Accounting in any company involves dealing with invoices every month.

One of the most challenging tasks while dealing with them is the verification of these invoices.

All invoices received by a company for products or services that have been purchased from a vendor must be checked for accuracy before payment is initiated.

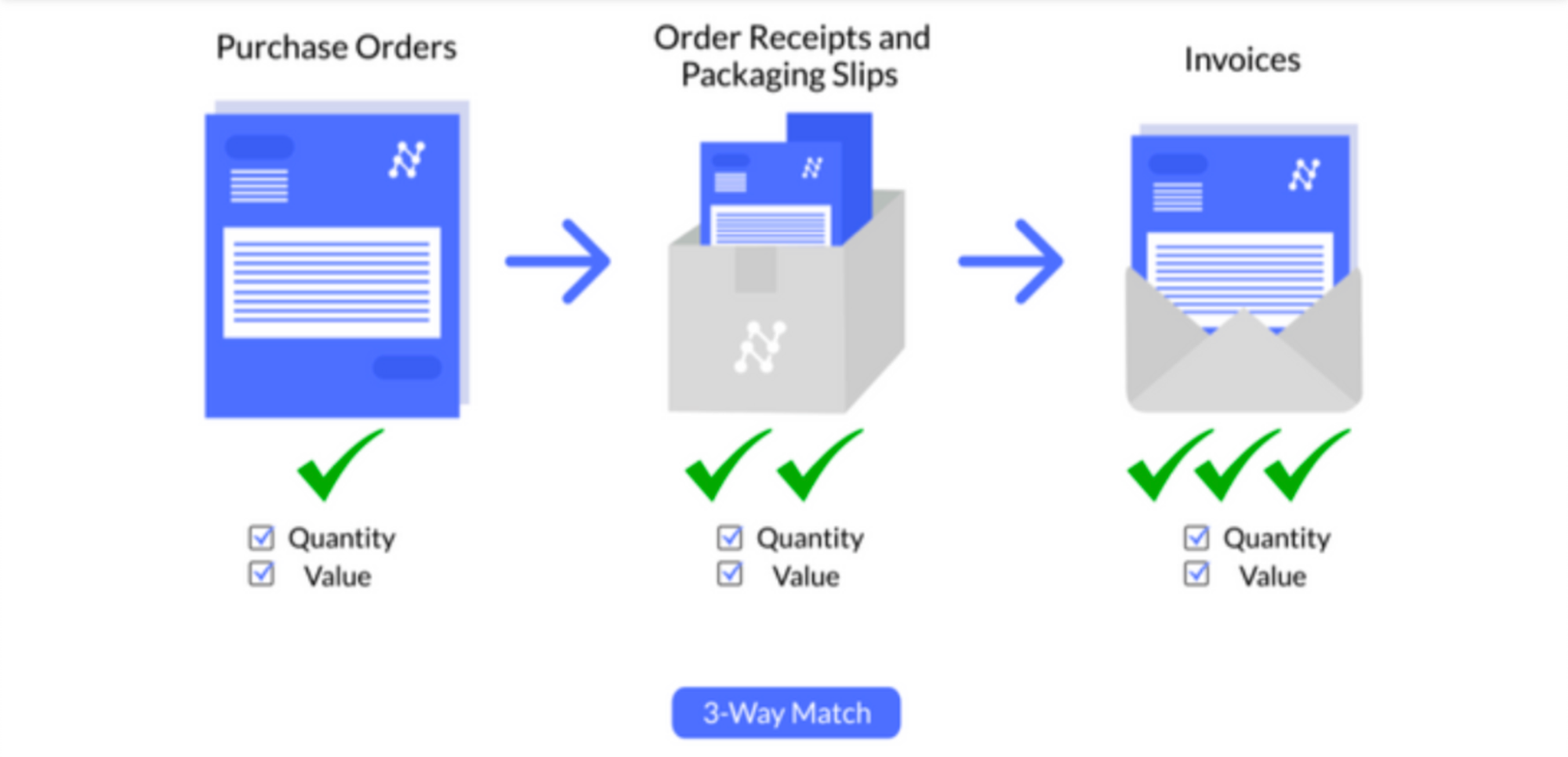

For this, all details of the purchase as mentioned in the invoice are matched with the corresponding purchase order to ensure that the product/services that were ordered were delivered correctly and at the price agreed upon. This verification process is called 2-way matching.

Let's quickly understand how this works.

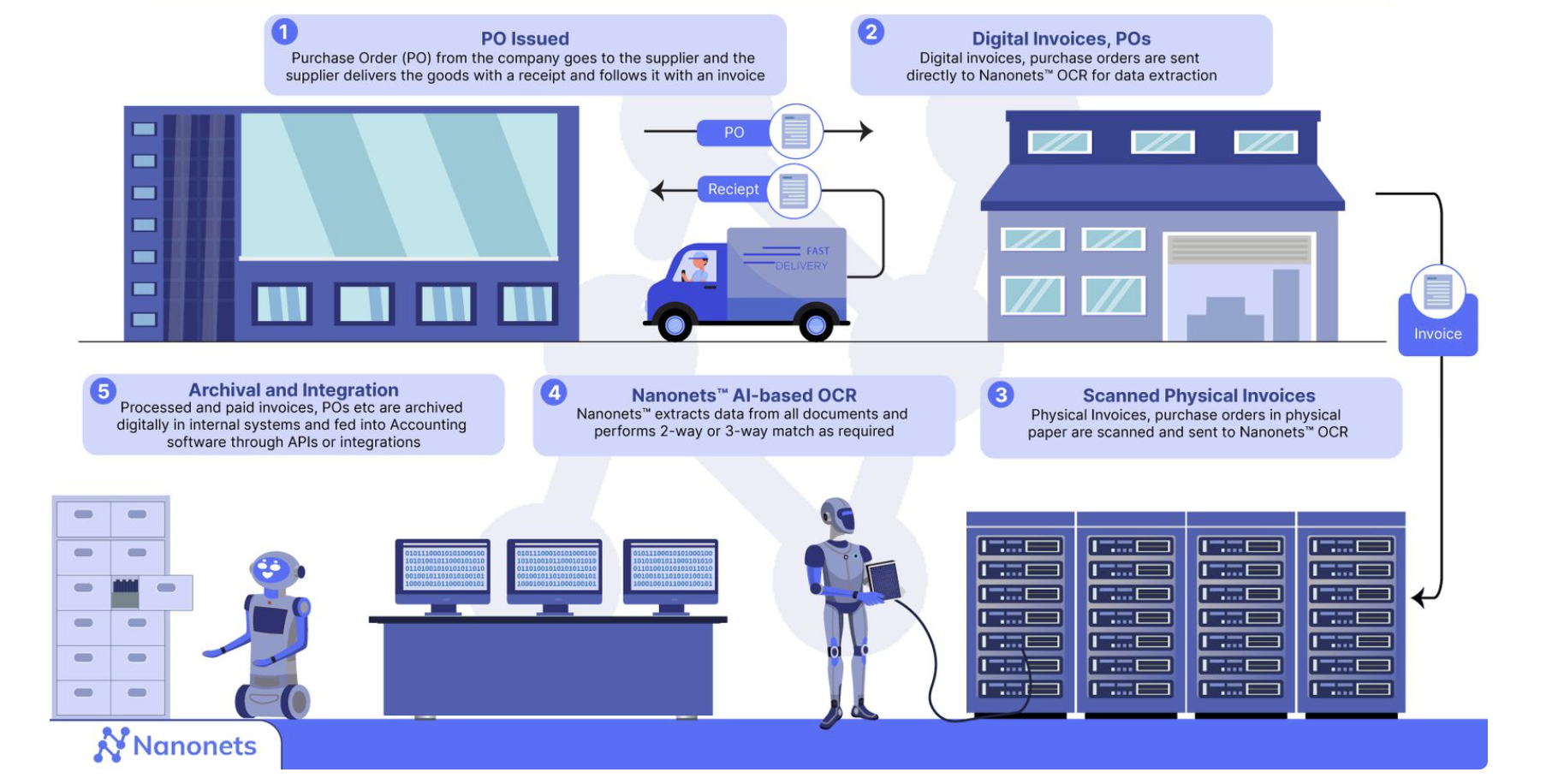

Recap of the Procurement Process

Before understanding 2-way matching, let’s quickly recap how procurement works in a business setting.

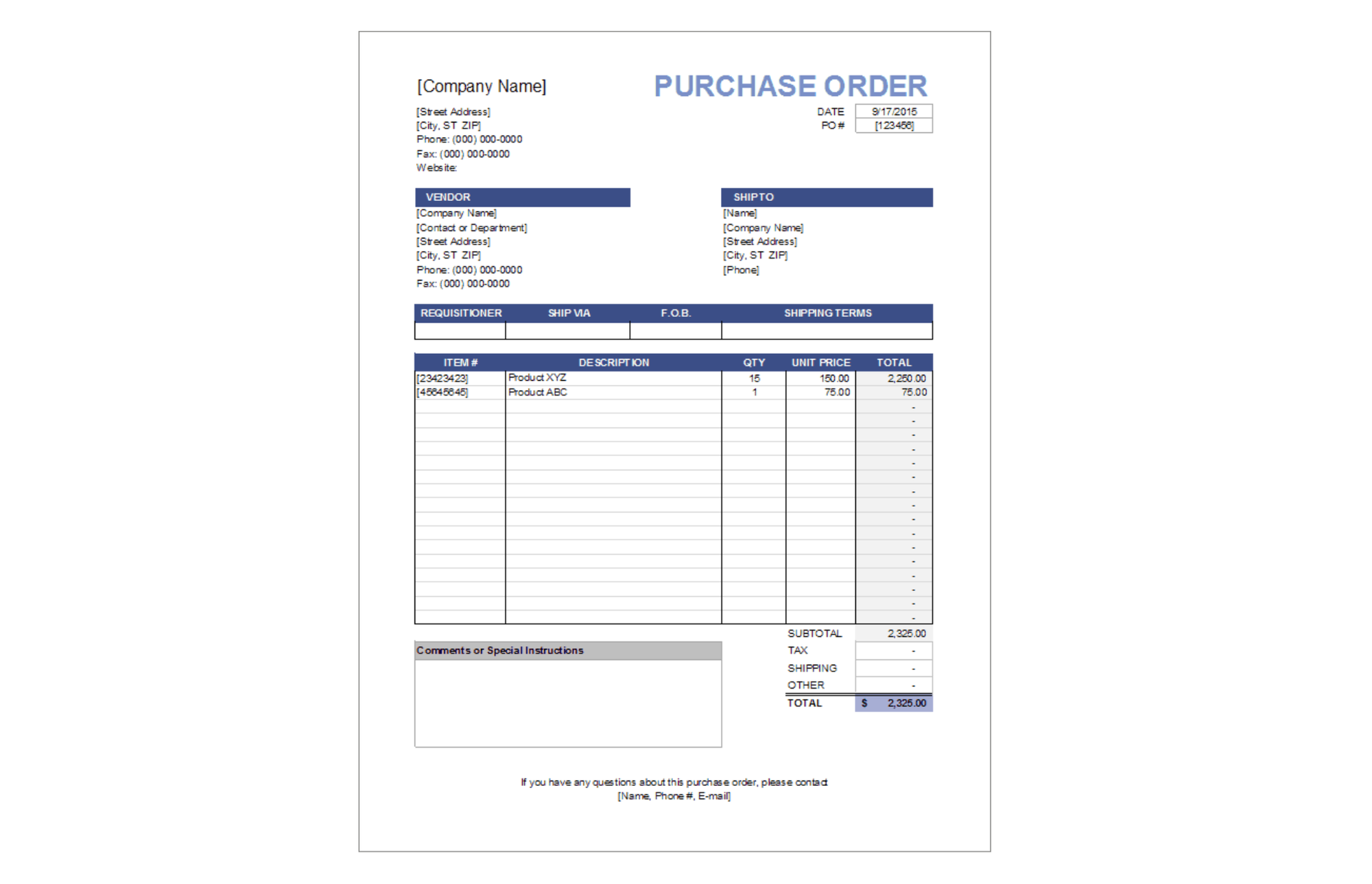

Purchase order (PO) is a legally binding agreement issued by the purchaser to the vendor, informing of the type of product/service ordered and the quantity and prices agreed upon.

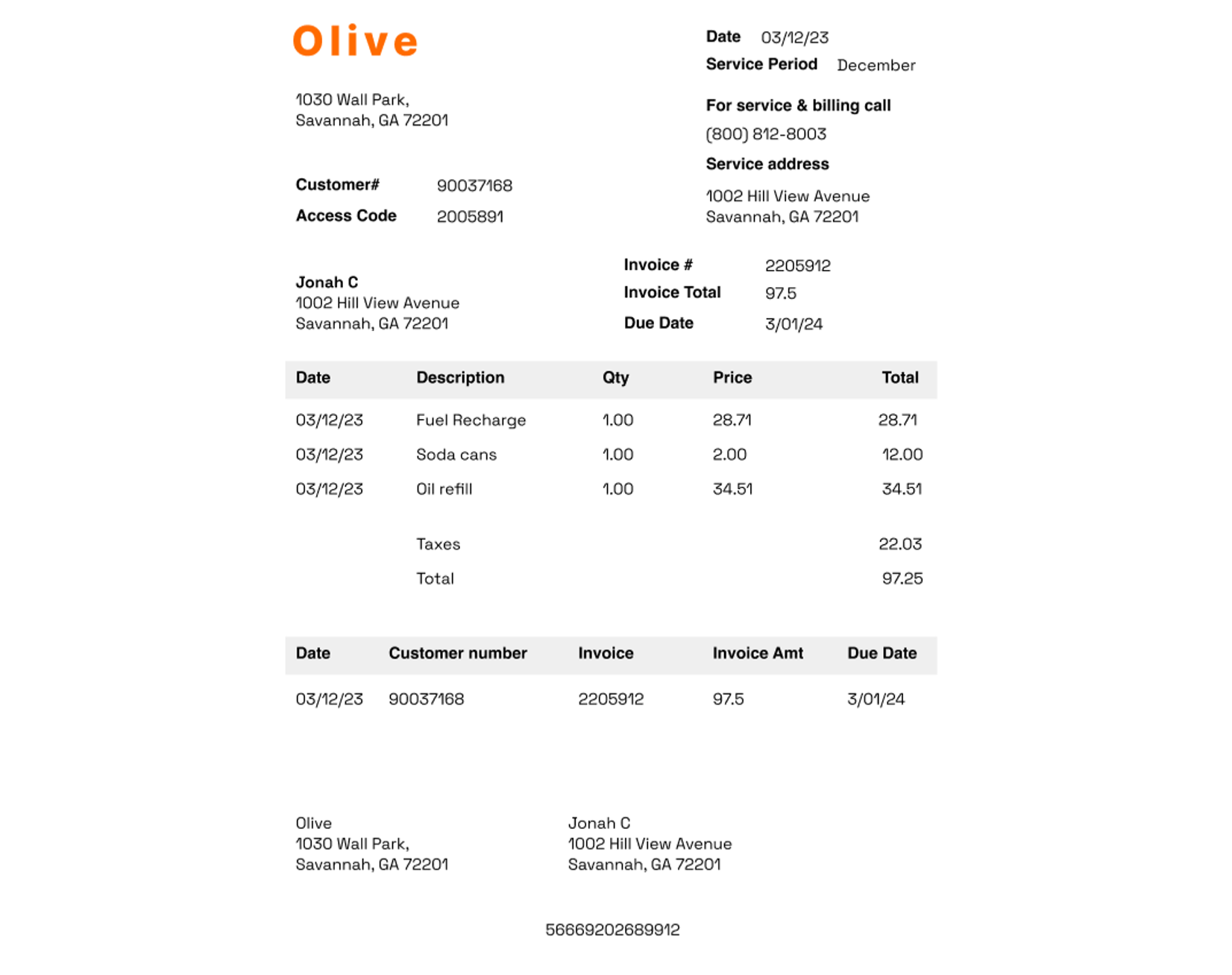

Invoice is a legally binding document that is issued by the vendor to the purchaser along with or after the delivery of the product/service to the customer. It has all details of the vendor, customer, product/service being delivered, pricing and payment mode.

Let's say the IT department of a company ABC, requires 10 swivel executive chairs for its IT executives.

- The IT department may (depending on company policy) issue a purchase requisition across the appropriate managerial hierarchy.

- A purchase request is sent to the Purchase (or equivalent) department in the company to find appropriate vendors of the product/service.

- Once a vendor is identified, the necessary groundwork is done to identify the product and price. For example XYZ, a supplier of office furniture can provide swivel executive chairs at a price of $250 per chair, to be delivered in five days.

- Once supplier XYZ is finalized, the purchase order is generated by the purchase department of ABC, citing the product and the price agreed upon.

- One copy of the PO is sent to XYZ, one is retained by the Purchase department of ABC, one to the Accounts Payable Department.

- When XYZ supplies the chairs, the invoice is provided along with or after the delivery to ABC.

Now that the invoice have been obtained, the matching process is performed by the accounts payable team at ABC.

What is 2-way matching?

Two way matching, also known as purchase order matching, is a process to verify that the details on the purchase orders and the associated invoices match so that the invoice can be paid.

The match is usually made for the quantity billed and the invoice price. The following conditions need to be met :

- The invoice quantity is less than or equal to the amount ordered in the PO.

- The invoice price is less than or equal to the price quoted in the PO.

A successful match can refer to a 100% exact match, or defined using a matching tolerance (eg. >=95% match required) based on the business setting.

Only once the match is successful upon verification by the AP team, the payment is initiated.

In case of unsuccessful match, the invoice processing and payment is paused. An accounts payable manager manually checks the invoice and either approves the invoice payment or rejects the invoice.

This is 2-way matching.

Let's summarize the 2-way matching process in a flowchart for easy comprehension.

In the above example, suppose ABC was not adhering to 2-way matching.

After discount discussions, they issue a purchase order for 10 chairs at a discounted total price of $2000 ($200/chair instead of $250/chair) as agreed with XYZ.

After reviewing and accepting the purchase order, and delivering the 10 chairs, XYZ sends an invoice for the original price of $2500 ($250/chair). The invoice creator at XYZ may not have been aware of the discount offered by the XYZ marketing person to the purchase department at ABC for the bulk purchase. Or it could be a deliberate bad business practice.

If the invoice details are not compared and matched with the PO details, the AP (Accounts Payable) team at ABC may pay the extra $500 that was originally waived.

A two-way match process can help catch this mistake before a payment is made. The process ensures that only invoices for the correct amount and quantity are paid.

Importance of 2-way matching

Two-way matching is crucial for maintaining accuracy and financial control in accounts payable.

- Accuracy Assurance: Two-way matching ensures that invoices are accurate by verifying them against corresponding purchase orders, preventing overpayment or payment for undelivered goods/services.

- Financial Control: It enhances financial control and reduces the risk of errors or fraud in the accounts payable process.

- Vendor Relationship: Effective implementation fosters transparency and trust in vendor relationships, as discrepancies are promptly addressed and resolved.

- Compliance: It ensures compliance with internal procurement policies and external regulations, minimizing financial risks and audit issues.

- Cost Savings: By avoiding overpayments and resolving discrepancies efficiently, companies can save significant costs in the long run.

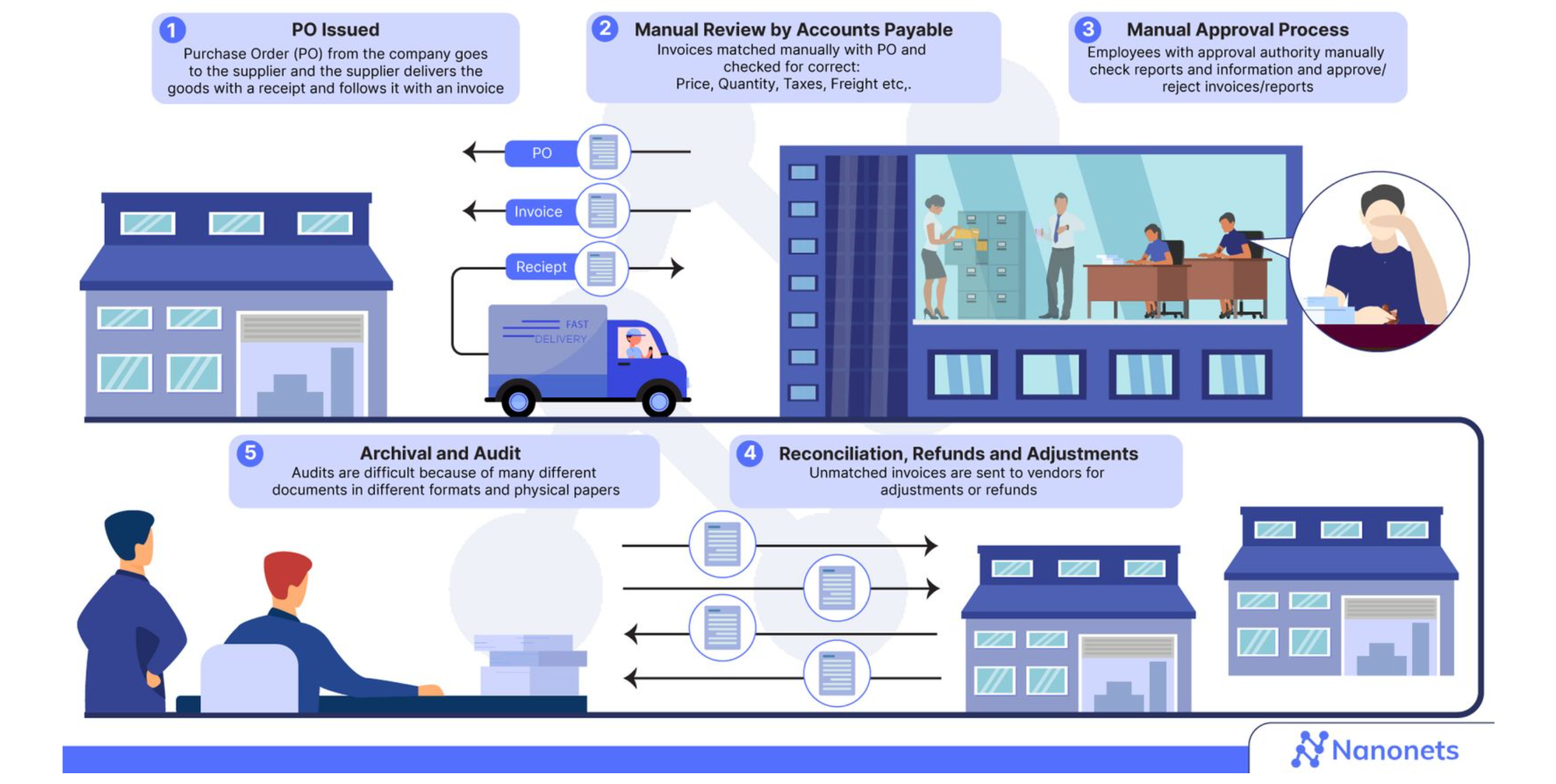

How manual 2-way matching works

Manual 2-way matching is typically favored only by businesses with very low transaction volumes or those with specific requirements necessitating human oversight.

Here is how the process looks like.

Let's take the example of XYZ Inc., and explore how they implement manual 2-way matching. XYZ Inc. uses Quickbooks for accounting. This is how their procurement process looks like with 2-way matching.

1. Generation of Purchase Order (PO):

- Quickbooks offers a PO creation and management module.

- XYZ Inc. creates / receives a PO for the vendor directly in Quickbooks, detailing ordered items, quantities, prices, and delivery dates.

2. Receipt of Vendor Invoice:

- Upon receiving the shipment, XYZ Inc. gets an invoice from the vendor, also logged into Quickbooks.

- The data entry team manually populates the item details, quantities, prices, taxes, and discounts against each invoice.

3. Manual Matching Process:

- The accounts payable team manually matches invoice details with the corresponding PO in Quickbooks, ensuring quantities and prices align.

4. Verification and Approval:

- Verified invoices are approved for payment within Quickbooks, while discrepancies are flagged for review.

- Reviewers manually process the invoices which fail 2-way matching.

5. Payment Initiation:

- Using Quickbooks, XYZ Inc. initiates payment for approved invoices, following their payment procedures.

Though meticulous, this process establishes a foundation for financial integrity.

Challenges in 2-way matching

While manual 2-way matching ensures a hands-on approach to verifying invoices against purchase orders, it poses several challenges:

Data mismatch challenges: The accounts payable team must align purchase orders with invoices by manually checking them which leads to missed details and slow operations, risking productivity and business relationships.

Long Processing Times: Accounts payable often contends with data inaccuracies in up to 20% of invoices, dedicating about 25% of their time to resolving such issues, which delays processes and increases operational risks.

Fraud and theft risks: The Association of Certified Fraud Examiners (ACFE) finds that organizations typically lose 5% of revenue annually to fraud, with criminals often duping accounts payable through convincing fraudulent invoices, posing a significant risk to vigilance and financial integrity.

Managing multiple invoice formats: Large organizations handle purchase orders and invoices from various sources in diverse formats such as word documents, spreadsheets, XML documents for EDI, PDFs, images, and paper documents. Manual consolidation is prone to errors, leading to issues like overpayment, incorrect payments, and invoice duplication, ultimately causing productivity and trust losses.

Cost implications of manual processing: Traditional invoice and purchase order matching involves significant costs due to labor, materials, and postage, with additional financial impacts from penalties, late fees, and lost business due to processing errors. Manual invoice processing costs are known to reach as high as $15-50/invoice.

How to automate 2-way matching?

Automated 2-way matching is like having a helpful robot for your accounting tasks.

Today, AP Automation tools can automatically check if the details on invoices match what's in your purchase orders, saving you time and reducing errors.

These tools can work with other accounting systems; many systems have ready to use integration options, or API / middleware to provide seamless data transfer between the different systems.

With these integrations, businesses can integrate automated 2-way matching into their AP workflows seamlessly, while still using the accounting software that they are comfortable with.

Nanonets' AP automation software, for example, can be integrated with other accounting systems, such as QuickBooks and Sage. Here is a simplified depiction of the automated 2-way matching workflow.

How does it work?

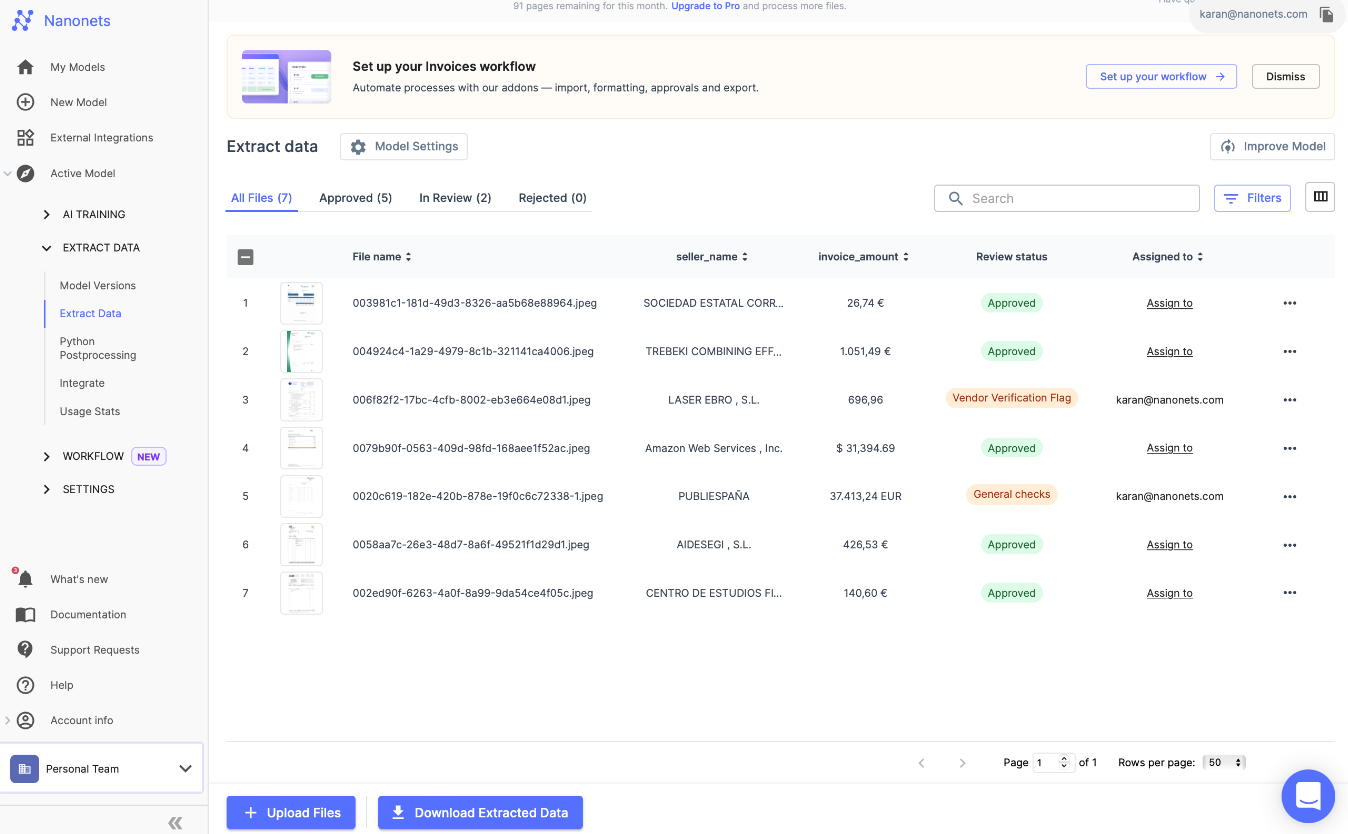

Let's take a look at how an AP Automation software like Nanonets automates the two-way matching process completely.

1. Automated Invoice Collection

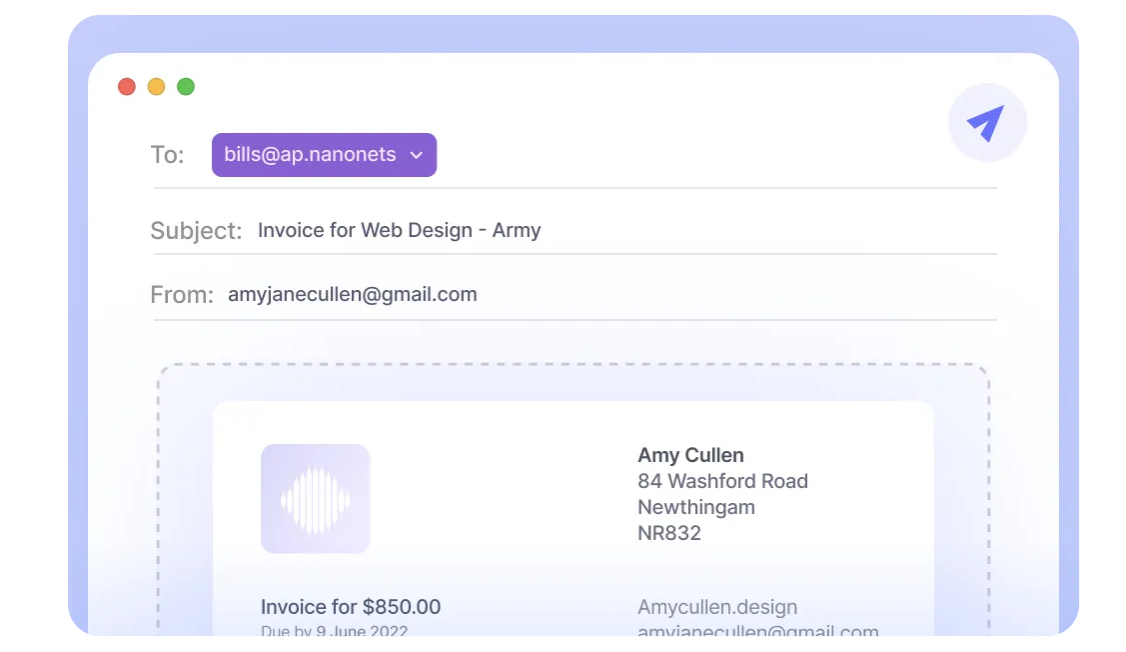

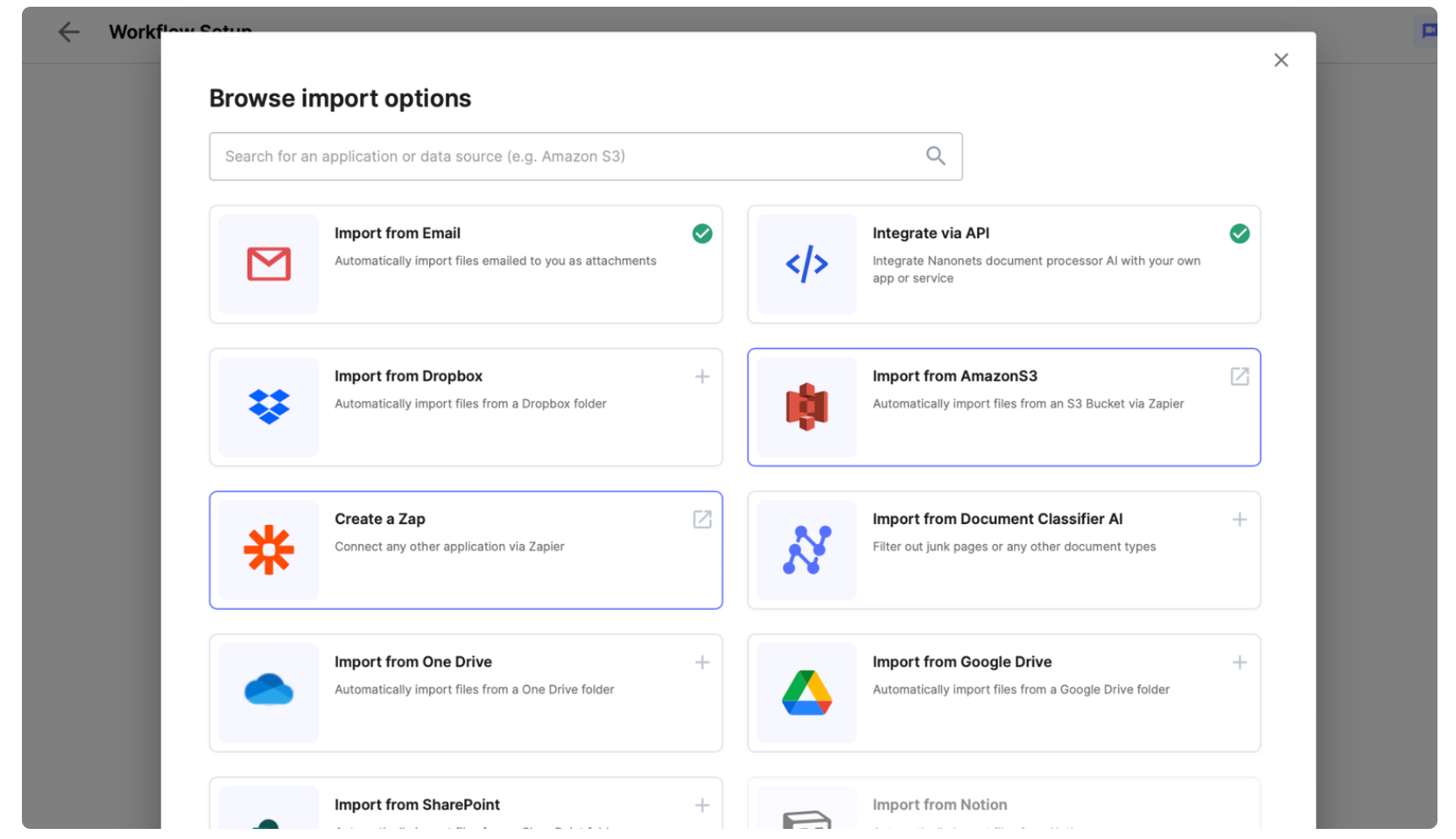

Nanonets simplifies this process by automatically importing invoices and POs from emails, drives, accounting software and databases as soon as they arrive, ensuring that every piece of data finds its place in a centralized, digital repository.

Nanonets can automatically retrieve emailed invoices and POs directly from your inbox, extracting relevant information seamlessly from both email bodies and attachments.

All handwritten and printed invoices can be easily scanned using a smartphone or directly uploaded into the platform.

Invoices and POs can also be imported into Nanonets from your mail, apps and databases.

2. Automated Data Entry

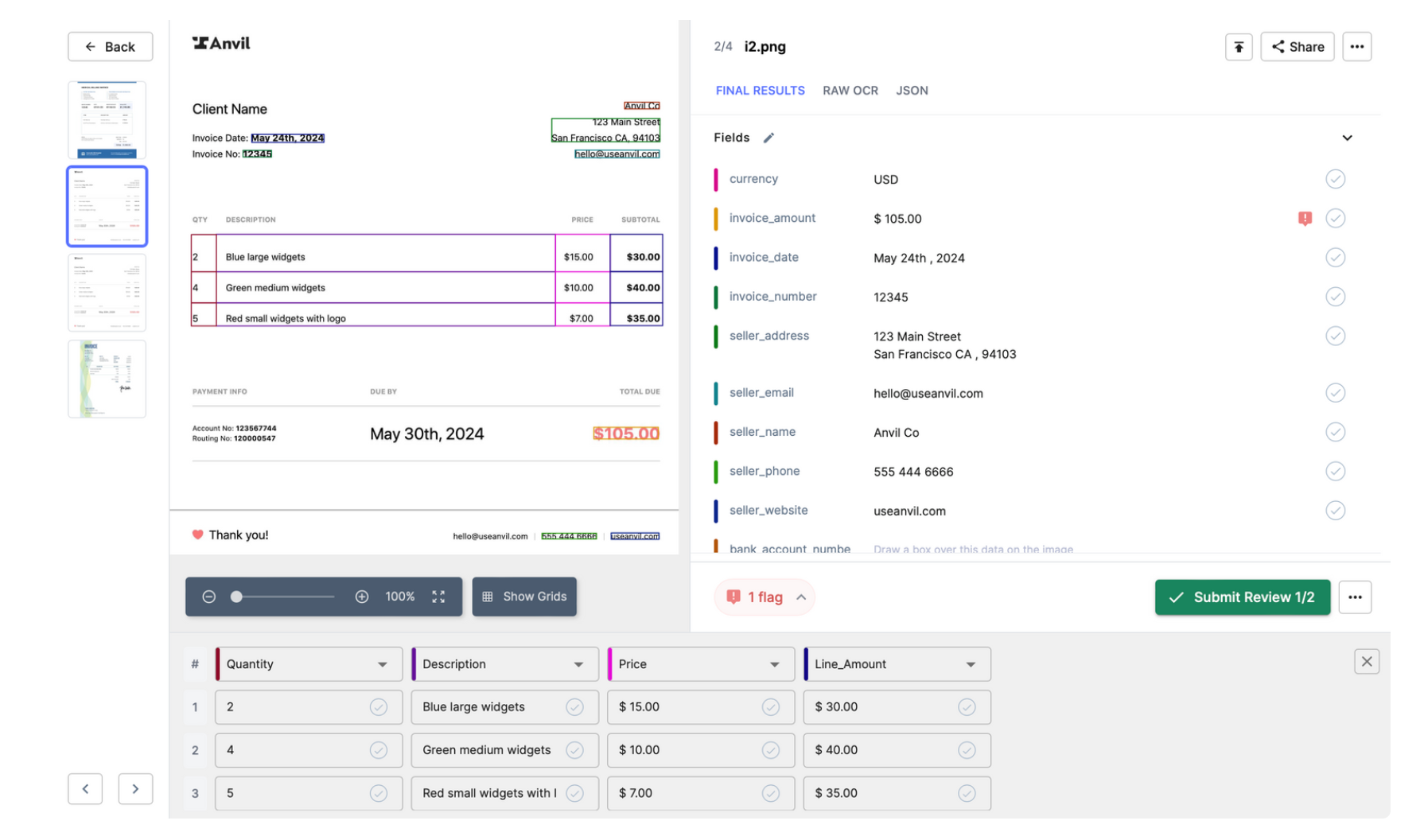

Say goodbye to hours of manual data entry. With Nanonets AI, invoices are read with over 99% accuracy, drastically reducing the time spent on tedious tasks.

This means your team can focus on more meaningful work while Nanonets takes care of data extraction and input directly into your accounting software / ERP, without any manual intervention.

3. Intelligent 2-way matching

Leveraging AI, Nanonets automatically performs two-way, three-way, or four-way matching by reading and cross-referencing the extracted invoice data with purchase orders, receiving reports, and inspection reports imported from various sources.

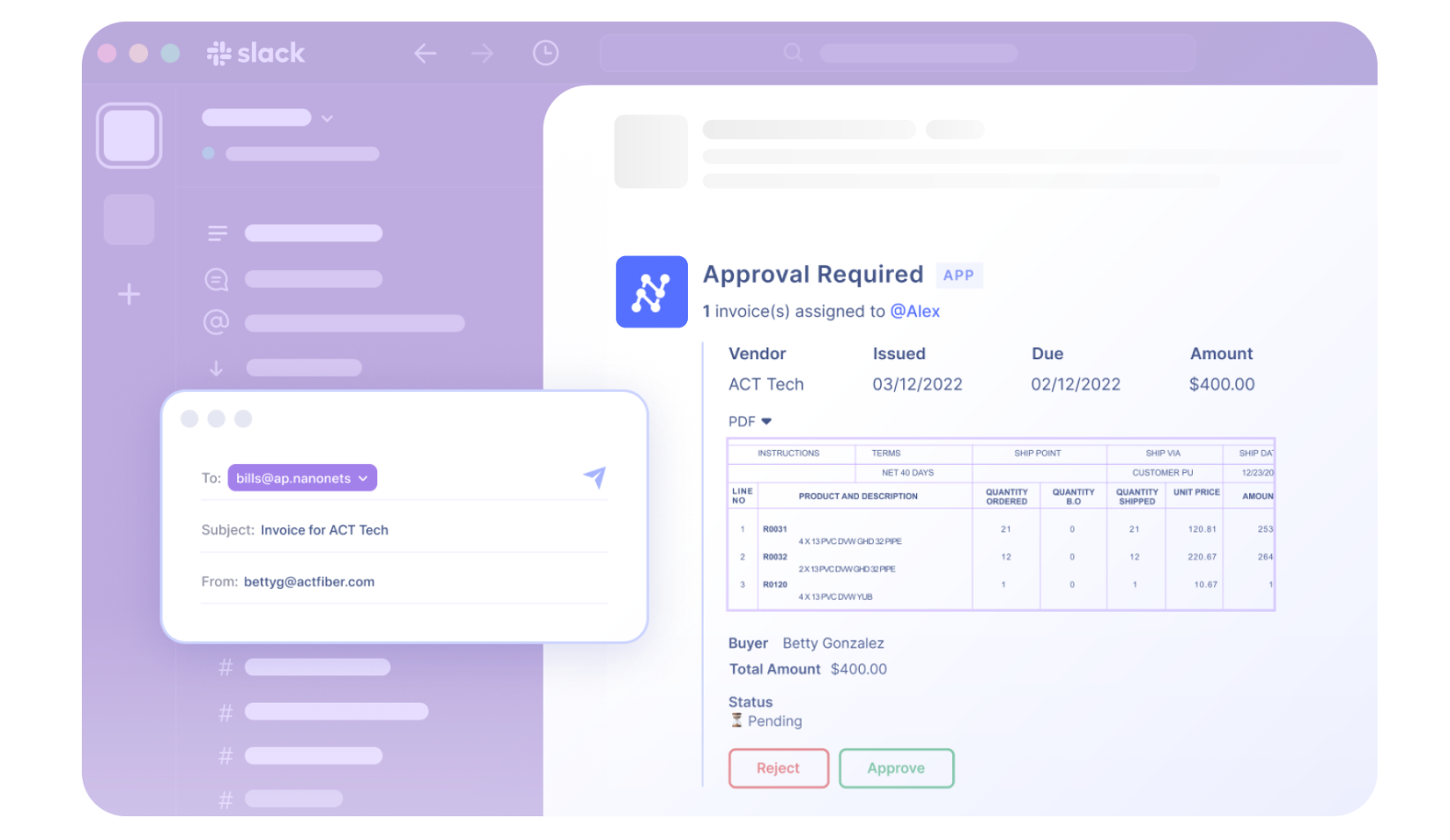

4. Approval Routing

The system flags any discrepancies for human review, but otherwise, invoices that match company criteria are automatically routed for approval or directly approved based on pre-set rules.

5. Approvals

Approvals with Nanonets are no longer a bottleneck. They become flexible and live where your organization does—whether that's on email, Slack, or Teams. This eliminates the need for disruptive phone calls and the all-too-familiar barrage of reminders.

- ERP Integrations

Ready-to-use integrations ensure that invoices and POs get recorded in your accounting software / ERP automatically as soon as they occur.

Approved invoices are automatically queued for payment in your accounting software.

7. Real-Time Analytics

Nanonets goes beyond mere transaction processing by offering advanced analytics capabilities and real-time data reporting.

This helps you get real-time insights into your accounts payable process, enabling you to monitor spending patterns, identify cost-saving opportunities, and enhance financial forecasting.

Selecting the right software for 2-way matching

Choosing the right software for automating 2-way matching depends on your business size and type.

Some options work as standalone solutions or as part of a larger accounting system, depending on what you already use. For example, integrating with existing systems, like ERP, is necessary for some tools.

- Nanonets makes handling invoices and purchase orders easy by automating the matching process. It auto-imports invoices and POs, uses AI for accurate data entry and matching, flags mismatches for easy and seamless manual reviews, and updates data in your accounting software / ERP in real time.

- Oracle's Payables tool automatically matches invoices to POs, checks compliance with set tolerance levels, and updates quantities and amounts billed based on the invoice details.

- Sage Intacct streamlines purchasing with set workflows for transactions and approvals. MineralTree automates matching invoices to POs or receipts for Sage Intacct, capturing details from invoices automatically and inserting them into approval and payment processes. It keeps everything consistent with the company’s ERP.

- Nexonia Expenses offers flexible, cloud-based expense management with deep integration into your systems.

- Tipalti simplifies invoice processing with OCR and data extraction, setting rules for matching invoices to POs and preparing them for payment.

- DocuWare uses AI to extract key invoice data, check for valid vendors and duplicates, and match invoices to POs and delivery notes, ensuring accurate amounts.

Many 2-way matching tools are available, each with features designed for different needs.

Why you should automate 2-way matching

Automating the 2-way matching process offers multiple advantages.

Paperless Handling

When documents like invoices and purchase orders are all digital, paperless handling cuts out the need for paper and reduces the amount of manual work needed. This means things work faster, can grow easily, and are more flexible. Documents get sent, turned into digital form, sorted, checked, approved, and processed without anyone needing to move paper around. Here's how it works:

- The system looks for new emails.

- It takes attachments from the emails to work on them.

- The system reads the attachments to get the information needed.

- It checks the details in invoices or purchase orders against set rules.

- An invoice is put together, matched with purchase orders and receipts according to rules, making sure there are no repeats.

- It lets users know if invoices were handled right.

AI helps the system get better over time, learning from its users and their unique needs.

Quick Matching

Matching purchase orders can be done super quickly by the system, a job that would be really hard for people to do alone.

Handling Lots of Documents at Scale

When there are a lot of purchase orders and invoices, automation makes it much easier and faster to sort through them all.

Always Ready for Audits

The system keeps track of everything, making sure everything is correct and quick. With documents already approved and organized, audit processes are smoother.

Less Work, More Productivity

The AI uses complex algorithms to understand data like the human brain, but faster. It learns and gets better, meaning less manual checking is needed.

With less routine work, the finance team can focus on more important tasks like planning and analysis, which can help the company's profits.

Less Errors

AI systems can catch mistakes early on, preventing bigger problems later. If something's wrong, it quickly lets the IT team know to fix it.

Saves Money

Though there's an initial cost, running these AI systems can be much cheaper than paying a full salary.

Secure and Able to Grow

The system can work all the time, unlike people, making operations more efficient and secure.

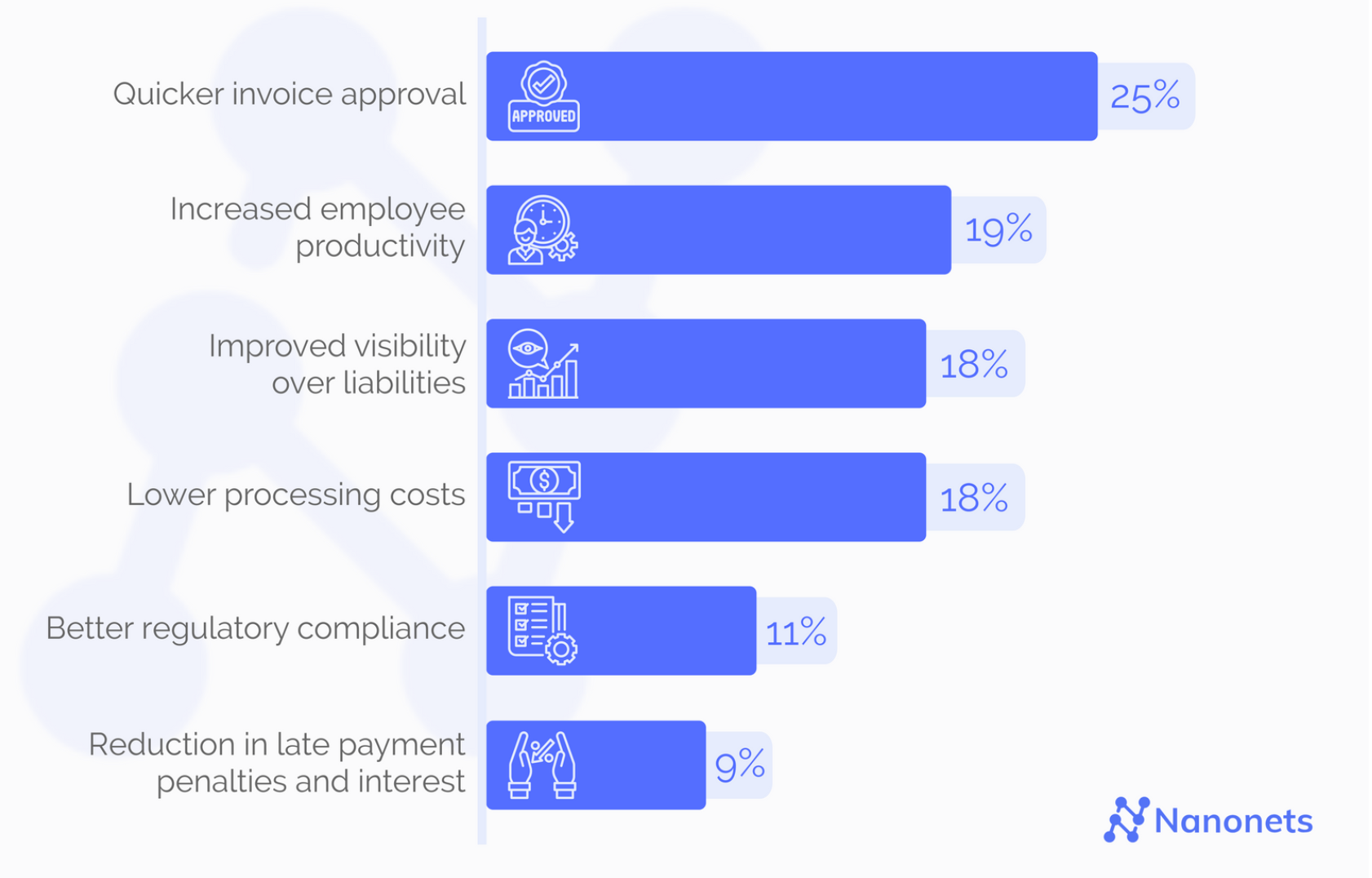

A survey by Levvel Research shows that quicker approval of invoices and increased employee productivity are the top two benefits experienced from a switch to AI-enabled 2-way and 3-way matching processes, along with numerous other tangible benefits reported by businesses automating invoice processing and 2-way matching.

It is imperative to note that automating invoice processing and purchase order matching benefits multiple functions in your business:

- Finance executives can lower expenses and reallocate resources to improve the bottom line and support strategic and corporate expansion.

- Corporate executives gain insights into performance and cash flow management through dashboard analytics provided by numerous automation tools.

- Accounts Payable Teams can remove the need for paper invoices and manual processes by leveraging automated routing, coding, and matching of supplier invoices according to established accounting principles.

- Accountants and Research Staff gain immediate and comprehensive access to purchase orders and invoices, aiding in future planning activities.

Conclusion

The concept of 2-way matching is a vital process in the realm of accounting within any business, primarily focused on ensuring the accuracy and integrity of transactions between a company and its vendors.

It involves a meticulous verification procedure where the details on purchase orders (POs) are matched against those on the corresponding invoices to confirm that the products or services ordered were delivered correctly and at the agreed-upon prices.

This process not only safeguards against overpayments or paying for undelivered goods but also reinforces financial control, fosters trust in vendor relationships, and adheres to compliance standards.

While manual 2-way matching offers precision through human oversight, it is fraught with challenges such as data mismatches, time inefficiency, fraud risks, and the high cost of manual processing.

With the advent of automation, 2-way matching becomes a slick, error-proof process. Platforms like Nanonets automate 2-way matching and integrate seamlessly with accounting systems. This automation streamlines invoice processing, enhances data accuracy, and enables real-time analytics, ultimately contributing to more robust financial management and operational efficiency.