The process of reconciliation plays a vital role in ensuring accurate and transparent financial records. Reconciliation is the act of comparing and matching two sets of data to ensure their consistency and accuracy.

In this article, we will explore the process of reconciliation, its purpose, types, and some best practices. We will also look into how you can automate the process of reconciliation with the help of Nanonets.

For an in-depth look at the nuances of ensuring financial records are accurate and trustworthy, delve into our detailed guide "What is Account Reconciliation?" available at Nanonets. It's a valuable resource that complements the fundamentals discussed in "What is the Process of Reconciliation?"

Understand the pivotal role of advanced reconciliation software in the reconciliation process by visiting Best Reconciliation Software.

What is Reconciliation?

Reconciliation is the method of comparing transactions and activity to supporting documentation. It entails identifying and resolving any discrepancies found in the process.

It involves comparing financial records, such as bank statements, balance sheets, cash registers, invoices, and receipts, to identify discrepancies or inconsistencies.

The aim is to reconcile the data and ensure that transactions match supporting documents across different sources. This is because these documents reflect the financial situation of a company. When they are accurate, they give insights into what risks the business is facing.

What is the Reconciliation Process?

The process of reconciliation involves several steps to ensure accuracy and consistency in financial records. Here are the general steps involved:

Gather relevant documents

Collect all the necessary financial documents that need to be reconciled. These include bank statements, vendor invoices, receipts, and internal records (such as general ledger or accounting software reports).

Compare beginning balances

Start by comparing the beginning balances of the accounts or records being reconciled. For example, compare the beginning balance of a bank account as per the bank statement with the balance recorded in the company's general ledger.

Verify transactions

Go through each transaction in the bank statement and compare it with the corresponding transaction in the internal records. Ensure that the transactions match date, description, and amount. Mark any discrepancies for further investigation.

Identify outstanding items

Look for outstanding items that may appear on either the bank statement or the internal records. Examples include outstanding checks, deposits in transit, or pending transactions. These items must be accounted for and reconciled to ensure accurate financial reporting.

Investigate discrepancies

Analyze the discrepancies or differences identified during the comparison process. This may involve contacting the bank for clarification, cross-referencing supporting documents, or communicating with relevant departments within the organization. Investigate each discrepancy to determine the root cause and take appropriate actions to resolve them.

Adjust records

Based on the investigation and resolution of discrepancies, make any necessary adjustments to the internal records. This may involve updating the general ledger, making journal entries, or correcting errors in the accounting software.

Reconcile ending balances

Once all discrepancies are resolved, and adjustments are made, compare the ending balances of the accounts or records being reconciled. Ensure that the ending balance as per the bank statement matches the balance in the internal records after all adjustments.

Prepare reconciliation report

Document the entire reconciliation process and its outcomes in a reconciliation report. The report should include details such as the beginning and ending balances, a summary of discrepancies found, actions taken to resolve them, and any adjustments made. This report serves as evidence of the thoroughness of the reconciliation process and provides documentation for auditing purposes.

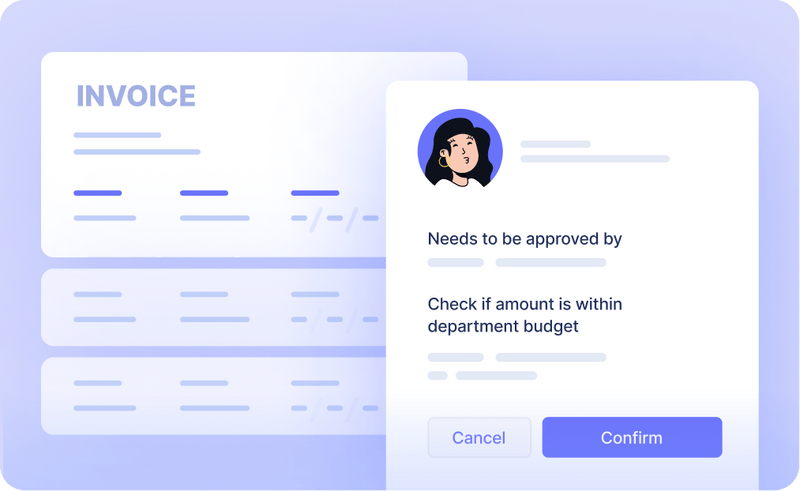

Review and approval

The appropriate personnel review and approve the reconciliation report to ensure accuracy.

Ongoing monitoring

Reconciliation is an ongoing process, so it is important to establish regular intervals for performing reconciliations. This should be done to track transactions and records to identify and address discrepancies on time.

It's worth noting that the specific steps may vary depending on the nature of the accounts being reconciled, the organization's internal processes, and the tools or software used for reconciliation.

What are the types of reconciliation?

Reconciliation can be done for various financial accounts, such as bank accounts, credit card accounts, and inventory. Reconciliation can help to identify errors and ensure that financial records are accurate.

There are many different types of reconciliation, but some of the most common include:

- Bank reconciliation: This is the process of comparing a bank statement to a company's ledger to ensure that the two agree. This can help to identify errors such as unauthorized transactions or unrecorded deposits.

- Account receivable reconciliation: This is the process of comparing a company's accounts receivable records to its customers' statements to ensure that the two agree. This can help to identify errors such as unpaid invoices or duplicate payments.

- Account payable reconciliation: This is the process of comparing a company's accounts payable records to its vendors' statements to ensure that the two agree. This can help to identify errors such as outstanding invoices or duplicate payments.

- Inventory reconciliation: This is the process of comparing a company's inventory records to its physical inventory to ensure that the two agree. This can help to identify errors such as lost or damaged inventory.

- Intercompany reconciliation: This is the process of comparing the financial records of two related companies to ensure that the two agree. This can help to identify errors such as unrecorded transactions or duplicate payments.

It is important to perform reconciliations on a regular basis to identify and correct any errors.

What is the Purpose of reconciliation?

Regular reconciliations will help businesses keep track of their financial health. The purpose of reconciliation is to:

- Identify errors: Reconciliation can help to identify errors in financial records, such as unauthorized transactions or unrecorded deposits. This can help to ensure that financial records are accurate and reliable.

- Prevent fraud: Reconciliation can help to prevent fraud by identifying unauthorized transactions. This can help to protect businesses from financial losses.

- Meet regulatory requirements: Some businesses must reconcile their financial records by law. This is especially true for businesses that operate in regulated industries.

- Improve cash flow: Reconciliation can help to improve cash flow by identifying outstanding payments or deposits. This can help businesses to manage their cash more effectively.

- Stay organized: Reconciliation can help businesses to stay organized by keeping track of their financial records. This can help to avoid confusion and errors.

How frequently reconciliations are done is usually decided by the finance departments of companies. The general rule of thumb is that they are conducted at the end of every accounting period.

What are some best practices for the reconciliation process?

The reconciliation process is important for every company, and done properly, they can do a world of good.

Here are some best practices for the reconciliation process:

- Establish a regular schedule: Reconciliations should be performed on a regular basis, such as monthly or quarterly. This will help to ensure that errors are identified and corrected promptly.

- Use the same documents: When reconciling two sets of records, use the same documents for both. This will help to avoid confusion and errors.

- Be thorough: When reconciling two sets of records, be thorough and check all transactions. This will help to ensure that all errors are identified.

- Document the reconciliation: Once the reconciliation is complete, document the process and the results. This will help to track any changes to the records and to troubleshoot any problems that may occur.

- Keep records: Keep all records related to the reconciliation process, such as the original documents, the reconciliation statements, and any notes or documentation. This will help provide a trail of evidence in case of discrepancies or disputes.

- Use a reliable reconciliation tool: Many different reconciliation tools are available, both manual and automated. Choose a tool that is right for your needs and will help you complete the reconciliation process efficiently.

- Get help from experts: If you are not familiar with the reconciliation process or if you have complex records, you may want to get help from an accountant or bookkeeper. They can help you to ensure that the reconciliation process is done correctly.

- Continuously monitor and improve: The reconciliation process is an ongoing process. As your business grows and your financial records become more complex, you may need to adjust your reconciliation procedures. Monitor the process regularly and make changes as needed to ensure effectiveness.

Following these best practices can help ensure the reconciliation process is accurate and efficient.

What are the benefits of automating the process of reconciliation?

Reconciliation can be a time-consuming and error-prone process, especially for businesses with large volumes of transactions. Automating the reconciliation process can help to improve efficiency and accuracy.

Here are some of the benefits of automating the process of reconciliation:

- Improved accuracy: Automated reconciliation can help to improve accuracy by reducing the risk of human error. This is because automated systems are less likely to make mistakes than humans.

- Reduced time and resources: Automated reconciliation can help to reduce the time and resources required for the reconciliation process. This is because automated systems can process transactions more quickly and efficiently than humans.

- Increased efficiency: Automated reconciliation can help improve efficiency by freeing employees to focus on other tasks. This can help businesses to save money and improve productivity.

- Reduced risk of fraud: Automated reconciliation can help reduce fraud risk by identifying unauthorized transactions. This can help businesses to protect their financial assets.

- Improved compliance: Automated reconciliation can help businesses to comply with regulations by ensuring that financial records are accurate and up-to-date.

How to automate the reconciliation process?

The first step is to identify the types of reconciliations that need to be automated. This will depend on the size and complexity of your business and the volume of transactions you process.

The next thing is to select the right tool. There are a number of different automated reconciliation tools available. The right tool for you will depend on your specific needs and requirements.

Nanonets offers an intelligent document automation platform that combines no-code workflow automation, OCR software, and a global payments platform to automate the reconciliation process. Organizations can use Nanonets to automate their financial processes, improve financial visibility, and track spending categories.

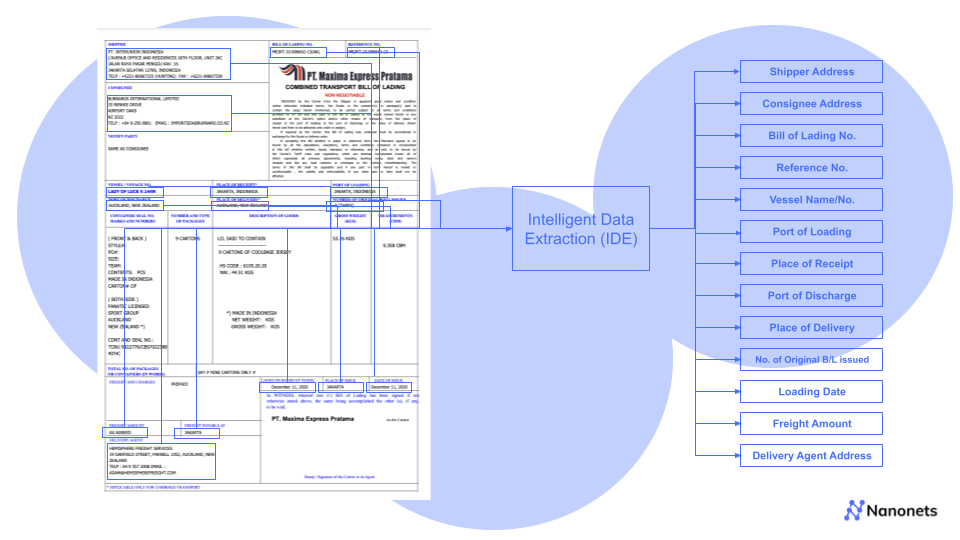

After you select the right tool, upload the necessary documents. Nanonets can automate the document upload process, so you can easily and seamlessly send your bank statements, cash registers, and proof of payments to their OCR models. This eliminates the need to collect and organize documents manually.

Once documents are uploaded, Nanonets automatically categorizes them and extracts relevant data using OCR technology. This data is then matched across various sources using rule-based workflows. Any mismatches are flagged for review. Nanonets also allows reviewers to annotate documents, which enhances collaboration and reduces errors.

Nanonets can automatically update the matching entries in your ERP or accounting software. You can also choose to export the data to Google Sheets or your preferred database for further analysis and reporting. This integration with your existing systems ensures that the reconciled data is accurately reflected in your financial records without any manual work.

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Conclusion

The reconciliation process helps to ensure the accuracy of financial records. There are a number of different ways to perform reconciliation, but the most common methods involve comparing bank statements to ledgers, accounts receivable to invoices, and accounts payable to vendors' statements.

Automating the reconciliation process has many benefits, such as improved accuracy, reduced time and resources, increased efficiency, reduced risk of fraud, and improved compliance.

FAQs

What is reconciliation?

Reconciliation is the process of comparing two sets of records to ensure that they agree.

What is the process of reconciliation?

The process of reconciliation is comparing two sets of records to ensure that they agree.

What is balance sheet reconciliation?

Balance sheet reconciliation is the process of ensuring that the balances on the balance sheet agree with the underlying accounting records.

What is an example of reconciliation?

An example of reconciliation is comparing a bank statement to a company's ledger.