QuickBooks is one of the most widely used apps for bookkeeping, and it offers a convenient way to reconcile credit cards without needing external tools.

In this article, we guide you through the credit card reconciliation process in QuickBooks, addressing common issues and providing useful tips to streamline the procedure.

Deepen your understanding of the credit card reconciliation process with our comprehensive guide at Credit Card Reconciliation, which complements the insights provided on reconciling within QuickBooks Online.

Learn how the best reconciliation software can simplify credit card reconciliation in QuickBooks Online at Best Reconciliation Software.

Step 1: Go to the reconciliation menu

In the top help menu bar, search for 'Reconcile.' Then, select the account you wish to reconcile. For this demonstration, we'll be using an account linked to an employee credit card.

Step 2: Reconciliation Opening Balance

The opening balance and date are automatically detected based on the ending balance and the date of the previous reconciliation.

For first-time QuickBooks Online (QBO) reconciliations, transactions will be listed from the account's inception. To access information about previous reconciliations, including statement end dates, navigate to the ‘Summary’ section.

Step 3: Reconciliation Closing Balance

Ending Balance & Date: Please enter the closing balance and ending date. The ending date is typically based on the credit card statement date. However, if you report financial statements date-wise, you may set the ending date to the end of the month.

Finance Charge: If finance charges are not captured in your QuickBooks Online account, you can add them manually. Please include the date, amount, and expense account. If you are using a card in a different currency, you must also add the exchange rate.

Step 4: Match and Clear Credit Card Transactions

The QBO reconciliation screen displays a tick mark and grey background for cleared transactions, while unmatched transactions do not have a checkmark.

Now, let's first understand the summary section at the top:

Statement Ending Balance: This is the ending balance we entered in the previous screen.

Cleared Balance - This begins from the opening balance in the previous screen plus any finance charges added, along with all cleared deposits minus cleared payments. The breakdown of the cleared balance is provided below.

Upon completing the reconciliation process, the cleared balance should match the statement ending balance, resulting in a difference of zero.

Match transactions:

- Select the unmatched transactions and find a matching transaction on the credit card statement.

- If the amount and other details match, clear the transaction.

- Repeat this process until all transactions are matched.

This can be quite time-consuming, so we have included some tips to simplify this at the end of the article. Once all transactions are matched, the difference should be 0, and you can skip to Step 5.

However, if the difference is not 0, you must identify the transactions that aren't recorded in QuickBooks. This could be due to accounting errors, unaccounted charges, or unauthorized transactions. Let's look at how you can troubleshoot this:

Identifying errors in your reconciliation

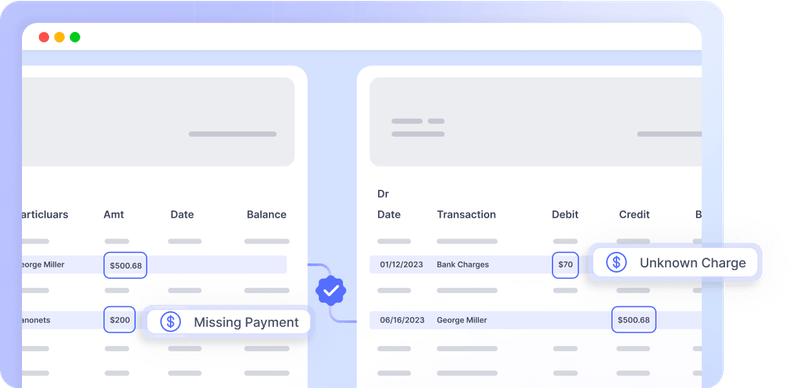

If you have unmatched transactions, this could be due to:

- Date or Amount mismatch: This could be due to data entry errors, bank delays, or bank errors. You would be required to find the transaction based on other details like the vendor account and in the vicinity of the reference date.

- Duplicate Payments: Search in your cleared transactions if you can find a very similar record. You can search based on the payee and amount.

There could also be charges that are missed in your accounting. You can search your credit card statement and find any transactions with no matches. Some common reasons for this could be:

- Credit Card Charges: Credit Cards have a whole list of hidden charges that could be easily missed. For example, foreign currency transfers incur a processing charge and an exchange markup. This has to be accounted for in the company ledger.

- Unauthorized transactions, fraud, or theft: Credit cards are the number one reason for losses due to theft and fraud. Unauthorized transactions can be made due to identity theft. There could also be unauthorized transactions that have been made due to employees. Reconciliation is a helpful process to identify this and quickly report it to safeguard the company from losses.

Step 5: Finish and print statement

Once your statement difference hits 0, the top right button will display a CTA - “finish now.” Click on this to conclude your reconciliation process.

Return to the reconciliation page, and in the top right corner, select “summary.” You can print your credit card reconciliation statement from here.

Additionally, you can pay your credit card bill directly or add any other bills.

Tips For Credit Card Reconciliation

Matching transactions is a manual process, and it can be time-consuming. Here are some tips to make it easier for you:

- Sort by transaction type: Begin by matching deposits and then payments. This organization can reduce confusion. You can switch between 'Payments' or 'Deposits' on the QBO top bar.

- Mark fees & interest: Highlight your statement's bank fees, interest charges, or other bank transactions. This will help you accurately account for them during reconciliation.

- Credit Card Reconciliation Software: Reconciliation in QBO can be time-consuming. Software like Nanonets can automate this process and sync the data to QBO. Learn more about reconciliation automation 👇

Automate Credit Card Reconciliation

Reconciling manually in Excel or QBO is not viable if you have many transactions or work with a small team. Reconciling hundreds of transactions can take days to resolve.

You can reduce the reconciliation process to minutes using automation software. This would require aggregating data from the bank, QBO, or other tools, extracting relevant data from them, matching data across different sources, and performing fraud checks. If you want to automate your credit card reconciliation process, set up a demo call with our experts to automate your workflows using Nanonets.

Automate fraud detection, bank reconciliations, or accounting processes with a ready-to-use custom workflow.

Here is how a reconciliation software like nanonets can automate three key items for you:

- Data collection: Nanonets can seamlessly integrate with your ERP or email to gather documents like credit card statements, general ledgers, invoices, and receipts. The software will only pull relevant information from each document through OCR technology.

- Data matching: With no-code automation, you can easily set up rules to match your credit card statement with the general ledger. You can set up new rules with time and don't have to struggle with formulas.

- Identifying errors & fraud checks: Set up flags to identify irregular, duplicate, or unauthorized transactions. These flags can also help you detect transactions like bank charges or interest earned!

Reconciliation software will help you save time and enable you and your team to focus on the tasks that matter. Check out Nanonets for more information on reconciliation automation.