How AI invoice processing works: An AP automation guide

AI invoice processing or automated invoice processing is no longer a sci-fi dream but a present reality. It is reshaping the way businesses manage their accounts payable (AP).

PwC's Global Artificial Intelligence Study expects AI's potential contribution to the global economy by 2030 to be close to $15.7 trillion. The rapid evolution of artificial intelligence (AI) and machine learning (ML) is pushing the boundaries of what's possible in business automation.

From automating invoice recognition and data capture to identifying invoice discrepancies, AI-based invoice processing is making accounting and spend management operations smoother, faster, and more reliable. So, what exactly is AI-based invoice processing, and how does it work?

Extract→Approve→Pay faster with Nanonets!

Never miss early payment discounts again. Automatically capture invoice data from any source, validate it against purchase orders, and seamlessly integrate it with your accounting software. Eliminate approval chasing and manual data entry, and ensure timely vendor payments.

What is AI invoice processing?

AI-based invoice processing, also known as AI for invoice processing, uses machine learning (ML), optical character recognition (OCR), natural language processing (NLP), and workflow automation to automate the capture, extraction, recognition, validation, and processing of invoice data and route it through the appropriate channels and tools for approval and payment.

AI invoice processing leverages several key technologies to automate and streamline the accounts payable workflow:

Machine Learning: Machine learning invoice processing uses ML algorithms that learn from historical invoice data to identify patterns, extract relevant information, and make accurate predictions.

Natural Language Processing: NLP allows the AI system to recognize, interpret, and extract fields like vendor names, invoice numbers, and payment terms, even from unstructured d0cuments.

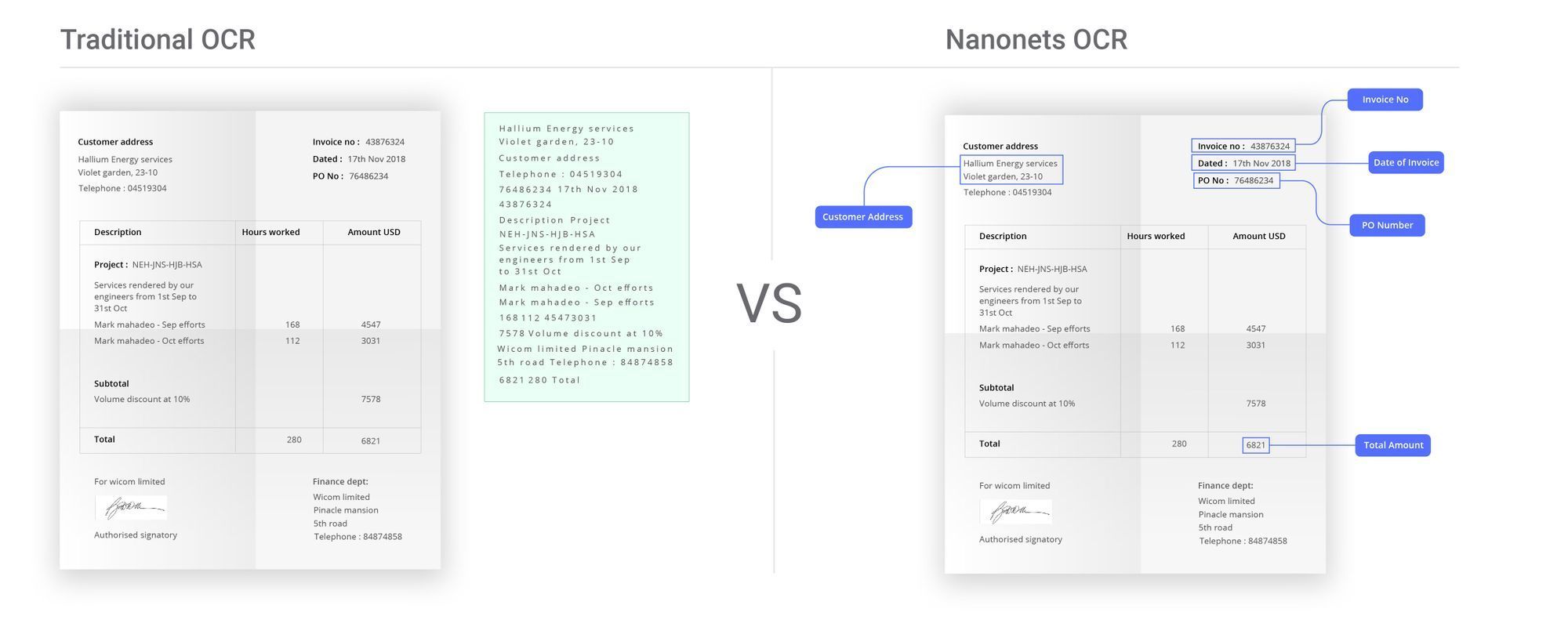

Optical Character Recognition: OCR technology converts text on invoice images into machine-readable text, capturing and digitizing paper invoices or converting scanned invoices into editable formats. It enables AI invoice data capture.

Workflow automation: Connect various technologies to create a seamless end-to-end process that automates invoice routing, triggers approval notifications, and integrates existing accounting systems.

Traditional invoice processing workflows often involve data entry, approval-chasing, and manual reconciliation, which can be time-consuming and error-prone. AI-based invoice processing automates these tasks, reducing the need for manual intervention.

It supports various invoice formats, including scanned images and PDFs, automates invoice coding, and auto-fills and validates entries. AI invoice recognition enables these systems to accurately identify and extract relevant information from invoices, regardless of their format or layout.

How does AI-based invoice processing work?

Did you know that AI and automation-based invoice processing can reduce average costs from $40.70 to $3.34 and the turnaround time from 16.3 days to 3.8 days?

Automated invoice processing ROI calculator

Notes and assumptions (click to expand)

- The manual processing cost per invoice ranges from $15 to $40

- According to salary data, an AP clerk's average annual salary varies between $40,766 and $50,080.

- Nanonets' PRO Plan is offered at a fixed rate of $999 per month for each model, which includes processing up to 10,000 pages.

- There is an additional charge of $0.10 for each page processed beyond the initial 10,000 pages included in the PRO Plan.

- According to feedback from our customers, the solution can reduce the turnaround time for manual invoice processing by up to 90%. This significant reduction in processing time is not included in the cost savings calculation to keep the computation straightforward.

- Employing a dedicated AP clerk to manage the Nanonets system is optional, depending on the company's size, policies, and volume of invoices.

- The cost savings we've calculated are only based on the differences in processing costs between the manual method and Nanonets AP automation. And it doesn't consider any potential decrease in turnaround time or clerical work hours.

- Nanonets also offers a pay-as-you-go model where the first 500 pages are free, then $0.3/page afterward. This model can be more cost-effective for smaller businesses or those with lower document processing volumes.

Let's break down how it achieves such efficiency:

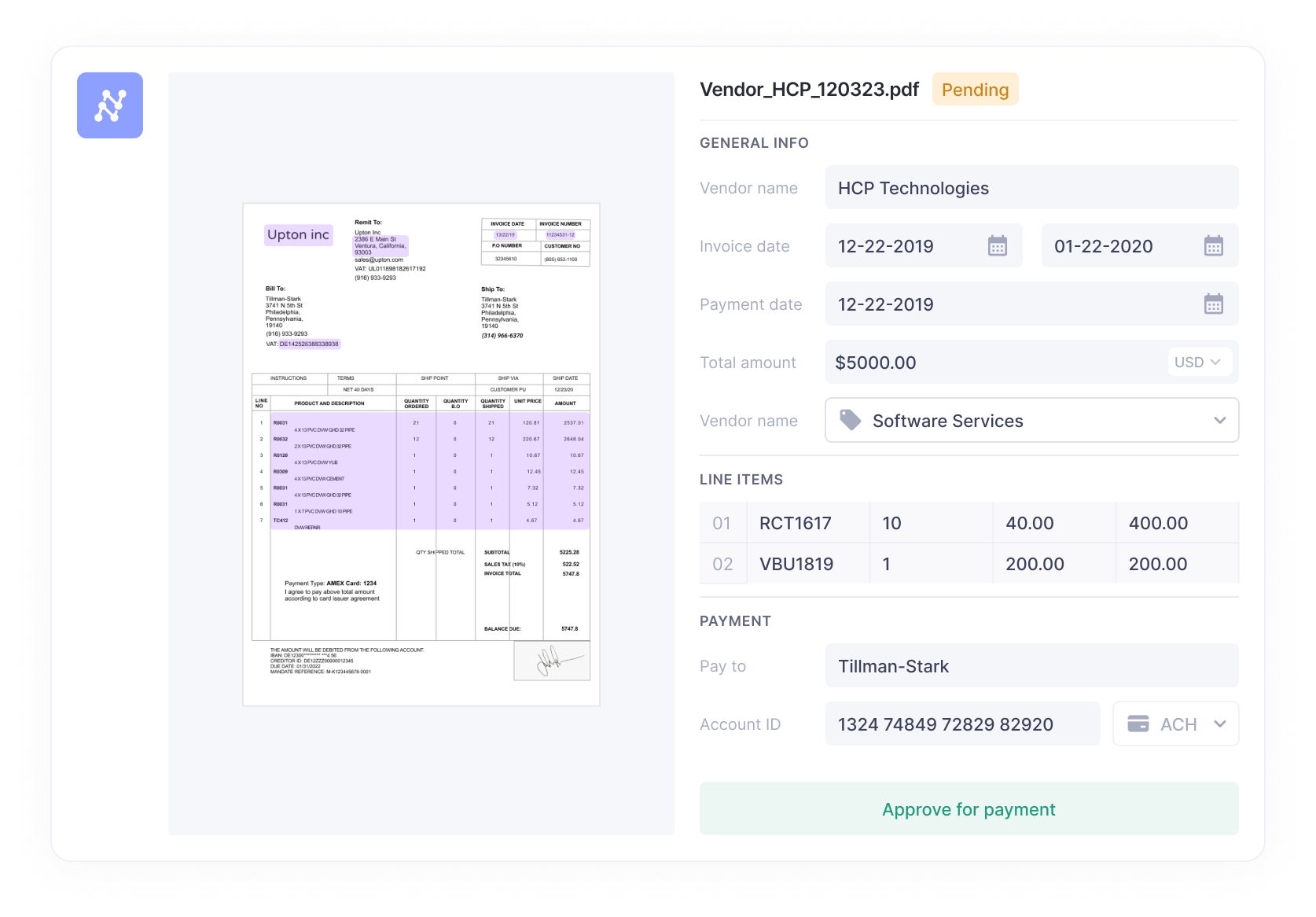

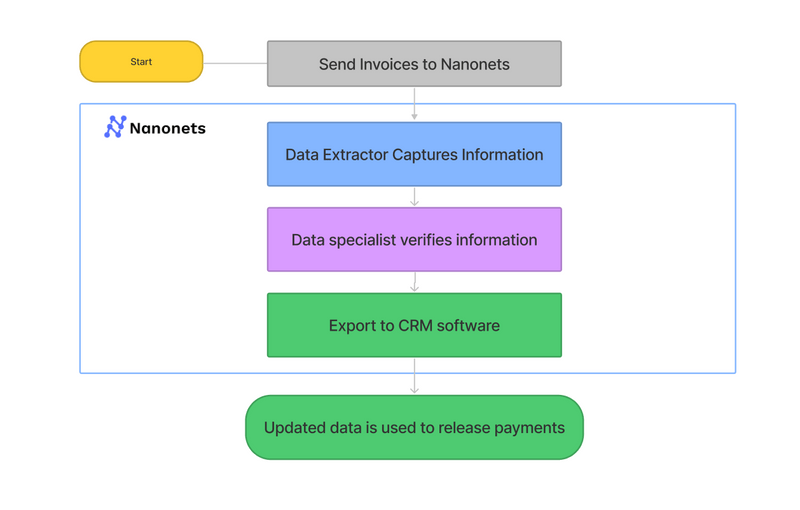

1. Invoice capture: The AI solution scans the physical or digital invoices. All you have to do is upload the invoice, and the software automatically captures the data and converts it into machine-readable format.

2. Data extraction: Once the invoice data is captured, the AI uses ML and NLP to recognize and extract relevant information such as invoice number, vendor details, date, total amount, line item details, etc.

3. Data validation: Post extraction, the AI validates the data by matching it with the purchase order details in the system. This step ensures that there is no discrepancy between the invoice and the order details.

4. Manual intervention and error correction: If the AI detects any discrepancy that it cannot resolve, it flags the invoice for manual review. Manual modifications help the AI learn and improve its accuracy in the future.

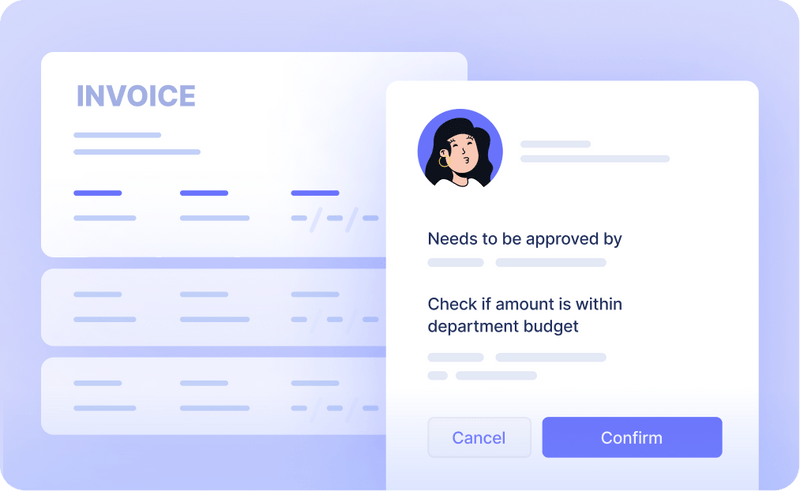

5. Route for approval: After data validation and error correction, the software routes the invoice to the relevant person or team for approval. This step helps in maintaining control and transparency in the process.

6. Payment processing: Once approved, the solution forwards it for netting or payments based on the invoice terms and business rules, helping avoid late fees and maintaining good relationships with vendors.

Struggling with high invoice volumes?

Get best-in-class OCR, customizable workflows, and easy-to-deploy integrations with QuickBooks, Xero, SAP, and Zapier to manage increased invoice loads without adding staff or stress. Contact us for a personalized demo today to learn how Nanonets can simplify your AP tasks.

How does using AI for invoice processing solve common AP challenges?

Invoice processing may be a time-honored business practice, but it's not without its challenges. Whether you're a small enterprise or a large corporation, inefficiencies can creep in, leading to financial loss and wasted resources.

Problems like delayed orders due to late supplier payments, credit denial from past inconsistencies, and time wasted fixing errors and chasing approvals are all too common.

Thankfully, the recent incorporation of AI into invoice processing has helped businesses mitigate many of these issues.

Problem 1: Time-consuming manual data entry

Extracting invoice data manually is not just labor-intensive but also time-consuming. While paper-based invoices would require manual data entry, digital invoices, albeit a step up, still require someone to sift through the data and copy or extract the necessary information.

And on the off-chance that your ERP is not integrated with your invoicing system, your staff will have to manually enter the data into two systems, doubling the work and increasing the chance of errors.

By combining OCR technology with AI, this process can now be completely automated. Invoices can be scanned, relevant data is captured and populated into the system.

This significantly reduces the time spent on data entry and allows your trade payable team to focus on more strategic tasks.

Problem 2: High error rate in manual data entry

Manual data capture is prone to human error. Even the most meticulous person can make mistakes when manually processing large volumes of data. These errors can lead to payment discrepancies, which can cause significant problems down the line, like financial discrepancies and weakened vendor relationships.

AI-based invoice processing drastically reduces these errors. Automating the data extraction process using ML and OCR eliminates human error in data entry. Any discrepancies are quickly flagged for review, preventing minor mistakes from becoming bigger issues.

Problem 3: Delay in invoice approvals

Delays could occur for several reasons — the approver might be busy, the invoice might get lost in a pile of paperwork, the invoice was routed to the wrong person, or there might be discrepancies in the invoice itself that need sorting out.

Your reason may be justified, but the result is the same — strained relationships with your vendors, delayed supplier orders, and potential late fees.

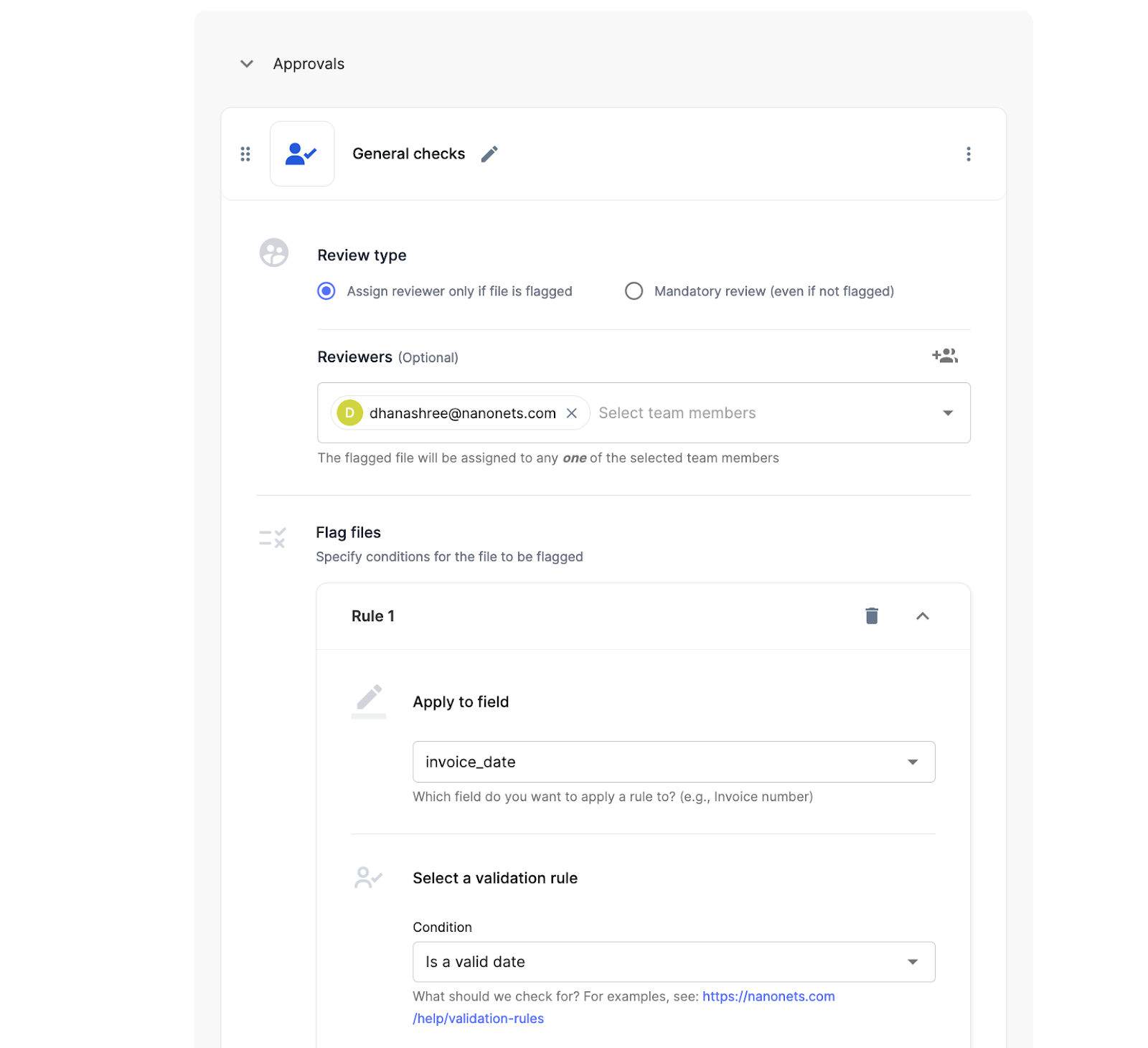

With AI-based invoice processing, you can route invoices based on predefined business rules. Customize the rules based on factors like invoice amount, department, and vendor to map approval workflow to the T. Unapproved purchase orders can be tracked easily.

The AI system automatically assigns invoices to the appropriate approvers, sends notifications, and tracks each invoice's status. This ensures a seamless and efficient approval process, reducing bottlenecks and minimizing manual intervention. It can also flag discrepancies for manual review. And since payment processing is built into the AI system, the payment is processed promptly once approved.

Accelerate your invoice approvals now.

Streamline your approval process, ensuring invoices reach the right person at the right time. Say goodbye to approval delays!

Problem 4: Lack of transparency and control

Paper invoices can easily get lost; even digital ones can be misplaced in the sea of files. The lack of a central repository for all invoices makes it difficult to maintain an audit trail.

Moreover, it’d be tough to effectively implement 2-way matching (or even 3-way matching if required). This lack of transparency and control can lead to fraud and compliance issues.

Deploying AI in invoice processing creates a centralized system, making it easy to set up internal controls. You can set up 2-way or 3-way matching workflows more effectively. Detecting fraud and discrepancies becomes significantly simpler with AI as it can quickly identify patterns and irregularities in the data.

It also ensures that all invoices are captured and stored securely with information on who reviewed and approved each one, increasing accountability and control over the process.

Problem 5: Difficulty in handling complex invoices

Invoices come in various formats, from scanned images to PDFs, and not all systems can handle these formats efficiently. This could lead to delays in processing or even loss of invoices, causing further frustrations and potential financial loss.

AI invoice recognition enables the system to identify and extract relevant data from scanned images, PDFs, and other digital formats using OCR technology and intelligent processing. The AI can also learn and adapt to different invoice layouts, languages, trade regulations, and currencies. These capabilities come in handy when dealing with international suppliers or complex purchase orders.

Handle complex invoice formats with ease!

Simplify complex AP workflows with Nanonets' intelligent invoice processing. Our AI adapts to your unique processing needs, no matter the format, language, or currency. Transform your AP today!

Problem 6: Scalability issues with growing business

As your business grows, so do your transactions and invoices. Manual invoice processing can become increasingly unmanageable.

You’ll have to spend more time, hire more staff, or deal with more errors and inefficiencies as your business scales. This can put a significant strain on your resources and hamper your growth plans.

AI systems can be configured to meet your growing needs without requiring additional human resources. You can easily onboard more vendors, process larger volumes of invoices, and handle complex transactions.

AI can also learn and adapt to your changing business needs, automating more tasks as required. Whether you're dealing with single or multi-line invoices or aiming to expand your vendor base, AI can scale up or down as necessary.

Problem 7: Difficulty in tracking and managing cash flow

Ineffective invoice processing can lead to cash flow issues. Without a clear view of incoming and outgoing payments, it can be challenging to manage your finances effectively. Late payments, missed payments, or even overpayments can lead to significant financial loss.

AI-based invoice processing gives you a real-time view of your financial status. The system can predict cash flow based on existing invoices and payment data, allowing you to plan your funds more effectively. A recent McKinsey report illustrates the potential impact of optimizing payment timing – a company that pays invoices five days early on an annual procurement spend of €1 billion could free up to €14 million in cash by avoiding early payments.

It also ensures timely payment processing, reducing the risk of late fees or missed payments. The AI can also flag potential overpayments, helping you avoid unnecessary costs.

Problem 8: Lack of interoperability

Not all systems can communicate with each other effectively. You may have an excellent invoicing system, but if it can't integrate with your existing financial software or ERP system, it can lead to inefficiencies and data silos. This lack of interoperability can create additional work, as data needs to be manually entered into multiple systems.

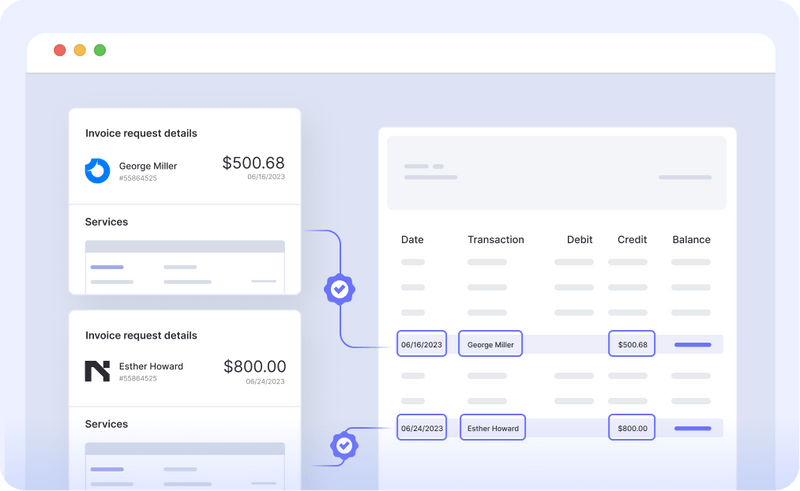

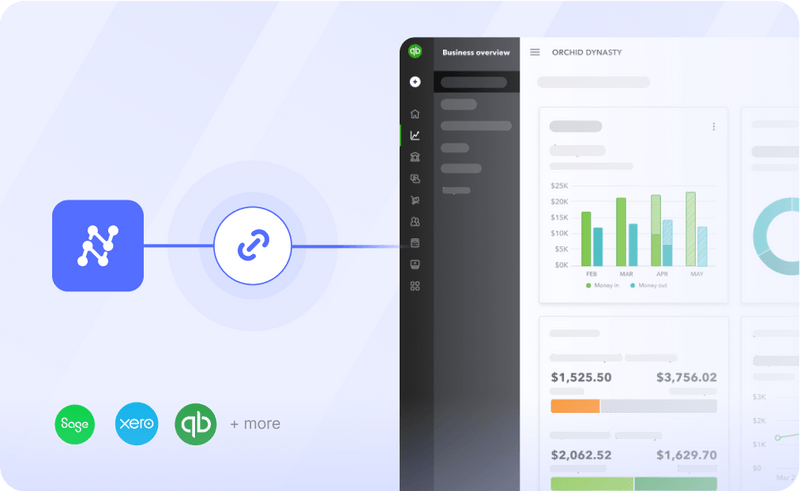

With AI, you can automate entire processes across different systems. The AI can integrate with your existing software, enabling seamless data transfer and synchronization. This interoperability eliminates data silos and reduces the workload on your staff.

AI for invoice processing helps businesses overcome many common challenges in accounts payable workflows. However, it is crucial to remember that not all invoice AI systems offer all of these features. You should carefully review the capabilities of each system before making a choice.

ROI is too high to even quantify!

"Our business grew 5x in last 4 years, to process invoices manually would mean a 5x increase in staff, this was neither cost effective or a scalable way to grow. Nanonets helped us avoid such an increase in staff. Our previous process used to take six hours a day to run. With Nanonets, it now takes 10 minutes to run everything. I found Nanonets very easy to integrate, the APIs are very easy to use." ~ David Giovanni, CEO at

Ascend Properties.

Book a demo with us and explore how Nanonets can streamline your invoice processing, just like it did for Ascend Properties.

How Nanonets' AI-based invoice processing can help?

Nanonets' AI for invoice processing combines OCR and AI technologies seamlessly to automate invoice processing. You can quickly train the system to recognize various invoice formats, layouts, and languages, making it suitable for businesses of all sizes and across industries.

Impact of Nanonets' AI invoice processing on Tapi's efficiency and cost-savings

| Aspect | Before Nanonets | After Nanonets implementation | Benefits |

|---|---|---|---|

| Invoice Processing Time | 6 hours per invoice | 12 seconds per invoice | Processing time reduced dramatically, enhancing productivity. |

| Operational Costs | High due to manual processing | Reduced by 70% | Significant cost savings achieved by automating invoice processing. |

| Data Extraction Accuracy | Reliant on manual entry, prone to error | 94% accuracy with AI and automation | Improved accuracy mitigated the risk of costly errors. |

| Invoice Volume | Challenged by scale, hindering growth | Effortless handling of 110,000 properties' invoices | Enabled efficient scaling and supported business expansion. |

| Customer Experience | Impacted by slow manual processes | Enhanced due to rapid invoice turnaround | Increased satisfaction with swift and reliable service delivery. |

| Resource Allocation | Substantial time investment in manual tasks | Resources reallocated to key business areas | Allowed focus on strategic, value-adding activities. |

New Zealand-based property maintenance company, Tapi, has harnessed the power of Nanonets to revolutionize its operational efficiency. Managing over 110,000 properties, Tapi faced the challenge of a slow, manual invoice processing system that hindered its growth.

Using Nanonets, they effortlessly captured crucial information from invoices, which were then sent to Tapi for checks and validation. The system proved reliable, with an impressive 94% data extraction and flexibility accuracy rate, enabling quick and seamless system integration.

The results were astounding. Manual processing, which previously took 6 hours, was reduced to just 12 seconds. The operational costs associated with invoicing plummeted by 70%, freeing up resources for other key business areas.

The rapid invoice turnaround greatly improved Tapi's customer experience, demonstrating the transformative power of Nanonets' AI-powered invoicing solution.

→

→

Sync transactions directly to QuickBooks!

Streamline your procurement process with automated invoice data syncing. Nanonets captures invoice data and syncs it with your other ERP, accounting software, and inventory management tools, saving you time and effort.

Here’s how Nanonets can help your business, too:

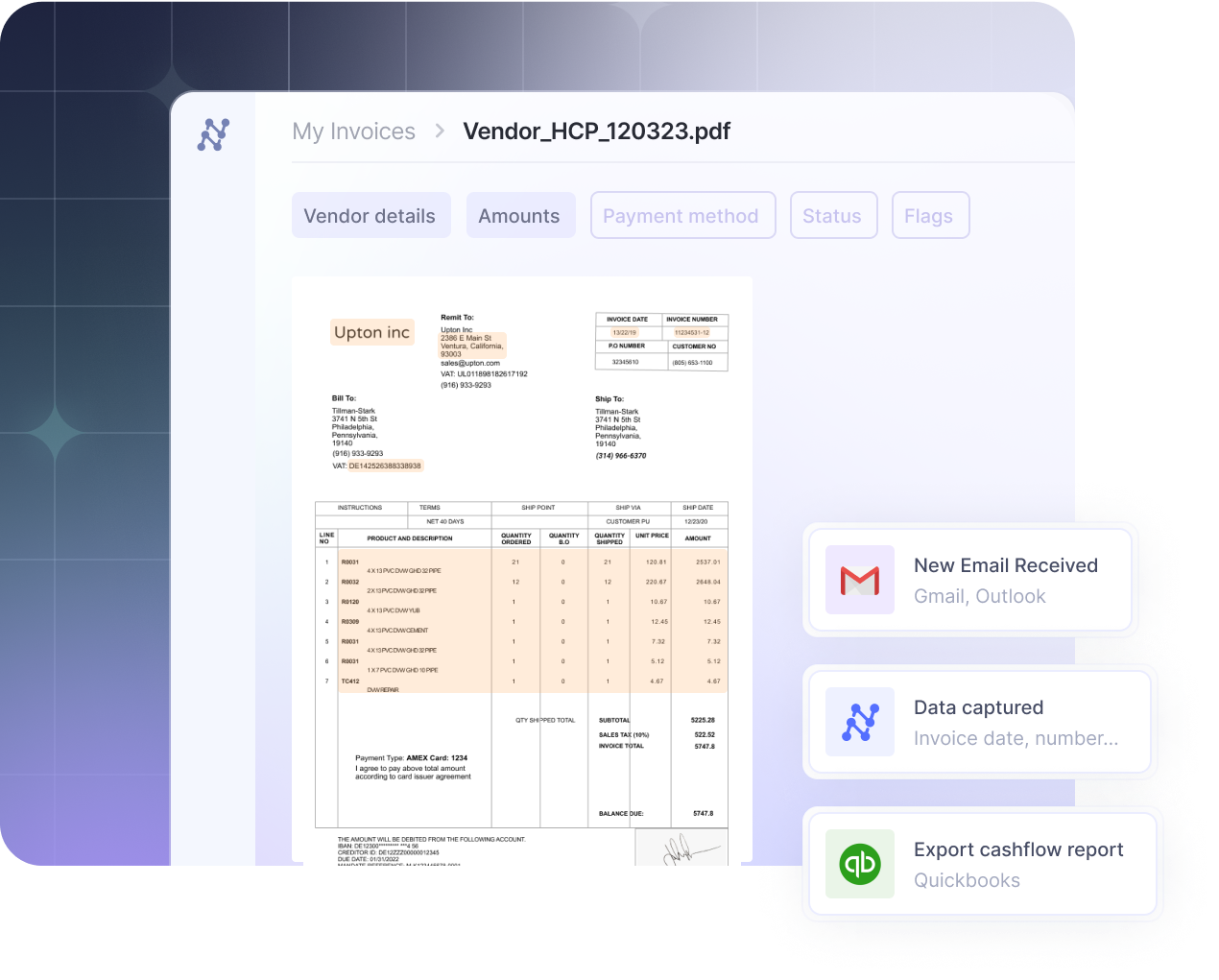

Automated data capture: Import invoice files from different sources – email, cloud storage, and business tools as and when they arrive. Regardless of format – PDF, image, spreadsheet, or other digital files – the system automatically extracts crucial information such as vendor details, line items, and totals with exceptional accuracy.

Seamless integration: Easily integrate with your existing software systems, such as Xero, Sage, Google Sheets, Gmail, Zapier, and others, to ensure real-time synchronization across the board. Set up customizable workflows that adapt to your unique business processes.

Enhance vendor management: The system automatically tracks and analyzes vendor performance, giving you valuable data to optimize your vendor relationships and negotiate better terms.

Scalability: Upload hundreds of invoices in one go and get them processed in minutes, not days. As your business grows, Nanonets can scale to meet your increased invoice processing needs. This flexibility ensures you can manage larger volumes of invoices without additional resources.

Intelligent invoice processing: Process invoices from various sources, including scanned images, PDFs, and electronic formats. It supports multiple languages and can extract data accurately, irrespective of the invoice layout. Additionally, the platform seamlessly handles different currencies, making it ideal for businesses with international suppliers.

Real-time analytics: Easily track the status of your invoices, monitor your cash flow, and make informed decisions based on accurate data. Get customizable dashboards that display key metrics, such as invoice volume, processing time, and exception rates.

Regulatory compliance: Automatically create audit trails and ensure all invoices comply with regulatory standards. This feature not only helps to maintain transparency but also makes it easier to remain compliant.

Cost reduction: Reduce operational costs by automating manual processing tasks. With a significantly faster processing time, you can lower your overhead expenses, leading to a healthier bottom line.

Prevent fraud: Automatically flag suspicious invoices or unusual patterns, adding an extra layer of security to your financial processes and helping to prevent fraud before it occurs.

Supplier collaboration: Enable suppliers to submit invoices directly via email or cloud storage, track payment status, and update their information independently.

Streamline three-way matching: Automatically match invoices with purchase orders and receiving documents, drastically reducing time spent on verification and improving accuracy.

Top-notch security: Nanonets prioritizes your data privacy with SOC-2 certification and GDPR compliance. Your sensitive invoice information is protected by the same security standards used by leading financial institutions, ensuring peace of mind as you leverage AI for AP tasks.

Nanonets AI invoice processing implementation guide

Getting started with Nanonets is straightforward. The interface is user-friendly and intuitive, and since it is a no-code platform, you don't need any technical expertise to set it up.

Here's a step-by-step guide to implementing Nanonets AI invoice processing:

Step 1: Sign up and log in

- Create your Nanonets account

- Log in to your account

Step 2: Choose or create a custom model

- Select the pre-trained Invoice model for quick setup

- For unique invoice formats, create a custom model:

- Upload at least 10 sample invoices

- Specify the data fields to capture

- Annotate the fields on each invoice

- Train the model and wait for email notification

Step 3: Configure your invoice processing workflow

a. Choose how invoices will enter the system:

- Direct upload

- Auto-import from email

- Integration with cloud storage (e.g., Google Drive, Dropbox)

b. Configure data capture

- The AI model automatically extracts key data fields

- Review extracted data and correct inaccuracies to improve model performance

c. Define approval workflow

- Establish approval rules and stages based on your requirements

- Assign approvers to review flagged invoices

d. Set up the export process

- Configure automatic export of approved invoices to your accounting software or ERP – Nanonets integrates with QuickBooks, Xero, SAP, and more

- Use Webhooks or Zapier to trigger actions in your external systems upon invoice approval

Step 4: Test the model with sample invoices

- Upload a batch of representative invoices

- Verify the model's ability to handle various invoice formats and capture line item details

Step 5: Refine the model based on results

- Review extracted data from sample invoices

- Make corrections and retrain the model for improved accuracy

Step 6: Integrate with existing systems

- Set up additional post-processing steps (e.g., matching extracted data with your database)

- Export the processed data to your accounting systems, ERPs, CRMs, and databases using integrations, APIs, and Webhooks

Step 7: Upload real invoices

- Deploy the workflow once satisfied with model performance

- Start importing and processing real invoices through Nanonets

Step 8: Monitor performance and optimize

- Monitor system performance and accuracy

- Adjust the model and rules as needed to optimize the workflow

- Continuously adapt the process to your evolving business needs

Final thoughts

AI-based invoice processing software is empowering businesses worldwide. It enables AP teams to shift from reactive to proactive roles, focusing more on strategic tasks than mundane data entry. While the upfront cost of implementing AI may seem high, its long-term savings and operational efficiencies make it a worthwhile investment.

As AI continues to evolve, so will its capabilities in invoice processing. The future promises more accurate data extraction, seamless system integration, and intuitive automation. AI invoice recognition will become increasingly sophisticated, enabling businesses to process invoices from a wide range of formats and layouts with minimal human intervention.

Remember, the success of implementing AI in your invoice processing depends on choosing the right solution that fits your business needs and goals. Take the time to review different options, understand their pros and cons, and make an informed decision.

From hours to seconds: Achieve similar results!

"Tapi has been able to save 70% on invoicing costs, improve customer experience by reducing turnaround time from over 6 hours to just seconds, and free up staff members from tedious work." - Luke Faulkner, Product Manager at Tapi. Schedule a personalized demo with Nanonets to learn how AI can streamline AP processing for your business.

AI invoice processing FAQs

How to use AI for invoice processing?

You can use AI for invoice processing by leveraging tools like Nanonets that automate data capture, seamlessly integrate with existing software, scale with business growth, process complex invoices intelligently, provide real-time analytics, operate round the clock, ensure regulatory compliance, and reduce operational costs.

Can AI create invoices?

Yes, AI can create invoices by extracting and processing data from various digital formats. It can adapt to different invoice layouts, languages, and currencies, ensuring accurate and efficient invoice creation.

How do I automate invoice processing?

Invoice processing can be automated using AI technologies like Nanonets. It captures and recognizes data, integrates with existing systems, scales as per business needs, provides real-time analytics, and ensures regulatory compliance.

What is generative AI for invoice processing?

Generative AI is where AI learns from existing invoice data to generate new invoices or process existing ones. It can be used for invoice processing in various ways: digitize paper-based invoices, extract data from multiple invoice formats, auto-populate or validate information, cross-check invoices, purchase orders, and inventory, monitor incoming invoices, and detect fraud. By automating tedious tasks, reducing errors, and improving efficiency, generative AI can optimize payments, manage cash flow effectively, and ensure compliance.

What is AI invoice processing?

AI invoice processing is the application of artificial intelligence to automate the capturing, extracting, and processing invoice data. This results in faster processing times, reduced errors, and improved operational efficiency.

How can AI help with invoicing?

AI can help with invoicing by digitizing documents, extracting data accurately, filling in data, cross-checking invoices, monitoring them automatically, and detecting fraud. By automating these tasks and improving efficiency, AI can optimize payments, manage cash flow effectively, and ensure compliance.

What is machine learning invoice processing?

Machine learning invoice processing is a method of automating invoice data extraction and processing using machine learning algorithms. These algorithms learn from historical invoice data to improve their accuracy and efficiency over time, reducing the need for manual intervention in the invoice processing workflow. By leveraging machine learning, businesses can streamline their accounts payable processes and adapt to various invoice formats more easily.