing comparison

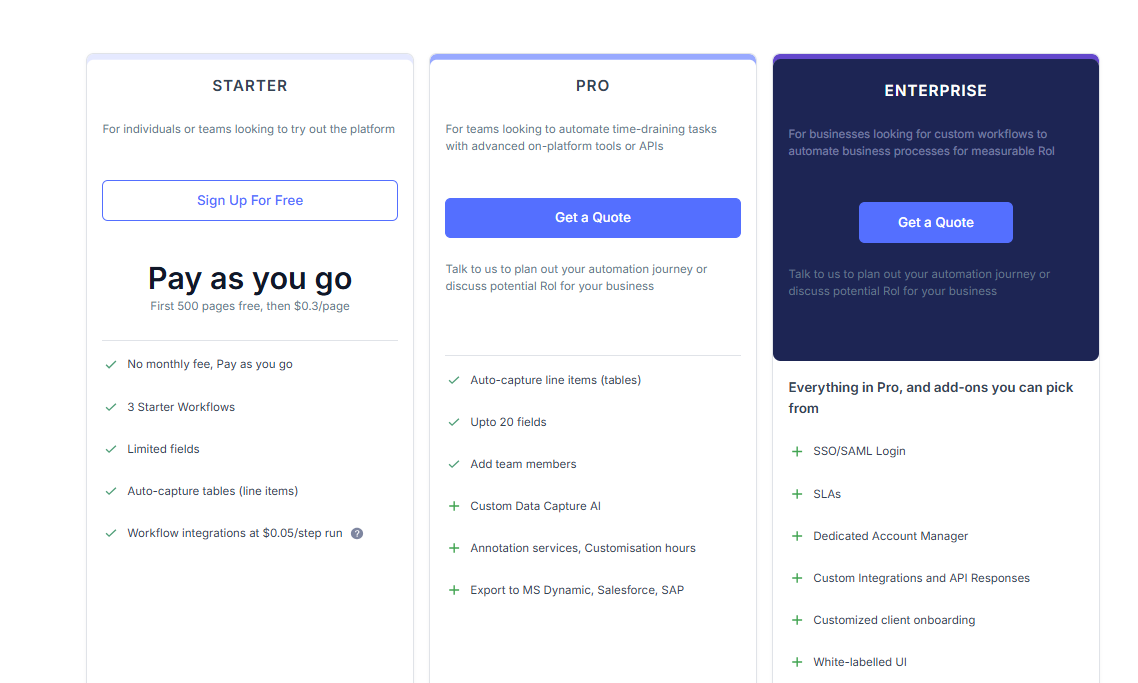

Nanonets pricing overview

Tipalti pricing overview

Tipalti's pricing model is designed to accommodate businesses at various stages of growth, but it may be more complex than Nanonets.

Their plans start at $129 per month for the platform fee, which includes features like supplier portals, an approval rules builder, and integrations with ERPs. You can upgrade to higher tiers as your business scales and requires advanced features such as W-8 tax forms, international tax IDs, or multi-entity payables.

However, the exact costs for these advanced tiers are not readily available, and you may need to consult with an account manager to determine your actual expenses.

When to choose Nanonets over Tipalti

Nanonets is an excellent choice for businesses seeking a flexible, user-friendly, affordable AP automation solution. Here are some scenarios where Nanonets may be the better fit:

1. Growing businesses with evolving AP needs

If you anticipate your AP processes becoming more complex over time, Nanonets' scalability and adaptability make it an ideal choice. With its flexible pricing model, customizable workflows, and easy integrations, it can scale with your business without requiring significant upfront investment or lengthy implementation.

2. The priority is ease of use and quick adoption

For AP teams that want to minimize the learning curve associated with new software, Nanonets' intuitive interface and guided onboarding process can be a game-changer. Its user-friendly UI, no-code workflows, and easy-to-setup integrations ensure that your team can start realizing efficiency gains without extensive training or technical expertise.

3. Businesses seeking an affordable, feature-rich solution

Nanonets offers a comprehensive set of AP automation features at a more accessible price than Tipalti. If you're looking for advanced capabilities like AI-powered data extraction, automated 3-way matching, and real-time analytics without breaking the bank, Nanonets provides excellent value for your investment.

4. Companies with diverse invoice formats and sources

If your business receives invoices in various formats from multiple sources, Nanonets' advanced OCR technology and AI-powered data extraction can be a lifesaver. The system accurately captures data from any invoice layout, regardless of language, currency, or tax laws, minimizing manual intervention and ensuring a seamless, automated workflow for diverse invoice types.

5. Companies look for customizable workflows

Nanonets allows users to create customizable approval workflows that align with their organization's unique policies and hierarchy. Additionally, the platform seamlessly integrates with popular ERPs and accounting systems, ensuring a smooth data flow between systems.

When to choose Tipalti over Nanonets

While Tipalti may have a steeper learning curve and higher costs, it excels in handling complex global payables for larger enterprises. Here are some scenarios where Tipalti may be the better fit:

1. Organizations with multiple entities and subsidiaries

Tipalti's multi-entity support and centralized AP management features can be invaluable for companies with a complex organizational structure involving multiple entities and subsidiaries. Its ability to consolidate and reconcile payments across different business units and geographies provides a unified view of your AP operations and streamlines inter-company transactions.

2. Businesses with stringent compliance and risk management requirements

Suppose your industry is subject to strict regulatory requirements, or you prioritize fraud prevention and risk management. Tipalti's advanced compliance and security features may be the best fit in that case. Its automated tax compliance, fraud detection, and supplier risk management capabilities help ensure your AP processes remain secure and compliant with evolving regulations.

3. Companies with a large, global supplier base

For businesses with a vast network of international suppliers, Tipalti's self-service supplier portal and onboarding tools can significantly reduce the administrative burden on your AP team. By automating supplier information collection, validation, and management, Tipalti streamlines the onboarding process and ensures accurate, up-to-date supplier data.

Final thoughts

Let’s be honest, there's no universal answer to that question. Both offer robust features and benefits, but only you would know which solution best aligns with your organization's unique needs and priorities.

So, evaluate your AP requirements, technology priorities, and growth trajectory to determine which solution aligns best with your goals.

Ultimately, the key is to take action. Whether you choose Nanonets, Tipalti, or another reputable AP automation solution, the most crucial step is embracing digital transformation and optimizing your accounts payable processes today.

For organizations seeking a flexible, user-friendly, and affordable Tipalti alternative to revolutionize their AP operations, Nanonets is certainly a top choice. Don't let manual, error-prone AP processes hold you back any longer. Take the first step towards a more intelligent, streamlined accounts payable workflow — try Nanonets today and experience the difference yourself.