Positive Pay - Definition, Examples, Pros, Cons, and More

Looking to implement positive pay at your organization? Try Nanonets to automate cheque data extraction, matching, and approval processes.

More than 8 out of 10 financial institutions are affected by payment fraud, according to the Association for Financial Professionals.

AFP President and CEO Jim Kaitz said, "Payments fraud is a persistent problem that is only growing worse despite repeated warnings and educational efforts."

With such a high probability of fraud, it is crucial for all organizations to establish preventative steps to secure payments, including training staff members about current payment fraud practices and putting in place the tools and procedures required to protect corporate assets and data from cybercrime.

One such service that aids in the prevention of payment fraud is Positive Pay.

Explore the foundational knowledge of account reconciliation and its significance in preventing fraud by visiting our detailed guide at What is Account Reconciliation?.

So let’s find out more about positive pay and how it helps organizations prevent fraud!

What is Positive Pay?

Online banking is becoming more practical for both individuals and companies because of technological advancements. Much of that was made possible by the Check 21 Act 2003, which enabled banks to process more checks, including digital image checks, more quickly than ever before. Although convenient, this exposes businesses and people to the risk of fraud.

Positive pay is one of the techniques utilized to stop such fraud.

What is positive pay?

Steps in the Positive Pay Process

Let's take a look at how positive pay works.

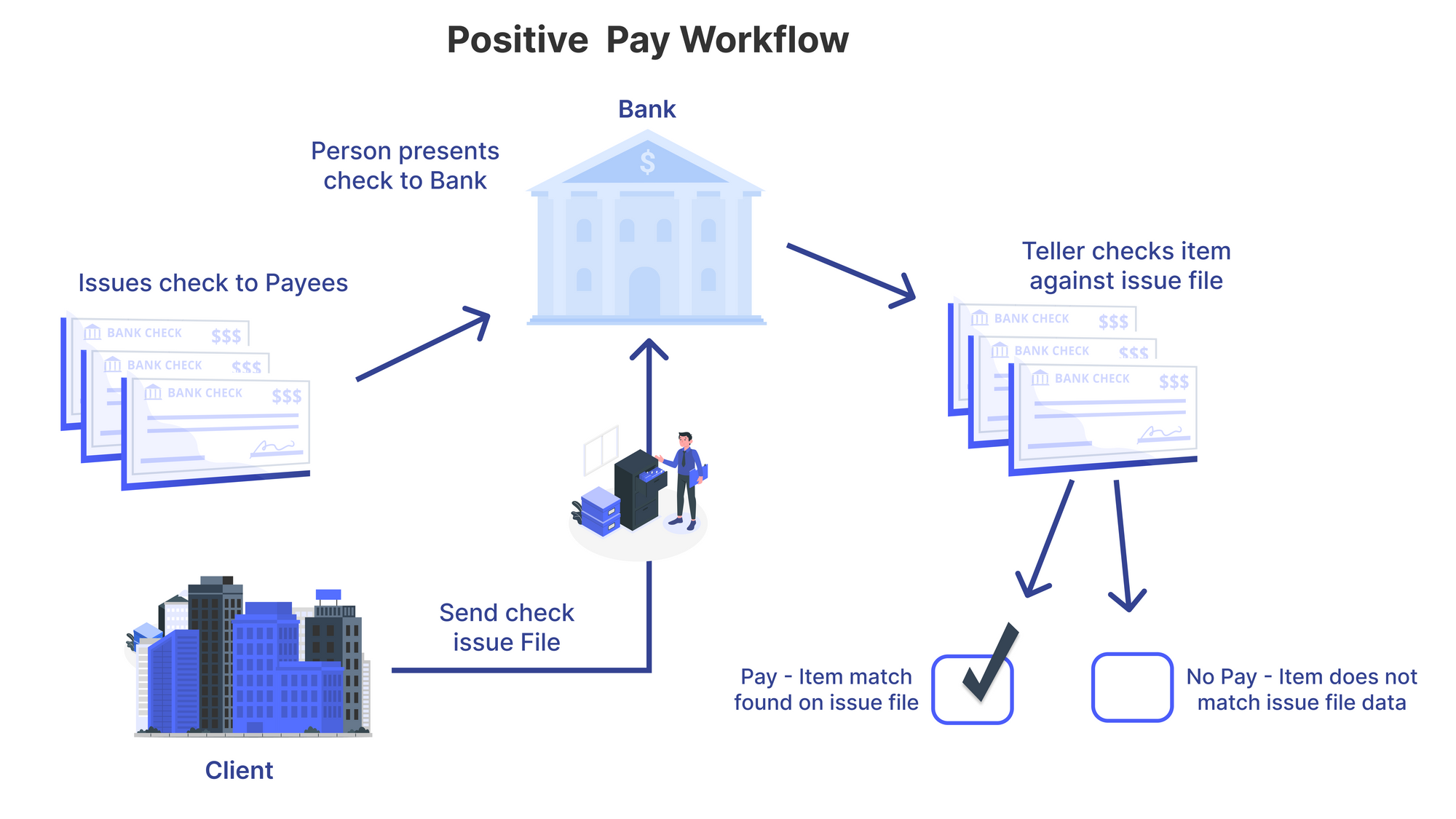

Stage 1. Send Information to Bank

The check numbers, dates, and amounts of every check issued in the most recent check run are documented in a file that the issuing company submits to its bank regularly. In order to prevent someone from fraudulently changing the payee's identity and having the payee issue payments to the fictitious firm, some banks additionally accept files from submitting businesses that include the payee's name for each check.

The issuing company sometimes sends a report to its bank, where the dates, check numbers and proportions of all the most recently issued checks are recorded. A couple of banks similarly recognize reports from submitting companies that contain the name of the payee for each check, which should keep someone from unlawfully changing the name of the payee and having the payee issue installments to the altered substance.

Stage 2. Contrast Presented Checks with Payment Information

At the point when a check is introduced to the bank for installments, the bank employee looks at the data on the check to the data presented by the company. In the event that there is a disparity, the bank holds the check and notifies the company.

Read more: How to convert bank statements to Excel?

If there is any discrepancy between the lists, such as unauthorized amounts or check numbers, the item will not be paid and will be returned unpaid to the customer's depository institution. This helps prevent fraud because it ensures that only authorized employees have access to checks.

Payment Fraud Trends in 2023

Do you really need positive pay at your banks? Let's see what impact they have and how prevalent payment fraud is.

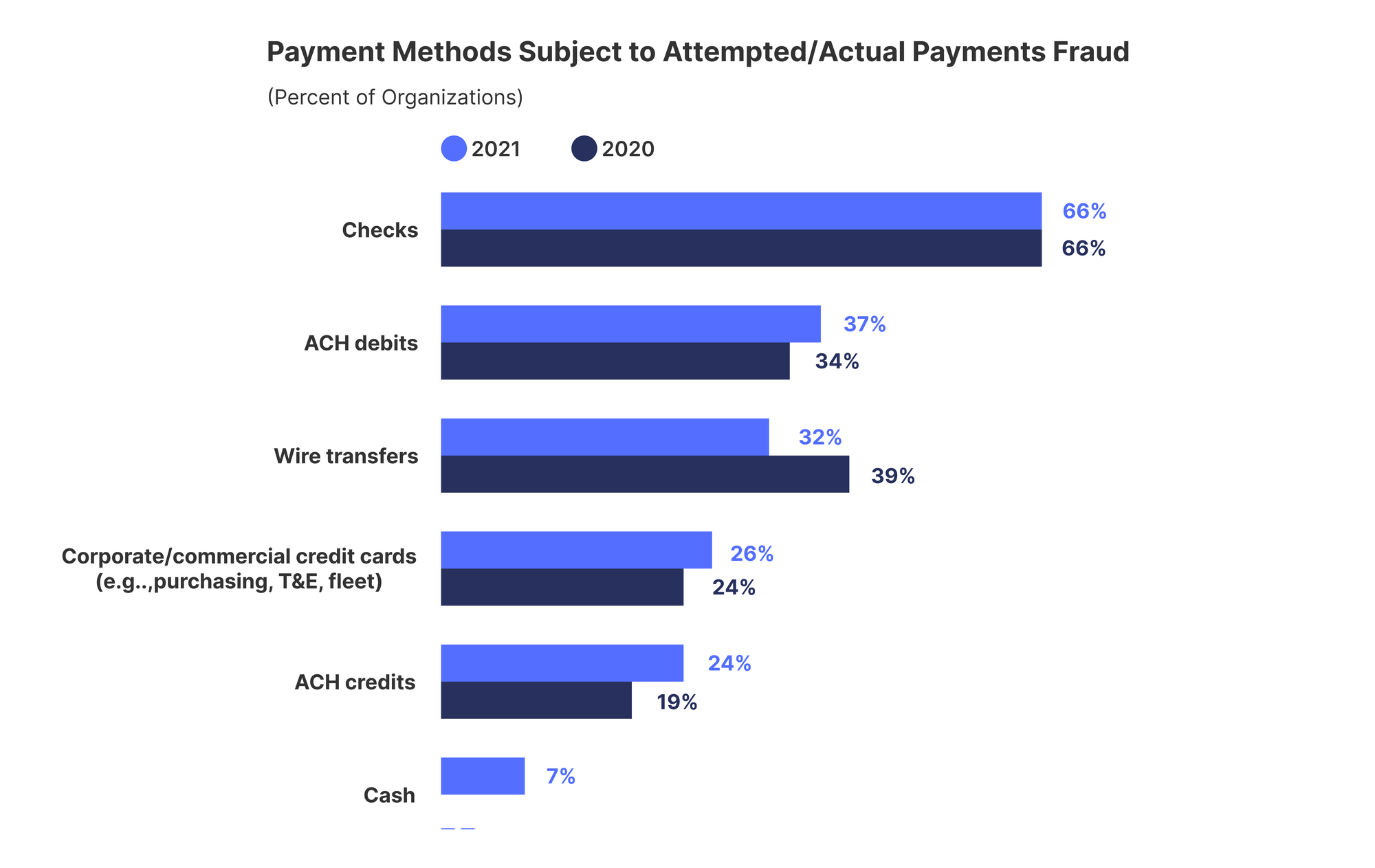

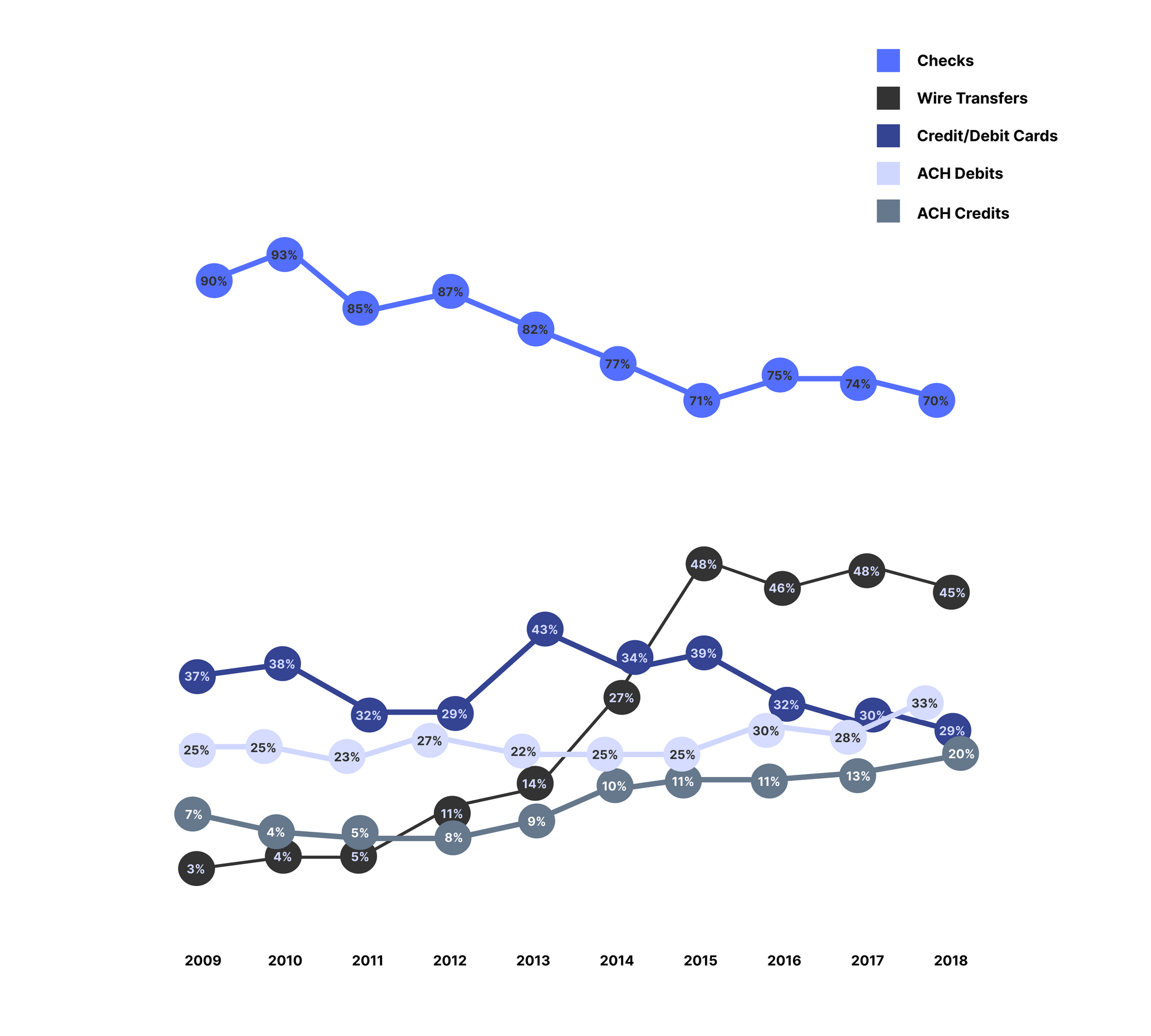

71% of organizations were victims of payment fraud attacks or attempts in 2021, as compared to 74% in 2020.

66% of attempted/actual payments fraud was through checks. 37% of Payment Fraud used ACH debits, whereas 32% used Wire Transfers.

Checks, ACH debits, and wire transfers continue to remain the top 3 contributors to payments fraud in 2021.

- Wire fraud remains elevated, with Business Email Compromise (BEC) a potential cause of assaults.

- Card-related fraud is decreasing

- Since 2012, ACH payments credit fraud has climbed steadily.

- ACH debit fraud has reached record levels and is continuing its upward trajectory.

Read more: How to identify and prevent fraud?

What is a Positive Pay File?

A Positive Pay File is a predetermined dispensing report serving as a security measure implemented by organizations, enhancing fraud prevention and financial security.

Here is an example of a positive pay file format

The report forestalls check extortion by guiding your payment framework or bank of issued payment records and their sums. The positive pay file prevents the payment framework or bank from paying deceitful checks since unapproved payments aren't recorded on the positive pay report.

Read more:

Other Check Fraud Preventive Measures

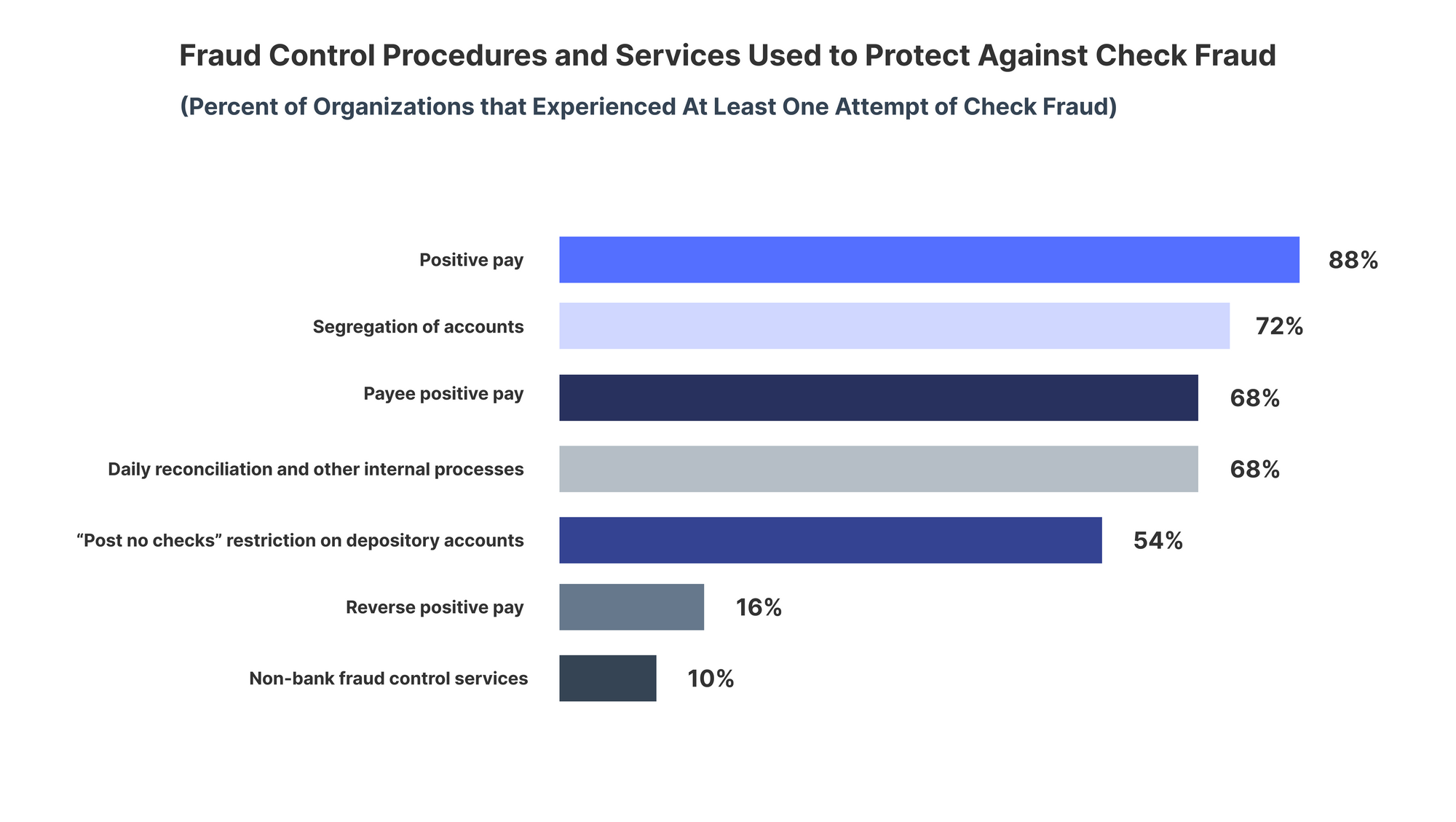

While positive pay is used by the majority of organizations (around 88% in 2020) —down from 90% in 2019, there are other methods to prevent check fraud.

Segregation of Accounts

The idea of segregating tasks is rather straightforward. Access to many functions is typically required to commit accounts payable fraud. For instance, one would need access to both the check stock and the signer. Therefore, delegating tasks in a way that reduces this risk is one of the simplest strategies to avoid fraud.

To do this, it can be essential to collaborate with another group, depending on the size of the department. Alternately, regular attentive examination of anybody with many conflicting obligations is advised.

Because the person in question has been with the company for a long time and has a variety of competing tasks, companies can feel overly secure. This is incorrect since long-term, dependable employees are typically the ones who perpetrate fraud.

Payee Positive Pay

This number is continuously rising and poses a serious problem for both enterprises and banks. The banking sector created a check fraud prevention technique known as payee positive pay to counteract the problems caused by check fraud. The primary components of a check are compared with an existing record using Positive Pay, a fraud detection tool. The bank declines to pay the cheque if one of these elements does not correspond to the data on file.

The companies have been making a huge difference by using this check fraud preventive measure.

Daily Reconciliation

You must be aware of your accounts' activity to spot a scam or fraudulent behavior. It is insufficient to merely assume that fraud will never affect you or your business. It's not if, it's when according to security specialists in today's atmosphere. Being proactive and keeping an eye on your accounts will protect you from falling for a scam that drains your bank account.

Account reconciliation is frequently mentioned as a monthly task. In other words, a company reconciles its accounts every 30 days to check for internal irregularities. However, because money is the lifeblood of your organization, there is a risk in merely doing a monthly account reconciliation.

Automate reconciliation processes with Nanonets workflows. Trusted by 30,000+ people from 500+ enterprises. Schedule a call now.

Post No Check Restriction

Check fraud risk can be decreased by imposing a "post no checks" restriction on accounts that are not required to accept checks as payment. Companies can also ask their bank to only conduct Automated Clearing House (ACH) transactions from these accounts, rather than checks, to further safeguard them without needing to process checks.

Reverse Positive Pay

Reverse Positive Pay is a solution for a check issuing file if you cannot do so to stop fraud. By analyzing checks that were submitted for payment the day before and entering a decision for each check, Reverse Positive Pay gives you the tools you need to discover any dubious checks on your own.

Advantages of Positive Pay

Positive pay offers a large number of advantages:

Reduces Check Fraud

Positive pay reduces check fraud and secures businesses by identifying possible fraud scenarios. The bank won't execute the check if the check's number, amount, payee name, and account number don't match the list given by the company.

Automates Fraud Prevention Processes

Positive pay automated fraud prevention by adding an additional check to validate the payment details. Manually keeping track of all your checks might be daunting and error-prone.

Examines Payee Information

Conventional positive pay arrangements just take a look at check information, for example, check numbers. They don't check the payee data. By adding this extra layer of investigation, positive pay gives considerably more advantages to both you and your clients.

Want to use robotic process automation? Check out Nanonets workflow-based document management software. No code. No hassle platform.

Disadvantages of Positive Pay

While the idea of positive pay may seem like a straightforward solution to the problem of fraudulent checks, there are several important drawbacks to consider.

Expensive

First, positive pay is an expensive solution. It requires that you have a bank account dedicated solely to your payroll deposit and withdrawal needs (which means paying separate banking fees) and hardware to process transactions.

In addition, you will need software that can manage this system on your behalf—and while some software options are available at no cost or at low prices, others require significant investment in both money and time spent learning how they work.

Time-Consuming

Second, positive pay is a time-consuming solution: it will take longer than simply mailing checks out every two weeks.

Positive pay requires regular monitoring of employee accounts and immediate action when any irregularities occur (and if you miss these irregularities in real time, they could lead directly to theft).

When is not Positive Pay Enough?

While Positive Pay is a great way to control your risk and costs, it’s not the only tool you need. You should look at additional ways to protect yourself from fraud and chargebacks.

Here are some examples of where Positive Pay isn’t enough:

Chargeback protection

Chargeback rules vary by the processor but generally include situations where the cardholder claims unauthorized or non-receipt of goods or services. To prevent these, be sure to follow best practices like having policies in place so customers can contact you with questions, keeping records of orders made online or over the phone (even if they don't use credit cards), and making sure all employees understand what's expected out of them when handling payments on behalf of your business, etc.

Over-the-counter Fraud

Some banks don't propose over-the-counter verification, where tellers at a retail banking area can check approaching checks at the financial counter, utilizing your check record.

While using Positive Pay, ensure your bank confirms check data against all check-changing out situations, not when checks are sent or filtered.

Payee Verification

In spite of the advanced solutions today, many of the Positive Pay administrations don't cover verification of the payee. Positive Pay just confirms checks through the data it contains, for example, check numbers, dollar amounts, dates, and so on.

Fortunately, a few banks give a Payee Positive Pay. However, bank Positive Pay typically accompanies an extra charge. Subsequently, organizations ought to dissect whether their special business needs incorporate Positive Pay before going overboard cash.

Automate anything and everything with no-code workflows.

Nanonets for Positive Pay

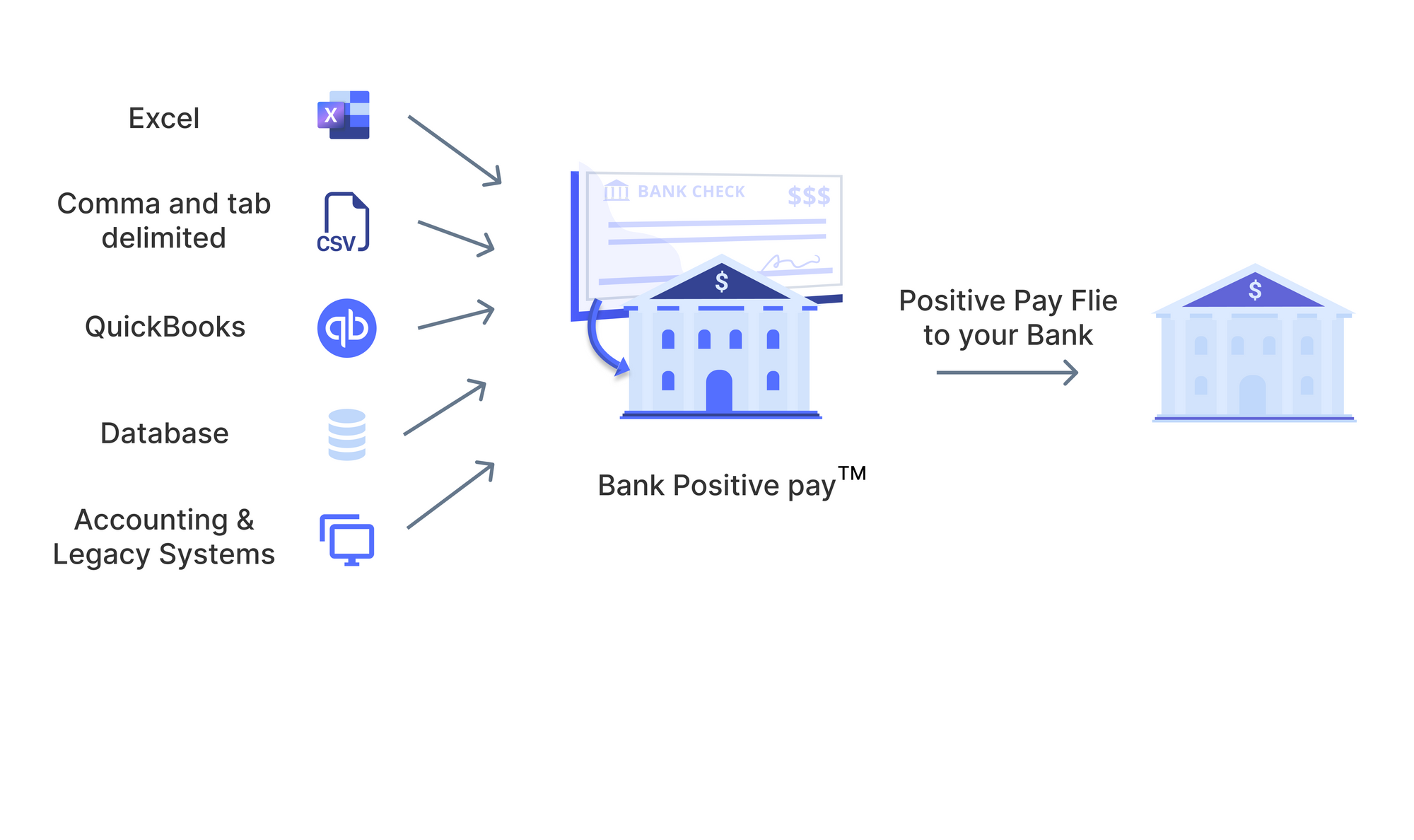

Nanonets is a no-code workflow-based intelligent document automation software. Nanonets can be used to extract information from check documents. The extracted information can be used to verify the authenticity of checks from the in-house database.

Nanonets is self-learning software, which means that you don’t have to create a new model for every template. It learns automatically and extracts relevant information with ease.

Try Nanonets for free or book a free consultation call to see how you can use positive pay.

Conclusion

Positive Pay is a method used by banks to reduce check fraud, and every business should use it.

This process can be automated through software such as Nanonets, which allows you to upload positive pay files directly into your accounting automation system without manually entering them into another program.

FAQs on Positive Pay

What is positive pay in accounting?

Positive pay is a process used by businesses to ensure that their customers' checks are paid by the bank.

If you're an accounting professional or someone who works with the financial aspect of business, then positive pay is something you may be familiar with because it's a way to ensure that the bank will not reject a check.

Read more: Accounts Payable Process

What is positive pay in banking?

Positive Pay is a banking feature intended to assist entrepreneurs with safeguarding themselves against deceitful checks being written for them. You give your bank subtleties for each check you write; then the bank confirms that your data matches the data on checks introduced to the bank before it processes the payment. In the event that things don't coordinate, your bank banners them and sends them to you for the survey. You can then choose if you have any desire to acknowledge or decline the payment.

What is a positive pay system?

Giving high-value checks just got significantly more secure. Viable from January 1st, 2021, the RBI has presented an electronic confirmation system called Positive Pay that will permit you to share the check subtleties with your bank before the bank processes it. This extra security layer is intended to address the rising examples of check extortion that have stood out as truly newsworthy over the course of the last year. As detailed by the RBI, the complete volume of misrepresentation exchanges in India was fixed at Rs. 64,681 crores during April and September 2020, with forged or fake cheques accounting for a significant share. Thus, as culprits' techniques for falsifying checks become more complex as time passes, launching Positive Pay is most certainly a jolt for banks.

What is positive pay for checks?

Positive pay is a system that helps businesses avoid paying for fraudulent checks. Positive pay ensures that the person writing the check has the funds to cover it, thereby preventing losses from bad checks.

For example,

- John Doe writes a check for $100 to ABC Company,

- Bank can use positive pay to check his bank account and ensure he has at least $100 before they deposit his check into their own bank account.

- Bank would then be able to clear the funds through their own accounts without any issues or potential losses due to fraudsters attempting to write fake checks.

Read more: Ultimate guide to document verification

How does positive pay work for businesses?

Positive pay is a system used to ensure that checks are only written to customers who have enough money in their accounts to cover the check.

Under positive pay, a company issuing a check will first use an electronic funds transfer (EFT) or wire transfer to collect money from the customer's bank. The funds are then placed with the issuing bank as collateral for payment of the check. If these funds aren't available at the time of issuance, the check cannot be issued until they become available.

Read more: How to get started with Enterprise Automation and Insurance Automation

What is ACH positive pay?

Organizations utilize the Automated Clearing House (ACH) system to send and get payments inside the United States. ACH empowers electronic bank-to-bank moves like direct store and merchant payments. To keep these payments secure, consider using ACH positive pay. The ACH positive pay definition refers to a service permitting clients to survey all approaching charges before they're cleared for deposit in a financial account balance. With custom channels, you can decide to block dubious ACH charges and attributes until you can approve them.

Why is a positive pay system important for customers?

A positive pay system is an important tool for businesses so that they can minimize the risk of accepting checks with insufficient funds to cover the payment. A positive pay system helps you avoid bounced checks, late fees, bad credit, and fraud. It also helps protect your business from over-drafting by making sure that every customer's check will clear before it is deposited in your bank account (or account of your choice).

What is The Positive Pay Fee In The US?

The banks might charge various expenses for giving a Positive Pay service to their clients. A few banks offer free services for chosen business accounts. For instance, Chase is a bank that offers free Positive Pay services for qualified business accounts.

Yet, in the event that you have a business banking account with Bank of America, you'd most likely need to pay a charge for Positive Pay services. Banks typically charge the Positive Pay expense consistently or per-check transaction. However, a few banks might offer a mix of the two.

The following table can provide you with a broad idea of how banks charge for the Positive Pay services they offer.

Generally, the expense of Positive Pay falls somewhere near $50 each month for a solitary business account. Notwithstanding, the expense can change in light of the financial service provider you decide for your business. Besides, a few banks offer waivers of the service fee for the initial few months.

What is reverse positive pay?

Reverse positive pay is a variation on the positive pay concept is reverse positive pay, where the bank sends data about its check acceptances to the organization every 24 hours. After the customer reviews all the checks, the bank processes the verified checks.

All being equal, in the event that the organization doesn't endorse the checks in 24 hours, the bank will be constrained to pay the checks. Consequently, reverse positive pay isn't as effective control as positive pay.

Every business day, the organization is responsible for checking all the outstanding checks sent by the bank. If the person is unsure about the check, the portal shows the digital format to validate.

What is better: Reverse Positive Pay or Positive Pay?

Positive Pay and Reverse Positive Pay are two different ways merchants can complete payment transactions.

Positive pay is a great way to avoid chargebacks because it allows you to check your customer's card directly from your terminal before the transaction takes place. If sufficient funds are in the account and the card isn't reported as lost or stolen, you can proceed with the sale without any risk of losing money.

Reverse positive pay works in a similar manner, but instead of waiting for approval from the bank before completing the transaction, it sends an instant approval number back to your POS system so that you can complete sales without worrying about whether or not they'll go through.

Let's look at how Positive Pay and Reverse Positive Pay differ from one other technique in several ways.

Authority for Review

The reviewing authority is the primary distinction between the two.

The information on the bank checks is examined by the bank in Positive Pay. However, the corporation itself conducts the approval procedure for Reverse Positive Pay services.

Handling Of Flagged Checks

The way flagged checks are handled is another notable distinction. Both standard Positive Pay and Reverse Positive Pay have a review deadline. It implies that the business has a deadline set by the bank within which to evaluate the highlighted bank checks.

With conventional Positive Pay, flagged checks are returned to the issuer if the firm doesn't evaluate them within the allotted period. A strategy like this provides stronger protection against fake bank checks. However, it also implies that real checks can frequently be used in large quantities, causing payment delays and other issues.

In contrast, the bank does not withhold the payment when a business neglects to examine the flagged checks in Reverse Positive Pay. The advantage here is that the bank will process your checks as opposed to interfering with the payment flow. On the other hand, this puts the security of check processing at risk and leaves you open to check fraud.

Find out how Nanonets can help you automate manual tasks.