ACH Transfer Times: How long do they take?

What is an ACH transfer?

ACH (Automated Clearing House) payments are essentially EFTs (electronic fund transfers) that use the ACH network to move funds between bank accounts in the United States. ACH is most commonly used for direct deposit of payroll, payment of bills, and business-to-business payments.

The ACH network is managed by NACHA, formerly known as the National Automated Clearing House Association. NACHA is a non-profit organization that is self-regulating, and they’re responsible for supervising and making rules for ACH transactions. All ACH transfers are processed through the centralized ACH network operated by NACHA, ensuring secure and accurate transfer of funds to the intended bank account.

ACH payments are faster and more dependable than traditional paper checks, thereby streamlining account payable processes. It is important to note that ACH is a separate network from major credit card systems such as Visa, Mastercard, and American Express.

What are the types of ACH transfers?

There are two basic types of ACH transfers: ACH credits and ACH debits. Fundamentally, the meaning of both of these terms can refer to the same actual transaction.

The key difference between the two is that an ACH credit is the money that’s delivered into an account, while an ACH debit is the money that’s pulled out of an account.

Some examples of typical ACH payments are:

- Direct deposit from employers (for paychecks)

- Paying bills with a bank account

- Transferring funds from one bank account to another

- Sending money to the IRS

- Businesses paying vendors and suppliers

How do ACH transfers work?

ACH transfers can basically be considered as digital mail sent out in bulk. Each transfer is sent as a message within a batch of outgoing requests by the bank making the request (known as the originating depository financial institution, or ODFI).

The ACH network then combines each message into a batch that is sent to the bank receiving the request (the receiving depository financial institution, or RDFI). This happens every day at 6 pre-decided intervals. Those intervals are 6:00 am, 12:00 pm, 4:00 pm, 5:30 pm, 10:00 pm, and 11:30 pm.

Several factors can influence this process:

- Whether the request is for an ACH debit or ACH credit

- Which processing partner is used by the party that raised the request

- Whether the person who raised the request is using a same-day or next-day ACH service

- Whether the request returns any of the listed return codes

Looking to automate your manual AP process? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Make efficient, fast ACH transfers with Flow.

A normal ACH transfer works like the below:

Day 1, 4:00 PM: You submits payment information to a processing partner.

Day 1, 10:00 PM: The processor works in conjunction with your bank (the ODFI) to submit a file to the ACH network. This file includes each of your individual payment ACH credit requests.

Day 1, 10:30 PM: The ACH network begins to break down all the files received since the last interval, repackaging them by the recipient.

Day 2, 12:00 PM: The ACH network delivers this latest round of files as ACH credit requests to every bank where your employees have an account (the RDFIs).

Day 2, 1:00 PM: If same-day processing was requested on any transfers, the RDFI has an hour to process those requests and settle with the ODFI.

Day 2, 1:30 PM: Same-day transferred funds must be processed and settled by this time.

Day 3, 8:30 AM: All remaining (non-same-day) transfers must be processed and settled by this time.

Day 4, 9:00 AM: Transferred funds are made available to recipients by this time.

How long does an ACH transfer take?

ACH transfers take between 3-4 business days, depending on the time of day and whether same-day/next-day processing has been used.

RDFIs who have the data ready with them can process transactions faster, but may wait if they sense that there is a risk of a return. For smaller transaction sizes, they might send the funds earlier, especially if the customer is seen as low-risk.

Errors can also interfere at times. Returns for insufficient funds are the most common error for debits. Credits, on the other hand, are more susceptible to things like wrong account numbers, wrong transfer amounts, closed accounts, and details that are mismatched.

Mistakes usually resulted in a delay of 1 to 2 days. To reduce error, fraud, and delays, NACHA added new regulations in 2021. They gave a requirement which basically requires that originators of transactions must verify that the recipient's account is open, valid, and able to receive ACH transfers—before initiating an online ACH debit.

Further complicating the topic, the system works on a basis where failures are highlighted, but successful transactions are not announced. Hence, no transaction is ever really, specifically confirmed—and thus can later be reversed. If a transaction fails, the RDFI has up to 48 hours to report it.

In some situations, a transaction that has already been processed may not stay that way if it’s reported by the RDFI as a failed transaction later on.

Consumers also have 60 days from the date of any statement containing an ACH debit transaction to dispute it with NACHA.

Set up seamless ACH payment and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

How much does an ACH transfer cost?

The National Automated Clearing House Association (NACHA), the governing body of ACH payments and transfers, states that the average processing fee for an ACH payment is around 11 cents. However, several factors can affect the cost per transaction.

The volume of transactions being processed is one such factor, with larger transaction volumes resulting in lower per-transaction fees. This is due to the availability of different fee structures that can be used.

The base price for ACH transactions is the network fees, which is just a percentage of a penny. However, most parties use third-party processing partners who will add a fixed fee at a per transaction level (ranging from $0.15 to $1.50). While higher-value transactions might also see a small percentage-based surcharge (0.5% to 1.5%), those fees usually do not go beyond $5.

ACH has been highly preferred to credit cards and checks recently. This is mostly due to being much lower in cost. A $1,000 debit transaction made by ACH, for example, would likely cost the originator a maximum of $2. A credit card, on the other hand, might charge between 2% to 3%—or between $20 and $30. In almost all cases, ACH is significantly cheaper than credit or debit card solutions.

Some institutions may have transfer limits in place for ACH transfers from savings accounts. Others may charge fees for more than six transfers or withdrawals per month.

ACH transfer benefits

For organizations that need to issue payments or transfers (let's face it, that's every business including yours), ACH offers many advantages. Let's take a closer look:

Convenience

When comparing the convenience of ACH to writing checks, ACH is undoubtedly more convenient. With ACH, there are no paper checks to handle, no file cabinets to store them, and no pens needed to sign them. It takes less time to process ACH payments and for vendors to have access to the funds. Although checks continue to be used in many industries, vendors are increasingly choosing ACH as their preferred method of payment.

Lower Cost than Credit

While credit systems offer similar convenience as ACH, they are often associated with higher costs, especially for businesses that process recurring payments. Credit card fees can be as high as 2.5% of the transaction value, in addition to flat-rate processing fees. In comparison, ACH transactions typically cost between 20 cents and $1.50 per transaction. For businesses that process a high volume of transactions, ACH can provide significant savings.

Works well Long Distance

ACH payments can be used for international money transfers, which can save several days or even weeks compared to using physical checks. Although there is no global ACH system, many countries have their own systems that interface with ACH. For example, SEPA (Single Euro Payments Area) is the equivalent system in Europe, while Australia uses "Direct Entry."

Tracking

The integration of the bank with the electronic funds transfer simplifies accounting by eliminating the need to manually update two separate records, as you would do in the case of balancing a check-book. This also allows for seamless integration with numerous accounting tools and software services that provide comprehensive transaction histories through the ACH system.

Set up seamless ACH payment and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

ACH transfer limitations

Although ACH transfers are easy, secure, and lower in cost, they’re not ideal for all payments. Business owners can select other methods for time-sensitive or high-dollar payments. International transfers are also not provided through the ACH network.

Processing times

Direct ACH payments typically take one to three business days to appear in the recipient’s account (usually due to batch processing limitations) — longer than it takes to process wires, credit card swipes, and cash transactions.

No international payments

ACH payments can only be deposited into US–based banks. International money transfers require wires or other payment methods.

Transfer limits

Some banks impose time-based or per-transaction limits on the amount of money that can be transferred via ACH. Checking with your bank is crucial to make sure its policies provide the kind of transfers you need to support your business operations.

Alternatives to ACH transfers

Wire transfers are the immediate alternative that comes to mind when people discuss alternatives to ACH payments. What are the advantages of wires? They are direct, absolute, and can be expensive.

In contrast, ACH transfers are batched, recallable, but also extremely cost-effective. This makes wires and ACH payments best suited for different use cases.

Getting started with ACH payments for your business

Nanonets is able to provide a seamless onboarding experience for businesses of all sizes, so that they can start processing ACH payments for their suppliers and creditors with ease.

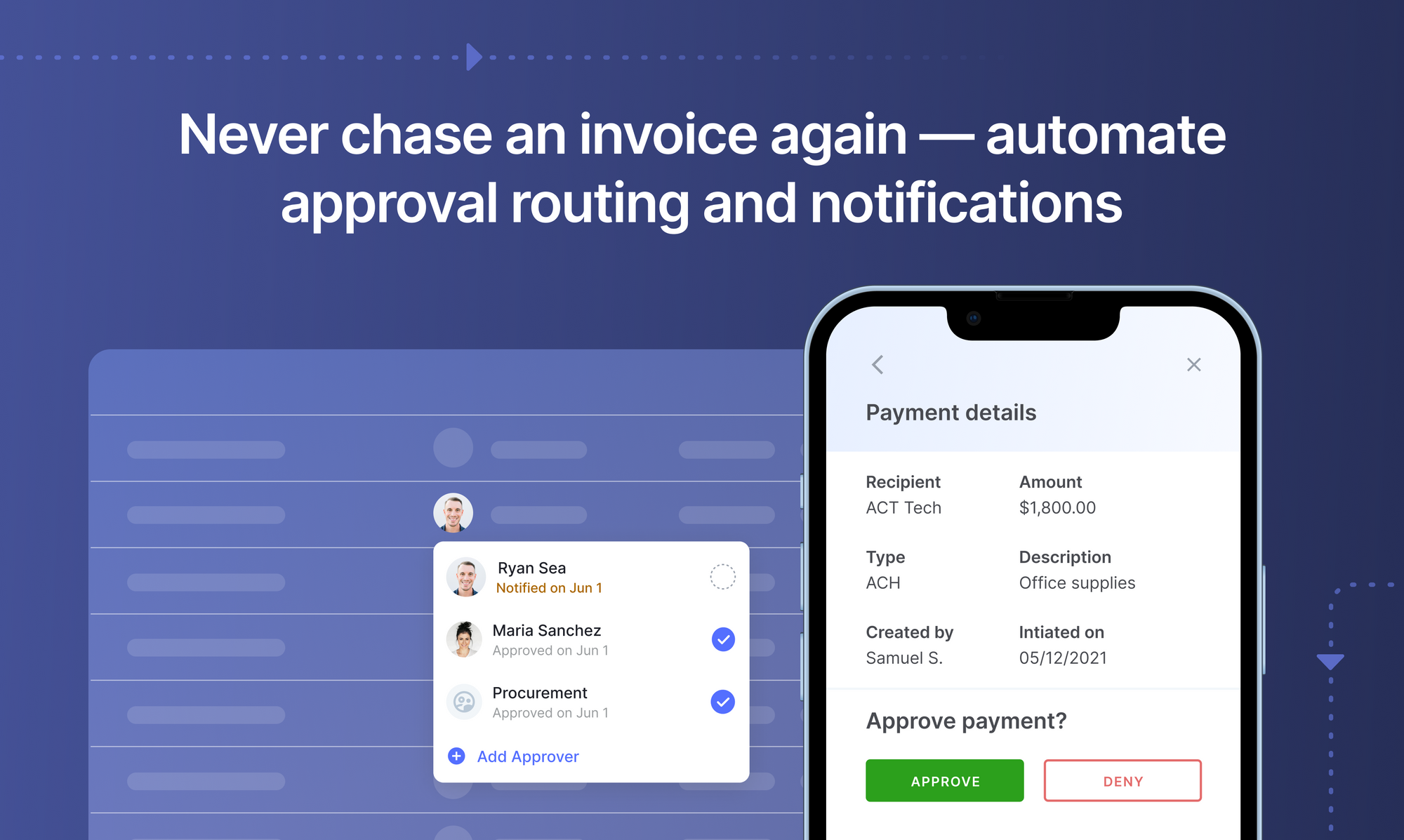

With an AI-enabled platform that reads invoice data, automates approval and sets up secure ACH payments at a reasonable cost - you can have your entire payable function in one place with Nanonets.