What is Invoice Capture & Why is it important In 2024?

Invoice data capture and processing is a vital function of the Accounts Payable department in any company.

It is the process of extracting relevant data such as invoice number, supplier name, address, amount etc., from invoices, validating the extracted information, uploading it to an ERP software, ascertaining match (against receipts & POs) and finally initiating payments.

A methodical invoice data capture prevents backlog, transaction errors, and enables seamless “closing of the books”.

Efficient invoice capture carries with it the following benefits:

- Reduces back-office cost and time investment by streamlining documentation and organising data.

- Highlights mismatch errors & keeps track of financial transactions and ensures smooth audits.

- Improves compliance to a format suited to a company’s needs and core competencies, and thus makes it independent of operator judgement.

Errors, delays, mismanagement, and inaccuracies in invoice capture could lead to frustration and relationship issues between departments and with vendors/clients.

Challenges in Invoice Data Capture

Invoices are often handled in varying formats/layouts across companies – as hard copy, as email attachments and as electronic data interchange (EDI); 43.8 per cent of invoices continue to be received by fax today.

The processing of invoices in these multiple formats can be time and effort consuming. This often leads to errors and resulting delays in processing documents.

A 2017 Billentis report showed that organizations continue to use manual invoice management methods to process over 90% of their invoices. Considerable delays result in invoice processing when the invoice management is manual. A recent survey found that nearly 45 per cent of invoices take a week or longer to process when five or more people are required to process and/or approve the invoice.

The common challenges in traditional invoice processing are:

- Difficulty in supplier management beyond a critical size.

- Delayed payments due to the tedious vendor matching process.

- Miscommunication between vendors and suppliers.

- Too much email and paper that requires physical file storage and organization.

- Lapses and complications in inter-departmental communication.

- Possibility of errors in payments.

- Poor visibility: Sharing of the invoice details with others in the department or other departments becomes tedious using paper based invoice management.

- Poor scalability: As the scale of operations grows, manual management of invoice becomes difficult, if not impossible.

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Automation in Invoice Capture

With business data and transactions increasingly going digital, companies are turning towards automated invoice capture (or invoice automation) solutions. Various levels of automation/digitization are possible when it comes to invoice data capture.

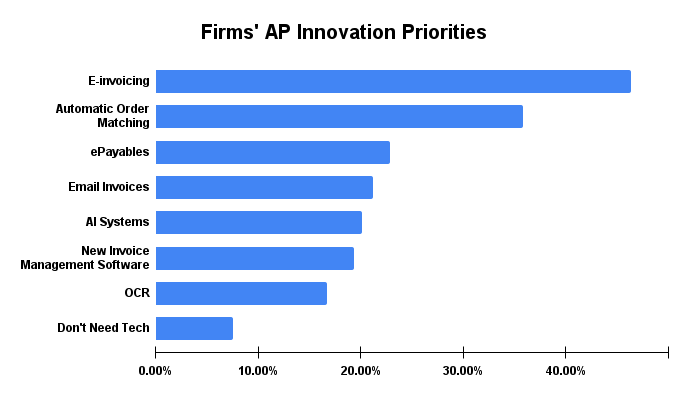

According to a recent survey, here are the top automated invoice processing solutions that AP teams would like to implement:

While electronic invoicing involves the client/customer filing an e-invoice in a standardized format, it hasn't gained universal acceptance. Most invoices continue to be either sent as hard copies by snail-mail/fax, or as an email attachment in various file types, styles and formats.

The capture of relevant data from these invoices is the first step towards automation. Thus, automated invoice data capture entails extraction of relevant information from invoices in structured formats such as csv, Excel, XML or JSON. Such structured data can then be easily fed/integrated with ERP software.

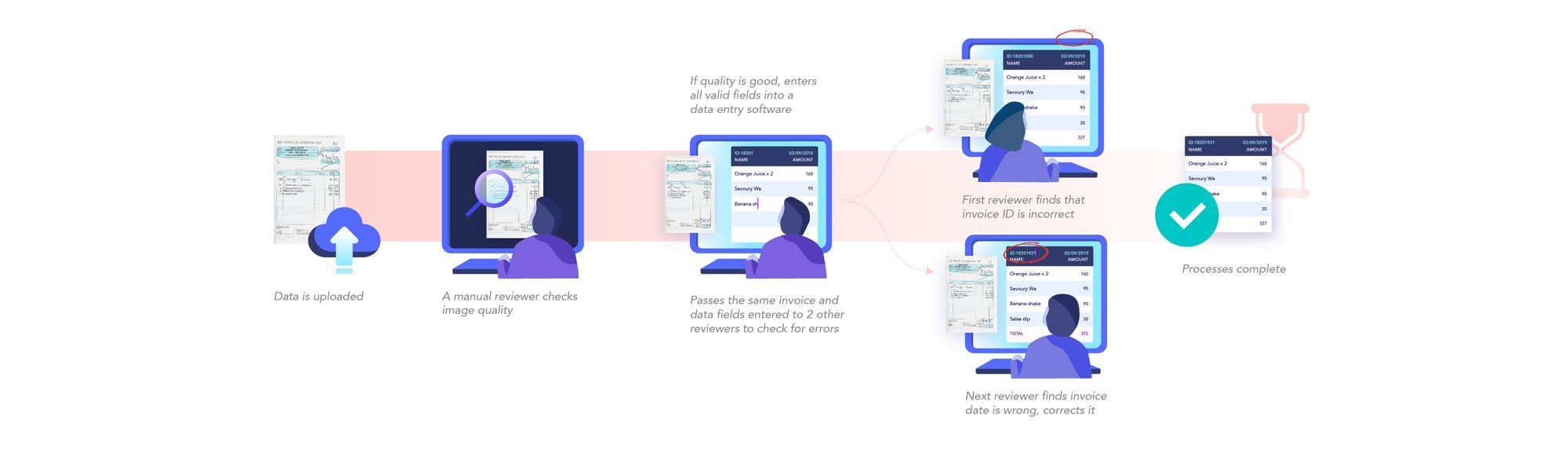

Here's graphical representation of a typical automated invoice processing workflow:

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

Types of Invoice Data Capture Solutions

The capability of the tools used for invoice capture determines its efficacy, cost, and impact on business processes. At the fundamental level, there are three types of invoice capture solutions:

Manual Data Entry:

An operator physically sees the paper or electronic invoice and enters relevant data into an appropriate program in the computer. Here's a detailed analysis of the manual invoice processing approach.

Advantages:

- Good for small companies with limited operations

Disadvantages:

- Time-consuming

- Error-prone

- Unsuitable for large volumes of data

Hence the increasing demand for automated data entry solutions

Traditional or Template-based Invoice OCR:

This type of solution works best for organizations that deal with a limited set of known invoice formats. Businesses that receive invoices from the same set of suppliers are an ideal use case for such solutions. They can make template-based rules for data/information extraction and validation.

Advantages

- Relatively low capital investment

- No need for coordination with suppliers

- No need for outsourcing

Disadvantages

- Return on investment poor because of requirement of support staff in addition to the software

- High error rates

- Validation of errors and exception required, which can lead to delays and cost penalties

- High level of verification required

Cognitive or AI-based Invoice OCR:

AI-based invoice OCR software, like Nanonets, intelligently capture relevant data from a variety of formats and forms. They leverage advanced AI & ML capabilities to ensure a high level of automation & intelligent document processing. This is unlike rigid template-based approaches such as zonal OCR.

Unlike template-based alternatives, AI-based OCR solutions "learn" to recognize important data even in unknown documents & formats. The continuous "learning" process ensures that such software maintain a high-level of accuracy and fidelity with respect to extracting relevant data.

Advantages

- Faster Invoice Processing: AI-enabled invoice data extraction takes an average of 27 seconds as against 3.5 minutes for manual capture.

- Cost effective: AI-based data capture is cost-effective; processing an invoice through any AI-based solution costs about $0.05/invoice, as against 1 to $5 per invoice for manual processing

- Enhanced Data Accuracy: AI/ML algorithms detect and capture invoice data using neural networks to minimise errors that are typically associated with manual data capture

- Algorithms don't get bored/tired while doing dull repetitive tasks; in fact they keep getting better

- Increased Productivity: With AI handling repetitive, time consuming tasks, the AP team can shift their focus on value-generating activities, such as financial planning, collaborations, improving interactions etc.

- Integrations with ERP & accounting software

Disadvantages

- Transitioning from legacy systems to an automated worflow might require some technical know-how

- Would require a fundamental change in management & overall processes

- While an apparent challence, this can act as a trigger for best practices across AP

Book this 30-min live demo to make this the last time that you'll ever have to manually key in data from invoices or receipts into ERP software.

Must Have Features for Efficient Invoice Capture

The Invoice Capture tool to be chosen by an enterprise depends upon the type of invoices that must be captured. Invoice scanning typically fall under 2 broad categories: “known invoice formats” vs “unknown invoice formats”.

- Known Invoice Formats: When the company deals with a fixed set of suppliers and vendors, the invoices are typically processed from the same bunch of suppliers/vendors month after month. Such companies can use a pre-trained invoice scanner offered by automated OCR software like Nanonets. Alternately, businesses can refine the pre-trained invoice scanner to recognize and capture data from the specific types of invoice formats that they receive.

- Unknown Invoice Formats: When businesses have to deal with a rapidly changing list of suppliers, various types of invoices must be captured. Such companies can leverage AI & ML capabilities such as those available in software like Nanonets to take on unknown invoice formats. Such AI based automated invoice scanners get more accurate with time.

Whether dealing with known formats or unknown formats, here are a few vital features that you should look for in automated invoice processing tools:

- Fields Captured

- Intelligent Key Value Pair Match

- Table Capture and Extraction

- Intuitive UI

- Three Way Match

- Customizability

- Pricing and Affordability

- Integrations

- Customer Support

Fields Captured

Some key fields that must be captured by the OCR from an invoice are:

- Vendor details: Seller Name, Seller Address, Seller Phone, Seller Email, Seller bank account details

- Invoice details: Invoice number, Invoice date, Invoice amount, Payment due date, Net_D, PO number, Currency

- Buyer Details: Buyer Address, Buyer Name

- Tax Details: Tax Amount, Tax_ID

- Table Details: Product Description, Quantity, Price, Line Amount

Intelligent Key Value Pair Match

A key-value pair is the variable and it's associated text value mentioned in documents (invoices). The key-value pair is the feature that is extracted and its associated value. E.g. “Invoice number” is the key and “002” is the value.

Traditional rule-based OCR engines struggle to recognize fields where keys are not clearly mentioned, or the name varies; for example, some invoices can have an "invoice number", while others call it "bill number".

An automated invoice capture software must be able to recognize various key-value pairs accurately.

Table Capture and Extraction

Most invoices have the transaction data in the form of tables. The tables may be captioned or not, have borders or not, and may be of different formats. A good AI-based invoice capture OCR must be able to recognize various types of tables and columns to extract relevant data from them.

Intuitive UI

There is a certain amount of human intervention involved in invoice management, especially in checking for accuracy & validating results; the software must be easy to use for human operators.

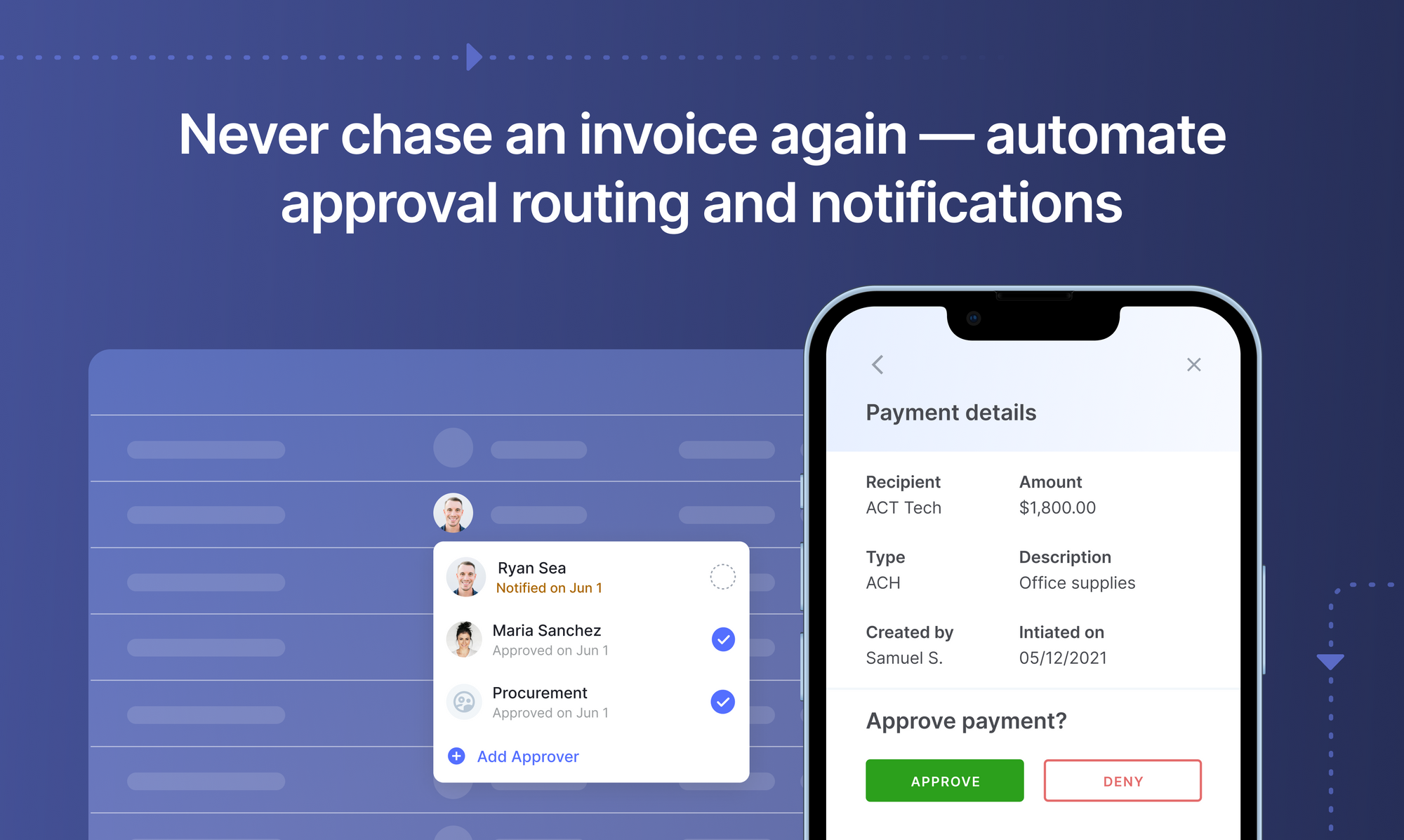

Three Way Match

An invoice is not a standalone document in a business transaction. It is often associated with a Purchase Order and a Receipt. The invoice capture OCR must be able to match all three documents associated with a single business transaction.

This means that your software should also recognise other document types (like POs and receipts) as well as have connectors to other databases where values can be looked up and matched.

On-Premises Deployment

Companies tend to prefer on-premise deployment of solutionsOn-Premises, especially when handling sensitive data (such as invoices & receipts). It is easier to comply with data privacy/security standards such as the GDPR, when you run such software on-premises.

Customizability

It should be easy to add new custom fields to the invoice capture tool to render the tool flexible for use with different types of invoices.

For example, construction/repair job invoices have additional fields called "job code" that are specific to their industry. The invoice capture tool must allow the addition of new fields and training the custom model for growth and modifications in operations.

Pricing and Affordability

Most invoice capture tools have opaque pricing requiring you to talk to their Sales team. Very few tools are transparent about their pricing and display it openly.

The cost of the system, setup fees, hidden charges and maintenance charges are some aspects that must be discussed before finalizing a solution.

Free trials can help potential users understand the software, assess the accuracy and test the performance before integrating the invoice capture tool with other downstream systems (ERPs).

Integrations

Invoice capture does not stop with the capture of data from invoices. This data needs to be fed into other systems such as ERPs (e.g. SAP, Oracle), accounting software (e.g. Quickbooks, Xero) and CRM (e.g. Salesforce) for payments to be processed.

A robust invoice capture tool should support integrations along with easy-to-use APIs and documentation.

Customer Support

Live and instant support is a critical component for ease of use of any software purchase. Look out for options that offer on-chat support 24X7.

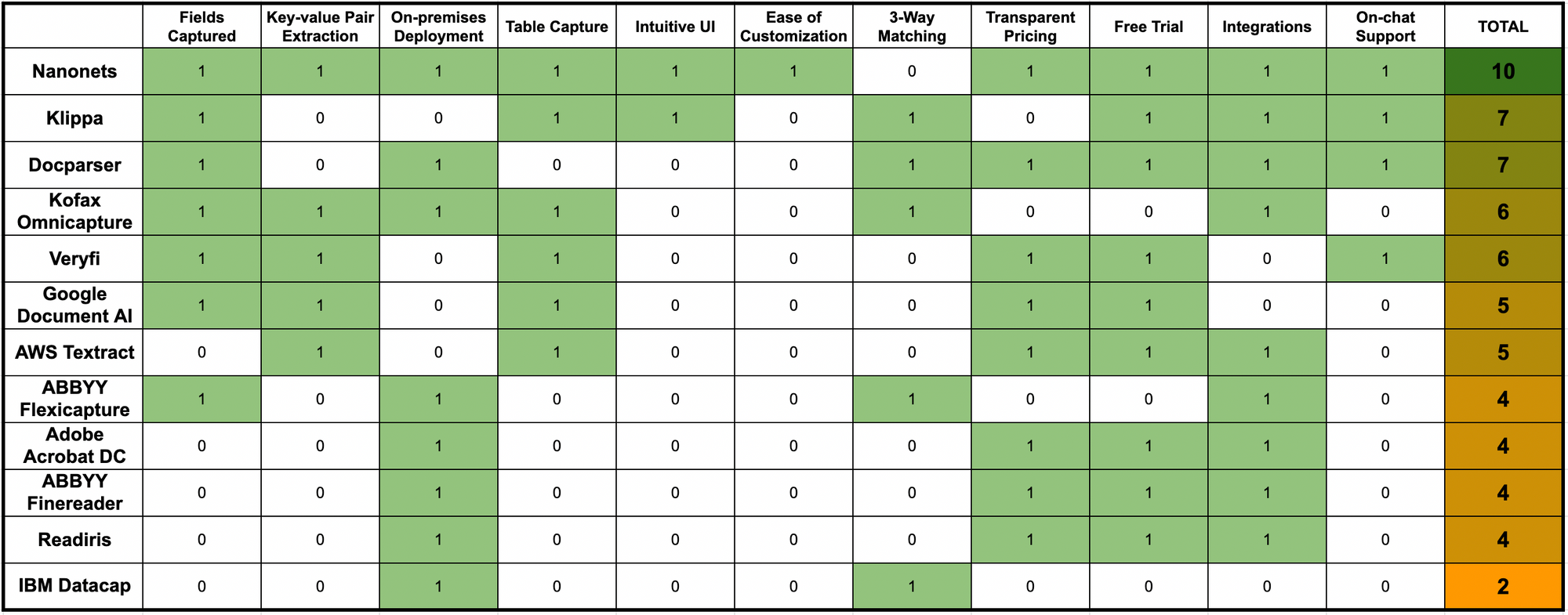

Comparing Various Invoice Capture Software

There are a range of cognitive OCRs available in the market for invoice capture & management. Some popular ones are Nanonets, Abbyy Flexicapture, Kofax Omnicapture, IBM Datacap, Google Document AI, Klippa and Veryfi.

Here's quick a comparison of various invoice or AP automation tools across the key features dicussed in the section above:

Scoring Mechanism - 1 if the said feature exists in the tool; 0 if it doesn't.

Nanonets has many use cases that could optimize your business performance, save costs and boost growth. Find out how Nanonets' use cases can apply to your product.

Automated Invoice Data Capture with Nanonets

Nanonets offers an intuitive GUI, an excellent design, robust hyperparameter settings, and a transparent pricing policy. Here is where Nanonets clearly stands out from its competitors:

- Ability to customize - You can add your data to pre-trained invoice model and add custom fields to train a model all on the UI

- On-premises - You can run Nanonets on-premises via a docker. Nanonet is GDPR-compliant

- Save time and money - Reduce turnaround time (TAT) from days to minutes & document processing costs by 90%

- Support - On-chat support for real-time query resolution helps users navigate the sometimes complicated world of invoice capture.

- API documentation - In the documentation, you will find ready to fire code samples in Shell, Ruby, Golang, Java, C# and Python, as well as detailed API specs for different endpoints.

The Nanonets invoice capture software can connect data sources like e-mail, Google Drive etc with the API that feeds the captured data directly into your CRM/WMS/DB.

Nanonets online OCR & OCR API have many interesting use cases that could optimize your business performance, save costs and boost growth. Find out how Nanonets' use cases can apply to your product.

Update Oct 2022: this post was originally published in May 2021 and has since been updated.

Here's a slide summarizing the findings in this article. Here's an alternate version of this post.