PO Matching is the process of connecting a purchase order (PO) issued by a client indicating types, quantities, and agreed prices for products/services to the invoice issued by a vendor for it's delivery.

The goal of PO matching is to ensure timely vendor payments, correct accounting of costs and easy detection of fraudulent practices. This is an important verification step in the invoice processing workflow and can be automated with AP automation or invoice automation software.

Manual PO Matching

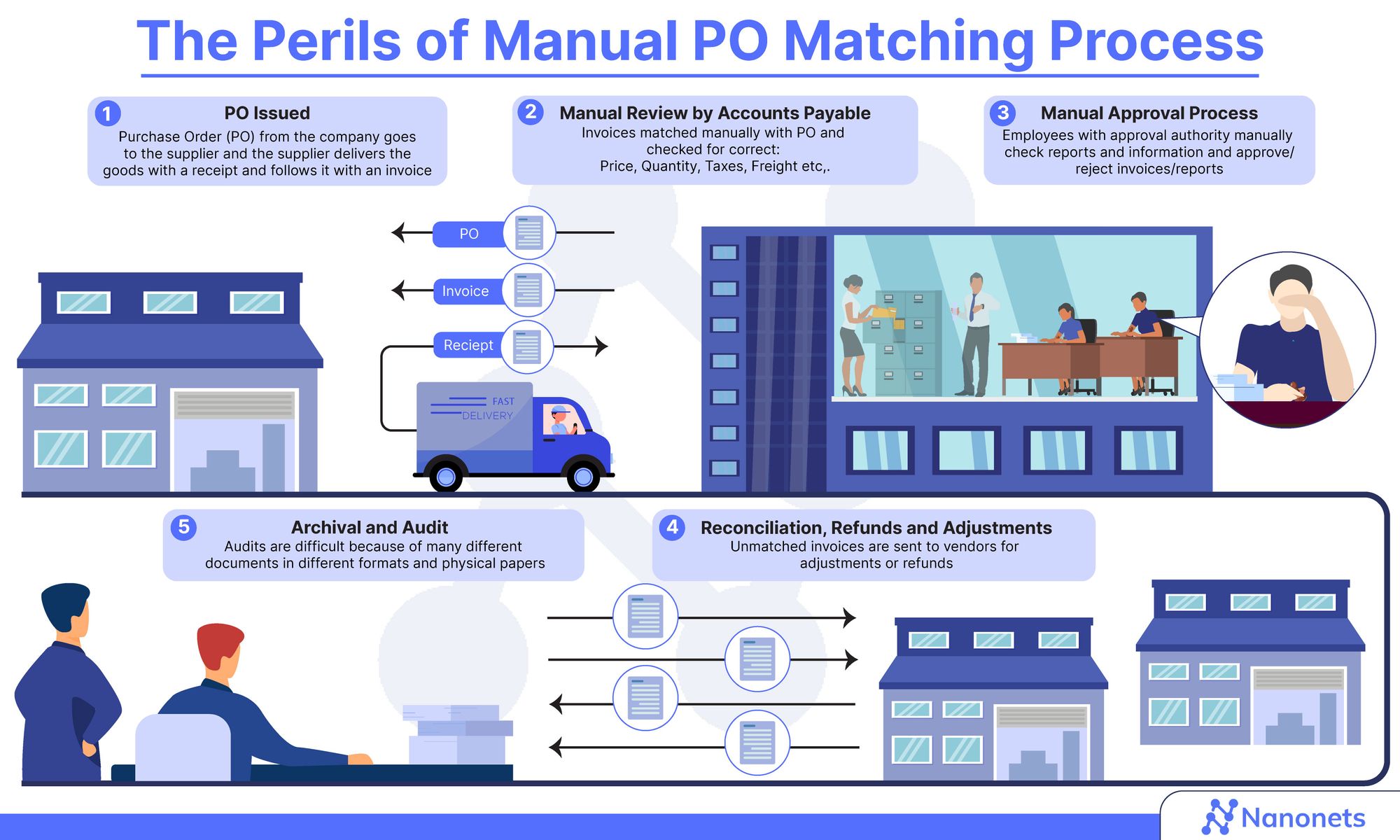

PO matching involves several steps, including the receipt & invoice capture data, verification with purchase order, matching the parameters, and resolution based on various parameters. Invoice processing and PO matching are complex, time-consuming, and resource-intensive processes when performed manually, especially in scaled-up business activities.

Even in departments where there is the digitization of information in the form of Enterprise Resource Planning (ERP) applications, a significant amount of human labour is required; from the time an invoice is raised or received to its entry into the ERP application, accounts payable personnel perform a seemingly endless list of chores.

· Opening and scanning the mail/opening physical invoices/POs

· Retrieving invoices/POs from an e-mail box, portal, or physical envelopes

· Keying the information from invoices into the computer

· Manually matching invoices with purchase orders (POs) and delivery receipts

· Physically routing invoices/OPs to managers and approval personnel

· Resolve exceptions through cumbersome eyeballing and manual analysis.

· Entering matched invoice information into the ERP

· Searching the ERP for duplication and omissions

· Reconciling invoices with payments

· Updating vendor master data

Some debilitating challenges in large-scale PO matching, especially when performed manually are:

Handling multiple invoice data points: Large organizations routinely deal with POs and/or invoices from multiple suppliers/clients in multiple formats including word processor files (e.g., MS-Word documents), data entry files (e.g., MS-Excel files), structured XML documents from Electronic Data Interchange (EDI), PDFs and image files, and sometimes as hard copy documents.

The unification of all these documents is time-consuming and error-prone when performed manually. Errors at the start of the invoice processing workflow can snowball into serious outcomes such as over-payment, incorrect payments, invoice duplication, etc. that can lead to loss of productivity and trust.

Data mismatch: The accounts payable department of the company often have to match the PO with the Goods Received Note (GRN), and contracts data, in addition to the Invoice. The “stare and compare” process of manual matching, besides being labour intensive and strenuous, can lead to serious errors such as missed dates and values, the correction of which would slow down operations and expose the organization to a risks of productivity loss and business-management/client relationship issues.

Exception handling: Accounts payable departments spend a lot of time dealing with exceptions, including incorrect, incomplete, and nonmatching information in invoices. Up to 20% of invoices regularly contain incorrect or incomplete information, and a conventional (manual) accounts payable department spends 25% of its time resolving issues and tracking down missing information.

Cost of processing an invoice: Manual invoice processing and PO matching entails costs including manual hours, paper, and postage, which would be exacerbated by penalties, late fees, product return and loss of business in cases of errors.

Fraud and theft: Certified Fraud Examiners (ACFE) reports that a typical organization loses 5% of its revenue to fraud every year. Criminals impersonating executives or suppliers email authentic-looking invoices or other requests for payment and a less than vigilant Accounts Payable team can fall prey to it.

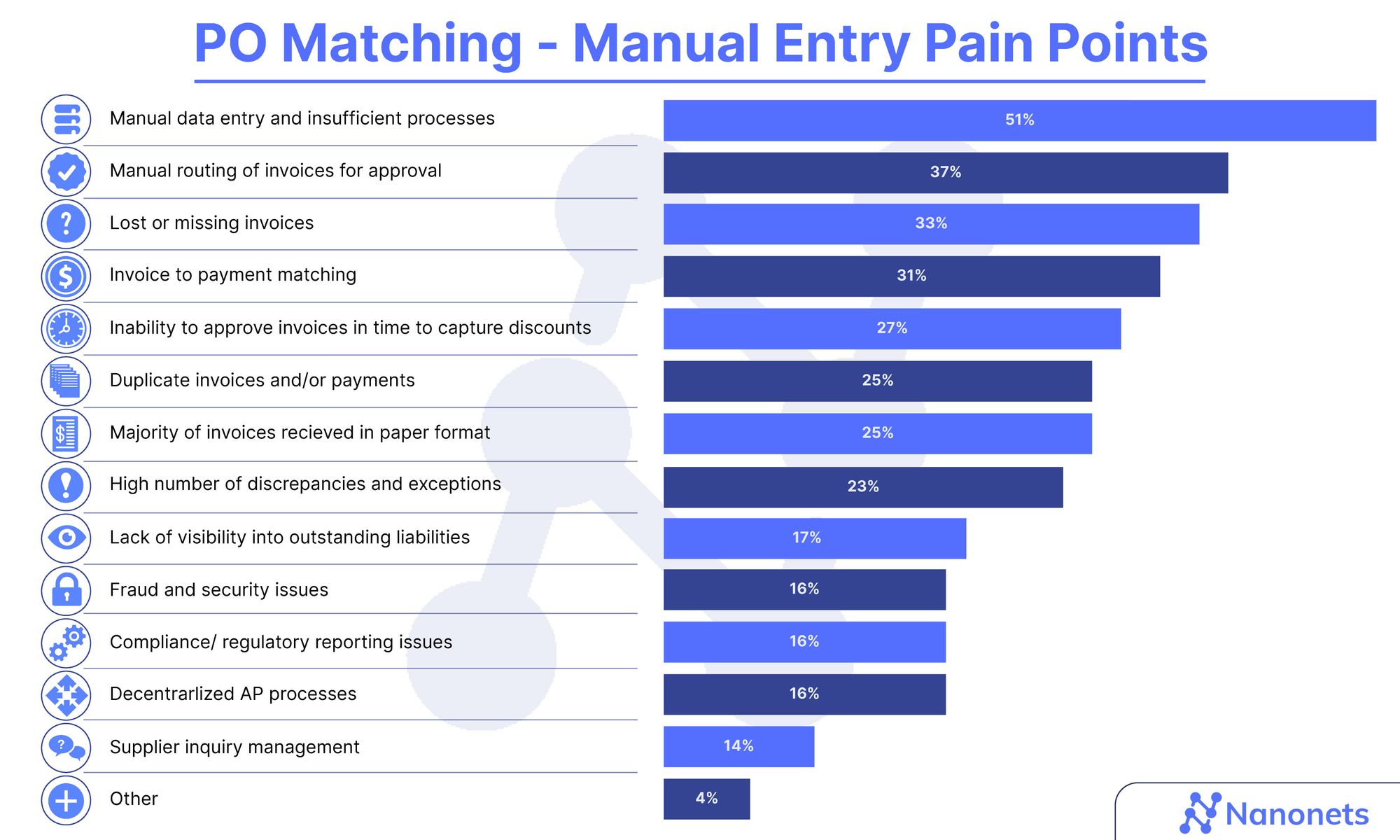

A 2020 survey by Levvel Research showed that manual data entry and inefficiency continue to be the pain points in the accounts payable process.

UK-based Accounts Payable Association found that:

- 56% of businesses experience cash flow forecasting problems due to Accounts Payable issues

- 91% of companies regularly receive phone calls from vendors chasing payments.

- 23% of businesses had suppliers who refused to work with them again due to Accounts Payable inefficiencies

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Automated PO Matching

Many of the above problems may be overcome using automated PO matching. Automation may be introduced at various steps in the process of the accounting process, and accordingly, there are two kinds of automation:

Optical Character Recognition (OCR)-based data capture:

OCR-based invoice data capture uses a combination of image capture hardware and conversion software to convert images into text that can be processed manually by the accounting team. It is obvious that this merely digitises the data and does not match them and must involve subsequent manual operations.

Furthermore, stand-alone OCR systems fail at working with different templates, file types and layouts, necessitating frequent human intervention to set template rules for different types of document.

Automated accounts processing/PO matching:

This is of three types:

- Robotic process automation (RPA) mimics human actions in repetitive tasks.

- Artificial intelligence (AI), computer science's "Holy Grail" in the words of Bill Gates, mimics human judgment and behaviour to match POs, invoices, and receipts.

- Machine learning (ML) is a subset of AI in which, the computer “learns from experience” through algorithms such as the Neural Network that mimics the learning process of the brain.

All three types of automated data processing capture pertinent data from invoices, POs and other financial documentation and auto-process them in a way that mimics the human mind. Of them, the AI-enabled processing can also compare and match records and make decisions such as passing the transaction, flagging errors, or raising exceptions.

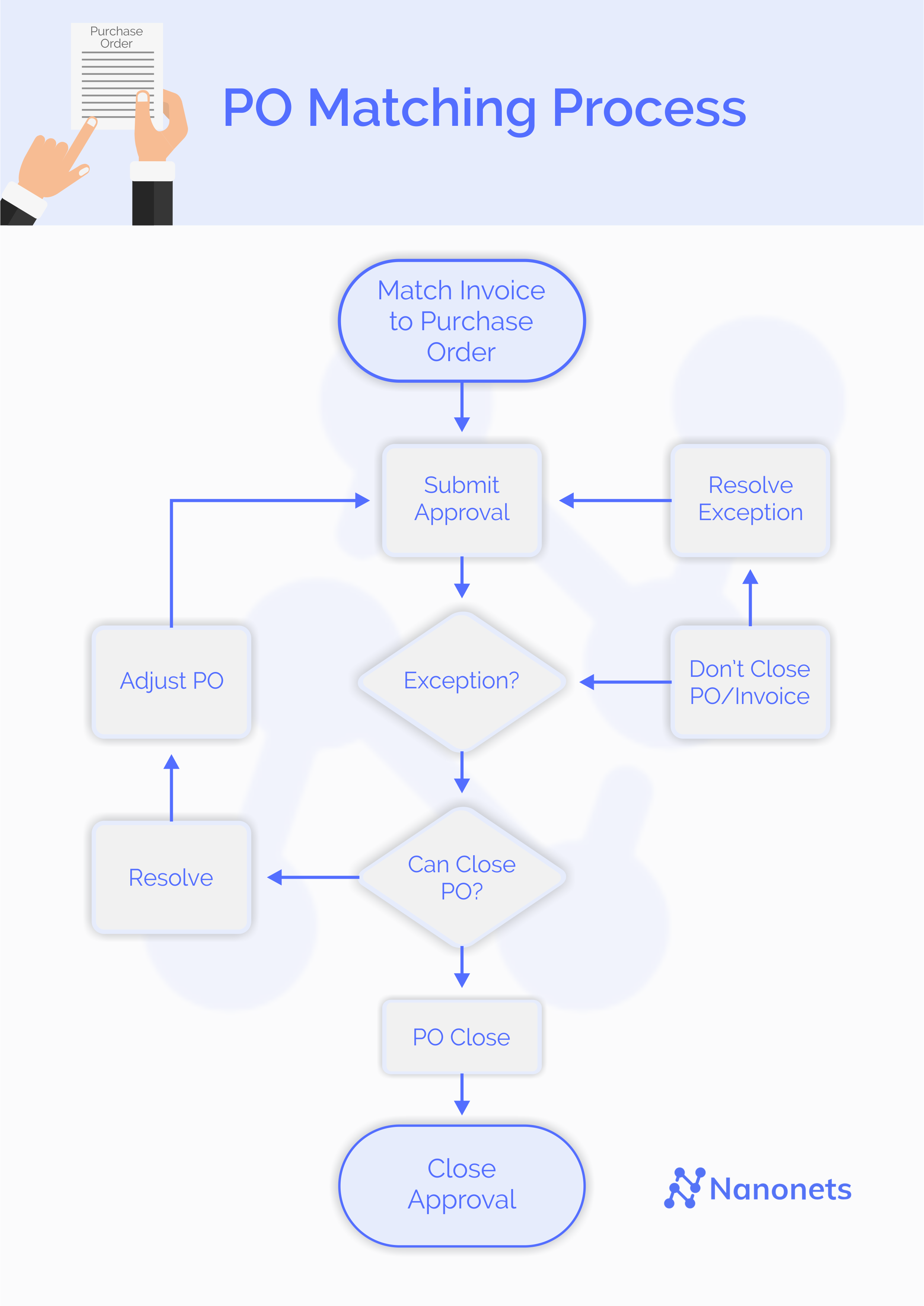

AI-based matching comprises four steps:

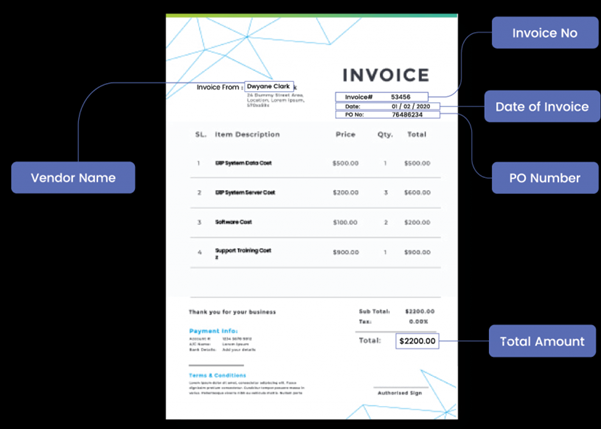

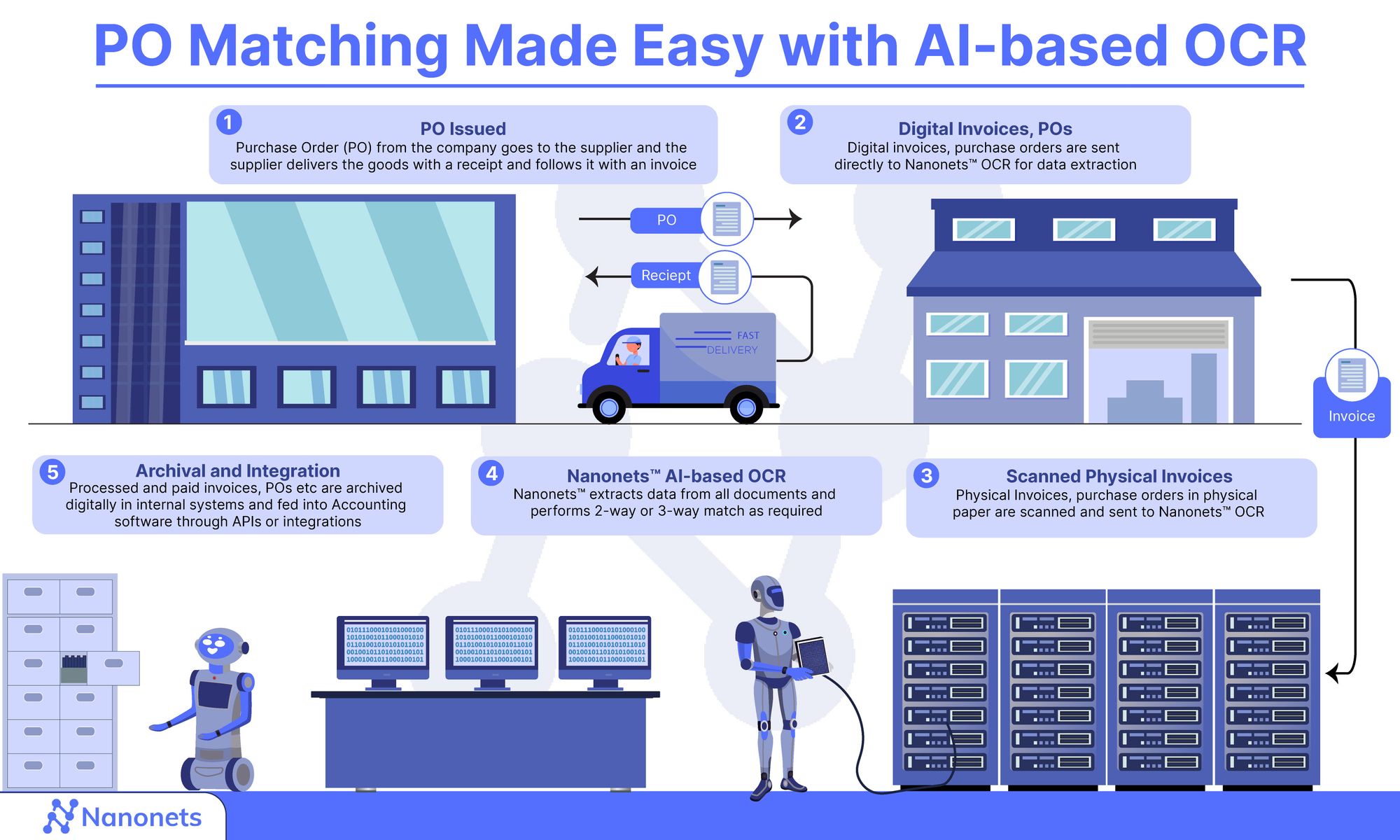

1. Data Capture and Extraction: This step involves a certain amount of human intervention in the manual scanning of physical invoices into systems or incorporation of faxed or emailed invoices for conversion into images. Zonal Optical Character Recognition (OCR), or Template OCR is used to extract text located at a specific location inside a scanned document. A Zonal OCR system is trained by defining where specific data fields can be found inside a document. OpenCV, Tesseract, and Python are some zonal OCR systems that can be trained to pick out specific fields from a captured invoice or PO.

2. Data recognition: The recognition and categorization of the captured data into types either through rule-based classification or by machine learning algorithms. AI OCR systems can eliminate over 80% of operations under invoice data capture, extraction, and indexing.

3. Record Matching and validation: The AI algorithm performs record matching – the process of finding matching pieces of information from large sets of data. The matching process can be 2-way, 3-way, or 4-way, depending on the needs of the company.

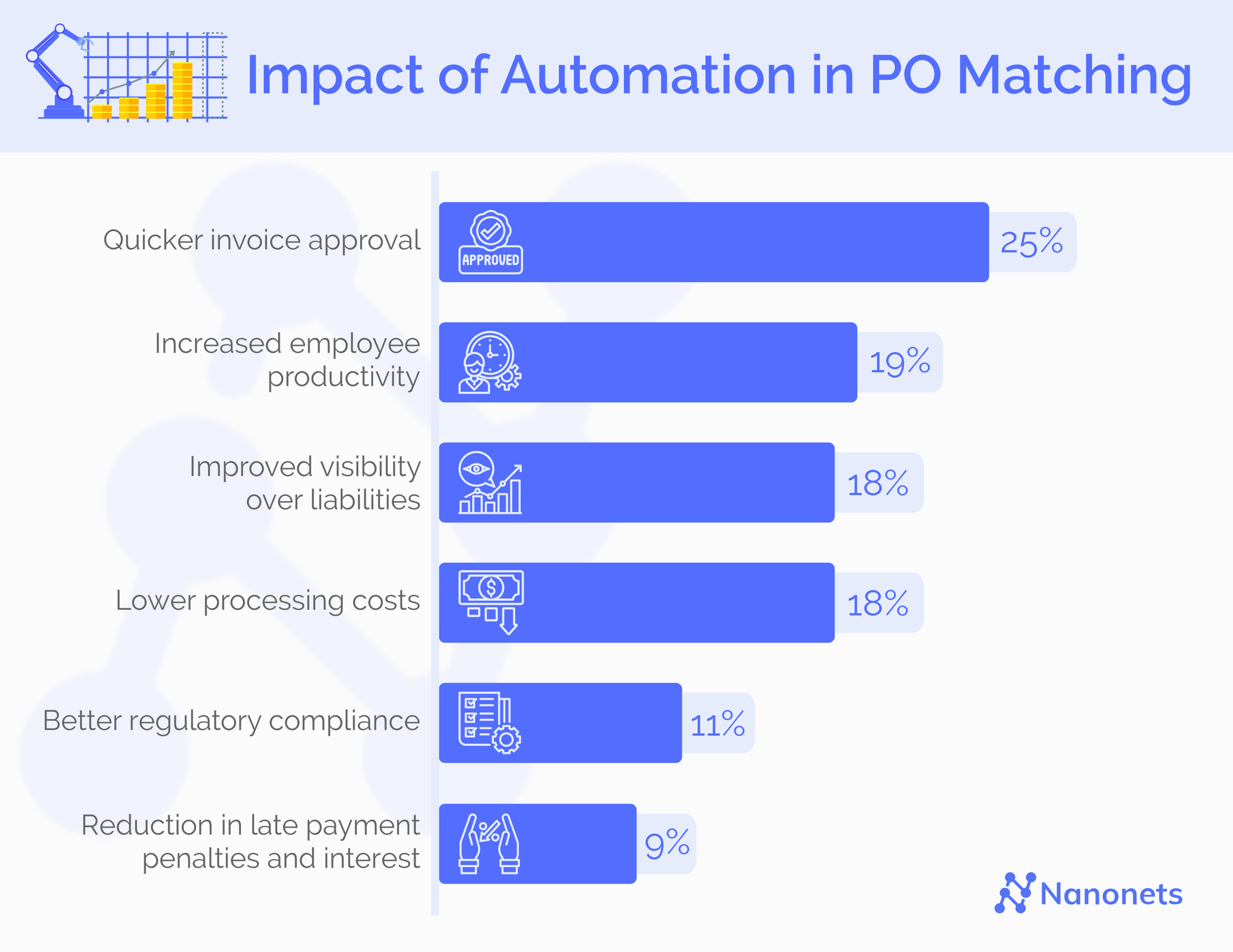

A survey by Levvel Research shows that quicker approval of invoices and increased employee productivity are the top two benefits experienced from a switch to AI-enabled 2-way matching process and 3-way matching processes.

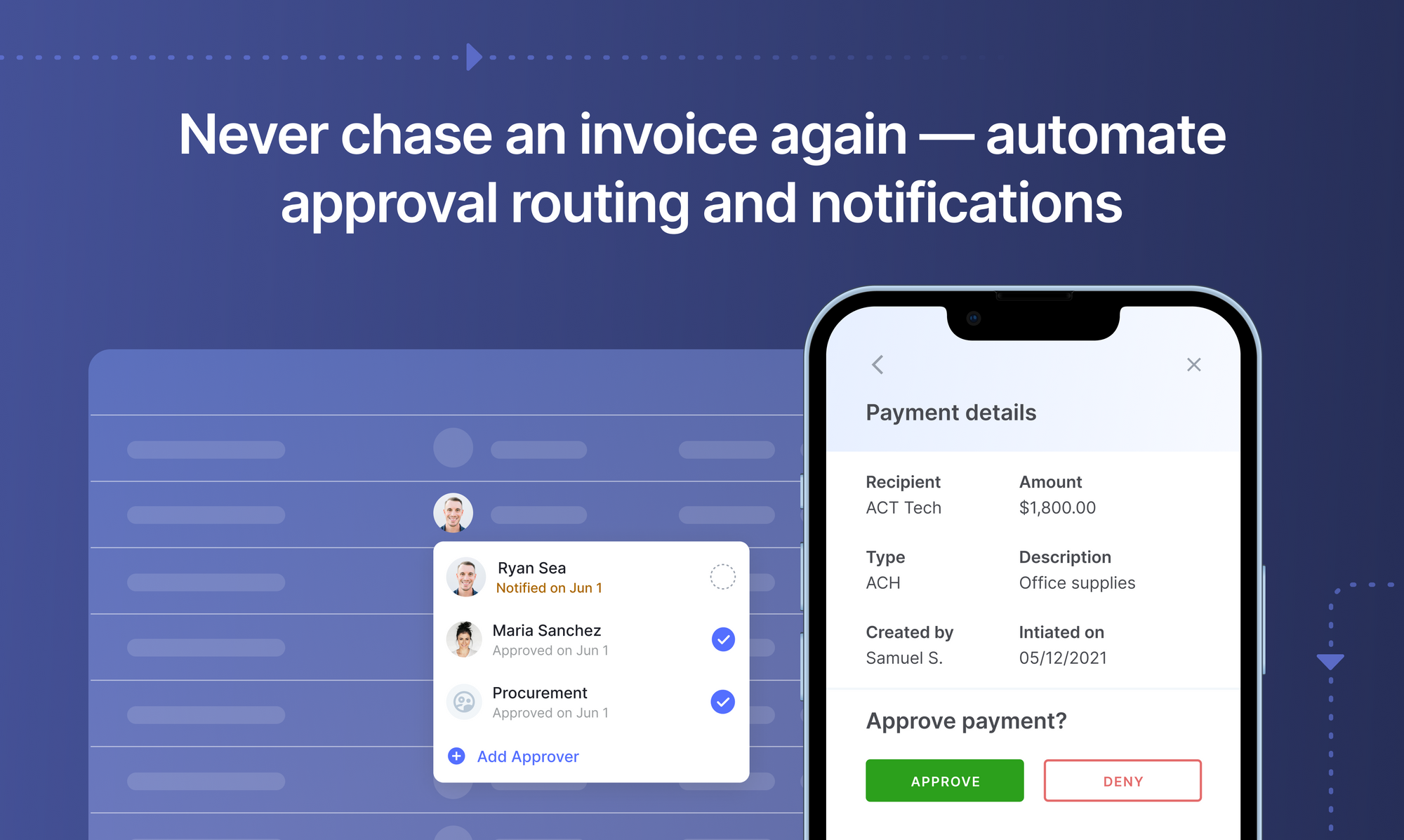

4. Accounts payable review and exception processing, based on the company’s unique needs, the matched data are passed through or routed to the appropriate employee for further processing.

Advantages of AI based PO Matching

Touchless processing:When all documents (invoice, purchase order, receipt etc.) are electronic in nature, “touchless processing” removes paper-centric processes and minimising human intervention, thus delivering better performance, scalability, and agility; all business documents are received, digitised, routed, matched, approved and processed without the need for shuttling a single piece of paper between personnel and departments. Touchless processing works through the following steps:

1. The software checks for unread emails.

2. Attachments are found and detached from the e-mail for processing.

3. The attachments are read using cognitive capabilities and data is extracted.

4. Invoice/PO information is validated based on pre-defined business rules.

5. An invoice is created, matched against POs and delivery receipts based on pre-set rules, and checked to ensure there are no duplicate invoices (Creating an invoice from a purchase order is known as a PO flip.).

6. Users are notified about whether invoices were successfully processed.

Touchless processing often uses machine learning to train AIs to perform better than simple rules-based AI systems. The system therefore learns from both the customer base and the specific intricacies of each customer.

Smart matching: POs can be matched by PO Number, Release, Line, Shipment and PO Receipt and sorted in various forms within seconds, a task that is herculean with human effort alone.

Easy handling of multiple POs to multiple invoices: Automation is particularly useful when the volume of POs and invoices is high, and manual effort would take days, if not months to manage and categorize them.

Complete audit trail and compliance: AI in audit systems can provide human operators with intuitive assistance and perform validations and corrections that take hours with human labour within seconds.

Manpower saving: AI operates on the basis of the “neural network” – algorithms that can recognize underlying relationships in a set of data much like the human brain. Apart from speed of performance, machine learning and deep learning possibilities within AI can help the software learn from experience, which can fine tune the operation to increase productivity and accuracy, obviating human intervention and validation.

Error flagging and minimization: Where the human brain can fail due to fatigue from repetitive action, AI-based system can in fact, improve in performance with time and “experience”. While automation cannot completely eliminate human error, it can ensure consistency on a large scale. Automated accounting can significantly increase the likelihood of identifying small issues before they cascade into larger ones. In case of problems or errors, an alert is automatically flagged to the IT team who can quickly identify the root cause and resolve it. Nothing is missed and the fix is much quicker. Timely error flagging can save time, reduce costly downtimes, and obviate serious firefighting at a later time.

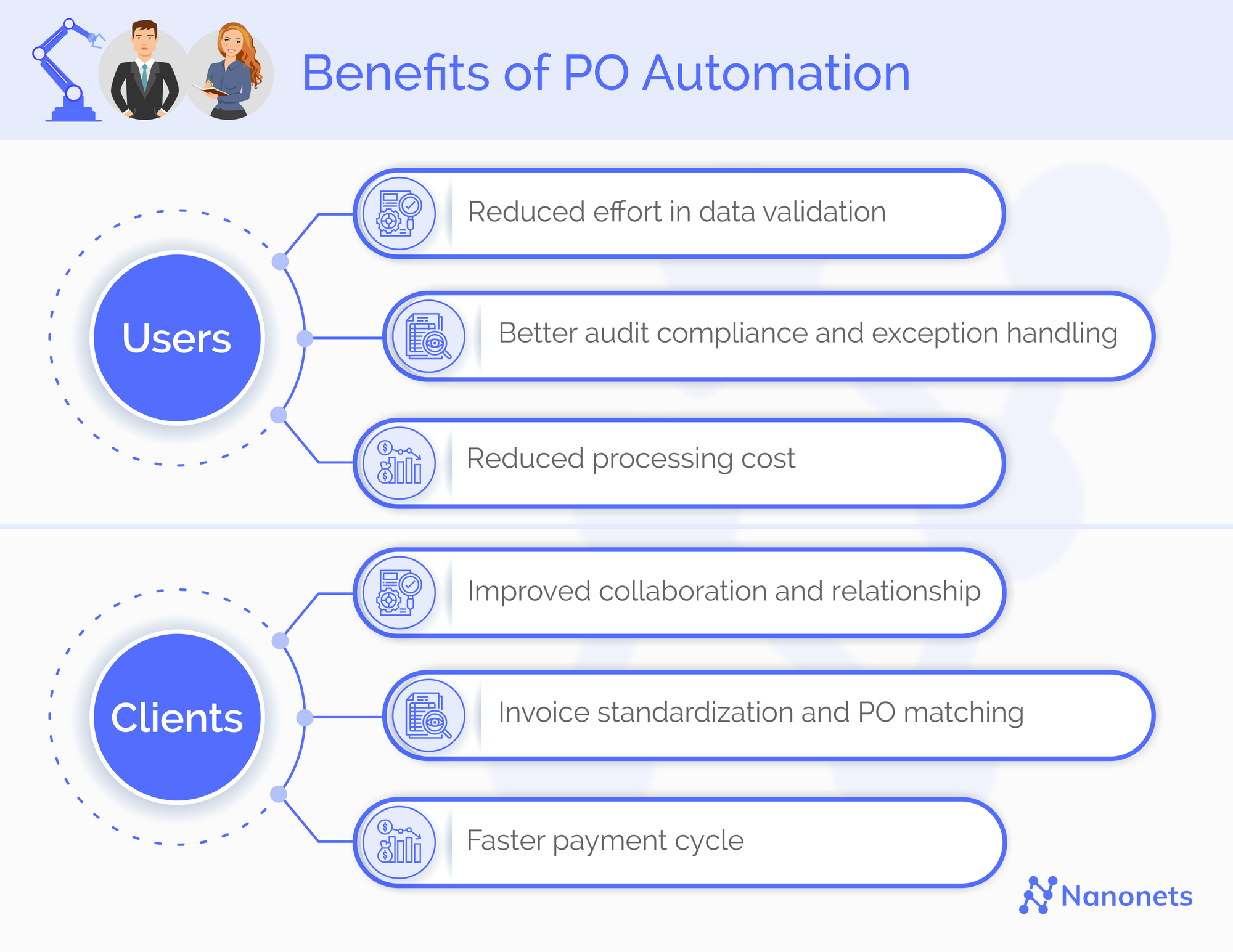

Increased Productivity: With freedom from time-consuming activities such as PO matching and invoice processing, the Accounts Payable team can now focus on human-centric activities such as financial planning, analysing, and deriving insights for improvements, and improving interpersonal and institutional relationships, all of which could improve the Bottom-Line.

Cost benefits: Although installing AI-enabled invoice processing is associated with a start-up cost, its operation would entail as little as 20 per cent of an employee’s salary.

Data security and scalability: Greater operational efficiency to global businesses results from being able to run 24X7, unlike human operators who are limited by mental bandwidth and time.

Audit Readiness: POs, GRNs, and invoices are among the most common documents asked during audits. AI-enabled PO matching already has these documents approved, matched, and organized, which enables seamless AP audit processes.

Automation of Invoice processing and PO matching can help various levels of executives in a company:

- Finance executives can reduce costs and free resources that can be reorganised to enhance the bottom line and assist in strategic and corporate growth.

- Corporate executives can better understand performance and monitor cash flow by analysis of the dashboard data offered by many of the automation software to measure.

- Accounts Payable Teams can eliminate paper invoices and manual interactions due to streamlined routing, coding, matching supplier invoices using pre-defined accounting rules.

- Accountants & Research Staff have complete and instant access to purchase orders and invoices for future planning.

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

Set up and implementation of AI-enabled PO Matching systems

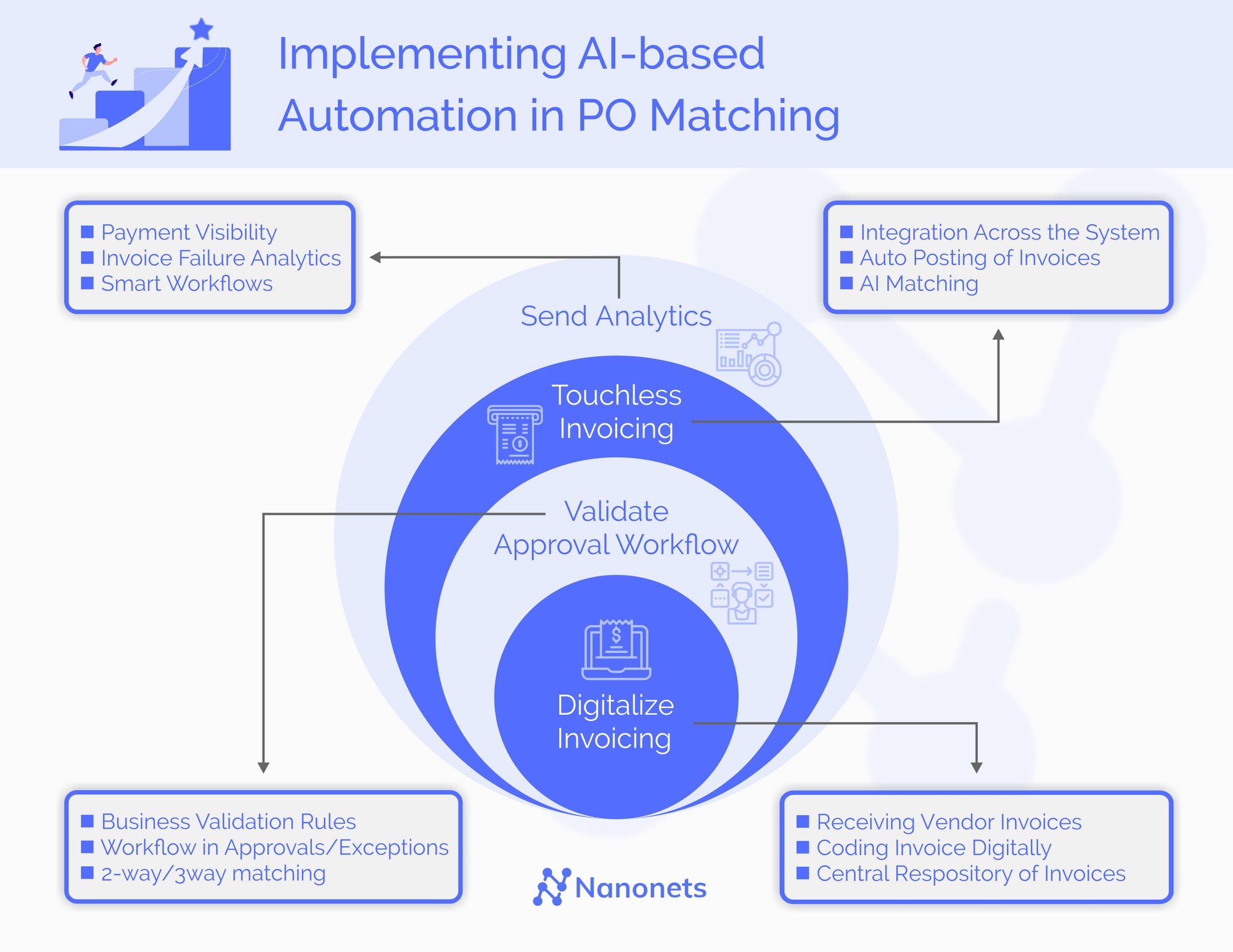

The setting up of an AI-enabled PO matching system in an organization is a three-tier process.

While automated invoice processing software and PO matching are advantageous when implemented, a learning curve undoubtedly exists, and the company/team must follow a few protocols for the automation to beget the expected results. Some steps that must be taken before and during implementation of automated accounting processes are as follows:

Full involvement of all stakeholders

Successful Accounts Payable automation depends on full participation by every member of the finance team, which entails periodic training and refresher programs to operate the system and handle exceptions.

Phase-wise automation

Harnessing the power of automation and AI hinges on correct setup and implementation. In addition, there is a rather steep learning curve associated with moving from manual accounting to AI-based invoice matching. By phase-wise transition, it is possible to setup without errors and also give the team time to adopt new processes.

Integration of all systems

The accounts payable team may already be using software for disjoint purposes such as enterprise resource planning (ERP), customer relationship management, and other core finance systems. The AI-automation system should be able to be integrated with existing software to make things easy for users. Solutions like 3 way match NetSuite are especially effective for seamless integration and efficiency.

Planning for contingencies

Server crash, power outage and network disruptions can severely disrupt operation of AI-enabled PO matching systems. But a solidified business continuity plan that includes backups, uninterrupted power supplies and cloud computing can help tackle these problems. It is also important to maintain a history of the processes in case the operations have to temporarily pivoted back to manual handling.

Organization of all relevant documents

In three and four-way matching. Purchase orders, GRN, and Invoices must be matched. While most vendors and clients are diligent about POs and invoices, they tend to be careless about GRNs and receipts. The absence of receipt can hang an AI-integrated 3-way match process and exceptions would be generated leading to bottle necks in the workflow.

This can be avoided through centralisation of the receipt of items, so creation of receipts is restricted to one or few people to avoid duplication and omissions. Another fail-proof way is to design a system-driven approach in which, an automated reminder is set for receipt generation and follow-up.

Ensuring that all invoices, POs, and receipts are entered into the system promptly, AP automation can dramatically reduce days payable outstanding (DPO) by an average of 5.55 days. A completely automated system wherein the software captures the documents directly from the soft source (emails, etc.) can ensure this, but in the case of manual uploading of data, this becomes an important point.

Vendor data matching

A 3-way match process hinges on the supplier as the key driver of the process. The accuracy of data provided by suppliers can ensure absence of data mismatch issues. For manual submissions of invoices, due diligence is required to ensure accuracy. Accuracy entails uniformity of unit of measure, unit price and delivery timeframe. Vendor catalogues can eliminate errors and enhance the purchasing experience.

Setting up a tolerance for auto-approval

Some common exceptions that arise during PO match are:

· Invoice quantities do not match the PO

· Missing or incorrect PO reference information on the invoice

· Missing supplier or tax structure for an invoice

· Pricing discrepancies at the line level or for the total invoice. For example, the PO could be for 10 item units at the cost of Rs.10/unit, and the invoice could be for 1 item unit for the price of Rs. 100.

Handling of edge cases

Edge cases are uncommon occurrences that must be handled by the software. In invoice PO matching, the complexity of recurring billing is often underestimated. The AI system must feature adaptive recurring billing to consider these edge cases that may arise due to time zone changes, multiple recurring charges, retrospective price adjustments, and variable month lengths to ensure error-free automation.

Book this 30-min live demo to make this the last time that you'll ever have to manually key in data from invoices or receipts into ERP software.

Examples of AI enabled PO Matching systems

Choosing an AI-enabled accounting suite depends on the nature of the business and the scale of operation. AO-enabled PO matching could be either a point solution or a full accounting suite, which would depend on the existing software or lack thereof. In the case of the former, it would need to communicate with existing systems, including ERP. PO Matching is available in many tools used for accounting including Nanonets AI-OCR, Oracle, Nexxonia, Intacct, MineralTree, etc.

In Oracle, Payables is the AI-enabled PO matching tool in which once an invoice is entered and matched to a PO, distributions are automatically created and the match is checked for compliance with the tolerance defined. Once matched, Payables updates the quantity billed for each matched shipment and its corresponding distribution(s) by the amount entered in the Quantity Invoiced field. Payables also updates the amount billed on the PO distribution(s).

Sage Intacct Purchasing creates structured, predefined transaction and purchase approval workflows. MineralTree, an Accounts Payable (AP) and payments automation solution provider, provides automated PO/invoice matching for Sage Intacc. In this, header and line-level details are automatically extracted using OCR technology from invoices sent by vendors to a designated email. It then automatically matches incoming invoices against purchase orders or receipts and then inserts them into the users’ internal automated workflows for invoice approval and payment. All data syncs with the company’s ERP for platform consistency.

Nexonia Expenses, a cloud-based web and mobile expense report management solution that has flexible approval workflows and deep integration with existing systems.

In Tipalti, all invoices go through a standard OCR, advanced data extraction, and approval workflows before payment is processed. Rules may be set to determine if an invoice is PO-backed and if it should go through the matching process. Base rules apply on supplier or bill amount and if an invoice has a purchase order, the PO bill coding data automatically pre-populates the invoice.

In DocuWare, when an invoice is captured, an AI-based, crowd-learning tool extracts all key data required for processing like Vendor Name, ID, Invoice Number, Sub-Total, Tax, Freight and Total Amount. To validate the invoice, the system confirms if they are a valid vendor, double checks for any duplicate invoice numbers, matches to purchase orders and delivery slips and recalculates the amounts.

There are many more PO matching tools available with various features to suit various applications.

Nanonets AI OCR

Nanonets AI-OCR reads unseen, semi-structured documents that do not follow a standard template and validates the data captured from the document. The software can capture data from a variety of documents including Invoice, ID Card, Purchase Orders, Income Proof, Tax Form, and Mortgage forms.

It enables importing of data from the user's platform and directly export the captured data to an existing workflow, without disrupting the system. Nanonets has language bindings in Shell, Ruby, Golang, Java, C# and Python. The AI engine learns and improves with use. With an intuitive web interface, it eliminates cumbersome manual processes and automates invoices, receipts, and document reviews. It is known to reduce processing time by up to 90% and save on costs by up to 50%.

AI the new frontier in PO Matching

Artificial intelligence is expected to play a critical role in transformation of the way accounting and PO matching is performed in the corporate world. However, it cannot eliminate human participation – technology cannot exist alone.

Artificial Intelligence will assist, not replace the Accountant. The key to successful implementation of an AI-enabled automated finance system is to bring them together. The future of the use of AI in accounting and PO matching relies heavily on how humans can anchorage it to improve their capacity to deliver long-term values.