According to an ACFE report, companies lose up to 5% of their annual revenue on fraudulent or unauthorized spends. That's why finance teams are increasingly adopting a 3 way match of vendor invoices as an essential step of their accounts payable process.

By 3 way matching supporting documents, companies can detect duplicate, erroneous, or fraudulent payments to vendors. This is vital for managing spend and cash outflow. Three way matching is best performed as an automated financial workflow powered by AP automation solutions such as Nanonets.

What is a 3 way match?

A 3-way matching involves reconciling purchase orders (PO), goods receipt notes, and supplier invoices. This process helps prevent fraud, save costs, and ensures a robust audit trail. Typically conducted before supplier payment after goods delivery, it enhances accuracy and transparency in financial transactions.

All invoice payments involve some sort of verification or control. A 3 way match is an internal control process that cross-references a supplier's invoice against its corresponding purchase order (PO) and good received note (GRN).

The goal here is to ensure that financial details (order quantity, order amount, total amount, PO number etc.) match across all 3 documents. 3 way matching helps approve AP invoice payments faster and also help the procurement management team flag any inconsistencies, errors or potential fraud.

A successfully verified invoice must match the PO and receipt within acceptable tolerance levels. An invoice that fails matching tolerances is placed on hold and is sent for appropriate review.

Two-way versus three-way matching

Three way matching compares line item details and totals across purchase orders (PO), receipts for good, and vendor invoices sent to the customer.

A 2 way matching, in comparison, only compares the PO with the invoice. The quantity billed (in the invoice) should match the quantity ordered (in the purchase order). And the invoice price should match the price quoted in the purchase order.

The 2 way matching process is the default approach to verify invoices across organizations. But companies are increasingly adopting three way matching to add an additional layer of verification and prevent overspending.

Looking to automate your manual 3 way match processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

How does 3 way matching work?

The accounts payable 3 way match process is largely dependent on tracking details across three documents: purchase orders, order receipts and invoices. Let's quickly review the role each document plays:

- Purchase orders: A purchase order (PO) is an official authorization sent from the buyer to a vendor confirming a requested order. The PO comes with a unique trackable PO number and lists details of the order including description, amount and quantity.

- Order receipts: Order receipts or delivery receipts (also known as receiving reports) confirm the delivery of an order. An order receipt lists the details of the items in the shipment.

- Invoices: An invoice is the vendor's request for payment in return for the delivered goods/services. It lists vendor contact information, the total amount due and a unique invoice number. It also details the payment method, payment schedule and credit policies (if any).

Before processing vendor payments, AP teams use these three documents, along with tools like NetSuite 3 way match, to verify that the product/service received by the company matches the details of what was initially ordered.

The three way matching process

3 way matching of invoices helps highlight errors or inconsistencies in any of the 3 important documents mentioned above. Issues could include wrong payment details, incorrect prices, wrong or damaged products etc.

Here are some common checks carried out on each of the documents that are part of the 3 way matching process:

- Was the PO filled out correctly?

- Is it missing any information such as the price, quantity or vendor contact details?

- Does the order receipt attached to the verified shipment mention the same quantity as in the PO?

- Is it a partial or complete fulfilment of the order?

- Does the price and quantity on the invoice match the authorized figures in the PO?

- Is the vendor seeking full or partial payment?

- Are payment details clearly mentioned?

- Are the credit terms clearly mentioned?

If errors are flagged in the 3 way matching process, the invoice is put on hold and payment is withheld. Once the issue is investigated and resolved, the invoice can be processed for payment.

The chances of missing a fraudulent invoice or payment are really low with a 3 way match process in place.

3 way matching - an example

To illustrate, suppose that a buyer, Buyer Inc., receives an invoice for $1500 from a vendor/supplier, Supplier Inc., for a hundred pen drives:

- The AP team first compares/matches the invoice with its PO to check if the description (pen drives), quantity (100), cost ($15 per piece), total price ($1500) and terms (payment terms) match those in the initially approved PO.

- Next, the invoice and PO details are compared/matched against those in the order receipt (receiving report). This receipt is prepared by the receiving department based on the packing slip that comes along with the delivery. The type and quantity of pen drives (100), the price ($15 per piece) and the total price ($1500) should match those detailed in the original PO and invoice.

- The receiving department also checks damage and quality at this stage.

If the invoice, PO and order receipt match exactly (or within an acceptable tolerance level), then you a have a successful 3 way match. The invoice can now be paid by the AP team.

If the 3 documents don't match then the invoice is put on hold until the errors/issues are sorted.

Benefits of 3 way matching

As mentioned earlier, more and more businesses are implementing 3 way matching in their accounts payable process. Here are some of the main reasons business owners and finance teams are adopting 3 way matching en masse:

- Improve vendor relationships: 3 way matching helps clear legitimate vendor payments in a timely fashion. This helps in establishing mutual trust and goodwill. Happy vendors prioritise your orders and also offer better pricing or credit terms.

- Improve bottomlines: the 3 way match process helps flag fraudulent invoices, duplicate payments and other discrepancies. Since only legitimate payments are allowed, this leads to large savings and optimal cashflow.

- [Be audit-ready]: 3 way matching neccesitates a proper system of storing and organising legitimate business documents. This organised data can be conveniently accessed during audits and internal checks - reducing time spent in such exercises.

Why automate three way matching?

Automating 3 way matching and the accounts payable approval workflow would help AP teams focus on higher value tasks and save them from a mountain of manual paper work.

Automating 3 way matching and accounts payable is extremely crucial for a growing business. Manual processes just can't be scaled effectively - imagine tracking each paper document manually in a large business!

Automation necessitates centralization of all data. This provides visibility and accessibility of all business data in a single organised database. This just makes all sorts of data comparisons pretty straightforward. Integrations with ERPs and accounting software also become convenient.

Pain points in manual 3 way matching

Manual matching of thousands of supporting documents can be time-consuming, expensive and extremely labor-intensive. AP teams end up spending lots of man-hours manually hunting for every invoice, PO and receipt! Delays and errors force the accounts payable team to work overtime and could also bring on penalties for late payments.

Here are some of the major pain points in the manual three way matching process that end up causing delays and cost overruns:

Lost or missing documents

A manual matching process requires all documents to be collected, stored and maintained for future reference. Over time, documents could get damaged, lost, stolen or go missing. This can severely affect visibility into payables and cause delays.

Handling variations

A variation arises when the line items, quantities, extended amounts, or total due on a vendor invoice don’t match the purchase order or receipt of goods or services. Handling variations or exceptions manually can be extremely tricky and hard to document.

One-off scenarios

If an accounts payable employee encounters a one-off matching error, they will need to investigate the problem to solve it. The resolution takes extra time compared to a known repetitive issue.

For example, if the vendor invoices the wrong product, trades payable will need to request a corrected invoice to complete the match. Waiting to receive a corrected invoice from the vendor will delay invoice approval, payment and reduce overall productivity.

Duplicate or fraudulent invoices

Duplicate invoices will not have necessary supporting documents, which have already been matched with the original invoice. But imagine trying to manually identify a duplicate or fraudulent invoice from among thousand others!

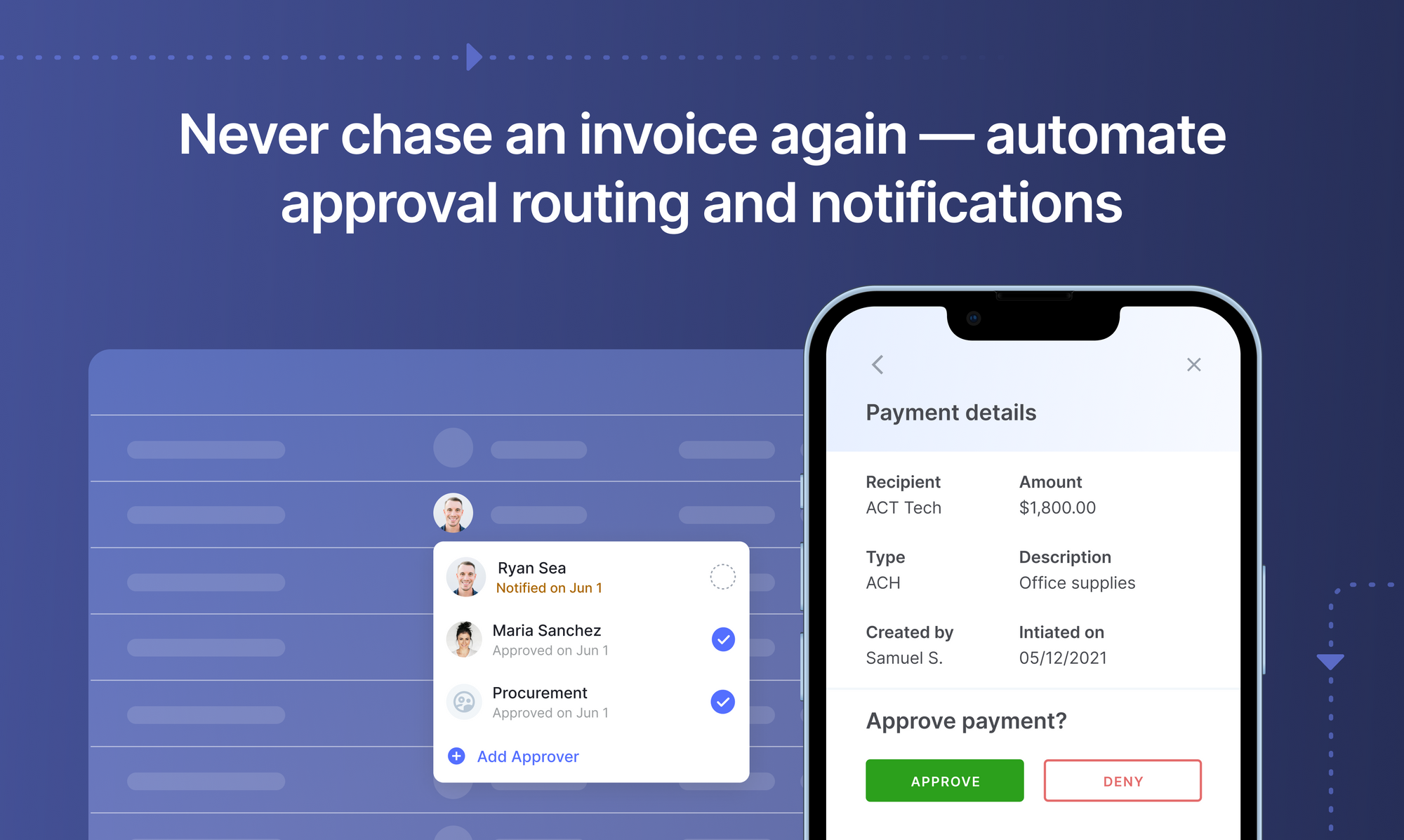

Invoice approval delays

In a manual invoice approval workflow, the invoice literally gets pushed from one desk to another until final approval. It is hard to keep track of which level of approval a document is currently stuck at, and who the approver is.

In paper-based three way matching and invoice approvals approver delays can result from procrastination, heavy workloads, resolving questions with the requester, and holidays/leaves.

Benefits of automated 3 way matching

Automating the 3 way matching process addresses most if not all the of pain points of manual matching covered above. Here are some of the top reasons why business are increasingly automating the three way match and the larger AP process:

Provide audit trails

An automated digital-first approach ensures that all records are consistent and provide a single source of truth. When data is readily accessible at all times, businesses can access clear audit trails and pinpoint financial inconsistencies quickly.

Reduce error rates & fraud

Automated 3 way matching software operate on preset rules/workflows based on tolerance levels and approvals. Such automated workflows are rapid and highly accurate. They quickly flag errors and potential cases of fraud so that AP teams can take immediate action.

Improve supplier relationships

A supercharged 3 way matching AP workflow ensures timely vendor payments. Vendors value early payments and could offer discounts in return. Thus automation can help save costs while establishing a stable supply chain.

Increase the bottom line

Automating three way matching and other AP processes saves time, reduces labour costs, optimizes AP days, prevents fraud/errors, and provides vendor discounts in the long run. This plays a significant role on the company's bottom line.

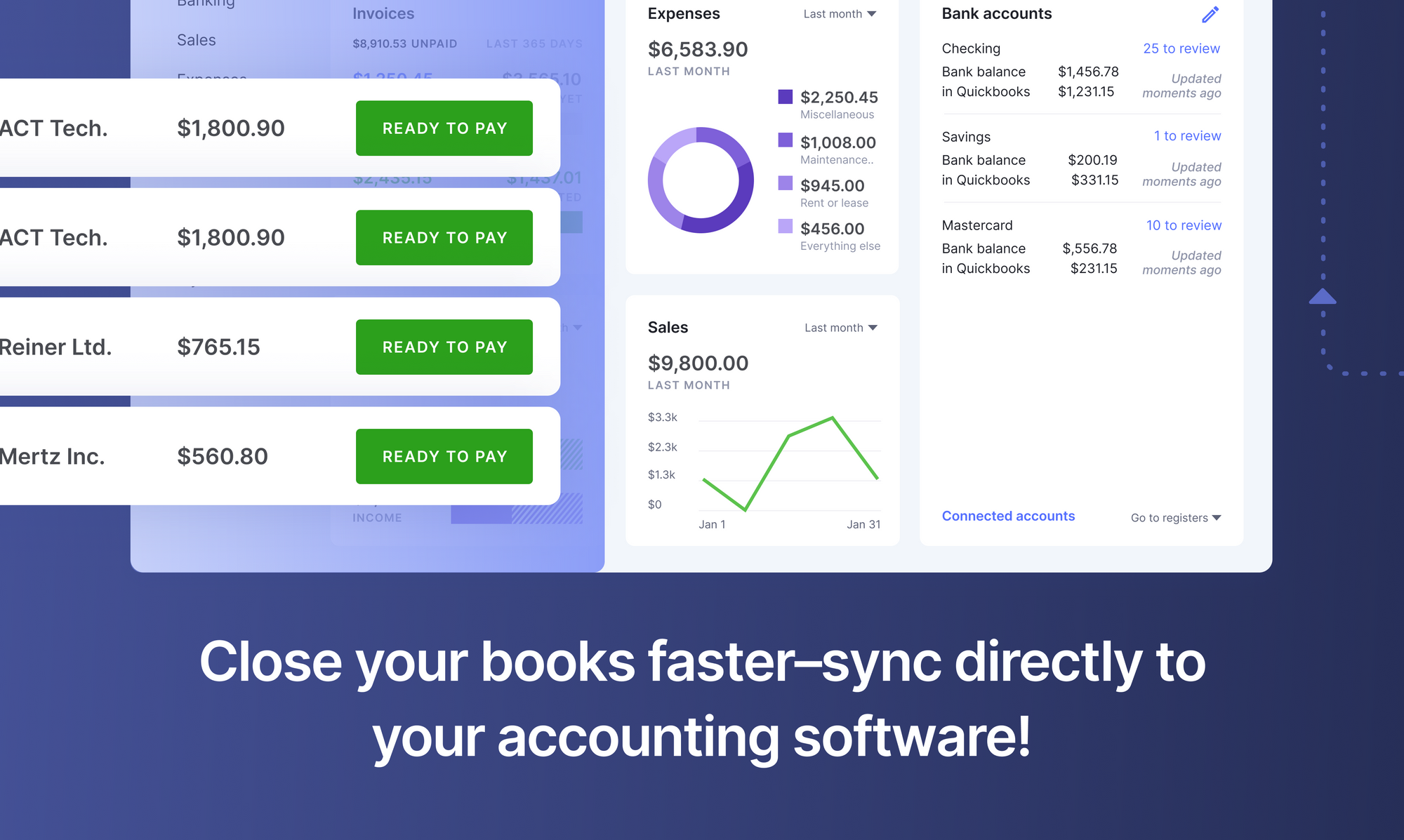

Seamless sync

Close your books faster by syncing your 3-way match directly on to your ERP or accounting automation software.

How to automate 3 way matching AP workflows

Most AP automation software or invoice automation software, like Nanonets, can help organizations switch from manual 3 way matching to a completely touchless automated workflow. AP teams across enterprises use Nanonets to build end-to-end automated accounts payable workflows.

AP automation & 3 way matching workflows set up on Nanonets can reduce 80% of the AP department’s workload without employing additional staff.

With Nanonets you can set up an automated AP 3 way matching workflow that automatically:

- Pulls documents and files from multiple sources - email, scanned documents, digital files/images, cloud storage, ERP etc.

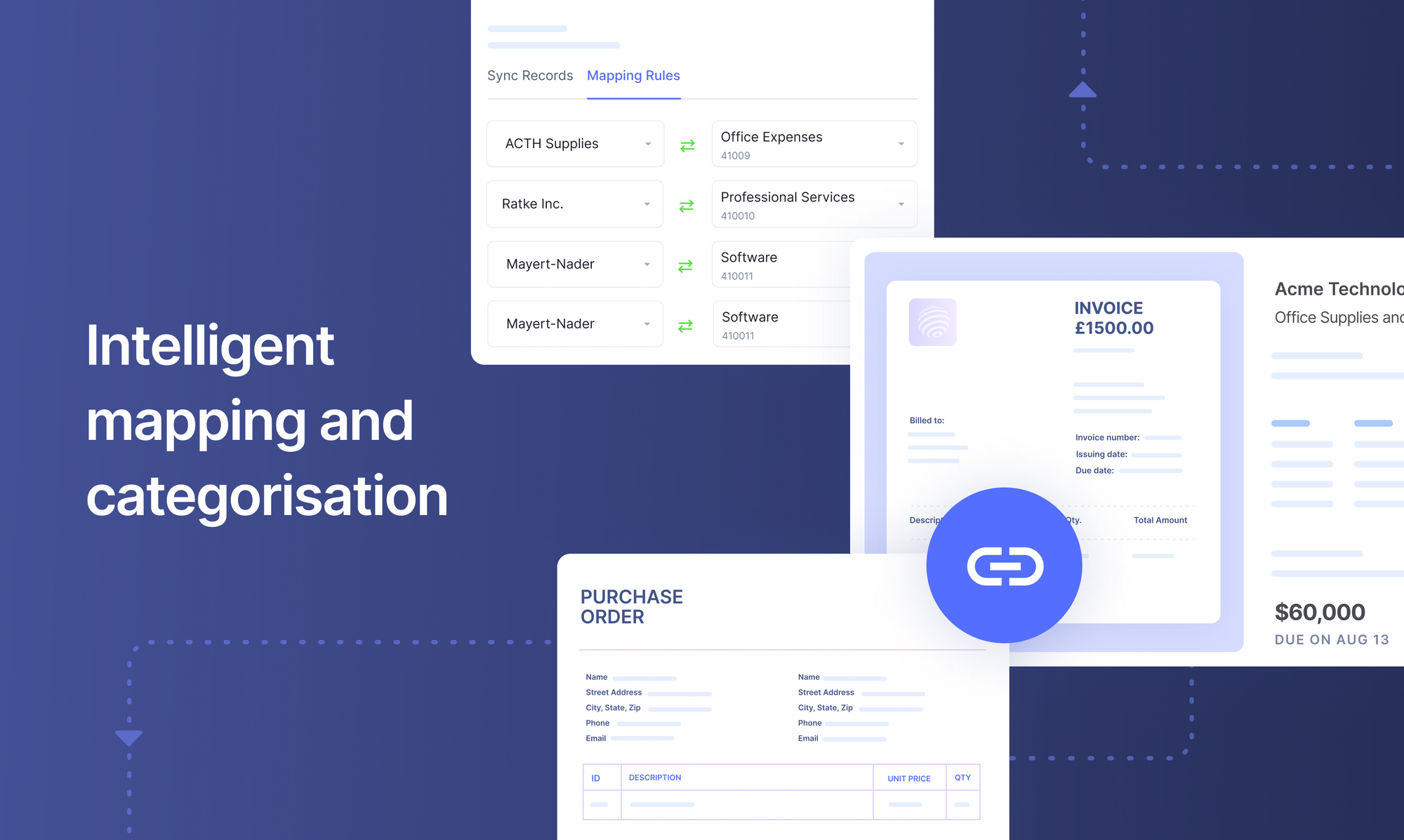

- Classifies and sorts the documents correctly as invoices, POs and receipts

- Reads & captures data from all invoices, POs and receipts accurately

- [Reconciles fields, expenses, balances and SKU level information across related invoices], POs and receipts by a 3 way match

- Flags 3 way match errors that breach tolerance levels or sends invoices for further approval on a successful 3 way match.

- Handle all expense workflows from creating an expense report to getting manager approvals

- And sync/integrate all the month end close process with any ERP, accounting software or business tool of your choice

- We readily integrate with Sage, Xero, Netsuite, Quickbooks and more

Save your AP team from tasks involving mountains of paper work. Book a demo to see how Nanonets can automate all your AP processes.