Electronic payment process: Everything you need to know

The electronic payment process is a method of making transactions or paying for goods and services through an electronic medium without using checks or cash. This process typically involves using electronic platforms, online banking, or payment processors. It can be initiated through computers, tablets, or smartphones and offers a convenient, efficient, and secure way of handling financial transactions.

Electronic payments or ePayments are the norms now, driven not only by the enormous digital developments of recent decades but also spurred on by the pandemic-induced lockdowns and social distancing. The World Bank reports that two-thirds of adults worldwide make or receive a digital payment today, with the share in developing economies growing from 35% in 2014 to 57% in 2021.

With digital payments now the transactional backbone of most businesses, it is essential to understand how the electronic payment process works and how the overlap between automation and ePayment applications would fit into a future world of hyper-automation.

What is an electronic payment?

Electronic payments are the systems by which consumers pay for goods and services electronically in ways that do not involve paper as currency or checks. ePayment methods such as credit and debit cards have existed for many decades. Bank transfers, EDI payments and digital wallets are recent developments that have leveraged the rapid expansion in digital data and interconnectivity.

B2B and B2C transactions are rapidly transitioning to electronic payments. The pressures on enterprises and individuals by the COVID-19 pandemic have dramatically spurred this move. According to a global study conducted by Accenture, 79 percent of Chief Financial Officers believe that the pandemic’s impacts have compelled them to resort to technology for payment processes.

Are you looking to automate the mundane & mechanical Payment Reconciliation process? Try Nanonets™ AI-based OCR solution to automate Payment Reconciliation in your organization!

Benefits of the electronic payment process

The most apparent benefit of the electronic payment process to businesses and individuals is convenience. But that's not all.

Benefits of the electronic payment process include:

- Cost and time savings: Paper-based payments, be it cash or checks, involve hidden costs such as human resources for collection and processing. The average cost of cash payment is 30 cents. While this appears small enough, it applies only to small transactions in geographic proximity. Further disadvantages of cash processing are that they are prone to error and fraud and complicate accounting and bookkeeping processes. The cost of processing checks is about $3. Check processing is also slow - clearing a simple statement can take 2-3 weeks.

- Limits of payment: Cash payments are limited by the amount of cash in the wallet. Cheque payments are determined by the amount of money in the bank account. Many (not all) types of electronic payments entail a credit system, which enables payments during tough times.

- Better B2B and B2C relationships: electronic payments could enable credit functionalities. These, in turn, could ensure prompt payment to businesses, which can improve relationships between vendors and customers.

- Enhanced visibility: Cash payments and check payments may be challenging to track. Maintaining the log of payment is an extra activity that must be performed when using these forms of payment. ePayment systems can provide a recorded trail of payments made and enhanced visibility into payment statuses and financial metrics.

- Efficiency: ePayment systems do not require waiting in long queues in ATMs and banks to withdraw cash or deposit checks. Online payments are now possible for various purchases, including shopping websites, which prevents visits to brick-and-mortar stores, unless by choice. Electronic payments offer features like contactless payments, which have their own merits – contactless payments have increasingly been practiced since the break of the pandemic in 2020.

- Cashless Economy: Beyond personal and business benefits, electronic payments can help the economy. A cashless economy can reduce rates of crimes involving tangible money, minimize money laundering evils, and enable international currency exchange.

Type of electronic payment methods

While several types of electronic payment systems are available today, the most common ones are credit cards, bank transfers, and digital wallets. These common electronic payment methods' workings, benefits, and drawbacks are described below.

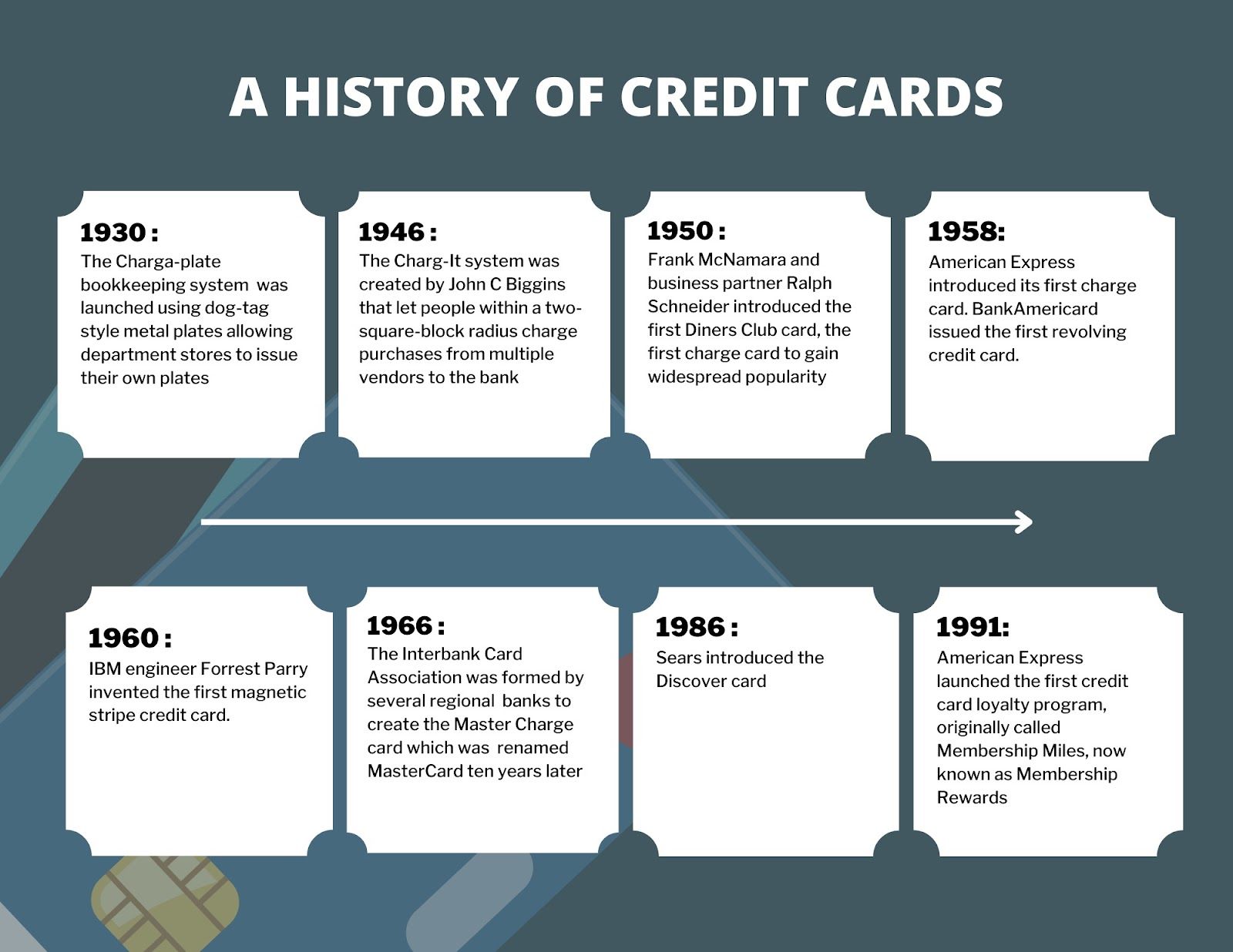

Credit card payments

Originally developed as “charge cards'' for business travel and entertainment, credit cards now serve many purposes. With a revolving credit line, credit cards offer holders the option to pay their balance in their chosen way – in full at the end of the billing cycle or in parts and installments. When a credit card is used at a merchant’s outlet, the money first arrives in the merchant’s account and sits in a holding zone until it is disbursed to the target bank account. Payment gateways and merchant accounts work in synergy to enable credit card payments. Payment gateways and merchant accounts may be merged into a single platform, such as PayPal and Venmo.

Advantages

- Credit cards are a mature FinTech. In almost all financially upward or upwardly mobile societies, credit cards have remained the preferred form of payment. This means that more people are aware of how credit cards work.

- Cards allow credit and often offer cash-back incentives, installment payments, and discounts.

- Cards are convenient to carry and have an extra layer of protection – even no-swipe, tap-based cards can be swiped with OTP approvals.

- Cards also come with built-in security and fraud prevention, an added benefit.

Disadvantages

- There is often a merchant fee for credit card transactions. Credit card processing fees may range between 2.8 and 4.3 percent. The merchant may add this to the product price to avoid loss, which means this fee is transferred to the customer.

- Credit cards may encourage impulsive and unnecessary purchases

- They may charge high interest rates for balances not paid in full by the due date

- Fees and fines may be charged for late payments

Bank transfers

Bank transfer is the movement of funds from one bank account to another using recipient data like account number, bank routing number, etc. While this was performed non-digitally at the customer’s side in the past, i.e., a form for fund transfer was filled and turned in manually, bank transfers can now be performed online directly by the customer.

Advantages

- Transactions are secure and quick. Both payer and payee receive notifications of funds transfer, which makes it a dependable process.

- There is no possibility of bounced checks or payment reversals because payment can only be made if there is a sufficient balance in the payer’s account.

Disadvantages

- Bank transfers may be associated with a fee, mainly when performed between countries.

- Bank transfers are also irreversible. It is a hassle to reverse wrong payments

- Bank transfers do not allow credit. Hence, the bank from which the money is being transferred must have sufficient funds.

Digital wallet payments

Boku, a FinTech company, conducted a survey that showed that half the population of the world – 4.8 billion people worldwide will use digital wallets by 2025. Digital wallets such as Apple Pay, Google Pay, and Samsung Pay are being increasingly used to make payments using a hand-held smart device such as a mobile phone or tablet. Digital wallets may be in the form of e-wallets that can be used from any digital medium, like computers, laptops, tablets, and mobile devices. M-wallets are specific to mobile devices. It is a money management app that enables payments to retailers or other people from bank accounts or credit cards.

Advantages

- Digital wallets are built using encryption software, which means that the financial information encoded in them is secure and cannot be hacked. Digital wallets don’t store the actual account number or credit card details but only a personal token and can be used only by the holder of the mobile phone because it is protected by passwords and OTPs.

- More and more merchants are accepting digital wallet payments. Payment is as easy as scanning a QR code and transferring the money after multiple levels of security checks.

- The need to have a stuffed wallet and bottomless purse into which one must root to get out the cash is eliminated. Almost everyone carries a smartphone, and that is pretty much the only tool necessary to make the payment.

Disadvantages

- Digital wallets can be platform-dependent and company dependent. Merchants may accept different kinds of digital wallets, and one wallet may not fit all.

- While digital wallets are secure as long as they are in the hands of the owner of the device that holds the wallet, safety is always compromised if the device is stolen. Risks of cyberattacks also exist as with all forms of e-Payment options. However, most digital wallets come with security features that protect them from hacks and cyberattacks. Losing the phone, however, is a more personal risk to using digital wallets.

- Ease of use may encourage impulsive and unnecessary purchases

Others

A subsect of the digital wallet is the virtual card. It is a plastic-free card that allows customers to generate single-use 16-digit numbers authorized for a specific payment amount. Virtual cards are just gaining a foothold in many countries.

There are also country-specific ePayment methods such as the Automated Clearing House (ACH) in the US. ACH is the bank-to-bank transfers that are aggregated and processed in batches through the Automated Clearing House network, run by NACHA. They are used in the US for bulk payments such as salaries.

Looking to automate the mundane & mechanical Payment Reconciliation process? Try Nanonets™ AI-based OCR solution to automate Payment Reconciliation in your organization!

Automation of the electronic payment process

The Accounts Payable Network reports that replacing paper checks with electronic payments would save $5.14 per check. The automation of ePayments, especially in the B2B area, can help companies save considerable time and money. While there are already many accounts payable software and tools available and being used by enterprises, the incorporation of vendor pay automation into the system would result in fully automated procure-to-pay processes.

Some benefits of electronic payment automation are:

- Time savings: Automation makes electronic payment processes faster when combined with automated invoice processing and enables the achievement of the optimum Days Payable Outstanding – a powerful metric that reflects the financial health of the company.

- Money savings: Automated payments are cost-effective when compared to paper transactions, as seen in the above statistic of $5.14 per check.

- Security: Automatic electronic payment software is equipped with high levels of security and encryption, which makes it easier to detect and prevent fraudulent activities.

- Error elimination: Automated electronic payments can eliminate duplication and overpayment errors because they can be connected to automated invoice management.

- Better relationships between enterprises: Setting up automated electronic payment processes can provide the recipients with real-time data on the status of the payment. This can enhance trust and improve customer-supplier relationships.

The choice of an automation tool for electronic payments must entail detailed research into the options available vis-à-vis the needs of the business. The automation tool for the ePayment process is not a stand-alone entity but is an extension of the larger AP automation process. Thus, the payment automation solution must be capable of being integrated with the larger AP automation or enterprise resource planning (ERP) systems.

Nanonets as part of the larger electronic payment automation process

The automation of the electronic payment process is a part of the larger accounts payable automation. Nanonets is an AI-enabled OCR software that automates the extraction of financial data from a variety of sources used in an automated AP process.

Accounts payable automation or AP Automation is the process by which accounts payable processes are handled digitally rather than manually. It basically comprises three sub-processes:

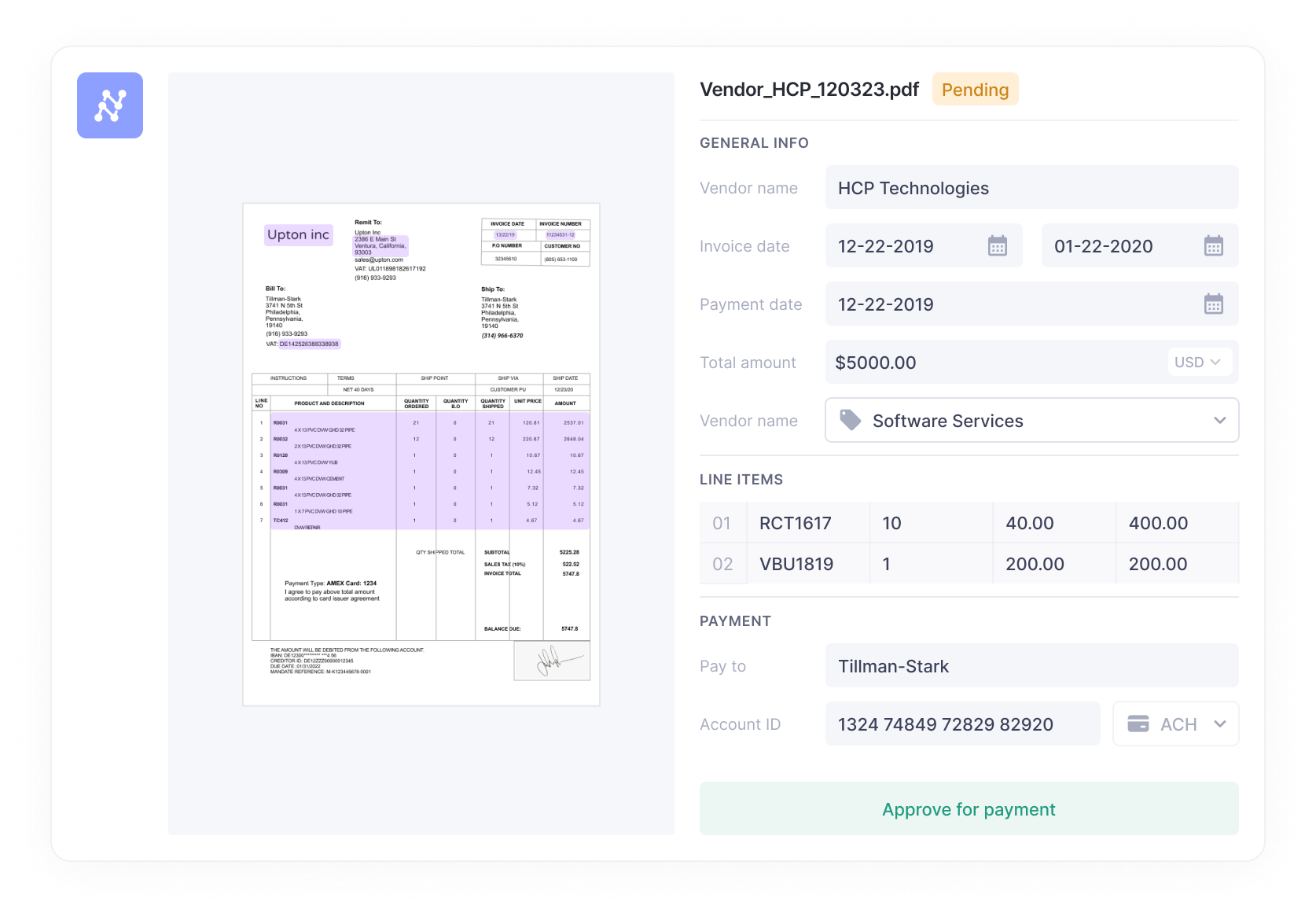

1. Invoice receipt and data extraction

This is the first step, where the business owner receives invoices and ideally uses an OCR tool to convert electronically scanned invoices to digital form. Nanonets can handle this workflow end-to-end in a completely automated fashion.

We can integrate with your email inboxes to directly import attachments as invoices, import invoices from Cloud Storage, such as G-Drive, One Drive, Dropbox, etc., integrate with databases such as Amazon S3, Integrate via APIs, and build any other integrations using Zapier.

2. Matching and approval workflow

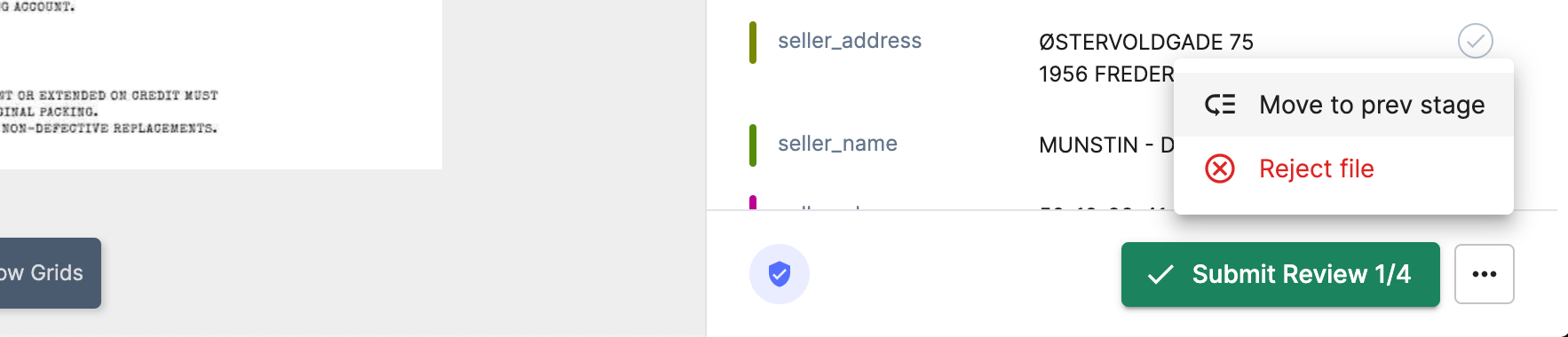

This is the second step, where invoices that are received, processed, and approved are matched with the purchase orders and goods receipts to ensure accuracy. They can also be manually verified by the relevant team within the organization.

Nanonets can perform 2-way and 3-way matching between invoices, purchase orders, and goods receipts, eliminating up to 90% manual labor and making the process more efficient, reliable, and accurate.

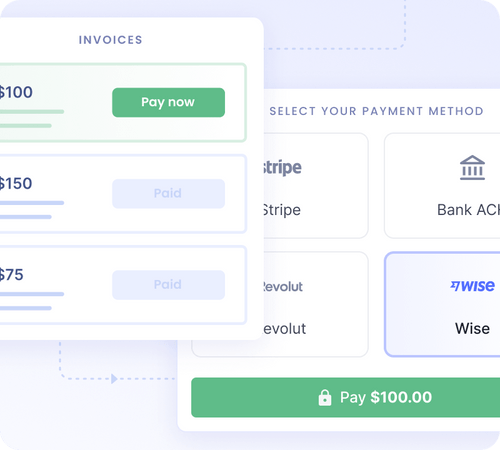

3. Payments and recordkeeping for audit purposes

The third and final step in this process is when one needs to pay out these Invoices and record these entries in their Accounts Payable Systems for Audit purposes.

Nanonets comes with pre-built integrations with popular accounting software, such as QuickBooks, Xero, Sage, Netsuite, etc., and can handle integrations with any other accounting software swiftly.

Take away

Electronic payment systems come with compelling benefits such as time and cost savings, streamlined accounts payable processes, and, ultimately, better bottom lines.

Automated ePayment solutions will enable human employees to concentrate on less mundane, higher-value tasks such as business development and other activities that contribute to enterprise value.

The choice of an electronic payment automation tool depends on the level of automation that the business warrants and the ability of the software to blend with the company’s larger AP automation processes.

Nanonets online OCR & OCR API have many interesting use cases that could optimize your business performance, save costs and boost growth. Find out how Nanonets' use cases can apply to your product.

FAQs

What are the steps for electronic payment?

There are several ways to make electronic payments. The most popular are credit cards, debit cards, ACH transfers, digital wallet payments, and wire transfers. Here are the general steps for making electronic payments:

1. Payment Initiation: Choose the type of electronic payment method you prefer and initiate the payment transfer by entering your payment details.

2. Payment Authentication: Submit your payment information, including account numbers or security codes, and wait for authentication.

3. Payment Authorization: Your bank or payment processor will authorize the payment.

4. Payment Settlement: The payment will be settled, and the funds will be transferred from your account to the merchant's account.

Setting up an electronic payment system is simple, and existing accounting software may already be able to accept electronic payments. If you work with a third-party payment processor, you must provide them with your bank account number and other relevant information. Electronic payment processing methods vary in cost, security, speed, and ease of use for merchants and customers. Understanding the pros and cons of the popular payment methods can help you choose the payment processing system that best meets your business's needs.

What are the 4 types of electronic payment systems?

Credit Card and Debit Card Systems: These are the most common types of electronic payments. They involve the use of physical cards issued by banks and financial institutions.

E-Wallets: These are digital wallets that store payment information securely. Examples include PayPal, Google Wallet, and Apple Pay.

Bank Transfers: This type of payment involves transferring money directly from one bank account to another. This can be done online or through mobile banking apps.

Cryptocurrencies: This is a relatively new form of digital currency that uses cryptography for security. Examples include Bitcoin, Ethereum, and Litecoin.

Mobile Payments: These are payments made through mobile devices. They can take various forms, such as mobile wallets, in-app purchases, or even SMS-based transactions. Some popular mobile payment systems include Apple Pay, Google Pay, and Samsung Pay.

Prepaid Cards. These are cards that are loaded with a specific amount of money in advance. They can be used for making payments until the preloaded amount is exhausted. Examples include gift cards, travel cards, and reloadable debit cards.