A complete guide to Automated Invoice Processing in 2024

The accounts payable department is responsible for processing invoices received from vendors. Traditional invoice processing has been largely inefficient and time consuming. Among other steps it involves entering invoice data received across disparate sources (email, fax, post, etc.), assigning appropriate GL codes, verifying or matching data against internal records, routing approvals, and processing or recording the payment.

Building strong vendor relationships is crucial for a stable and reliable procurement process. Vendors expect prompt invoice processing and timely payments. Automated invoice processing or invoice automation can help in this regard by streamlining the overall invoice processing workflow and ensuring timely vendor payments.

This article is a complete guide to automated invoice processing and how it can help your organization optimize its invoice processing workflows.

What is automated invoice processing?

Automated invoice processing leverages software solutions to streamline accounts payable invoice processing workflows. Right from extracting invoice data to updating ERP entries, invoice processing automation simplifies and enhances the overall efficiency of processing vendor payments. This not only saves time and money but also reduces the likelihood of errors and fraud.

Such automated invoice systems speed up routine accounts payable tasks such as invoice data extraction, 3 way matching, GL coding, approvals based on business rules, data entry into ERPs or accounting systems like QuickBooks, and releasing vendor payments. The use of automated invoice processing software frees up accounts payable teams from repetitive manual work, helping them achieve a faster financial close and allowing them to focus on more strategic activities.

How does invoice automation work?

Any automated invoice processing workflow proceeds through these 3 stages:

- Reading or capturing invoice data

- Verifying or interpreting invoice data according to business rules

- And filing or posting data into an ERP or accounting system

Let’s look at how invoice automation works in each of these stages:

1. Reading or capturing invoice data

Businesses often receive invoices across multiple channels. Automated invoice processing systems consolidate invoice data received across these disparate channels. Invoices received via email are auto-forwarded to a dedicated receiving email address. Physical invoices are scanned in bulk and saved into a master folder or emailed to the dedicated receiving email address.

Invoices that hit the dedicated receiving email address are readily pulled into the automated invoice processing system. Invoices saved in folders on a computer or on the cloud (Drive, Dropbox etc.) can be synced in real time with the invoice automation software.

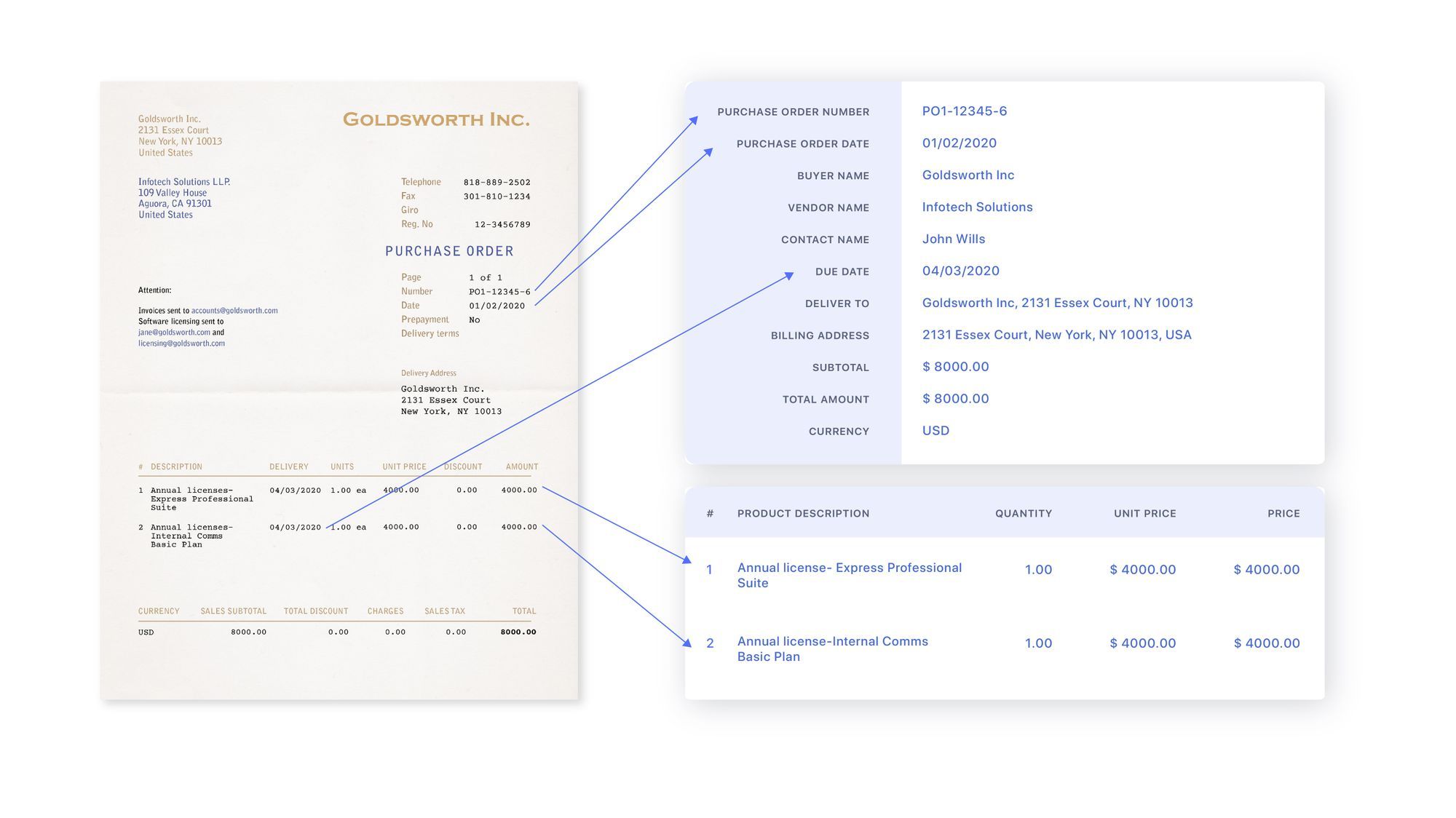

As the invoices are captured, the system automatically reads the invoice data using a combination of AI, ML and OCR technologies. The invoice data thus read is presented to the users for further validation and verification.

2. Verifying or interpreting invoice data according to business rules

Incoming vendor invoices need to go through a few mandatory verifications related to the vendor, vendor details, invoice amount etc. These verifications are based on internal financial controls or business rules.

Automated invoice systems can verify if the vendor exists in the master vendor database and flag invoices received from unknown vendors. These systems can also highlight key vendor data (bank account details, address etc.) that is inconsistent with that in the internal vendor database.

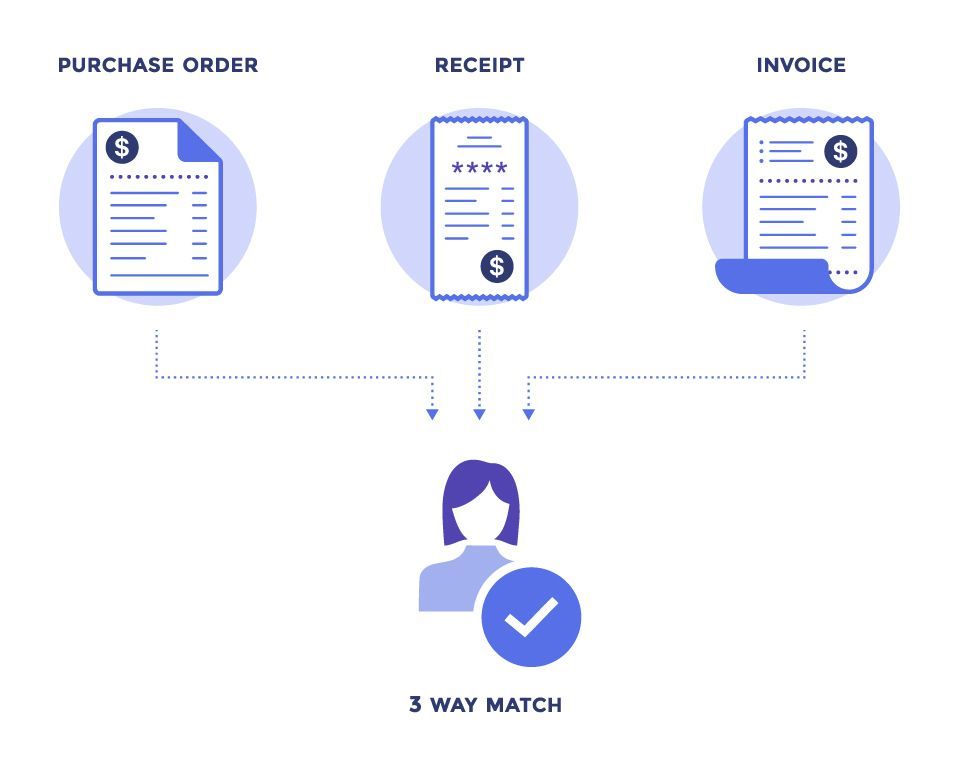

Invoices are routinely matched (3 way matching) against POs, receipts or other internal records to ensure that all the data match and are consistent. Custom validation rules can be easily set up as steps/sequences in the invoice processing workflow. For example, is the PO# on the invoice equal to six characters in length? Or does the amount/quantity in the invoice match that in the PO? Invoices that don’t clear these validations/verifications are flagged for review and will not proceed to the next stage.

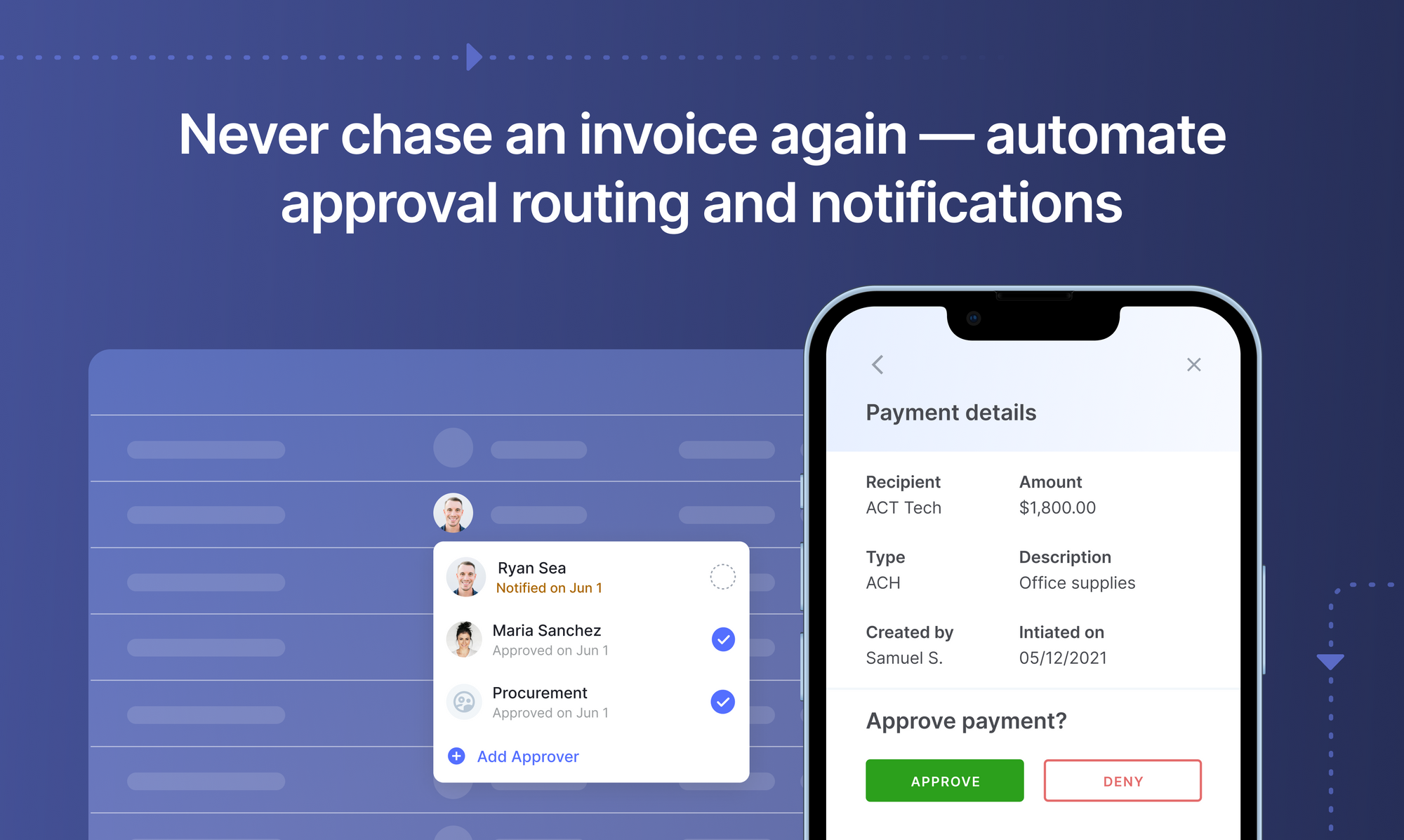

Automated invoice processing software also streamline approval routing workflows. Incoming invoices are routed to the right decision makers for approval based on the vendor or invoice amount. For example, a Figma invoice would be sent to the design or marketing team for approval while any invoice that exceeds $10,000 could be sent for additional AP approvals from the CFO or CEO.

Once an invoice passes all these validation/verification stages it is cleared/processed for payment. Certain invoice automation software (AP automation software) can also automate vendor payments at this stage.

Filing or posting data into an ERP or accounting system

Automated invoice systems can export a final report containing all invoice data in a format compatible with ERPs. They can also directly integrate with ERPs and accounting software via API.

They connect to your existing accounting software or ERP and enter/update data concerning invoices that have been processed/paid. This seamless transfer of data ensures a faster financial close.

How to automate invoice processing with Nanonets?

Manage supplier communication, process invoices in seconds, set up controls, gain visibility into spends, and streamline the financial close with Nanonets' AI-based AP Automation software.

How Automated Invoice Processing Improves Invoice Management

Automated invoice processing revolutionizes the way businesses manage their invoices, offering a plethora of benefits that range from time and cost savings to improved accuracy and enhanced insights. Traditional invoice processing methods, involving manual data entry, paper invoices, and endless filing, have long been associated with inefficiency and delays, exacerbated by invoices received through various channels such as mail, fax, and email.

Automated invoice processing represents a significant leap forward from manual processes, driven by the power of artificial intelligence and machine learning. This software automates the entire invoice processing workflow, from extracting data from business systems to seamlessly integrating with Enterprise Resource Planning (ERP) systems. By doing so, it not only saves time and money but also mitigates the risk of fraud.

The process begins when an invoice arrives, eliminating the need for laborious data entry. Instead, the software scans and digitizes the invoice, creating a text-searchable document. It then intelligently extracts and maps essential data, such as supplier names, purchase amounts, and quantities, into the ERP system. Invoices are then routed to the appropriate parties for review and approval, streamlining the entire accounts payable process.

The advantages of automated invoice processing are manifold. Firstly, it significantly reduces processing time, transforming what could take up to 20 to 21 days manually into a mere 3 or 4 days, especially when machine learning services are incorporated. This time-saving translates directly into cost savings, as the adage goes, "time is money." Reduced labor costs, avoided interest and late fees, and the move towards a paperless environment contribute to these savings.

Moreover, the software dramatically reduces the occurrence of errors, eliminating the hassles of incorrect payments or lost invoices. It enhances employee productivity, allowing accounts payable teams to process invoices faster and more accurately. This increased efficiency can defer the need for hiring additional staff, a costly and time-consuming endeavor.

Furthermore, automated invoice processing systems collect valuable data and provide deeper insights, allowing businesses to make informed decisions about vendor relationships, payment strategies, and cost-saving measures. The software also enhances control and transparency by simplifying invoice tracking and offering real-time visibility into productivity.

Ultimately, automated invoice processing, with the support of machine learning services, is a catalyst for business growth. It equips companies to handle a growing volume of invoices without the immediate need for expansion, while also freeing up capital for strategic investments. By optimizing the invoicing process, businesses can navigate their growth trajectories with greater control and confidence, making automated invoice processing a cornerstone of modern invoice management.

Benefits

- Costs: Reduce actual keystrokes typed by almost 90% and take advantage of discounts on early payments

- Productivity: By removing the task manual tiresome data entry, your finance team does the more important tasks 75% faster

- Analytics: Using machines you can now extract a lot more data a lot faster leading to deep analytics into business processes inefficiencies and bottlenecks

- On-premises: We understand this is sensitive data to your business. Nanonets AP Automation software can run on-prem

How to evaluate an Automated Invoice Processing Software

Selecting the right automated invoice processing software is a pivotal decision for any organization looking to streamline their financial operations. To make an informed choice, consider the following essential factors:

- Ease of Use: Opt for software that boasts a user-friendly interface. An intuitive system reduces the learning curve for your team, ensuring a smooth transition to automation.

- Scalability: Your chosen software should have the capacity to handle your current volume of invoices while also accommodating future growth. Scalability ensures that the solution remains viable as your business expands.

- Customization: Each organization has unique invoice processing requirements and approval workflows. Look for software that is flexible and customizable to align with your specific needs.

- Integration: The software should seamlessly integrate with your existing accounting and ERP systems. This ensures data consistency and reduces the risk of information silos.

- Security: Verify that the software adheres to industry-standard security practices. Protecting sensitive financial data is paramount, and robust security features should be non-negotiable.

- Support: Partner with a vendor that provides reliable customer support, comprehensive training, and ongoing maintenance. A responsive support team is essential for a smooth implementation and continuous improvement.

Implementing Automated Invoice Processing

Once you've chosen the right software, implementing automated invoice processing involves several key steps:

Step 1: Assess Your Current Process: Analyze your existing invoice processing workflow to identify bottlenecks and inefficiencies. Prioritize areas where automation can deliver the most significant value.

Step 2: Gather Stakeholder Input: Engage key stakeholders, including finance, procurement, and IT teams, to gather input and address concerns. Their involvement is crucial for a successful transition.

Step 3: Establish Approval Workflows: Define approval hierarchies, rules, and thresholds to ensure that the automated system aligns with your organization's policies and procedures.

Step 4: Configure and Integrate: Collaborate with your chosen vendor to configure the software to your requirements and integrate it with your existing systems. Ensure that integrations are seamless for optimal efficiency.

Step 5: Test the System: Conduct thorough testing before going live to address any issues and gather feedback from internal stakeholders.

Step 6: Train Your Team: Provide comprehensive training to ensure your team can effectively use the new system. A well-trained team is essential for maximizing the benefits of automation.

Step 7: Monitor and Optimize: Continuously monitor the performance of your automated invoice processing system, identifying areas for improvement and making necessary adjustments.

Measuring Success and ROI

Evaluating the success of your automated invoice processing system involves tracking key performance indicators (KPIs):

- Processing Time: Measure the time from receipt to payment. A decrease in processing time indicates improved efficiency.

- Error Rate: Track errors like duplicate payments or data entry mistakes to assess accuracy.

- Cost per Invoice: Calculate the cost of processing each invoice, including labor and software expenses. Lowering this cost signifies increased efficiency.

- Invoice Approval Time: Measure how long it takes for invoices to gain approval, reflecting the effectiveness of your approval workflow.

- Supplier Satisfaction: Gauge supplier satisfaction through surveys or feedback, as timely and accurate processing impacts business relationships.

To calculate the ROI of invoice processing automation, compare the benefits (savings, efficiency gains) to the costs (software, training, maintenance). The ROI formula is:

ROI = (Benefits - Costs) / Costs x 100%

By considering these factors and diligently measuring success, organizations can not only choose the right automated invoice processing software but also ensure a successful implementation that delivers tangible benefits and ROI.

How to digitize invoices better?

By using OCR and deep learning, we have enabled machines to perform as well and in some cases even better than humans.

Digitizing invoices involves several human moderated steps :

- Digital images of invoices taken and uploaded by the user.

- Image verified to be fit for further processing - good resolution, all data visible in the image, dates verified, etc.

- Images checked for fraud.

- Text in these images extracted and put in the right format.

- Text data entered into tables, spreadsheets, databases, balance sheets, etc.

Validation

The data extracted from any invoice needs to be verified to ensure proper sums, VAT rates, VAT IDs, currencies, seller details and more. Most companies have workflows of multiple levels of approvals to ensure that an error doesn't slip through it's cracks where reconciliation later is a very painful process. A good invoice processing automation software allows you to setup some of these basic rules and in case any extracted value violates that, it raises a flag for a manual review. So now you're adding a layer of Artificial intelligence led checks. In these redundant repetitive processes, machines have been said to been humans hands down.

Handling mismatches

In case there is a discrepancy in the information extracted against said business rules, one can create a resolution handling workflow where there is manual verification of this data. You can set confidence score thresholds to handle such automation - if a value is below a pre-decided confidence score number you route to a manual workflow, else push it to the automated payment workflow.