A complete guide to invoice settlement in 2024

Settlement of invoices isn’t simply about paying off a bill. It's a process that ensures every payment, adjustment, or write-off tied to an invoice is accounted for and settled. There are no messy records, just tidy transactions.

It paves the way for flawless financial records, better cash flow, and smooth business operations. Which business owner wouldn't want that?

However, nearly 50% of businesses struggle with late supplier payments and missed discounts due to protracted AP approval cycles. In this article, we will guide you through the essential aspects of invoice settlement and provide practical tips to help you settle an invoice properly.

What is an invoice settlement?

Invoice settlement in accounts payable and receivable indicates the reconciliation of an invoice balance. It involves partial payment, adjusting the balance to zero through credit or debit memos. Adjustments may result from returned goods, invoicing errors, dispute resolution, overpayments, or write-offs, ensuring accurate financial records.

This might sound straightforward, but consider situations where there are adjustments such as discounts, returns, or errors. In such cases, the invoice settlement process can be more complex. It could involve issuing or receiving credit or debit memos, adjusting the invoice amount, or even disputing the invoice before it is settled.

The impact of efficient invoice settlement

Accurately settling your invoices helps maintain a healthy cash flow as it ensures that your records are precise and payments are timely. It reduces disputes and delays, thus preventing late fees and other financial complications.

Here are some benefits of efficiently handling invoice settlements:

1. Improved cash flow: By regularly reconciling your invoices, you can accurately forecast your cash flow, helping you maintain a positive cash balance and avoiding unnecessary borrowing.

2. Accurate financial records: Consistent invoice settlement allows for accurate documentation of all transactions. This aids in better financial analysis and reporting, ensuring all payments, nettings, credits, and debits are recorded correctly.

3. Smooth business operations: When invoices are settled promptly and accurately, relationships with suppliers, customers, and third parties are improved. This leads to smoother business operations and potential growth opportunities.

4. Compliance gets easier: When your financial records are accurate and up-to-date, it becomes easier to comply with financial rules and regulations. Whether it's tax season or a routine invoice audit, you can confidently share your records, knowing they reflect the actual state of your business's finances.

5. Better forecasts: Accurate invoice settlements provide a clear picture of your financial status, allowing for better financial planning and forecasting. This can guide your business decisions and strategies, helping you to invest wisely and grow your business.

The different types of invoice settlements

It is essential to understand that not all invoice settlements are the same. Different types of invoice settlements may apply depending on the specific circumstances and terms of the agreement.

An overview of different types of invoice settlements

| Settlement Type | Description | When/Why Used |

|---|---|---|

| Full Payment | Complete amount of the invoice is paid off. | No discrepancies, standard transaction. |

| Partial Payment | Only part of the invoice amount is settled. | Disputes or financial constraints. |

| Credit Memo | Seller issues a document reducing the amount owed. | Overcharges, returns, rebates, discounts. |

| Debit Memo | Buyer issues a document requesting a reduction in the amount owed. | Vendor overcharges, defective goods. |

| Third-Party Payment | Payment is made through an intermediary or financial service provider. | Use of payment gateways or insurance claims. |

| Disputed Payment | Invoice amount is contested and withheld until resolved. | Discrepancies in invoicing details. |

| Exchange of Goods | Settlement through exchange of goods or services instead of monetary payment. | When there is a cash crunch or to neutralize the risks posed by currency fluctuations. |

| Discount Received | Buyer settles less than the total amount due because of a discount. | Early payment, bulk purchase, promotional offer. |

| Payment in Installments | The total invoice amount is broken down into several payments over a period. | Large invoices or agreed-upon payment plans. |

| Write-Off | Seller considers the invoice as a loss, typically due to non-payment. | Unrecoverable debts, financial hardship. |

Businesses use various methods to settle invoices based on their unique context. For example, retainage—typical in construction—relies on withholding a percentage of the total contract cost until work is entirely done to client satisfaction.

Mastering these methods is critical to efficient financial management and smooth operations. Different situations may necessitate different approaches to invoice settlements, and understanding these offers flexibility and convenience.

The accounting treatment of invoice settlements

Now that you know about the different types of invoice settlements, let's explore how they will be recorded in your accounting records.

1. Full payment received: When the entire payment for an invoice is received, it is recorded as a debit in your cash account and a credit in your accounts receivable account. This is because the cash account increases with the receipt of money, while the accounts receivable account decreases as the invoice is settled.

2. Partial payment received: A partial payment is recorded as a decrease in the accounts receivable account and an increase in the cash account. You might also need to record a bad debt or allowance for doubtful accounts for the unpaid amount.

3. Credit memos received: When you get a credit note from a supplier, it's recorded as a decrease in your accounts payable and an increase in your purchase returns account. This reflects the reduction in the amount owed by the customer.

4. Debit memos received: When you receive a debit memo from a customer, it's recorded as a decrease in your accounts receivable and an increase in your sales returns and allowances account.

5. Payments through third parties: When payments are made through a third party, it's recorded as a decrease in your accounts receivable and an increase in your cash account. The third party's fee might also be recorded as an expense in your books.

6. Disputed payment: When a payment is disputed, it's recorded as a potential decrease in your accounts receivable, pending dispute resolution. Till the dispute is resolved, the amount might be recorded as a separate line item in your books to reflect the uncertainty.

7. Receipt of goods: When you accept goods or services in lieu of payment, the value of the goods or services is recorded as a decrease in your accounts receivable and an increase in your inventory or assets, as applicable.

8. Writing off as bad debts: When you write off an invoice as a bad debt, it's recorded as a decrease in your accounts receivable and an increase in your bad debts expense account. This reflects the acknowledgment that the invoice will not be paid and needs to be removed from your expected income.

9. Discounts allowed: When you allow a discount on an invoice, it's recorded as a decrease in your accounts receivable and an increase in your sales discounts account. This shows the reduced amount due to the discount offered on the invoice.

10. Advance payment: An advance payment is recorded as an increase in your cash account and your unearned revenue (a liability account) until the goods are delivered or services are rendered. Once the delivery or services are fulfilled, the unearned revenue is decreased, and revenue is recognized in your income statement. This reflects your obligation to deliver goods or services for which you have already received payment.

Whether using a digital accounting tool or employing traditional bookkeeping methods, consistent and accurate application of these principles will result in a clear and understandable financial picture of your business.

How does the settlement of invoice process work?

The invoice settlement process is a multi-step procedure. It typically begins with the issuance of an invoice by the seller to the buyer and ends with the receipt of payment.

Here's a general overview of the steps involved in the invoice settlement process:

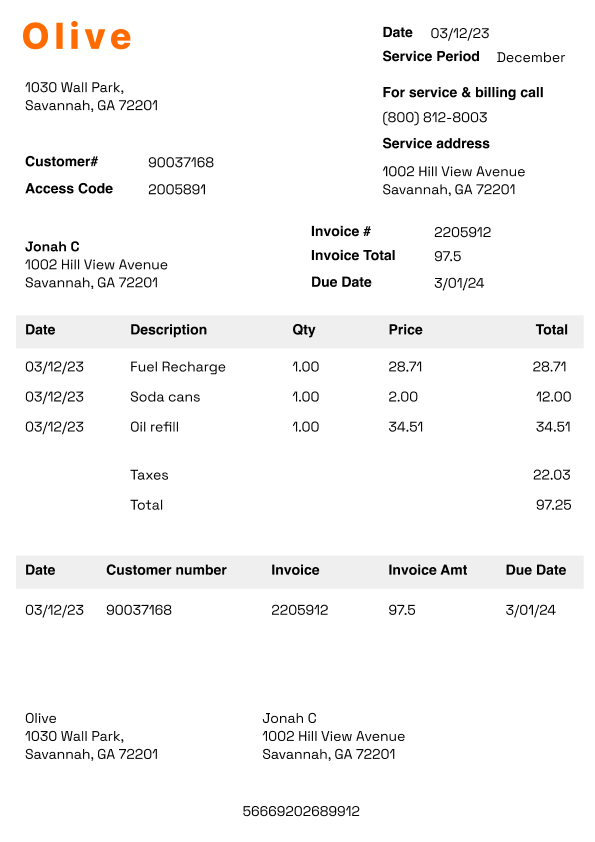

1. Issuance of the invoice: The seller issues an invoice to the buyer detailing the goods or services provided, their costs, and the total amount due. The invoice could be sent via email, mail, or even hand-delivered, depending on the agreed-upon method of communication.

2. Receipt of the invoice: The buyer receives it, extracts the necessary information, and records it in their accounting and ERP systems. This step involves verifying the invoice details, including purchase order number, invoice number, date, vendor name, and amount due.

3. Invoice matching and review: To ensure accurate information, the buyer then matches the invoice with their purchase order and any delivery receipts. Any discrepancies would need to be taken care of at this stage before further processing. This might involve contacting the seller for clarification or rectification.

4. Approval of the invoice: Once verified, it's approved for payment. Depending on the company's internal processes, this might require sign-off from multiple departments or individuals.

5. Scheduling and making payment: After approval, the accounting system generates a payment schedule, initiating the payment process. The payment could be made via various methods, such as bank transfer, check, or online payment gateway.

6. Posting and reconciliation: The payment is then posted in the buyer's accounting records, and the payment updates the accounts payable ledger. After posting, the accounting system will automatically reconcile the payment with the corresponding invoice, closing out the payable.

7. Invoice closure: Once payment is confirmed and the accounts are reconciled, the invoice is marked as paid and closed. This indicates that there's no need for anything else for this particular invoice.

8. Confirmation of payment: The seller receives the payment and confirms its receipt. This could be through a formal receipt acknowledgment or an update in their own accounting records to reflect the payment received against that particular invoice.

9. Financial reporting: Both the buyer and the seller reflect the transaction and its settlement in their respective financial statements. This includes updating the income statement, balance sheet, and cash flow statement as necessary, providing an accurate and up-to-date financial picture of the business.

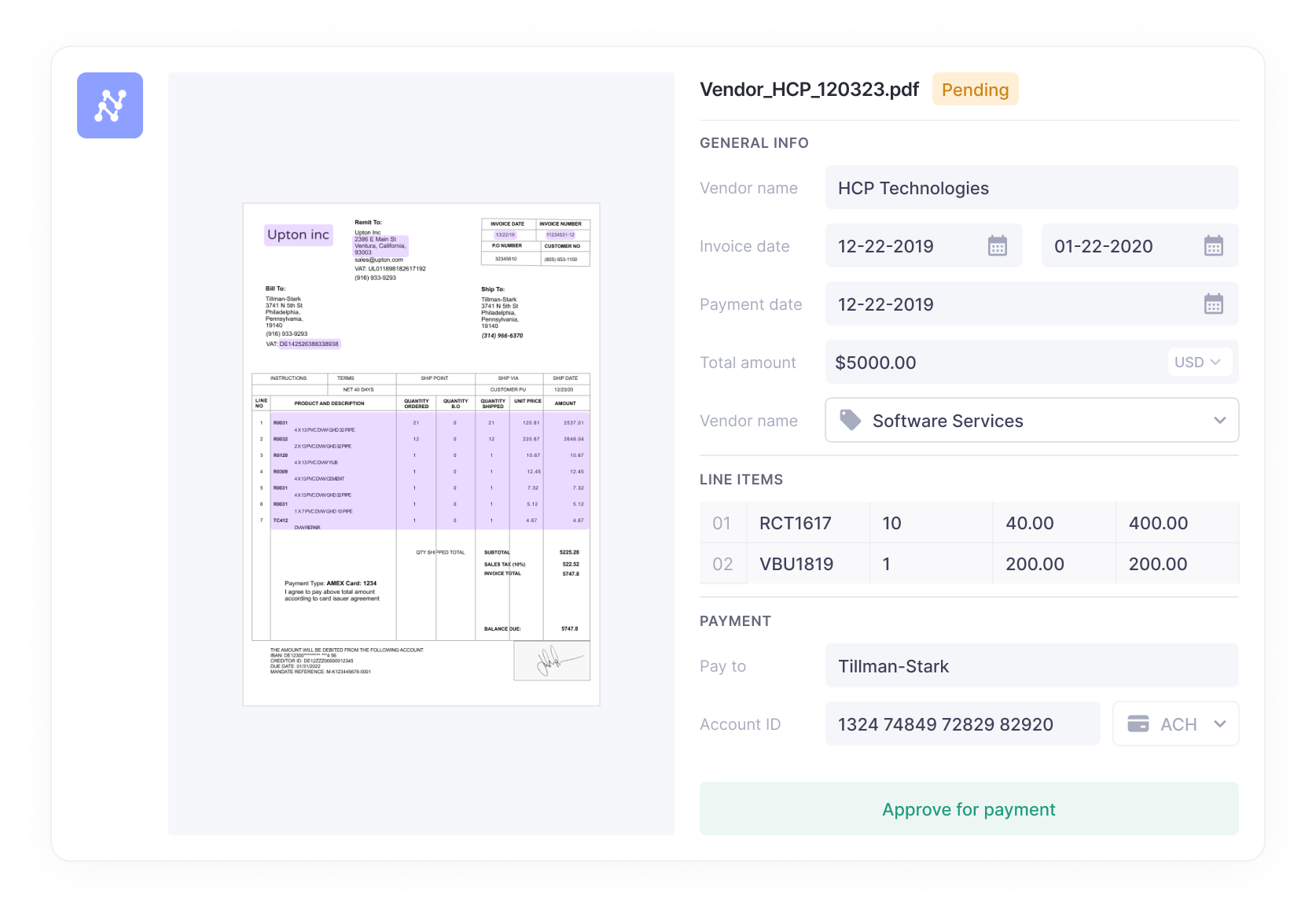

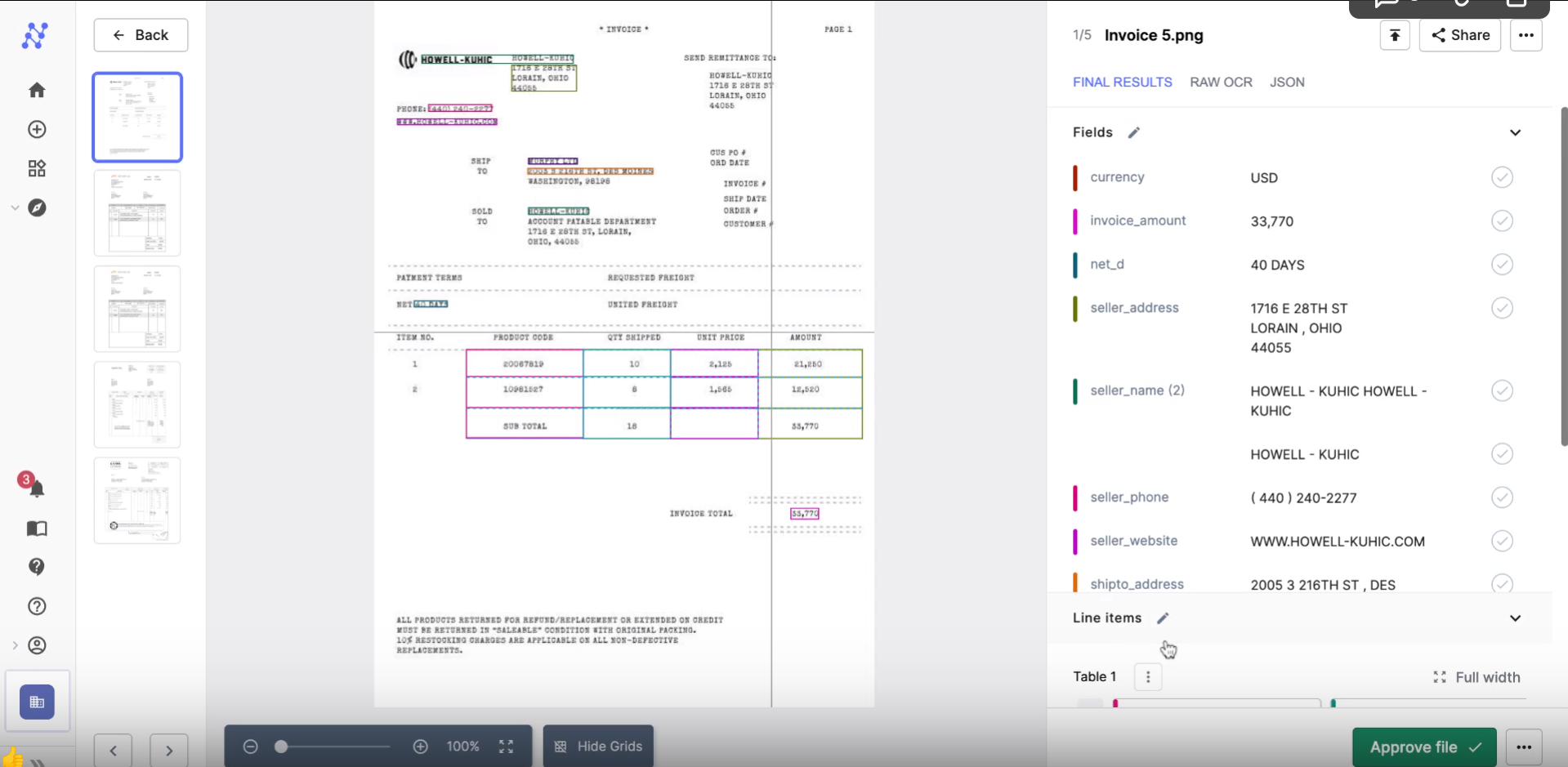

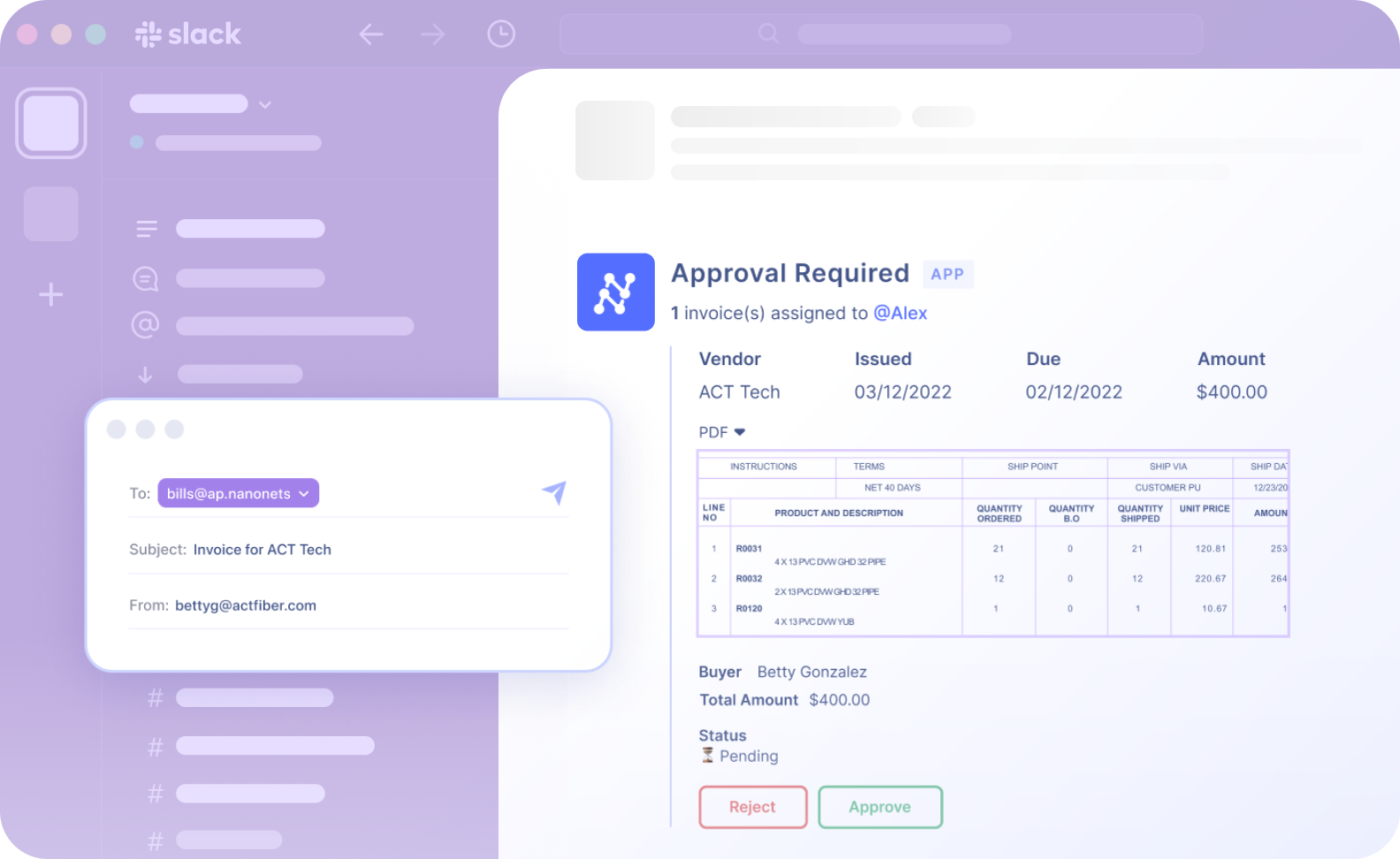

ERP software and digital accounting tools often automate many of these steps, reducing the potential for error and enhancing efficiency. Nanonets AP automation is one such tool that can streamline the invoice settlement process from end to end.

Automate your accounts payable with Nanonets

How can Nanonets improve the process of settling invoices?

Some common challenges in the invoice settlement process include incorrect invoices, delayed payments, and inefficient manual processes. These can lead to increased workload, reduced cash flow, and strained vendor relationships.

Nanonets AP Automation can help you overcome these challenges and optimize the invoice settlement process:

1. Automate invoice ingestion

According to a study by Levvel Research, 79% of SMEs and 68% of mid-market firms cite manual data input and inefficient procedures as their primary pain point. It is a pain for your team to manually upload each invoice and enter the data into your system. Constantly refreshing your email inbox and scanning through attachments is hardly efficient.

Instead, having an automatic data import feature will save you time and reduce the chances of error. It will also ensure a smooth flow of invoices into the system without any bottlenecks or delays.

Nanonets provides various options for auto-import, such as email, API integration, OneDrive, Google Drive, Dropbox, and Zapier. Regardless of the origin of your invoices, you can easily import them into the system automatically.

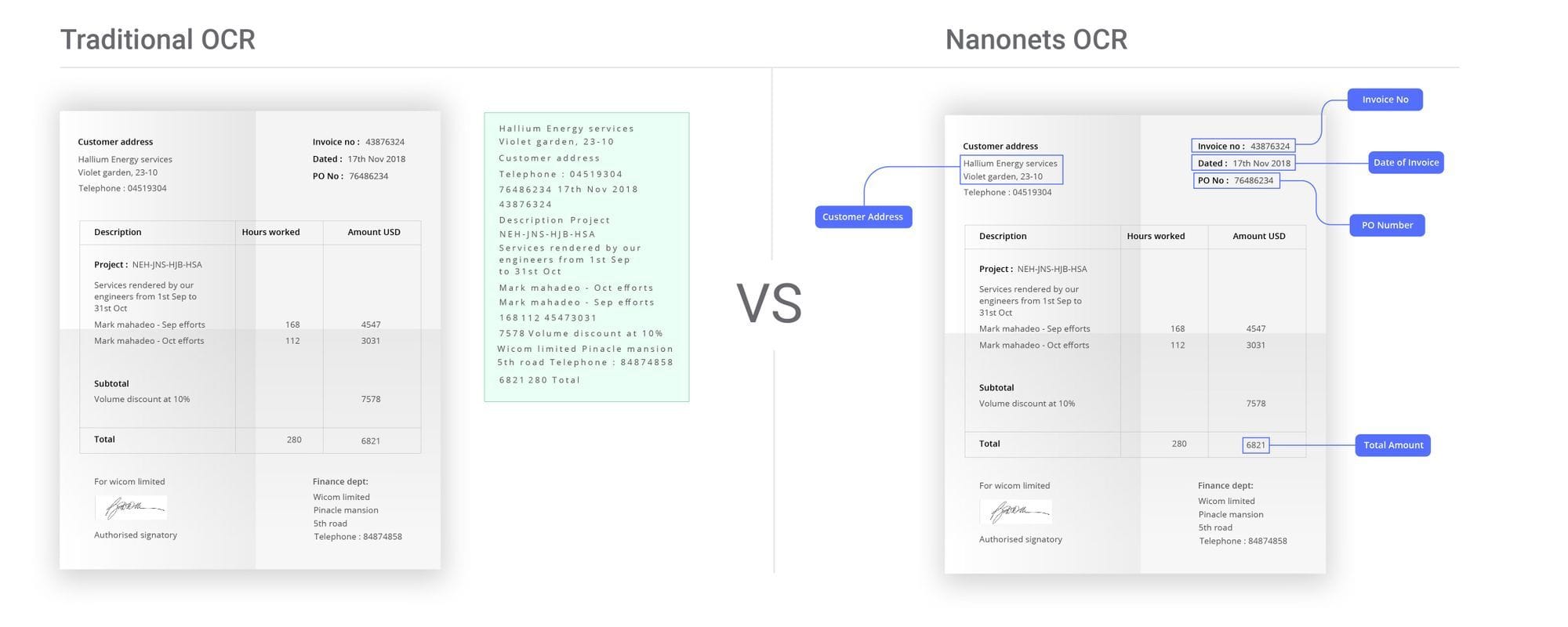

2. Use AI-OCR for invoice data capture

It's important to note that every invoice contains specific information, and not all invoices are structured similarly. Some invoices may be in a different language, have a foreign currency, or be subject to different compliance laws. Additionally, the format of each invoice may vary. Therefore, traditional OCR tools cannot be used for data capture.

Nanonets uses AI and ML to understand and accurately capture data from various invoice formats. It can recognize text in multiple languages and convert it into actionable data. This reduces the need for manual data entry, minimizes errors, and speeds up the entire invoice processing cycle.

3. Implement three-way matching

Employ a three-way matching system to ensure that you only pay for what you've received. This process compares the purchase order, the goods receipt note, and the invoice to confirm that everything aligns before payment is released. Any discrepancies can be automatically flagged for review.

This automated check not only safeguards against overpayments but also helps prevent fraud. Setting up such controls can significantly reduce the risk of paying for undelivered or incorrect items.

With Nanonets, this becomes a seamless part of the process. The platform can automatically match and verify these documents, alerting you to any issues early on. This capability ensures that all your payments are accurate and legitimate.

4. Streamline invoice approval

The manual approval process can be delayed as invoices get stuck awaiting sign-offs from busy stakeholders. This slows down the payment cycle and increases the chances of losing invoices or forgetting to follow up.

By leveraging automated workflow capabilities, you can substantially reduce the time it takes to approve invoices. Based on pre-defined rules, a computerized system can route invoices to the appropriate personnel for approval. Additionally, reminders and notifications can be set to ensure approvers complete their tasks promptly.

With Nanonets, businesses can customize their approval workflow based on their needs. Custom approval sequences can be set up based on invoice amount, department, project, or other criteria. Live status updates, automated alerts, and reminders can help businesses track each invoice's progress and prevent delays or missed payments.

5. Implement dynamic discounting

Take advantage of early payment discounts by setting up dynamic discounting protocols. These arrangements encourage early invoice settlement by offering a discount for payments made before the due date.

For instance, a vendor might offer a 2% discount on the invoice total if paid within ten days of receipt. Not only does this improve your working capital by lowering costs, but it also strengthens relationships with vendors who benefit from improved cash flow.

Using Nanonets, you can configure payment terms to capture discount opportunities automatically. The system can alert you when discounts are available, ensuring you take advantage of potential savings.

6. Ensure seamless data flow between your systems

Integrating your accounting software with other business systems you use is critical. Without seamless integration, data has to be manually transferred between systems, which is time-consuming and prone to error.

An integrated system ensures that once an invoice is approved, all necessary data automatically flows into your accounting ledger, inventory management system, and other relevant systems.

Nanonets can be integrated with QuickBooks, Xero, Sage, SAP, Microsoft Dynamics, and other leading accounting packages, ensuring a smooth data exchange. Moreover, it has a Zapier integration, which means it can connect with over 6,000 apps, further automating workflows.

The data from Nanonets can be easily synced with these systems in real time, eliminating data silos and ensuring smooth, error-free data transfer. Moreover, when all relevant data is synced across platforms, you can trust that your financial reports are up-to-date and reflective of your current business activities.

7. Regularly audit and update your processes

Even with automation and advanced technologies in place, reviewing and refining your invoice settlement processes regularly is crucial. Markets evolve, new compliance regulations emerge, and business needs change over time.

Regular audits can help identify bottlenecks or inefficiencies that may have crept into the system. These reviews also offer an opportunity to update workflows to adapt to new business realities or to take advantage of emerging technologies.

Ensuring that your invoice management processes remain robust and responsive to the changing environment will save you time and money in the long run.

Nanonets provides analytics and reporting tools that enable you to track your invoicing process and identify areas for improvement. Analyzing trends and performance metrics allows you to make data-driven decisions to optimize your workflows and ensure compliance with the latest standards.

Discover an easier way to process your supplier invoices with precision and speed.

Final thoughts

In today's fast-paced business environment, managing invoice settlement is about keeping the books in order and enhancing your company's operational efficiency and financial health. AI-driven tools like Nanonets can transform a traditionally labor-intensive and error-prone process into a strategic advantage.

By automating critical elements of invoice processing, from data capture to payment execution, businesses can reduce costs, take control of their cash flow, and build stronger relationships with suppliers.