How to find the best invoice automation software

Did you know that over half of AP teams (56%) spend more than ten hours a week processing invoices?

In the age of automation software, accounts payable (AP) teams are still doing things manually and facing avoidable challenges.

To help you pick the right invoice processing software, we’ve sifted through 50+ leading solutions, identified the strongest on the market in 2024, and prepared a comprehensive guide.

Our goal is to make your selection of invoice automation software a breeze.

What is an invoice automation software?

An invoice automation software or invoice processing tool automates and manages every part of the invoicing and payment process, such as creating and sending invoices, tracking payments, and generating reports.

It provides real-time visibility of your invoice tracking, streamlines approval workflows, and manages vendors and payment processing.

An invoice automation tool is a must-have in your finance tech stack. Some of its best features are:

- OCR-based invoice capture

- Rule-based approval workflows

- Electronic invoice routing

- Customizable invoice templates

- Duplicate receipt detection

- 2, 3, and 4-way invoice matching

- Vendor management platform

- Automated recurring invoicing

- Invoice tracking and payment processing

- Reporting capabilities like custom dashboards and analytics

Overall, invoice automation software increases the accuracy and efficiency of your finance teams, eliminates manual work, improves vendor management, and leads to faster approval processes and payments.

Read more: Find the best accounts payable software solution

List of top 10 software to choose from

Let’s have a quick look at some of the top invoice automation software companies:

1. Nanonets Flow

2. Airbase

3. BILL

4. Stampli

5. Tipalti

6. Ramp

7. Freshbooks

8. Xero

9. Intuit Quickbooks

10. SAP Concur

A comparison table of 10 best invoice automation software

Top 10 invoice automation solutions

Nanonets Flow

Nanonets Flow automatically extracts data fields from every invoice your business receives. Invoices don’t have to be received in a uniform format; instead, its invoice AI model is trained to locate all the key fields needed to process an invoice.

Since the platform offers end-to-end automated invoice management, your AP team can import, approve, and pay invoices in one place.

Nanonets Flow also has customized dashboards and advanced reporting to help you streamline your invoice management.

Key features of Nanonets

- 98% accuracy in OCR data extraction from invoices

- Reconciles invoices with 2, 3, and 4-way matching

- Single-click approvals from multiple sources (mobile, emails, Slack)

- 100% customized verification and approval policies

- Smart financial controls to prevent overpayments

- Duplication detection, fraud prevention, and payment tracking features

Pros of Nanonets

- No-code workflow automation platform

- 1-day setup with 24*7 support

- Extremely accurate and easy to train

- Integrates easily with major ERPs like QuickBooks, Xero, Sage, NetSuite

- Compatible with currencies from more than 45+ countries

- A fair pay-as-you-use pricing model

Cons of Nanonets

- It needs some customizations and model training for complex documents

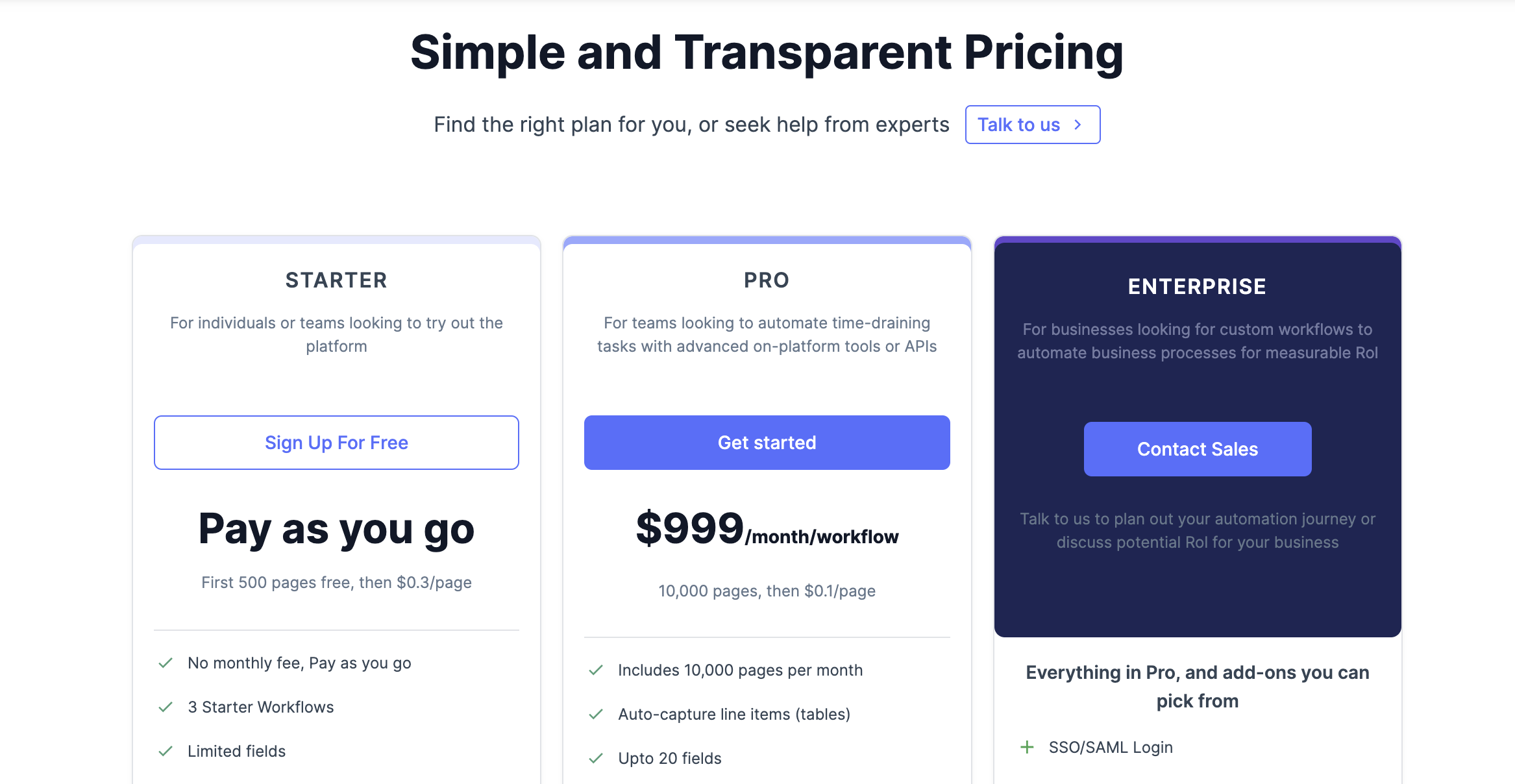

Nanonets pricing

Starter: First 500 pages free, then $0.3/page

Pro: 10,000 pages, then $0.1/page

Best for

Small, medium, and large businesses looking for advanced automation

Airbase

If complete spend management is your primary goal, Airbase is one of the top invoice processing solutions. It combines AP functionality with expense management and supports complex business requirements like multi-subsidiaries and multi-currency purchase orders.

Most used in technical spaces, Airbase offers your business a chance to refresh its invoicing approach with this automated invoice processing.

Key features of Airbase

- Rule-based approval automation with unique, multilayered approval rules

- Accommodates unique purchase orders (POs) and multi-layered supplier agreements

- Scans and populates invoices using AI-driven OCR technology

- Secure global payments in 145+ currencies and 200+ countries

- Real-time sync with ERP

Pros of Airbase

- Quick vendor onboarding and easy-to-use

- 3-way matching of invoices to POs and receipts

- Combines AP automation, expense management, and corporate cards

Cons of Airbase

- Airbase adoption has a long learning curve

- It doesn't support all international banks

- Limited reporting functionalities

- Takes a larger effort for full customization

- Mobile app functionality could be better

Subscription-based mode with 3 plans:

Standard - For small businesses with less than 200 employees

Premium - Mid-sized companies with up to 500 employees

Enterprise - For enterprises with up to 10,000 employees

Best for

Mid-size to large companies looking for complete spend management

BILL

Bill.com is an invoice automation solution that offers a wide range of financial capabilities, making it an excellent foundational tool for small businesses. With all AP process needs in one place, Bill can transform the daily grind associated with AP roles. It also lets you switch between accounts payable and accounts receivable, giving greater cash flow visibility and control.

A popular financial operations platform, BILL is famous among smaller online retailers, freelancers, and similar digital-centric small businesses.

Key features of BILL

- Simplified AP with a cloud-based system

- Automatic sync with integrated accounting software

- AI-driven invoice capture and duplicate invoice detection

- Digitize payments with flexible ACH, international payments, and credit card option

Pros of BILL

- Simple and intuitive platform

- Unlimited document storage in the cloud

- Integrates with a finance tech stack that includes Quickbooks, Oracle Netsuite, Xero, Sage

- Easy switch between AP and AR, if you get both

Cons of BILL

- Poor support for international payments (outside the U.S.) in multiple currencies

- Expensive for small businesses

- Not the best fit for large companies with highly customized AP needs

Essentials plan: $45 per month per user

Team plan: $55 per month per user

Corporate plan: $79 per month per user

Enterprise plan: Custom pricing

Accounting partner plan: $49 per month per user

Best for

Freelancers, self-employed professionals, SMBs, independent accountants

Stampli

If you want the benefits of AP automation but don’t want to overhaul your entire technology stack, Stampli thrives in the middle ground. All AP communication, documentation, and approval flows can be transitioned to Stampli, while upstream and downstream processes like procurement management and manufacturing automation can remain in functional ERPs.

Key features of Stampli

- Uses AI (Billy the Bot) to automate invoice capture, GL coding, approval routing, and fraud detection

- Supports all native functionality for 70+ ERP such as Sage, Microsoft, SAP, Oracle, QuickBooks

- Offers a vendor portal for onboarding, collecting information, and tracking invoice status

- Integrates with Stampli Direct Pay for domestic and international payments via ACH

- Fastens payments through ETH (Electronics Fund Transfer)

Pros of Stampli

- Easy-to-learn and navigate the system

- Automates most AP processes like invoice capture, coding, routing, and approval

- Simplifies invoice management with a centralized platform for vendors and team members

- Duplicate payment prevention

- Efficient and easy-to-reach customer service team

Cons of Stampli

- No free trial

- Not great for netting

- Long and complex supplier payment process

- Grouping of all invoices often leads to confusion

- Limited vendor reporting capabilities

Usage-based model - Pricing

Flexible monthly and annual contract options

Best for

Medium to large-sized businesses

Tipalti

Tipalti is a crowd favorite for fully integrated invoice automation and accounts payable software. Supporting fast-growing companies means that Tipalti is agile, adaptive, and up for a challenge.

It makes supplier onboarding easy, reduces the cost of processing every invoice, and has built-in tax compliance capabilities on a global scale.

Key features of Tipalti

- Instant account reconciliation

- Duplicate invoice protection alerts

- A second layer of invoice data extraction after OCR

- Mobile-friendly built-in messaging and file upload capabilities

- Built-in communication Tipalti hub

- Global blocklist scanning for compliance with international regulations

Pros of Tipalti

- Global payment support

- Self-service vendor onboarding

- Automated 2-way and 3-way matching

- Payment dispute resolution

Cons of Tipalti

- Intricate and lengthy setup with complex integrations

- Lagging customer support

- The core platform fee is high in comparison to competitors

Starter plan starts for $129 per month

Custom pricing for all other plans

Best for

Medium to large companies looking for global AP automation

Ramp

Ramp has rapidly overtaken some of its biggest competitors and made itself a name as an all-in-one finance automation platform. With robust invoice processing capabilities, Ramp allows businesses to automate AP workflows that include recording, approving, and paying bills with minimal data entry.

Ramp claims to be the only card platform built around saving time for teams and keeping money in your bank. It does not charge any card replacement fees, late fees, or interest for the Ramp Card.

Key features of Ramp

- Bill Pay identifies duplicate invoices, routes approvals for you, and 2-way matches to purchase orders

- Pay bills via check, card, ACH, or international wire, all within a single platform

- Global payments in USD and 40+ foreign currencies across 195 countries

- Spend analysis with vendor data tracking

- Ramp Flex to extend payment terms and set up recurring vendor payments

Pros of Ramp

- Completely free to use for businesses for starter plan

- Self-service portal for vendors

- Automatic invoice forwarding

- Single-use Ramp cards for vendor bill payments

- Automatic accounting sync

Cons of Ramp

- Limited international use

- The company has to be registered in the US to qualify for Ramp

- Need at least $50,000 in cash in any US business bank account

- It does not accept individuals or sole proprietors

Ramp: Free for unlimited users

Ramp Plus: $15 per month per user

Enterprise: Custom pricing

Best for

Companies looking for an all-in-one corporate spend card options

Freshbooks

Freshbooks is a popular invoicing software designed primarily for individuals, small businesses, and freelancers/contractors. Focused on making finance tracking better and more accessible for individuals, it is an excellent choice for those just starting their invoice automation journey.

Key features of Freshbooks

- Customizable invoices and automated recurring invoices

- Send late payment notifications and reminders, automatic additional late fees

- Project tracking capabilities

- Client profiles and portals

- Mobile app that allows to communicate with vendors and clients on the go

- Basic reporting and tax filing

Pros of Freshbooks

- Free 30-day trial

- No credit card required for sign-up

- Beginner-friendly interface

- Multi-language invoices

- Efficient customer support

- Integrated with 100+ apps

Cons of Freshbooks

- Struggles with complex invoices and documents

- The lite plan is limited in features

- Only suited for small businesses

Lite: $19 per month

Plus: $33 per month

Premium: $60 per month

Select: Custom pricing

Best for

Small businesses looking for a complete invoice and accounting solution

Xero

Xero offers cloud-based accounting services and targets the small business segment. It helps maintain invoicing records, whether fed by digital or manual sources, and automates approval processes to save finance teams more time.

Key features of Xero

- Automatic data entry from electronic invoices and photos

- Early payment opportunities to save time and maintain vendor relationships

- Robust mobile app to create, send, and track invoices on the go

- A range of financial reports for accounts receivable, PnL (profit and loss), cash flow statements

- Automated recurring invoices

Pros of Xero

- Affordable pricing

- Automates late payment reminders

- User-friendly interface

- Integrates seamlessly with many accounting software

Cons of Xero

- The cost of implementation is high for small businesses

- Integration seems to be complex and requires support

- Limited customization

- Performance issues with a large set of data

Starter: $29 per month

Standard: $37 per month

Premium: $62 per month

Best for

Small businesses

Intuit Quickbooks

Quickbooks is a popular one-stop-shop accounting solution for small and medium businesses. It allows users to create instantly payable invoices, set up recurring payments throughout the year, and take the bookkeeping legwork off their shoulders.

Key features of Quickbooks

- Record-keeping and comprehensive reporting, with the entry-level plan offering over 50 reports

- Integrates with 750+ apps, along with options for on-premise accounting and payroll

- Personalized custom invoice templates

- Payment dispute protection covering card payments

- Offers competitive payment processing rates without any setup costs or hidden fees

Pros of Quickbooks

- Extremely user-friendly

- Integrates with 750+ apps

- All plans offer phone customer support and live expert assistance

Cons of Quickbooks

- Monthly plans are relatively more expensive than other alternatives

- Learning curve people without any accounting understanding

- The number of users is limited, hence unsuitable for large teams

Simple Start: $18 per month

Essentials: $27 per month

Plus: $38 per month

Advanced: $76 per month

Best for

Small business owners and freelancers

SAP Concur

Widely recognized as a travel expense management tool, SAP Concur has a broader application that seamlessly reaches the invoice processing solutions space. This invoice automation solution has a favorable mobile app for employees and employers to use when processing expenses. The application breaks down expense types, allows individual-level tracking, and automates the payout process.

Key features of SAP Concur

- Automatic invoice routing and approvals with Concur’s mobile app

- Complete spend management with ERP integration

Pros of SAP Concur

- Recognized across the world

- Centralized integration with all SAP ERP tools

- Complete travel expense management

- Automated expense reports

- Digital receipt management

Cons of SAP Concur

- Complex integration and difficult-to-customize

- Non-intuitive interface

- Slow to adopt new functionalities

- The mobile app is not as good as the web-based platform

- Not suitable for small businesses

- Lack of transparent pricing and expensive

Custom pricing model with feature-based costs

Includes variable licensing costs

Best for

Large companies and enterprises looking for SAP integration

Other popular automated invoicing software

The above list is not exhaustive. The market for invoice automation is growing rapidly.

While the above are our top picks for invoice processing software, there is no such thing as the best solution.

We want to help you pick the most suitable one based on your needs. If you haven’t found the right invoicing tool for you, here are 10 additional invoice processing software/tools worth looking into:

Need for automating invoice processing using software solutions

Your accounts payable team processes many invoices daily, ensuring funds are disbursed correctly to vendors, business partners, customers, and sometimes employees. Processing an invoice can take days when done manually.

An AP expert has to conduct three-way matching checks. This is to check and validate a match of details on a vendor’s purchase order, the supplier's invoice, and the delivery receipt before the payment is processed and an invoice is considered paid.

This 3-way payable process looks simple but has many potential obstacles. With invoice processing automation, the time it takes for invoice check validation and payment processing is dramatically reduced.

These solutions can conduct matching processes, route the invoice for approval, prepare necessary payment information, and save your AP team a lot of time.

Invoice automation is essential for your AP team, finance leadership, and CFOs to improve cash flow visibility and control, mitigate risks, reduce costs, and boost profitability.

How to choose the best invoice processing software solution

Choosing the right invoicing software today has become more challenging than ever.

Start by trying a few invoice processing tools and work up from there. Sign up for free demos and show up. When you evaluate your options, differentiate the tools based on your team’s needs.

Leverage third-party software review tools like G2, TrustRadius, Gartner, and community platforms like Reddit and Quora to understand user experience.

Here are a few things to consider when choosing an invoicing software:

Features of the invoice automation software

This one is a no-brainer. While most software these days have similar functionalities, the feature differentiator is essential when picking the right software.

When it comes to invoice processing, look for features that can reduce your team's manual tasks, such as automated invoice sending, invoice matching and reconciliation, approval workflows, and automated data entry.

For a good vendor relationship, consider the tool's mobile functionality and the usability of the web interface to make invoice processing smooth for vendors.

Cost of Ownership

While many invoice processing tools are in the market, few allow you to test their capabilities, and even fewer have transparent pricing. Many of these tools don’t just focus on invoice processing or AP automation and only provide a custom quote.

While it is easy to be lured by the big legacy names, evaluating the tools based on their cost of ownership and your budget is essential.

The cost of ownership doesn’t just end at the tool's price. It also includes maintenance, annual fees, implementation costs, and the potential cost of scaling. This will save you any later expensive surprises in the future.

Understand the subscription model and pricing structure—it’s usually based on transaction volume, the number of users/employees, or a flat licensing fee.

Implementation and ease-of-use

Many financial and accounting tools have a long learning curve, and employees often resist adopting new technologies.

To avoid this, evaluate the tools' usability and check the efficiency of customer support—not just at the beginning but also later. Assess the tool's complexity and check in with your AP or finance team on the level of automation required.

Adopting a simple invoice processing tool takes at least a few days or weeks. If you want a complete AP automation solution, onboarding can take a few weeks or months. The times vary depending on your organization's size, the tool's complexity, and the integration required.

Prioritize tools that are no-code or require little to no technical expertise. Your finance team shouldn’t have to spend days or weeks training your invoice processing tool with multiple invoices or POs only to find inaccurate results.

Automation and level of integration

Your invoicing automation software should be compatible with your other tools, like ERP software, and show deep integration penetration—from data sources like emails and Slack to reconciliation and accounting.

Integration is the key to perfect implementation.

Prioritize solutions that offer flexibility, like custom rule-based approval workflows and OCR-powered data extraction.

Assess the pre-built integration capabilities of the invoice-processing software to minimize training and face issues later.

Payment capabilities

Consider the invoicing tool's global payment capabilities if you are a global company or manage vendors outside your country.

Making global payments can be costly if your invoicing software doesn’t support the said currencies. The software should be able to reconcile domestic and international payments easily.

Accuracy and speed

Automation aims to increase task accuracy and efficiency and ensure no employee effort or time is wasted on repetitive manual data entry.

Invoice capture accuracy and speed sync are essential in evaluating invoice processing tools.

Ask questions like:

These are some of the critical questions to find answers to before implementing a new invoice automation software.

How to start OCR-based invoice processing with Nanonets

Nanonets uses Invoice OCR, a technology that extracts data from invoices and financial documents using machine learning and artificial intelligence.

How does Invoice OCR work?

Step 1: Seamless document import

Upload PDFs or images by importing from email, API, Drive, Dropbox, RPA, or cloud storage.

Step 2: Intelligent document processing

Capture the information you need and validate it for accuracy.

Step 3: Easy data export

Connect with your existing system and apps for an easy and efficient export.

Which fields can be captured from your invoices?

The best part about Nanonets is that the invoice OCR reader model comes with highly trained built-in fields.

It includes many flat fields like Invoice number, PO number, Currency, Vendor/Buyer name, VAT ID, and Payment Method, and also includes line items such as Description, Quantity, Unit Price, Line amount, Discount, Subtotal, etc.

What can Invoice OCR do for you?

- Capture data from any source

- Extract data with superior accuracy

- Simplify workflows and automation

- Save time and money

- Enhance productivity

How much does Nanonets’ Invoice OCR cost?

Check out more details on Nanonets pricing or talk to our Sales team to find the best pricing plan.

Final word

Invoicing is a basic need of all businesses. While a few still choose to do it manually with freely available online templates, manual data entry, and payment processing, many others have automated it partially with different invoice processing tools.

Invoice automation software goes one step further, taking over tedious tasks such as invoice creation, vendor management, approval, and payment processing. Before investing in automation, whether invoicing tools or fully integrated AP automation software, it’s important to evaluate everything and not rush into purchasing new software.

Frequently Asked Questions (FAQs)

Q. What is invoice processing software?

A. Invoice processing software (more widely sold as accounts payable automation software) is an automated tool that finance or AP (accounts payable) teams use to track and manage invoices, streamline approvals, and process payments.

Q. Which software is best for invoice processing?

A. The best software depends on your company’s requirements. Some of the industry's most popular and best invoice-processing processing software are Nanonets, Quickbooks, Melio, Stampli, Tipalti, SAP Concur, BILL, Ramp, Zoho Invoice, and Xero.

Q. How much does invoice automation software cost?

A. The invoice automation software costs depend on the volume of invoices processed and can range between $0.2 and $3 per invoice. Based on our research of 30+ invoice automation software, this number is only an estimate.

Nanonets Flow invoice automation software allows you to process the first 500 invoices for free, and thereafter, it costs $0.3/invoice.