8 Best Finance AI Tools in 2024

Traditionally, finance has been the domain of the smartest in our society.

Now, AI tools are pushing the limits of analysis and decision-making in finance, changing the lives and careers of finance professionals around the world. AI’s can analyze more data faster than any human can. They can make decisions on the margin with information updated with milliseconds of accuracy. All this means that finance professionals can concentrate on the higher-level decisions and on the most important thing of all: client relationships and customer experience.

What are finance AI tools?

Finance AI tools utilize artificial intelligence and machine learning technology to automate financial work, analyze, and make decisions. These improve efficiency and accuracy in any business, financial institution, or individual's strategic planning.

Benefits of AI in Finance

Enhanced Efficiency

Automation: Reduces time and effort on routine tasks like data entry and transaction processing. Increased Processing Speed: Processes large datasets quickly for timely decision-making.

Improved Accuracy

Error Minimization: Minimizes human error in calculation and data entry. Consistent Analysis: Ensures accurate and consistent financial analysis.

Advanced Data Analysis

Predictive Analytics: Estimates financial trends through historical data. Risk Management: Identification of risks and anomalies, facilitating proactive management.

Personalized Financial Services

Custom Suggestions: Offers tailored financial advice based on your information.

24/7 Support: AI chatbots and assistants improve customer service.

Cost Savings

Lower Operational Costs: Automation means reduced dependence on human intervention.

Resource Optimization: More efficient allocation and use of resources.

Strategic Planning

Data-Driven Insights: Informs strategic decisions through valuable data insights.

Market Analysis: Understand the market trend and competitors' behavior.

The biggest overarching challenge for finance professionals is data analysis for decision-making. This has many niche challenges under it: credit ratings, loan applications, underwriting, stock buy and sell decisions, cash flow management, and more. All of these involve processing large amounts of data – and the more, the better.

This list of finance AI tools covers the most useful and interesting tools available to address each of the challenges finance professionals face.

Top Finance AI Tools

Finchat.io

Finchat is another financial chatbot – one that solves a different problem. Finchat also includes transcripts of quotes from the company’s executives in addition to pure financial data. This makes it possible for Finchat to provide more accurate data, and data that can be used by human decision-makers to get better information faster.

There is no word currently on the accuracy of the responses generated by Finchat. Since it is such a new technology, and ChatGPT itself is still working out accuracy errors, it could be that it is not as accurate as it could be with the information it has available to it.

Pricing:

Starting Price: Free

Free Trial: Yes

Free Plan: Available

Pricing Plans:

Free Plan: $0 per month

Plus Plan: $29 per month

Pro Plan: $79 per month

Predict by Planful

Planful is a financial performance management software. It allows teams to make decisions faster, with the most accurate data.

It combines traditional data integration tools with AI analysis to give companies the best performance insights possible. The AI tool, called Predict, shows companies the weak spots in their company financials. This allows them to budget their time and resources to correct shortfalls before they start. This maximizes company efficiency.

Unlike some of the other AIs on this list, Planful and Predict are designed for CEOs and CFOs for their decision-making. This tool is not necessarily for low-level analysts. Instead, it does some of the work of those analysts.

Planful is a tool that could possibly take the place of low-level finance analysts: the sort of people who would crunch numbers in Excel before preparing the reports for the CFO. However, it still needs to be fed the right data.

Nanonets Flow

Nanonets Flow is an innovative AI-driven platform designed to streamline various finance-related tasks and address challenges faced by finance professionals. By leveraging the power of artificial intelligence, machine learning, and advanced data processing, Nanonets Flow automates complex processes, enabling finance professionals to focus on strategic decision-making and business growth.

At the core of Nanonets Flow is its ability to extract structured data from unstructured documents, such as invoices, receipts, and bank statements. By employing state-of-the-art OCR (Optical Character Recognition) and NLP (Natural Language Processing) technologies, the platform accurately extracts, validates, and organizes critical financial data, reducing the need for manual data entry and minimizing errors.

Pricing plans:

Free Trial: Yes

Paid Plans starts from $0.3/page

Contact our team to get the best price for your use case.

Domo

Domo was one of the earliest data analysis pioneers. Founded in 2010, it’s been on the data analysis scene for over a decade.

Domo’s specialty is focusing on integrating data from multiple sources into one clean dashboard for business decision-makers.

They strive to solve the problems of untimely data, data that is too hard to share with a team, and data that does not update in real-time. It gives teams the ability to work with one dashboard, pulling data in from Excel, Salesforce, Workday, and over a thousand other apps and finance tools.

Plans and Pricing:

Free Plan: Available

Custom Paid Plans: Starter, Enterprise & Business critical

Domo serves finance professionals through:

- Cash flow modeling

- Customer lifetime value

- Demand forecasting

- Risk modeling

- Remote work cost efficiency modeling

- Economic shock modeling

Domo does not strive to replace human decision-makers, but to empower those decision-makers to conduct faster analysis and make better decisions. Whether the decisions affect internal company matters or clients’ finances, Domo provides the data tools needed for the best possible outcome. Since Domo is a connector rather than a generator of data, there is also no need to worry about its accuracy.

Rebank

Rebank is a finance and legal database for companies operating in multiple countries and currencies. Its AI sorts transactions by country and currency to ensure finance and tax compliance with different countries' laws.

It also acts as a transfer tool when companies need to transfer cash, inventory, or other assets between different countries. Rebanknow will create transfer agreements, loan agreements, local tax documents, and more. Each document will be completely legal for each country that it affects.

Rebanknow handles the side of accounting and finance that intersects with the law. As our world grows increasingly globalized, international trade and operations come more within the reach of all businesses, not just the largest ones. Small companies don’t necessarily have the resources to retain or employ an international lawyer to draft compliant agreement forms for them on a regular basis. Tech like Rebanknow puts compliance into the hands of far more people than a traditional lawyer.

Rebank handles:

- Finance documents

- International legal and financial compliance

Rebank is not likely to affect traditional international legal document drafting. There will always be a market for that sort of work. Rebank, on the other hand, fills a gap by making these documents available to more businesses and startups than before.

On its website, Rebank states that in order to get an accurate picture of what your business needs, it may ask for financial data. All financial data uploaded to Rebank, as well as all the documents generated by Rebank, are stored securely in your Rebank account online.

Rebank uses multiple laters of data encryption and multi-factor authentication to protect its users’ financial data.

Plans and Pricing:

Lite: starts from $5000

Autopilot & Growth: Contact for Pricing

Finalle

Finalle is an analytics tool for investors. It allows next-gen investors to bring financial data together from across the Internet – Twitter, Youtube, blogs, news apps, and more – to make better financial decisions.

It’s a new innovation on the market: there is a waitlist for the Finalle API integration. On the surface, it looks really useful and powerful. When you first enter the website, you can choose a stock ticker. Then, you can ask an AI chatbot questions about that stock.

In our testing for this article, we asked the chatbot a simple question and received an error message. This AI is probably still working out some bugs, but it looks like it has the potential to be a really useful tool for investors in the future.

Finalle is intended to level the playing field for investors. Beginning investors may not know what stock they want to buy or sell. They may not know how to interpret financial charts or graphs. A conversational chatbot breaks down the knowledge barrier. Finalle has the potential to change financial information on the Internet in the same way that ChatGPT brought knowledge from Google into accessible information in one place – after they fix the bugs.

Plans and Pricing:

Basic: $9/month

Pro: $39/month

Enterprise: Custom pricing

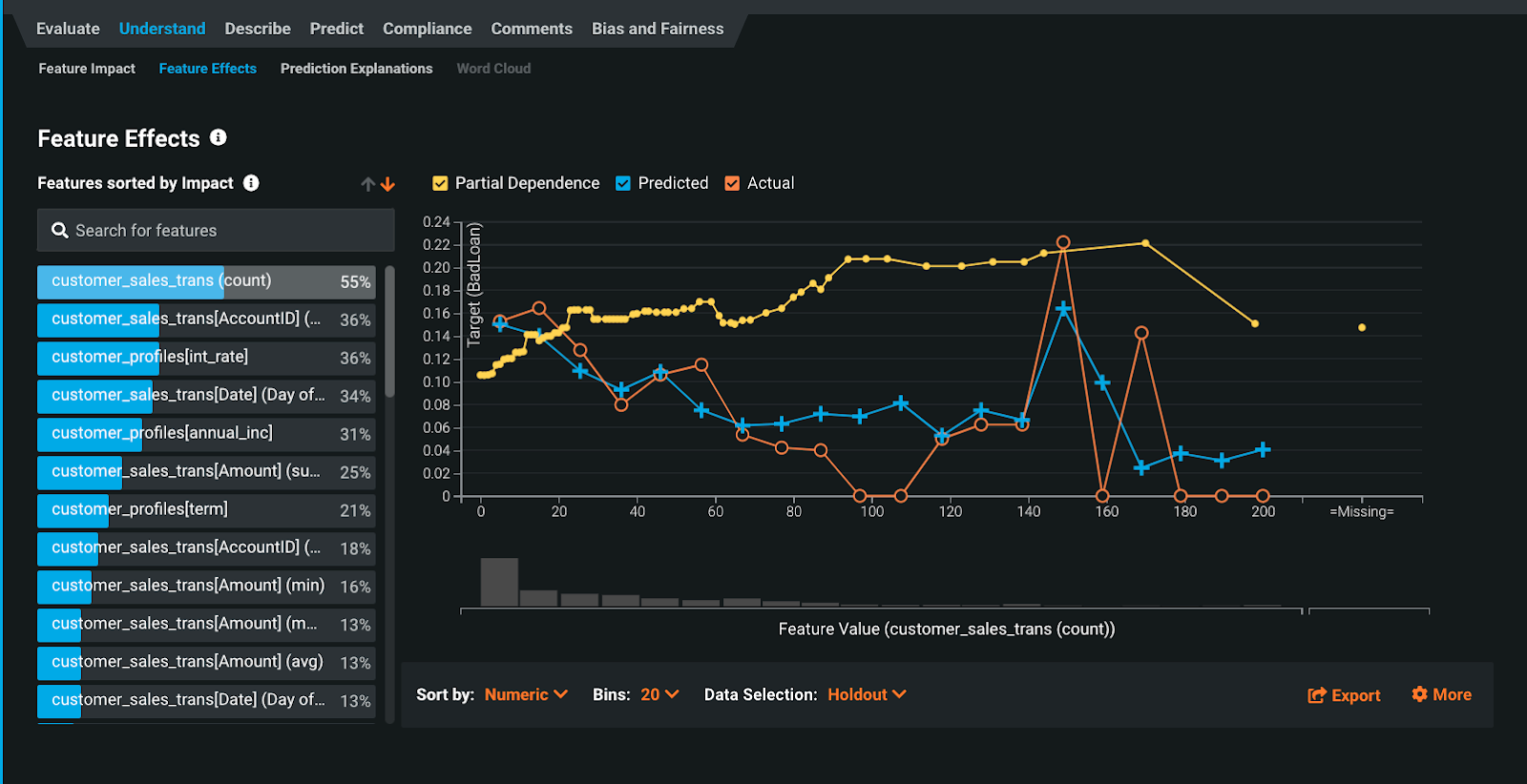

DataRobot

DataRobot is a data analysis tool with functionality across a wide range of industries and knowledge bases. Multiple customers from different industries use DataRobot to enhance their business decision-making. It also has multiple APIs to connect to Microsoft, Amazon AWS, and more data storage platforms for increased utility.

DataRobot is not an AI that will take the place of most human jobs, except perhaps some low-level analysts. Its main functions are to make the data more understandable and to do most of the rote calculations of probability analysis. It can also make some suggestions based on that probability analysis, but due to the importance of these decisions in business, DataRobot’s suggestions would have to be finalized by a human or team of people.

The security concern for DataRobot, like most other AI-powered tools, is how the company would handle the privacy of data fed to the machine by users. Database information found on the internet or otherwise publicly available is not at risk of leaks, but company-specific information from a private AWS server might have to be carefully screened before being fed into a third-party-owned AI tool like this one.

Range

Range is a fintech AI based on personal wealth management for millennials. It’s basically an AI financial advisor who can give people semi-personalized financial advice based on their income, debt, preferred risk level and more. It can give advice on insurance coverage, tax and estate planning, and more. Range is more than a robo-advisor, as it is backed by machine learning and artificial intelligence combined with the expertise of real certified financial planners.

The implications of this for personal finance professionals, especially financial advisors, can be enormous. It appears that Range currently is intended to be used by financial advisors as an aid to data analysis and as a way to create a better client experience, and not by clients directly.

This is most likely because of the liability issue – if people took the AI’s advice and lost money, it would reflect poorly on the company. However, there is the potential for an improved version of Range to be used by clients as an AI financial advisor. This could conceivably lower the bar for accessibility to financial planning tools to people who otherwise could not afford a financial advisor. It might take away some jobs from existing financial planners, but, like other AI tools, it will replace the advisors at the bottom of the barrel – not those at the top.

Plans and Pricing:

Premium: $1,475/semi-annually

Platinum: $2,475/semi-annually

Titanium: $3,975/semi-annually

Challenges of Using AI Tools for Financial Analysis

Data Quality and Integration

Inconsistency: Ensuring the information is consistent from one source to another.

Integration: Significant effort required to integrate with existing systems.

Complexity and Cost

Implementation Costs: High costs, especially for smaller businesses.

Technical Complexity: Management and maintenance require specialized knowledge.

Security and Privacy

Security Risks: Needs robust measures to protect sensitive data.

Privacy Compliance: Must comply with privacy laws and regulations associated with data.

Regulatory and Ethical Considerations

Compliance: Adherence to complex financial regulations.

Ethical Use: Avoiding biased algorithms and ensuring fairness.

Dependence on Data Quality

Quality of Dependence: AI effectiveness is based on input data quality.

Governance: Data management and cleaning are needed on an ongoing basis.

Resistance to Change

Cultural Resistance: Fear of losing jobs and fear of replacement by AIs.

Training Needs: There is a need for high investment in training and adjustments.

How Many Jobs Will These Tools Replace?

In my view, there are two different sides to being good with money. The first is the highly technical knowledge and power of nuanced decision-making that only comes with years of experience. The second is the heavy number-crunching and data analysis that goes into calculating probabilities and making those decisions.

AI will likely completely take over the data analysis side of finance and accounting, and quickly – AI and machine learning tools already have the ability to process enormous amounts of data and draw basic conclusions from that data. This ability will only get better with further iterations of the programs and computers involved.

However, it is uncertain how much AI can take away from the technical knowledge, nuanced high-level decision-making, and customer relationship side of finance. While AI can be fed technical data, it does not have the ability to create any new insights or breakthroughs from the data it has. True creation and idea synthesis is, and likely will stay a purely human activity. AI chats are often also remarkably unempathetic – a trait that will not endear it to clients or customers.

AI is rapidly changing how various industries process data and make decisions. These tools are only the first generation of AI tools that will continue to improve and disrupt fintech for years to come.

Nanonets online OCR & OCR API have many interesting use cases that could optimize your business performance, save costs and boost growth. Find out how Nanonets' use cases can apply to your product.