The Comprehensive Guide to Invoice & Billing Reconciliation in 2024

For the effective growth of any business, large or small, financial management is imperative. A key part of good financial management is invoice and billing reconciliation. Done properly, invoice reconciliation not only keeps a company's finances under control but also offers insights into spending and inventory, enabling informed decision-making.

In this guide, we will explain what invoice and billing reconciliation is, why they are important, best practices through implementation, and where and how automation can benefit your business in this process.

- For foundational insights into the principles of ensuring accurate financial records, dive into our article "What is Account Reconciliation?" available at Nanonets. It sets the stage perfectly for mastering invoice reconciliation.

- Discover the critical steps of balance sheet reconciliation to enhance your invoice reconciliation practices by visiting What is Balance Sheet Reconciliation?.

What is Invoice & Billing Reconciliation?

Invoice reconciliation is the process of matching vendor invoices to relevant supporting documents like bank statements, purchase orders, etc., to ensure the accuracy and integrity of financial transactions. It consists of reviewing the details of each invoice with relevant purchase orders, receipts, and any other records to resolve discrepancies. This process ensures that accounts have been settled and there are accurate book entries to reflect this, which enables financial accuracy within the organisation.

Billing reconciliation, on the other hand, focuses on verifying the accuracy of outgoing invoices, sent to customers or clients for goods or services rendered. It involves comparing the details on the invoices, such as quantities, prices, and discounts, with the agreed-upon terms and contractual obligations. The purpose of billing reconciliation is to ensure that invoices are generated correctly, reflect the agreed-upon terms, and facilitate timely payments from customers.

What is the Difference Between Invoice and Billing Reconciliation?

While invoice reconciliation and billing reconciliation share similarities in their objectives of ensuring accuracy and completeness in financial transactions, they differ in their scope and focus.

Invoice reconciliation primarily deals with verifying incoming invoices from vendors or suppliers, whereas billing reconciliation focuses on outgoing invoices sent to customers or clients. The former focuses on validating the accuracy of received invoices against internal records and purchase agreements. In contrast, billing reconciliation verifies the accuracy of outgoing invoices against contractual terms and agreements with customers.

The process of invoice reconciliation involves reviewing and matching received invoices with purchase orders, contracts, or receipts. Billing reconciliation entails reviewing outgoing invoices against contractual terms, pricing agreements, and sales orders.

The primary objective of invoice reconciliation is to prevent payment errors, avoid overpayments or duplicate payments, and maintain vendor relationships. And billing reconciliation aims to ensure that invoices accurately reflect the products or services provided, comply with contractual terms, and facilitate prompt payment from customers.

Why are Invoice and Billing Reconciliations Important?

Effective invoice and billing reconciliations are essential to help maintain a business's financial health. Discrepancies like duplicate entries, extra payouts, or data entry errors can be identified and dealt with, which prevents inefficient spending, regulatory mishaps, or bad operational practices.

- Accuracy and Compliance: Invoice and billing reconciliation ensure that financial transactions are accurate and comply with contractual agreements, pricing terms, and regulatory requirements. By verifying the details on invoices against internal records and contractual obligations, businesses can prevent errors, discrepancies, and potential compliance issues.

- Prevention of Errors and Fraud: Reconciliation processes help identify and rectify errors, discrepancies, and irregularities in invoices and billing statements. This reduces the risk of overpayments, underpayments, duplicate payments, and fraudulent activities. By detecting and addressing discrepancies promptly, businesses can safeguard their financial resources and maintain trust with vendors and customers.

- Financial Transparency: Invoice and billing reconciliation promote transparency in financial transactions by providing clear documentation and audit trails of all invoicing activities. Transparent financial practices enhance stakeholders' confidence in the accuracy and integrity of the company's financial reporting and operations.

- Cost Savings: Effective invoice and billing reconciliation processes help businesses identify opportunities for cost savings and optimization. By detecting billing errors, pricing discrepancies, and payment inaccuracies, businesses can avoid unnecessary expenses, negotiate favourable terms with vendors and suppliers, and improve cash flow management.

- Timely Payments and Receivables Management: Invoice reconciliation ensures that incoming invoices from vendors and suppliers are processed accurately and paid on time. Similarly, billing reconciliation ensures that outgoing invoices to customers are accurate and reflect the products or services provided. Timely payments and receivables management are critical for maintaining positive vendor relationships, minimising late payment penalties, and optimising cash flow.

- Operational Efficiency: Streamlining invoice and billing reconciliation processes improves operational efficiency by reducing manual errors, streamlining workflows, and automating repetitive tasks. By leveraging technology and automation tools, businesses can eliminate tedious manual reconciliation tasks, accelerate processing times, and allocate resources more efficiently to strategic activities.

In conclusion, invoice and billing reconciliation are vital components of financial management that ensure accuracy, compliance, transparency, cost savings, and operational efficiency. By implementing robust reconciliation processes and leveraging technology solutions, businesses can mitigate risks, improve financial control, and achieve greater efficiency in their invoicing and billing operations.

How to Reconcile Invoices & Bills?

Invoice reconciliation requires a systematic process to ensure accuracy. The following step-by-step guide details the process.

- Gather invoice and billing documentation: Collect all relevant invoices, incoming and outgoing, purchase orders, receipts, contractual agreements, other supporting documents for the reconciliation process. Ensure that you have a complete set of records to compare and match.

- Verify invoice details: Review each invoice for accuracy, including vendor details, invoice number, dates, item descriptions, quantities, and prices. Cross-reference this information with the corresponding purchase orders and contracts to ensure consistency.

- Match invoices with payments: Compare invoices with payment records, such as bank statements, to identify any discrepancies or missing payments. Ensure that all invoices have been adequately accounted for in your financial records.

- Check for errors or discrepancies: Carefully review each invoice and supporting document for any errors, such as incorrect amounts, duplicate charges, or unauthorised expenses. Investigate any discrepancies and take necessary steps to rectify them.

- Reconcile outstanding balances: Identify any outstanding balances or open invoices that have not been resolved. Follow up with vendors or suppliers to clarify any outstanding amounts and ensure they are accounted for correctly.

- Update general ledger and accounting records: Make the necessary adjustments in your general ledger and accounting records to reflect the reconciled invoice data accurately. Update the corresponding accounts, expense categories, and any relevant financial metrics.

- Document reconciliation process: Maintain a record of your invoice reconciliation processes, including the steps taken, findings, and any corrective actions. This documentation is an audit trail and can be helpful for future reference or internal/external audits.

- Reconcile regularly: Establish a schedule for invoice and billing reconciliation to ensure timely and consistent financial control. Depending on your business needs and transaction volume, this may be a weekly, monthly, or quarterly process.

Invoice and billing reconciliation require a thorough implementation to be done effectively. While it may seem daunting, automation can help streamline the process and reduce manual effort. The next section details how.

Types of Reconciliations

Reconciliation is a critical process for businesses to ensure that payments made match the goods or services received. The choice of reconciliation method often depends on the business's size, transaction complexity, and specific operational needs. Here's a concise overview of various invoice reconciliation methods:

- Two-Way Matching: Ideal for smaller businesses or straightforward transactions, this method verifies that the invoice amount aligns with the purchase order. For instance, a café might use it to confirm the cost of coffee beans ordered matches the invoice.

- Three-Way Matching: This method is suited for businesses dealing with physical goods, adding a receiving report to the mix for an extra layer of verification, ensuring the quantity received matches the order and invoice.

- Four-Way Matching: Used when quality cannot be compromised, it incorporates a quality inspection into the reconciliation process, ensuring the products not only arrive but also meet the required standards before payment is processed.

- Vendor Statement Reconciliation: For businesses with significant transactions with a specific vendor, matching invoices and payments against the vendor’s monthly statement confirms mutual account accuracy.

- Credit Card Reconciliation: Businesses with expenses incurred via company credit cards use this method to align credit card statements with receipts and invoices, particularly useful for tracking travel expenses.

- Automated Invoice Reconciliation: High-volume businesses may opt for software solutions that automate the matching of invoices, purchase orders, and receiving reports to manage numerous transactions efficiently.

- Manual Invoice Reconciliation: Smaller or resource-limited businesses may reconcile invoices manually, ensuring each transaction is verified for accuracy and completeness.

Selecting the right invoice reconciliation method is pivotal for maintaining financial integrity. Businesses should continually evaluate their processes to ensure they remain compliant and efficient, adapting as necessary to meet evolving needs.

Why Invoice and Billing Reconciliation matters for businesses

Invoice reconciliation is crucial for several reasons, directly impacting a business's financial health, operational efficiency, and compliance. Here are the key points, numerically listed, to highlight the importance of this process:

- Rectification of Billing Errors: It addresses discrepancies arising from various scenarios like early payment discounts, currency conversion discrepancies, misplaced invoices, or timing differences in bank reflections.

- Financial Integrity: Ensures the accuracy of financial records by matching invoices with purchase orders and bank statements, thereby maintaining the ledger's integrity.

- Cash Flow Management: By confirming that payments correspond with actual orders and deliveries, businesses can prevent overpayments and manage their cash flow more effectively.

- Vendor Relationship Management: Timely and accurate payments, facilitated by invoice reconciliation, help in maintaining positive relationships with vendors, possibly leading to better terms and pricing.

- Fraud Detection and Prevention: Identifies unauthorized transactions, unexpected expenses, or unfamiliar vendors, serving as a preventive measure against potential fraud.

- Regulatory Compliance and Auditing: Accurate and timely reconciled records are essential for meeting audit requirements and regulatory compliance, thus avoiding fines and legal issues.

- Operational Efficiency: Supports informed decision-making regarding inventory management and pricing strategies, enhancing overall operational efficiency.

- Customer Satisfaction: Ensures costs are accurately reflected, aiding in stable pricing strategies and inventory availability, thereby contributing to customer satisfaction.

Manual vs Automated Invoice Reconciliation

Invoice and billing reconciliation are essential for businesses, especially those handling a significant volume of transactions. The traditional manual approach can be cumbersome, leading to delayed detection of errors or missing fraudulent activities. However, automation can greatly simplify the task, offering several advantages:

- Efficiency and Error Reduction: Automated solutions like procure-to-pay applications streamline the reconciliation process, performing tasks such as the three-way match automatically and highlighting discrepancies for immediate review, thus minimising human error.

- Labour Cost Savings: By automating invoice reconciliation, businesses can allocate staff more strategically, reducing the need for additional hires to manage reconciliation tasks, which, in turn, reduces operational costs.

- Document Management: The risk of losing or misplacing paper documents is eliminated with automated systems, ensuring all invoices are electronic, accounted for, and easily accessible.

- Operational Flow: Automating the reconciliation process eliminates bottlenecks and delays, enabling timely invoice approvals and avoiding late payment fees, thereby enhancing cash flow management.

- Environmental Impact: Transitioning to an automated accounts payable system significantly reduces paper usage, contributing to more sustainable business practices.

- Audit Preparedness: Automated systems provide a comprehensive audit trail for all documents, ensuring transparency and accountability in financial transactions.

Looking out for a Reconciliation Software?

Check out Nanonets Reconciliation where you can easily integrate Nanonets with your existing tools to instantly match your books and identify discrepancies.

How Automation Streamlines Invoice & Billing Reconciliation

Manual invoice and billing reconciliation is both time- and labour-intensive. There may be several pain points like document storage issues, employee training, and more.

According to the 2021 Payables Insight Report by Levvel Research, 33 percent of those surveyed found manual data entry and inefficient processes to be the most significant challenges in their organisation's accounts payable process, which includes invoice reconciliation. In fact, Ardent Partners found that, on average, it takes ten days to process an invoice manually.

This is where automation can help. At a high level, automation helps reduce processing time, errors, paper volume, and manual effort. It can help reduce the complexity of the invoice reconciliation process, reduce errors, increase employee productivity and the efficiency of the overall process. There are other benefits too:

Improved accuracy and error reduction

Optical character recognition (OCR) can extract data from invoices automatically, reducing the risk of data entry errors.

Automated systems can be programmed to check for specific discrepancies, such as incorrect amounts or missing information.

Enhanced visibility and tracking

Automation makes it easy to see what is happening with invoice reconciliation at any given time.

You can see where invoices are in the process, identify any problems, and take action quickly. This can help to ensure that invoices are reconciled on time and accurately.

Streamlined approval and exception handling

Automated workflows can help to speed up the invoice approval process by automatically routing invoices to the right people for review.

Automated workflows can also help to identify and resolve exceptions more quickly, such as invoices with discrepancies or missing information.

Increased compliance and auditability

Automation can be used to check invoices for compliance with specific regulations, such as the Sarbanes-Oxley Act or the Foreign Corrupt Practices Act.

It can also be used to generate audit trails that track the flow of invoices through the system. This can be used to investigate any discrepancies or problems that may arise.

Invoice and Billing Reconciliation Best Practices

While automation helps to streamline the invoice reconciliation process, it can benefit from having organisation-wide guidelines to optimise it. Here are some best practices to follow, whether you use automation software or not:

Establish clear policies and procedures

The first step is to establish clear policies and procedures for invoice reconciliation.

This should include a definition of what constitutes an invoice, the steps involved in the reconciliation process, and the responsibilities of each involved party.

You should also ideally assign key personnel for each responsibility to ensure accountability.

Use a standardised format for invoices

This will make it easier to match invoices to purchase orders and payments. If you use automation software, these generally come with standardised formats.

Have a process for resolving discrepancies

Any discrepancy should be promptly investigated and resolved if it is identified during the reconciliation process. The process for resolving discrepancies should be clear and documented.

Review the reconciliation process regularly

The reconciliation process should be reviewed regularly to ensure its effectiveness. This may involve changing the policies and procedures or implementing new automation tools.

How Nanonets Streamlines Invoice and Billing Reconciliation

In the past, invoice reconciliation was a manual process that could be time-consuming and error-prone. But advanced automation technologies like Nanonets now help cutting-edge businesses streamline their invoice and billing reconciliation processes, making them more efficient.

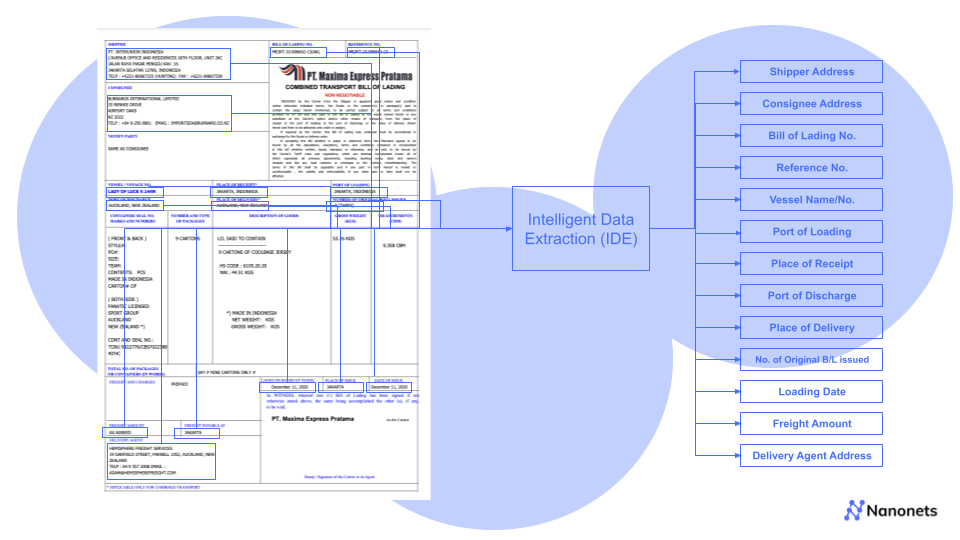

- Advanced Data Extraction: Nanonets employs sophisticated AI algorithms to extract key information from invoices and billing documents accurately. Its advanced data extraction capabilities ensure that relevant details, such as invoice numbers, dates, amounts, and line items, are captured with precision.

- Automated Matching and Reconciliation: Leveraging its AI-powered matching algorithms, Nanonets automates the process of reconciling invoices with purchase orders, contracts, and other relevant documents. By comparing data across different sources, Nanonets identifies discrepancies and inconsistencies, streamlining the reconciliation process.

- Workflow Automation: Nanonets facilitates automated workflows for invoice and billing reconciliation, reducing manual intervention and speeding up the reconciliation cycle. It automatically routes invoices for approval, tracks the reconciliation progress, and sends notifications for pending actions, ensuring smooth and efficient operations.

- Customizable Solutions: Nanonets offers customizable solutions tailored to the unique needs of businesses. Whether it's integration with existing ERP systems, adaptation to specific industry requirements, or scalability to accommodate growing volumes, Nanonets provides flexible solutions that align with business objectives.

- Accuracy and Efficiency: By eliminating manual data entry and reducing human error, Nanonets enhances the accuracy and efficiency of invoice and billing reconciliation processes. Its AI-driven approach ensures consistent and reliable results, leading to improved financial transparency and compliance.

- Cost Savings: With Nanonets, businesses can achieve significant cost savings by reducing the time and resources required for manual reconciliation tasks. By automating repetitive processes and optimising workflows, Nanonets enables organisations to reallocate resources to more strategic initiatives, driving overall efficiency and productivity.

FAQs

What are the three types of reconciliation?

The three most common types of reconciliation are bank reconciliation, account reconciliation, and balance sheet reconciliation. Each serves to ensure that financial records align with external data sources or internal accounts.

Why is invoice reconciliation important?

Invoice reconciliation is important because it helps to ensure that all invoices are paid correctly and on time, which can help to prevent financial losses and improve cash flow.

What is an example of invoice reconciliation?

An example of invoice reconciliation is matching a vendor invoice to a purchase order to ensure that the correct amount was paid for the correct goods or services.

What is billing reconciliation?

Billing reconciliation is the process of comparing invoices or bills received from vendors or service providers with internal records to ensure accuracy and completeness.

Why is billing reconciliation important?

Billing reconciliation helps organisations identify discrepancies, resolve billing errors, and ensure that they only pay for the services or products they have received. Additionally, it aids in maintaining financial transparency, preventing overpayments, and improving cash flow management.