OCR and Invoice Scanning Software for Quickbooks

QuickBooks is the accounting software of choice for millions of users, most of these being small to medium-sized enterprises. It offers a comprehensive accounting suite that promises not just to keep the books in order but to propel businesses forward with smart financial insights.

Yet, the leap from traditional bookkeeping to a streamlined, automated financial ecosystem is one that many QuickBooks users are yet to fully embrace.

The Challenges of Traditional Invoice Processing in QuickBooks

Even with QuickBooks' robust capabilities, the manual handling of invoices and accounts payable presents a bottleneck fraught with challenges:

- Time-Consuming Data Entry: Manual entry is not just slow; it's a drain on resources, pulling staff away from more value-added activities.

- Error-Prone Transactions: The human factor introduces a margin for error in data entry, leading to discrepancies that can cascade through financial reporting.

- Inefficient Approval Workflows: Traditional processes often involve cumbersome approval chains that delay payments and complicate cash flow management.

In essence, while QuickBooks provides the foundation for solid financial management, the manual processing of invoices acts as a brake on potential efficiency gains.

The Solution

Businesses are constantly seeking ways to streamline these critical operations. Today, AP automation technology can automate what was once a laborious process. When paired with Quickbooks accounting software suites on the market, the integration of AP Automation software, this technology transcends the mere digitization of paper documents, offering a suite of capabilities designed to automate and optimize every facet of invoice processing:

- Automated Data Capture: Leveraging OCR, invoice details are extracted with precision, from vendor information and invoice numbers to line items and amounts, transforming paper documents into actionable digital data.

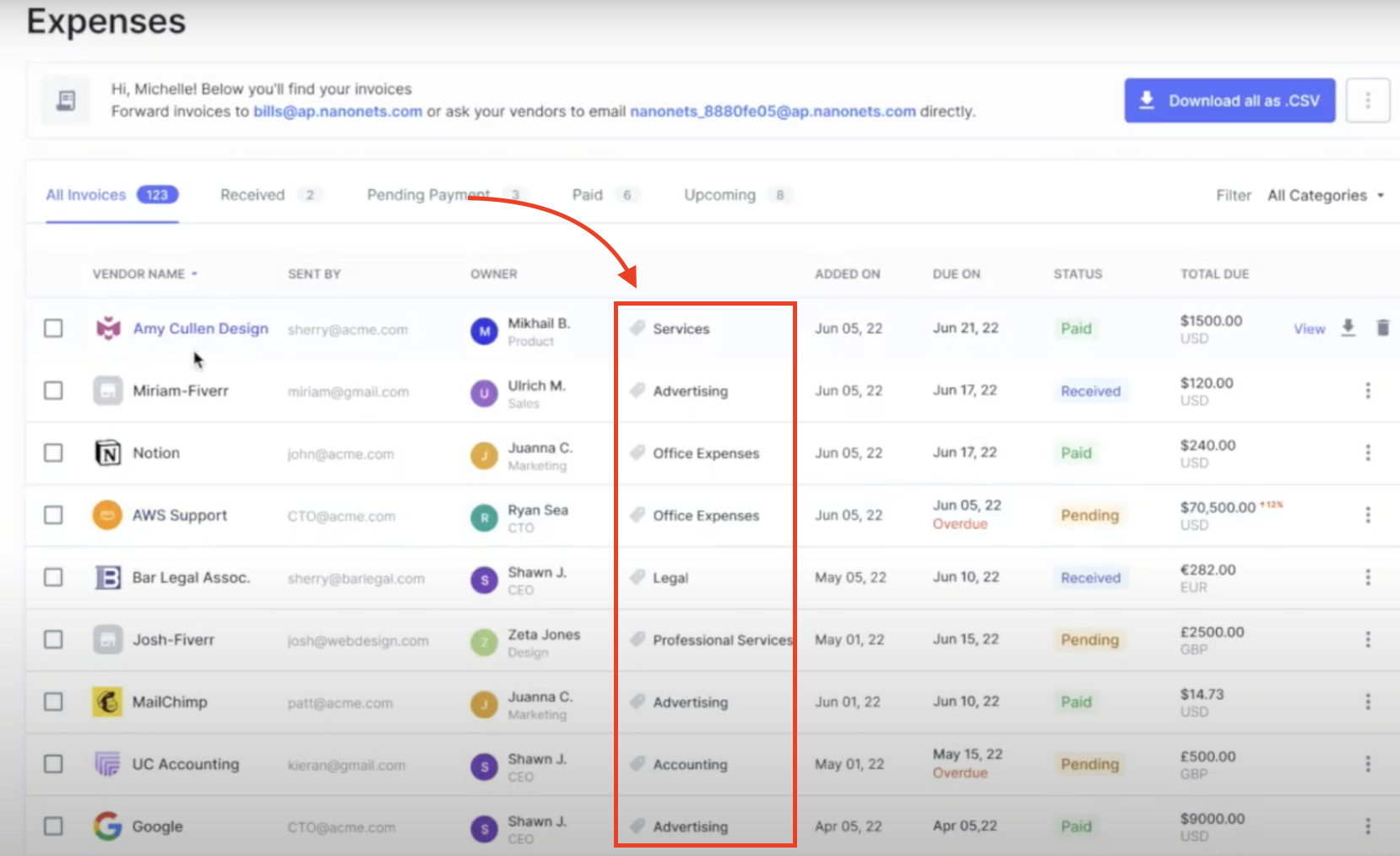

- Intelligent Data Interpretation: Beyond mere extraction, advanced AI algorithms interpret invoice data, automating tasks such as general ledger coding and expense categorization based on historical data and contextual understanding.

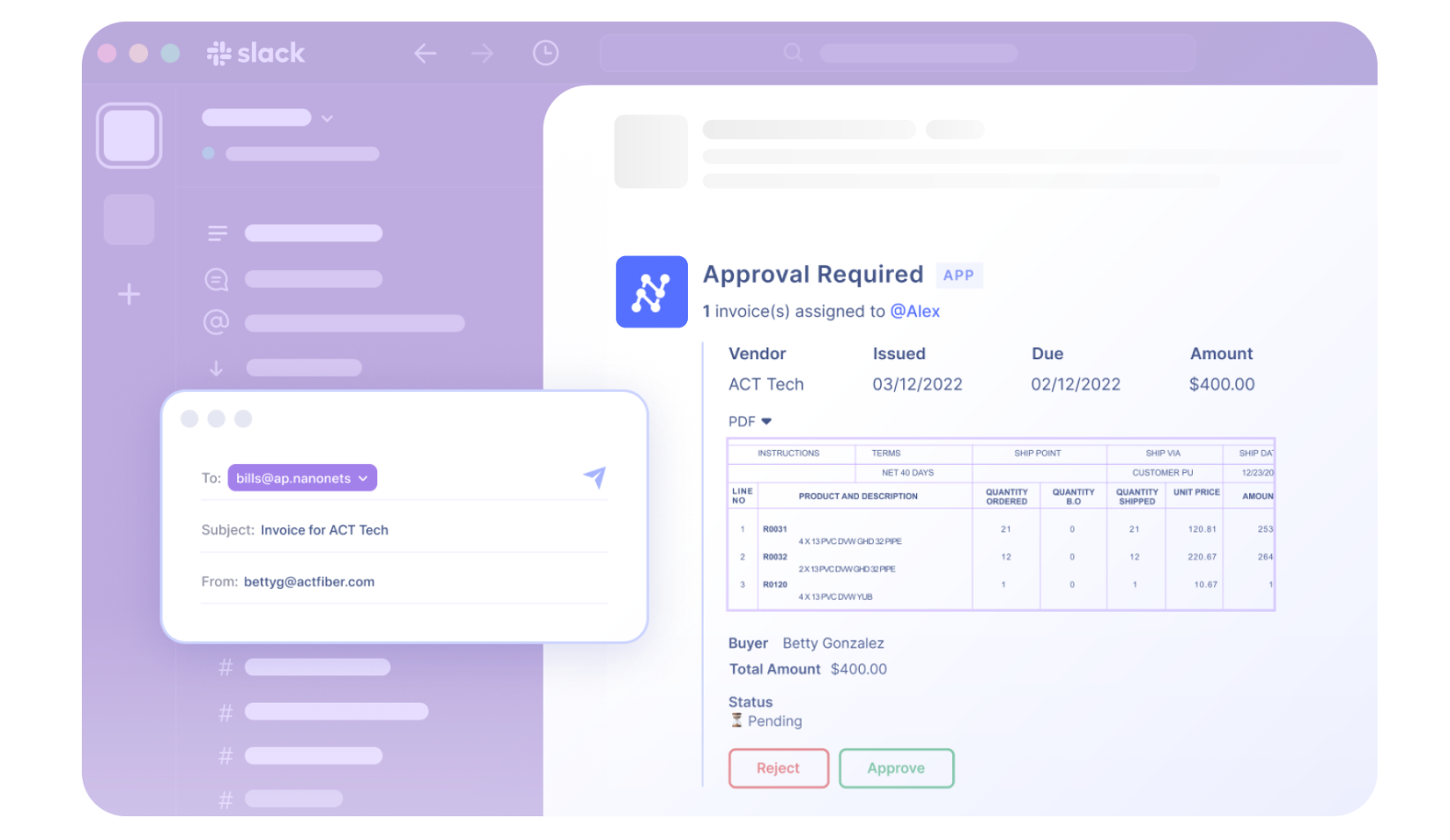

- Streamlined Approvals and Payment Processing: With data accurately captured and entered into QuickBooks, the software can streamline the approval process and bring it where your organization lives—whether that's on email, Slack, or Teams.

- Real-Time Data Sync with Workflow Automation: OCR and invoice scanning software today synchronize data with QuickBooks and other apps (Slack, Email, Stripe, etc.) in real time. This ensures that every piece of information is where it needs to be, when it needs to be there, without manual intervention.

Nanonets integration with Quickbooks represents a leap forward in managing financial transactions, setting a new standard for operational efficiency in the digital age. Let's see how this works, and how you can set this up for your teams.

The Evolution of Invoice Processing

The journey of invoice processing from its traditional, manual roots to the digital frontier is a tale of technological evolution.

- Pre 1980s - Manual Accounts Payable: Accounts payable processes were entirely manual, involving physical invoices, paper checks, and ledger books.

- 1980s-1990s - Digital Ledgers: Early software solutions provided basic digital ledger capabilities, streamlining some parts of the process.

- 2000s - Electronic Invoicing Unlocked : The internet revolutionized accounts payable, introducing electronic invoicing, online transactions, and email communications. This era saw a significant reduction in paper-based processes.

- 2010s - Easy-to-use Cloud Solutions: Cloud-based solutions allowed for more scalable, flexible, and accessible financial operations, while mobile technology enabled on-the-go invoice management and approvals.

- Late 2010s-Present - Automated Accounts Payable Solutions: The latest evolution involves the use of automation and artificial intelligence to automate the entire process including -

- Accounting and AP Intelligence: The advent of AI-based accounting systems has ushered in a new era of efficiency. Capable of performing repetitive tasks such as data entry, invoice matching, and transaction processing, these systems operate with a speed and accuracy beyond human capabilities.

- Connected Workflow Across Apps: In today's interconnected digital landscape, seamless communication between applications is crucial. Emails, AP tools, accounting software, ERPs, and other databases now operate in concert, automating data capture and synchronization across platforms.

- Intelligent Data Capture: Leveraging AI technologies like natural language processing and optical character recognition (OCR), today's systems automate the extraction and interpretation of data from various invoice formats. This includes handling unstructured and scanned data with unprecedented efficiency, making the accounts payable process smoother and more accurate than ever before.

OCR Technology for Invoice Scanning

OCR technology has transformed document management across various industries, and its application in invoice processing for QuickBooks users is no exception. By converting paper invoices and digital documents into editable and searchable data, OCR enables businesses to automate data entry, minimize errors, and improve efficiency.

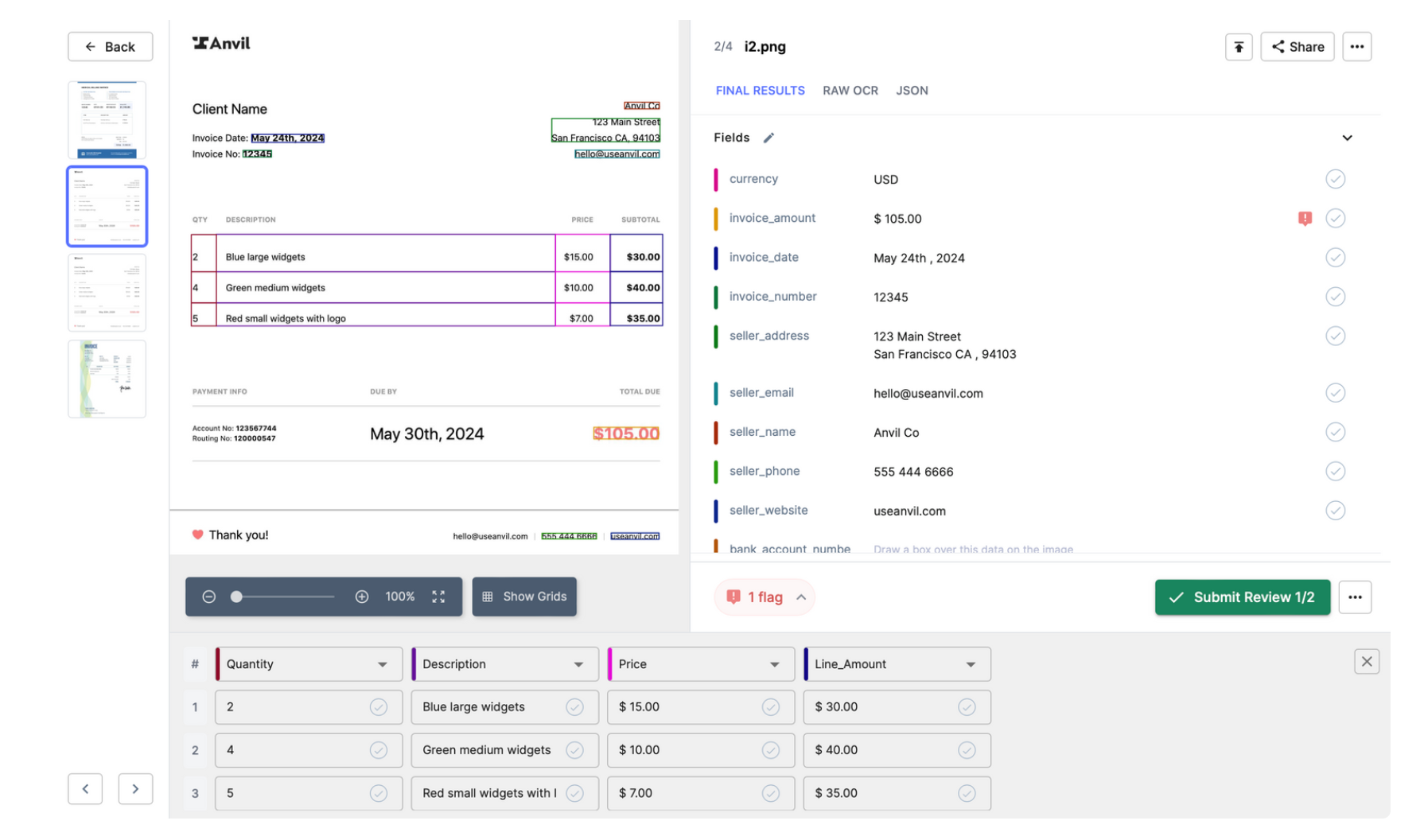

OCR scans invoices and other paper documents, turning them into digital text. The digital text is interpreted using AI and invoice details are extracted -

- Fields (invoice date, invoice number, amount, seller details, buyer details, etc)

- Line Items (descriptions and costs of the Goods and Services Sold).

- GL Codes (automatically assigned by AI based on past data).

- Other dimensions based on context (expense categorization, etc.)

The extracted data is then mapped and synced to Quickbooks.

Nanonets for OCR and Invoice Scanning in Quickbooks

For companies utilizing Quickbooks for their accounting needs, the manual process of handling invoices is not just a test of patience but also a significant drain on resources. An OCR and Invoice Scanning Software for Quickbooks transforms this critical yet cumbersome process into a streamlined, efficient workflow.

Let's take a look at how accounting teams can use an OCR-based AP automation software like Nanonets and integrate it with Quickbooks to streamline their accounting workflow.

Manual AP Workflow in Quickbooks

First, Let's revisit the typical manual AP process for a company using Quickbooks:

Invoice Receipt: Invoices arrive in various formats, including paper and digital. Staff must manually collect and organize these documents to ensure they are processed correctly.

Manual Sorting and GL Coding: Each invoice is then sorted based on criteria such as vendor, amount, or due date, requiring significant time and effort. Subsequently, each invoice must be accurately coded to the correct General Ledger (GL) accounts, a critical step for maintaining organized financial records.

Data Entry: The next phase involves the manual entry of crucial invoice details into QuickBooks. This includes information like vendor names, billed amounts, and payment due dates. Accurate data entry is essential to ensure financial records are reliable and up to date.

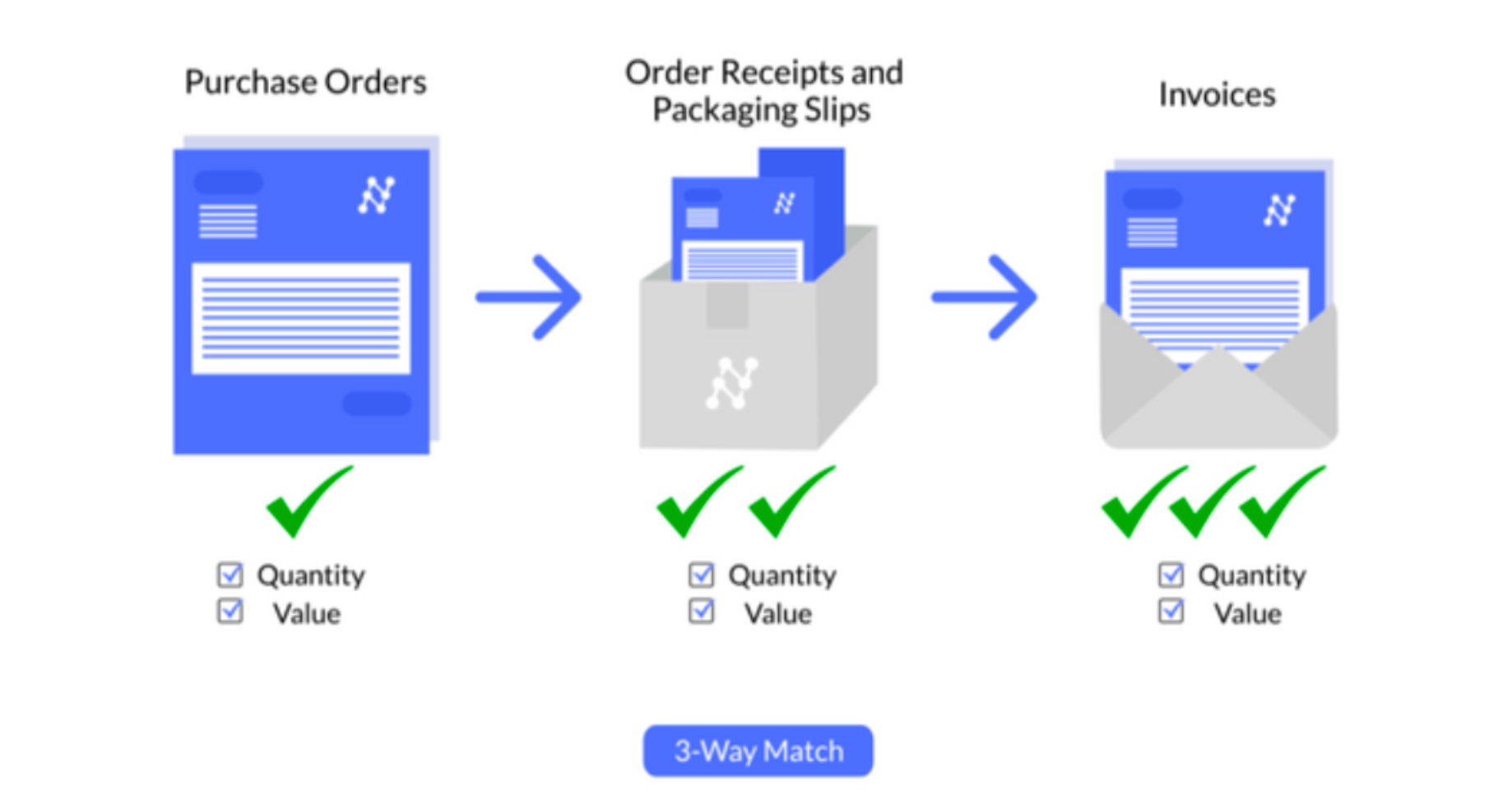

Invoice Verification: Depending on the company’s policies, invoices may undergo two-way (invoice and PO), three-way (invoice, PO, and receiving report), or four-way (invoice, PO, receiving report, and inspection report) matching to verify transactions. This step is vital for confirming the accuracy of transactions and preventing fraud.

Approval: Once verified, invoices are routed for approval. This process often involves multiple departments or levels of authority within the company, each with its own set of criteria for approval. It's a safeguard to ensure that expenditures are authorized and necessary.

Payment Processing: Approved invoices are scheduled for payment based on terms and cash flow considerations. It is important to maintain good relationships with vendors through timely payments.

Reconciliation: Finally, payments are reconciled in Quickbooks, ensuring that all transactions are accurately reflected in financial records. Reconciliation is crucial for maintaining accurate financial records and for the preparation of financial reports.

Automated AP Workflow with Nanonets

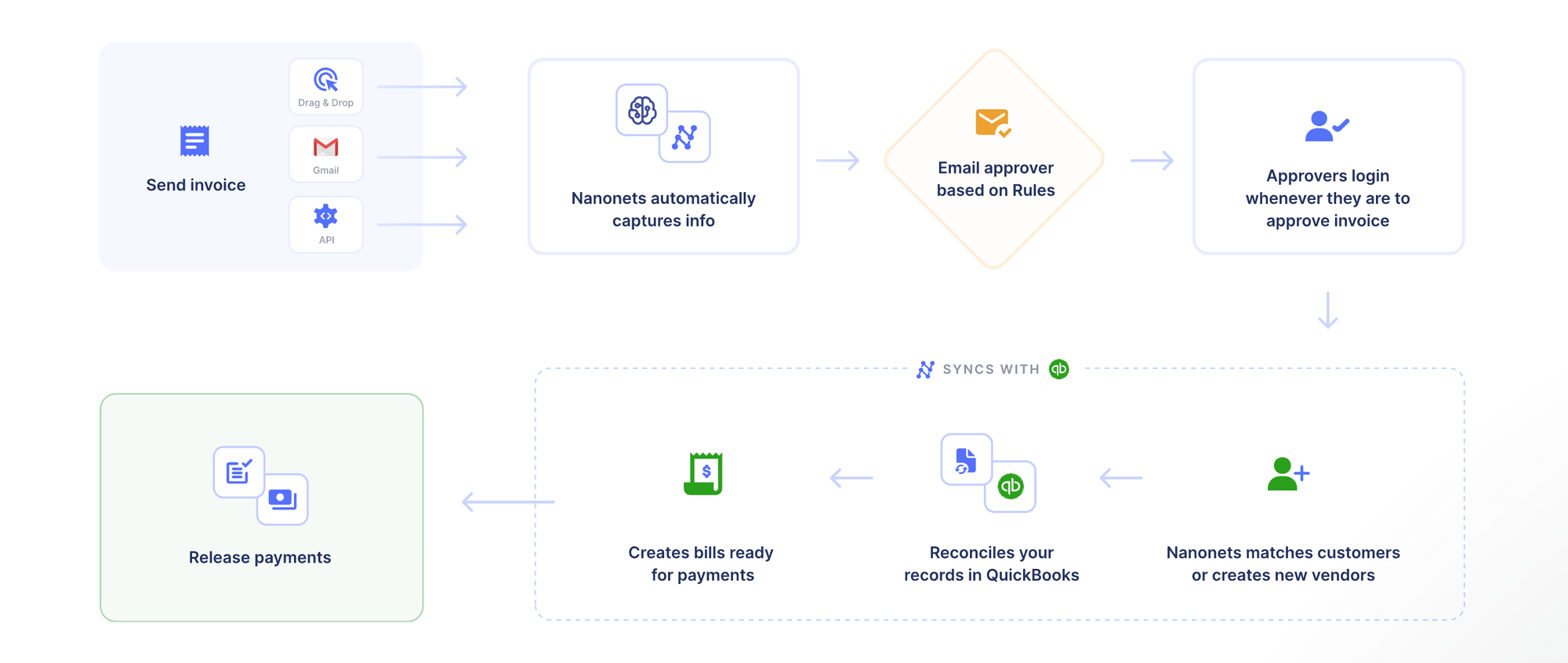

Now, let's explore how integrating Nanonets into QuickBooks can transform the Accounts Payable (AP) workflow from manual to automated, streamlining processes and enhancing efficiency:

Invoice Receipt: Picture this- every invoice your business receives, regardless of its source, lands neatly in one digital spot. Invoices are automatically imported from the mess of emails, drives, and databases as soon as they arrive, saving you time and reducing mistakes.

Nanonets automatically reads emailed invoices from email body and attachments.

All handwritten and printed invoices can be easily scanned using a smartphone or directly uploaded into the platform.

Digital receipts can either be created and printed directly using the Nanonets platform, or imported into Nanonets from your mail, apps and databases.

This process ensures that every piece of data, regardless of its origin, finds its place in a centralized, digital repository, ready for further action.

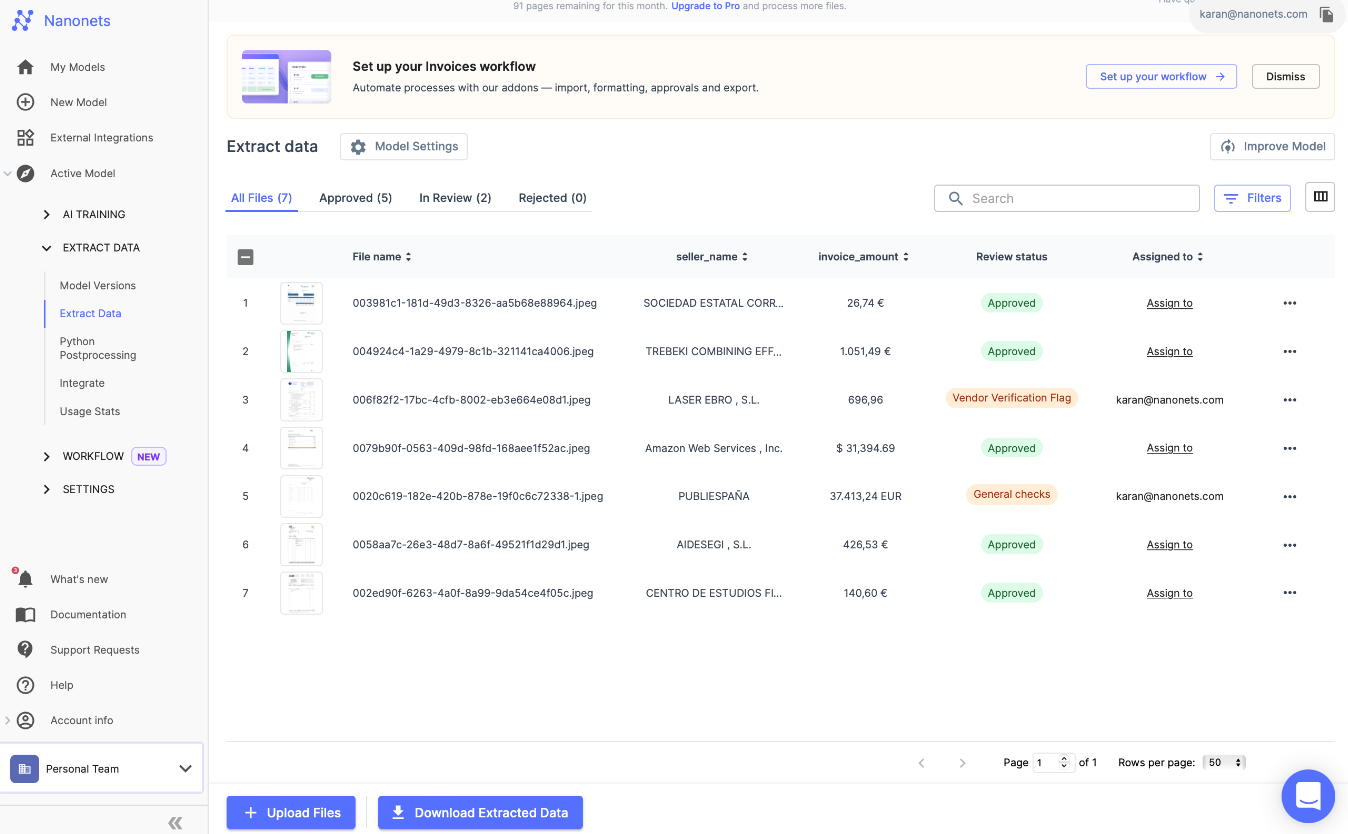

Automated Data Entry: Nanonets leverages AI to achieve over 99% accuracy in reading invoices, transforming hours of manual work into mere moments. This automation allows your team to focus on more meaningful tasks, as data extracted from invoices is directly inputted into QuickBooks without any manual intervention.

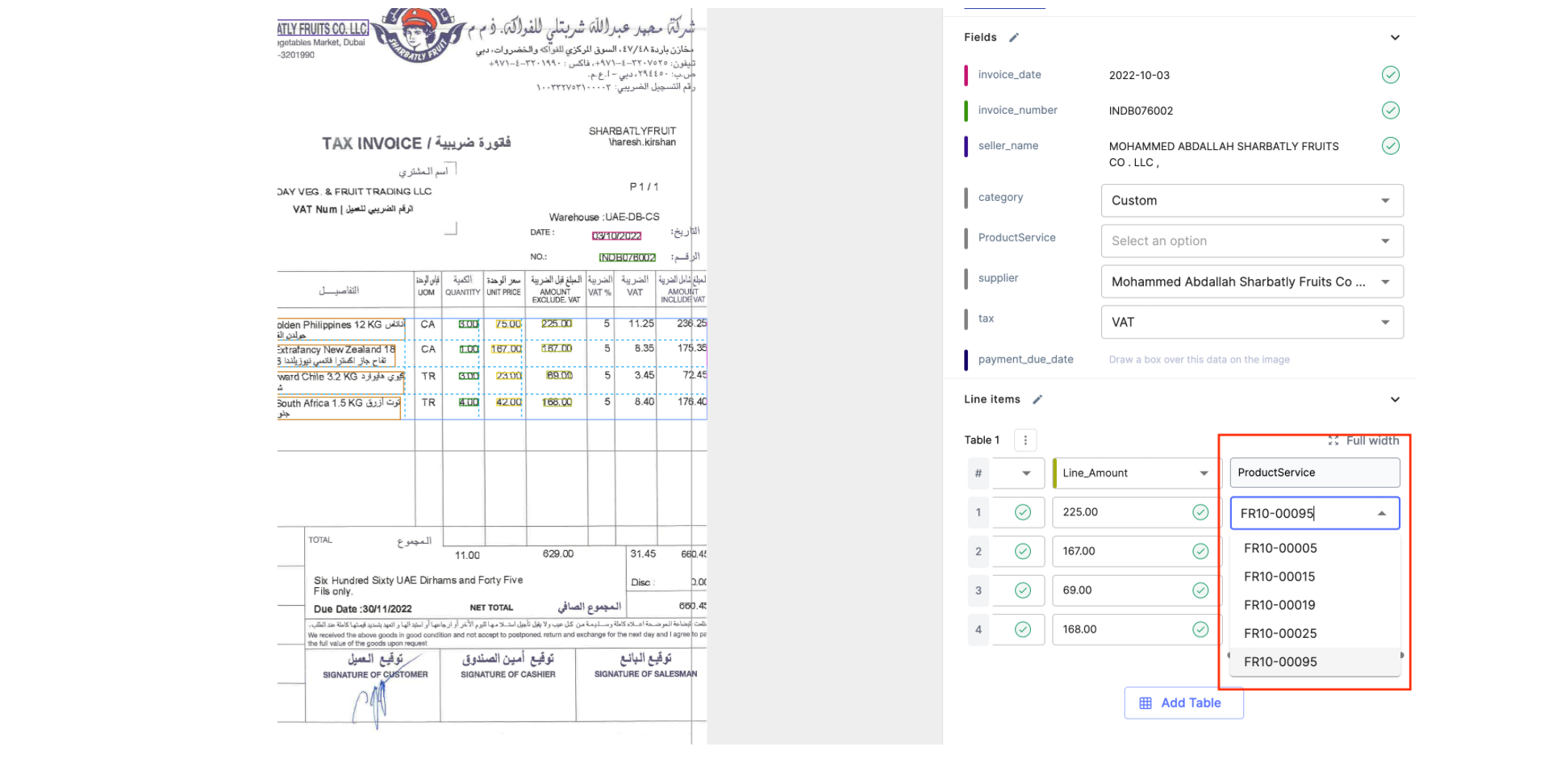

Automated Sorting and GL Coding: Utilizing OCR technology, Nanonets automatically recognizes and categorizes invoices by various criteria such as vendor, date, and amount. It also automates the assignment of GL codes through:

- Training on past data: This involves uploading historical financial documents and transactions tagged with historically correct GL codes. The model learns from these examples to accurately predict GL codes for new transactions.

- Out of the Box Gen AI: By using Nanonets GenAI, our software can interpret the text on financial documents in a way that mimics human understanding. This allows it to extract relevant information, context and semantics in order to apply complex reasoning to assign GL codes accurately, even in cases where transaction details are ambiguous or sparse.

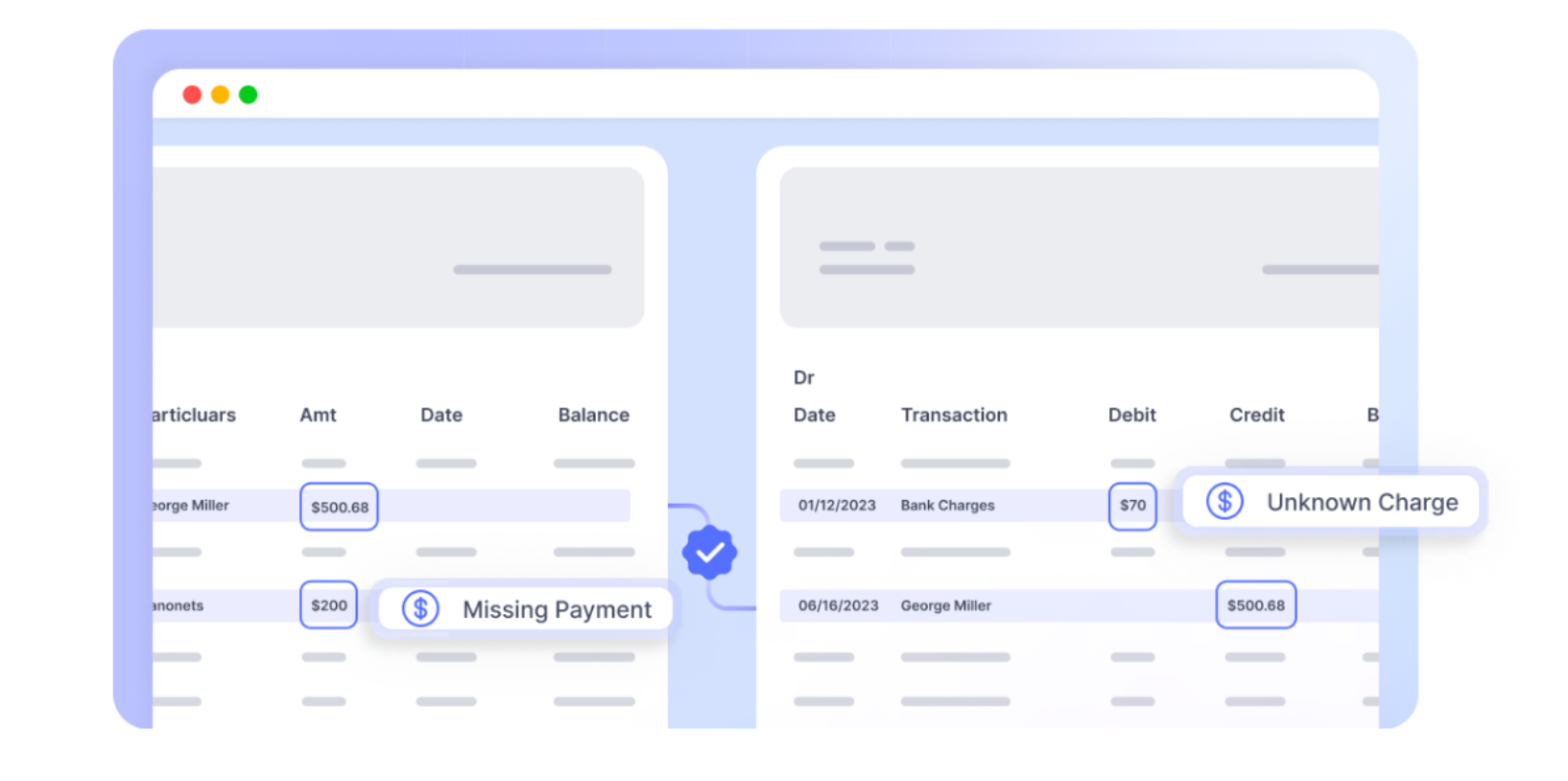

Intelligent Invoice Verification: Leveraging AI, Nanonets automatically performs two-way, three-way, or four-way matching by reading and cross-referencing the extracted invoice data with purchase orders, receiving reports, and inspection reports present in QuickBooks.

Validation and Routing: The system identifies discrepancies for human review, but automatically routes or approves invoices matching pre-defined criteria, significantly reducing manual oversight.

Approval: Approvals with Nanonets are no longer a bottleneck. They become flexible and live where your organization does—whether that's on email, Slack, or Teams. This eliminates the need for disruptive phone calls and the all-too-familiar barrage of reminders.

Payment Processing: Once invoices have been coded and approved in Nanonets, the integration will automatically create ready-to-send bills for payments. With all this in place, companies can now optimize their payment timings to take full advantage of early payment discounts or avoid late fees, directly contributing to cost savings.

Reconciliation: You can import your bank statements, and Nanonets reconciles the payments automatically with the data in Quickbooks, ensuring that financial statements are up-to-date and accurate, and your books close 90% faster.

We discussed the tangible benefits of using OCR and Invoice Scanning Software for Xero earlier. But on top of that, the transition from a manual to an automated AP process represents not just a shift in how tasks are performed but a fundamental transformation in the role of the finance department. With tools like Nanonets, finance teams move from back-office functions to strategic contributors, leveraging real-time data and analytics to drive business decisions. This is the future of finance, and it's available now for Xero users through the power of automation with Nanonets.

What impact does OCR and Invoice Scanning Software have?

Various reported statistics underscore the impact of automation software. These numbers represent a narrative of the kind of success that you and your team can look forward to experiencing.

Dramatic Cost Reductions in Processing

Let's start with the financial health of your department. AP Automation has been shown to slash processing costs by a staggering 70%. This isn't just about saving pennies; it's about reallocating your budget towards growth, training, and maybe even that office espresso machine everyone's been eyeing. Think of this as an investment in both your team's efficiency and their well-being.

Time is of the Essence

Now, imagine reducing your invoice processing time by 384%. This dramatic decrease means your team can process more invoices faster than ever before, freeing up time to focus on strategic initiatives that truly matter. With AP Automation, "I don't have time for that" becomes "What’s next on the agenda?"

Error Reduction for Peace of Mind

We know errors can be more than just annoying—they can be costly. With a 37% reduction in invoice processing errors, AP Automation brings peace of mind to your operations. Fewer errors mean fewer hours spent in correction cycles and more confidence in your data integrity. This also translates into less friction with vendors and stakeholders, smoothing the way for smoother relationships and operations.

Cultivating Vendor Relationships

Speaking of relationships, let’s talk about the 76% of organizations reporting increased vendor satisfaction. This is key. Happy vendors mean a reliable supply chain and opportunities for negotiations and discounts down the road. Your vendors will notice and appreciate the punctuality and accuracy of your payments, thanks to AP Automation.

Cash Flow Optimization through Early Payment Discounts

A 3% savings through early payment discounts gives your organization a financial facelift, enhancing your cash flow, and providing you with more leverage and flexibility in your financial operations.

Compliance Without the Complications

Lastly, the crown jewel of AP Automation: 100% stress-free compliance. In an age where regulatory demands are ever-increasing, achieving complete compliance without the stress is nothing short of miraculous.

Ready to revolutionize your invoice processing with Nanonets for QuickBooks? Schedule a call today to explore how our cutting-edge solution can streamline your financial operations.

Steps to Integrate Nanonets for Quickbooks

You can integrate Nanonets with QuickBooks within minutes, and start using the platform to automate your invoice processing and AP workflows.

A fully automated invoice processing Nanonets workflow integrated with QuickBooks looks as follows.

Here's a complete step by step guide on how to set up your Nanonets integration with QuickBooks within minutes -

1. Setting Up Your Account

- Sign up / Login on https://app.nanonets.com.

- Choose the Invoices pre-trained model.

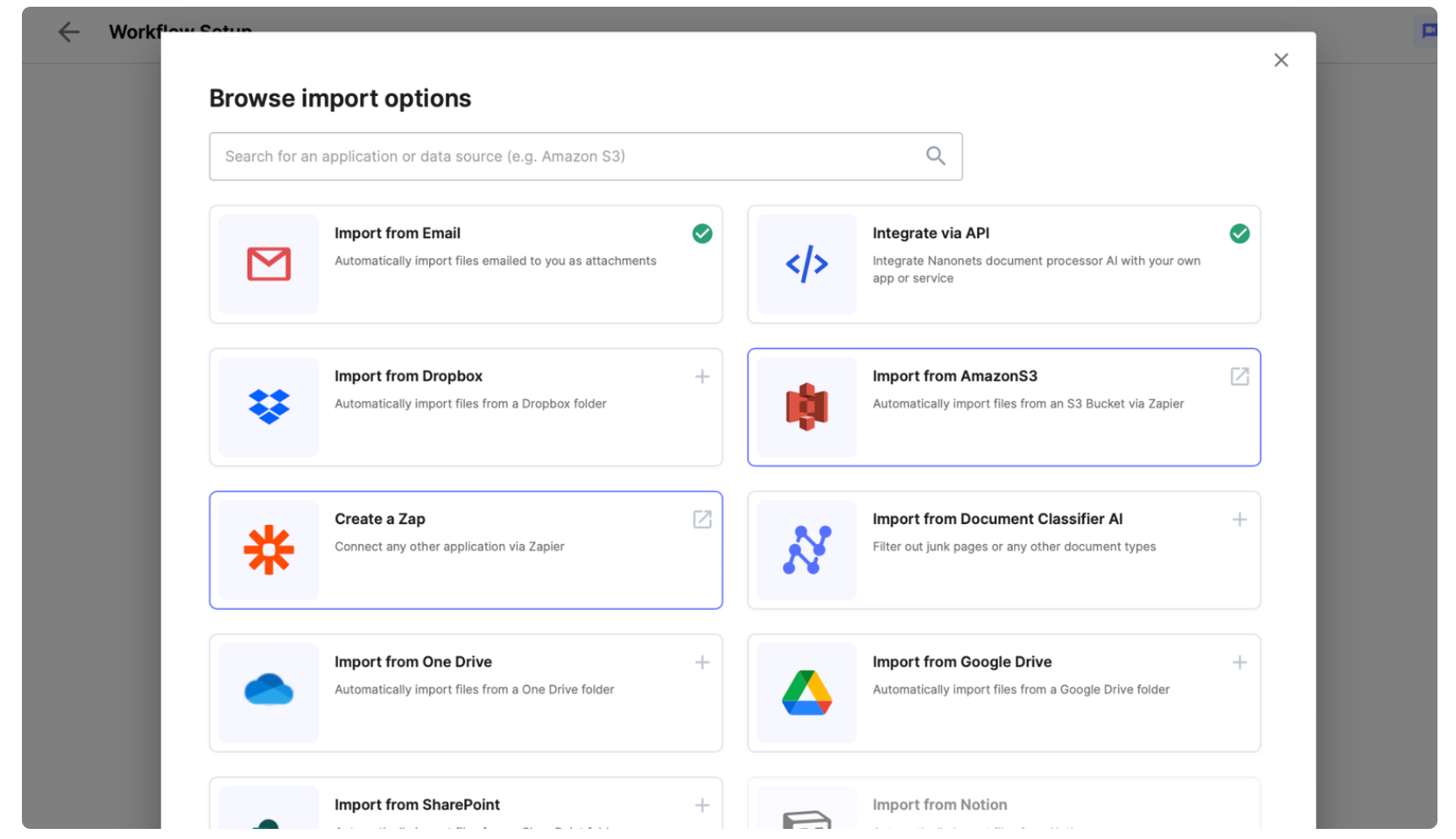

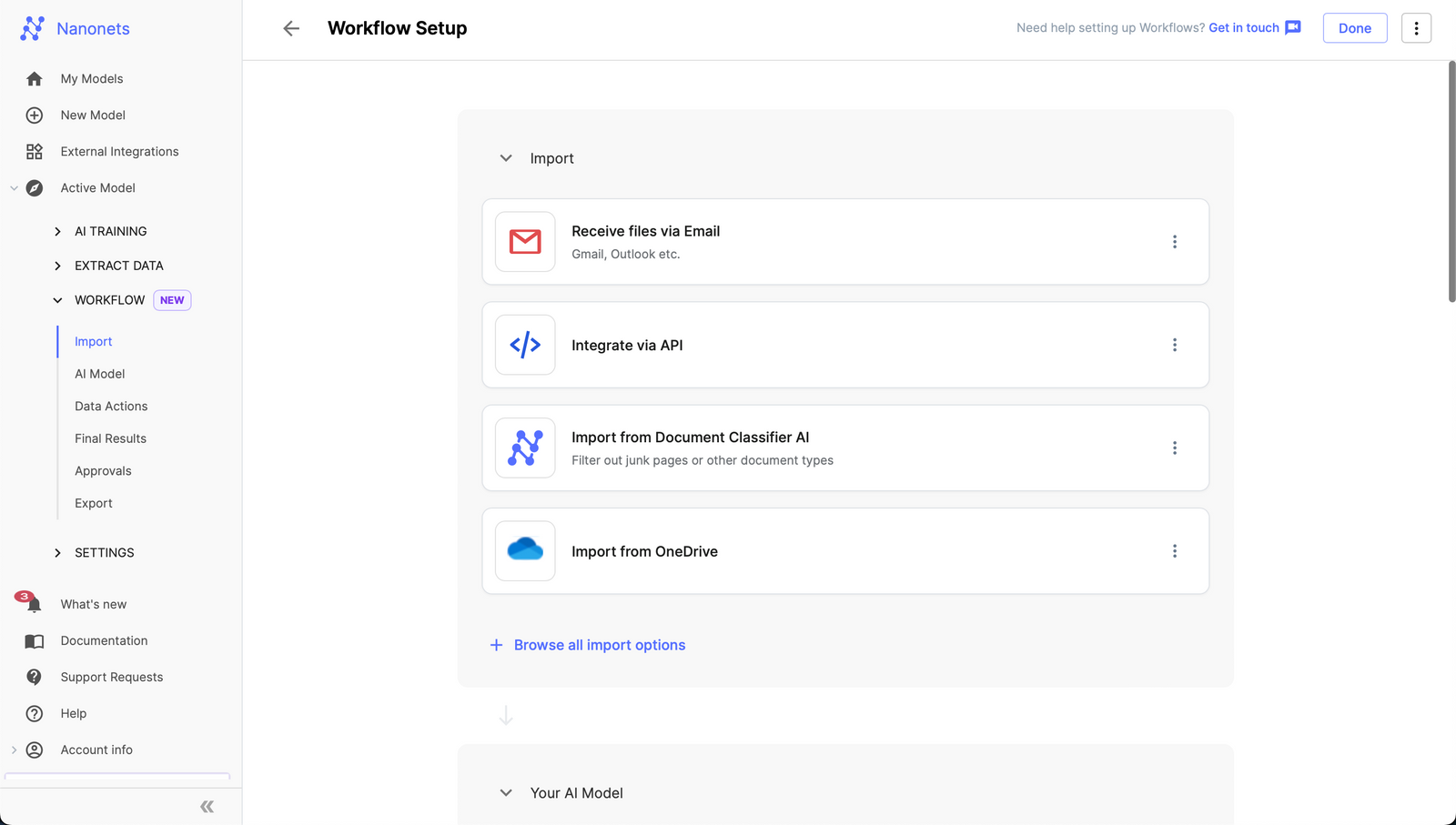

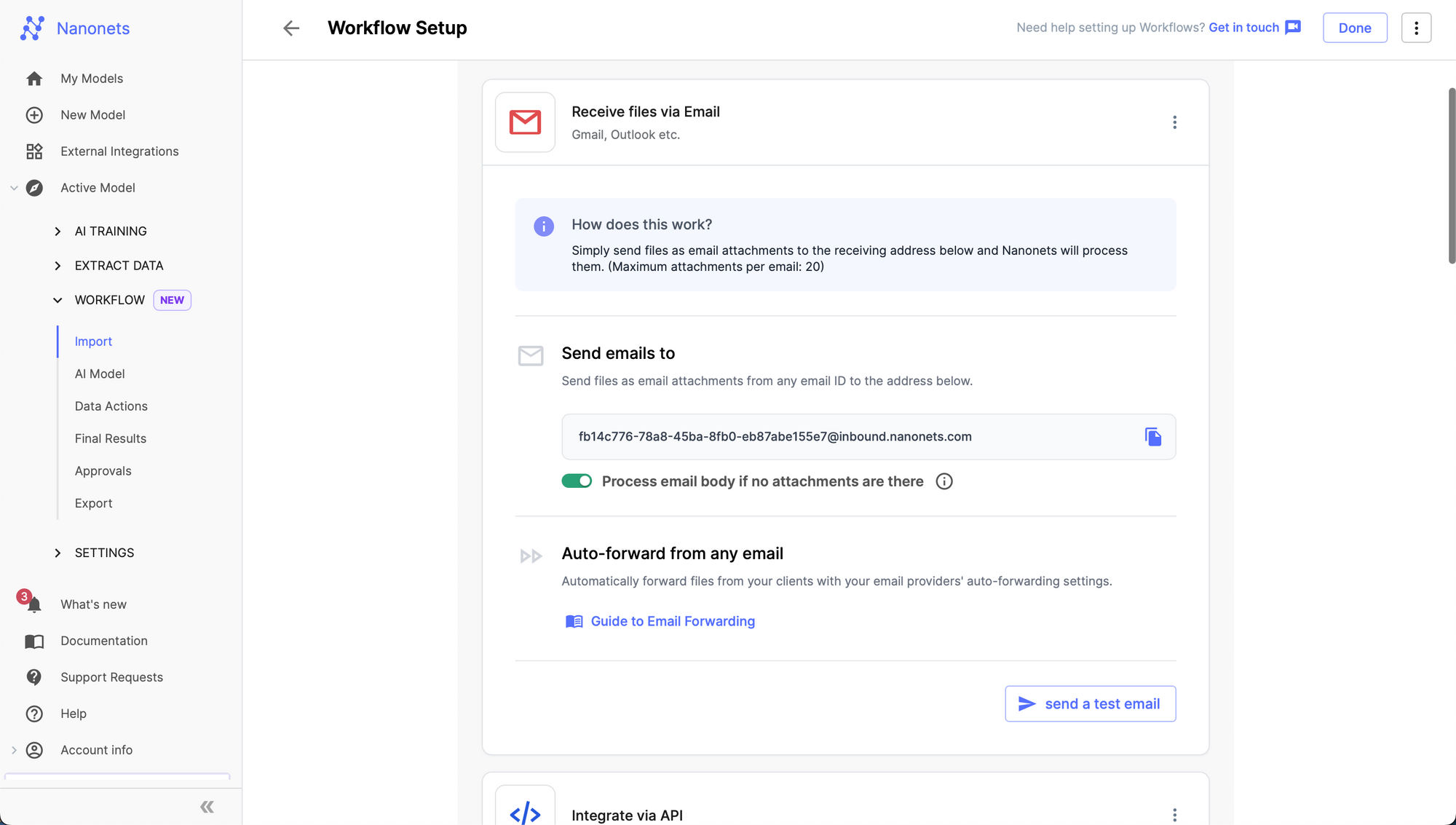

2. Configuring Automated Invoice Collection

- Once you have created the model, navigate to the Workflow section in the left navigation pane.

- Go to the import tab and configure your import options -

- 1. Email :

- Go to the import tab and click on "Receive files via Email".

- In the expanded view, you will be able to find an auto generated email address created by Nanonets.

- 1. Email :

- Any Email sent to this address will be ingested by the Nanonets model you created and structured data will be extracted from it. You can set up email forwarding to automatically forward incoming emails from any email address to the Nanonets email address to automate email ingestion and data extraction.

- Learn how to set up Email Forwarding from any email

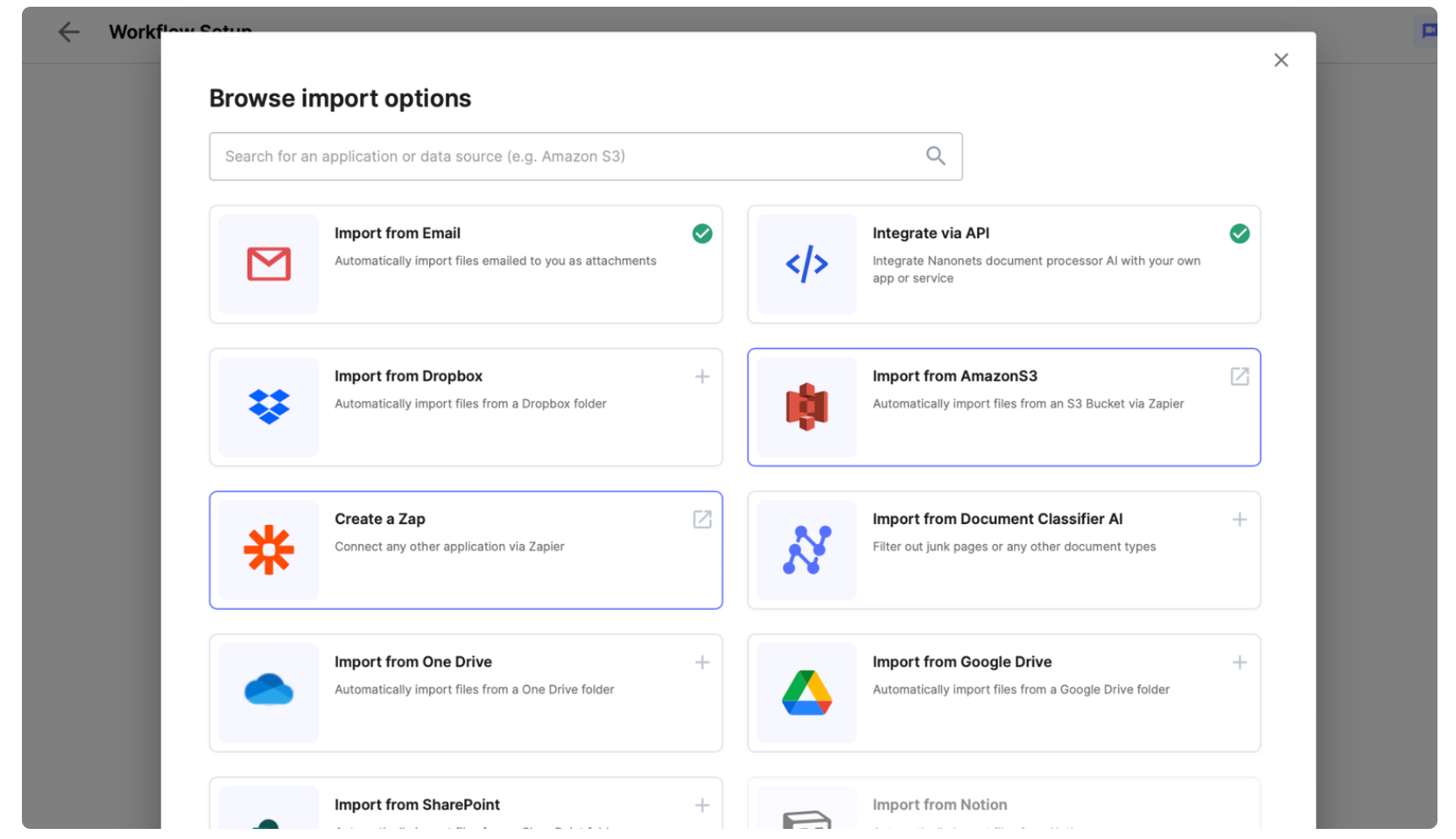

- 2. Automated Import from Apps and Databases

- Set up your imports from the "Browse all import options" modal.

- 3. Direct Upload

- You can also choose to directly take photos and upload invoices using the Nanonets platform or mobile app.

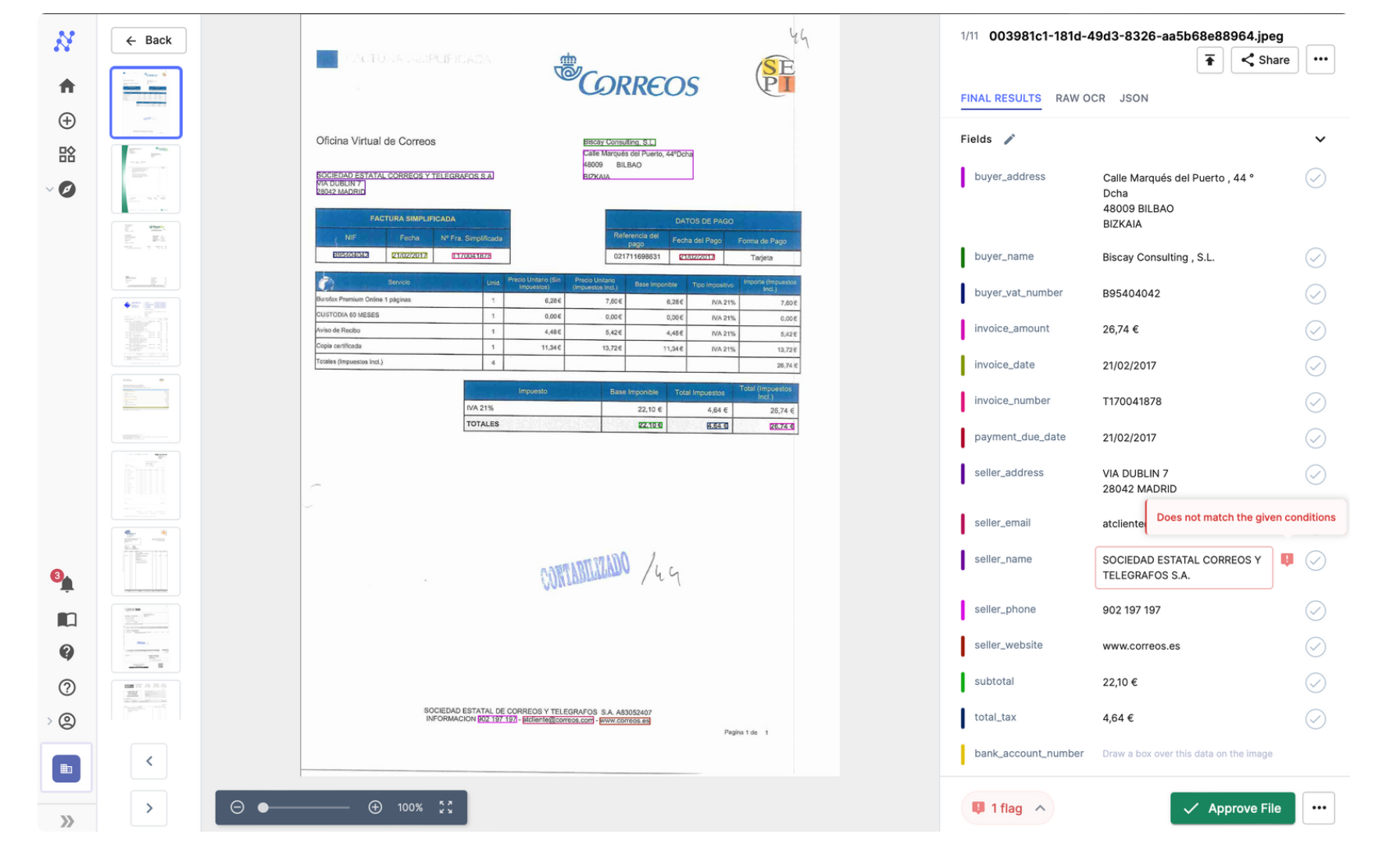

3. Data Extraction

- Test Data Extraction: Upload a test invoice and Nanonets works on the imported document and extracts fields, line items and tables.

4. Add post-processing steps

- After testing the data extraction with a test invoice, you can automate further processing of the extracted data using Actions. Go to the Actions section in the Workflow page.

- Click on Add an action.

- Select and configure an action. Here is a list of actions you can add -

| Convert to Date format | Change text to a selected date format. |

| Currency detector | Extracts currency field as a 3-character code (e.g., USD). |

| Find and Replace | Replace instances of any character or phrase. |

| Remove characters | Remove alphabets, numbers, or special characters. |

| Combine instances | Concatenate separated values of data into a single string. |

| Change to closest match | Change text to a value that is a close match of captured data. |

| Change case | Change text to uppercase/lowercase or all caps. |

| Convert to integer | Remove decimal places from numbers. |

| Convert to float | Add decimal places to numbers. |

| Remove Currency symbols | Keep only numbers, decimals, and commas in amounts. |

| Convert to ASCII | Convert a string into American Standard Code for Information Interchange encoding. |

| Match Regex | Extract the substring matching the regular expression. |

| Create a new field with Regex | Derive fields from captured regex groups and assign to variables. |

| Add/Replace value | Add new label or replace value of a label with a combination of strings and other labels. |

| Delete value | Delete values(contents) of the specified field while retaining the label in the final results/output. |

| Barcode Scanner | Scan barcodes. |

| QR Code Scanner | Scan QR codes. |

| Checkbox Detector | Get all generic checkbox fields. |

| Specific Checkbox Detector | Get specific checkbox fields. |

| Math Functions | Perform math operations on labels and values. |

| LLM data action | Use Large Language Models and prompts to process data. |

| Lookup in various databases | PostgreSQL, MySQL, MariaDB, MSSQL, Salesforce, Quickbooks, Microsoft Dynamics-365, Sage Intacct, Nanonets DB, CSV files. |

| Lookup in CSV | Find and get additional data from .csv files. |

| General Ledger Categories | Add General Ledger accounts, automate categorization based on any captured field. |

| Python code | Create a custom step with Python code block. |

| Gmail - Send Email | Send email to anyone with extracted data. |

| Slack - Send Channel Message | Send message to a public channel with extracted data. |

| Google Sheets - Update Spreadsheet | Automatically update a Google Sheets spreadsheet with invoice details. |

| Twilio - Send SMS | Send SMS to any phone number with extracted data. |

| Zapier - Trigger Event | Trigger an event in Zapier with extracted data. |

| Salesforce - Update Records | Update Salesforce records with invoice information. |

| Microsoft Dynamics 365 - Update Entity | Update entities in Dynamics 365 with invoice details. |

| Webhooks - Custom Integration | Send extracted invoice data to any endpoint as a webhook. |

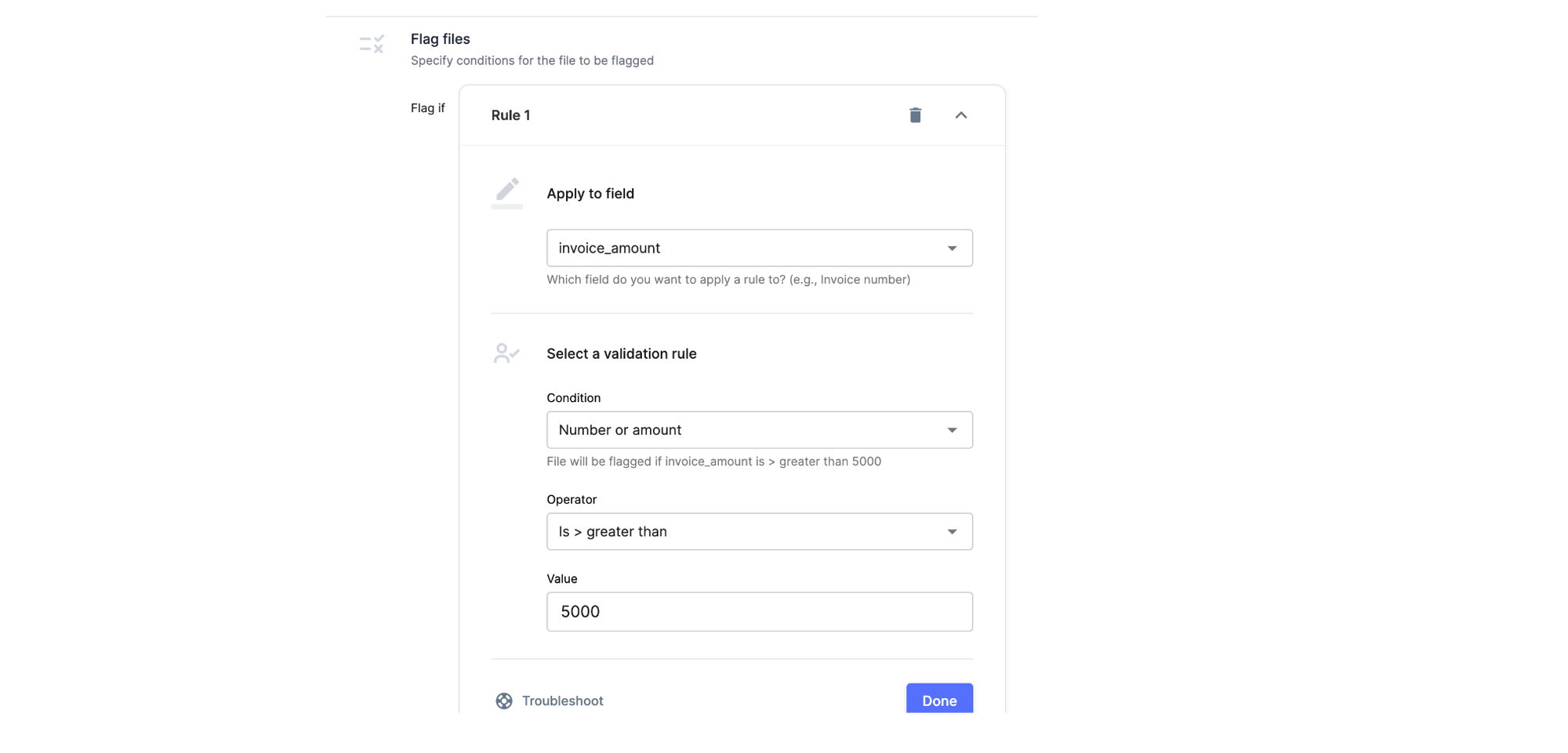

4. Set up your Approval Process

- Go to the Approval section in the Workflow page.

- Click on Add a Review stage.

- A Stage block will be added to your Workflow.

- Select a Review Type.

- Assign Reviewer only if Flagged - use this if you want to skip manual review for files without any errors flagged and assign a reviewer only to the files with errors.

- Mandatory Review - use this if you want to send all files to the selected member for manual review whether or not they are flagged.

- Add Reviewers

- You can add one or more member here. If multiple members are added, the file will be assigned to any one of them.

- Select the field to apply the condition to.

- Select the condition to flag the field. Rules are applied in this Format: If <condition> is True, Then <field> will be flagged.

- Set up the condition. Based on the selected condition, you may need to select an operator or fill in additional details to set up the rule.

- Add Rules to flag the files. Example: Set up a rule to flag files if Invoice_amount is > 5000.

- Select the field to apply the condition to

- Select the condition to flag the field. Rules are applied in this Format: If <condition> is True, Then <field> will be flagged.

- Set up the condition. Based on the selected condition, you may need to select an operator or fill in additional details to set up the rule.

- You can add more Rules if required. The operators between rules can be either 'AND' or 'OR'.

- AND: If multiple rules are added with AND operator, a file will be flagged only if all the rules in that stage fail.

- OR: If multiple rules are added with OR operator, a file will be flagged if any one of the rules in that stage fail.

- Click on Done.

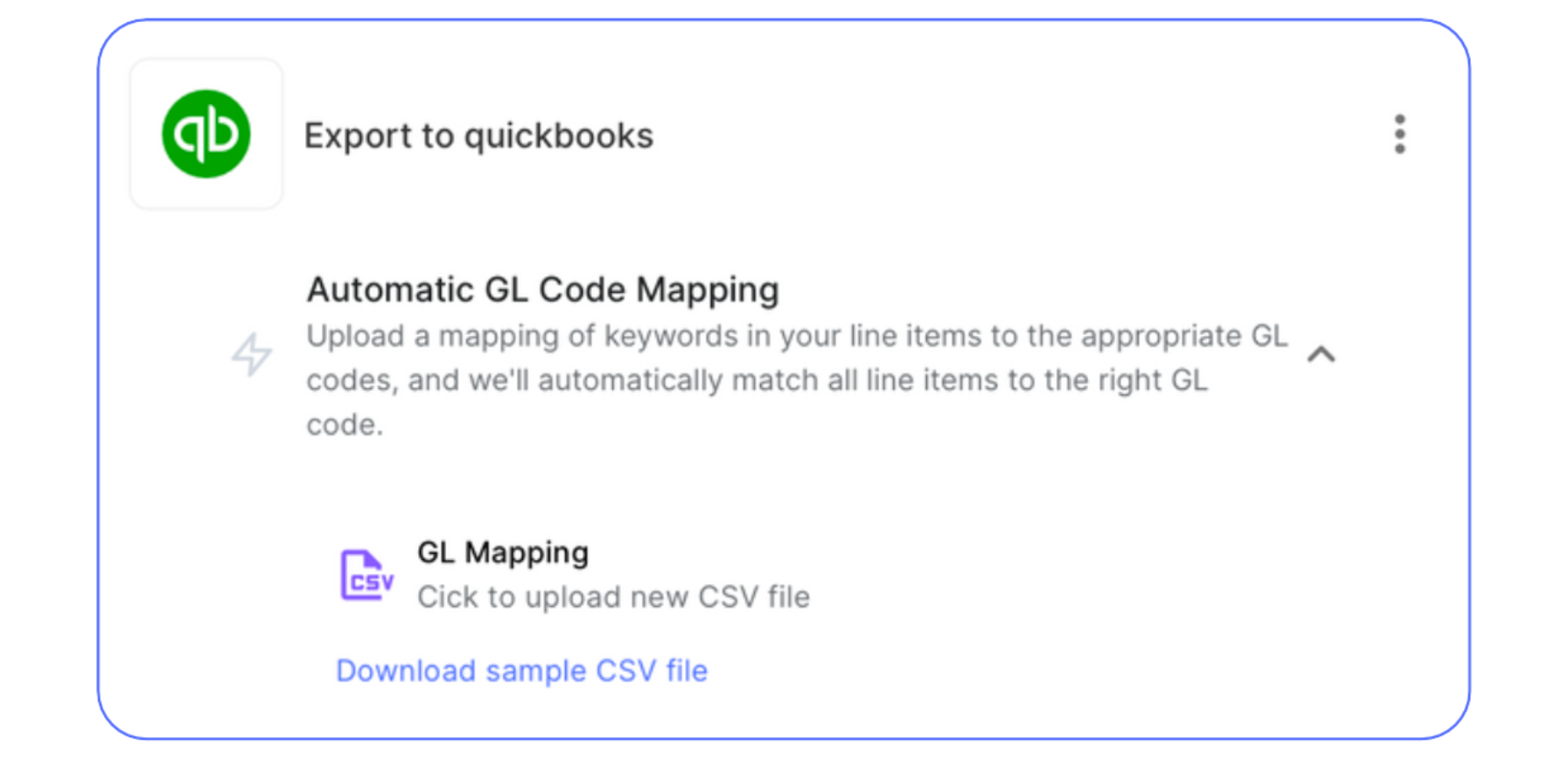

5. Exporting Data to QuickBooks

- Go to Workflows -> Exports -> Browse All Export Options.

- Click on the QuickBooks card to add it to your workflow.

- Once added to your workflow, click on the card to open it.

- Click on Sign in to QuickBooks. You will be redirected to QuickBooks.

- Enter your QuickBooks credentials. You will be asked for the relevant permissions, and then redirected back to Nanonets.

- Back on the Nanonets QuickBooks card, select the type of object that you would like to create inside QuickBooks:

- Account-based Bills (this is usually the default when you're trying to export payable invoices to QuickBooks)

- Item-based Bills

- Expense entries

- Select the appropriate AP account / Expense account to post to.

- Map the Nanonets fields to the corresponding columns in QuickBooks.

Eg: The Invoice_number captured in Nanonets should be populated under 'Doc Number' in QuickBooks. To link these two entities, they need to be mapped in the QuickBooks export block.

- Upload your chart of accounts and set up automated GL coding within the QuickBooks export card.

- Select an Export Trigger:

- The file can be exported as soon as it is processed by the model, or

- The file can be exported only if marked "Approved" (this is the recommended setting)

- Select an Export Action:

- The file can be upserted a new entry will be created only if there isn't an existing one with the same data)

- The file can be inserted (a new entry will always be created)

- Select an Export Type:

- You can export each page of the uploaded file separately, or

- You can export each file as an entire document

- Test Action - You can select a sample file from your model and test the export on it

- From this page, you can verify the status of your export on the Workflow Run History screen.

- Once you are satisfied with your workflow test run, click on Done to save your workflow.

And voila, your Nanonets workflow is now live, streamlining the once cumbersome process of invoice processing and accounts payable workflows into a seamless, automated system. With Nanonets seeamlessly integrated with Quickbooks, each invoice is automatically ingested as soon as it arrives, its details meticulously extracted, and then, based on predefined rules, categorized, approved, and cleared for payment with manual intervention only required to approve/reject invoices sent for manual review.

Ready to revolutionize your invoice processing with Nanonets for QuickBooks? Schedule a call today to explore how our cutting-edge solution can streamline your financial operations.

Case Study

As we explore the tangible benefits of OCR and Invoice Scanning Software for QuickBooks, let's dive into a real-world application that demonstrates the transformative power of this technology. One compelling success story comes from Pro Partners Wealth, a firm that has harnessed the capabilities of Nanonets to revolutionize its accounting data entry process.

Client: Pro Partners Wealth

Pro Partners Wealth is an accounting and wealth management firm headquartered in Columbia, Missouri. They have offered comprehensive wealth management solutions to veterinary owners for over two decades. Their expertise is collecting and analyzing vital financial documents, such as tax returns, investment prospectuses, legal papers, and personal financial statements, to provide tailored advice to their clients.

Pro Partners Wealth also handles client bookkeeping services, ensuring their finances are up-to-date and organized. Their financial advisors, Kale Flaspohler and James Michael, are dedicated to helping clients streamline their financial operations and manage their accounting.

The Challenge: Manual Data Entry and Its Limitations

As bookkeepers, they understand the importance of high accuracy and error-free accounting to avoid unwarranted losses for their clients. However, their process of data extraction, validation, and updating it in QuickBooks was time-consuming. This issue posed a scalability problem, making it difficult to take on new clients as a significant amount of time was spent on creating an error-free accounts payable process.

Pro Partners Wealth used automation services but faced multiple challenges, such as:

- Despite implementing automation software, their employees still had to spend significant time correcting invoice data entries manually.

- The Straight Through Processing (STP) rate was very low, with nearly every invoice requiring manual review or editing.

- The existing solution lacked automation and flexibility, requiring additional manual work for essential processes such as validating invoice totals and line items.

Kale and James knew a more efficient and streamlined solution was needed to address these issues. They needed a company that could provide them customization and support to tailor a solution fit for their business.

The Solution: Implementing Nanonets for a streamlined accounting process

With traditional automation tools, Pro Partners Wealth saw a high error rate which required them to manually check each invoice and validate them based on their business rules. They had to further do manual processing in feeding this validated data to their accounting software - Quickbooks.

To overcome these challenges, Kale and James sought a solution to capture invoices accurately, perform certain data validation checks, and feed data directly into QuickBooks at the required level. This is why they chose Flow, by Nanonets, which offered customizations that enabled them to streamline their invoicing process and automate their entire flow.

With Nanonets, they could upload client images or set up auto-forwarding, and ensure data extraction with a high degree of accuracy. They also set up validation steps based on business logic to flag out erroneous invoices, making identifying and resolving issues quickly easier.

Using Nanonets, Pro Partners Wealth gained greater visibility into their revenue and costs, allowing them to calculate profit margins and recommend informed business decisions to their clients. The reduced turnaround times and increased accuracy of their invoicing process improved the user experience of their current clients and allowed them to scale their business by onboarding new clients.

Impactful Results: Efficiency, Accuracy, and Cost Savings

Pro Partners Wealth is in a growth phase, so they needed to remove bottlenecks that were reducing their efficiency. Their traditional OCR tool couldn’t provide a long-term solution due to slow processing times and a lack of customizations and support. With the implementation of Nanonets, they immediately received the support needed to address issues quickly and customize the product to reduce turnaround times further.

Before Nanonets, their OCR had an accuracy rate of only 80%, and Nanonets provided an accuracy rate greater than 95%. By primarily performing spot checks instead of manually validating every invoice, Pro Partners Wealth has been able to save 40% in time when compared to their previous tool. Moving forward, they plan to continue working with Nanonets to improve accuracy further and implement additional tools that can help save even more time. This allows them to streamline Accounts Payable and focus on scaling their core business.

Take a look at what they had to say about Nanonets.

Conclusion

The integration of Nanonets with QuickBooks transforms the arduous task of manual invoice processing into a seamless, automated workflow, empowering businesses to transcend traditional limitations. By leveraging advanced OCR technology and AI-driven insights, companies can now enjoy accelerated invoice processing, minimized errors, and enhanced decision-making capabilities. The automated synchronization with QuickBooks not only streamlines financial operations but also positions finance teams as strategic partners in business growth.

Ready to revolutionize your invoice processing with Nanonets for QuickBooks? Schedule a call today to explore how our cutting-edge solution can streamline your financial operations.