Accounts Payable (AP) Automation in Sage Intacct

Sage Intacct, a world-renowned ERP solution, is one of the top choices for small and medium businesses globally. Finance teams and many others use it to facilitate their operations. Improving the efficiency of the Accounts Payable (AP) process is a strategic initiative for businesses, as the complex and resource-intensive work is unsustainable, challenging to scale, and prone to error.

Automation in accounts payable refers to using software to digitize, streamline, and optimize the end-to-end process of managing payables. It addresses the challenges of traditional processes by reducing manual intervention, speeding up processing times, and enhancing visibility.

In this blog, we will discuss Sage Intacct, specifically for finance teams, and how Account Payable Automation (APA) is the next step to improving the process.

Sage Intacct: The cloud-based ERP

Sage Intacct, a world-renowned ERP solution, ranks among the top choices for businesses globally. Sage Intacct serves customers across industries and geographies, mainly in North America. While suitable for enterprises, Sage Intacct's distinction and strength lie in the Small-Medium Business (SMB) market.

Sage Intacct is an AICPA-endorsed, HIPAA-compliant cloud accounting system. Its ability to quickly 'tag' your transactions and operational data with dimensional values is a unique distinction of Sage Intacct.

Here's how Sage Intacct can power your financial teams :

- Account Payable / Receivable: eliminates inefficiencies and gets you paid faster.

- Multi-Entity Insights: Intacct empowers growing multi-entity businesses with valuable insights for clarity and enhanced efficiency

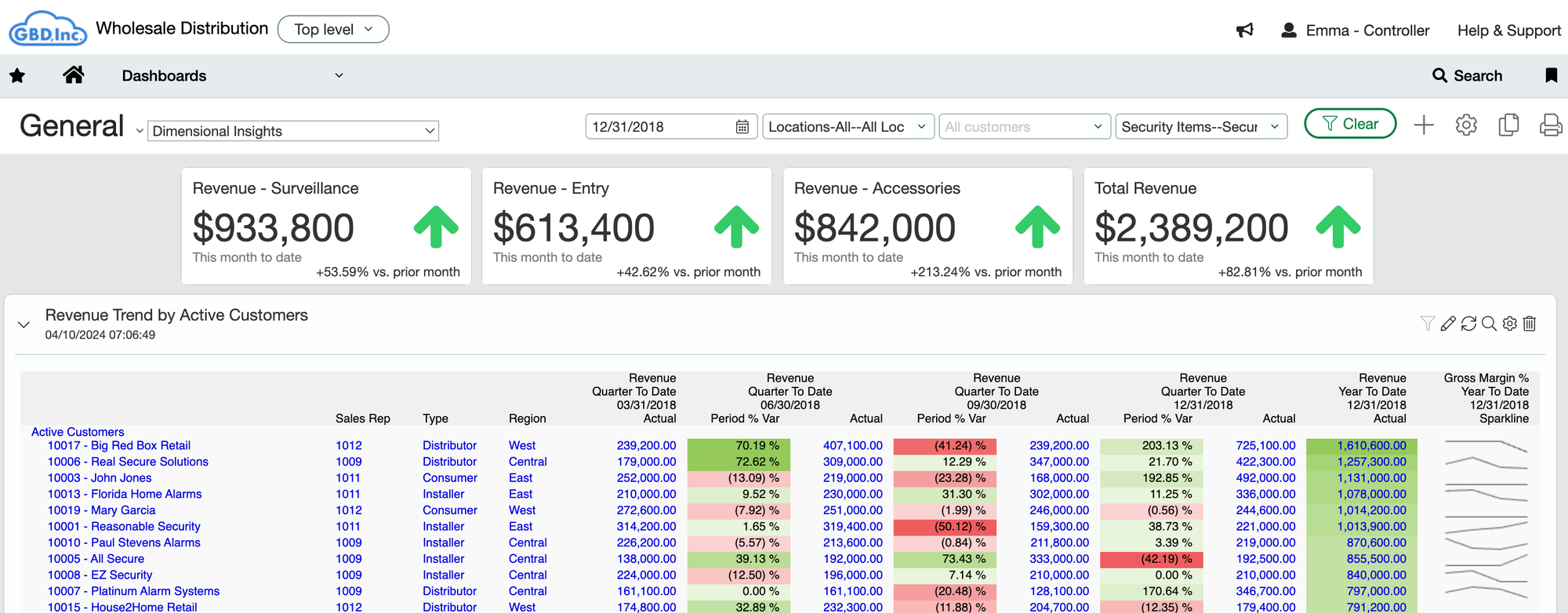

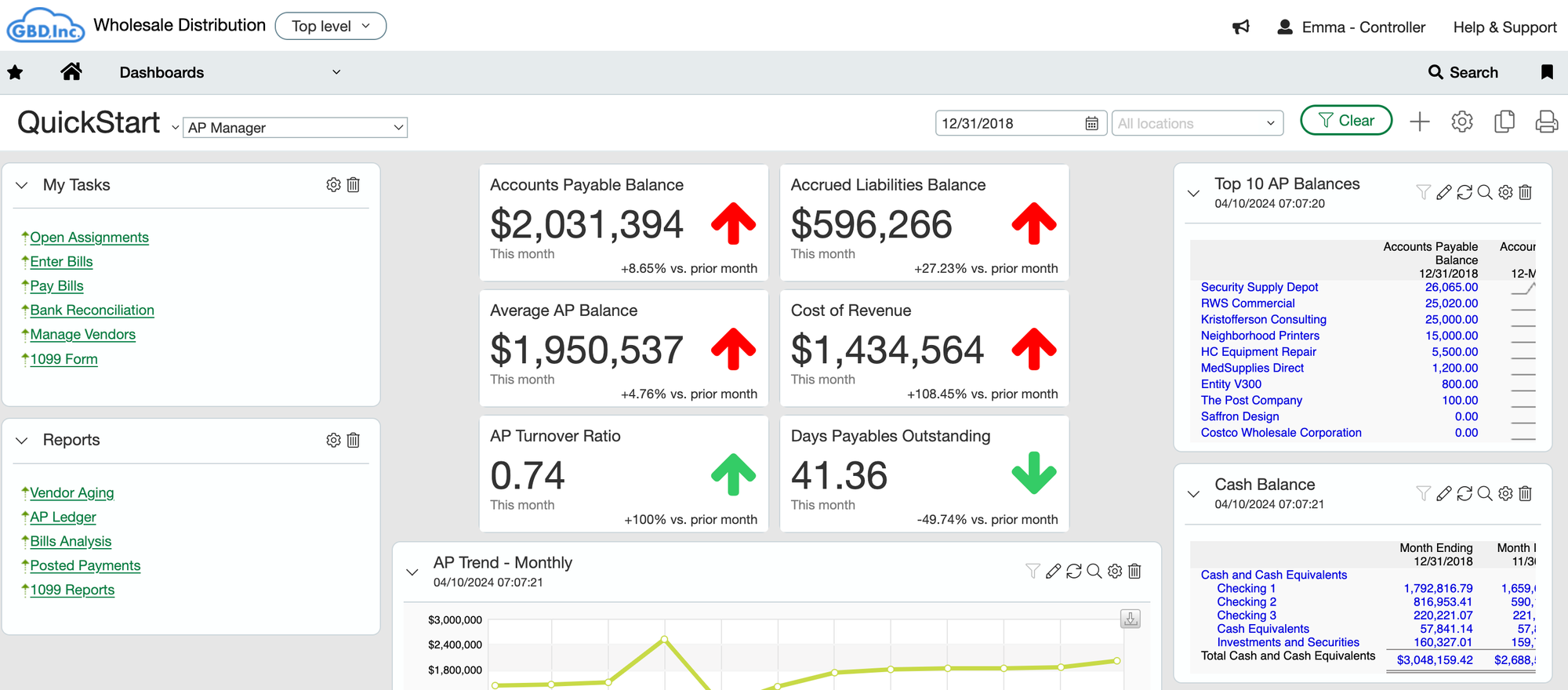

- Dashboard & Insights: Turn data into insights and reach peak performance with rich, flexible, real-time financial reports and customizable dashboards.

Sage Intacct Accounts Payable (AP)

Accounts payable, or AP is the amount of money a business owes to its vendors for goods or services that have been delivered but have not been paid. The AP department is responsible for keeping a close record of invoices, ensuring that payments are processed accurately and on time, and maintaining detailed financial records.

Sage Intacct powers the Accounts Payable team with insights. It also enables bills, reconciliation, and other relevant tasks.

Traditionally, AP workflows involve a substantial amount of manual effort. Here's a breakdown of a typical manual AP process:

- Invoice Reception: Invoices arrive from vendors via various channels, including email, mail, and fax.

- Data Entry: Manual data entry involves keying invoice details like vendor name, invoice date, invoice amount, and due date into the accounting software. This repetitive task is prone to errors.

- Approval Workflow: Invoices are routed to designated personnel for approval based on pre-defined criteria, often involving physical paperwork and manual routing.

- Payment Processing: Once approved, payments are manually initiated through checks or ACH transfers.

- Recordkeeping: Invoices and payment records are meticulously filed for future reference and audit purposes.

The manual AP process could be more active, vulnerable to human error, and labor-intensive. Account Payable Automation, or APA, becomes crucial to digitizing, streamlining, and optimizing.

It's estimated across industries that AP automation can cut costs by 81% and improve efficiency by 73%, making it a top priority for CFOs.

We will deep dive into how to get started with automation and gain these benefits

Sage Intacct AP Automation

Sage Intacct offers two main ways to automate your accounts payable (AP) process:

- Sage Intacct AI: Sage has a built-in AP automation feature with AI capabilities. Here's what it can accomplish

- Upload an invoice, and Sage can capture data from the invoice

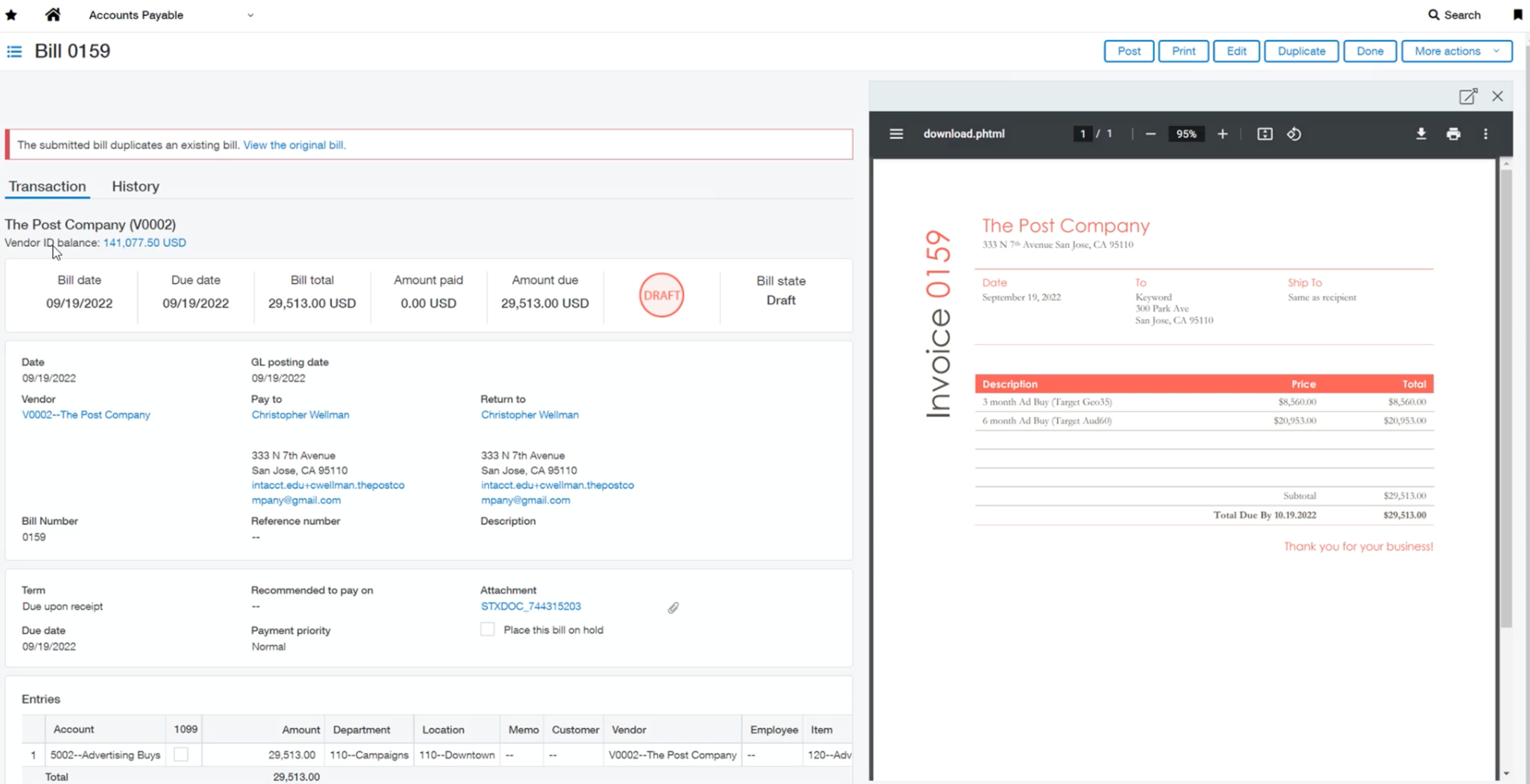

- It also flags any duplicate invoices

- Third-party AP Automation Integrations: Sage Intacct boasts of a wide range of integration and technology partners, some in their Marketplace. They offer solutions with a broader range of functionalities, including:

- Accurate capturing of Invoice data from various sources

- Two/Three way matching for Purchase Orders

- Approval rules and workflows

- Payment Integrations

Sage Intacct AI for AP Automation

Sage has a built-in AP automation feature with AI capabilities. Sage Intacct automatically identifies the vendor and fills in your bill details.

To activate your account, you'll have to contact your account manager.

Sage Intacct AI automates each part of the above-mentioned manual AP process.

Invoice Reception

The following events trigger the automated billing process:

- You upload bills within Intacct using the Upload button on the Bills list.

- You forward bills to the email address we provide or ask vendors to send bills to that address.

- Intacct assigns a unique email address for bill automation to each entity in your company and the top level.

Data Entry

For each Bill document you submit, the system creates a corresponding Sage Intacct bill in a draft state and attaches the original bill document.

Using artificial intelligence and machine learning (AI/ML), Intacct fills in bill details, automatically matching vendor information and including:

- Data captured from the uploaded or emailed Bill, such as the bill number, date, line items, and amounts

- GL account and dimension coding, based on your past transactions, for Early Adopters

- Machine learning insights gained from your historical transaction patterns

When the analysis is complete, AP Automation saves the Bill as a draft, ready for you to review and then submit or post.

Reviewing and posting incoming bills

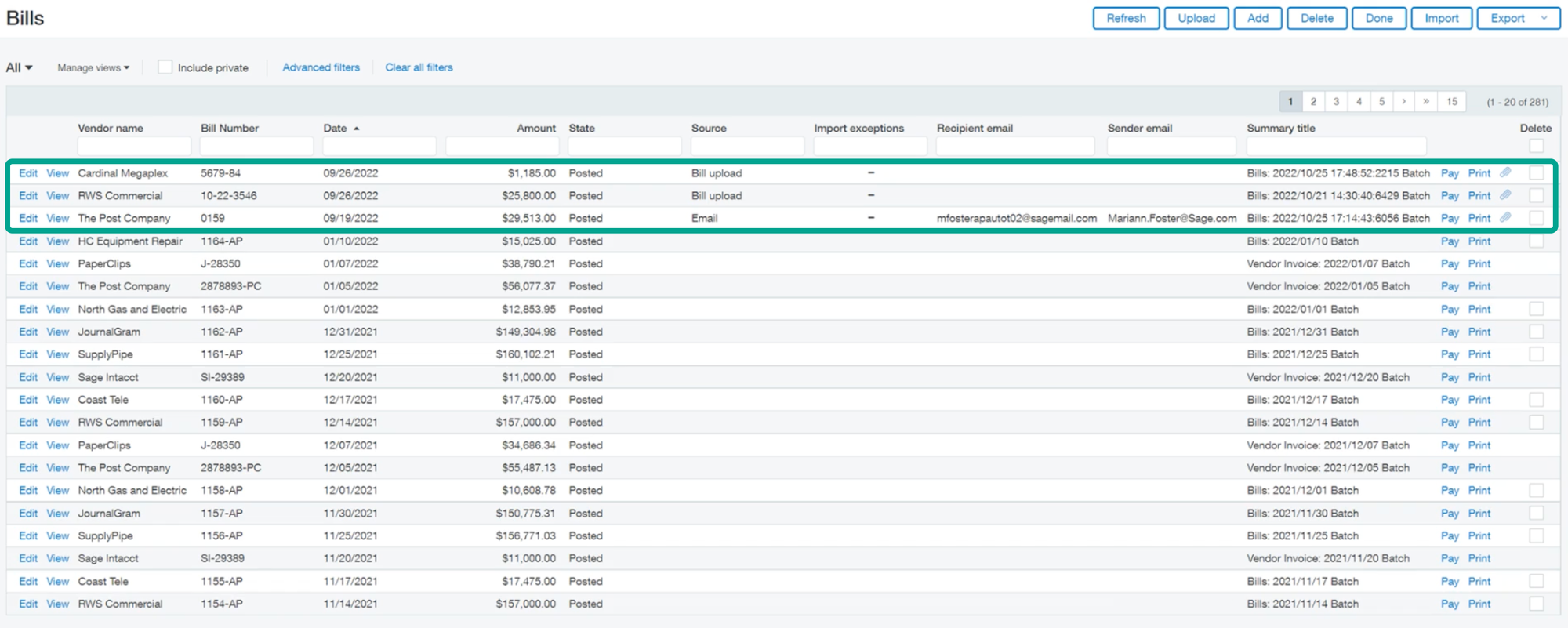

Draft bills created using AP Automation appear in the Bills list. When you first load the Bills page, it shows new incoming automated bills. At any time after loading the page, you can select Refresh to see newly arrived bills and updated bill states.

- To review and update a bill, select Edit on that row.

- Review bill details and edit them as necessary. Select Post or Submit.

The Bill has been updated, and you have been returned to the Bill's List. As depicted in the screenshot below, you can review the bills, post them, and approve payments, too.

Approvals & Payment Processing

Setup approval process by following the below steps:

- Go to Accounts Payable >Setup > Configuration.

- In the Payment Approval Settings section, define your approval process.

- You specify how many levels of approval you want, the amounts that require approval, and the number of required approvers.

Permit at least one user to approve payments for each approval level in your approval process. Admin users can approve payments by editing the Accounts Payable permissions and giving permissions to Approve payments for both the List and the approval level.

The approval process allows you to approve payments before they can be paid. You can agree to or decline payments for which you have the appropriate level-setting

- Go to Accounts Payable > All > Payments > Approve payments

- Select Approve or Decline. If you approve a payment, the bill will be paid using the selected payment method.

This is a glimpse of how you can accomplish AP automation with Sage Intacct AI. While this is a capable solution, it still has areas of improvement where third-party integrations from Sage Intacct Marketplace can come into the picture. They offer solutions with a broader range of functionalities, including:

- Accurate capturing of Invoice data from various sources

- Two/Three way matching for Purchase Orders

- Complex Approval rules and workflows

Nanonets: Your Sage Intacct AP Automation Champion

Nanonets is a powerful AP automation solution that leverages the magic of Artificial Intelligence (AI) to streamline invoice processing.

Trusted by over 10,000+ brands, Nanonets is a Sage Intacct Marketplace Partner with best-in-class invoice recognition and AI software for accurate recognition and processing of AP

Here's a glimpse into how Nanonets automates the AP workflow:

- Automated Invoice Receipts: Importing invoices into Nanonets from multiple sources is the best in class

- Automated Data Entry: Nanonets extracts structured data from your invoices, irrespective of the invoice format and whether the invoice is scanned or digital.

- Automated Verification: Two-way matching and beyond. Match invoice information against open Purchase Orders, Delivery Notes, and other AP documents.

- Multi-stage Approval routing: Send automated notifications to the right person in the organization to review invoices before approval.

- Automated Payment Scheduling and Processing: Pay invoices using any payment method

- Real-time syncing: Import your Sage chart of accounts and create rules to code documents from your Vendors.

By automating these critical tasks, Nanonets significantly reduces manual effort, minimizes errors, and expedites the AP process, allowing your team to focus on more strategic endeavors.

Unleashing the Power of Integration

Integrating Nanonets with Sage Intacct unlocks many benefits for businesses of all sizes. Here are some of the most compelling advantages:

- Reduced Effort: Nanonets automates invoice processing, freeing up your AP team.

- Enhanced Accuracy: Integration reduces errors and ensures data integrity.

- Faster Processing: Automate tasks for quicker approvals and payments.

- Increased Visibility: Gain insights into data with real-time dashboards.

- Improved Compliance: Ensures a streamlined and auditable AP process.

Integrating Nanonets with Sage Intacct can automate and optimize accounts payable operations. This combination can streamline the AP process, reduce costs, and empower the team to focus on more strategic initiatives.

Taking the First Step Towards AP Automation

Nanonets automates accounts payable, driving efficiency, accuracy, and a robust financial process. With Nanonets, you can leverage AI and machine learning to harness the next level of efficiency in financial management.

Eliminate errors, automate tasks, and seamlessly integrate all your AP workflows. See how Nanonets tailors solutions with a free demo.