Finance automation is no longer a luxury—it's the key to staying competitive. Top-performing companies are already reaping the rewards, with 36% embracing intelligent automation powered by artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA).

Incorporating finance automation enables organizations to process transactions more efficiently, generate accurate reports, and make data-driven decisions. Key areas that benefit from automation in finance include accounts payable, accounts receivable cycle, spend management and financial reporting.

McKinsey estimates that over 60% of finance activities can be automated with current technology. This guide will show you how to harness this potential, transforming your finance function from a cost center to a strategic powerhouse.

Let's get started.

What is finance automation?

Finance automation refers to using technology-driven solutions to streamline and optimize financial processes and operations. At its core, it's about leveraging AI, ML, and RPA to revolutionize financial processes such as analysis, payroll administration, invoice automation, expense management, and statement preparation.

It minimizes the need for human intervention, freeing up resources for strategic tasks. By integrating AI and ML, financial automation enhances accuracy, ensures compliance, and reduces errors. This involves establishing a sequence of activities, known as workflows, and employing technology to initiate steps or triggers, allowing for complete automation of certain finance procedures without the need for any human involvement.

This isn't just a digital facelift for your finance department. Finance automation is fundamentally changing how finance functions operate, transforming them from cost centers into strategic drivers of business value.

In practice, finance automation can look like:

- AI-powered invoice processing that extracts data and matches it with purchase orders

- ML algorithms that predict cash flow trends and optimize working capital

- RPA bots that reconcile accounts and generate financial reports

The goal is to free up your finance team from mundane tasks so they can focus on strategic initiatives. By automating repetitive processes, finance professionals can spend more time on analysis, decision-making, and providing valuable insights to guide business strategy.

Remember, finance automation isn't about replacing humans—it's about augmenting their capabilities and enabling finance teams to contribute more meaningfully to organizational success.

Benefits of finance automation

Sure, saying goodbye to manual invoice translations and data standardization is nice, but that's just the tip of the iceberg. The advantages of finance automation extend far beyond mere convenience.

It can significantly improve your organization's financial operations and overall performance:

- Faster invoice processing and payment collection lead to better working capital management, crucial for business growth and stability.

- Automatic adherence to the latest standards (like GDPR, SOX, IFRS) reduces the risk of costly penalties and reputational damage.

- Minimized human errors ensure data integrity and reliable financial reporting through automated validation and reconciliation.

- Strategic focus for finance teams: Freed from repetitive tasks, your team can shift from number-crunching to uncovering insights that drive business growth.

- Capture early-payment discounts, eliminate late fees, and reduce operational costs associated with manual processes and errors.

- Instant access to up-to-date financial data enables quicker, more informed decision-making and agile responses to market changes.

In a recent McKinsey survey, 55% of CFOs surveyed expect their organizations to build new businesses in the next year to create new revenues, with automation playing a key role. This shift towards automation and new business creation highlights the evolving role of finance departments. As routine tasks become automated, finance professionals are increasingly expected to drive innovation and growth.

ROI is too high to even quantify!

"Our business grew 5x in last 4 years, to process invoices manually would mean a 5x increase in staff, this was neither cost effective or a scalable way to grow. Nanonets helped us avoid such an increase in staff. Our previous process used to take six hours a day to run. With Nanonets, it now takes 10 minutes to run everything. I found Nanonets very easy to integrate, the APIs are very easy to use." ~ David Giovanni, CEO at

Ascend Properties.

Book a demo with us and explore how Nanonets can streamline your invoice processing, just like it did for Ascend Properties.

Core financial processes that can be automated

Financial automation can transform every corner of your financial management — from smoothing out accounts payable and receivable to keeping expenses in check and churning out spot-on financial reports.

By embracing automation in these key areas, you're not just tidying up your finances. You're setting the stage for improved operations and a healthier bottom line.

Let's take a closer look at how financial process automation can revolutionize some specific functions:

1. Bookkeeping automation

Bookkeeping automation turns a tedious task into a strategic advantage. It automatically categorizes transactions, reconciles accounts, and highlights discrepancies. This not only minimizes errors but also offers real-time insights into your financial status and facilitates easier audits and reporting. Make quick decisions while your team focuses on valuable analysis instead of mundane data entry.

2. Accounts payable automation

AP automation involves the end-to-end automation of invoice processing, approval workflows, and payment execution. These systems automate three-way matching comparing invoices, purchase orders, and receipts. You can create approval hierarchies using custom rules, and strategically time payments to get early discounts.

It reduces invoice processing time and costs significantly. Visibility into cash flow and spending patterns is enhanced. Various steps in the source-to-pay workflow can be further automated to manage procurement effectively.

3. Accounts receivable automation

AR automation streamlines invoicing, payment collection, and reconciliation processes, helping you improve your cash flow. Intelligent systems auto-generate invoices, monitor payment progress, and launch tailored follow-ups.

Days of Sales Outstanding (DSO) are reduced, improving cash flow. Manual effort in payment matching and reconciliation is decreased. Convenient self-service options enhance customer experience. Netting payments ensures a more controlled and optimized cash flow.

4. Spend and expense management

Expense management automation transforms the tedious task of expense tracking into a streamlined powerhouse. It enables you to categorize costs, catch policy breaches, and forecast spending trends.

It's not just a time-saver – you can enforce policy compliance better, and cut maverick spend. Real-time visibility into company-wide expenditures, including purchasing, is achieved. Data-driven insights enable cost optimization and informed budget planning.

5. Financial reporting

Automated financial reporting isn't just faster—it's smarter. Financial reporting automation integrates real-time data from various systems, uses AI for predictive analytics, and generates automated reports with narrative insights powered by natural language processing.

It enables you to close books accurately, generate regulatory reports at the click of a button, and create customized dashboards for various stakeholders. This way, you can turn financial data into a powerful, real-time decision-making tool.

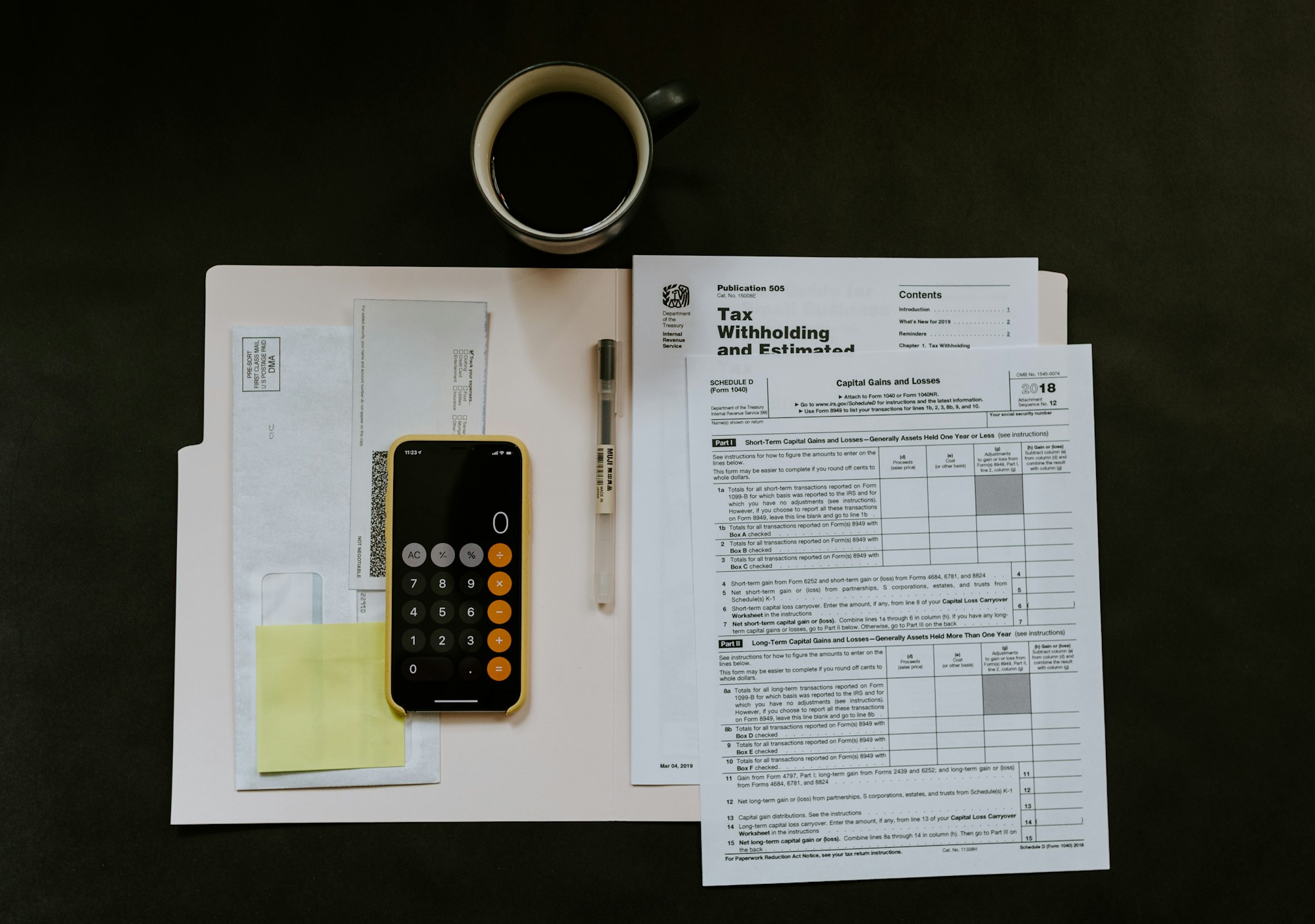

6. Tax management

Tax automation brings clarity to complexity. These systems allow you to stay updated with evolving regulations, automate calculations, and ensure compliance across multiple jurisdictions.

Beyond filing returns, tax automation tools can proactively identify savings opportunities, turning tax management from a compliance function into a strategic advantage.

7. Risk management and compliance

Automation in risk management and compliance leverages AI to continuously monitor transactions, detect anomalies, and ensure adherence to regulatory requirements.

It can predict potential risks, automate compliance reporting, and provide real-time risk assessments, turning risk management into a proactive rather than reactive function.

8. Payroll management

Automated payroll systems integrate time tracking, tax calculations, and payment processing. They ensure accurate, timely payments while automatically adjusting for policy changes and compliance requirements.

This not only reduces errors but also improves employee satisfaction and helps manage labor costs more effectively.

9. Cash flow forecasting

Cash flow forecasting automation uses advanced analytics and machine learning to predict future cash positions, inflows, and outflows with greater accuracy and granularity. It merges historical data with real-time information, predicting future cash positions with high accuracy.

The system anticipates cash shortages, identifies investment opportunities, and offers scenario analysis for various business conditions. This precision enables smarter, more strategic cash management decisions.

10. Financial Planning and Analysis (FP&A)

Financial Planning & Analysis (FP&A) FP&A automation integrates cross-organizational data and applies machine learning to identify trends, anomalies, and correlations in financial and operational data.

The budgeting and forecasting process becomes more efficient and accurate, significantly reducing cycle times. It enables data-driven decision-making and faster assessment of the financial impact of various strategic options.

In a Forrester survey, 52% of respondents reported that their finance operations teams spend too much time on routine tasks, leaving them little bandwidth to flex their strategic-thinking capabilities. This underscores the importance of automating routine financial tasks to free up time for strategic initiatives.

Struggling with high invoice volumes?

Get best-in-class OCR, customizable workflows, and easy-to-deploy integrations with QuickBooks, Xero, SAP, and Zapier to manage increased invoice loads without adding staff or stress. Contact us for a personalized demo today to learn how Nanonets can simplify your AP tasks.

Practical ways to implement finance automation

Implementing finance automation may seem daunting, but focusing on specific use cases can help break it down into manageable steps.

.png)

Here are a few practical workflow ideas for implementing finance automation:

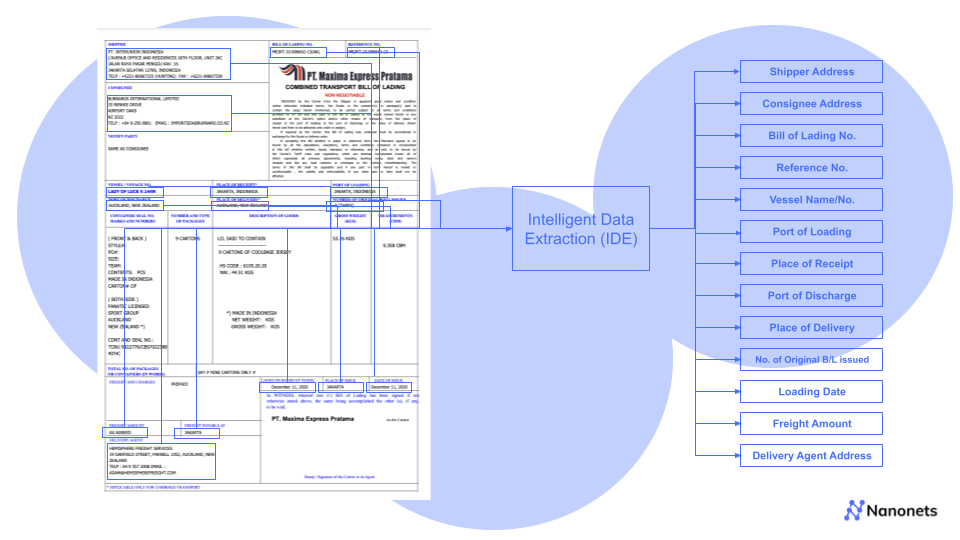

1. Automated invoice processing:

- Use Nanonets' pre-trained invoice model to automatically extract key information from invoices, including invoice number, date, amount, tax, and line item details

- Set up a workflow that imports invoices from multiple sources (Gmail, Google Drive, Dropbox, or OneDrive) and automatically routes them through the OCR model

- Configure rules to automatically create and populate invoice entries in your accounting system like QuickBooks or Xero with the extracted data

2. Intelligent document classification and routing:

- Use Nanonets to classify incoming documents (invoices, receipts, purchase orders)

- Configure workflows to route each document type to the appropriate OCR model

- Create workflows to route each document type to its appropriate specialized OCR model for detailed data extraction

- Implement post-classification actions, such as notifying relevant team members or updating document status in your system

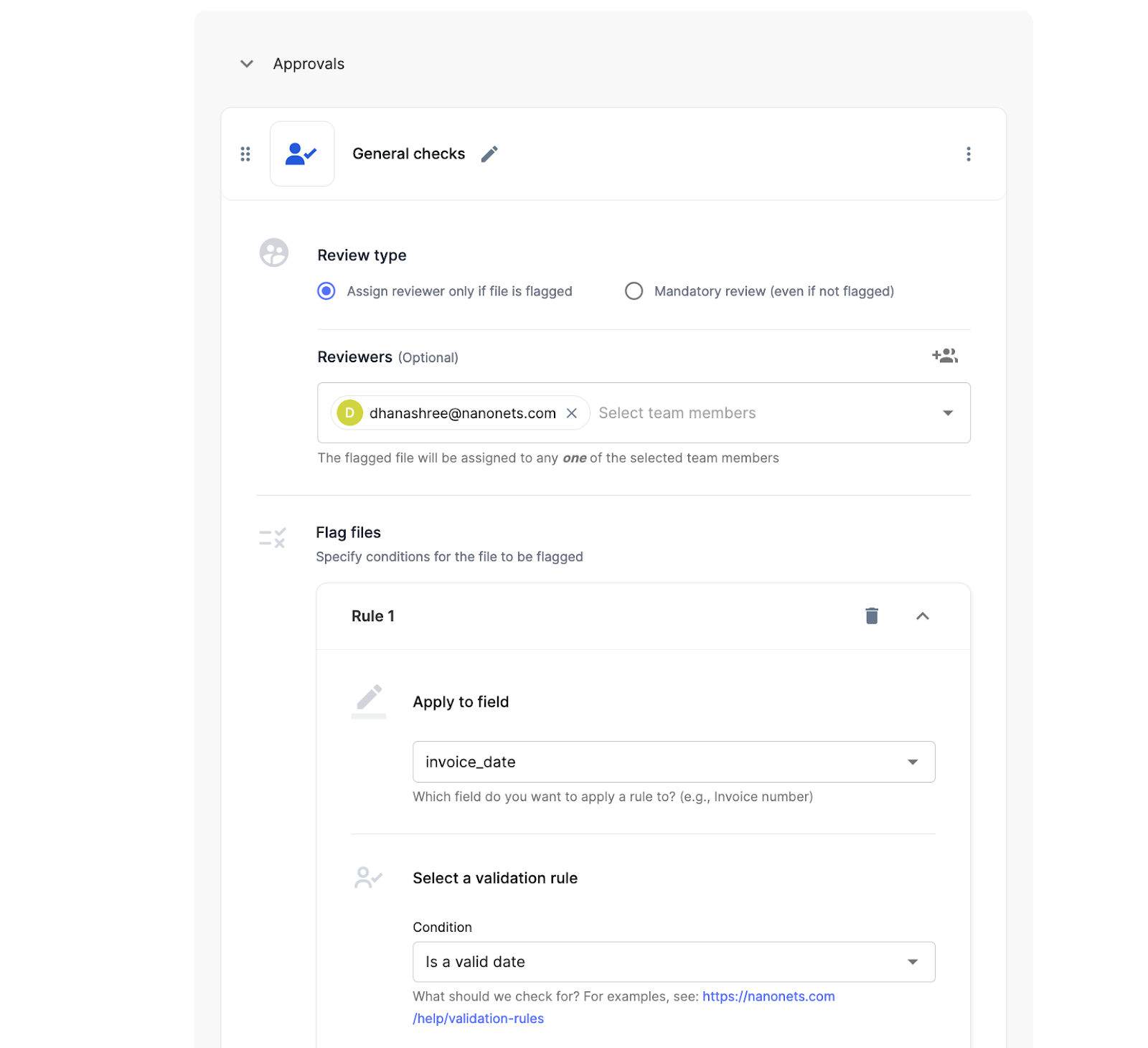

3. Data validation and approval workflow:

- Establish custom approval rules in Nanonets based on extracted data (e.g., flag invoices over $5000 for review)

- Configure Nanonets to automatically assign flagged documents to specific team members based on predefined criteria

- Set up email or Slack notifications to alert approvers of pending items requiring their review

- Implement an escalation process for approvals not completed within a specified timeframe

- Create a dashboard to track approval statuses and processing times for all documents

4. Automated expense report processing:

- Have employees forward expense receipts to the designated Nanonets email address

- Nanonets processes the receipts, extracting relevant data like date, amount, and vendor

- Use Nanonets' post-processing rules to categorize expenses based on predefined criteria

- Export structured expense data to your accounting system or expense management tool

5. Automated 3-way matching:

- Set up Nanonets to pull documents from multiple sources (email, scanned documents, cloud storage, ERP) and to automatically sort incoming files as invoices, POs, or receipts

- Configure OCR to extract detailed data from each document type, including line items and SKU information

- Implement a 3-way matching process that reconciles fields, expenses, balances, and SKU-level information across related invoices, POs, and receipts

- Set up rules to flag 3-way match errors that breach predefined tolerance levels

- Create automated workflows for successful matches, routing invoices for approval or payment

- Configure integration with your ERP or accounting software (e.g., Sage, Xero, NetSuite, QuickBooks) to sync processed data and update payment statuses

6. Automated data export:

- Utilize Nanonets' integrations to directly export processed data to financial systems like QuickBooks, Xero, or Salesforce

- Leverage Zapier integration to connect Nanonets with thousands of other apps and automate workflows without coding

- Set up Zapier to trigger actions in other apps based on new Nanonets predictions or document uploads

- For systems without direct integration or Zapier support, configure scheduled CSV exports to a secure folder for regular import

- Utilize webhooks to send real-time updates to your custom applications or databases when documents are processed

7. Automated payment processing:

- Extract payment terms and due dates from invoices

- Set up automated reminders for upcoming payments

- Integrate with banking systems to initiate payments for approved invoices

8. Fraud detection:

- Configure Nanonets to check extracted vendor information against your approved vendor list

- Set up rules to flag potential duplicate invoices or unusual transaction patterns

9. Multi-currency processing:

- Leverage Nanonets' ability to process documents in multiple languages and detect different currencies

- Use post-processing rules to standardize currency formats and apply conversion rates if needed

10. Automated audit trail creation:

- Utilize Nanonets' logging and tracking features to maintain a detailed record of all document processing activities

- Export this data regularly to maintain an external audit log if required

11. Automated reconciliation process:

- Upload bank statements to Nanonets for processing

- Use extracted transaction data to match against records in your accounting system

- Set up rules to automatically reconcile matching transactions and flag discrepancies for review

12. Contract management:

- Use Nanonets to extract essential information from contracts (dates, amounts, terms)

- Set up automated reminders for contract renewals or key dates

- Link contracts with related invoices and payments for easy tracking

While your business might not require all these workflows, they illustrate the potential of finance automation. And the best part is that you can kickstart most of these workflows with a straightforward tech setup. A powerful AI-OCR tool like Nanonets combined with a versatile workflow automation platform like Zapier and your current accounting software is often all you need to get the ball rolling.

Start with high-volume, repetitive tasks for quick wins, then expand to complex workflows. Track key metrics like processing time and cost savings to prove ROI and build support. Remember to communicate clearly with your team about the benefits of automation and provide adequate training.

Why choose Nanonets for finance automation

If you’re considering an end-to-end finance automation solution, Nanonets offers a comprehensive platform that addresses all aspects of the process. Our AI-powered tools can streamline your financial operations, from document processing to advanced analytics.

From hours to seconds: Achieve similar results!

"Tapi has been able to save 70% on invoicing costs, improve customer experience by reducing turnaround time from over 6 hours to just seconds, and free up staff members from tedious work." - Luke Faulkner, Product Manager at Tapi. Schedule a personalized demo with Nanonets to learn how AI can streamline AP processing for your business.

With Nanonets, you can:

1. Become more adaptable: Your financial processes are often as unique as your company itself. With Nanonets, you can seamlessly process your documents regardless of their format or layout. Whether you're dealing with invoices from different vendors or receipts in various languages, it adapts to your needs. The platform supports multiple file formats including PNG, JPEG, and PDF, and automates file import – Gmail, Dropbox, Google Drive, and online forms – ensuring complete flexibility in your document intake process.

2. Automate end-to-end: Imagine freeing your finance team from the drudgery of manual data entry. With Nanonets, you can do just that. Its comprehensive document processing capabilities mean your team can shift focus from inputting data to analyzing it. You can set up complex approval flows, implement validation rules, and automate post-processing tasks. This allows you to streamline entire financial processes, from document intake to data validation and approval routing, all within a single platform.

3. Build custom model: Along with pre-trained models for common document types, you can create custom OCR models tailored to your specific document layouts and data fields. With a few sample documents, you can train the AI to recognize exactly what you need, ensuring high accuracy for your unique financial documents. You can also set up custom workflows that suit your AP needs.

4. Integrate with your existing stack: You've invested time and resources into your current tech stack. Nanonets respects that investment by offering direct integrations with popular tools like QuickBooks, Xero, and Salesforce. Plus, with Zapier, API, and Webhook support, it works well with hundreds of other applications, fitting seamlessly into your existing workflow.

5. Enhance data: With features like currency detection and database matching validations, you can ensure the extracted data is standardized and verified against your existing records. This significantly reduces errors and improves the overall quality of your financial data.

6. Continuous improvement: Finance automation isn't a set-it-and-forget-it solution. As your business changes, your automation needs to keep pace. Nanonets makes this easy with simple model retraining. As you process more documents and make corrections, the system learns and improves, becoming more accurate over time without requiring a complete overhaul.

7. Get scalable and secure infrastructure: Built on a cloud-based infrastructure, Nanonets can handle everything from a few hundred to millions of documents per month. As your business grows, the platform scales effortlessly to meet your increasing needs. Moreover, with robust security measures including data encryption and compliance with standards like GDPR and SOC 2, Nanonets ensures your sensitive financial data remains protected.

8. Get started quickly: The clean, intuitive interface makes it easy to set up automated workflows. Get a user-friendly dashboard for quick process overviews, a visual drag-and-drop workflow builder, and a real-time document viewer for efficient data review and editing. Customizable reports and detailed data visualizations allow you to access critical financial information quickly when needed.

Final thoughts

Finance automation is a powerful tool that can revolutionize financial management processes, enabling businesses to achieve enhanced efficiency, reduce costs, and make more informed business decisions. Embracing automation in finance is a crucial step towards staying competitive in the rapidly evolving financial landscape.

By automating key areas such as accounts payable, accounts receivable, spend and expense management, and financial reporting, businesses can improve cash flow control, eliminate manual tasks, and free up their finance teams to focus on more critical functions like financial planning and analysis.

Ultimately, finance automation is not just about improving operational efficiency. It also has a significant impact on business decisions. By providing accurate and timely data, finance automation empowers businesses to make more informed and strategic decisions, driving overall financial success and business growth.

FAQs

What is automation in finance?

Automation in finance refers to the use of technology to perform financial tasks and processes with minimal human intervention. This includes automating repetitive tasks like data entry, report generation, and transaction processing, as well as more complex functions like financial analysis and forecasting.

Will finance be automated by AI?

AI will automate many finance tasks but won't completely replace human finance professionals. AI and automation will handle routine tasks, data processing, and some analysis, allowing finance professionals to focus on strategic decision-making, complex problem-solving, and providing insights that require human judgment.

What is RPA for finance?

Robotic Process Automation (RPA) in finance involves using software robots or "bots" to automate rule-based, repetitive financial tasks. RPA can be used for processes like data entry, reconciliations, report generation, and invoice processing. It helps improve accuracy, speed, and efficiency in financial operations while reducing costs and freeing up staff for higher-value tasks.

How do you automate finance?

Finance automation can be implemented across several key areas: Accounts Payable (invoice processing, three-way matching), Accounts Receivable (automated invoicing, payment reminders), Financial Close (account reconciliations, journal entries), Expense Management (receipt scanning, policy compliance checks), Reporting (automated data consolidation, real-time dashboards), Budgeting and Forecasting (AI-driven models), Cash Flow Management (automated forecasting, working capital optimization), Payroll (time tracking, tax calculations), Compliance and Risk Management (continuous monitoring systems), and Procurement (purchase order creation, vendor management).