Reconciliation is the matching and verification of financial transactions across multiple documents and accounts, with the aim of ensuring there are no discrepancies. This is a crucial aspect of business operations, providing insights into a company’s spending and financial health in real-time.

Typical manual account reconciliation methods are time-consuming and error-prone, risking discrepancies in reporting, matching, and decision-making. But the advent of intelligent automation is changing the reconciliation and financial reporting landscape, offering smart, efficient solutions that streamline processes and increase accuracy and efficiency..

Advanced accounting automation softwares like Nanonets have revolutionised financial reconciliation by optimising how businesses manage their financial reporting, spends and inflows, and maintain up-to-date books. With its AI/ML and Optical Character Recognition (OCR) technology, Nanonets automates many of the tedious manual steps involved in reconciliation, saving time, reducing errors, and improving business outcomes.

Let’s look at the reconciliation processes and how a reconciliation software like Nanonets simplifies processes for your finance department.

Looking out for a Reconciliation Software?

Check out Nanonets Reconciliation where you can easily integrate Nanonets with your existing tools to instantly match your books and identify discrepancies.

The Manual Reconciliation Process Explained

Traditionally, businesses have followed a multi-step process to perform account reconciliations:

- Collecting & Comparing Documents: Initially, businesses gather bank statements, cash registers, and proof of payments to compare them. Each transaction listed in the bank statement should correspond with an entry in the cash register, accompanied by proof of payment.

- Extracting Data from Documents: To ensure accurate comparison, data from the documents must be extracted. This task typically involves manual data entry into spreadsheets or utilising a bank statement to CSV converter.

- Matching Entries: Once the data is extracted, entries that match across all three documents are identified and marked accordingly.

- Addressing Discrepancies: Not all entries will match, requiring further investigation. Accountants must identify the reasons for discrepancies and adjust balances accordingly, assigning proper expense categories where necessary.

- Verifying Ending Balance: Finally, the ending balance of the general ledger should align with the bank statement balance after all adjustments are made.

This manual process entails:

- Manually matching documents or utilising various Excel sheets.

- Collecting proof of payments manually.

- Inconsistencies in processes, as each accountant may follow slightly different steps.

To eliminate manual elements from this process, businesses can leverage accounting automation software like Nanonets. But before diving into automation, it's essential to address a crucial question.

What is Automated Reconciliation?

Automatic reconciliation, also known as automated reconciliation, is a process of comparing and matching financial transactions between different data sources with minimal human intervention. It involves the use of advanced technologies such as artificial intelligence (AI), machine learning (ML), and automation software to streamline and expedite the reconciliation process.

In essence, automatic reconciliation eliminates the need for manual intervention in matching transactions, thereby significantly reducing the time, effort, and resources traditionally required for reconciliation tasks. By leveraging algorithms and predefined rules, automatic reconciliation software can quickly identify and resolve discrepancies between various financial records, including bank statements, invoices, purchase orders, and general ledger entries.

The key objective of automatic reconciliation is to ensure accuracy, consistency, and efficiency in reconciling financial data, thereby enabling organisations to maintain precise and up-to-date financial records. This automated approach to reconciliation is particularly valuable for businesses with high transaction volumes, complex financial structures, and stringent regulatory requirements.

How does Automated Reconciliation Work?

Automated reconciliation works by leveraging technology to automate the comparison and matching of financial transactions across multiple data sources. Here's a breakdown of the typical steps involved in the automatic reconciliation process:

- Data Acquisition: Automatic reconciliation software retrieves financial data from various sources, including bank statements, accounting systems, invoices, and purchase orders.

- Data Standardization: The retrieved data is standardised and normalised to ensure consistency in format and structure, facilitating accurate comparison and matching.

- Matching Algorithms: Advanced matching algorithms are applied to compare the financial transactions from different sources. These algorithms utilise predefined rules, logic, and criteria to identify matching transactions based on key attributes such as date, amount, reference number, and description.

- Exception Handling: In cases where discrepancies or mismatches are detected, the automatic reconciliation software flags these exceptions for further review. Users can define exception handling workflows to investigate and resolve discrepancies efficiently.

- Resolution and Reconciliation: Upon identifying and resolving discrepancies, the automatic reconciliation software updates the reconciled transactions in the organisation's financial records. The software generates reconciliation reports and audit trails to document the reconciliation process and ensure compliance with regulatory requirements.

In the coming sections, we will explore various automation reconciliation softwares, each of which offer benefits and features that you can choose from based on your business’ needs. Before that, we’ll also cover the benefits and risks associated with using automation reconciliation software.

Benefits & Risks Associated with Automatic Reconciliation

By leveraging advanced technologies and automation software, businesses can streamline the reconciliation process, enhance accuracy, and unlock numerous benefits. But there are also risks associated with the process, knowledge about which can help mitigate them. Below, we explore both the benefits and risks of automated reconciliation, providing insights into how organisations can harness its potential while avoiding challenges.

Benefits: Automated reconciliation streamlines the reconciliation process, reducing the time and effort required for manual tasks. It enables organisations to reconcile large volumes of transactions quickly and accurately, therefore improving the efficiency of the process.

By automating the matching process, automated reconciliation minimises the risk of human error and discrepancies in financial records. It ensures greater consistency and reliability in reconciled data, leading to improved financial reporting and decision-making.

Automation reduces the need for manual labour, resulting in cost savings associated with labour hours and resources. It enables finance teams to focus on value-added activities rather than repetitive reconciliation tasks.

Automated reconciliation also provides real-time visibility into financial transactions and reconciliation status, enabling organisations to make informed decisions. It provides a ready-made audit trail of a business’ important financial transactions, enabling not only better financial management but also easier compliance with regulatory requirements.

Risks: There may be challenges implementing automated reconciliation software, as there needs to be initial investment in technology infrastructure, training, and integration with existing systems. Organisations will need to customise and configure the software to align with their specific reconciliation processes.

While automation reduces the risk of human error, it relies on accurate and consistent data inputs. Inaccurate or incomplete data may lead to incorrect reconciliation results and decision-making.

Automatic reconciliation software may handle sensitive financial data, raising concerns about data security and privacy.Organizations thus need to implement robust security measures to protect financial information from unauthorised access or breaches, as well as choose vendors that have built-in security protocols to prevent this.

Organisations become reliant on automatic reconciliation software for critical financial processes. Any system failures, technical glitches, or software updates may disrupt reconciliation operations and impact business continuity.

In conclusion, while automatic reconciliation offers significant benefits in terms of efficiency, accuracy, and cost savings, organisations need to carefully assess and mitigate the associated risks to maximise the effectiveness of automated reconciliation.

Nanonets for Automated Account Reconciliation

Automating account reconciliation with Nanonets offers a seamless and efficient solution for businesses seeking to streamline their financial processes. With its advanced AI/ML models and OCR technology, here's how Nanonets transforms the reconciliation process:

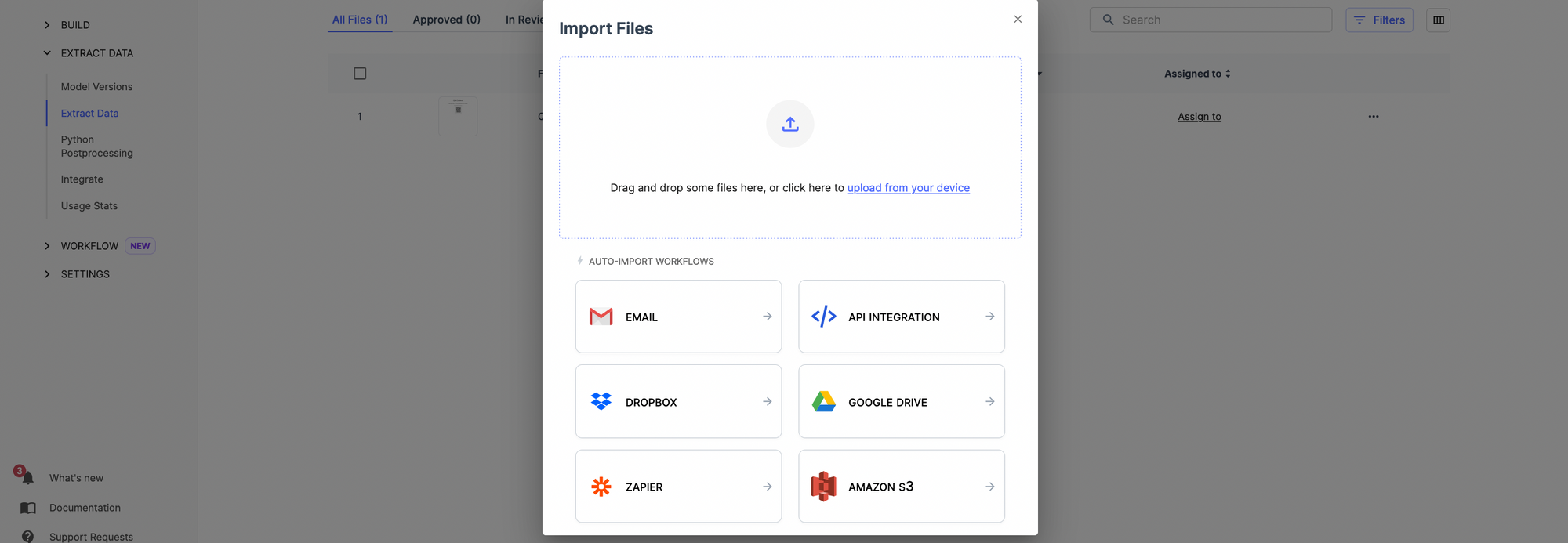

- Document Input: Easily upload bank statements, cash registers, and proof of payments to Nanonets through various channels such as email forwarding, Google Drive, or direct integrations. Nanonets automates the document upload process, eliminating the need for manual collection.

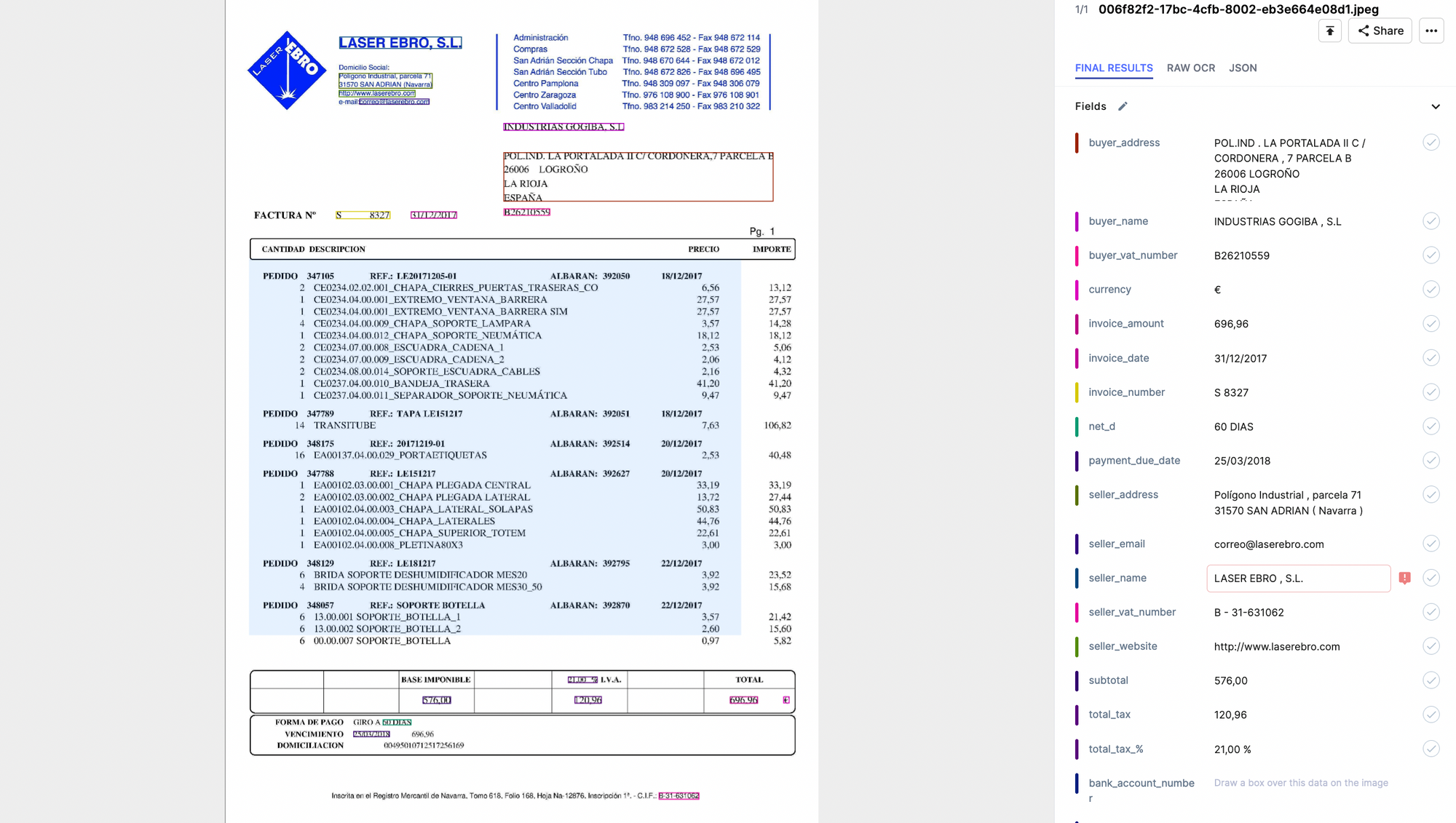

- Document Data Extraction: Once documents are uploaded, Nanonets automatically categorises them using its document classifier. It then extracts relevant data such as time period, currency, comments, transaction details from tables in bank statements and cash registers, subtotals, and total amounts. This data is converted into a preferred format such as CSV, providing convenience and flexibility. [See how it works with Nanonets’ PDF to CSV tool.]

- Document Data Matching: Utilise rule-based workflows to match extracted data seamlessly. Nanonets' workflows are configured to match data accurately and swiftly, ensuring efficient reconciliation. Now that you have the data, you can use rule-based workflows to match the data. Once set, the workflows will match data in seconds.

- Flagging & Sending Data for Review: Any discrepancies in the matched data are flagged for review using automated approval workflows. Businesses can set up rules to route queries to the appropriate reviewer, who then receives notifications to review non-matching entries and suggest adjustments to reconcile ending balances.

- Document Annotation: Reviewers have the option to add comments directly to the documents, promoting collaboration and reducing the risk of errors in the final file. Nanonets facilitates transparent communication and feedback among team members involved in the reconciliation process.

- Final Review: Upon completion of the reconciliation process, reviewers receive the final file for thorough inspection. They double-check all entries and approve the file with any necessary corrections, ensuring accuracy and completeness.

- Update Matching Entries: Once approved, all reconciled entries are seamlessly updated in the ERP or accounting software. Additionally, Nanonets allows businesses to create new files on platforms like Google Sheets or their preferred database, containing all extracted data for further analysis and reporting

By leveraging Nanonets for automated account reconciliation, businesses can streamline their financial operations, reduce manual effort, and improve accuracy, ultimately enhancing efficiency and productivity.

Top Automated Account Reconciliation Software

Apart from Nanonets, there are other reconciliation softwares that can help you with account reconciliation automation. Here are three popular options:

Xero

Xero is a powerful accounting software for small businesses, accountants, and bookkeepers. It offers features like capturing bank transactions daily, custom rules to match invoices & bank transactions, and grouping of similar spends. Xero + Nanonets are a perfect match for mid to large-size businesses looking to combine the power of intelligent document processing and simple accounting software.

Blackline

Blackline specialises in financial close management with many reconciliation tools like templates, procedures, policies, and workflows. Blackline reconciliation software provides powerful reporting capabilities to monitor reconciliation processes. You’ll still have to enter data into Blackline, which you can automate using Nanonets.

ReconArt

ReconArt provides an easy-to-use reconciliation software for bank reconciliation, ,credit card reconciliation, balance sheet reconciliation, financial close, accounts reconciliation, variance analysis, journal entry, and intercompany reconciliation. ReconArt doesn’t have a free version, and their monthly plans start from $1500.

Why Choose Nanonets for Your Reconciliation Needs?

Nanonets offers a comprehensive suite of features and benefits that make it the ideal choice for businesses seeking to streamline their reconciliation processes. Here's why Nanonets stands out:

- Simplified Workflow: Nanonets provides a simplified reconciliation workflow that automates tedious manual tasks, saving time and effort for your finance team.

- 24x7 Support: With round-the-clock support, Nanonets ensures that you have assistance whenever you need it, ensuring smooth operations.

- Free Trial: Experience the power of Nanonets with a free trial, allowing you to explore its features and functionalities risk-free.

- Free Migration Assistance: Nanonets offers free migration assistance, making it easy to transition to its platform without any hassle.

- Flexible Pricing Plans: Choose from flexible pricing plans that suit your budget and requirements, ensuring cost-effectiveness.

- Customization Services: Customise Nanonets' OCR models and workflows according to your specific use cases, ensuring a tailored solution for your business needs.

- 5000+ Integrations: Benefit from Nanonets' extensive integrations with over 5000 platforms, enabling seamless connectivity with your existing systems.

- Training Support: Nanonets provides comprehensive training support to ensure that your team is equipped with the knowledge and skills to leverage its capabilities effectively.

- No-Code Platform: Nanonets offers a no-code platform that allows you to automate reconciliation processes without the need for coding expertise, making it accessible to users of all skill levels.

- Dedicated Customer Success Manager: Receive personalised assistance and guidance from a dedicated customer success manager, ensuring a smooth and successful implementation of Nanonets.

- Cloud or On-Premise Hosting: Choose between cloud-based or on-premise hosting options based on your preferences and requirements.

By choosing Nanonets for your reconciliation software, you could solve all your reconciliation problems. Enhance financial visibility, update your financial records on the go, match bills with bank transactions with zero errors, and ensure timely review of entries, ultimately optimising your reconciliation processes for maximum efficiency and accuracy.

You can book a free consultation call with Nanonets here.

Conclusion

Real-time financial data helps you make proper business decisions. With reconciliation software, automate all your finance processes while reducing costs, saving time, and enhancing productivity. With so many benefits, it would be difficult not to try it.

Nanonets can automate reconciliation processes efficiently while seamlessly integrating with your existing tech stack. With a 14-day free trial, you get to experience all its features, including 24x7 support and free migration assistance. Get on a free consultation call now or start a free trial.