Balancing your open invoices is one of the most common struggles for businesses of all sizes. A small startup has the same problem chasing down customers to keep cash coming in for services rendered or products delivered as the large corporate monolith down the street.

The difference between the two, generally, is that companies learn and gain experience through time that helps develop an internal standard operating procedure (SOP) for managing open invoices and closing them as quickly as possible.

However, properly managing open invoicing is more than having your accounting team call clients with payments outstanding or ensuring timely delivery. Instead, open invoices are a hinge upon which your entire accounting cycle operates and serve as a microcosm of your overall financial management – handle the small things effectively, like managing open invoices, and you have a multiplier effect on downstream finance and accounting systems that ultimate save – and make – your company money.

What is an Open Invoice?

An open invoice is any invoice that’s sent and delivered but not yet paid by the recipient. If you’re any sort of business not dealing exclusively in cash (like most), you manage open invoices.

It’s not a perfect one-to-one comparison, but you can think of a waiter dropping off your check at a restaurant as creating an open invoice. The restaurant delivers your product (food and drinks), and the waiter gives you the invoice (check), which remains open until you pay and complete the transaction.

From a more direct perspective, an open invoice serves as an official payment request after a job is completed, service is rendered, or product is delivered. The open invoice effectively records a line of credit you’ve extended to a customer or client that’s closed upon payment.

Open invoices include a range of details depending upon the business type and SOP, but commonly detail:

- Type, quantity, and date of delivery (depending on product or service).

- Administrative information like invoice number, addresses, and official business names for both parties involved.

- Payment details, including method (ACH, credit card, check, etc.) and a maximum authorized period before payment must be rendered, such as on net-30 terms.

How Do Open Invoices Affect Your Business?

An open invoice immediately affects your business by growing your accounts receivable. The A/R portion of your balance sheet is an asset detailing money owed to you, and an open invoice is an official record of who owes what and by when it’s expected.

However, open invoices contribute to a range of business intelligence analytics that can help identify issues within your accounting cycle and operational model that can feed optimization. For example, your open invoices feed your days sales outstanding (DSO) metric, which describes how long, on average, your customers take to pay you. DSO can be used in many ways to analyze your business; a long DSO might indicate you’re not accurately gauging your customers’ creditworthiness or can create efficiencies in your collections process, for example.

Open invoices are also part of the bigger-picture cash conversion cycle (CCC), which describes how efficiently your company turns cash into inventory and back again through its sales process. If you can move product quickly but can’t turn the open invoices into cash, you’re again missing out on possible efficiencies. In both cases, using open invoices as a data point to feed holistic analysis is a great way to round out your strategic planning initiatives.

What are the Types of Open Invoice?

Open invoices describe the blanket concept; you’re likely to encounter one of many permutations when operating in the real world. Common types or variations of an open invoice include:

Online vs. Offline Open Invoices

Even if your company isn’t fully digitized, you likely generate open invoices as part of your sales cycle. A manual open invoice, therefore, acts the same as an online open invoice, but payment parameters are more restrictive, i.e., include cash, check, ACH transfer, and similar analog processes.

By comparison, look at an online open invoice example – it’s an invoice sent to the client or customer digitally and usually includes a wider range of digital payment options. As accounting automation tools increasingly pervade accounting offices, many online invoicing options automatically send the invoice to a customer based on predetermined workflow triggers or parameters.

In both cases, an open invoice is also described as a pending payment status until payment is rendered.

Bills

When an open invoice’s terms are broken, i.e., not paid within the required period, the open invoice transforms into a bill. If you’re using automation tools, your past-due, open invoice should automatically convert to a bill once it passes the set date while still in a pending status. Monitoring and managing your bills and past due open invoices is important because it contributes to lengthened DSO and CCC metrics, which, of course, are indicative of mismanagement or inefficient operations.

Late Fees and Discounting

You may also consider tacking late fees or other financial penalties onto past-due open invoices and bills. You can charge a flat rate immediately upon missing a payment, calculate the late fee as a percentage of the total, or even have a tiered system that increases the late fee by each predetermined window (i.e., charged 2% of the total weekly).

On the flipside, to prevent an open invoice from going past the due date and becoming a bill, you can offer “early payment” discounts. For example, if you issue an invoice on net-30 terms, you might offer a 1% discount if paid within 20 days, 2% within 10 days, etc. This helps keep cash coming in more rapidly, increasing your CCC and helping generate goodwill between you and your customers while offering them some flexibility.

Incomplete Payments

Less extreme than a past-due open invoice that becomes a bill, an incomplete payment happens when an invoice isn’t paid properly the first time but remains within the past-due window.

For example, if the customer’s account has insufficient funds or their credit card is denied, the payment remains incomplete. While not yet affecting your business too badly, as long as the incomplete payment remains within the payment terms, you’ll want to diligently address the incomplete payment quickly before it becomes a more severe issue.

How Does an Open Invoice Work?

Depending on your level of automation and SOP-driven workflows, your method of handling open invoices varies. But, in general, you might see something like this open invoice example settlement cycle:

- An open invoice statement is issued with terms including net-30, with a 2/10 discount (2% off the total if paid within ten days of issue).

- The customer doesn’t close the open invoice statement within ten days, forgoing the discount. That’s fine, but your automation tool sends them an email as a courtesy to remind them the discount option is void and they have 21 days remaining to pay.

- Another week goes by, and your automation software sends them another reminder but flags the invoice in your dashboard to let you know the open invoice may become a problem – call it amber status for now. You’ve been copied on the automated email, and a friendly note is sent as a follow-up a day or two later.

- You’re at ten days remaining, and give the customer a courtesy call to offer any assistance or see if they’ll need an extension. They assure you they’re fine, but the net-30 window comes and goes without payment.

- Your automation tool has now flagged the open invoice as red and turned it into a bill, which is generated with an included late fee (flat $50) and sent to the customer. From here, your SOP determines your next steps, but they might include sending the bill to collections, writing the invoice off as part of your allowances for bad debt, or negotiating a lower payment and blackballing the customer once received.

How Many Open Invoices Are Too Many?

Outstanding invoices expand your account receivables total and contribute to a greater asset stat, true – but if you can’t convert a bunch of open invoices into cash, there’s not much use to collecting them or carrying too many at once.

Ultimately, the number of open invoices that’re too many is operation-specific and driven by your collection procedures and scale. But if you do cross that threshold and carry too many open invoices concurrently, you could lose the bubble and:

- Negatively impact your CCC, which has downstream effects on your entire financial position and ability to model and forecast operational strategies accurately.

- End up having more open invoices than you can reasonably run down, with unaddressed issues going unnoticed and turning into past-due bills or sent to collections.

- Exhausting your allowances for bad debt account, which also has downstream effects on your pro forma financial statements.

Though open invoices are part of business today and not inherently bad, don’t get complacent – they still need diligence, action, and attention to prevent routine business matters from going bad.

How to Close an Open Invoice?

Once your customer or client pays the outstanding invoice and you’ve confirmed funds in your own account, the invoice is technically closed. In actuality, a handful of back-office accounting happens simultaneous to payment, including:

- The customer subtracts the payment total from their accounts payable.

- You deduct the equivalent from your accounts receivable and transfer the balance to your cash and cash equivalents account (in most cases).

- You validate the transaction during the accounting cycle when closing the books.

But, again, from a practical perspective – once payment is received and funds confirmed, the invoice is closed.

Conclusion

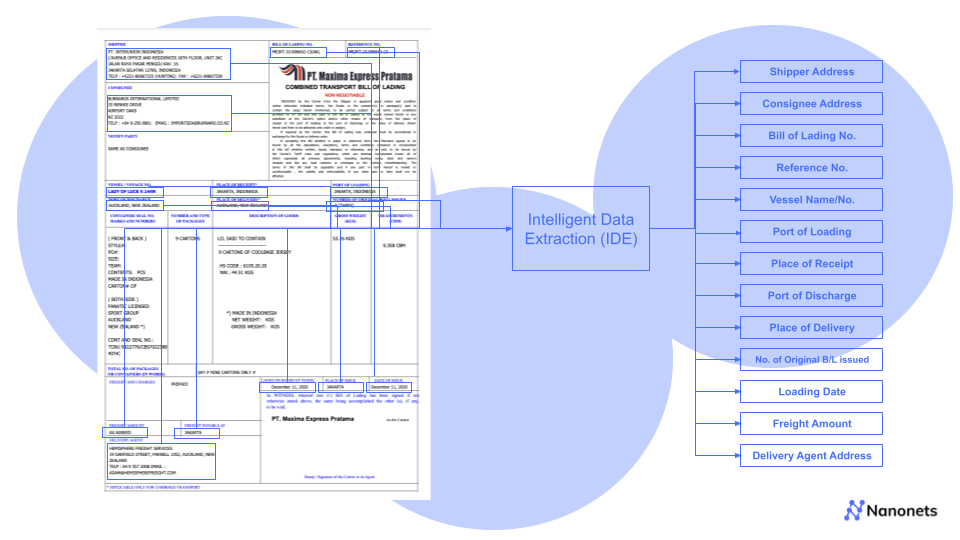

Managing open and outstanding invoices is just one of many “small things” that, when done well, contribute to a seamless operation but quickly compound into massive problems when managed poorly. Of course, digitization, automation, and invoice processing using artificial intelligence all contribute to a transformation in open invoice management (and accounting in general).

Specifically, automation tools can help streamline open invoice management by:

- Automatically invoicing for a transaction when receipt is confirmed, an end date is reached, or other workflow trigger is activated.

- Send recurring reminders.

- Convert a past due open invoice into a bill and calculate late fees as required.

- Maintain a document log for legal, compliance, and audit purposes. Open invoice testing is a routine part of an audit, and comprehensive platforms make this portion a breeze.

- Keeping customer records accurate.

- Offering a range of templates to base your invoicing SOP on, or the tools to customize your own.

- Automatically converting between local currencies to reduce friction and ease cross-border transaction pain.

- Centralizing all operations within a single platform, rather than bouncing between one that exclusively automates your payables and another for invoicing.

Of course, those are just a handful of tactical tricks. Effective software and platforms also let you generate reports that include DSO, CCC, and other open invoice-driven metrics to pin down inefficiencies and let you take an unbiased look at your operations.