More than 640,0000 tons of business receipts are printed annually. That’s a lot. In business, every transaction counts and every penny matters. Whether you're a freelancer juggling multiple clients or a CFO overseeing a multinational corporation, the way you organize and store receipts can significantly impact your financial health and operational efficiency.

This guide aims to provide you with the best practices and technological tools to turn receipt tracking from a chore into a strategic advantage.

Importance of Organizing Receipts

Organizing receipts and maintaining efficient tracking is crucial for several reasons:

- Tax Preparation: Properly organized receipts simplify the tax filing process, ensuring you claim all eligible deductions and credits.

- Expense Management: Tracking spending helps in budgeting and identifying areas for cost savings.

- Financial Transparency: Keeping detailed records supports financial analysis, forecasting, and decision-making.

- Audit Readiness: Well-organized receipts ensure you're prepared for any inquiries or audits from tax authorities.

- Fraud Prevention: By closely monitoring receipts, businesses can detect discrepancies, unauthorized transactions, and prevent potential fraud.

Follow Best Practices in Receipt Tracking

Managing receipts effectively is fundamental for businesses to ensure financial accuracy and compliance. Here are comprehensive, practical steps to enhance your receipt management process:

Use Pen for Annotations: Always use a pen to annotate receipts. Unlike pencil markings, pen annotations do not fade or erase over time, ensuring that your notes, categorizations, or any additional information remain intact and legible for future reference.

Categorize and Sub-Categorize: Develop a detailed categorization system for your expenses. Start with broad categories like travel, office supplies, and client entertainment, then sub-categorize (e.g., domestic travel vs. international travel). This granularity aids in more precise tracking and reporting.

Implement GL Codes Early: Assign General Ledger (GL) codes to each receipt as they are processed. This practice streamlines tax preparation and deductions by directly linking expenses to their appropriate accounts, simplifying the end-of-year accounting process.

Digitize Receipts Promptly: Convert physical receipts to digital format using a receipt scanner app as soon as they are received. Digital receipts are easier to organize, search, and back up, reducing the risk of loss or damage.

Regular Reconciliation: Regularly reconcile receipts with bank statements and expense reports. This practice helps identify discrepancies early, ensuring that all transactions are accounted for and properly documented.

Use Business Cards: Tracking cash payments can be hard, so it's smart to use designated credit and debit cards to check your paper receipts. Keeping separate cards for separate use cases / accounts can help a lot in re-organizing expenses later.

Set a Retention Schedule: Be aware of legal requirements for receipt retention in your jurisdiction and set a schedule accordingly. Typically, it's advisable to keep receipts for at least seven years to comply with tax and audit requirements.

Leverage Technology to Organize Receipts

Technology today can transform the way you manage receipts, making the process streamlined and less prone to error. Here's how different technologies can help:

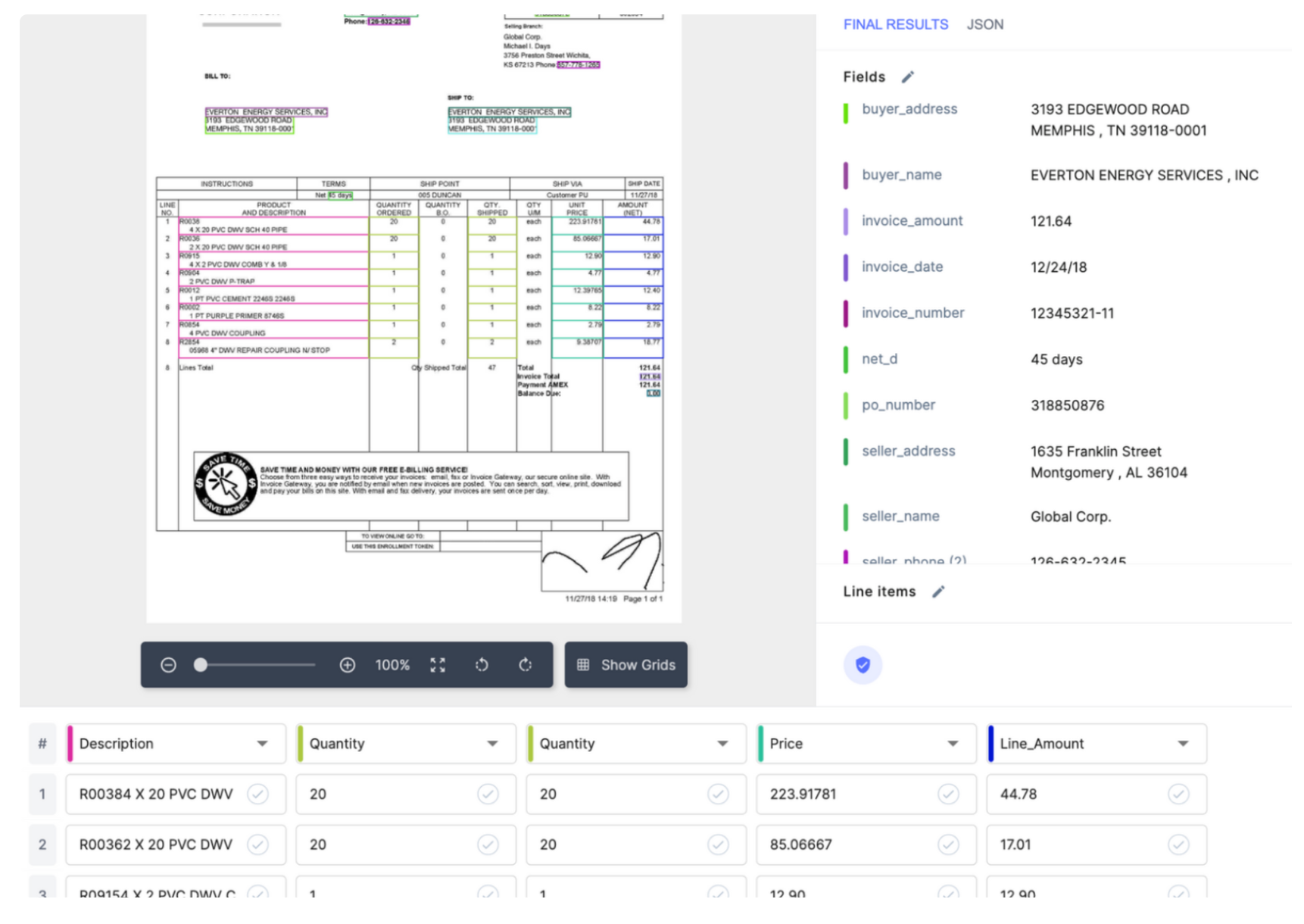

OCR (Optical Character Recognition): Converts text from images into editable and searchable data, making it easier to organize and retrieve information from receipts.

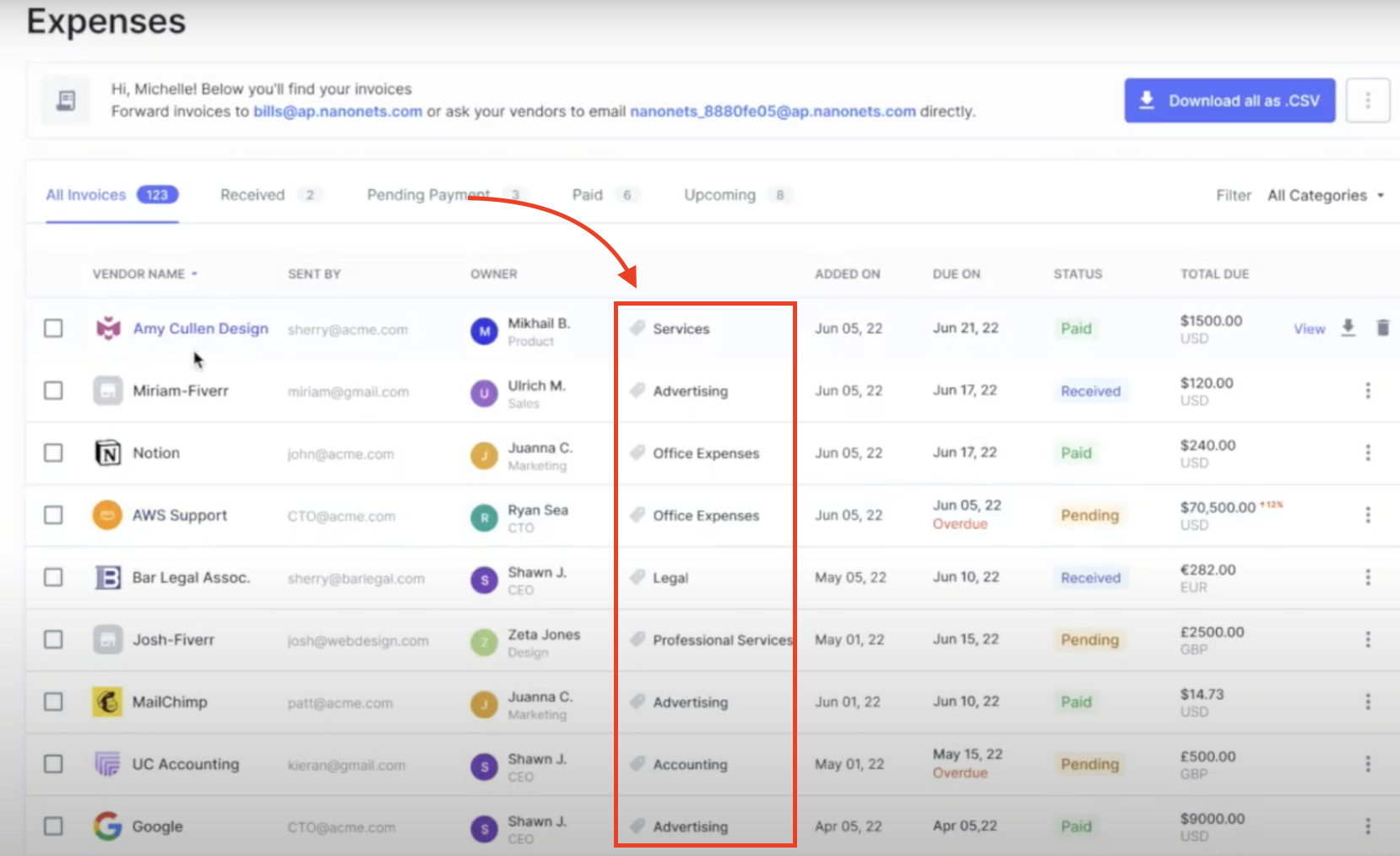

Expense Categorization: Automatically sorts receipts into predefined categories, streamlining the process of organizing expenses and simplifying reporting.

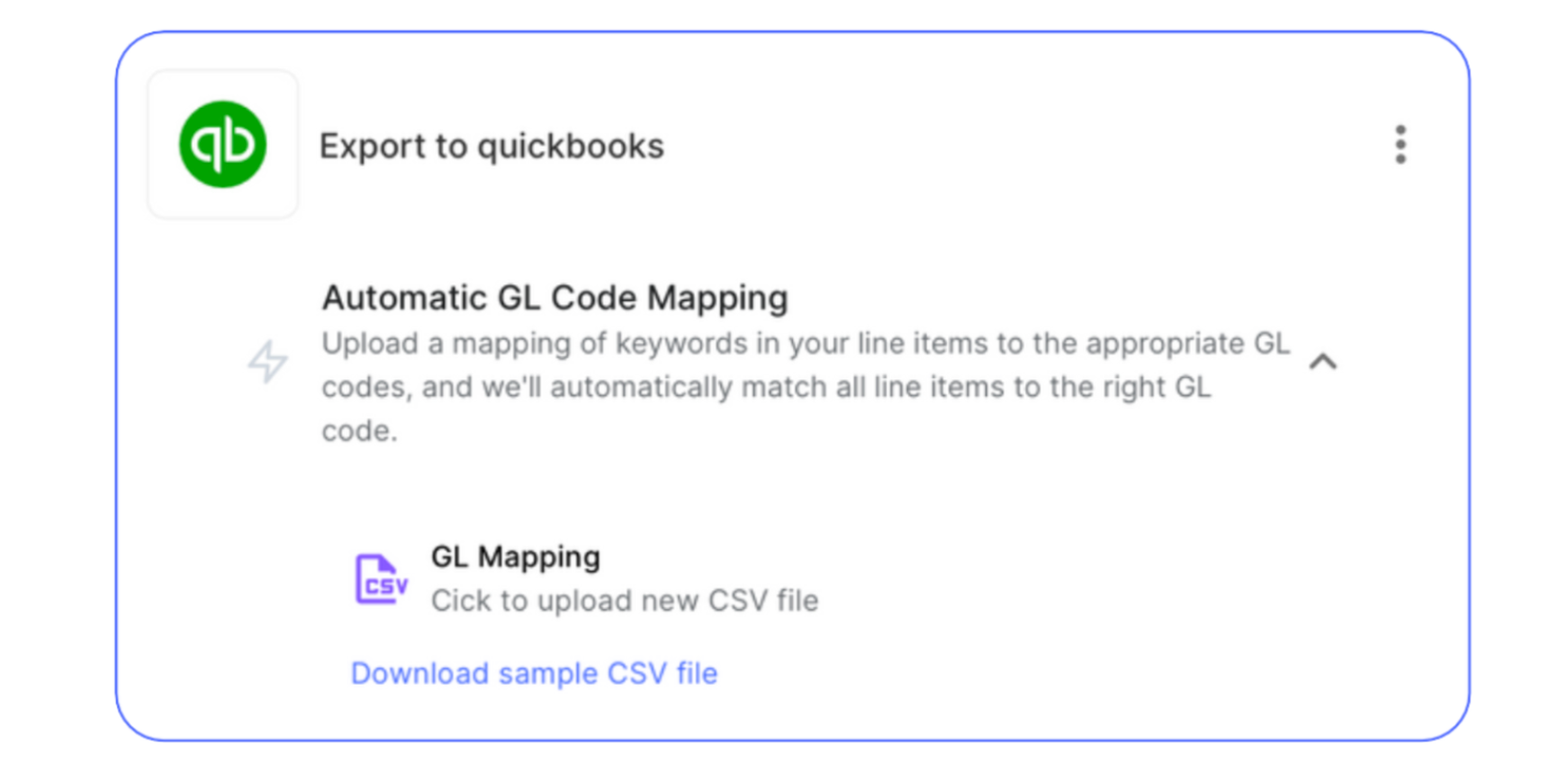

GL (General Ledger) Coding: Facilitates the automatic assignment of expenses to the correct general ledger accounts, enhancing accounting accuracy and efficiency.

Easy Approvals via Communication Platforms: Integrations with platforms like Slack, Teams, and email allow for swift expense approvals within the tools you already use daily, speeding up the workflow.

Integration with ERP/Accounting Software: Connecting your receipt tracking system to your ERP or accounting software ensures seamless data flow, reducing manual entry and improving overall financial management.

By incorporating these technologies into your expense management strategy, you can significantly reduce the time and effort required to organize and track receipts, freeing up resources to focus on more strategic tasks. Whether through improved accuracy, enhanced efficiency, or better financial insights, the right tools can make all the difference in managing your business's expenses effectively.

Imagine a small business, "XYZ Corp," still operating with a manual expense management system. Here's how their process might unfold:

1. Expense Incurrence

An employee incurs an expense while on a business trip. They collect a physical receipt, making sure to note any relevant details on the back with a pen, such as the business purpose of the expense.

2. Expense Date Entry for Expense Report

Upon returning, the employee fills out an expense report form, either on paper or a basic spreadsheet, entering details of each expense, including date, amount, and category.

3. Expense Categorization

The employee categorizes each expense according to the company's predefined list (e.g., travel, meals, lodging) and attaches the corresponding receipts. This step often requires consulting a chart of accounts or GL codes provided by the accounting department.

4. Expense Approval

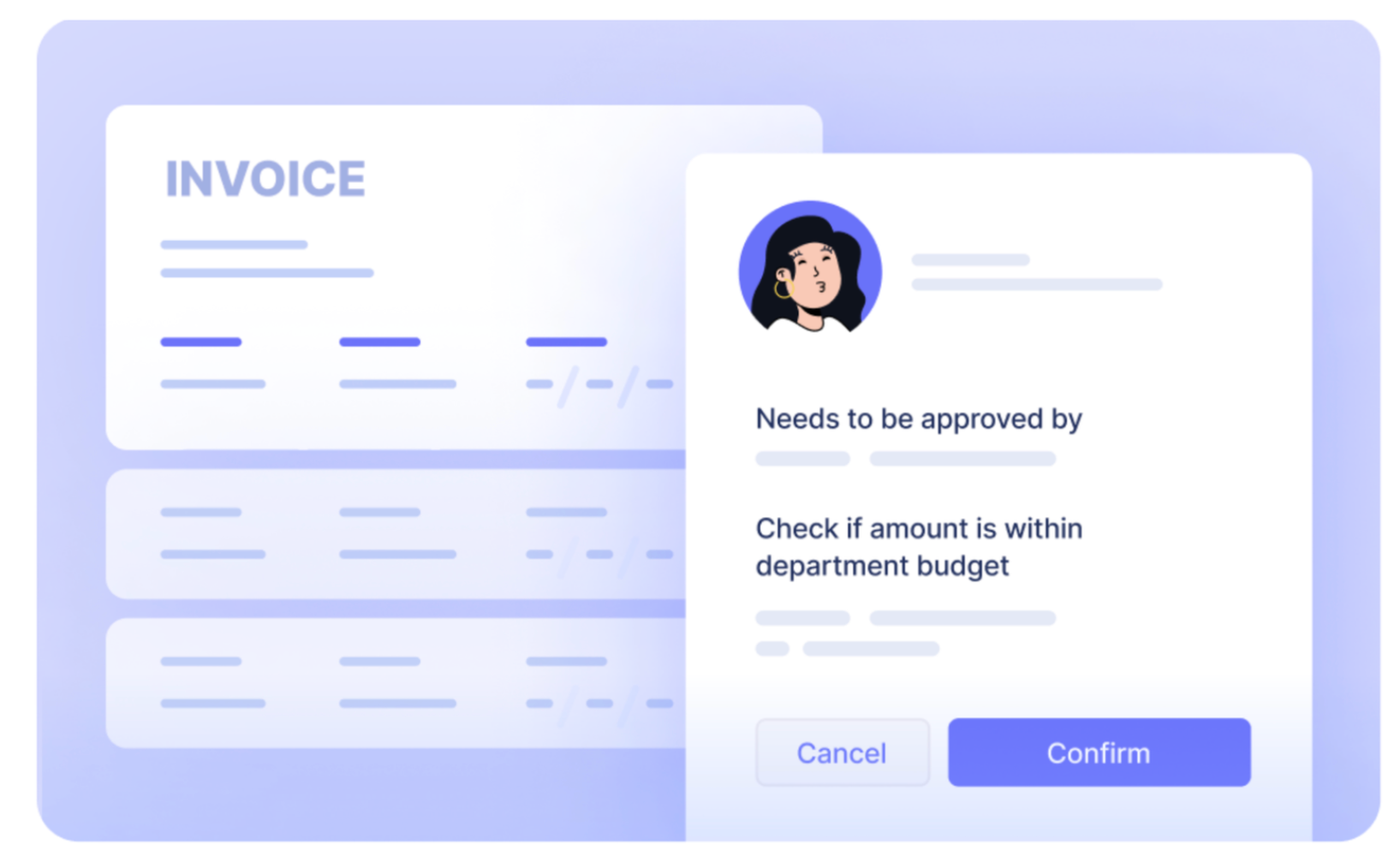

The completed expense report, along with all receipts, is submitted to the manager for approval. The manager reviews the report, ensuring compliance with company policies before signing off. This process can involve cumbersome back-and-forth communication for clarification or missing information.

5. Expense Reimbursement

Once approved, the expense report is forwarded to the accounting department. The accounting team then processes reimbursement, which involves manual entry into the accounting system and issuing payment to the employee, typically through a payroll addition.

6. Data Export to ERP

The accounting team manually enters expense data into the company's ERP (Enterprise Resource Planning) system for financial reporting and analysis. This step is prone to data entry errors and can be time-consuming.

7. Reconciliation

At the end of the month, the accounting team reconciles expenses by matching entries in the ERP with bank statements and receipts. This process verifies the accuracy of expense recording and ensures compliance with financial policies.

Now, let's reimagine XYZ Corp's expense management workflow using NanoNets, an end-to-end expense management solution:

1. Expense Incurrence

An employee snaps a photo of a receipt right after incurring an expense using the NanoNets mobile app, or directly uploads the expense document irrespective of format. The app uses OCR to automatically extract relevant data (date, amount, merchant) from the receipt.

2. Automatic Categorization and GL Coding

NanoNets' AI categorizes the expense based on the company's predefined categories and assigns the correct GL code, minimizing manual work and errors.

3. Instant Expense Report Generation

The expense is automatically added to the employee's digital expense report in NanoNets, eliminating the need for manual entry. Employees can review and edit details if necessary.

4. Seamless Expense Approval

Managers receive a notification to review and approve expenses directly your workspace lives- Slack, Teams, Mail. They can approve or reject expenses with a click, significantly speeding up the process.

5. Automated Expense Reimbursement

Once approved, NanoNets automatically processes reimbursements, integrating with payroll systems to issue payments without manual intervention.

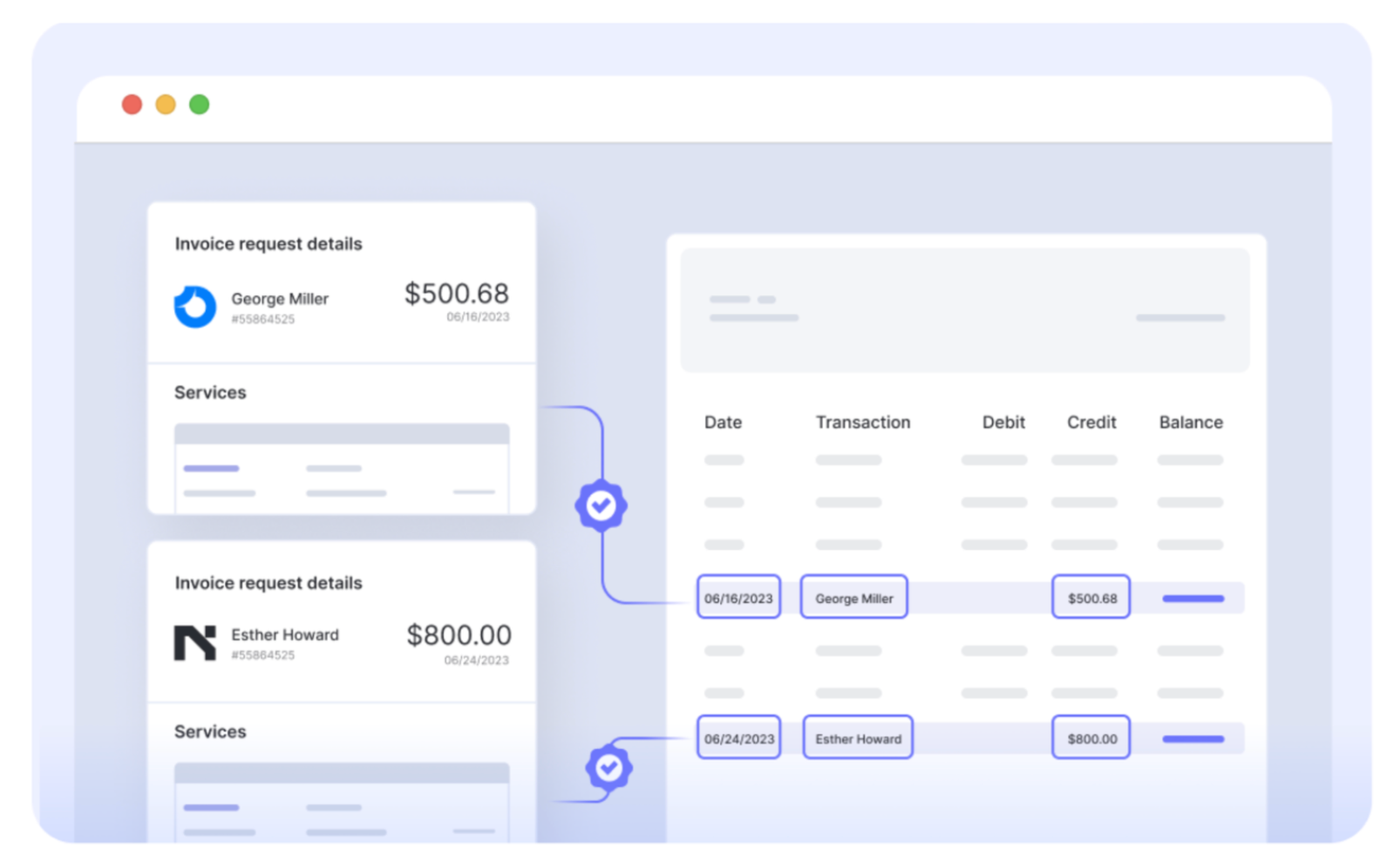

6. ERP Integration

NanoNets integrates seamlessly with XYZ Corp's ERP software, automatically exporting expense data. This integration eliminates manual data entry and enhances data accuracy.

7. Real-time Reconciliation

NanoNets offers real-time reconciliation features, automatically matching expenses with imported bank statement transactions and highlighting discrepancies. This feature ensures continuous compliance and financial accuracy.

By transitioning from a manual to an automated workflow with NanoNets, XYZ Corp not only streamlines its expense management process but also achieves higher accuracy, faster reimbursement times, and better compliance. Automation reduces the administrative burden on employees and accounting teams, allowing them to focus on more strategic tasks.

Here are a few cases studies of businesses that have successfully streamlined their expense management using technology -

- SaltPay Uses Nanonets to Integrate with SAP to Manage Vendor Invoices.

- In2 Project Management helps Water Supply Corporation save 700,000 AUD with Nanonets AI.

- How Happy Jewellers, a SMB, benefitted from NanoNets.

- Nanonets AI helps ACM Services automate extraction from expense documents, saving 90% time for the Accounts Payable team.

- Tapi automates property maintenance invoices using Nanonets.

- Puma automates their expense management process with Zoho Expense.

- SWISS improved expense processing efficiency by 80% with Rydoo.

- Suncommon manages their company spend and saves company time by leveraging the the Expensify Card.

Conclusion

From annotating receipts with a pen for durability to categorizing expenses with precision, and from digitizing receipts for easy access to automating the reconciliation process, each step discussed above contributes to a streamlined workflow that enhances operational efficiency and financial transparency. The implementation of technologies such as OCR for data extraction, automated expense categorization, and integration with ERP/accounting software further simplifies the process, reducing the risk of errors and ensuring compliance with tax and audit requirements.

By prioritizing receipt management and embracing the tools and practices recommended, businesses can achieve not only improved financial health but also gain strategic insights that drive better decision-making and sustainable growth.