Procure-to-Pay Process & how to optimize P2P Cycle

Businesses today purchase various kinds of goods and services for different purposes.

The procure-to-pay process encompasses all processes involved in the entire lifecycle of purchasing goods and services.

From initial requisition to final payment, this process involves multiple stakeholders with complex workflows and necessitates significant financial checks and control over itself.

Having a well-defined procure-to-pay process for all procurement activities is crucial for achieving operational efficiency and reducing costs. All this goes towards moving the needle towards more profit for the business.

With that being said, let us define the procure-to-pay process, understand the steps involved in completing it, and learn how it can be optimized today with the help of automation.

What is Procure-to-Pay?

Procure-to-Pay (P2P) is the complete process carried out by a business when purchasing goods or services. It comprises of all steps right from ordering the goods/services to paying the supplier.

An example of P2P would be a business needing to purchase office chairs. First, a purchase requisition is created. It is then approved based on certain criteria. The company would then choose a supplier and place an order. When the chairs are delivered, the delivery is checked against the order. The invoice from the supplier is then received, checked against the order, approved, and paid. This entire process, from identifying the need to making the payment, is the P2P process.

Steps of the Procure-to-Pay process

The procure-to-pay process is a subset of the larger source-to-pay process.

The initial Source-to-Pay (S2P) steps are not involved in the procure-to-pay process. These are namely -

- identifying a new need,

- finding and evaluating suppliers,

- sending out requests for proposals,

- selecting the best supplier,

- and finalizing supplier contracts.

The above steps are not part of the procure-to-pay process. Instead, the P2P process starts once the above steps are complete.

Let us now go through the steps of the P2P process itself.

Certainly! Let's continue with the steps of the procure-to-pay (P2P) process, using a practical example to illustrate each step.

Step 1: Identify Needs

Imagine this mid-sized manufacturing company called XYZ Corp. They're running low on raw materials for their production. So, the production team takes a look at their upcoming orders and realizes they need 500 units of high-quality steel sheets.

To make sure everything runs smoothly, the production manager and procurement team work together to nail down the exact specifications and quantities needed.

Step 2: Create Requisitions

Once they've figured out the specifics for the steel sheets, the procurement team gets to work creating a formal purchase requisition. This requisition includes all the important details like the type of steel, how many they need, when they need them by, and any special handling instructions.

They fill out the requisition form and submit it electronically through the company's procurement system, making sure they've got all the necessary approvals in place.

Step 3: Purchase Requisition Approval

Now the purchase requisition gets sent to the department head for approval. The department head takes a good look at the requisition, checks the budget, and makes sure they really do need those materials. If everything checks out, they give it the green light and pass it on to the procurement team for the next steps. If there are any issues or changes needed, they'll send it back for revisions.

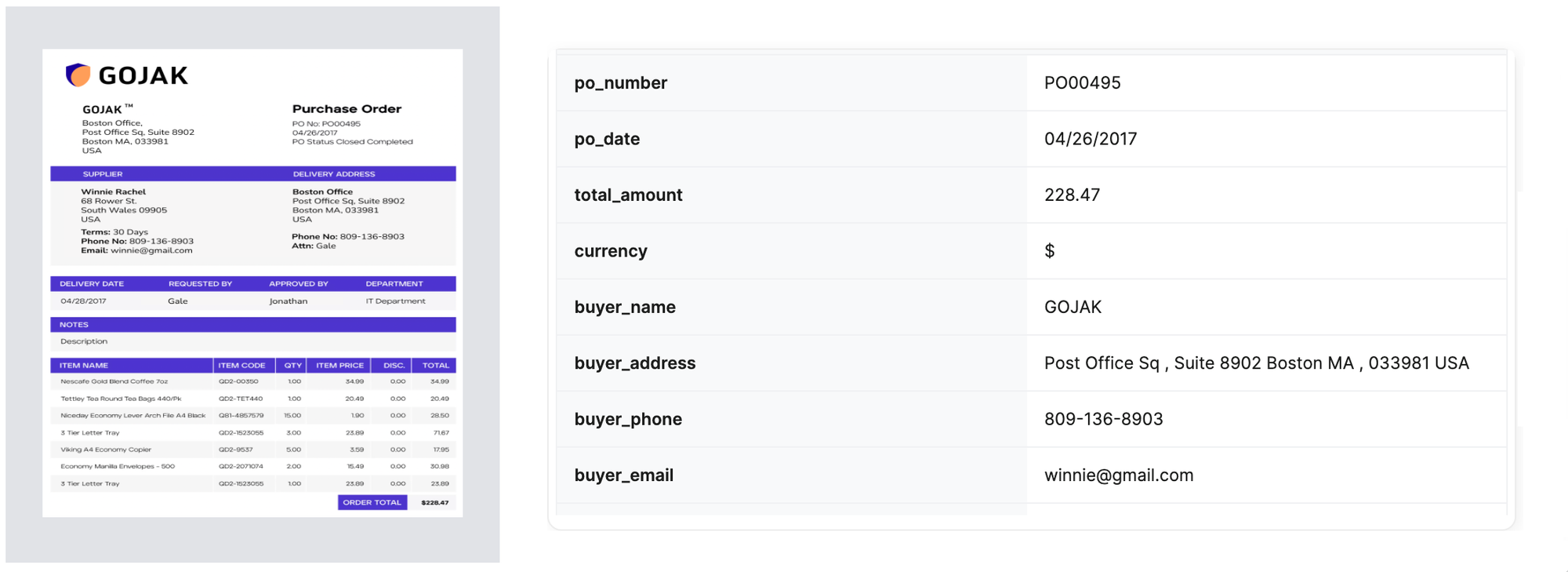

Step 4: Create a Purchase Order

The procurement team puts together a detailed PO based on the approved requisition. It includes things like the name of the vendor, how they'll deliver the goods, and the payment terms.

Step 5: Purchase Order Approval

The procurement manager takes a look at the newly created PO to double-check everything. They want to make sure it's all accurate and follows the company's policies. Once they're satisfied, they give it the thumbs up and send it off to the chosen vendor. The vendor reviews the PO, agrees to the terms, and confirms the order. This makes it a legally binding contract.

Step 6: Goods Receipt

When the steel sheets arrive at XYZ Corp's warehouse, the receiving team carefully inspects the delivery to make sure it matches the specifications in the PO. They check for things like quality, quantity, and any damages. Once they've done a thorough inspection and everything meets the required standards, they record the goods receipt in the system.

Step 7: Supplier Performance

After a successful delivery, XYZ Corp takes a moment to evaluate how the supplier performed. They consider things like whether the materials were delivered on time, the quality of the materials, and whether the supplier stuck to the contract terms. This performance data gets logged into the company's supplier management system. It helps them make smarter purchasing decisions in the future and maintain high standards for their suppliers.

Step 8: Invoice Approval

The supplier sends over an invoice for the steel sheets that were delivered. The finance team does a three-way match, comparing the invoice to the PO and the goods receipt. If everything lines up and there are no discrepancies, they approve the invoice for payment. But if they find any mismatches or issues, they'll send it back to the supplier to get things sorted out.

Step 9: Vendor Payment

Finally, the finance team takes care of processing the approved invoice according to the agreed payment terms. XYZ Corp has a net 30 payment term with the supplier. What does that mean? Well, it means that the payment will be made 30 days after the invoice has been given the thumbs up. The finance team is on top of things, making sure to schedule the payment and settle the supplier's dues accurately and on time.

As we have seen above, the P2P process involves four key stakeholders: the department that initiates the request, suppliers, procurement, and accounts payable (or an external agency in case of outsourcing).

Challenges in the P2P Process

Implementing the procure-to-pay (P2P) process is not without its challenges.

As we have seen above, P2P is a relay race - both the execution of each task and the speed of transition to each next task determines the efficiency of a business' P2P process.

Let's delve into some common challenges faced in the P2P process:

- Manual Processes and Errors: Many businesses still rely on manual processes for various stages of the P2P cycle, such as invoice processing, approval workflows, and data entry. This reliance on manual tasks can lead to human errors, delays, and inconsistencies.

- Lack of Visibility and Control: Without a centralized system to manage procurement activities, businesses often struggle with limited visibility into the P2P process. This lack of transparency makes it difficult to track spending and results in unauthorized purchases slipping through the cracks.

- Complex Approval Workflows: Approval workflows in the P2P process can be cumbersome and time-consuming, especially in larger organizations. Multiple levels of approval, unclear approval hierarchies, and delayed responses can slow down the procurement process, affecting overall productivity and operational efficiency.

- Compliance and Regulatory Issues: Adhering to procurement policies, industry regulations, and compliance standards is essential for avoiding legal and financial risks. However, managing compliance manually can be challenging, leading to potential breaches, penalties, and reputational damage.

- Data Management and Integration: The P2P process generates vast amounts of data, from purchase requisitions to supplier invoices. Efficiently managing and integrating this data across different systems, such as ERP and accounting software, is crucial for accurate reporting and informed decision-making. Poor data management can result in data silos, duplication, and discrepancies.

An outdated P2P process can slow a business down tremendously.

The next section will explore how these challenges can be mitigated and the P2P process optimized through automation.

How to Optimize the Procure-to-Pay Process?

Efficient procurement performance, cost control, and strong supplier relationships depend heavily on a streamlined procure-to-pay (P2P) cycle.

We know that manual processes still hamper teams during critical stages such as invoice processing, payment, goods receipt verification, and utilization of supplier portals.

Even in today's technological landscape, it's surprising that 31% of organizations rely on manual systems to manage these stages.

The good news is that the P2P processes have evolved significantly over the past few years. AI, ML, and automated workflows can now be integrated to increase efficiency. These advancements reduce processing times, mitigate errors, and let your teams concentrate on important tasks rather than data entry, operational tasks and manual reconciliation.

These days, various P2P automation software are available which automate and streamline majority of the procure to pay process.

if you are thinking about getting a procure-to-pay solution for your organization, here are a few top ones for you to consider:

- Nanonets

- SAP Ariba

- Coupa BSM Platform

- Jaggaer One

- Basware Purchase to Pay solution

But let's dig deeper into how a P2P automation software like Nanonets optimizes P2P.

Here is how a typical P2P process automated using Nanonets looks like -

The workflow starts with the need of a new purchase.

1. Purchase Request:

An employee logs into the Nanonets portal to submit a purchase request digitally.

2. Purchase Order Creation:

Nanonets automatically creates a Purchase Order (PO) based on the details provided in the request.

3. Purchase Order Approval:

The PO undergoes an automated approval process within Nanonets.

You can set predefined rules and conditions to ensure consistency across procurement activities, minimizing errors and preventing unauthorized expenditures.

Approval notifications are sent and managed easily through popular communication tools like Slack and Microsoft Teams, featuring direct Call To Actions (CTAs) for quick decision-making.

4. Purchase Order Dispatch:

Once approved, the system automatically sends the PO to the supplier via integrated email or supplier portals such as SAP Ariba or Coupa.

.png)

5. Goods or Services Delivery:

The supplier processes the order and updates the delivery status in the supplier portal, which syncs with Nanonets.

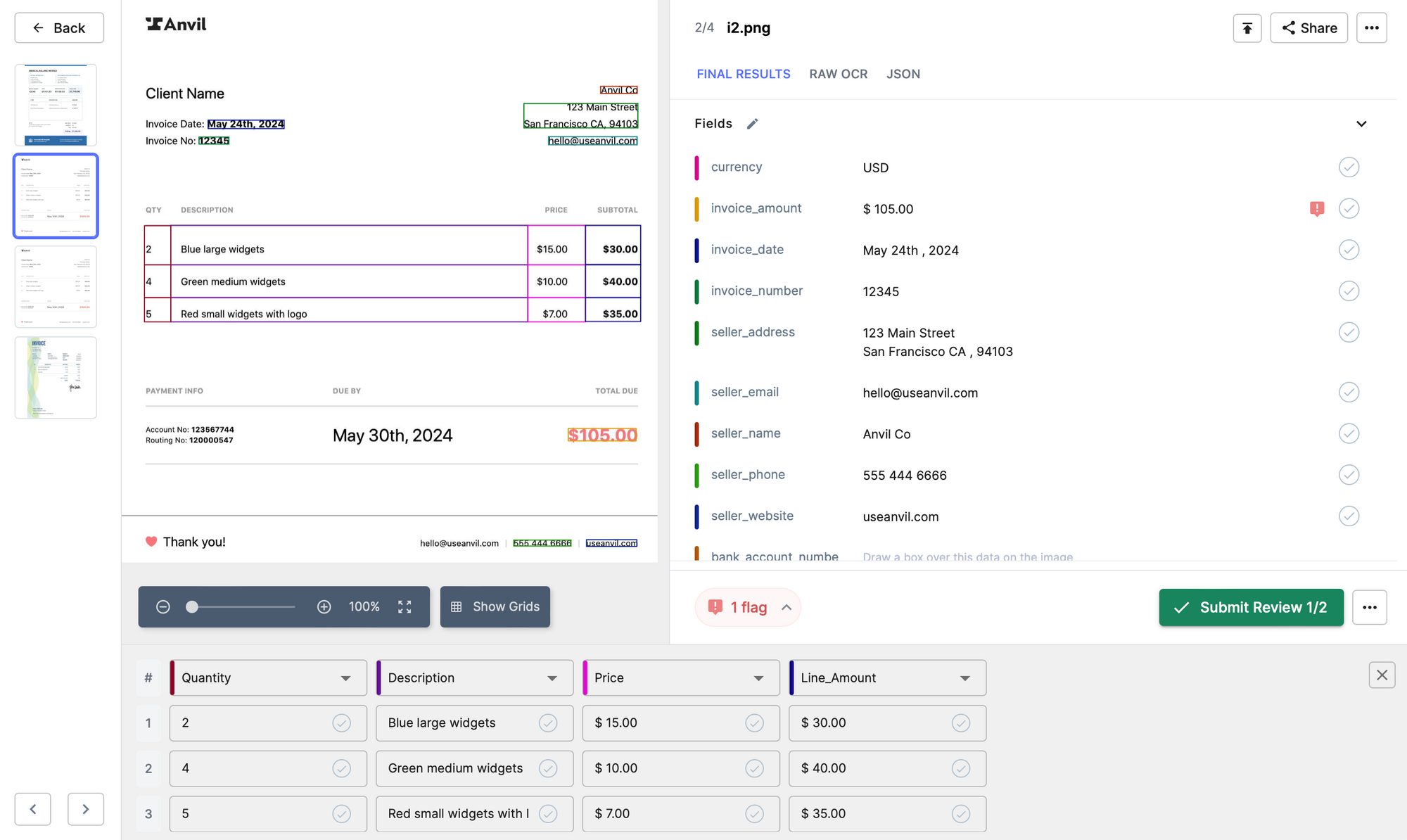

6. Invoice Data Capture and Matching:

Nanonets automatically extracts data from invoices, purchase orders, and delivery notes, reducing manual entry and errors.

Automated three-way matching ensures accuracy by verifying the alignment of invoices, purchase orders, and delivery notes before payment processing.

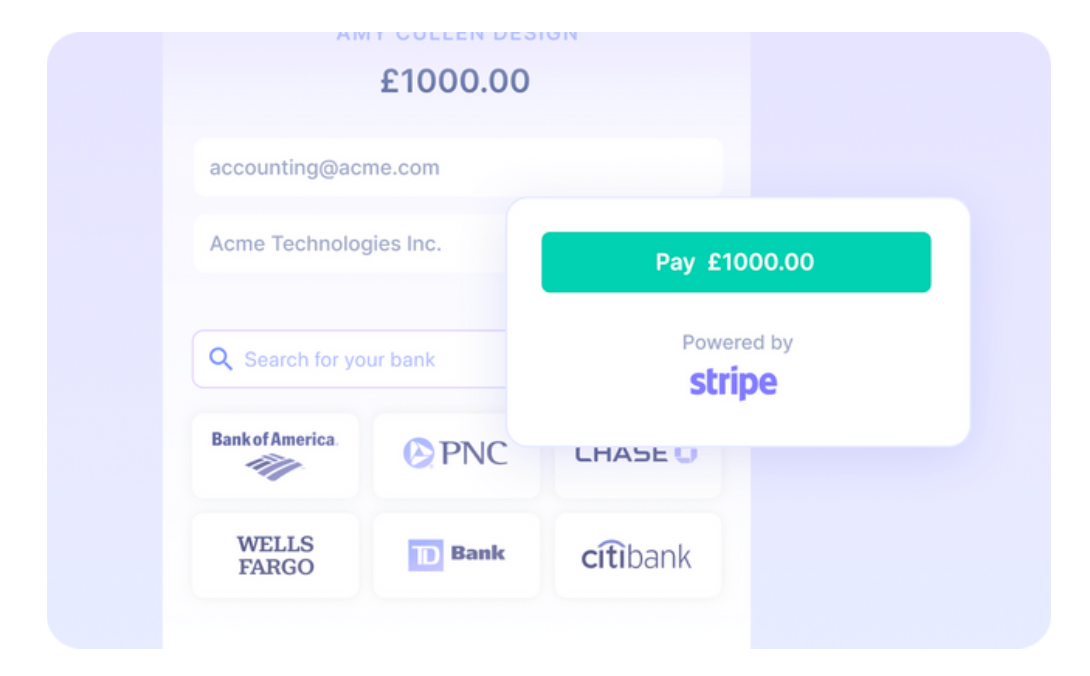

7. Payment Processing:

Nanonets streamlines the payment process, ensuring all transactions are completed efficiently and on time.

This helps maintain good relationships with suppliers and avoid late payment penalties.

8. Integration with ERP/Accounting Software:

Nanonets integrates seamlessly with various ERP and accounting systems, providing a unified experience for procurement and financial data management.

It is clear that procure-to-pay automation streamlines the purchase process and enhances the performance of your business function.

Here are some commonly seen benefits of automating the procure-to-pay process:

- Cost Reduction: Automate repetitive tasks to reduce labor costs and minimize errors.

- Efficiency Gains: Streamline approval and invoice processing workflows to speed up the procurement process.

- Compliance Improvement: Ensure adherence to procurement policies and standards through automated checks and balances.

- Supplier Relationship Management: Enhance communication and coordination with suppliers through automated systems.

Final thoughts

Running a successful business is like managing pit stops for a Formula 1 team. You have to constantly optimize your processes so that you can eke out every last bit of performance.

Your P2P cycle is certainly one area that you shouldn’t overlook. Seamless procurement is the way forward. Those who embrace P2P technologies will have an advantage in expenditure incurred, user experience, and avoiding business disruptions.