Managing expenses often proves to be a Herculean task for many organizations. Traditional expense management systems are often fraught with challenges: manual data entry is time-consuming and prone to errors; fraudulent claims can slip through the cracks; and ensuring compliance with company policies and tax laws can feel like navigating a minefield. These inefficiencies not only drain valuable resources but also divert focus from core business activities, stifling growth and innovation.

Artificial Intelligence (AI) today has become a transformative power in the realm of expense management. AI technologies offer promising solutions to these age-old problems, automating mundane tasks, enhancing accuracy, and streamlining processes.

Use Cases of AI in Expense Management

At its core, Artificial Intelligence (AI) is the simulation of human intelligence in machines that are programmed to think like humans and mimic their actions. The following AI solutions are relevant in the context of expense management -

Automating the Expense Management Workflow

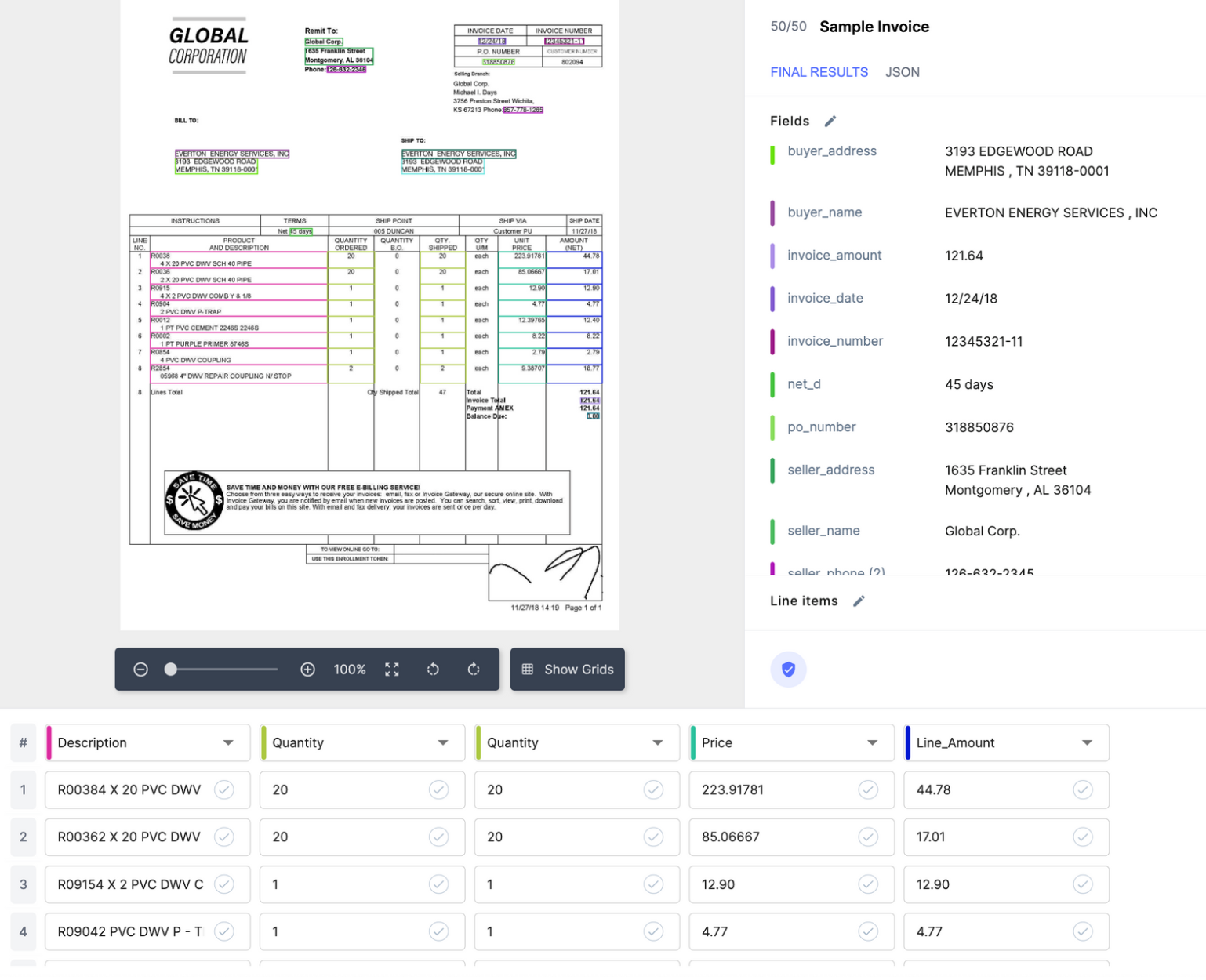

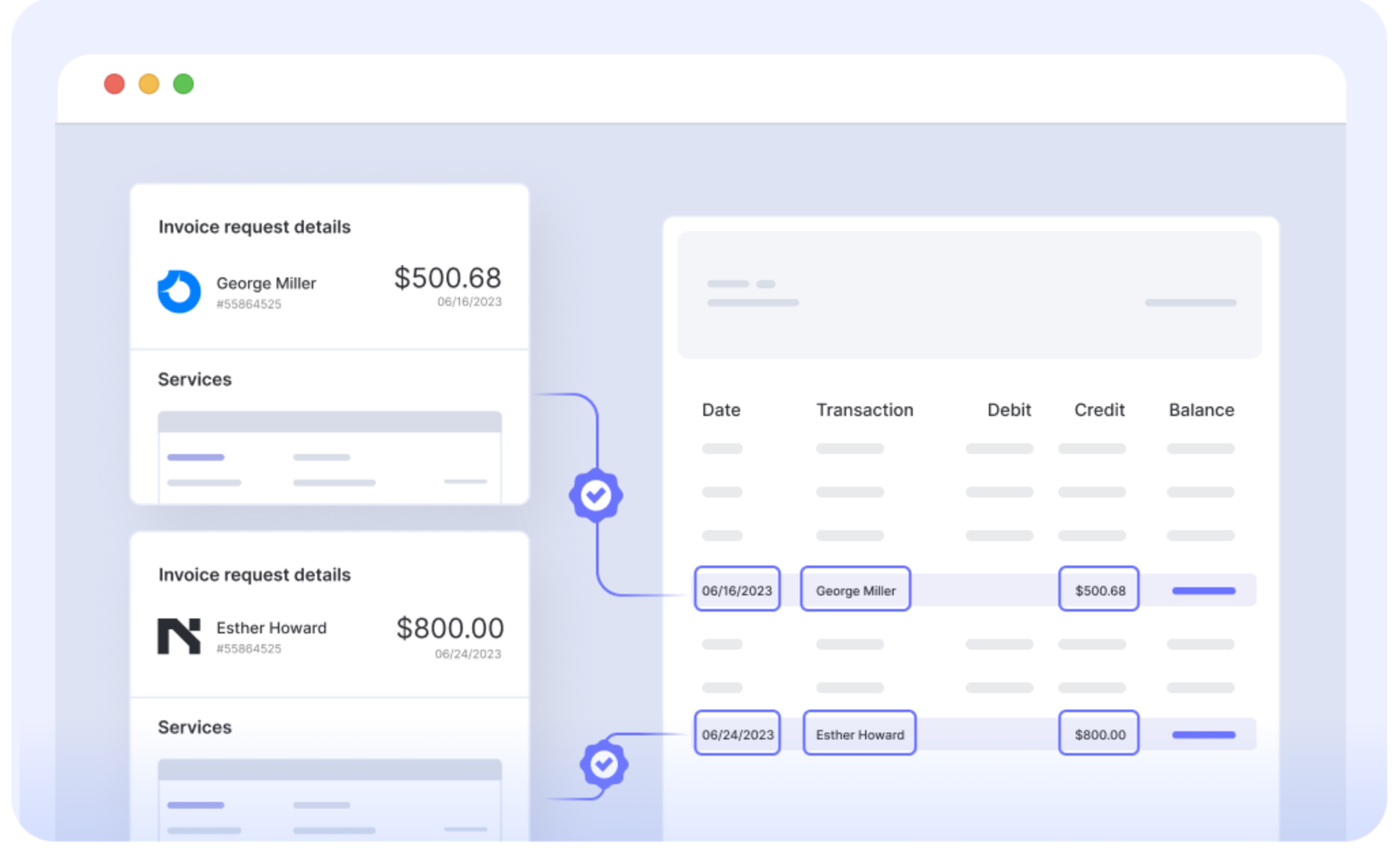

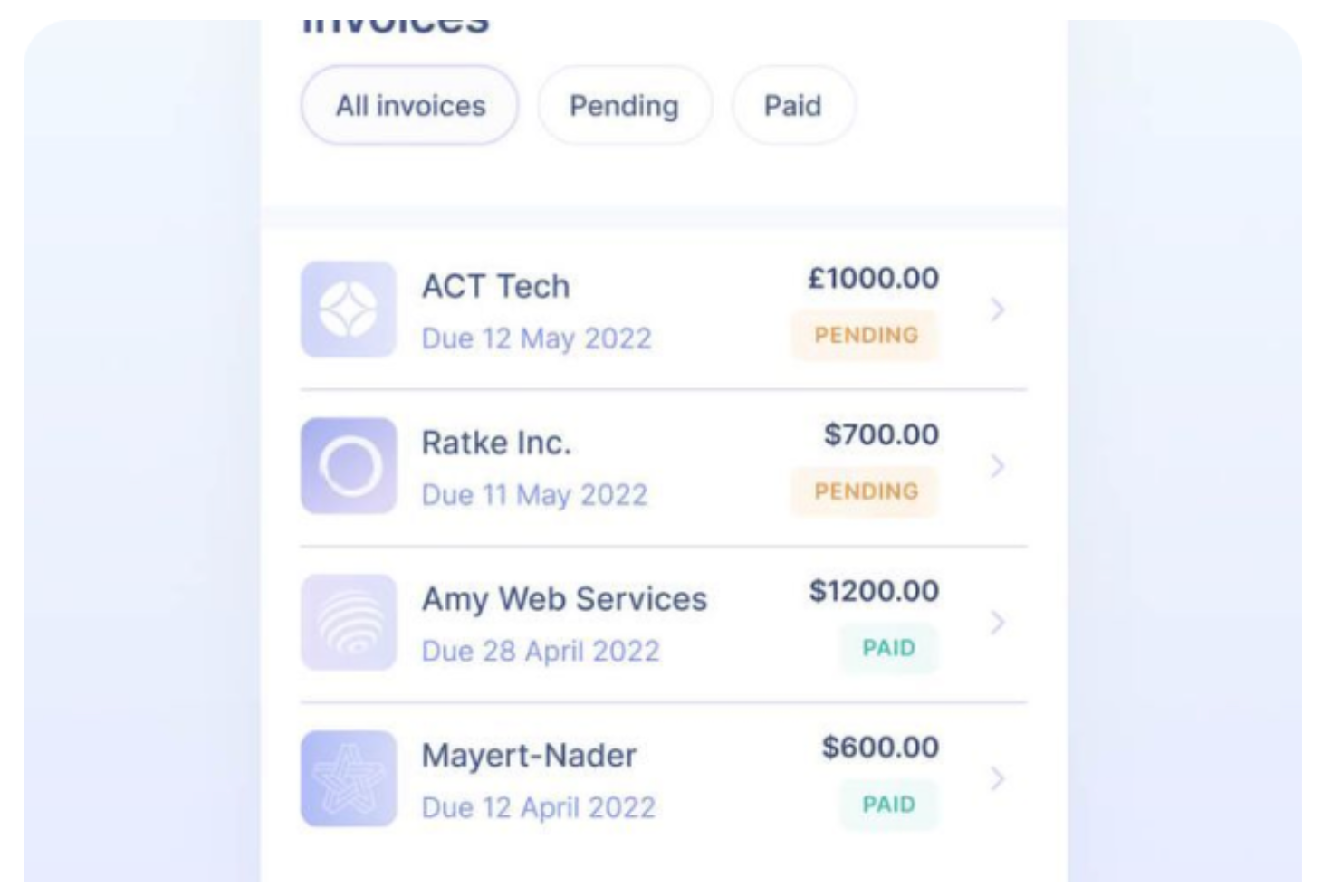

1. Receipt and Invoice Processing: AI algorithms can automatically extract data from receipts and invoices, reducing manual data entry. This capability streamlines expense reporting and reimbursement processes, minimizing errors and fraud.

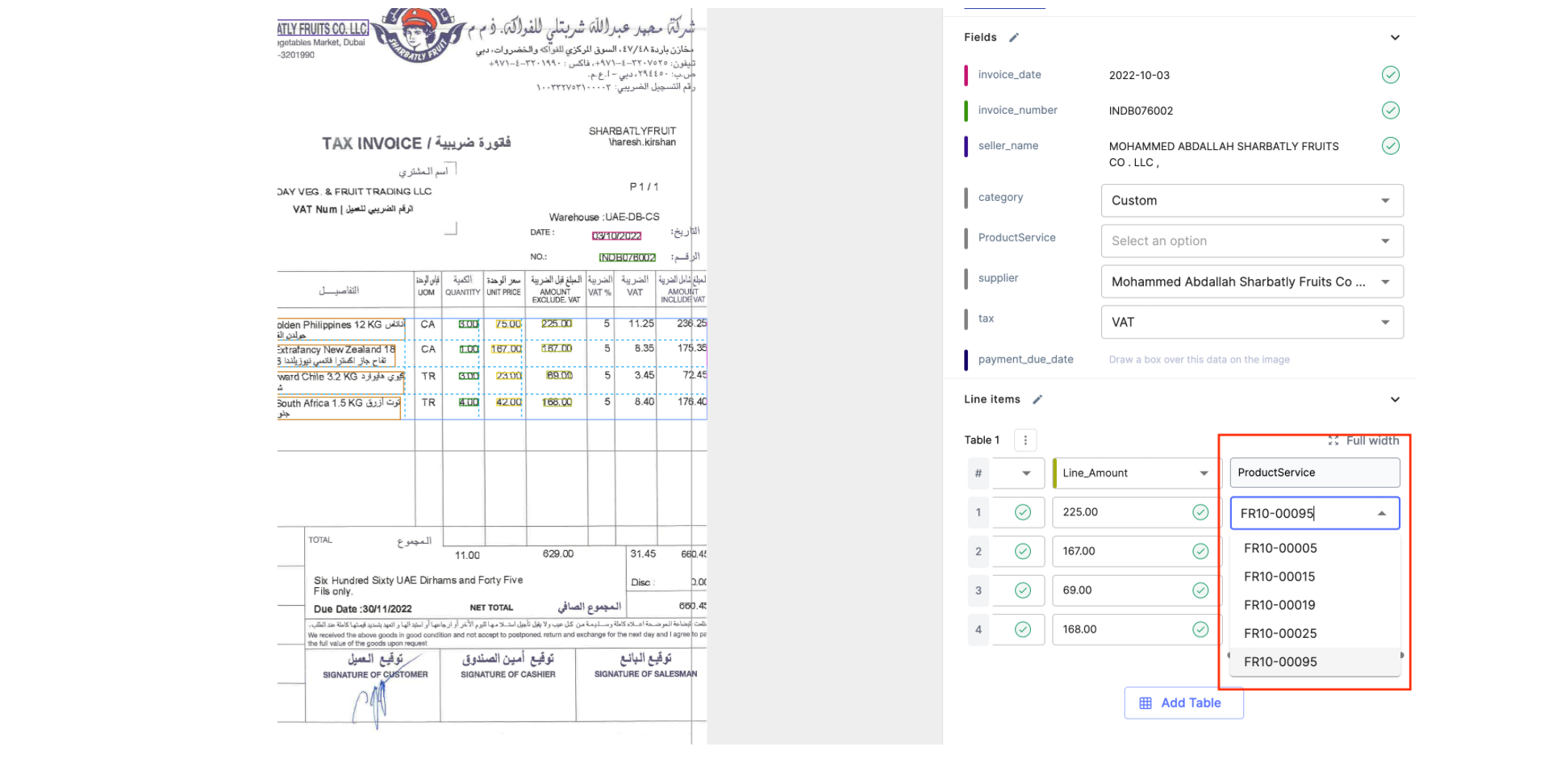

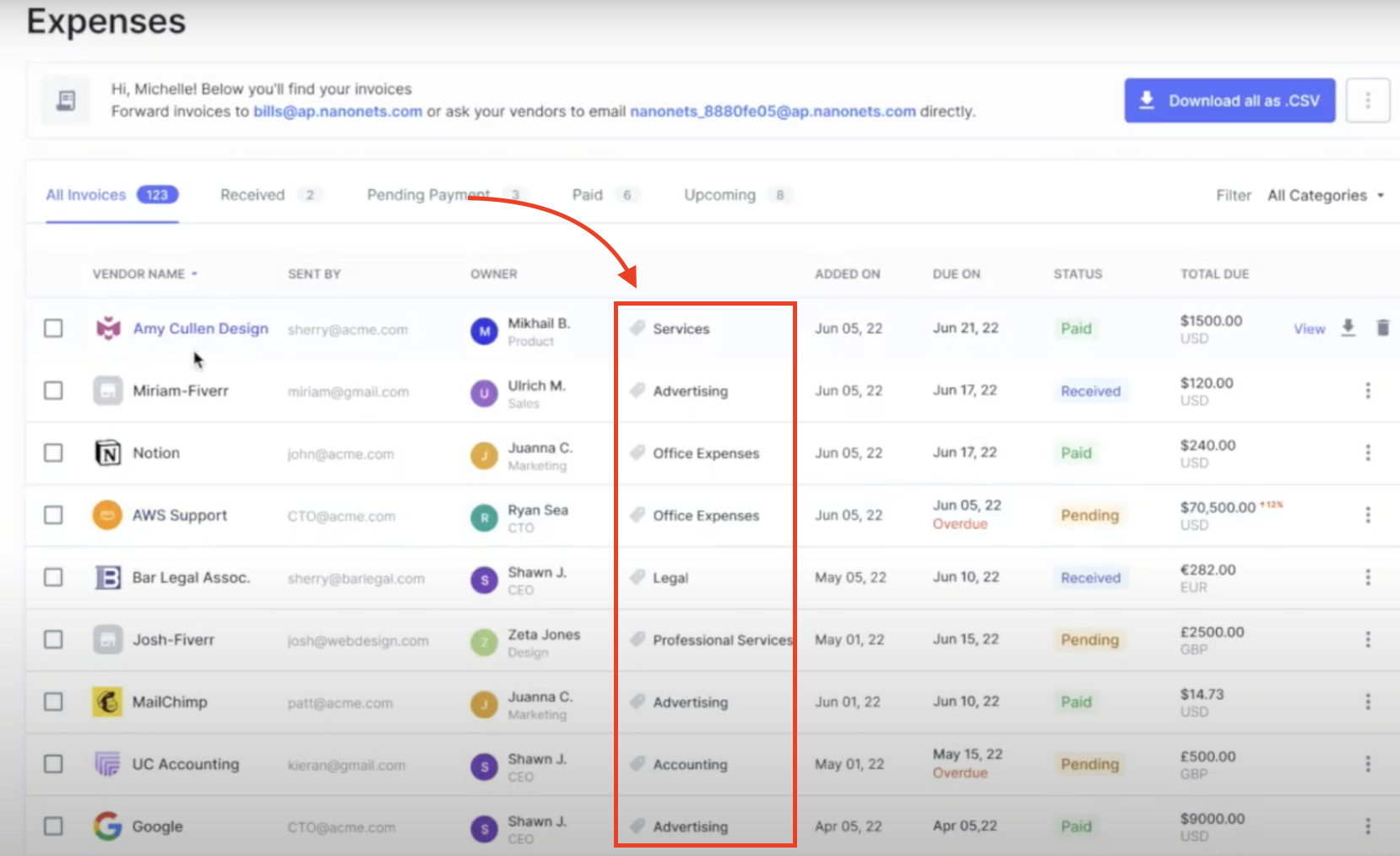

2. Expense Categorization and GL Coding: AI enhances efficiency by automatically categorizing expenses and assigning them to the correct General Ledger (GL) codes. It reduces manual effort, increases accuracy, and ensures consistency in financial reporting.

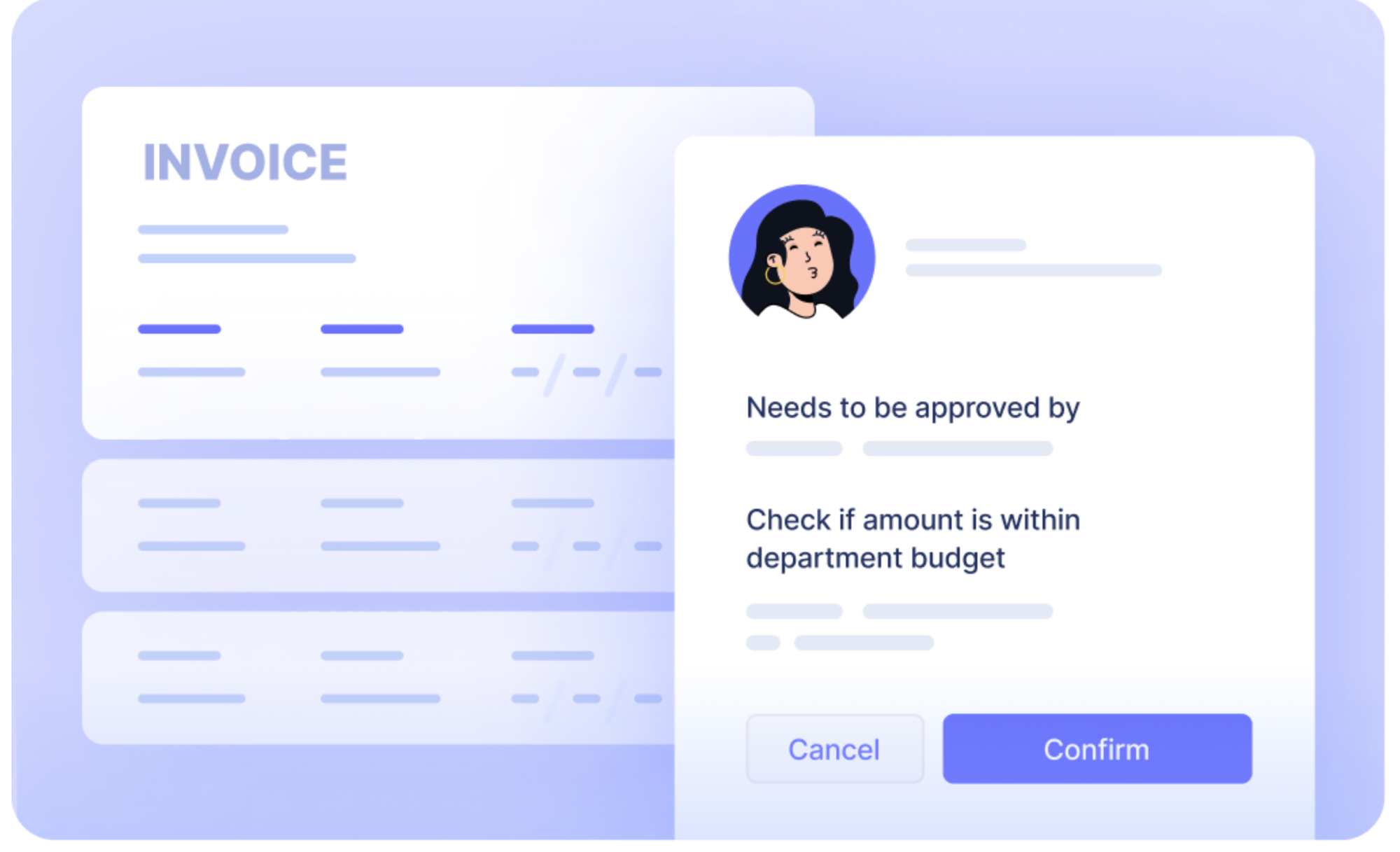

3. Automated Approval Workflows: AI can enforce company policies by automatically categorizing expenses and routing them through the appropriate approval workflows. This ensures that expenses are reviewed and approved faster, with consistent adherence to policies.

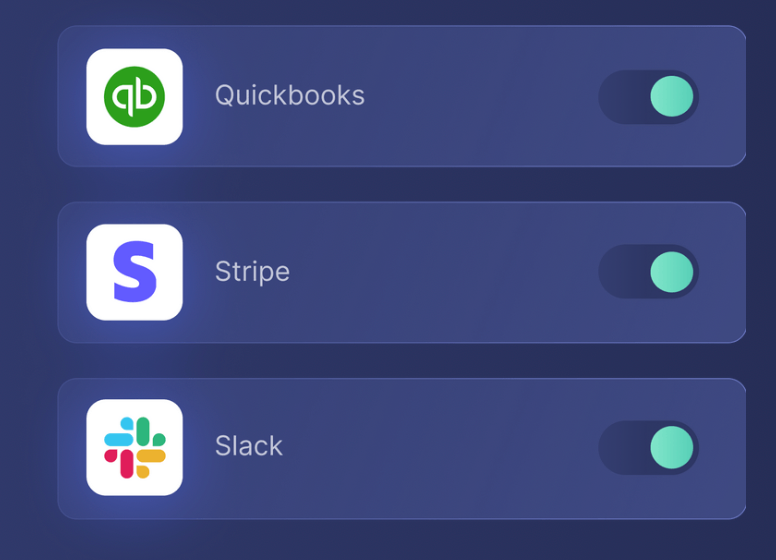

4. Integration with Financial Systems: AI can seamlessly integrate expense management systems with other financial software, such as accounting systems or ERP solutions. This integration facilitates real-time financial analysis and helps maintain accurate financial records.

5. Fraud Detection and Prevention: By analyzing patterns and anomalies in expense reports, AI can identify potential fraud or policy violations. This proactive approach helps organizations mitigate risks and enforce compliance more effectively.

Leveraging Generative AI

6. Chatbots for Expense Queries: AI-powered chatbots can provide instant assistance to employees with questions about expense policies, submission processes, or the status of reimbursements. This improves the user experience and reduces the workload on finance teams.

7. Out-of-the-box Categorization: Leveraging GenAI to automatically classify financial transactions into predefined categories without extensive training, customization or manual intervention. This approach provides a quick, accurate, and scalable solution to categorizing expenses.

Implement AI for Expense Management

Now that we have an understanding of the use cases that can be solved using AI, let's explore how to implement them for your business.

Automating the Expense Management Workflow

This can be done by employing the right expense management software for managing your expenses end-to-end.

Assess the specific needs of your organization, considering factors like size, expense volume, and specific features required (e.g., OCR, approval setup, mobile accessibility, integration with accounting software, etc.).

Then look into different expense management software options, comparing features, user reviews, pricing, and ease of integration with existing systems.

The next step is to set up your workflow in your expense management software.

Before that, let's quickly revisit how a manual workflow without AI and automation looks like.

1. Expense Incurrence: Employees rack up expenses – travel, meals, you name it. They cling to receipts like precious artifacts, which, let's face it, often end up washed-out after a laundry expedition.

2. Manual Data Entry: Employees manually log expenses. Think spreadsheets, crumpled receipts, and the occasional coffee stain. It's a painstaking process, riddled with human error and about as efficient as a one-legged race.

3. Expense Report Generation: The process of trying to compile these spreadsheets into something resembling an expense report.

4. Cumbersome Approvals: Managers then step into the arena to battle policy compliance and reasonability. This process often involves more back-and-forth than a ping-pong match.

5. Slow Reimbursements: Once approved, employees enter the stage of reimbursement waiting times. It's a limbo where time stands still and morale often takes a hit.

6. Data Entry in ERP/accounting software: Data entry – the bane of the finance team's existence returns again. Manually inputting the data into the accounting systems with correct categorization and coding is as thrilling as watching paint dry.

7. Insights? More Like Hindsight: Periodic reports are generated, offering insights that are often as timely as yesterday's newspaper.

Automation and Artificial Intelligence has transformed this gloomy landscape.

A modern expense management software like Nanonets employs these technological advancements to make expense management seamless, efficient and error-free.

Now let's take a look at how the automated expense management workflow looks like with Nanonets.

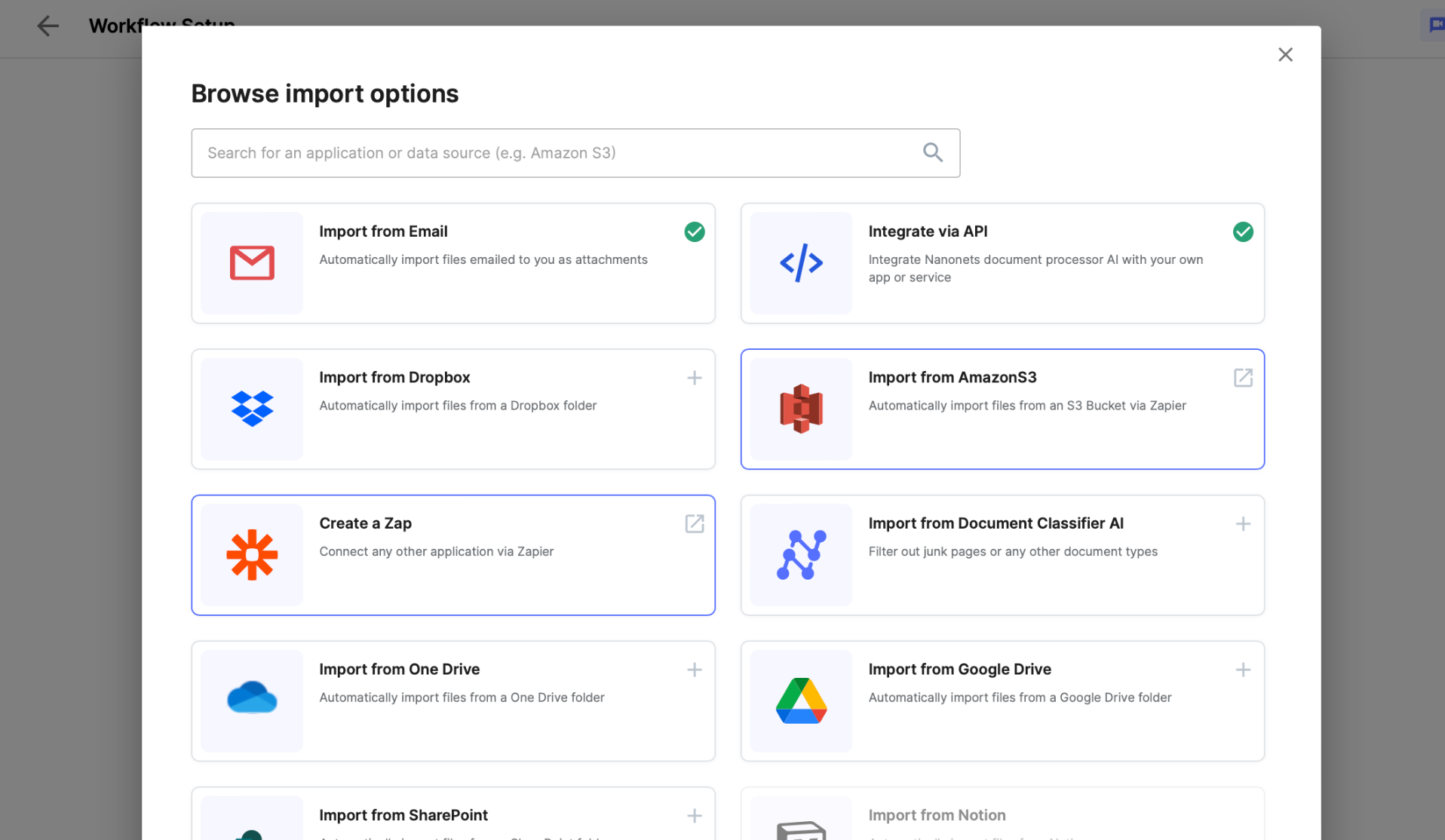

1. Expense Incurrence: Same old expenses, but here's where the magic happens. Receipts are captured faster than a speeding bullet, thanks to the wonders of mobile technology and seamless integrations to import receipts from your apps and databases.

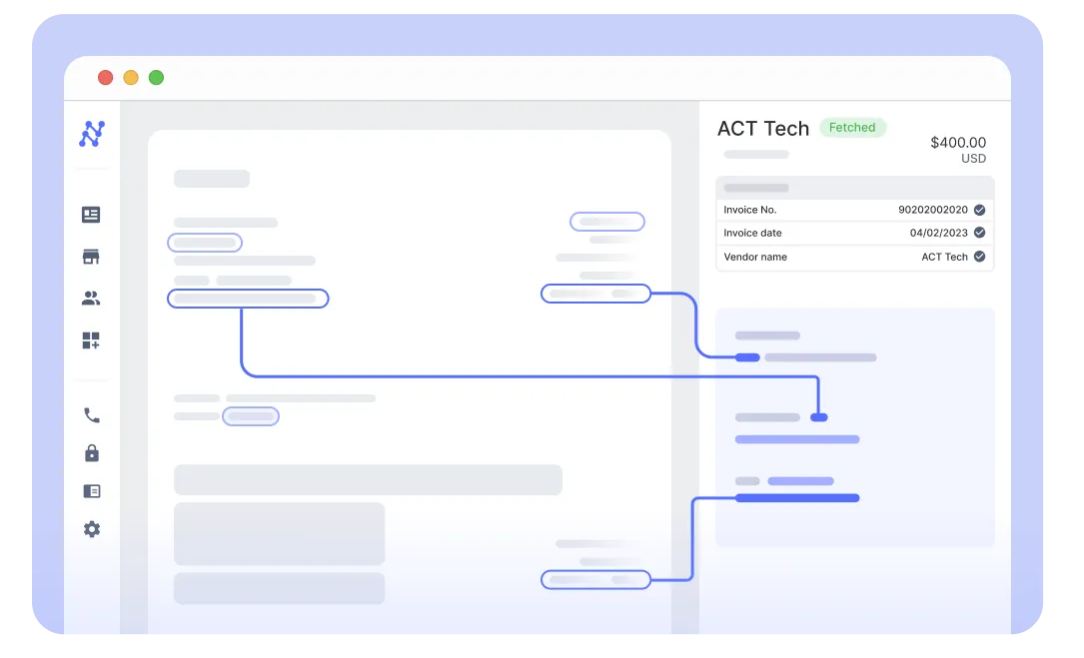

2. Auto-Magic Recording: Optical Character Recognition (OCR) technology steps in, extracting structured data from receipts into digital data faster than you can say "expensed."

3. Expense Categorization and GL coding: Nanonets offers the flexibility to customize rules and categories according to your specific needs. You can turn on Intelligent Expense Categorization, customize expense categories and subcategories based on your business needs, and Nanonets automatically assigns expenses to the appropriate categories, subcategories, and detect anomalies for further review. What's more, this feature works out-of-the-box without requiring any training data!

GL code assignment can be effectively executed by -

- Training on past data: With Nanonets, you can train a machine learning model to recognize and categorize financial transactions. This involves uploading historical financial documents and transactions tagged with historically correct GL codes. The model learns from these examples to accurately predict GL codes for new transactions.

- Out of the Box Gen AI: By using Nanonets GenAI, our software can interpret the text on financial documents in a way that mimics human understanding. This allows it to extract relevant information, context and semantics in order to apply complex reasoning to assign GL codes accurately, even in cases where transaction details are ambiguous or sparse.

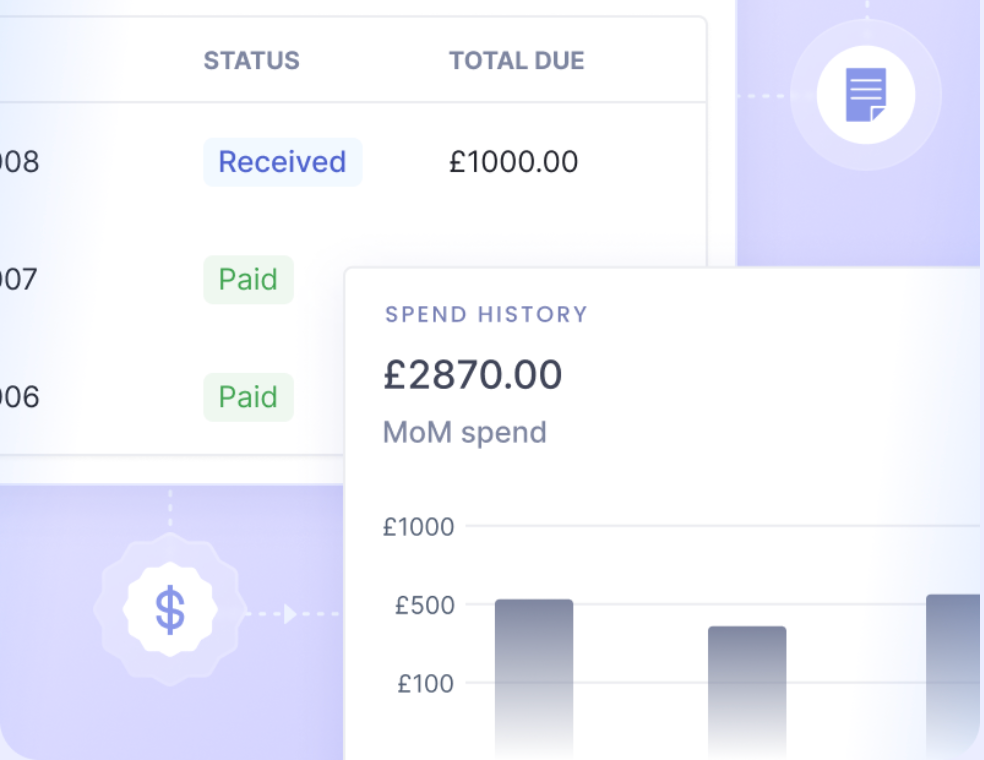

4. Real-Time Reporting: Reports are generated with the click of a button – it's like having your own personal assistant, minus the coffee runs. Real-time data is present in the system ensuring complete visibility into business expenses without lag and errors.

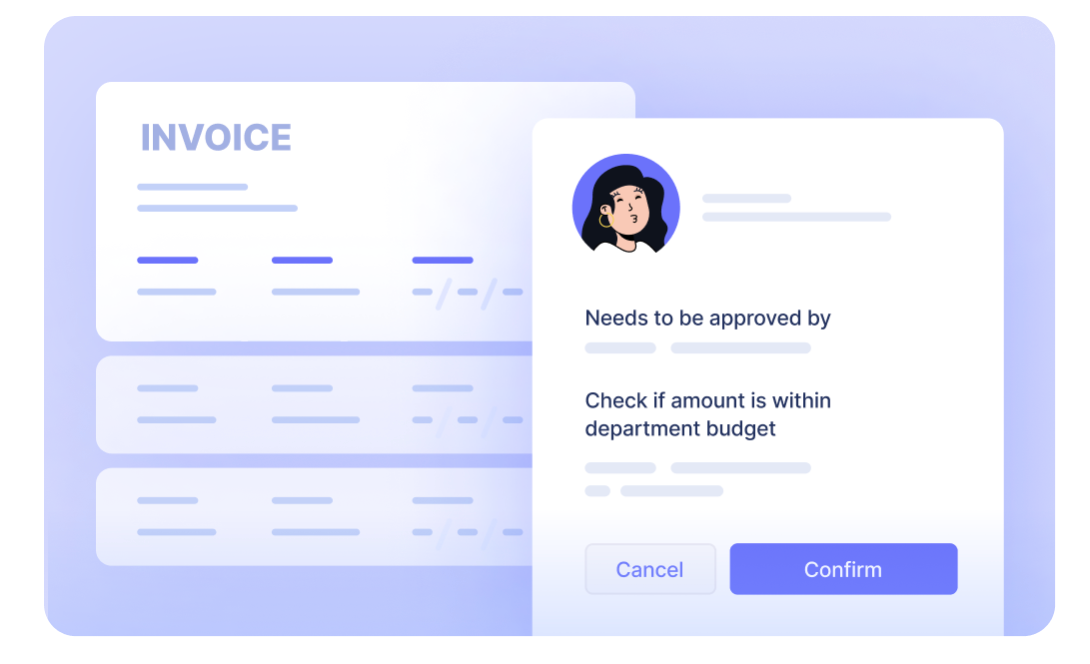

5. Easy Approvals: System-driven compliance checks kick in first, flagging only the outliers. Managers get to focus on real issues instead of playing Whack-a-Mole with every report. You can then add humans-in-the-loop to ensure invoices are sent to approval to the right person at the right time. Furthermore, you can enforce your approval policy and custom validation checks.

6. Compliance Cruise Control: Continuous, automated audits make life easier. Anomalies stick out like a sore thumb, and policy enforcement is tighter than a drum.

7. Speed of Light Reimbursements: Reimbursements happen at warp speed, boosting employee morale to the stratosphere.

8. The Sync Symphony: Seamless integration with your accounting software and other apps turns data entry and reconciliation into a harmonious symphony rather than a chaotic cacophony.

9. Analytics at the Speed of Thought: Real-time insights are at your fingertips, offering a crystal ball into spending patterns and saving opportunities.

Chatbots for Expense Queries

This involves creating a custom chatbot which ingests your expense policy and answers expense related queries based on it. Thanks to advancements in generative AI, implementing this is as simple as uploading your expense policy.

To do this, you can -

- Use a workspace ChatGPT account.

- Deploy your own Chatbot.

- Use a Chatbot Software which creates this chatbot for you.

Benefits of AI in Expense Management

The integration of Artificial Intelligence (AI) into expense management systems brings a host of benefits that revolutionize the way organizations handle their finances.

1. Enhanced Efficiency and Productivity

AI automates tedious and time-consuming tasks such as data entry, expense categorization, and the approval process. This automation frees up employees' time, allowing them to focus on more strategic tasks rather than getting bogged down by administrative duties. The speed of processing expenses and reimbursements increases significantly, reducing the cycle time from submission to approval and payment.

2. Increased Accuracy and Reduced Errors

Manual data entry is prone to human error, which can lead to inaccuracies in financial records. AI-powered systems use Optical Character Recognition (OCR) and machine learning algorithms to extract and process data from receipts and invoices with high precision. This minimizes errors, ensures accuracy in expense reports, and maintains the integrity of financial data.

3. Improved Compliance and Fraud Detection

AI systems can be programmed to understand and enforce company policies and regulatory requirements automatically. They can detect anomalies, unusual spending patterns, and potential fraudulent activities by analyzing vast amounts of data in real-time. This proactive approach to compliance and fraud detection helps organizations mitigate risks and avoid potential financial losses and legal issues.

4. Enhanced Employee Experience

AI-powered chatbots and intuitive interfaces make it easier for employees to submit expenses, inquire about policies, and track the status of their reimbursements. This user-friendly approach improves the overall experience for employees, leading to higher satisfaction and compliance with expense reporting procedures.

5. Cost Reduction

The adoption of AI in expense management leads to direct and indirect cost savings. Automating routine tasks reduces labor costs, while improved accuracy and fraud detection prevent financial losses. Additionally, the strategic insights provided by AI can help companies optimize their spending, leading to more effective budget use.

6. Scalability and Flexibility

AI systems can easily adapt to changing business needs and scale up to handle increasing volumes of expense transactions without a corresponding increase in errors or processing time. This scalability ensures that businesses can grow and evolve without being constrained by their expense management processes.

While the jump from implementing manual to automated expense management might seem like a giant leap, in reality, it's a series of small, practical steps towards efficiency, clarity, and ultimately increased profitability.

Here are a few case studies of businesses that have successfully implemented expense management and automation using AI.

Conclusion

By automating processes, enhancing accuracy, ensuring compliance, and providing strategic insights, AI technologies transform expense management into a strategic asset rather than an administrative burden.

Organizations that adopt AI-powered expense management solutions position themselves for increased operational efficiency, financial control, and competitive advantage in the marketplace.