Enhance your organisational efficacy with practical application of the right key performance indicators!

Peter Drucker once said, “If you don’t measure it, you can’t improve it.”

Tracking the performance of the Accounts Payable department of your company requires way more effort than just tracking the number of invoices that are past their due date!

A strategic approach to handling your AP team can expose your business to a whirlwind of lucrative opportunities while also avoiding problems such as - poor cash flow within the company, controversial relationships with the suppliers, and zero sources of additional revenues; today we are going to show you how employing certain KPIs can ultimately help your AP team increase their efficiency.

What Are KPIs?

KPI is an acronym for the term - key performance indicator. As the name suggests, KPIs are a quantifiable indicator of the performance of any specific objective over a period of time.

Business-owners and trained professionals often get confused between the terms - Key performance indicator and Metrics. Here’s how the two differ:

Key performance indicators have a positive impact on your overall business outcomes. They play a key role in supporting your overall business strategy and chalk out what’s important to help the business grow in the long run. For example: Average time taken to approve an invoice and Days payable outstanding.

Metrics, on the other hand, are a tool to measure the everyday activities in your business that help support the key performance indicators. They’re not a critical measure per se, but may still have a minor impact on your business. An example of metrics can be - Percentage of straight-through invoices and ROI on invoice automation.

There are many flavors of key performance indicators that can prove to be fruitful for your business. While some businesses like to track their monthly measurable progress, others like to have more of a long-term vision. Here are some of the common types of KPIs you should know about:

Operational: These KPIs help measure the performance of your business in a shorter time frame while mainly focusing on the business process. Example: Finance report error rate, Reports produced per employee.

Leading and Lagging: Leading indicators help track the growth of your business and future business outcomes. Whereas, the lagging KPIs help track your past business decisions. A mix of both can give birth to an excellent business strategy. Example: Average revenue per user.

Functional: Some of the key performance indicators may be associated with specific functions like accounting, finance, etc. Example: Accounting costs, Accounts payable turnover.

Strategic: These help monitor your business goals in the long run. Example: Market share, and return on investment.

Why Are KPIs Important For Accounts Payable AP Teams?

Key Performance Indicators can be a crucial metric to measure whether the progress of your Accounts Payable team align with the overall business goals of your company. Some of the critical reasons why KPIs are being increasingly used by AP teams across businesses are:

- Reduce Risk Factors: KPIs can play a crucial role in indicating the health of your organization. In the long run, they can help reduce financial risk factors and turn your business into a profitable one.

- Align Your Teams: Ensure you and your AP teams are always on track for month end book closing, and you as a manager can evaluate whether you need to add resources - either people or software to boost performance.

- Track Progress: KPIs ensure that every employee on the AP team feels accountable for their progress. This also helps the team managers to move things in a more systematic fashion.

- Adjust Your Strategies: With a clear record of what’s working for the business and what’s not, you can steer your business strategies in the right direction and work accordingly.

What Are The Pain Points That KPIs Can Solve For The AP Team?

If you are an AP manager, you know how difficult it can get to manage vendor relationships, keep track of invoices, and manage liquidity. Most enterprises view an AP team as a quintessential revenue sap.

The Accounts Payable department forms a critical component of every business domain. Even the slightest mistake in the business functions handled by the department could cost the company a major setback.

Key Performance Indicators can provide deeper insights into the business operations and thereby help arrive at comprehensive solutions to the problems.

For example, a high KPI like “Average time to payment “ could indicate that there’s a delay in the payments to be made to the business suppliers because there’s not enough cash flow in the company. Therefore, this would work as an indicator that there’s an issue with revenue generation in the business.

Another example that would help you to understand the importance of KPIs for the AP teams is the number of invoices processed by the company. If your company has a higher number of invoices as compared to your competitors, then this implies that you are working with way too many suppliers. Therefore, you are in turn missing out on amazing discounts from consolidating business.

Similarly, a lot of payment indicators could imply that your business is engaging in malicious AP practices. For example, if you want to track how much it costs your team to process a single invoice, you could track - Cost Per Invoice.

Did you know that it takes almost 25 days for an AP team to process paper-based invoices? Now if you don't want to fall in this tracking bracket, then you can track the lead time!

What Are The Important KPIs To Track?

Achieve internal business targets and benchmark against your business competitors using Key Performance Indicators!

1. Accounts Payable Cost Per Invoice

If you’re convinced about benchmarking your AP team’s progress with KPIs, then the first KPI to cross your mind would be - Accounts Payable Cost Per Invoice.

Now, this is a key performance indicator that can vary across businesses and industries. Therefore, it’s worth every second of your time to measure it. As you can probably tell by its name, Cost Per Invoice is used to calculate how much money it costs the AP department to process a single invoice.

It is measured by dividing the total expense sustained by the department with the number of invoices processed in the given amount of time. To get a more accurate KPI figure, it is important that you consider both direct and indirect costs during your calculations.

Costs to be included during calculations: IT infrastructure and software support cost, cost of all the employees involved in the AP department, the approver’s time, and any additional costs sustained in the form of late payment fee, etc.

A high Cost Per Invoice could be a result of inefficiencies within the AP department itself ( largely due to manual tasks), frequent disagreements with the vendor regarding the invoices, or subpar training.

Formula = Total expenses of the AP department/No. of invoices processed

The total expenses must include every personnel and infrastructure cost you can probably think of along with the other overheads. The no. of invoices should include all the scheduled, processed, and paid invoices during the stipulated time period.

Industrial benchmark: Manually processing a single invoice will cost you an average of $12-$30. For some organizations, it can go upwards till $40.

2. Average Time to Payment

If you’re measuring the Cost Per Invoice, then spare some time to measure the Average Time to Payment of your AP team as well!

To measure this KPI, you need to first calculate the total time spent by the AP team on processing invoices. The clock for calculating this metric starts ticking as soon as the department receives an invoice till the time the designated vendor receives their payment.

The more time it takes for the AP team to process an invoice, the higher the Cost Per Invoice KPI gets.

In layman's terms, the faster your AP team works with handling the past invoices or netting payments, the less set back they’ll be when new invoices arrive. The target Average Time to Payment can differ across companies mainly depending on their policies with respect to holding onto cash. What’s crucial here is to understand that this metric gives you an insight into your company’s cash flow.

Formula = Total Time Spent While Processing Invoices/ No. of Invoices Processed

Industrial benchmark: It is a variable metric and can average anywhere between 3.7 - 12.2 days.

3. Average Time Per Invoice

As you know, your business might start losing money instead of making it if you process your invoices slowly. Some of the major reasons behind a high Average Time Per Invoice Processed could be:

Over-exhaustive Workflows: An overly complicated workflow isn’t just a hassle for the AP team, but for all the departments working across the board.

Delayed Invoice Verification: Even though the invoices land on the right business desks at the right time, most of them sit unapproved on the desk for days on end.

Time Consuming Coding: Lag time for invoice processing creeps up due to the use of legacy software or double-checking every reference in the invoice.

The Average Time Per Invoice Processed also depends on the size of the business and its industrial domain. As you might’ve guessed by now, if the average time of processing a single invoice is high, then your team gets stuck in a vicious cycle of high average time to payment and cost per invoice.

Formula = Time spent on keying + re-keying + material reviews + identifying route checkpoints + approvals + remitting + reconciling + communication updates.

Industry benchmark: A small to medium-sized business can take about 25 days to manually process a single invoice.

4. Number Of Invoices Processed Per Day Per AP Staff

Another critical KPI to measure your and your AP teams performance is the Number of Invoices Processed Per Day Per Employee. This will help you understand the strengths of your AP team and also the gray areas that they need to improve upon.

The time taken by an AP team employee to process an invoice significantly affects other business departments as well. Until and unless an invoice gets filed into the ERP system by the employee, no other department can assess its developments.

Other major issues that can stem from this delay are - missed vendor discounts, cash flow mismanagement, disrupted business-supplier relationships, etc.

Here, you’ll also need to consider the processing task being handled by every AP staff member.

Industry benchmark: An average AP staff employee processes approximately 5 invoices every hour. That makes up 42 invoices per day!

5. Invoice Exception Rate

Discrepancies in the invoice data and the purchase orders or a bottleneck in the invoice approval process can lead to exceptions. A typical example of invoice exception is when there are routing errors with invoice processing or there’s a pending approval. This can delay the invoice payment process and can even give rise to malicious AP practices like duplicate payments.

Formula = Rate of exception of invoices/ No. of processed invoices * 100

Industry benchmark: The industrial average for invoice exception rate is around 24.6%.

6. % Invoices Processed Within Payment Terms (Cash Flow Optimization)

This metric calculates the number of supplier invoices that the company has paid on time. It tracks the number of invoices that are paid on the listed date within the invoice terms or before that. A low value for this metric could indicate an error-prone manual invoice processing, unclear supplier invoice-related guidelines, and subpar training of the AP staff.

To help you keep a tab on the above-mentioned KPIs effortlessly, we’ve weaved a list of guidelines. Here’s how you can track the key performance indicators of your AP team:

Define your short-term and long-term business goals to monitor whether your company’s revenue is growing or is stagnant.

To get powerful insights into KPI monitoring, you need to have complete access to historical and real-time data.

Pick the correct visualisations for every designated metric. You can use several types of charts, graphs, and dashboards to visualise your business data. Investing in the right innovations for tracking KPIs will help you make lucrative business decisions.

Pick cohesive KPIs to complement visualisations and set the right benchmarks. With your chosen KPI benchmarks, allow the stakeholders to test the indicators.

How Do You Track The KPIs?

To help you keep a tab on the above-mentioned KPIs effortlessly, we’ve weaved a list of guidelines. Here’s how you can track the key performance indicators of your AP team:

Define your short-term and long-term business goals to monitor whether your company’s revenue is growing or is stagnant.

To get powerful insights into KPI monitoring, you need to have complete access to historical and real-time data.

Pick the correct visualisations for every designated metric. You can use several types of charts, graphs, and dashboards to visualise your business data. Investing in the right innovations for tracking KPIs will help you make lucrative business decisions.

Pick cohesive KPIs to complement visualisations and set the right benchmarks. With your chosen KPI benchmarks, allow the stakeholders to test the indicators.

How Does Automation Improve The KPI?

Drive your company’s internal success and discover cutting edge technologies to help consolidate your business!

Accounting is a daunting task for several businesses. Even after rounds and rounds of manual data processing, you’re somehow always left with more company data to sort! This is why businesses are headed towards the era of automation.

With the advent of technology, today it’s possible to save money, streamline payables and receivables, and improve business efficiency at the same time. It can not only relieve you of some administrative company duties but also provide you with important business data in a more structured format.

Here are six compelling reasons why you must pick up pace with this trend!

Save Your Time: If you are an AP manager, then you'd be familiar with how painfully slow manual processing can affect your AP KPIs. Automating your Accounts Payable process helps get mundane tasks such as entering data and checking purchase forms done with higher accuracy and in a lesser time frame.

Error-Free Invoice Processing: Us humans are prone to errors whereas AI is not. Automated AP processes lead to endless repetition of AP tasks with zero errors.

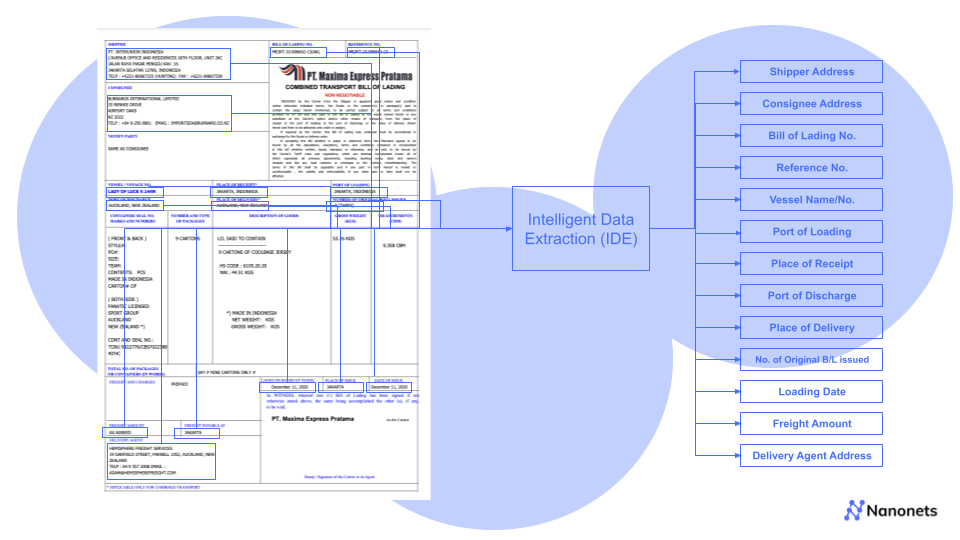

Access to Digitized Documents: Another key advantage of using an automated AP process is that you don't have to worry about filling important paperwork. Through automation, you can straightaway create digitized documents right from the beginning and bid goodbye to the trouble of following, scanning, and emailing purchase orders.

Data Validation: KPI tracking systems give you the power to make the requisite business changes through monitoring the graphs and other statistics. You can also chart the progress of your business through data validation.

Enhanced Productivity: One of the greatest advantages of automating your AP process is that you can save yourself from tedious manual tasks and focus on more important business tasks.

Improved Accessibility: Through digitization, you can take your AP processes to the cloud and no longer worry about filing the paperwork in the right cabinets!

Financial automation is easy with software like Flow Nanonets which can handle the end-to-end accounts payable process and help you 10x your efficiency. You can automate your invoices, approval, and payment process. Sync data in real-time with your ERP like Quickbooks for reconcilliation, monitoring and performing analytics on your AP process.

Schedule a demo with Flow by Nanonets today:

Conclusion: Wire Transfer with Paypal

Learn How To Achieve Your Accounts Payable Goals More Strategically

The importance of automation for digitizing the AP processes of your AP team cannot be undermined.

Experience the power of automation by improving your team efficiency through managing tedious manual tasks and digitizing important paperwork!

Nanonets can help you manage your Accounts Payable team efficiently, so that you can spend your time leading your business from the front! Through the powers of deep learning, you can easily capture any industrial data from any document you desire!

Automate mundane manual tasks such as filing invoices in cabinets, scanning purchase orders, and much more!

Capture data from multiple resources and utilize them to advance your AP team!

Get exclusive access to template agnostic solutions which help join the dots between varied pieces of information.

Cut down the time you spend chasing invoices and automate your payment collection!

Reduce late invoice payments and enhance your cash flow