The era of automation has brought about a revolution in various industries, and the audit sector is no exception. The integration of Artificial Intelligence (AI), cloud-based data storage solutions, and data analytics tools is set to transform the audit industry, reshaping the way accountants and auditors carry out their tasks. Mundane activities like data entry, financial data processing, audit report generation, and large-scale fin-data analysis are now increasingly being handled by AI and RPA-driven automation solutions, allowing accountants and auditors to focus on more value-added services.

The financial services industry, particularly in Internal Audit, has emerged as a pioneer in embracing automation and analytics. A comprehensive survey conducted by Ernst & Young LLP assessed the progress of 16 banking and wealth management firms, comparing the findings to a similar study conducted in 2014. The survey revealed a remarkable increase in the adoption of data analytics, with around half of the respondents in 2017 utilizing analytics in more than 50% of their audits – a substantial rise from the mere 31% reported in 2014.

According to a 2021 survey conducted by Forbes among finance and accounts-related executives, almost all respondents (98%) stated that their external audit firm employs advanced technology. The majority of executives (98%) believe that this utilization of technology contributes to improving the quality of their audits by providing deeper insights into areas of elevated risk, better benchmarking, and broader data coverage. Additionally, a significant number of executives (94%) also perceive that this technology enhances the overall client experience.

The above statistics highlight the increasing influence of automation and AI in the audit process.

What is audit automation?

Audit automation is a targeted approach that involves automating specific steps in the auditing process, aiming to streamline workflows and minimize human error. Built on advanced AI software and cloud-based data, audit automation effectively addresses the drawbacks of using disparate and stand-alone applications and tools for the aggregation and processing of financial data. The automated audit approach enables the use of data analytics tools to extract and analyze large volumes of data from various sources, including financial systems and operational databases.

A diverse range of digital technologies builds the audit automation spectrum. On one end, predictive models and data integration tools offer insights and anticipate outcomes, while on the other end, advanced cognitive intelligence technologies enable auditors to work with unstructured data and make informed decisions. Artificial intelligence applications mimic human behavior in optimizing and expediting the audit process.

By implementing automation, auditors can significantly reduce workloads, cut down labor costs, and enhance overall efficiency, producing highly accurate data in a fraction of the time. This speed is especially crucial in rapidly changing regulatory environments, where swift auditing is necessary to maintain compliance.

In addition to time-saving benefits, audit automation streamlines workflows and reduces the resources required to achieve compliance. As organizations face increasing pressure to adapt to evolving regulations, audit automation emerges as an indispensable tool for enhancing efficiency, gaining valuable insights, and effectively mitigating risks.

What are the benefits of audit automation?

Audit automation offers numerous benefits that address common auditing challenges, resulting in improved efficiency and accuracy for organizations. One key advantage is real-time collaboration enabled by cloud-based technology, allowing auditors to access and work on the same document simultaneously from any location, eliminating version control issues and facilitating seamless data updates. An audit is a continuous and iterative procedure. By incorporating automated workpapers, trial balance, and analytics, a cloud-based audit suite equipped with integrated AI-enabled software and applications provides auditors with instant access to audit data in real-time.

Audit automation enhances data security by adhering to strict standards and independent audits, safeguarding sensitive information and reducing reliance on less secure options like laptops. The cloud-based approach also eliminates the need for manual backups and software updates, ensuring data and applications are always up-to-date and secure.

The integration of AI-enabled audit applications and data analytics tools further boosts efficiency by saving time and providing valuable insights to clients. Auditors can access and analyze client data at a transactional level, identify risks, benchmark business metrics, and offer key insights to improve business effectiveness.

Automation obviates labor-intensive tasks like data entry and analysis. Audit Automation tools that can extract and analyze data from multiple sources in a fraction of the time. This not only saves on labor costs but also reduces errors and enhances consistency in auditing tasks.

The accuracy of audit automation surpasses manual auditing, as automation obviates human errors that may arise from fatigue or carelessness. Automation ensures standardized, reliable results. These consistent and accurate audit reports simplify compliance and improve risk management by identifying irregularities and potential risks faster and more accurately.

Audit automation also streamlines stakeholder communication, allowing easy sharing of audit-related information, enhancing collaboration, and strengthening auditor-investor-client relationships.

What audit tasks can be automated?

Audit automation offers significant advantages in streamlining and improving the efficiency of various audit tasks, benefiting different phases of the auditing process. In audit engagement management, automation serves as a centralized hub, organizing work papers and trial balances digitally, eliminating the need for manual document management and reporting. This digital approach enables auditors to access and update information in real-time, fostering seamless collaboration and data updates.

Automation also enhances audit methodology by allowing customized audit programs based on risk assessments, ensuring a targeted and efficient approach. It assists auditors in staying up-to-date with regulatory changes and adapting their procedures accordingly, ensuring compliance and mitigating risks effectively.

Secure confirmations, a critical aspect of the audit process, can be greatly improved through automation. Traditional methods, prone to errors and delays, can be replaced with streamlined digital processes that enhance data security and integrity.

Audit automation optimizes scarce resources by automating manual activities, freeing up employee capacity to focus on higher-impact tasks like process improvement, accelerating and improving operating effectiveness.

Throughout the auditing process, audit automation seamlessly integrates into various phases, including risk assessment, audit planning, design effectiveness assessment, reporting/closing, and issue tracking/ongoing monitoring.

- In the risk assessment phase, analytics techniques, dashboards, robotic process automation, and natural language processing streamline compliance risk assessment, location risk assessment visualization, cross-business unit/region comparative analysis, and continuous business operations monitoring.

- During the audit planning phase, automation tools optimize the automation of documents with extensive text, business operations profiling, exploratory analytics, and "what-if" analysis.

- The design effectiveness assessment benefits from automation through the automation of internal audit tasks, data modeling, and batched reporting.

- The reporting/closing phase utilizes analytics techniques, robotic process automation, and natural language generation to automatically generate text-based audit reports and enable data visualization through audit storyboards.

- The issue tracking/ongoing monitoring phase utilizes automation tools for real-time anomaly reporting, enhanced dashboarding and reporting, thematic risk identification, and computer-aided engineering dashboard visualization.

How can Nanonets help with audit automation?

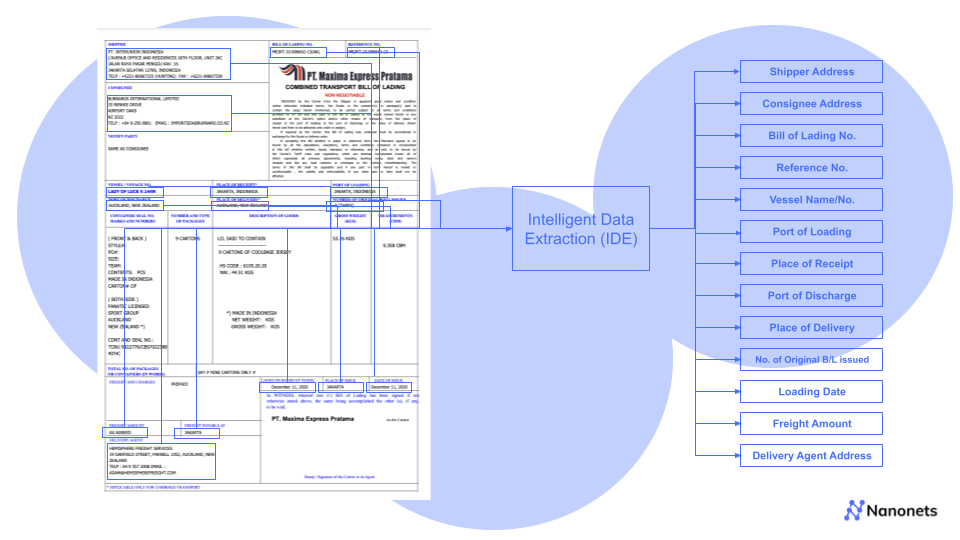

Nanonets, a smart OCR software, presents an innovative solution to streamline and enhance the audit process by tackling the challenges associated with handling large volumes of paperwork and manual data entry.

Optical Character Recognition (OCR) is a crucial tool in accelerating data collection from scanned images of documents. By converting paper-based documents into machine-readable text, OCR simplifies the storage of papers and makes previously inaccessible details easily accessible within seconds. However, basic OCR alone may not suffice when it comes to gaining context and extracting meaning from various types of digital assets.

This is where Nanonets helps. Nanonets employs machine learning (ML) algorithms to search for specific entries, such as dates, purchase order numbers, and reference IDs across various financial documents. With training, Nanonets achieves over 90% accuracy and can analyze thousands of documents in a fraction of the time.

The unique benefits of using Nanonets over other OCR software parsers are significant. Unlike template-based solutions, Nanonets offers an intelligent document processing algorithm that can handle unseen document types. It excels in handling unstructured data, common data constraints, multi-page documents, tables, and multi-line items effortlessly.

As a no-code intelligent automation platform, Nanonets can continuously re-train itself and learn from custom data sets, resulting in outputs that require minimal post-processing. Every aspect of document processing can be tailored to specific needs, from document recognition and data extraction to output styles and formats.

Finally, Nanonets facilitates seamless integration, even with legacy systems, and can be easily integrated with most CRM, ERP, or RPA software, ensuring a hassle-free implementation process.

Takeaway

The integration of various digital technologies along the automation spectrum, from predictive models and data integration tools to advanced cognitive intelligence and artificial intelligence applications, empowers auditors to streamline workflows, minimize human error, and uncover valuable insights from vast volumes of data. By embracing data-driven approaches and leveraging cutting-edge automation solutions like Nanonets, auditors can focus on high-risk areas, deliver more comprehensive audits, and provide clients with deeper business insights.

The benefits of audit automation extend beyond traditional manual processes, leading to increased productivity, improved risk management, and enhanced stakeholder communication. As the landscape of auditing continues to evolve, embracing the power of automation will undoubtedly be a key factor in ensuring audits remain effective, precise, and adaptive in the face of ever-changing business environments. In this digital age, the future of auditing is undoubtedly intertwined with the remarkable advancements brought forth by audit automation.