7 Best Ways to Use ChatGPT in Accounting and Bookkeeping

Do you know what the future of accounting looks like?

ChatGPT is the technology that will revolutionize the accounting field, making it faster and more efficient than ever before.

With ChatGPT, accountants & Bookkeepers can use computer-aided automation to streamline tasks and processes, leaving more time for analysis and insights.

In this article, we'll look at how you can use ChatGPT in bookkeeping to help simplify tedious tasks, generate financial projections quickly, create accurate audit reports, assist with invoice processing and expenses, and manage client communications effectively.

Read on to learn how to leverage ChatGPT in accounting to transform your operations.

What is ChatGPT?

ChatGPT is a language model from OpenAI that builds on the GPT (Generative Pre-trained Transformer) architecture. It uses deep learning techniques to comprehend and generate human-like text based on the input it receives. ChatGPT can chat, answer questions, explain, and help with many different tasks, making it quite helpful both personally and professionally.

Limitations of ChatGPT

Despite its advanced capabilities, ChatGPT has several limitations that users should be aware of:

- Lack of Understanding: Responds with patterns, not really understanding.

- Potential Inaccuracies: Could provide wrong or misleading information and might not get context right.

- Dependence on Input Quality: The quality of responses depends on question making. Thus, it may reflect the biases latent in data used for training.

- Ethical & Security Issues: Data privacy and misuse of the data for generating harmful content.

Why do businesses need to use ChatGPT for accounting?

Integrating ChatGPT into accounting & bookkeeping processes can offer numerous benefits, making it a valuable tool for businesses:

- Improved productivity: automating routine activities such as data entry helps save time and reduces errors.

- Greater Precision: Reduces the chances of human errors in financial records and allows uniform reporting.

- Cost-effective: Lower labor costs and scalable solutions are just among them.

- Better Customer Service: It provides 24/7 customer care for billing and financial matters, as well as individual assistance.

- Advanced analytics: detail out analytics around financial data, trends identified, and insights on the way forward for strategic planning.

- Compliance and Risk Management: ensure compliance with regulations and identify potential financial risks.

How to Use ChatGPT for Accounting

Using ChatGPT for accounting & bookkeeping can streamline tasks such as data entry, financial analysis, documentation, reporting, FAQs and queries, forecasting, budgeting, compliance, and regulations. This can improve efficiency and accuracy in accounting processes, enabling accountants to focus on higher-level analysis and decision-making. Major sections include:

1. Process Invoices And Categorize Expenses

Processing invoices and categorizing expenses can be a time-consuming and tedious task, requiring accountants to allocate significant resources to manage their clients’ finances.

ChatGPT can analyze invoices and extract relevant information such as invoice number, due date, amount, and vendor detail, in addition to categorizing expenses based on predefined categories such as rent, utilities, office supplies, and travel expenses.

For example, you could prompt ChatGPT with the following:

“Act as an accountant. Can you help me categorize expenses from a credit card statement if I provide you with vendors’ names and amounts?”

Tip: Ensure your prompts are as accurate and precise as possible.

While ChatGPT can extract invoice data, you can use Nanonets to automate the bulk processing of invoices. See how it works.

2. Automate Data Analysis

Despite the need to assess large volumes of data, accountants can often find themselves overwhelmed by the prospect of working with such documents. Moreover, manual analysis can often be time-consuming, and the risk of errors and omissions is high.

However, accountants & bookkeepers can use ChatGPT to automate this type of data analysis, saving time and improving accuracy. According to a 2020 study, 43% of accountants already felt that the integration of technology had made them more productive.

Since ChatGPT can perform calculations, statistical analysis, and discover trends and patterns in data, it can automate data analysis and be a massive time-saver for accountants. Thus, instead of sifting through thousands of pages to identify potential cost savings or risks, you can use ChatGPT to do the job in just a few minutes.

Automate manual tasks and enhance your client experience with Nanonets. Automate accounting processes with intelligent document automation software.

3. Deal With Repetitive Accounting Tasks

Research shows that finance and accounting departments spend over 500 hours per year on manual and repetitive tasks. But what if you could unlock the potential of your accounting and finance teams by freeing them up from menial tasks?

ChatGPT can help you handle various repetitive accounting problem based tasks, allowing you to focus on other essential aspects of your business.

ChatGPT can provide instructions on inputting accounting data into Excel, such as mind-numbing data entry into spreadsheets, including financial data, customer information, inventory data, and other data types.

Around 33% of accountants use Google Sheets, and about half use Excel for accounting, so ChatGPT can give an upper hand in becoming more productive

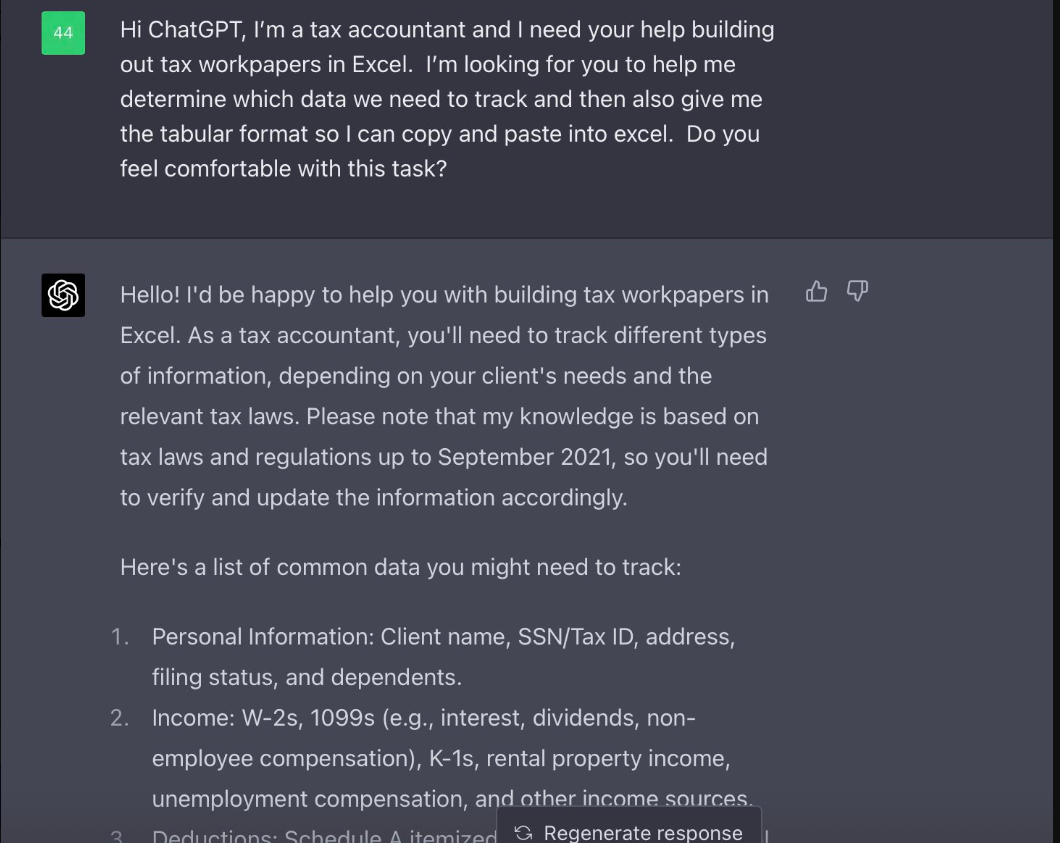

Check out how a tax accountant used ChatGPT to produce a tax work paper in Excel.

4. Produce Audit Reports

Given that an integral aspect of accounting is doing routine audits to evaluate the financial state of customers, any accounting firm must be able to provide timely and accurate financial reports. While necessary, audits may be a significant drain on resources.

That said, accounting cycles can benefit significantly from ChatGPT's ability to automate the audit process and provide reliable reports. In particular, it can analyze financial data with remarkable precision and identify any discrepancies, errors, or anomalies.

Things to consider: Sharing sensitive data with ChatGPT can result in data leaks, like Samsung. OpenAI has mentioned: "We are not able to delete specific prompts from your history. Please don't share any sensitive information in your conversations," OpenAI's user guide notes.

5. Generate Financial Projections

Another way of using ChatGPT is to evaluate financial data to understand KPIs like revenue growth, cash flow, and business expenses.

Businesses can't afford to guess their future income and earnings; therefore, accurate financial predictions are crucial. Producing these projections requires reviewing things like income statements, balance sheets, and cash flow projections, which is typically very time-consuming.

No more formatting woes. Let Nanonets take the wheel for flawless invoice conversions.

Convert with Ease

6. Create Financial Reports

It is common for accountants to experience a great deal of frustration when preparing financial reports like income statements and balance sheets due to the lengthy preparation process and the chance of mistakes.

Yet, with ChatGPT, accounting firms can save time and increase precision thanks to its ability to simplify financial report-making.

The tool can assist accountants in generating accurate and reliable financial reports with its advanced machine-learning algorithms. It can analyze vast amounts of financial data and identify any errors or discrepancies, providing a streamlined and efficient solution for generating high-quality financial reports quickly and efficiently, allowing your team to focus on more critical tasks.

7. Handle Client Communication

As a seasoned accountant, you are likely aware that effective client communication is crucial to your profession. With the dynamic nature of the accounting industry, staying on top of regulatory changes and critical deadlines is vital for your clients' financial well-being.

The Accounting Today 2022 Year Ahead Survey found that over half of the firms surveyed (51%) cited the challenge of keeping up with regulatory changes as their top concern. However, it’s usually your job to communicate such changes to the clients.

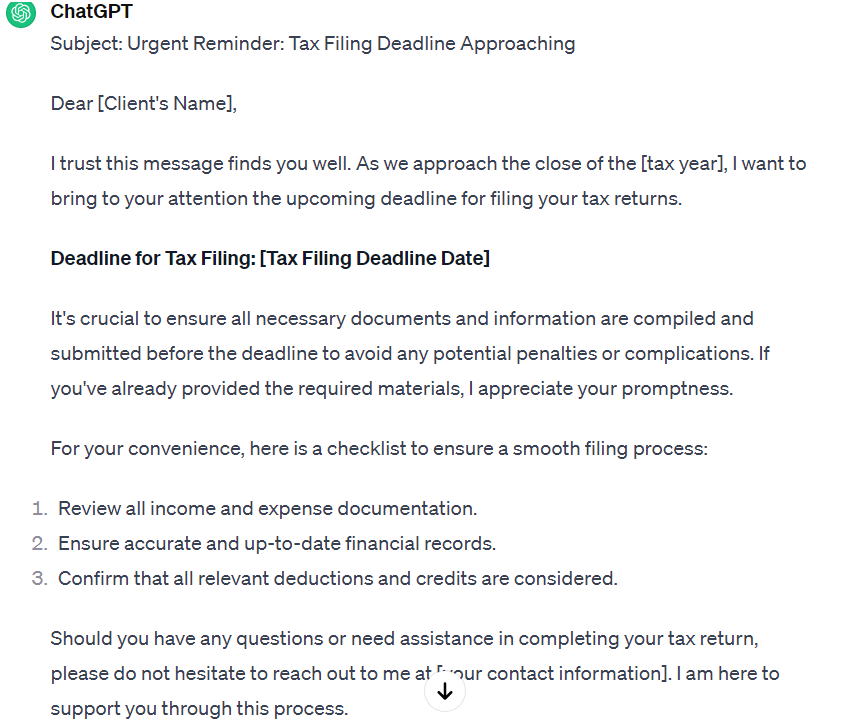

Fortunately, with the aid of ChatGPT, you can effortlessly produce top-quality emails and other content to keep your clients informed. By simply providing a few prompts, you can generate multiple emails and distribute them with ease, ensuring that your clients stay up-to-date and in the know.

Consider the following scenarios and prompts:

- An email reminding your clients about an important deadline.

Source: ChatGPT.

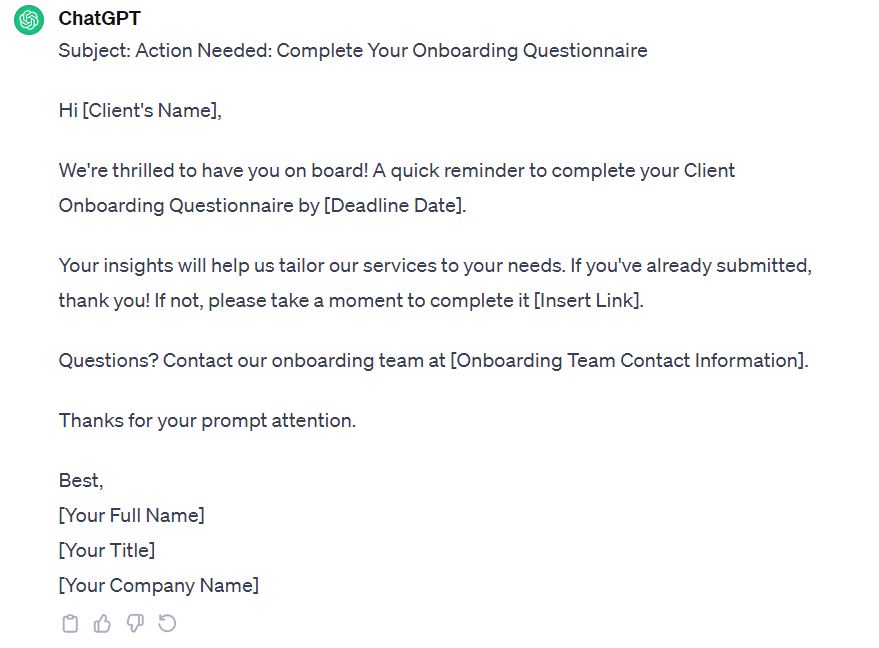

2. A reminder email about a pending client onboarding questionnaire.

Source: ChatGPT.

Nanonets for Accounting Automation

While ChatGPT can simplify accounting tasks, if you're looking for an accounting automation platform that can automate your financial processes without compromising security, Nanonets is the software you can look at.

Nanonets is an AI-based financial automation platform with in-built OCR software, no-code workflow management, and global payments platforms. Nanonets can automate all financial processes in bookkeeping, accounting, accounts payable, accounts receivable cycle, and more. Nanonets can automate manual processes like

- Invoices, Receipts & Bills processing

- Data extraction from documents like contracts, invoices, etc

- Reimbursements & payroll accounting

- Vendor payment and vendor management

- Manual data entry into ERPs

Here’s what customers say about Nanonets.

Rated 4.9 on Capterra and G2. Try Nanonets today. Start your free trial without any credit card details.

Summing Up

The emergence of ChatGPT is creating ripples throughout various industries, leaving a profound impact. Leveraging the power of ChatGPT in accounting and bookkeeping can help you expedite your accounting processes and become more agile. This increased efficiency will enable you to cater to more clients, leading to faster revenue growth.

However, if you truly want to supercharge your accounting processes, consider using Nanonets. With Nanonets, you can instantly tap into AI capabilities to automate manual data entry and extract essential data from documents. Whether it’s an invoice, a receipt, a purchase order, or a tax statement, Nanonets makes document processing & document automation a breeze.