What is Financial Statement Analysis? A complete guide for 2024

Financial data analysis is critical for investors, creditors, and other stakeholders who want to understand a company's financial health and prospects.

It can be a complex and challenging process, but it is essential for making effective financial reports and sound financial decisions. By carefully analyzing a company's financial data, investors, creditors, and other stakeholders can gain valuable insights into its financial health and prospects.

Let’s examine why it is important and how businesses can streamline it using automation.

What is financial data analysis?

Financial data analysis is the process of examining a company's financial statements and other data like balance sheets, invoices, and more to assess its financial performance, identify trends, and make informed decisions.

Financial data analysis can be used for a variety of purposes, such as:

- Investment analysis: Investors use financial data analysis to identify undervalued or overvalued stocks, assess the risk of an investment, and make informed investment decisions.

- Credit analysis: Creditors use financial data analysis to assess a borrower's creditworthiness and determine whether to extend credit.

- Business analysis: Businesses use financial data analysis to track their financial performance, identify areas for improvement, and make better business decisions.

How is financial data analysis done?

There are many different methods of financial data analysis, but some of the most common include:

- Horizontal analysis: This involves comparing a company's financial statements over time to identify trends.

- Vertical analysis: This involves comparing different items on a company's financial statements to each other.

- Ratio analysis involves calculating financial ratios to compare a company's performance to its peers or industry standards.

- Time series analysis: This involves using statistical methods to analyze trends in a company's financial data over time.

- Forecasting: This involves using historical data to predict future financial performance.

The specific methods used for financial data analysis will vary depending on the purpose of the analysis and the type of data available. However, all financial data analysis should follow these general steps:

- Gather the data. This may involve collecting financial statements, market data, economic data, or other relevant information.

- Clean and prepare the data. This may involve removing errors, correcting inconsistencies, and formatting the data for analysis.

- Choose the appropriate methods. The specific techniques used will depend on the purpose of the analysis and the type of data available.

- Analyze the data. This may involve calculating ratios, creating charts and graphs, or running statistical tests.

Interpret the results. This involves drawing conclusions from the analysis and making recommendations.

How do businesses use financial data analysis?

Businesses use financial data analysis to track their financial performance, identify areas for improvement, and make better business decisions. Some of the specific ways that companies use financial data analysis include:

- Budgeting: Businesses use financial data analysis to create budgets and track their accounts. This helps them ensure that they spend their money wisely and stay on track with their financial goals.

- Forecasting: Businesses use financial data analysis to forecast future financial performance. This helps them make informed decisions about pricing, hiring, and expansion.

- Risk management: Businesses use financial data analysis to identify and manage risks. This helps them to protect their assets and avoid financial losses.

- Investment decisions: Businesses use financial data analysis to make investment decisions. This helps them to choose the suitable investments for their goals and risk tolerance.

- Performance evaluation: Businesses use financial data analysis to evaluate their performance. This helps them to identify areas where they are doing well and areas where they need to improve.

- Competitive analysis: Businesses use financial data analysis to analyze their competitors. This helps them to understand their competitors' strengths and weaknesses and identify opportunities to gain a competitive advantage.

By carefully analyzing their financial data, businesses can gain valuable insights into their operations and identify opportunities for improvement.

What are the benefits of financial data analysis?

Financial data analysis can benefit businesses, investors, and other stakeholders in several ways.

Some of the key benefits of financial data analysis include:

- Improved decision-making: Financial data analysis can help businesses make better decisions by giving them insights into their financial performance and the factors affecting it.

- Increased efficiency: Financial data analysis can help businesses identify areas to improve their efficiency and reduce costs.

- Reduced risk: Financial data analysis can help businesses identify and manage risks.

- Increased transparency: Financial data analysis can help businesses improve transparency and accountability.

- Enhanced competitive advantage: Financial data analysis can help businesses gain a competitive advantage by giving them insights into their competitors' strengths and weaknesses.

By carefully analyzing financial data, businesses, investors, and other stakeholders can gain valuable insights into their operations and identify opportunities for improvement.

Challenges of manual financial data analysis

Manual financial data analysis is the process of analyzing financial data by hand. This can be a time-consuming and error-prone process, and it can be challenging to identify trends and patterns in the data.

Some of the challenges of manual financial data analysis include:

- Time-consuming: Manual data entry and analysis can take a lot of time, especially if a large amount of data is to be processed.

- Error-prone: Manual data entry is prone to errors, leading to inaccurate results.

- Identifying trends: It can be challenging to identify trends and patterns in data when it is analyzed manually.

- Limited insights: Manual analysis can only provide limited insights into the data, as it is not possible to run complex calculations or statistical tests.

- Lack of scalability: Manual analysis is not scalable, as it cannot be easily applied to large datasets.

As a result of these challenges, manual financial data analysis is often not suitable for businesses that need to analyze large datasets or identify complex trends. In these cases, it is more efficient and accurate to use automated financial data analysis tools.

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

How Nanonets can streamline your financial data analysis process

Financial data analysis is a critical process for businesses of all sizes. It can help companies to make better decisions, improve efficiency, and reduce risk. However, the financial data analysis process can be complex and time-consuming. This is where Nanonets can help.

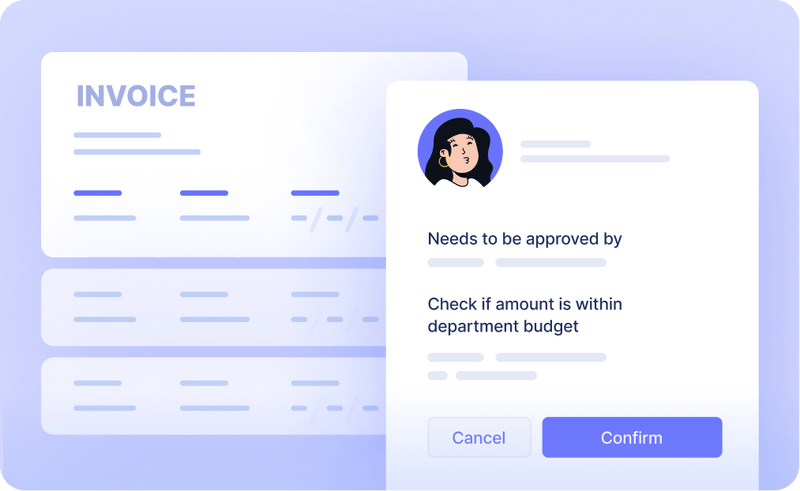

Nanonets is an AI-powered data extraction platform that automates financial data analysis. Nanonets can extract data from various sources, including invoices, receipts, and financial statements. It can also identify trends and patterns in the data. This allows businesses to quickly and easily gain insights into their financial performance.

Nanonets can help businesses address the following challenges in the financial data analysis process:

- Poor data quality: Nanonets can extract data accurately and reliably, ensuring businesses have the data they need to make informed decisions.

- Difficulties accessing data: Nanonets can extract data from various sources, making it easy for businesses to access the data they need.

- Data spread across multiple systems: Nanonets can consolidate data from various systems, giving businesses a single view of their financial data.

- Different views of data: Nanonets can help businesses standardize how they view their financial data, ensuring everyone is on the same page.

- Fear of failure: Nanonets offers customer support to help businesses get started and overcome any challenges they may face.

By automating the financial data analysis process, Nanonets can save businesses time and money. It can also help businesses to improve their decision-making, efficiency, and risk management.

FAQs

What is financial data analysis?

Financial data analysis is the process of examining financial data to identify trends, patterns, and insights.

Why is financial data analysis useful?

Financial data analysis is useful for making informed decisions about a company's financial health.

What are the 4 types of financial data?

The 4 types of financial data are financial statements, market data, economic data, and internal data.

What is an example of financial data analysis?

An example of financial data analysis is calculating a marketing campaign's return on investment (ROI).

How to do financial data analysis?

Financial data analysis can be done by collecting, cleaning, analyzing, and interpreting financial data.