Imagine turning your often-overlooked accounts payable (AP) department into a strategic powerhouse. While businesses focus on optimizing every corner of their operations, AP often remains overlooked despite its untapped potential.

The future of accounts payable lies in paperless accounts payable and AP automation, which can turn this traditional back-office function into a key driver of growth.

As businesses face increasing financial pressures, the modern AP team must evolve beyond manual tasks. In the new era of accounts payable— every invoice processed should be a step towards long-term success.

AP automation: A landscape of opportunity

Building on accounts payable's evolving role, the AP automation market offers a wide range of solutions to meet this new strategic imperative.

These tools go beyond simple digitization, offering comprehensive platforms that automate invoice processing, streamline approvals, and optimize payment workflows.

Finding the right vendor can be overwhelming with so many players in the AP automation market. This overview highlights critical providers offering solutions to streamline workflows, optimize payments, and boost efficiency.

From AI-driven platforms to full-service automation, these top AP automation vendors help organizations future-proof processes and free up valuable resources.

| AP Solution | Market Segment | Value Proposition | G2 Rating* |

|---|---|---|---|

| Nanonets | Midmarket + Enterprise | AI-powered invoice OCR automation with customizable workflows | 4.8/5 |

| Tipalti | Midmarket + Enterprise | Global payments automation with tax compliance | 4.5/5 |

| AvidXchange | Midmarket + Enterprise | Paperless processing with extensive system compatibility | 4.3/5 |

| Stampli | Midmarket | User-friendly interface with real-time collaboration for quick invoice approvals | 4.6/5 |

| MineralTree | SMB + Midmarket | Full AP automation with ERP integration and fraud protection | 4.5/5 |

| BILL AP/AR | SMB | Easy-to-use AP automation for payments and vendor management | 4.4/5 |

| Basware | Enterprise | Scalable AP and procurement automation for global operations | 4.3/5 |

| SAP Concur | Enterprise | Comprehensive spend management integrated with ERP systems | 4.0/5 |

| NetSuite | Midmarket + Enterprise | All-in-one ERP with automated AP workflows and detailed financial analytics | 4.4/5 |

| Coupa | Midmarket + Enterprise | Procurement and AP automation with real-time spend visibility | 4.2/5 |

| Beanworks | SMB + Midmarket | Streamlined invoice approvals with accounting integration | 4.5/5 |

| Melio | SMB | Flexible payment options with automated reconciliation | 4.5/5 |

*G2 ratings are as of 18th October, 2024

Want the complete guide to transforming your AP function?

Challenges with current accounts payable processes

As the accounts payable (commonly referred to as "AP" or "payables") process evolves, organizations are caught between the promise of full automation and the reality of what current solutions offer.

AI-powered, end-to-end AP systems are meant to simplify everything from procurement to payment, removing the need for manual work. However, most existing tools only automate certain parts, leaving businesses to deal with manual workarounds or extra software. This creates many inefficiencies and challenges.

Let's take a closer look at some of the common issues businesses face with these partial solutions.

Integration complexity and overreliance on consultants

A major challenge in AP automation is integrating various tools for different tasks.

Many businesses rely on multiple systems for OCR data capture, invoice processing, approvals, and payment reconciliation, which makes the process lengthy, expensive, and highly inefficient.

For example:

They overcame this by adopting Nanonets' unified AP automation solution, which streamlined workflows and achieved 90% automation in invoice processing. This significantly reduced the need for manual intervention and allowed for faster, more accurate processing.

Many companies face similar challenges. They rely on specialized skills or consultants for custom integrations, which increases complexity and costs. Such companies also have to spend heavily on third-party implementations as the AP provider fails to adopt to modern innovations and challenges.

The future of AP lies in seamless, integrated platforms that eliminate the need for disjointed systems and reliance on external consultants.

Limited or nonexistent inventory management and PO matching

Many AP platforms lack robust inventory management or item-level PO matching. This forces businesses to manually reconcile POs with invoices, slowing the process and increasing errors. It also creates a gap in automating the entire procure-to-pay cycle.

Automated systems that support 2-way matching or 3-way matching are critical for verifying that invoices match POs and goods received, reducing the risk of overpayment or fraud. For instance, 3-way matching ensures that invoices, POs, and receipts are cross-checked before payment, improving accuracy and compliance.

If you’re considering adopting an automated AP solution, look for tools that offer seamless PO matching capabilities to avoid manual reconciliation and ensure a smoother, more accurate payment process.

Reliance on manual ways of working

Many AP teams still have to rely on manual entry for invoice coding and data enrichment, which increases the risk of errors and slows down the process. Without AI-driven tools, these platforms can't automatically apply the correct general ledger codes or detect discrepancies in invoice data.

This lack of intelligence in existing systems results in inefficiencies, making it harder for AP teams to keep up with high invoice volumes and maintain accuracy.

By adopting Nanonets, Tapi reduced costs by 70%, and invoice processing time dropped to just 12 seconds, greatly enhancing their efficiency and customer experience.

Limited approval routing customization and poor exception handling

So, now we have an automated workflow system that streamlines the invoice-approval process. It assigns invoices by due dates and amounts so the most important bills are paid first, keeping cash flow healthy. It literally cuts the red tape and allows us to better allocate our finances."

- Thomas Franklin, CEO, Swapped

Approval routing is often a huge challenge for AP teams, especially in businesses with complex workflows. Managing invoice exceptions without intelligent automation is manual and time-consuming.

For example, mismatches between a purchase order (PO) and an invoice often need manual review, causing delays and inefficiencies.

Traditional systems offer rigid approval processes that slow invoice approvals and create bottlenecks, leading to delays and errors. These systems lack AI capabilities for automatic exception handling, leading to increased intervention from AP teams.

"We reduced our manual workload by 90% using Nanonets' automated workflows." - Happy Jewelers

Adopting flexible approval routing through automated workflows will help AP teams manage high invoice volumes more efficiently, reducing errors and improving financial oversight.

Cross-border multi-currency transactions

The future of AP automation will focus on simplifying complex, cross-border transactions.

Managing different currencies, tax regulations, and compliance rules across countries can be overwhelming for AP teams, but AI-driven automation can help. These systems can automatically handle real-time currency conversions, validate taxes, and reduce manual errors.

For example, Nanonets’ two- and three-way matching features compare invoices with purchase orders and receipts, making the payment process faster and more accurate without the need for manual checks.

Nanonets automates multi-currency reconciliation by syncing directly with ERP systems. With AI-powered tools like these, AP teams can streamline global transactions, ensuring payments are processed accurately and on time.

Key technologies in future AP processes

The future of AP lies in intelligent automation, yet adoption often faces hesitation.

Concerns about complexity and job security can overshadow these technologies' transformative potential. However, AI and related tools aid human capabilities rather than replace them.

Let's have a look at the key accounts payable automation technologies, including AI-powered AP automation, that AP teams must explore and adopt.

AI-driven invoice processing

Automated invoice processing, driven by AI, can significantly transform an organization by addressing inefficiencies in traditional methods.

AI-powered tools streamline the payables process from start to finish, automating the capture of invoices, matching them against purchase orders and delivery notes, routing them for approval, and recording transactions within accounting systems—all in a few clicks.

Nanonets has enabled businesses to reduce invoice processing times by 60% and cut costs dramatically, demonstrating the potential of AI-driven automation to improve efficiency, accuracy, and cost savings.

One significant challenge in AP is managing data accuracy and manual errors. By implementing AI-driven tools for data management, I've improved payment-collection efficiency by 54%. This approach ensures that data errors are at a minimum, enhancing both accuracy and operational flow."

- Ryan T. Murphy, Sales Operations Manager, Upfront Operations

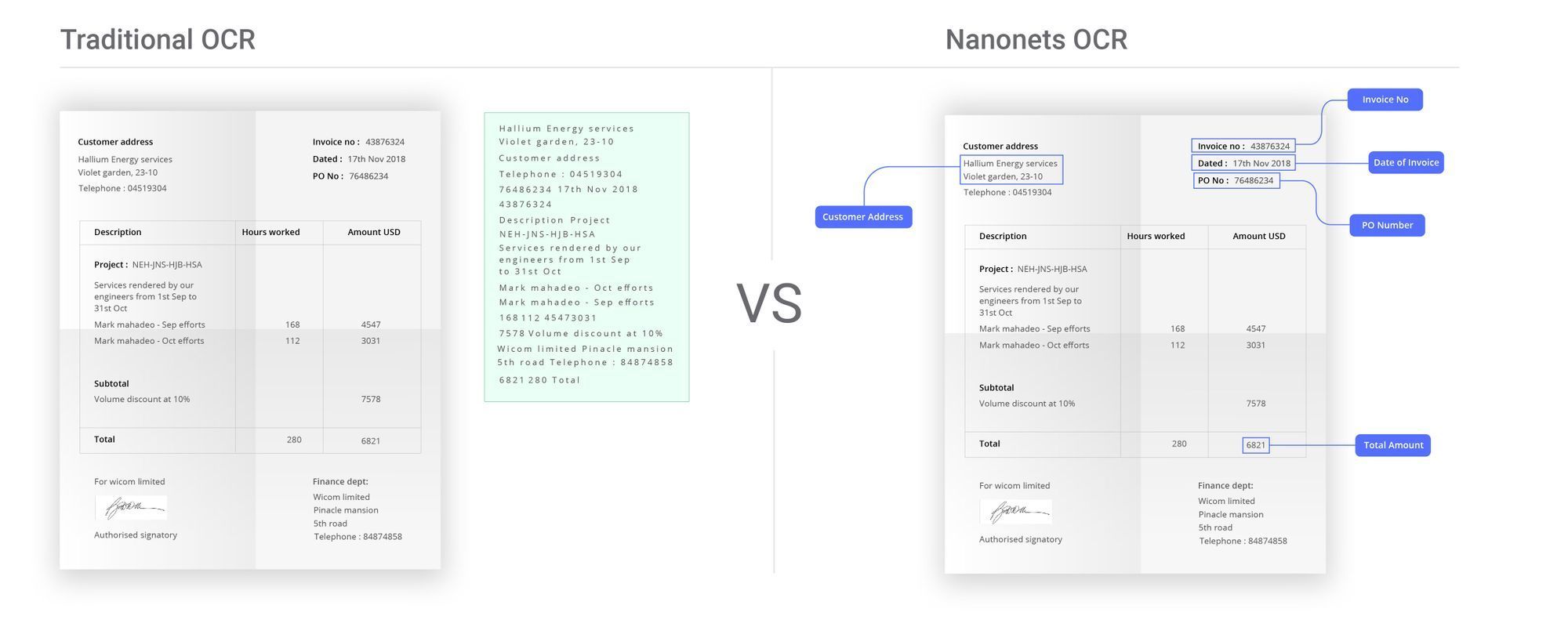

OCR and NLP enabled invoice capture

AI-powered OCR and NLP technologies have revolutionized invoice capture, significantly easing the workload of AP teams by automating the extraction of invoice data from scanned documents, PDFs, or images, regardless of format.

This automation eliminates the need for manual data entry, drastically reducing errors and accelerating invoice processing times.

With such tools, AP teams can focus on higher-value tasks while the system accurately captures vendor details, invoice numbers, and amounts, streamlining the workflow.

Invoice templates: AI vs template-based solutions

Traditional AP systems rely on pre-defined templates to process invoices, but AI-driven systems learn and adapt to new formats, reducing the need for constant updates.

Template-based solutions require continuous manual adjustments, whereas AI systems automatically recognize new invoice structures, offering greater flexibility and scalability.

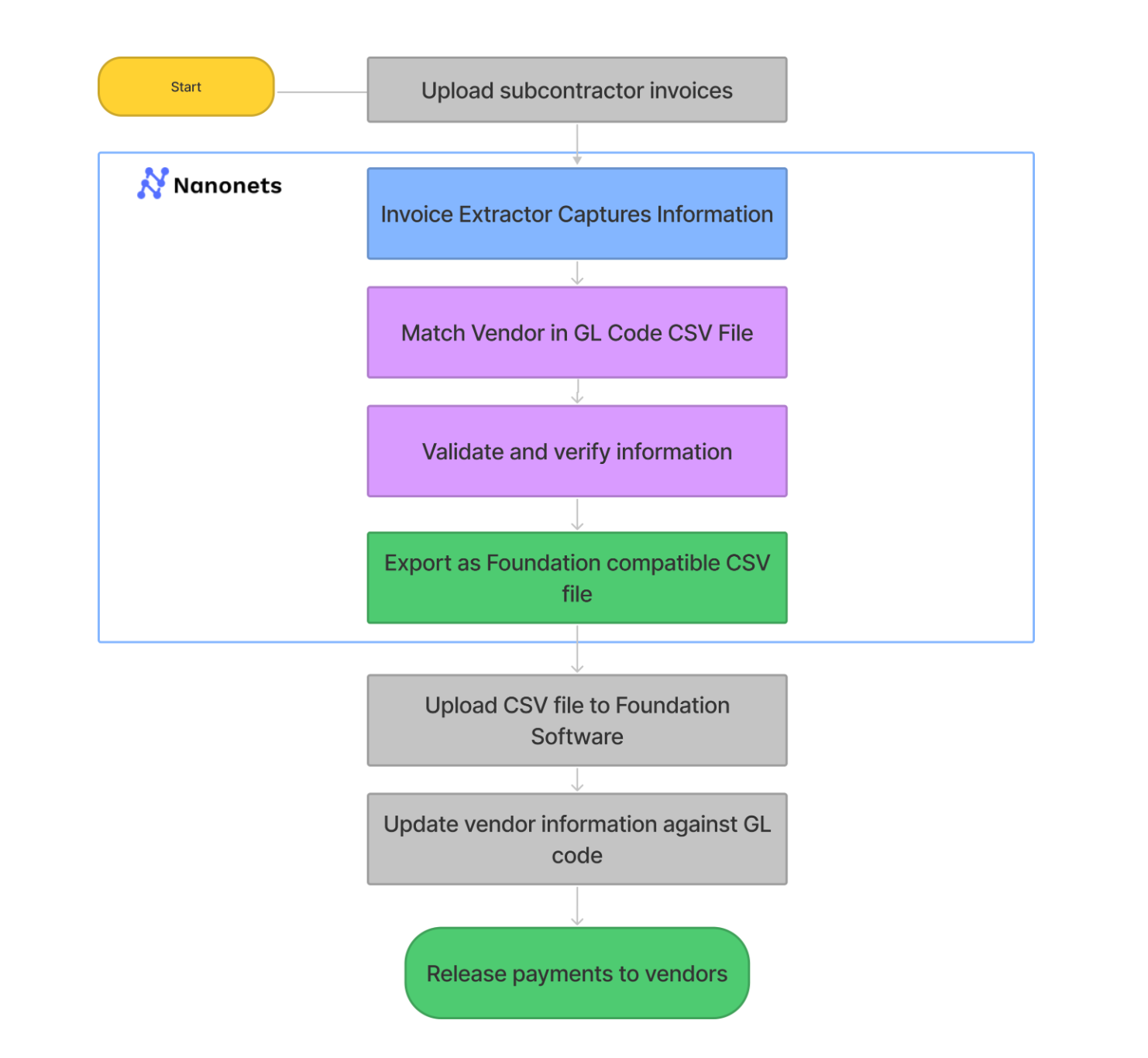

ACM Services, a Maryland-based remediation contractor, is an example of a shift from template-based to AI-driven invoice processing. Before implementing Nanonets, ACM relied on traditional systems that required continuous manual adjustments to process invoices due to rigid templates.

ACM saved 90% of its time on manual data entry, making its AP processes much more efficient.

Automating 3-way matching

AI-based automation enhances the 3-way matching process by cross-referencing invoices, purchase orders, and delivery receipts in real-time. This ensures that every detail, such as quantities and prices, matches across documents before processing payments, reducing discrepancies and delays.

By automating these tasks, Tapi reduced their AP costs by 70%, highlighting how AI-driven 3-way matching can improve accuracy, speed, and efficiency for high-volume AP teams.

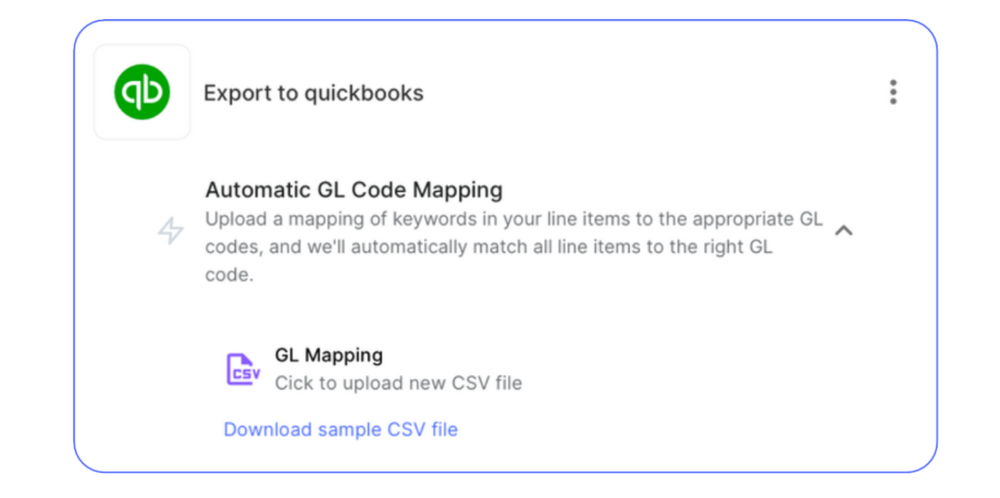

Machine learning for GL coding

Manual GL coding can be a time-consuming and error-prone process, especially for AP teams dealing with large volumes of invoices. Traditionally, AP staff manually assign general ledger (GL) codes based on invoice data, often leading to inconsistencies and delays in financial reporting.

Studies show that companies using automated GL coding can process more than 18,649 invoices per full-time employee annually, compared to just 8,689 for those still relying on manual methods.

This shift to automation results in significant time savings and cost reductions.

ACM achieved a 90% reduction in manual data entry, which not only streamlined their AP operations but also significantly improved the accuracy of their financial reporting.

Here's the workflow that Nanonets implemented for ACM:

Adopting machine learning for GL coding empowers AP teams to operate with higher efficiency, reduce operational costs, and maintain more accurate financial records.

Robotic Process Automation (RPA) for multistep workflows

Based on pre-set rules, RPA streamlines AP processes by automating multi-step workflows, such as invoice receipt, approval routing, and vendor payments. This eliminates manual intervention, improves accuracy, and reduces invoice processing times.

Automating tasks based on value thresholds reduced delays and improved efficiency, allowing the team to handle high invoice volumes without extra staff. Large invoices were sent for senior management approval, while smaller ones were auto-approved.

Upskilling for the AI future: How AP teams can get ahead

As the financial landscape rapidly evolves, AP teams face increasing pressure to become future-ready. The days of manual data entry and basic invoice processing are quickly fading.

AP professionals must embrace AI, automation, and data-driven decision-making to stay competitive and contribute strategically to their companies.

These emerging technologies aren’t just trends; they are essential tools that will redefine how AP teams operate—enabling faster, more accurate processing, reducing errors, and improving overall efficiency.

Being future-ready isn’t just about keeping pace; it’s about leading the way in efficiency, compliance, and financial optimization. To achieve this, AP teams must proactively develop skills that go beyond traditional roles. Let’s explore the core skills AP teams need:

Learning Artificial Intelligence (AI) for AP tasks

AI in AP isn’t just about automating repetitive tasks; it can also reduce errors and improve efficiency by automatically matching invoices with purchase orders (POs) and flagging discrepancies.

AP teams should understand how to quickly configure these models to adapt to specific use cases, reducing the learning curve and speeding up implementation.

Using Machine Learning (ML) for predictive AP insights

ML can help predict payment patterns, optimize cash flow, and improve budgeting accuracy.

AP professionals should focus on learning to interpret ML outputs from such tools, such as detecting discrepancies in payment patterns, to address potential issues and maintain cash flow health preemptively.

Leveraging data analytics for strategic AP decision-making

Analytics tools like Power BI and Tableau enable AP teams to visualize KPIs such as invoice cycle times, vendor performance, and processing costs.

For instance, creating a dashboard that tracks real-time payment approvals and bottlenecks can help AP teams identify inefficiencies and implement cost-saving measures. AP professionals should practice building such dashboards and interpreting trends to make strategic decisions that enhance their performance.

Using low-code and no-code platforms for customization

In the future, more non-technical AP professionals or "citizen developers" will explore low-code and no-code platforms for automating accounts payable process, making it easier for teams to build custom solutions with minimal coding.

These platforms use drag-and-drop interfaces, pre-built templates, and visual workflows to automate invoice approvals, data capture, and payment reconciliation processes.

More such platforms are expected to become popular for AP workflows with changing business needs and compliance requirements. These platforms will have prebuilt APIs and connectors that can seamlessly integrate with existing ERP systems, databases, and payment platforms.

Adopting mobile-friendly AP solutions

Remote work and mobile workflows are growing trends in AP automation. AP teams should get familiar with mobile solutions that allow invoice approvals, payment tracking, and data access on the go to increase productivity and responsiveness even when working remotely.

These solutions will include self-service vendor portals, enabling suppliers to submit invoices, check payment statuses, and manage account details directly. AP teams can receive instant alerts for invoice approvals, payment status updates, and vendor communication, ensuring they stay informed and can act swiftly to prevent delays.

Building a culture of innovation and continuous learning in AP departments

Building a culture of continuous learning is vital for AP teams to harness the benefits of AI and related technologies fully. Encouraging a growth and innovation mindset enables teams to keep pace with rapidly changing technological demands.

By fostering collaboration on AI-related projects and providing opportunities for hands-on learning, organizations can empower AP professionals to drive innovation.

Emphasizing continuous learning will help businesses stay agile and future-proof in a tech-driven landscape.

Looking to transform your AP processes with automated invoice processing? Explore Nanonets AP automation.