What are your bank statements telling you about your business?

They're not just lists of numbers — they're packed with valuable information about your company's financial health.

Bank statement analysis helps you uncover this hidden data. It gives you a clear picture of your cash flow, spending patterns, and overall financial health. With this knowledge, you can make better budgeting decisions, spot potential problems early, and keep your business on track financially.

In this blog, we’ll explore bank statement analysis, why it matters for your business, and how new technology is making it easier and more effective than ever.

What is bank statement analysis?

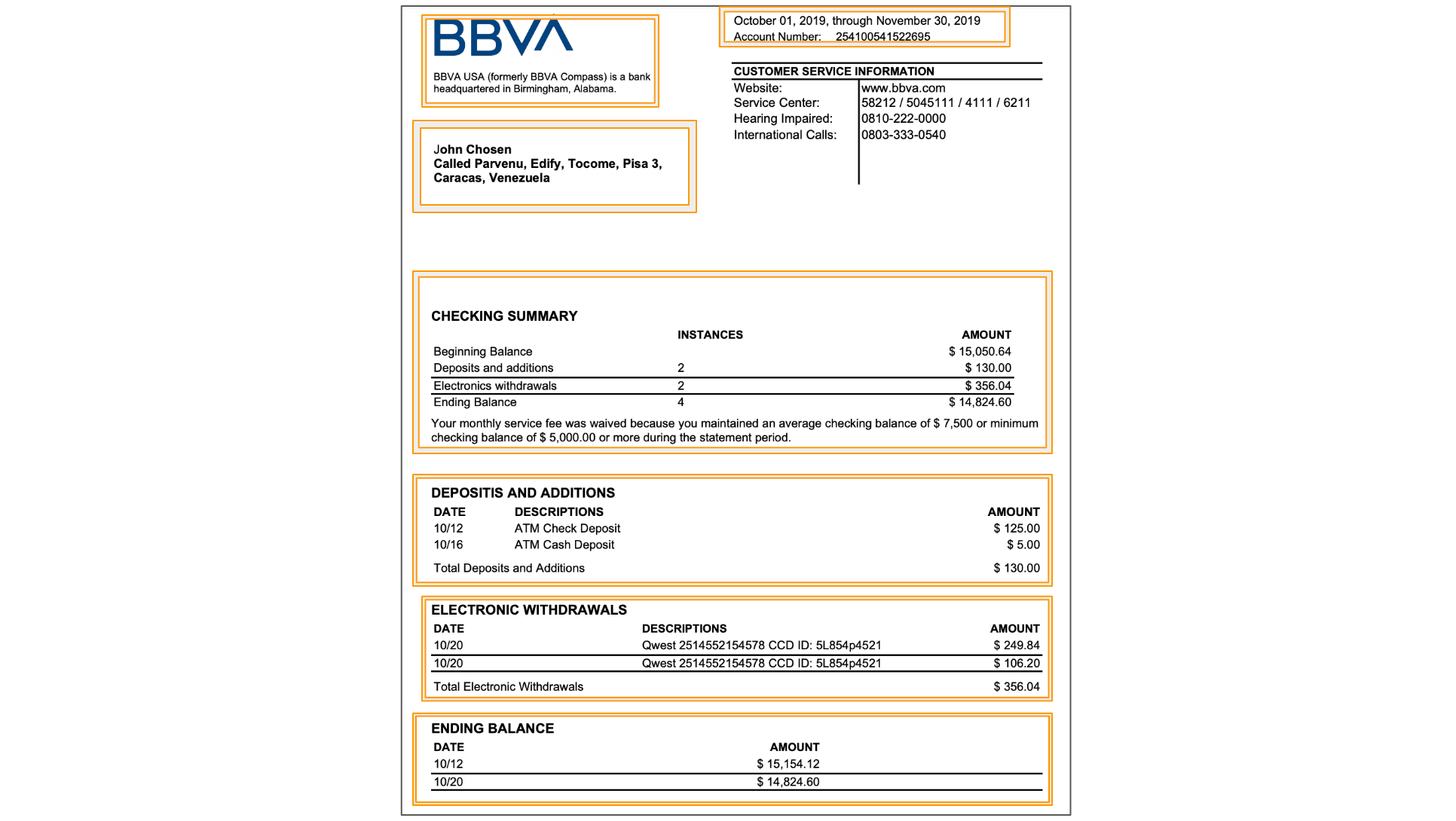

Bank statement analysis is the process of systematically reviewing and interpreting all entries in a bank statement over a specific period. It is a crucial step in the bank statement verification process.

It's like putting your financial transactions under a microscope to better understand your business's financial health and activities.

Key aspects of bank statement analysis

- Transaction categorization: Classify entries as deposits, withdrawals, transfers, payments, etc.

- Expense analysis: Review outgoing payments such as vendor payments, payroll, and operational costs.

- Revenue tracking: Monitor income sources, including customer payments and interest income.

- Asset and liability changes: Track fluctuations in the company's assets (cash, investments) and liabilities (loans, credits).

- Balance verification: Confirm the accuracy of the final balance at the end of the statement period.

- Pattern recognition: Identify recurring transactions or unusual fraud activities.

Key aspects of bank statement analysis

- Transaction categorization: Classify entries as deposits, withdrawals, transfers, payments, etc.

- Expense analysis: Review outgoing payments such as vendor payments, payroll, and operational costs.

- Revenue tracking: Monitor income sources, including customer payments and interest income.

- Asset and liability changes: Track fluctuations in the company's assets (cash, investments) and liabilities (loans, credits).

- Balance verification: Confirm the accuracy of the final balance at the end of the statement period.

- Pattern recognition: Identify recurring transactions or unusual fraud activities.

This detailed review helps businesses get a clear picture of their financial standing and spot any irregularities early on.

Why is bank statement analysis important?

Cash flow analysis

- Identify regular expenses (e.g., payroll, utilities) and flags unexpected costs

- Track steady income streams and highlight irregular earnings

- Spot fake bank statements that may indicate errors or bank statement fraud

- Predict future cash flows and plan for potential overdrafts

Bank reconciliation

- Compare bank statement data with internal records to ensure every transaction is accounted for properly

- Detect errors or fraud by catching discrepancies between the bank’s records and your financial documentation

- Catch and correct errors before they cause significant financial damage

Read About: Bank Reconciliation Statement Format

Managing future liabilities

- Bank statement analysis helps review the balance to ensure sufficient funds are available for upcoming obligations

- The insights from bank statement analysis can help avoid unnecessary spending and improve operational efficiency

Loan and client assessment

- To understand the financial reliability and creditworthiness of loan applicants and clients and to evaluate loan repayment ability

- The analysis gives you a better picture of the applicant’s liabilities and income streams

Audit and compliance

- Support the audit process with detailed transaction histories

- Ensure accurate tax filings

- Maintain adherence to financial regulations

Spreadsheet-based bank statement analysis

Spreadsheet tools like Microsoft Excel, Google Sheets, or LibreOffice Calc have long been the go-to tools for bank statement analysis. They offer a familiar interface and features that can be used for effective financial management.

The data from the bank statement is imported or manually copy pasted into the spreadsheet templates. Formulae are prebuilt into the spreadsheet to perform calculations, which can then be manually analyzed.

Pros of using spreadsheets for bank statement analysis

- Using spreadsheet templates is a low-cost solution for bank statement analysis.

- It can be learned using free online resources and YouTube tutorials - which makes it popular among individual professionals.

- Spreadsheets can be used offline and be easily customized to fit specific business needs or accounting practices.

- Advanced users can create complex calculations and leverage built-in charting tools for better visualization.

Cons of using spreadsheets for bank statement analysis

While spreadsheets offer flexibility, they have many drawbacks for bank statement analysis.

- Manual data entry is time-consuming and prone to errors, especially as transaction volumes grow.

- Spreadsheets struggle with scalability, often becoming sluggish with large datasets.

- They also lack robust security features, potentially exposing sensitive financial data.

- Version control can be challenging, particularly in collaborative environments, and spreadsheets offer limited audit trails for tracking changes.

- While possible, complex financial modeling and advanced analysis are challenging in spreadsheets.

Let's face it - going through bank statements line by line is time-consuming and tedious.

Traditionally, only trained accountants and auditors performed bank statement analysis, which involved examining and analyzing each entry in the bank statement. This is practically impossible with today's scaled-up operations and multiple formats of bank statements.

That's where modern AI-powered tools come in. They can quickly analyze your statements, giving you valuable insights without the headache of manual number-crunching.

Let’s examine how this is done and explore some advanced bank statement analysers.

AI-powered bank statement analysis

AI-powered tools are paving the way for financial analysis across all industries.

Bank statement analysis can be done by leveraging machine learning (ML) and artificial intelligence (AI) to automate and enhance the extraction and interpretation of financial data. Bank statement extraction software uses advanced OCR to extract data with more than 98% accuracy and comes with self-learning and adaptive capabilities.

Pros of using AI-powered bank statement analysis

- These tools automate data extraction and categorization and can dramatically reduce manual effort and human error by increasing speed and accuracy.

- They excel in handling large volumes of data across multiple accounts, making them highly scalable for growing businesses.

- AI's intelligent categorization capabilities improve over time, providing increasingly accurate insights.

- Can be easily integrated with all other financial systems using API to act as bank statement analyzers.

- By automating time-consuming tasks, AI tools free up valuable resources, allowing employees to focus on strategic decision-making rather than data processing.

Cons of using AI-powered bank statement analysis

While AI-powered automation tools offer significant advantages, they aren't without drawbacks.

- The initial setup and training period for some AI tools can be time-consuming, and staff may experience a learning curve, especially for advanced complex integrations.

- Require a substantial initial investment and might not be suitable for really small businesses or low-volume bank statement users.

- While they are highly accurate (up to 99% accuracy), AI tools are not perfect and may occasionally misinterpret unusual transactions and require human oversight.

How to set up bank statement extraction and analysis workflow

Bank statement analysis needs to be spot-on, with no room for errors.

Let's see how you can use Nanonets, an AI-powered OCR data extraction tool, to make the process easier and more efficient. Note that this can be done for free for up to 500 bank statements:

- Open the web application at app.nanonets.com. If you don’t have an account yet, sign up for free and log in.

- Navigate to "New workflow" and select "Pre-built bank statement extractor." If this option isn’t available, you can use the Zero-training extractor instead.

- Upload/Import all your bank statements —whether they’re PDFs, scanned images, or spreadsheets. Nanonets can handle all file types.

- Review the extracted data and extract more fields if any missed.

- You can also customize and add more bank statement fields by editing different labels.

- Download/export the data as different file formats (CSV, Excel, Google Sheet, XML).

- While the above steps covered the basic steps to set up a bank statement extraction workflow, for more analysis you can also export it to your accounting or ERP software for further processing. All you need to do is setup an integration workflow.

Nanonets comes with 30+ built-in integrations, you can set up any new integration workflow using a bank statement API.

- You can also used advanced analytics to get insights into your workflows.

Overcoming challenges in bank statement analysis

Difficulties arise in bank statement analysis primarily due to the inconsistencies in the source data.

High volume and velocity of data

Traditional methods like manual data entry, spreadsheet-based analysis, and periodic batch processing struggle with the increasing volume and speed of financial transactions and often lead to delays. To address this, implement real-time data processing solutions and use big data analytics tools capable of handling large volumes of transaction data continuously.

AI-powered data extraction tools can significantly improve this process by bank statement processing, automatically processing bank statements and categorizing high volumes of transactions in real-time, regardless of the data source or format.

Diverse statement formats

Banks use different styles and formats for their statements, making standardized data extraction difficult. A library of templates for commonly used bank statement formats can help streamline the process if you are currently using or planning to adopt a template-based data extraction tool.

In the case of advanced intelligent document processing (IDP) tools such as Nanonets, the AI models automatically adapt to various templates and can help overcome this challenge.

Poor source quality

Poor-quality scans can lead to low accuracy in data extraction. Invest in high-quality scanning equipment for physical statements and use image preprocessing techniques to enhance document quality before extraction. AI algorithms capable of handling low-quality inputs can significantly improve accuracy.

Multiple currencies and international standards

For companies operating across different countries, handling multiple currencies and varying bank types adds another layer of complexity. Financial standards and terminologies can differ from one country to another, making data extraction and harmonization a bit of a challenge.

Use advanced tools that come with built-in currency conversion capabilities and implement a standardized chart of accounts to accommodate international variations. Leverage AI tools that can recognize and categorize transactions across different languages and currencies.

Ensuring data security and compliance

Finally, safeguarding data security and ensuring compliance with regulations like GDPR or HIPAA (in healthcare) is crucial. Financial information is sensitive, and managing compliance can be challenging.

Choose a reputed software solution with robust encryption and compliance certifications. Implement strict access controls and audit trails for all financial data and regularly train staff on data security best practices.

Industry applications of bank statement analysis and its automation

Bank statement analysis is used across many industries for financial management and decision-making. Below are some key examples of how different sectors use bank statement analysis and ways in which automation can help:

Banking and financial services

- Verify income and cash flow patterns for loan applications

- Detect irregular transactions or potential money laundering activities

- Analyze spending habits to offer personalized financial products

- Assess debt-to-income ratio for credit decisions

- Assess loan applicants' creditworthiness

- Evaluate client companies' cash flow for valuations

- Assess financial stability for mergers and acquisitions

Insurance

- Verify income for insurance premium calculations

- Detect potential insurance fraud by analyzing transaction patterns

- Assess financial stability for high-value policy applications

- Verify claims by cross-referencing with bank statement transactions

- Assessing clients' financial standing.

Taxation and accounting

- Identify undisclosed income sources by analyzing deposit patterns

- Verify reported cash transactions against bank deposits

- Analyze the timing of income receipts for tax planning

- Detect potential structuring activities to avoid reporting thresholds

- Automatically categorize income sources and expenses

- Identify potential tax deductions from transaction data

Retail and e-commerce

- Analyze customer refund and chargeback patterns

- Verify merchant settlements against bank deposits

- Detect potential employee theft by analyzing POS data against deposits

- Analyze seasonal cash flow patterns for inventory planning

Real estate

- Verify rental income for property investors

- Analyze vacancy impact on cash flow from bank statements

- Detect potential tenant fraud by analyzing their bank statements

- Verify property management fee deductions

Healthcare

- Reconcile insurance payments with patient accounts

- Analyze payment patterns for different treatment types

- Detect potential insurance fraud by analyzing payment histories

- Track timing of medicare/medicaid deposits

Non-profit organizations

- Track and categorize donations by source and purpose

- Analyze the timing of grant payments for cash flow management

- Detect potential misuse of funds by analyzing expense patterns

- Reconcile fundraising event revenues with bank deposits

Government agencies

- Reconcile tax payments with taxpayer accounts

- Analyze timing of federal or state fund deposits

- Detect potential embezzlement by analyzing transaction patterns

- Track grant fund utilization through recipient bank statements