Introduction

If you've ever wondered how businesses keep track of their spending or ensure that every dollar is accounted for, you’re in the right place. Expense reconciliation is the process through which businesses track expenditures, identify anomalies, adhere to regulatory requirements, and maintain financial accuracy and integrity.

Through this guide, we will define what expense reconciliation is, explore its significance to companies, the formal methods of going about it, as well as the challenges and best practices involved. We will also uncover how cutting-edge automation solutions such as Nanonets can revolutionise the expense reconciliation process, unlocking newfound efficiencies and insights for businesses of all sizes.

What is Expense Reconciliation?

Expense reconciliation is a process within finance and accounting that ensures that a company's financial records accurately reflect its spending activities. At its core, it involves comparing financial data from various sources within a business to identify any discrepancies or errors and bring them into alignment.

In simpler terms, expense reconciliation is a way for businesses to double-check their financial records to make sure everything adds up correctly. Just like balancing a chequebook or tallying up receipts to match your monthly bank statement, expense reconciliation helps ensure that all of a business’ expenses are properly accounted for and recorded.

This process typically involves reviewing transactions, invoices, receipts, and other financial documents to verify that they match up with the company's records and budget. By comparing these records, businesses can identify any discrepancies, such as missing or duplicate transactions, incorrect or false amounts, or any unauthorised expenses and transactions. This process is essential for maintaining financial accuracy, compliance with regulations, and preventing fraud or errors. It provides organisations with a clear and accurate picture of their spending habits and overall financial situation, allowing them to manage budgets, make informed decisions, and effectively manage the business.

In the next sections, we'll explore different methods of expense reconciliation, examples of how it's used in practice, and why it's so important for businesses of all sizes.

The Importance of Expense Reconciliation

Expense reconciliation holds significant importance in the realm of finance and accounting for several reasons:

- Financial Accuracy: One of the primary reasons for expense reconciliation is to ensure the accuracy of financial records. By comparing and reconciling expenses against various financial documents, businesses can detect and correct any discrepancies or errors, ensuring that their financial statements reflect the true state of their finances.

- Compliance and Regulation: Expense reconciliation is crucial for compliance with financial regulations and standards. Many industries are subject to regulatory requirements regarding financial reporting and transparency. By reconciling expenses, businesses can ensure that they comply with these regulations and avoid potential penalties or legal issues.

- Fraud Prevention: Expense reconciliation plays a critical role in fraud prevention. By thoroughly reviewing financial transactions and identifying any irregularities or unauthorised expenses, businesses can detect and prevent fraudulent activities. This helps safeguard the company's assets and reputation.

- Budget Management: Expense reconciliation provides businesses with valuable insights into their spending patterns and helps them manage their budgets more effectively. By tracking expenses and identifying areas of overspending or inefficiency, businesses can make informed decisions to optimise their budget allocation and improve financial performance.

- Decision-Making: Accurate financial data is essential for making informed business decisions. Expense reconciliation ensures that businesses have reliable and up-to-date information about their expenses, enabling them to make strategic decisions that drive growth and profitability.

Overall, expense reconciliation is critical to ensuring financial accuracy, regulatory compliance, fraud prevention, efficient budget management, and informed decision-making. By prioritising expense reconciliation, businesses can maintain financial integrity and achieve their long-term financial goals.

Expense Reconciliation: Multiple Methods and Models

Expense reconciliation can be conducted using various methods, each tailored to the specific needs and requirements of a business. Here are some of the common methods for expense reconciliation:

Manual Reconciliation

In manual expense reconciliation, financial professionals review and compare expense records, such as receipts, invoices, and bank statements, manually. This method is painstaking and involves matching each expense entry with the corresponding documentation—bills, invoices, purchase orders, cheques, bank statements and the likes—to identify discrepancies and errors. While manual reconciliation can be time-consuming, labour-intensive, and error-prone, it offers a high level of control and subjective human oversight into the process.

Spreadsheet Reconciliation

Spreadsheet software like Microsoft Excel is often used for expense reconciliation. Financial professionals input expense data into spreadsheets and use formulas and functions to compare and reconcile expenses. Spreadsheet reconciliation offers flexibility customization options, but can also be prone to errors. It also lacks scalability, as the professionals working with the relevant Excel sheets possess a kind of tribal knowledge that is not easily transferable to any new stakeholder who might need to become involved in expense reconciliation.

Automated Reconciliation

With advancements in technology, many businesses are turning to advanced automated expense reconciliation softwares, such as Nanonets. Such tools streamline the reconciliation process by automatically extracting and matching expense data from different sources, such as bank statements, credit card transactions, and expense reports. Nanonets uses advanced artificial intelligence and machine learning algorithms to identify patterns and discrepancies, significantly reducing the time, effort, and errors involved in reconciling expenses. Automated reconciliation offers increased efficiency, accuracy, and scalability compared to manual methods.

Integrated Reconciliation

Integrated reconciliation involves integrating expense reconciliation functionalities into existing accounting or ERP (Enterprise Resource Planning) systems. By integrating reconciliation capabilities directly into the accounting software, businesses can streamline the reconciliation process and ensure consistency and accuracy across financial workflows. Integrated reconciliation solutions often offer real-time data synchronisation and seamless integration with other financial processes, such as accounts payable and accounts receivable.

Outsourced Reconciliation

Some businesses choose to outsource their expense reconciliation tasks to third-party service providers. Outsourced reconciliation services typically involve sending expense data to a specialised firm or accounting service, which handles the reconciliation process on behalf of the business. While outsourcing can alleviate the burden of reconciliation for businesses, it's essential to choose a reputable provider and ensure data security and confidentiality.

Overall, the method of expense reconciliation chosen by a business will depend on factors such as the size of the organisation, the volume of transactions, available resources, and specific business needs. Each method has its advantages and limitations, and businesses should carefully evaluate their options to determine the most suitable approach for their requirements.

Examples of Expense Reconciliation

Expense reconciliation is a necessary element of businesses across various industries and sizes. It is an integral part of a business’ operations, helping them maintain accurate financial records and ensuring compliance with regulatory requirements. Here are some examples of expense reconciliation commonly performed by businesses:

- Bank Reconciliation: Bank reconciliation involves comparing the transactions recorded in a company's accounting records with those in the bank statement to ensure consistency and accuracy. This process helps identify discrepancies such as missing transactions, bank errors, or unauthorised withdrawals. Bank reconciliation is typically conducted monthly and involves matching deposits, withdrawals, and other bank transactions with corresponding entries in the company's accounting system.

- Credit Card Reconciliation: Similar to bank reconciliation, credit card reconciliation involves reconciling credit card transactions recorded in the company's accounting system with the credit card statements received from the credit card issuer. This process ensures that all credit card transactions are accurately recorded and accounted for in the company's financial records. Credit card reconciliation helps identify discrepancies such as fraudulent transactions, duplicate charges, or unauthorised expenses.

- Vendor Reconciliation: Vendor reconciliation involves reconciling accounts payable transactions with vendor statements to ensure that all invoices and payments are accurately recorded and accounted for. This process helps identify discrepancies such as missing invoices, overpayments, or pricing errors. Vendor reconciliation is essential for maintaining good relationships with suppliers and avoiding payment disputes.

- Expense Report Reconciliation: Expense report reconciliation involves reconciling employee expense reports with receipts and other supporting documentation to ensure that all expenses are legitimate and properly documented. This process helps identify discrepancies such as unauthorised expenses, duplicate reimbursements, and non-compliant expenses. Expense report reconciliation is crucial for controlling costs and ensuring compliance with company policies and regulations.

- Inventory Reconciliation: Inventory reconciliation involves reconciling physical inventory counts with inventory records to ensure accuracy and prevent inventory shrinkage or loss. This process helps identify discrepancies such as inventory discrepancies, stockouts, or surplus inventory. Inventory reconciliation is essential for optimising inventory management, controlling costs, and improving supply chain efficiency.

These are just a few examples of expense reconciliation processes commonly performed by businesses. Depending on the nature of the business and its operations, other types of expense reconciliation may also be necessary to ensure financial accuracy and integrity. By regularly reconciling expenses, businesses can identify and resolve discrepancies promptly, maintain accurate financial records, and make informed business decisions.

Step-by-Step Guide to Performing Expense Reconciliation

Expense reconciliation is a systematic process that involves comparing and verifying financial transactions to ensure accuracy and consistency. Here's a step-by-step guide to performing expense reconciliation effectively:

- Gather Documentation: Collect all relevant financial documents, including bank statements, credit card statements, vendor invoices, employee expense reports, and inventory records. Ensure that you have access to accurate and up-to-date financial data to facilitate the reconciliation process.

- Review Transactions: Carefully review each transaction recorded in your financial records, including deposits, withdrawals, purchases, payments, and expenses. Verify the accuracy of transaction details such as dates, amounts, descriptions, and account codes.

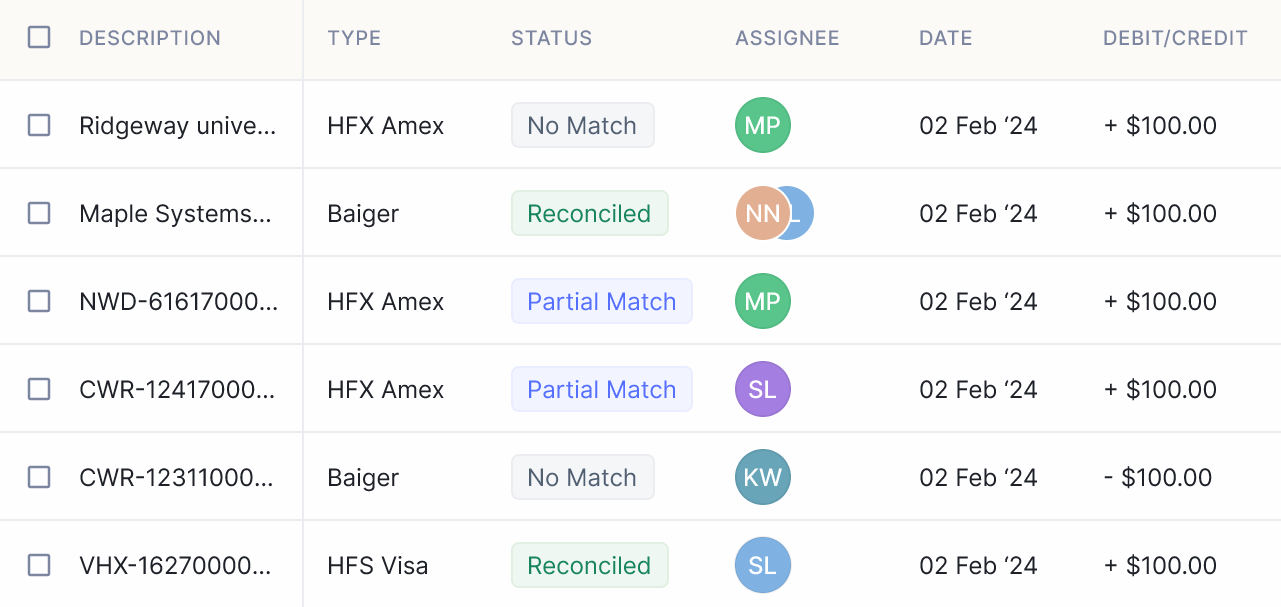

- Match Transactions: Compare the transactions recorded in your financial records with those in external statements or documents, such as bank statements, credit card statements, vendor invoices, or employee expense reports. Ensure that each transaction is correctly matched and reconciled with its corresponding entry in the financial records.

- Identify Discrepancies: If you encounter any discrepancies or differences between the transactions recorded in your financial records and external statements or documents, investigate the root cause of the discrepancies. Common discrepancies may include missing transactions, duplicate entries, errors in amounts, or unauthorised expenses.

- Resolve Discrepancies: Take appropriate actions to resolve any identified discrepancies or errors. This may involve correcting data entry errors, contacting vendors or financial institutions to clarify transactions, or updating financial records to reflect accurate information.

- Document Findings: Maintain detailed documentation of the reconciliation process, including the steps taken, findings, and resolutions for any discrepancies encountered. Documentation helps ensure transparency, accountability, and compliance with internal policies and external regulations.

- Perform Reconciliation Controls: Implement reconciliation controls and procedures to prevent future discrepancies and errors. This may include regular review and validation of financial transactions, segregation of duties, approval workflows, and periodic audits.

- Monitor and Review: Continuously monitor and review the reconciliation process to ensure ongoing accuracy and effectiveness. Regularly assess the adequacy of reconciliation controls, identify areas for improvement, and make necessary adjustments to enhance the efficiency and reliability of the process.

By following these step-by-step guidelines, businesses can effectively perform expense reconciliation, maintain accurate financial records, and mitigate the risk of errors, discrepancies, and fraud. Consistent and thorough expense reconciliation practices are essential for ensuring financial integrity, compliance, and informed decision-making within organisations.

How Nanonets can 10x Your Expense Reconciliation Process

Nanonets offers cutting-edge automation solutions that can revolutionise the expense reconciliation process in your company, agnostic of sector and size. Here's how Nanonets can improve the efficiency, accuracy, and speed of your expense reconciliation:

Nanonets leverages advanced OCR (Optical Character Recognition) technology to automatically extract data from various financial documents, including bank statements, invoices, receipts, expense reports, credit card statements, and more. By eliminating the need for manual data entry, Nanonets accelerates the reconciliation process and reduces the risk of human errors.

Nanonets' AI-powered intelligent document classification algorithms categorise and organise financial documents based on predefined criteria, such as transaction type, vendor name, date range, and amount. This enables seamless sorting and grouping of documents, facilitating faster and more efficient reconciliation.

Nanonets allows you to customise expense reconciliation workflows according to your specific business requirements and preferences. You can define rules, thresholds, and validation criteria to automate decision-making and exception handling, ensuring a standardised yet optimised reconciliation processes.

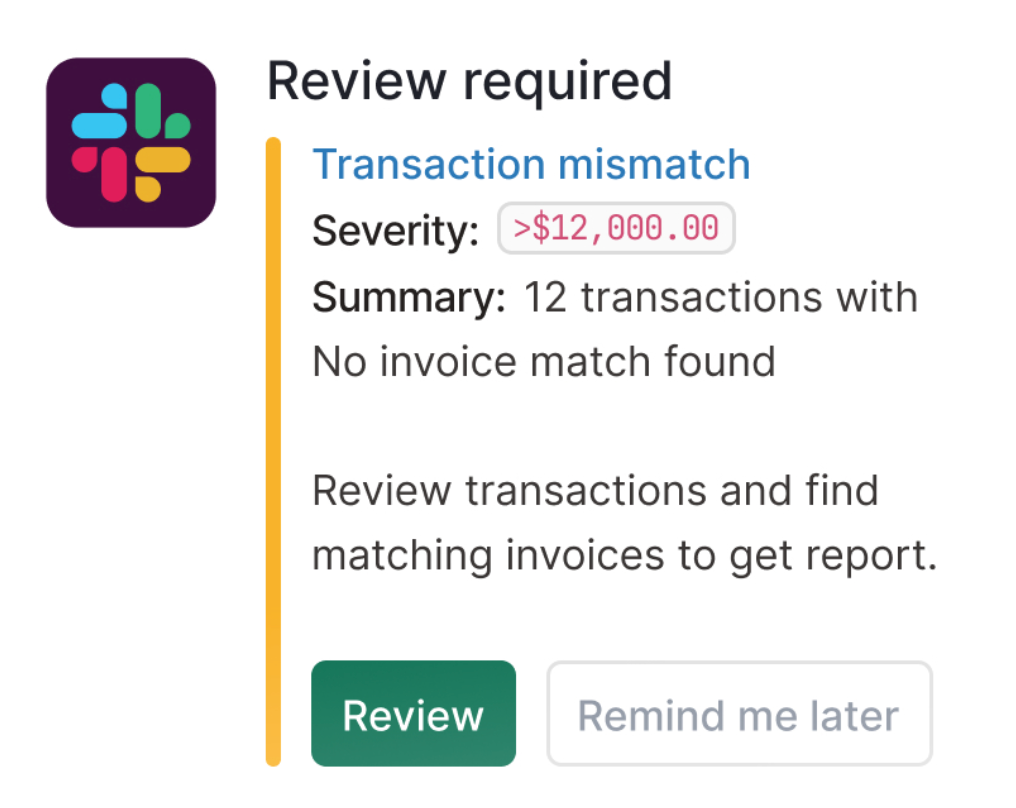

Nanonets provides real-time monitoring and alerts to keep you informed about the progress and status of expense reconciliation activities. You can receive notifications for completed reconciliations, pending tasks, exceptions, discrepancies, or anomalies, allowing you to take timely action and address issues proactively.

Nanonets easily integrates with existing accounting systems, ERP (Enterprise Resource Planning) software, and financial management platforms, which enables smooth data exchange and synchronisation. You can import/export reconciled data, generate custom reports, and track financial metrics within your preferred software environment.

Whether you're a small business or a large enterprise, Nanonets offers scalable and flexible solutions that can adapt to your evolving needs and growing volume of financial transactions. You can easily scale up or down your usage, add new users, or expand functionality to accommodate changing business requirements.

Nanonets provides robust data security and compliance with industry standards and regulations, such as GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act). Your sensitive financial data is encrypted, stored securely, and protected against unauthorised access, guaranteeing confidentiality and integrity.

Additionally, Nanonets is committed to ongoing innovation and enhancement of its automation solutions to deliver maximum value and performance to customers. You can benefit from regular updates, new features, and improvements that optimise the expense reconciliation process and drive operational excellence.

Book a free consultation call with Nanonets for your expense reconciliation needs here. By leveraging Nanonets' advanced automation capabilities, you can achieve significant gains in operational efficiency, cost savings, and productivity.

Expense Reconciliation: Challenges and Best Practices

Expense reconciliation is a critical aspect of financial management, ensuring the accuracy and integrity of an organisation's financial records. However, it is not without its challenges: One of the most significant hindrances while reconciling expenses is the reliance on manual data entry for recording transactions and reconciling accounts. This process is time-consuming, labour-intensive, and prone to errors, leading to discrepancies in financial records.

To address this challenge, organisations can embrace automation technologies, such as AI-powered software and robotic process automation (RPA), to streamline and automate expense reconciliation tasks. By automating data extraction, categorization, matching, and validation, organisations can improve efficiency, accuracy, and scalability while reducing manual effort and errors.

Additionally, financial data can be complex, especially when dealing with multiple currencies, payment methods, and expense categories. Managing and reconciling diverse data sources, formats, and structures can pose a significant challenge for organisations, particularly those operating in global markets. To overcome this, organizations can implement standardisation initiatives to standardise expense categories, coding conventions, reconciliation procedures, and documentation templates. By establishing clear guidelines and protocols, organisations can minimise errors, confusion, and discrepancies in financial records.

Compliance with regulatory standards and reporting requirements adds another layer of complexity to the expense reconciliation process. Organisations must ensure adherence to accounting principles, tax regulations, and industry-specific guidelines, which may vary depending on the jurisdiction and business sector. To address compliance challenges, organisations can implement robust internal controls, segregation of duties, and approval workflows to prevent fraud, errors, and unauthorised transactions. By enforcing strict adherence to policies, procedures, and authorization protocols, organisations can mitigate risks and maintain compliance with regulatory standards.

Limited visibility into financial transactions, expenses, and reconciliation activities can hinder decision-making and accountability. Without real-time insights and analytics, organisations may struggle to identify trends, anomalies, or areas for improvement in their expense management processes. To enhance visibility, organisations can invest in data quality management initiatives to improve the accuracy, completeness, and reliability of financial data. By implementing data validation checks, error detection mechanisms, and data cleansing techniques, organisations can identify and rectify inconsistencies or inaccuracies in expense records.

Many organisations face resource constraints, including budget limitations, staffing shortages, and technological gaps, which can impede their ability to perform expense reconciliation effectively. Without sufficient resources and support, organisations may struggle to implement best practices and adopt automation solutions. To address resource constraints, organisations can foster collaboration and communication between finance, procurement, and other departments involved in the expense reconciliation process. By promoting cross-functional teamwork, knowledge sharing, and transparency, organisations can facilitate alignment, coordination, and accountability.

In summary, by addressing these challenges and implementing best practices, organisations can enhance the effectiveness, efficiency, and reliability of their expense reconciliation process. By embracing automation, standardisation, compliance, visibility, and collaboration, organisations can improve financial management, compliance, and decision-making.

Conclusion

Expense reconciliation is a fundamental aspect of financial management, enabling organisations to maintain accuracy, integrity, and compliance in their financial records. While the expense reconciliation process may pose various challenges, such as manual data entry, complexity, compliance requirements, limited visibility, and resource constraints, organisations can overcome these obstacles by implementing best practices and leveraging technology solutions.

By embracing automation, standardisation, compliance, visibility, and collaboration, organisations can streamline expense reconciliation tasks, improve efficiency, accuracy, and scalability, and enhance decision-making and accountability. Automation technologies, such as advanced AI-powered software and OCR technologies like Nanonets, can automate data extraction, categorization, matching, and validation, reducing manual effort and errors.

Furthermore, standardisation initiatives, internal controls, and data quality management can help organisations ensure consistency, accuracy, and compliance in their expense reconciliation processes. By enforcing strict adherence to policies, procedures, and authorization protocols, organisations can mitigate risks and maintain compliance with regulatory standards.

Moreover, fostering collaboration, communication, and transparency between finance, procurement, and other departments involved in the expense reconciliation process can facilitate alignment, coordination, and accountability. By promoting cross-functional teamwork and knowledge sharing, organisations can optimise resource allocation and maximise the effectiveness of their expense reconciliation efforts.

In conclusion, by addressing challenges, implementing best practices, and leveraging technology solutions, organisations can optimise their expense reconciliation process, enhance financial management, compliance, and decision-making, and drive business success.