Processing invoices is an integral and critical part of the accounts payable department's daily operations. Invoices are the breadcrumbs that lead to financial clarity—or chaos.

Miss a decimal here or overlook the date - things start falling apart. Suddenly, you're facing late fees, angry suppliers, or worse, a full-blown audit. This is where invoice data extraction comes to the rescue.

With advancements in artificial intelligence invoice processing, the accuracy and efficiency of invoice data extraction have significantly improved.

This article will explore different invoice extraction methods and provide a step-by-step guide. We'll also discuss how cutting-edge intelligent technology has transformed invoice extraction and how to use Nanonets AI-powered OCR to extract data from invoices.

What is invoice data extraction?

Invoice data extraction isn’t just about digitizing paper invoices; it's about pulling data from invoices to analyze and process them further for payments and accounting.

At its core, invoice data extraction identifies, captures, and extracts key invoice data using an invoice reader.

AP teams are the frontline beneficiaries of invoice data extraction. They use it to verify transactions, match them with documents like purchase orders or delivery receipts, and ensure accurate and timely payments.

The benefits of invoice extraction go far beyond just the AP team-

- Finance and accounting - Performing spend analysis to identify cost-saving opportunities, prepare for audits

- Procurement - Analyzing vendor pricing trends

- Legal compliance - Stay tax regulation compliant by accurately tracking taxes, investigating cases of suspicious transactions or fraud

- Customer service - Resolve billing issues

- IT teams - Ensure data consistency across ERP and accounting software

- Employees - Speeding reimbursements for business expenses

Key invoice data to extract

Invoices contain a wealth of information. Key fields must be accurately extracted from invoices for proper record-keeping, verification, and payment processing. Let’s break these down:

Essential information about invoice, buyer & supplier:

- Header information: Invoice number, invoice date, purchase order (PO) number, payment due date

- Vendor details: Vendor name, vendor address, phone/mobile number, and tax identification number.

- Customer information: Customer name, contact information, billing address, shipping address

Invoices also include tables with a breakdown of the products or services provided:

- Line items: Product or service descriptions, quantities, unit prices, and total amounts for each item.

- Subtotal: The sum of all line items before taxes and discounts.

Different payment-related fields:

- Taxes: Different taxes and tax categories, such as sales tax or VAT, are listed, along with their rate and total tax amount.

- Discounts: Any discounts applicable, including early payment discounts or bulk purchase discounts.

- Shipping charges: Costs associated with shipping and handling, if applicable.

- Total amount due: The overall amount owed after adding taxes and removing discounts.

- Payment terms: Terms that outline the payment due date, early payment incentives, late payment fees, and accepted payment methods (bank transfer, credit card, etc.)

- Banking details: Information needed to process the payment, such as the vendor’s bank account number and routing number.

- Currency: The currency in which the invoice is denominated.

- Due date: The date by which the payment must be made to avoid late fees.

Accurate extraction of these fields ensures that invoices are processed efficiently and payments are made on time.

Challenges in extracting data from invoices

While extracting data from invoices may sound simple, it’s a huge pain point for AP teams. At the end of the month, these teams are buried knee-deep in invoices.

Invoice extraction is challenging for accounts payable teams for several reasons:

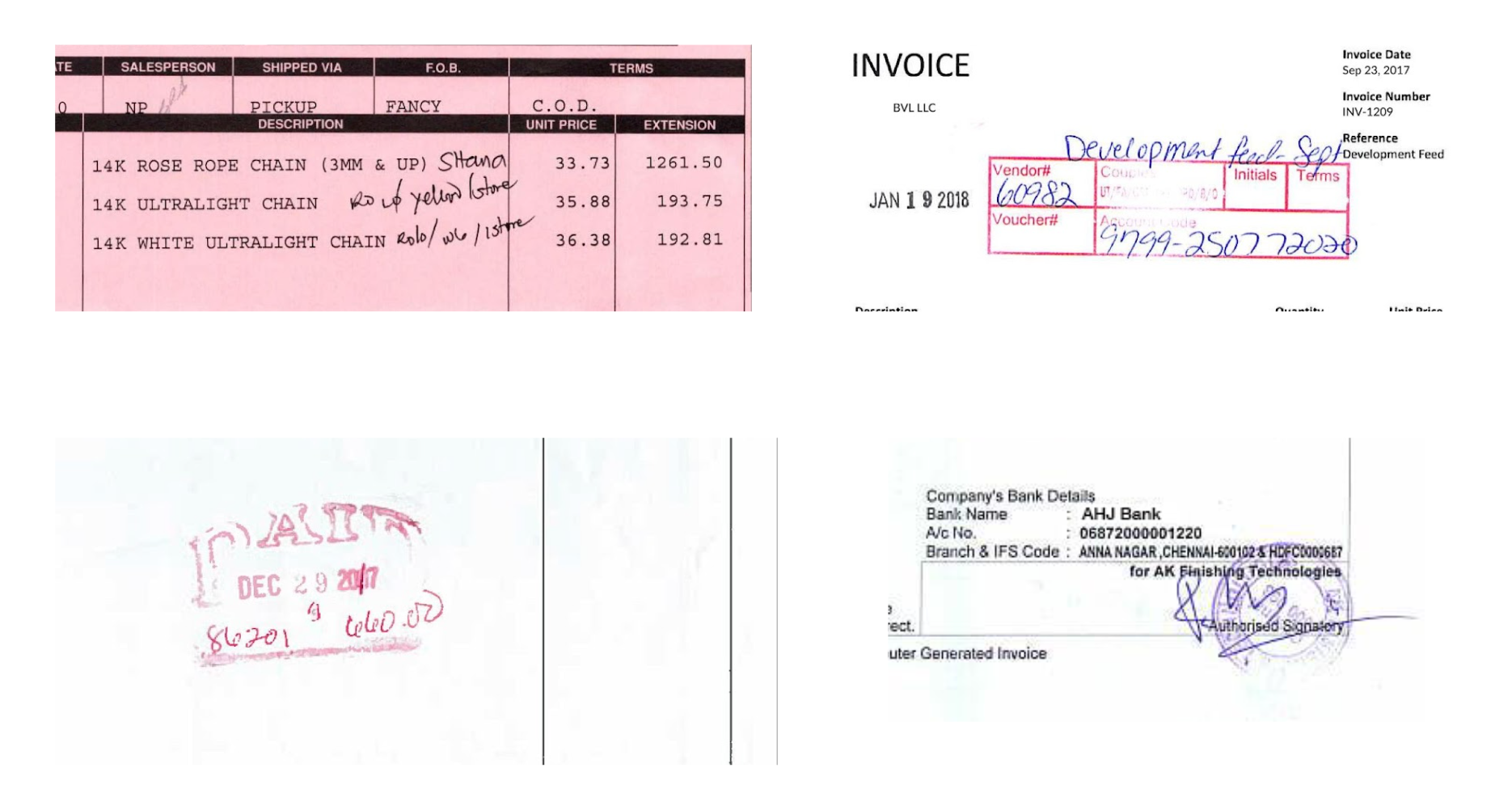

Format diversity and data complexity

Multiple sources: Invoices come via various channels (Slack, Email, EDI) in different formats, such as Excel spreadsheets, receipts, handwritten invoices, scanned images, and PDFs.

Non-standard invoice templates: Invoices vary across companies, countries, and suppliers. Invoices don’t have a standard template, making applying a one-size-fits-all approach to extracting invoice data impossible.

Scanning issues: Poor-quality scans, skewed/distorted images, and blurred and low-resolution documents can cause OCR tools to misinterpret characters or miss key data points, requiring significant manual correction.

Structured vs unstructured data: Invoices contain both structured (e.g., invoice number, dates) and unstructured data (e.g., notes, terms). Unstructured data is crucial for context but is difficult for basic OCR systems to interpret correctly.

Accuracy issues

Manual errors: Human data entry is prone to mistakes, which can lead to inaccurate data extraction, delayed payment processing, and vendor disputes.

OCR limitations: While OCR technology has improved since its introduction in the late 90s, it still struggles with complex invoice layouts, non-standard fonts, and inconsistent column arrangements.

Quality issues: Poorly scanned and blurry invoices lead to misinterpreted data and processing delays.

Business complexities

Multilingual invoices: International vendors submit invoices in various languages, creating additional hurdles for monolingual AP teams. Simple OCR and traditional tools struggle with language-specific nuances, worsened by handwritten text and invoice signatures.

Currency and date formats: Diverse regional standards, currency formats, and information styles (e.g., DD/MM/YYYY and MM/DD/YYYY) further complicate data interpretation and financial reconciliation.

These challenges illustrate the complexities of invoice data extraction and underscore the need for advanced, AI-driven solutions that can handle diverse invoice formats, languages, and data types with greater accuracy and efficiency.

Ways to extract invoice data

Choosing the right method to extract invoice data can significantly impact AP team’s efficiency and accuracy. Let’s explore the three most common approaches businesses use to extract invoices:

1. Manual invoice data extraction (using Excel)

The traditional method of invoice extraction involves reviewing an invoice individually, manually copying and pasting each field into an Excel spreadsheet, and importing the Excel into accounting software.

This traditional data entry process has been semi-automated with Excel’s Get Data (Power Query) feature. Small businesses and individual professionals/freelancers often use this approach to extract data from PDF invoices.

Steps to use the Get Data (Power Query) feature of Excel:

- Open a new Excel file

- Go to Data tab > Get Data > From File > From PDF

- Import your PDF invoice > Load

- Review the extracted data, clean the data, and validate

Note: This feature is not available on all Excel versions.

However, it still requires human oversight and may not be scalable for businesses with high invoice volumes or complex, varied invoice formats.

2. Template-based invoice data extraction

Template-based OCR extraction is a semi-automated method to extract invoice data.

This method uses pre-defined templates to extract data from invoices with consistent formats. This approach bridges the gap between manual data entry and fully automated AI-based solutions, offering a balance of accuracy and efficiency for businesses with stable vendors or standardized invoice formats.

Steps to use template-based invoice extractors:

- Analyze template formats and pick consistent invoice layouts/formats

- Choose a template-based invoice OCR tool (e.g., Docparser, Parseur)

- Create templates for all such consistent sets of invoices by defining key invoice fields

- Set up rules of data validation (e.g., date format, numerical formats)

- Set up OCR to extract text from invoices and define workflows

- Test the invoice extraction on sample invoices

- Regularly update and refine templates for accuracy

The main limitation arises when the invoice format changes. Any layout, content, or design variation can cause the template to fail and start again, requiring time-consuming manual intervention to correct errors or reconfigure the template. This method doesn’t fully automate the invoice data extraction process accurately.

3. Automated invoice data extraction using OCR and AI

Automated invoice data extraction tools leverage the power of artificial intelligence (AI), machine learning (ML), natural language processing (NLP), and computer vision to enhance accuracy and efficiency.

These data extraction tools go beyond simple OCR technology. They enable automated invoice processing by transforming unstructured or semi-structured invoice data into a structured, machine-readable format that can be quickly processed, analyzed, and integrated into various financial systems.

These tools can handle large volumes of invoices in diverse formats without any pre-defined template. They can extract key data fields from invoices with up to 99% accuracy and intelligently apply learning to become more accurate as they process more invoices.

These automated tools also recognize and extract text from scanned documents, images, PDFs, and handwritten documents. They can detect discrepancies and anomalies to help detect potential invoice fraud. They can also handle increasing invoice volumes without a proportional increase in cost or resources.

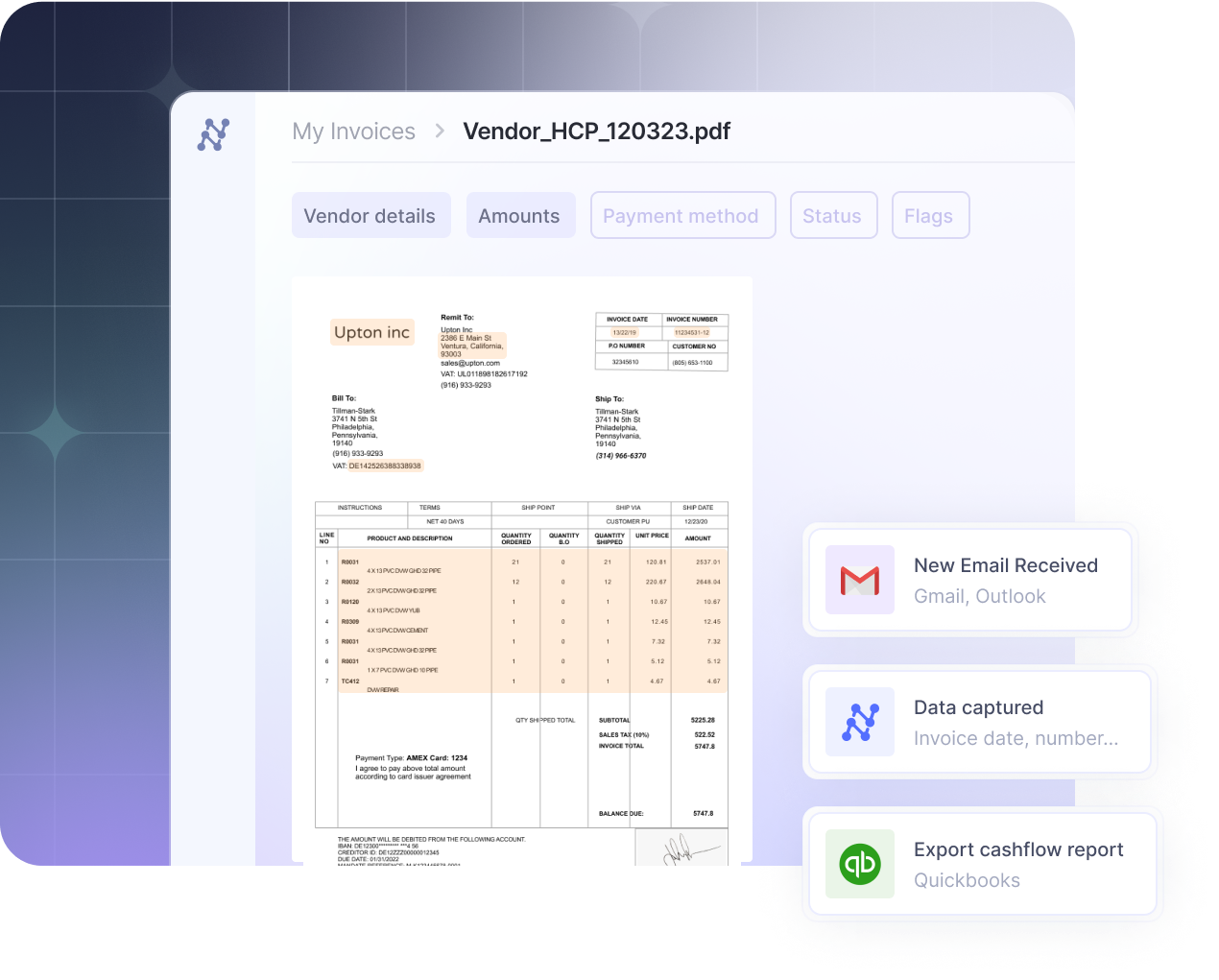

Here are the steps to use an AI-powered automated invoice data extraction tool. We’ve taken Nanonets AI's pre-built invoice extractor as an example:

Step 1: Sign up on Nanonets App

Step 2: Choose the suitable pre-built Invoice extractor model

Step 3: Upload all your invoice(s) in different formats (PDFs, JPG, PNG, etc.)

You can also import invoices from different sources, such as email or the cloud, such as Google Drive, OneDrive, or Dropbox.

Step 4: Once the model extracts data from invoice(s), review the extract fields. You can also tweak the extracted data by adding additional fields or editing the fields.

Extracting invoice data using Nanonets AI

Step 5: Download the final extracted invoice data in CSV, Excel, XML, or a Google Sheet. You can also share an open link with other team members and users.

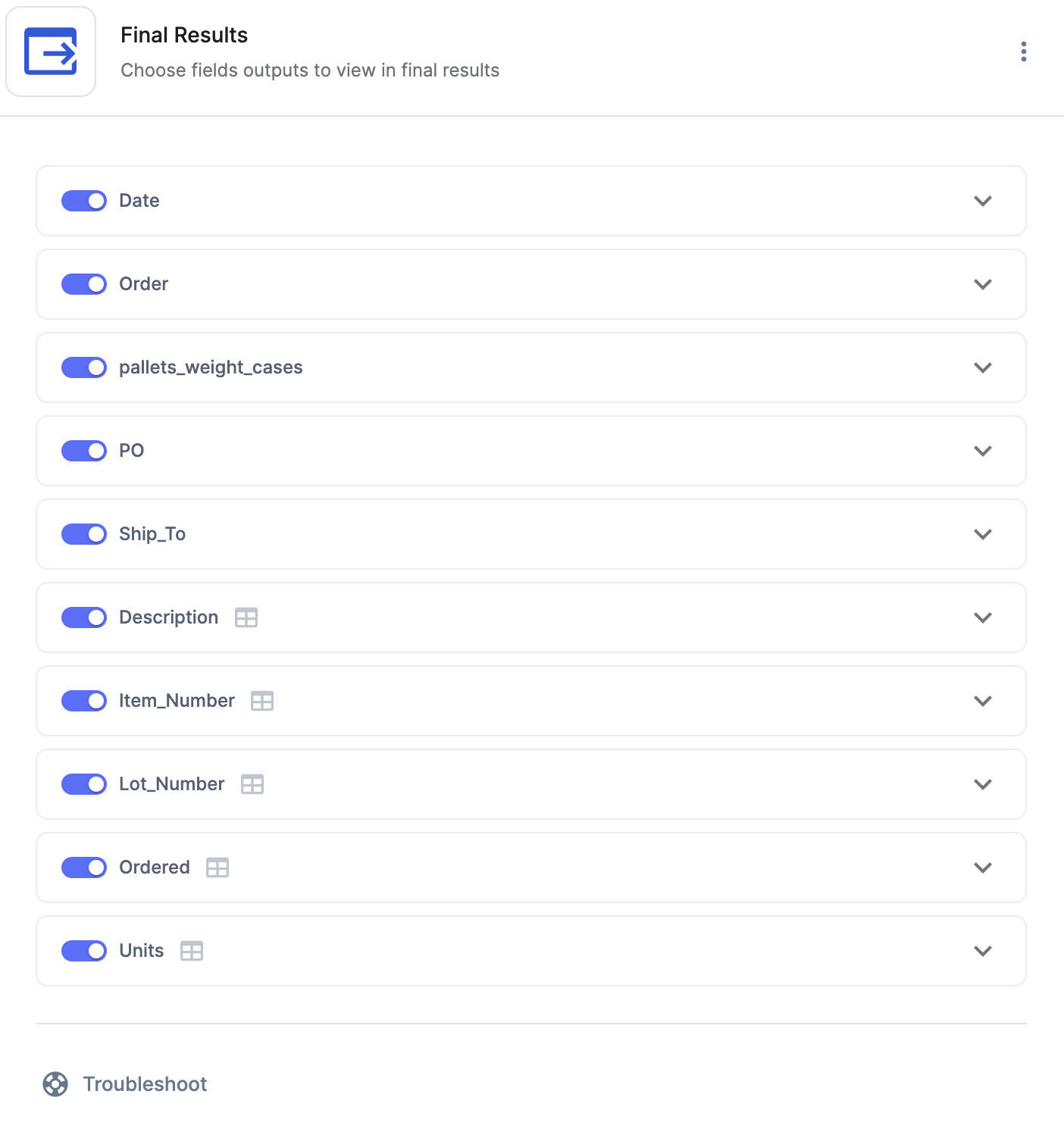

You can also set up advanced customized workflows with Nanonets' automated invoice extractor:

- Import workflows: Set up imports from different sources, like email and the cloud, or integrate with your existing apps or services using API or by creating a Zap.

- Advanced data actions: Use the Data Action feature to set up customized actions for your invoice, including multiple steps such as converting to date format, removing currency symbols, scanning a barcode, copying metadata fields, etc.

- Customize invoice fields: You can selectively retain the fields needed in the final invoice output and remove unnecessary ones.

- Automated workflows: Set up approvals with rule-based workflows. You can add multiple reviewers, including optional and mandatory reviews. You can also specify conditions for flagging the file (e.g., Manager approval for invoice amount greater than $500).

You can also set up reminders and notifications via email and Slack for timely follow-ups.

- Export workflows: You can set up export workflows for invoice processing with your accounting software and ERP tools such as Quickbooks, Sage Intacct, Netsuite, Zoho Books, and other existing applications.

The biggest advantage of automated tools is that as the AI learns from corrections and new invoice formats, human intervention typically decreases over time, leading to a more efficient and accurate invoice processing system.

If you are looking for a customized solution and need to extract a high volume of invoices, contact our team of automation experts.

How to best prepare invoices for extraction

Preparing invoices for data extraction ensures that the data extracted is accurate, reliable, and ready for further processing.

Below are key techniques and best practices to prepare invoices for extraction. These techniques are crucial; some are required for manual or template-based OCR invoice extractors.

File naming conventions

Adopt a consistent, logical file naming system. Include key identifiers like vendor name and invoice date in the filename.

Digital transformation

Convert all paper invoices to digital format (preferably searchable PDFs). Use high-quality invoice readers and scanning equipment to ensure invoice clarity for accurate extraction.

Data cleaning and processing

Cleaning and preprocessing the invoice data is essential to eliminate errors, inconsistencies, and other accuracy issues. This involves thoroughly reviewing the data to ensure it is ready for extraction.

Data normalization

Normalization involves transforming data into a consistent format, making it easier to process and analyze.

This would include standardizing the format of dates (DD/MM/YYYY or MM/DD/YYYY), times, and other important elements and converting data into consistent types, such as numeric or categorical (e.g., due in a month or due in 30 days). This is especially important if you are using a template-based invoice extractor.

Work with vendors to adopt a consistent invoice template wherever possible. Ensure key information is always on the right or in a similar location.

Ensuring all data follows a uniform structure makes the extraction process smoother and more reliable.

Text cleaning

Text cleaning is stripping out unnecessary or irrelevant information from the data, such as stop words, punctuation, special characters, and other non-textual characters that can confuse extraction software.

This step is vital for improving the accuracy of text-based extraction techniques like OCR and IDP (Intelligent Document Processing).

Data validation

Data validation involves checking the data for errors and inconsistencies before extraction. This might include cross-referencing invoice data with external sources, such as customer databases or product catalogs, to verify that the information is accurate and up-to-date.

Validating the data beforehand significantly reduces the likelihood of errors during extraction.