Invoice coding involves categorizing expenses and assigning them to specific accounts. It seems simple, which is why it's often overlooked in AP efficiency discussions. But here's the kicker: it may be costing you more than you think.

Companies without automation spend $6.30 per invoice, while automated counterparts pay just $1.45. That's right— automation could save you nearly 77% per invoice! It gives you an idea of the potential savings at stake. But it's beyond just cost. Accurate invoice coding is crucial for financial reporting, budgeting, and decision-making. Mistakes, even as simple as incorrect debit or credit recording, can lead to compliance issues and skewed financial data.

Want to know how exactly does it work? And how can you implement invoice in your organization? You're in the right place. This guide will walk you through the process of invoice coding, how to automate it, and the best practices.

Let's start with the basics.

What is invoice coding?

Invoice coding is the process of assigning specific identifiers to each line item on an invoice. These codes, often called General Ledger (GL) codes, categorize expenses for accounting purposes. Think of it as giving each expense its own 'address' in your financial records.

A correctly coded invoice should include a unique vendor ID (like OFF001 for OfficeMax), a specific GL code (such as 6100 for Office Expenses), a department code (MKT for Marketing), a cost center (MKTG-01), and a project code (Q2CAM for Q2 Campaign).

This detailed coding enables accurate budget tracking, easier reporting, faster approvals, and better financial analysis. For instance, you can quickly generate reports on all Q2 campaign expenses or total OfficeMax purchases, automatically route invoices to the right approvers, and analyze spending patterns across departments, projects, or vendors.

Traditionally, AP staff had to manually review each invoice, determine the right codes, and painstakingly enter them into the accounting system. This process, while thorough, is time-consuming and prone to errors.

Modern AP automation software uses AI, ML, OCR, and workflow automation to streamline this process. It can:

- Automatically extract data from invoices, regardless of format

- Suggest appropriate GL codes based on historical data and patterns

- Route invoices for approval based on predefined rules

- Integrate with existing ERP systems for seamless data flow

The invoice coding process

Your AP staff may already be using some form of invoice coding. It may involve manually assigning categories to invoices in spreadsheets, or perhaps you're using your ERP's built-in coding features. Whatever your current method, understanding the standard invoice coding process can help you identify areas for improvement.

Typically, invoice coding follows these steps:

- Invoice receipt: You may receive invoices via email, web portals, supplier platforms, or even as paper documents. The first step is to gather and digitize them if necessary.

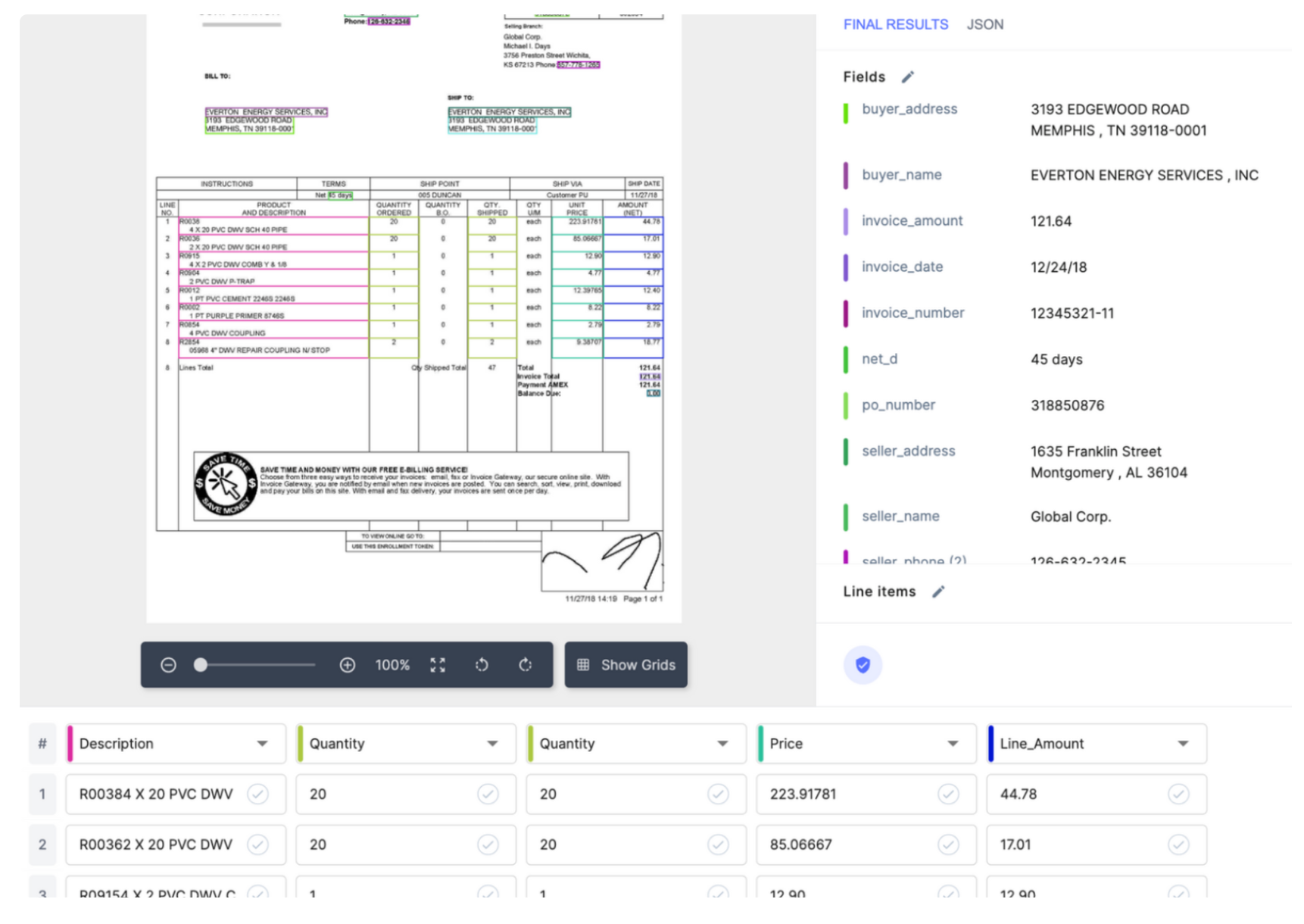

- Data capture: This is where your team extracts key information from the invoice. In manual systems, this means keying in details by hand. More advanced setups might use OCR technology to automate this step.

- Code assignment: Here's where the actual 'coding' happens. Your team assigns each line item a GL code based on your chart of accounts. This step requires a deep understanding of your financial structure.

- Validation and matching: Next, the invoice is checked against purchase orders and receiving documents. This helps catch discrepancies early.

- Approval routing: The coded invoice then moves through your approval chain. This might involve physical handoffs, emails, or digital workflows, depending on your current system.

- Posting to the accounting system: Finally, the approved and coded invoice data is entered into your accounting software or ERP.

How does your current process compare to this standard flow? If you're still relying on manual methods, you're likely facing challenges like:

- Time drain: AP staff must manually key in each invoice detail, often cross-referencing with other documents. This tedious process can take hours, especially for complex invoices.

- Error rates: Human errors in data entry or code assignment can ripple through your financial reports. A misplaced decimal or incorrect GL code can significantly skew your financial data.

- Late payments: Physical routing of invoices or email chains can lead to bottlenecks. Invoices might sit on someone's desk or get lost in an inbox, resulting in missed payment deadlines and potential late fees.

- Poor visibility: Without a centralized system, it's challenging to know where an invoice is in the approval process. This leads to time wasted on status inquiries and potential duplicate payments.

- Incorrect cashflow position: Manual processes often mean delayed data entry, making it hard to get an accurate, real-time picture of your financial position.

- Coding inconsistencies: Different team members might interpret coding guidelines differently, leading to inconsistencies in financial reporting.

- Scaling problems: As your business grows and invoice volume increases, manual processes become increasingly unsustainable.

These challenges aren't just inconveniences—they're costing you money. Remember, manual processes can cost up to $6.30 per invoice, compared to just $1.45 with automation.

How to automate invoice coding

Setting up automation can be scary. You've got to find the right software, convince finance to invest, train your team, and integrate the system. But once you get past these hurdles, you'll wonder why you didn't do it sooner.

Here's how to get started:

1. Choose the right software:

You would need an AP automation solution that seamlessly integrates with your existing ERP system. Look for features like OCR technology, AI-powered data extraction, automated matching, and customizable approval workflows. Also, ensure the software can handle your invoice volume.

Nanonets’ pre-trained model can recognize common invoice fields out of the box, saving you time in setup.

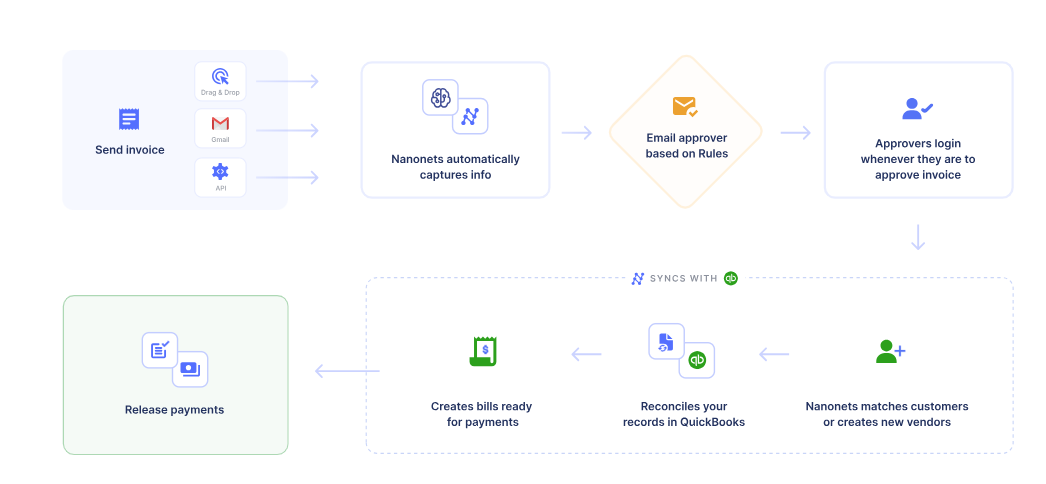

2. Digitize your invoices:

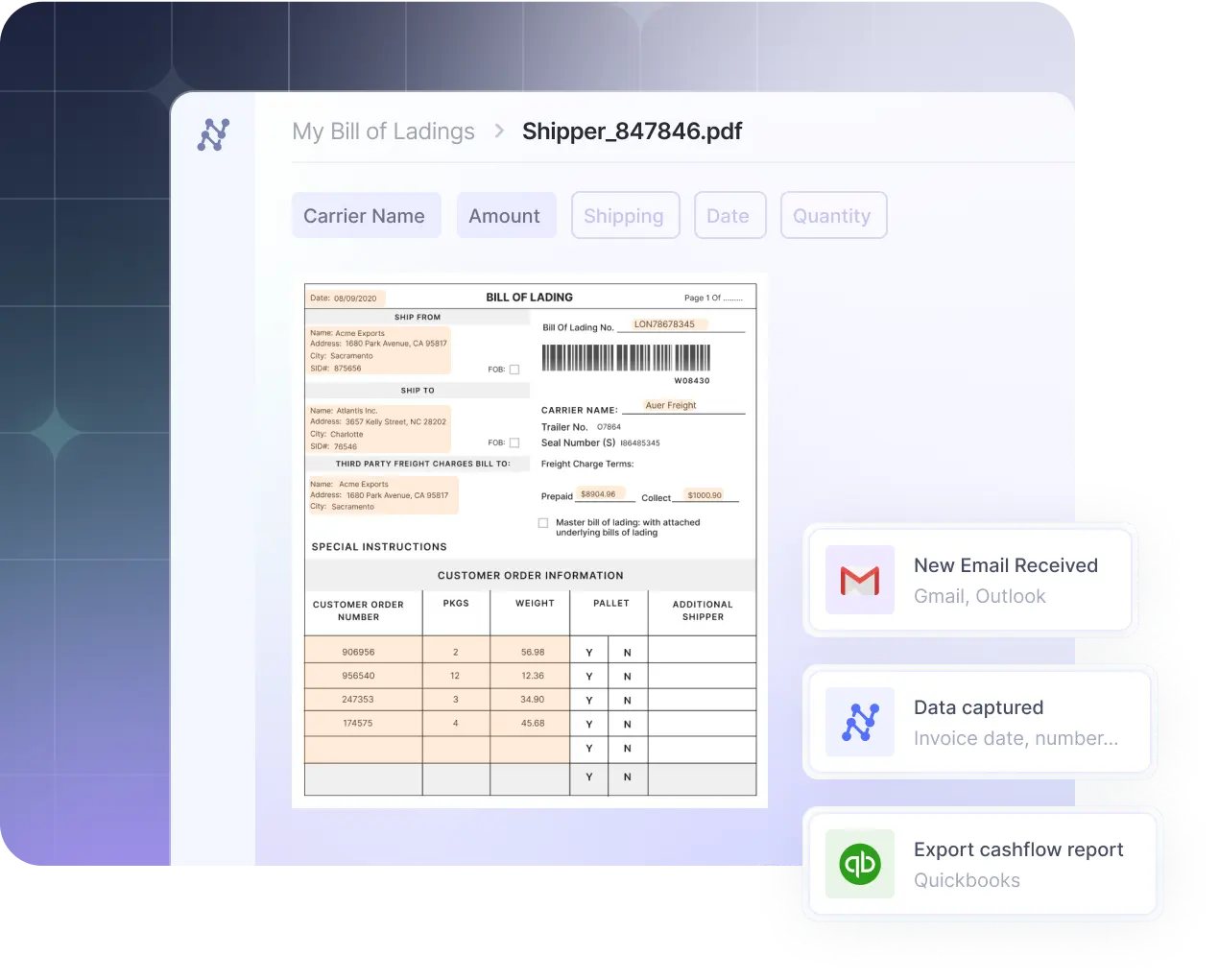

Upload your scanned and electronic invoices into the system. Many solutions offer bulk upload options or can automatically capture invoices from designated email addresses.

With Nanonets, you can set up email integration to automatically process emailed invoices, connect cloud storage services like Google Drive or Dropbox for batch uploads, or use the API for direct integration with your existing systems. This flexibility ensures you can process invoices from all your sources.

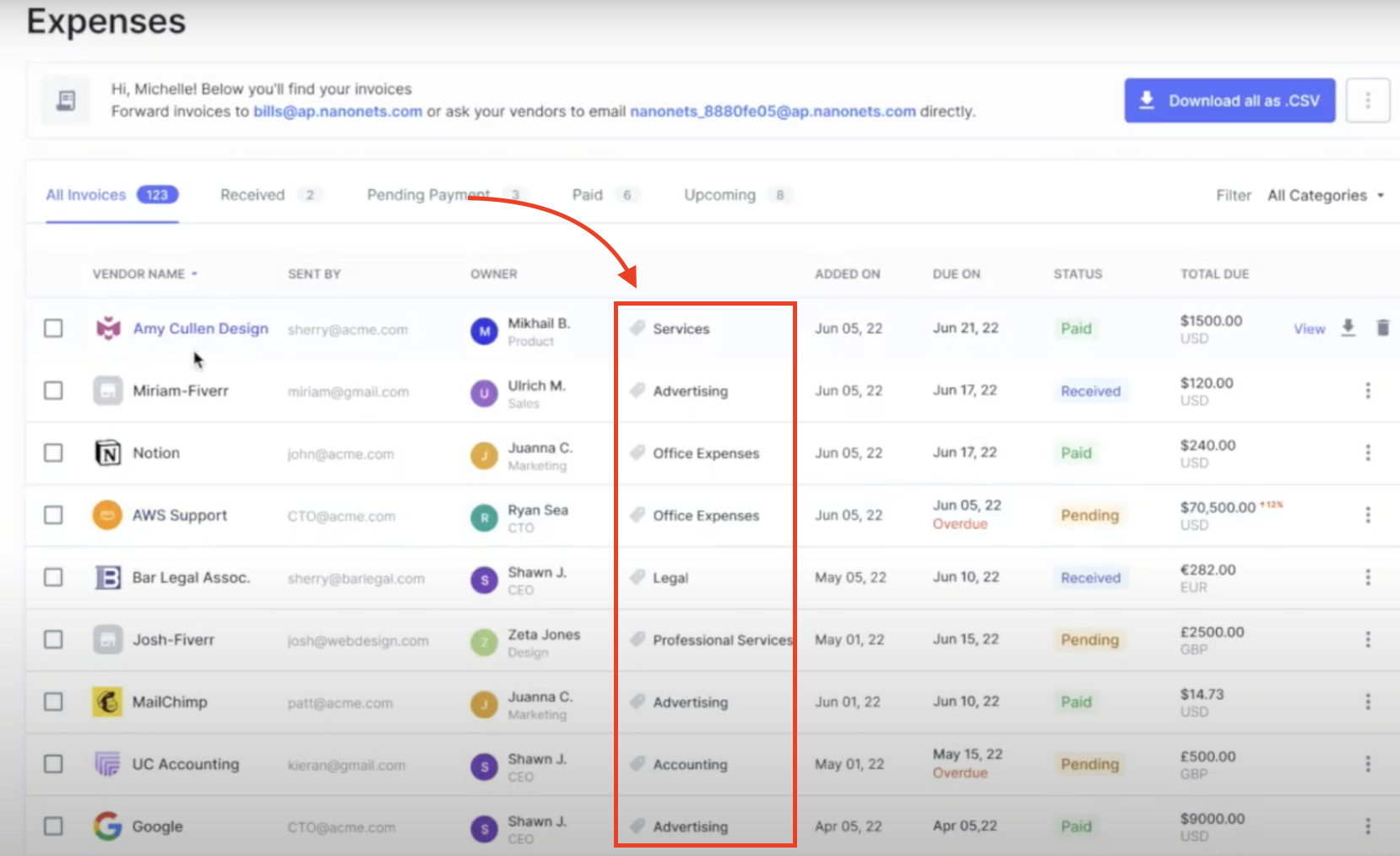

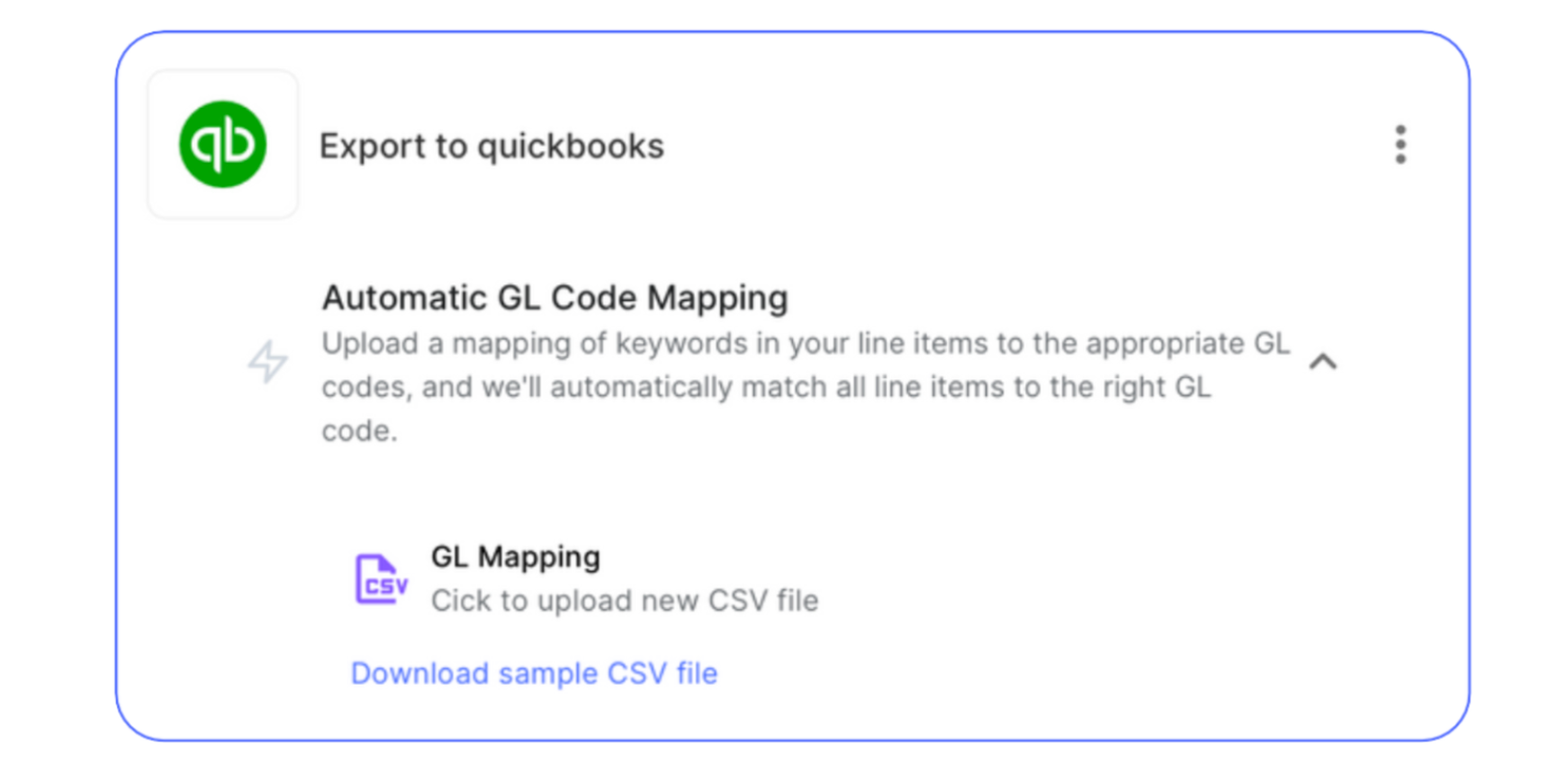

3. Set up GL code mapping:

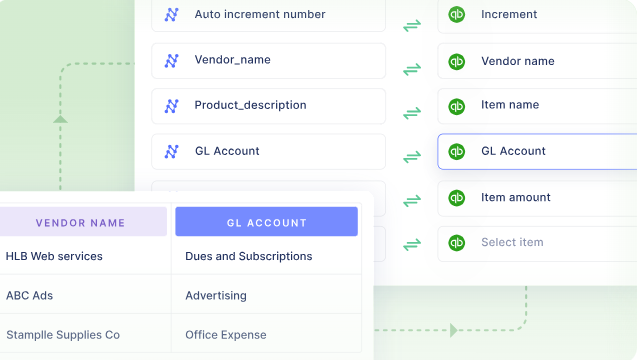

Define clear guidelines for assigning GL codes. Create a comprehensive chart of accounts. You can use historical data to train the system on your coding patterns. Many automation solutions allow you to create rules for automatic code assignment based on vendor, item description, or other invoice fields.

Nanonets, you can create custom fields for each piece of information you need to extract, like 'GL Code' or 'Cost Center'. Then, train the model by uploading sample invoices and manually labeling these fields. Once you've labeled enough samples, the AI will learn to recognize and extract these fields automatically. You can also set up rules to assign GL codes based on specific criteria, such as vendor name or item description.

5. Set up validation and matching:

Configure your system to automatically match invoices with purchase orders and receiving documents. Set up rules for flagging discrepancies, such as price variances or quantity mismatches. This step ensures accuracy and helps prevent overpayments or duplicate payments.

With Nanonets, you can automate 3-way matching by setting up database matching as part of your validation rules. This allows you to automatically compare invoice data against your purchase orders and receiving documents. You can create conditional blocks to flag invoices for review if there are discrepancies in quantities, prices, or totals.

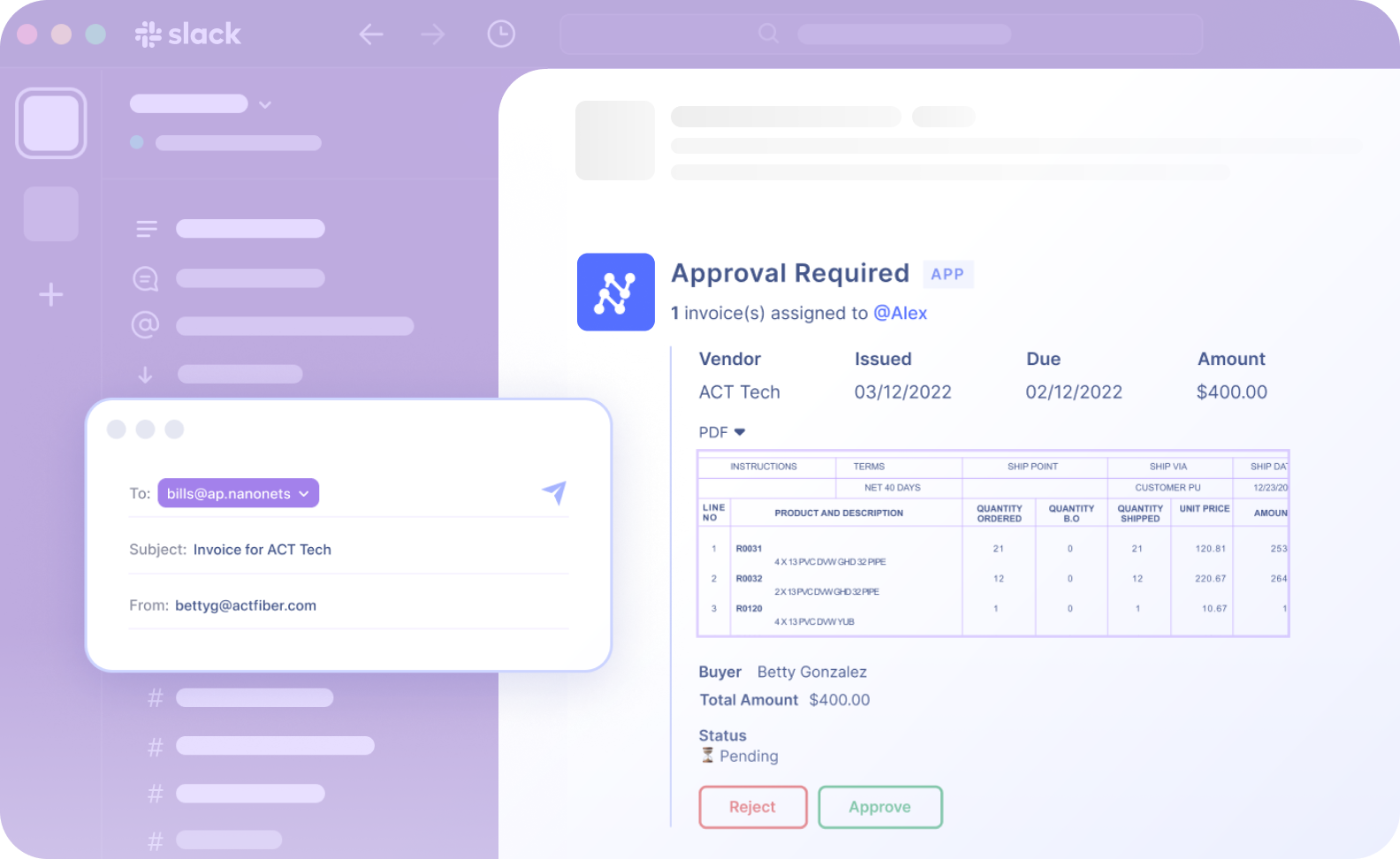

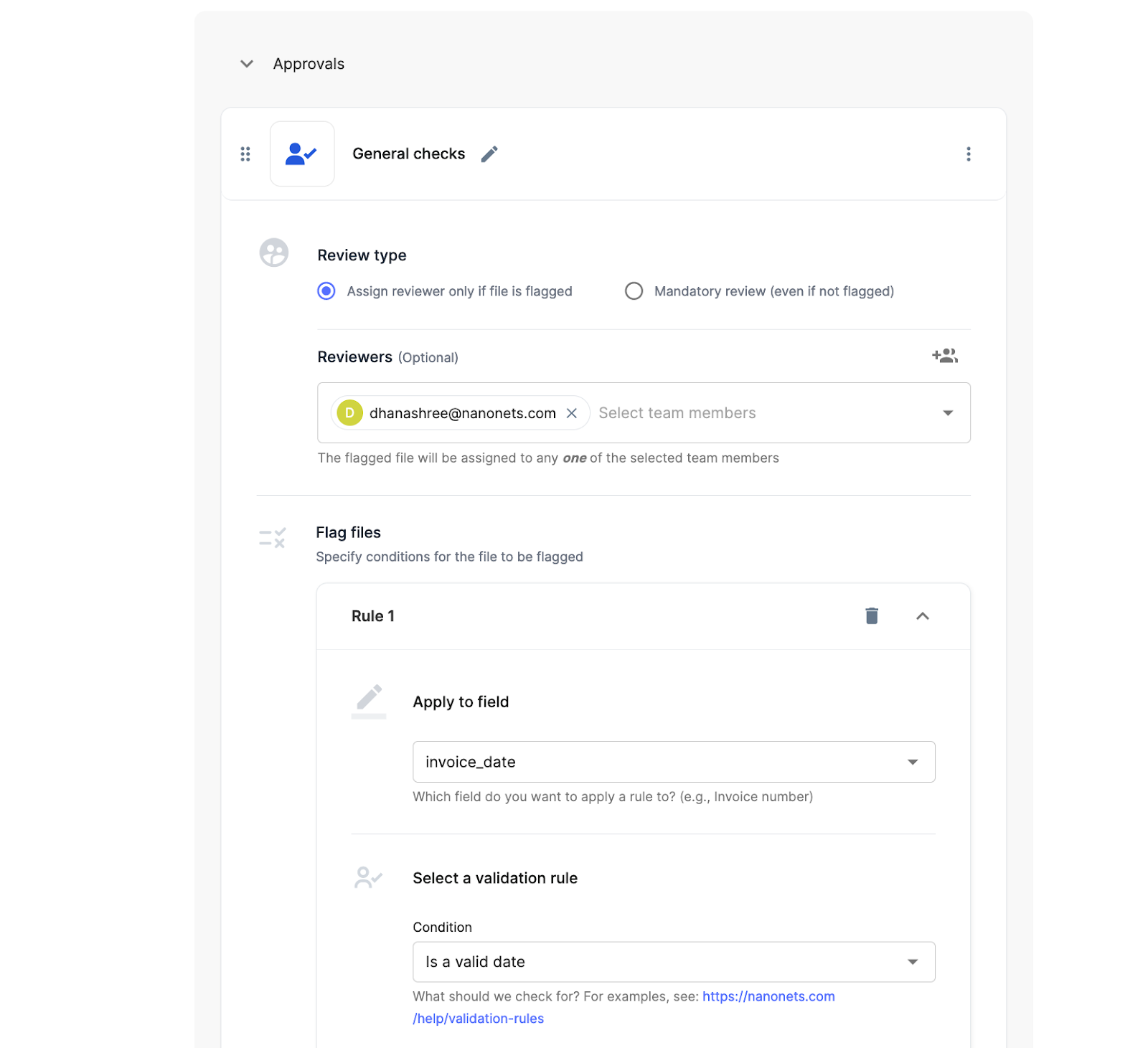

6. Establish approval workflows:

Design approval workflows that align with your organization's policies. Determine who needs to review and approve invoices based on factors like amount, department, or vendor. Automated routing can significantly speed up the approval process.

Nanonets offers powerful approval workflow features. You can set up multiple review stages with different rules for each stage. For example, you might create a rule to route invoices over a certain amount to a senior finance manager, while standard invoices go to the AP team. You can also set up mandatory reviews or assign reviewers only if certain conditions are met.

7. Integrate with your business systems:

Set up automated data export and syncing with your ERP or accounting software. This ensures that approved and coded invoice data flows seamlessly into your financial systems, eliminating the need for manual data entry. Also, consider connecting your AP automation solution with other relevant systems like contract management or procurement platforms. This holistic approach can provide even greater visibility and control over your financial processes.

With Nanonets, you can set up direct connections to popular ERP and accounting systems like QuickBooks, Xero, and Salesforce. For other systems, you can use Nanonets' API, the Zapier integration, or webhook features to push data automatically. This ensures that your coded and approved invoice data flows smoothly into your financial systems without manual intervention.

Once your system is set up, focus on successful implementation and ongoing improvement. Train your AP team thoroughly, emphasizing exception handling and correction procedures. Start with a pilot run using a subset of invoices, gradually increasing volume as you gain confidence.

With Nanonets' user-friendly interface, you can easily retrain your model, update GL codes, or modify approval workflows without IT intervention. This flexibility ensures your invoice coding automation remains efficient and aligned with your business processes over time.

Final thoughts

Embracing invoice coding automation isn't just about keeping up with technology—it's about transforming your AP department into a strategic asset. By streamlining processes, reducing errors, and freeing up your team's time, you're paving the way for better financial decision-making and improved cash flow management.

By streamlining processes, slashing errors, and freeing up your team's time, you're setting the stage for smarter financial decisions and smoother cash flow management. But here's the thing: automation isn't a one-and-done deal. It's a journey.

Start small, learn as you go, and keep refining your processes. With the right approach and tools like Nanonets, you can turn invoice coding from a tedious chore into a powerful driver of efficiency and accuracy.