Claims Process Automation - A Guide to Automating Claims Processing in 2023

What is Claims Process Automation ?

Claims process automation is the use of technology to automate the handling and processing of healthcare and insurance claims. This technology enables insurers to streamline their claims processes, reduce manual work, and improve efficiency. Automated claims processing software uses machine learning, artificial intelligence, and natural language processing to collect and analyze data from various sources, allowing insurers to process claims faster and more accurately. Claims process automation also provides benefits such as cost savings, better customer service, improved data accuracy and security, and reduced risk of errors and fraud.

How Claims Process Automation Works

We will now paint a picture of how an end to end fully automated claims processing workflow looks like. A lot of establishments selectively incorporate certain aspects of this workflow into their operations, while others adopt the fully automated workflow end to end.

This is followed by a collated list of the best businesses offering each aspect of the claims process workflow for you.

Here is a step-by-step overview of how claims process automation works -

- Initial claim reporting: The process begins when a policyholder reports a claim to the insurer. In many cases, this can be done through an online portal or mobile app. The policyholder provides basic information about the claim, such as the date and location of the incident, and any supporting documentation or images.

- Claim assessment: Once the claim is reported, the insurer uses automated tools to assess the claim and determine whether it is covered by the policy. This may involve analyzing the policy language, reviewing the reported damages, and consulting with third-party databases to verify the claimant's identity and prior claims history.

- Claim validation: If the claim is deemed valid, the insurer will begin the process of validating the claim by gathering additional information, such as medical records or repair estimates. This process can also be automated, with software pulling data from various sources and using AI algorithms to assess the validity of the claim.

- Claims decision-making: Based on the information gathered during the assessment and validation stages, the insurer will make a decision about the claim. This decision can also be automated, with the system applying predefined rules to determine the appropriate payment amount or coverage level.

- Payment processing: If the claim is approved, the insurer will initiate payment to the claimant. This may involve automating the payment process through electronic funds transfer or other digital payment methods.

- Claims analysis: Finally, the insurer may use automated tools to analyze the claims data to identify patterns and trends that can be used to improve claims processes and reduce fraud.

Business Offering These Services -

Here are some examples of companies that offer services for each step of the claims process automation:

- Initial claim reporting:

- Snapsheet: Offers a digital claims platform that allows policyholders to submit claims online or through a mobile app. https://www.snapsheetclaims.com/

- Guidewell: Provides a digital platform for health insurance claims management that allows policyholders to submit claims and track their status online. https://www.guidewell.com/

- Claim assessment:

- Shift Technology: Uses AI algorithms to analyze claims data and detect fraud, errors, and anomalies. https://www.shift-technology.com/

- Casentric: Provides a claims management platform that uses predictive analytics to identify potential issues and speed up the claims process. https://www.casentric.com/

- Claim validation:

- Nanonets: Nanonets OCR can help automate the process of validating claims by extracting key information from claim forms, such as policy numbers, claimant names, and damage descriptions. The system can use machine learning algorithms to analyze the extracted data and flag any potential errors or inconsistencies. This can help insurers process claims more quickly and accurately, reducing the time and cost involved in manual validation.

Looking to automate Claims Processing? Look no further! Try Nanonets Claims Processing Automated Workflows for free.

2. Verisk Analytics: Offers a suite of tools for claims validation, including property and casualty claims analytics, medical bill review, and workers' compensation claims management. https://www.verisk.com/

3. ClaimGenius: Uses computer vision and AI to automatically assess vehicle damage and generate repair estimates. https://www.claimgenius.com/

- Claims decision-making:

- Nanonets: Nanonets OCR can be used to automate the process of claims decision-making. For example, the system can extract data from repair estimates, medical bills, or other documentation, and use machine learning models to determine the appropriate payment amount based on predefined rules. This can help insurers make faster and more consistent decisions, while also reducing the risk of errors or bias.

- Octo Telematics: Provides telematics-based solutions that allow insurers to monitor driving behavior and calculate premiums based on risk. https://www.octotelematics.com/

- Tractable: Uses computer vision and AI to automatically assess vehicle damage and determine the appropriate repair costs. https://tractable.ai/

- Payment processing:

- Checkbook.io: Offers a digital check platform that allows insurers to issue payments electronically and securely. https://checkbook.io/

- PayPal: Provides a range of digital payment solutions, including online and mobile payments, that can be used for claims processing. https://www.paypal.com/

- Claims analysis:

- EXL Service: Offers analytics solutions that help insurers analyze claims data and improve their processes. https://www.exlservice.com/

- Mitchell International: Provides claims management and analytics software for the automotive and workers' compensation industries. https://www.mitchell.com/

Benefits of Automating Claims Processing

- Increased Efficiency: Automation reduces manual work, increases speed, and streamlines the claims process.

- Improved Accuracy: Automation reduces the chances of human error and improves accuracy in claims processing.

- Faster Turnaround Times: Automated claims processing allows for quicker turnaround times, which can improve customer satisfaction.

- Better Customer Service: Faster claims processing times, better accuracy, and quicker responses to customer inquiries can all improve customer service.

- Reduced Costs: Automation reduces the need for manual labor, which can reduce costs and improve profitability.

- Enhanced Compliance: Automation can help ensure compliance with regulatory requirements and reduce the risk of fines and penalties.

- Reduce Risk Mitigation: Incorporates fraud detection algorithms and machine learning to identify suspicious claims patterns.

- Improved Environmental Impact: Reduces reliance on paper-based processes, contributing to environmental sustainability & mitigates waste, aligning with eco-friendly practices in claims processing.

Claims Process Automation with Nanonets

Nanonets OCR is an AI-powered optical character recognition technology that enables companies to extract information from unstructured documents such as invoices, receipts, and insurance claims. Healthcare and insurance companies can leverage this technology to automate their claims processing, thus reducing manual errors, minimizing processing time, and improving customer satisfaction.

Let us explore some specific use cases with examples on how insurance and healthcare establishments can further use Nanonets OCR for claims process automation.

Insurance Claims Processing

Insurance companies receive a large volume of claims every day, which need to be processed quickly and accurately. However, claims processing is a time-consuming and error-prone task, often requiring manual data entry and verification. By using Nanonets OCR, insurance companies can automate their claims processing, reducing processing time and minimizing manual errors.

For example, an insurance company may receive a claim for car damage caused by an accident. The claimant submits an image of the invoice from the repair shop. The insurance company can use Nanonets OCR to extract the relevant information from the invoice, such as the repair costs, date of repair, and the name of the repair shop. This information can be automatically fed into the claims management system, which can then process the claim faster and more accurately.

Looking to automate Claims Processing? Look no further! Try Nanonets Claims Processing Automated Workflows for free.

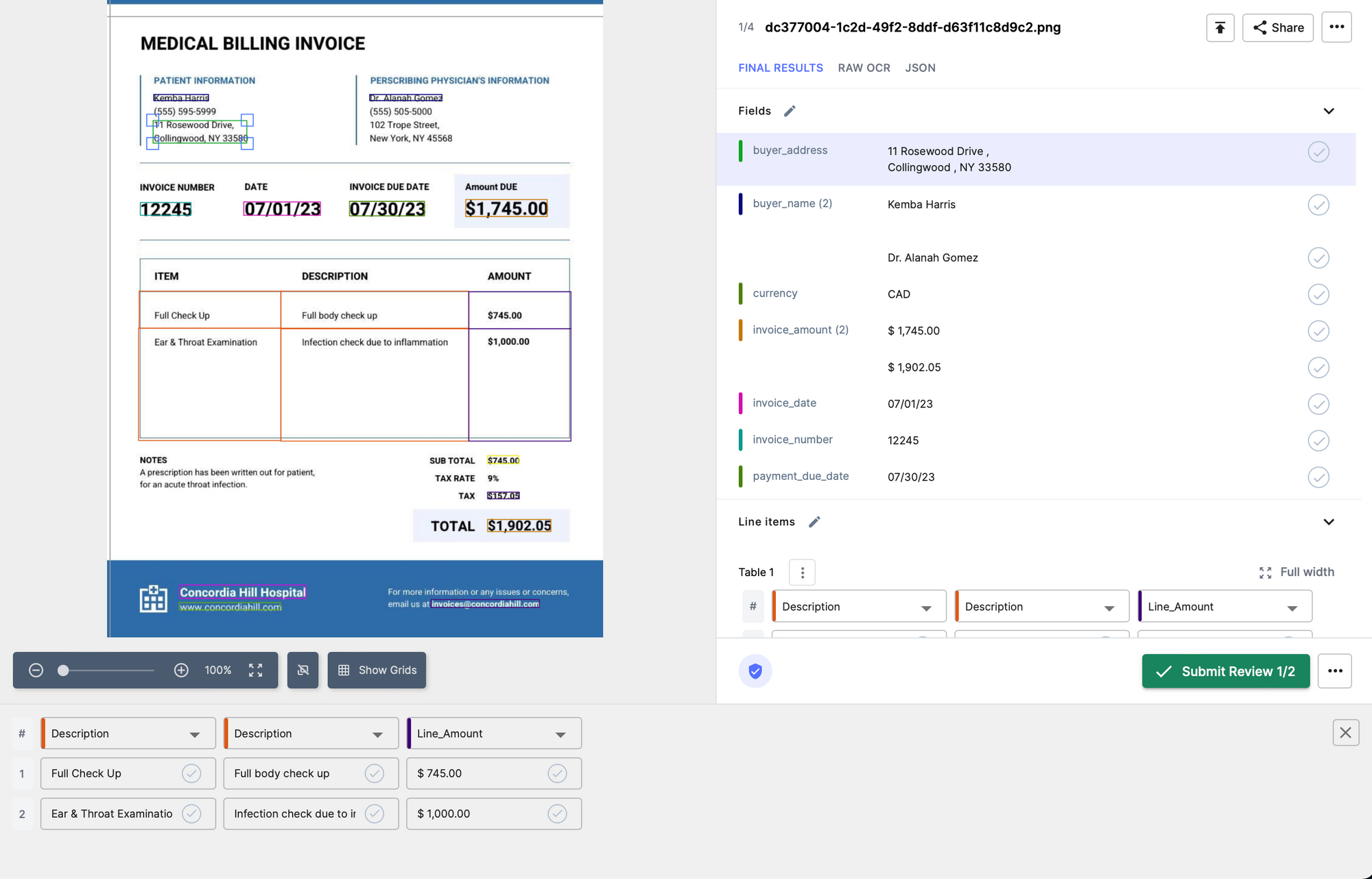

Healthcare Claims Processing

Healthcare providers often deal with a large number of insurance claims, which need to be processed quickly and accurately. Nanonets OCR can be used to automate the process of extracting data from medical bills, insurance claims, and other related documents. This can help healthcare providers reduce manual errors and speed up the processing of claims.

For example, a hospital may receive an insurance claim for a patient's surgery. The hospital can use Nanonets OCR to extract the relevant information from the claim, such as the patient's name, date of surgery, type of surgery performed, and the cost of the procedure. This information can be automatically fed into the hospital's claims management system, which can then process the claim faster and more accurately.

Two-Way Matching

Another use case for Nanonets OCR in insurance and healthcare companies is two-way matching. This process involves matching data from two different sources, such as an invoice and a purchase order or a medical bill and an insurance claim.

For example, an insurance company may receive an invoice from a healthcare provider for a patient's treatment. The insurance company can use Nanonets OCR to extract the relevant information from the invoice, such as the patient's name, date of treatment, and the cost of the procedure. The same information can also be extracted from the insurance claim submitted by the patient.

By using two-way matching, the insurance company can compare the information extracted from the invoice and the insurance claim to ensure that they match. This can help to identify any discrepancies or errors, enabling the company to resolve any issues before processing the claim.

Verification of Policy Documents

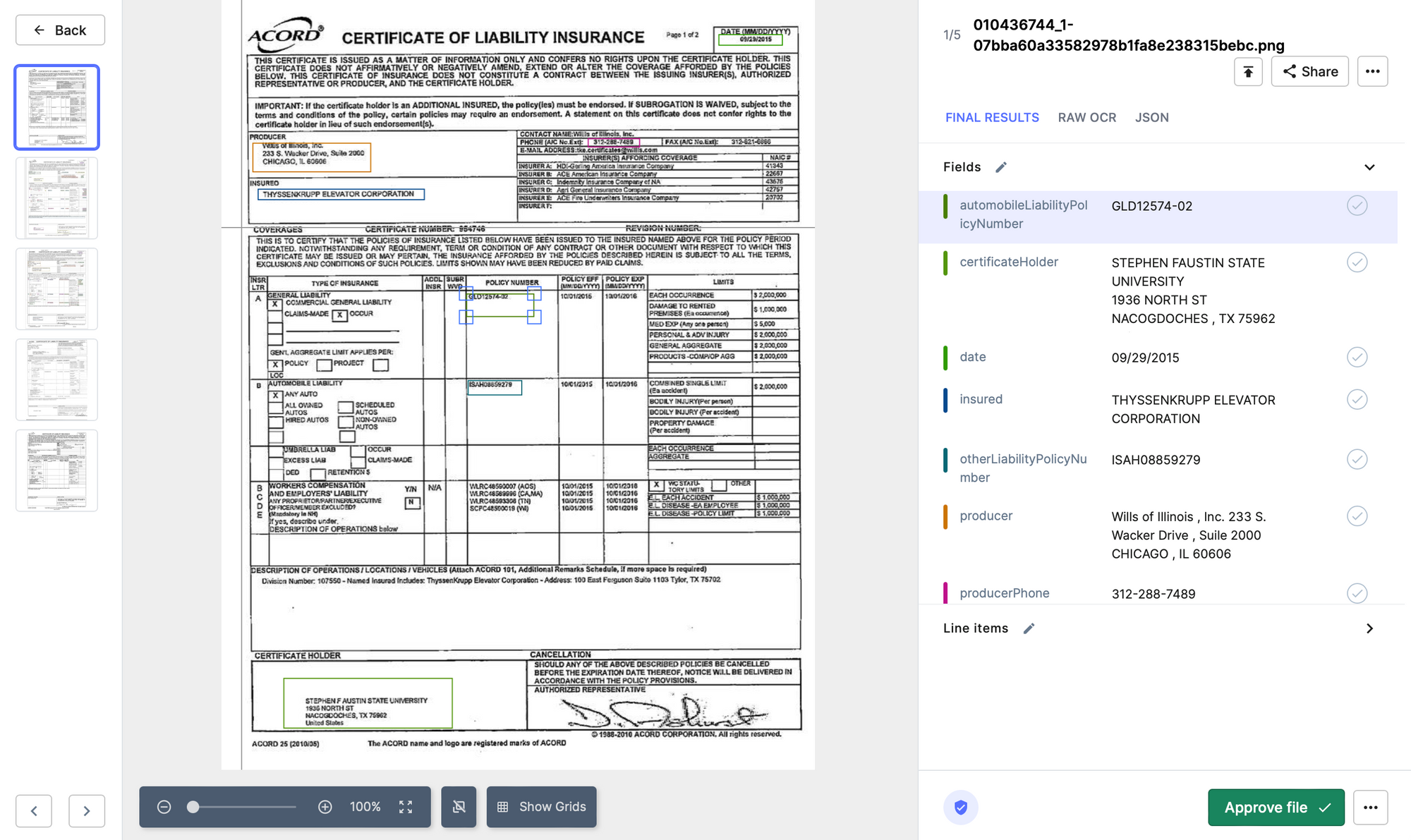

Insurance companies often receive policy documents from their customers, which need to be verified and processed. By using Nanonets OCR, insurance companies can automate the process of extracting information from policy documents, reducing manual errors and speeding up the verification process.

For example, an insurance company may receive a policy document from a customer, which needs to be verified. The company can use Nanonets OCR to extract the relevant information from the document, such as the customer's name, policy number, and the type of policy. This information can be automatically verified against the company's database, reducing the time and effort required for manual verification.

Verification of Medical Records

Healthcare providers often need to verify patient medical records for insurance claims and other purposes. By using Nanonets OCR, healthcare providers can automate the process of extracting data from medical records, reducing manual errors and speeding up the verification process.

For example, a healthcare provider may need to verify a patient's medical history for an insurance claim. The provider can use Nanonets OCR to extract the relevant information from the medical records, such as the patient's name, medical conditions, and treatment history. This information can be automatically verified against the insurance company's database, reducing the time and effort required for manual verification.

Benefits of Nanonets

Nanonets OCR is the best way to start automating claims processing. This technology can be used to automate the process of reading and processing claims documents, which can be time-consuming and error-prone when done manually.

Benefits of adopting Nanonets have been seen for multiple clients already -

- Fast and accurate data extraction: Nanonets OCR can extract text data from claims documents quickly and accurately, reducing the time and costs associated with manual data entry. This technology can also reduce the risk of errors that can occur during manual data entry, improving data accuracy.

- Improved processing times: By automating claims processing with Nanonets OCR, claims can be processed faster and more efficiently. This can reduce the time it takes to process a claim, which can improve customer satisfaction and reduce costs associated with manual processing.

- Automated claim classification: Nanonets OCR can also be used to classify claims based on specific criteria, such as claim type or severity. This can help insurers prioritize claims processing, ensuring that urgent claims are processed first.

- Fraud detection: Nanonets OCR can be used to detect potential fraud in claims documents by identifying inconsistencies or anomalies in the data. This can help insurers prevent fraudulent claims and save costs associated with fraudulent activity.

- Better customer experience: By automating claims processing with Nanonets OCR, insurers can provide a better customer experience by reducing processing times and improving accuracy. This can lead to increased customer satisfaction and loyalty.

- Reduced operational costs: Automating claims processing with Nanonets OCR can reduce the costs associated with manual data entry and processing. This can result in significant cost savings for insurers, which can be passed on to customers in the form of lower premiums or improved benefits.

One of our AI experts at Nanonets can get on a call with you to discuss your use case, set up your model and provide a demo within 15 minutes.

Looking to automate Claims Processing? Look no further! Try Nanonets Claims Processing Automated Workflows for free.

Case Studies of Claims Process Automation

Claims Prcoess Automation has been fiercily adopted by healthcare and insurance establishments, and they have seen immediate and significant ROIs.

There is more and more buzz around this domain. Take a look -

- Claims intake and triage: Automating the initial intake and triage of claims can reduce the time and resources needed to process claims, improving efficiency and reducing errors. According to a study by Accenture, automation can reduce claims processing times by up to 80%.

- Provider credentialing: Automating provider credentialing can reduce the time and cost of manual review, as well as improve accuracy. A study by the National Committee for Quality Assurance (NCQA) found that automating provider credentialing can save up to $1.5 million annually for large health plans.

- Claims adjudication: Automating claims adjudication can reduce the time and cost of manual review, as well as improve accuracy. Blue Cross Blue Shield of North Carolina Implements AI-Powered Claims Automation.

- Prior authorization: Automating prior authorization can reduce the time and cost of manual review, as well as improve accuracy. According to a study by CAQH, automating prior authorization can save healthcare providers up to $3.3 billion annually.

- Fraud detection: Automating fraud detection can reduce the risk of fraudulent claims being paid, saving healthcare providers and insurance companies billions of dollars annually. Anthem has partnered with Google to tackle fraud detection using AI.

- Denial management: Automating denial management can reduce the time and resources needed to appeal denied claims, improving efficiency and reducing errors. According to a study by The Advisory Board Company, automating denial management can reduce the average time to appeal a denied claim by up to 63%.

- Eligibility verification: Automated eligibility verification can ensure that claims are only paid for eligible patients, reducing the risk of fraud and errors. A study found that automating eligibility verification can save healthcare providers up to $11.1 billion annually.

- Payment processing: Automating payment processing can reduce the time and cost of manual review, as well as improve accuracy. According to a study by the National Association of Insurance Commissioners (NAIC), automating payment processing can reduce costs by up to 30%.

- Customer service: Automating customer service can improve the customer experience and reduce the time and cost of manual review. According to a study by Forrester, 63% of customers would be more likely to return to a company with good customer service.

- Reporting and analytics: Automating reporting and analytics can provide healthcare providers and insurance companies with valuable insights into claims processing and trends. According to a study by Deloitte, automating reporting and analytics can improve decision-making and reduce costs by up to 50%.

Steps for Automating Claims Processing

Here are step-by-step instructions on what a business should do to start using Nanonets OCR for claims process automation:

- Define your requirements: The first step is to identify your specific requirements for automating your claims process using Nanonets OCR. This includes determining the types of documents you need to process, the data fields you want to extract, and the business rules you want to apply.

- Sign up for Nanonets OCR: Visit the Nanonets website (https://app.nanonets.com/#/signup) and sign up for an account. Nanonets offers a free trial, which allows you to test the OCR technology and determine if it meets your needs.

- Upload sample documents: Once you have signed up for an account, upload a set of sample documents to the Nanonets OCR platform. These documents should represent the types of documents you will be processing in your claims process, such as medical bills or insurance claims forms.

- Train the OCR model: Use the Nanonets OCR platform to train the OCR model to recognize the data fields you want to extract from the sample documents. This involves highlighting the relevant data fields in the sample documents and providing examples of what the data should look like.

- Test the OCR model: Once you have trained the OCR model, test it on a set of test documents to ensure that it can accurately extract the data fields you need. If necessary, refine the model and retrain it until it achieves the desired level of accuracy.

- Integrate with your claims process: Once you are satisfied with the accuracy of the OCR model, integrate it with your claims process automation system. This may involve working with your IT team to develop custom integrations or using pre-built connectors provided by Nanonets.

- Monitor and refine: Finally, monitor the performance of the OCR model and refine it as necessary to ensure that it continues to accurately extract data from your claims documents.

By following these steps, a business can successfully implement Nanonets OCR for claims process automation and achieve increased efficiency, accuracy, and cost savings.

In addition to the above steps, you can also schedule a demo with an AI expert from Nanonets to discuss their specific use case related to claims process automation. This option allows businesses to get a more personalized experience and to have any questions they may have answered by an expert. During the demo, the AI expert will set up a Nanonets account and model based on the business's requirements, provide a personalized demo of the OCR technology, and discuss integration options. They can also help businesses find the best pricing plan for their needs.

Looking to automate Claims Processing? Look no further! Try Nanonets Claims Processing Automated Workflows for free.

Future of Claims Process Automation

With the advent of AI, more and more processes of the claims processing workflow can now be automated. Never seen before implementations of automated workflows in this domain are now possible. Let us take a look at some examples -

- Real-time processing of claims: One of the main benefits of automation in claims processing is the ability to process claims in real-time. Insurance companies can leverage automation tools to analyze claims data and make decisions on claims quickly, without the need for manual intervention. This can help reduce the time and effort required to process each claim, leading to faster payouts and greater customer satisfaction.

- Personalized claims processing: Another key benefit of automation is the ability to personalize the claims process based on customer preferences and history. With the help of AI-powered tools, insurance companies can analyze customer data and provide customized claims processing experiences, tailored to each customer's needs. This can help improve customer satisfaction and loyalty, as customers feel their unique needs are being met.

- Fraud detection and prevention: Automation tools can also be used to detect and prevent insurance fraud, a significant challenge for the industry. By analyzing data and patterns, machine learning algorithms can detect fraudulent claims, minimizing losses for insurance companies and ensuring that legitimate claims are paid out quickly and accurately.

- Streamlined claims workflow: Automation can help streamline the claims workflow by reducing the likelihood of errors and automating repetitive tasks. This can help ensure that claims are processed quickly and accurately, reducing the time and effort required to manage claims.

- Chatbots for customer service: The use of chatbots in claims processing can help customers submit claims quickly and easily. Chatbots can guide customers through the claims submission process, answer questions, and provide support, reducing the need for human intervention and speeding up the claims process.

- Automatic claim assessments: With automation tools, claims can be assessed automatically, reducing the need for manual intervention and speeding up the process. Machine learning algorithms can analyze data and make decisions on claims quickly and accurately, leading to faster payouts and greater customer satisfaction.

- Digital claim documentation: By digitizing and automating the documentation process, insurance companies can reduce the amount of paper-based documents involved in the claims process. This can help streamline the claims workflow and reduce costs, leading to greater efficiency and accuracy.

- Image and video analysis: Advanced image and video analysis tools can be used to process claims based on visual data, such as vehicle damage, property damage, and medical scans. With the help of automation tools, insurance companies can analyze this data quickly and accurately, reducing the time and effort required to manage claims.

- Nanonets OCR for document scanning: Nanonets OCR is a powerful tool that can be used to automate the scanning of documents and improve accuracy in reading and extracting data from documents. By using OCR technology, insurance companies can reduce the time and effort required to manage claims and improve accuracy in document processing.

- AI-powered claims processing: By leveraging machine learning algorithms, insurance companies can analyze data and make more accurate predictions about the likelihood of claims being accepted or rejected. This can help improve the accuracy of claims processing and reduce the need for manual intervention.

- Voice recognition for claims submissions: Voice recognition technology can be used to convert spoken word into text data that can be processed by automation tools. By allowing customers to submit claims via voice, insurance companies can reduce the time and effort required to manage claims and improve the customer experience.

- Smart contracts for claims management: Smart contracts can be used to automate claims processing and enforce rules and conditions based on predefined criteria. This can help improve the accuracy of claims processing and reduce the need for manual intervention, leading to faster payouts and greater customer satisfaction.

- Predictive analytics for claims processing: By analyzing historical data and patterns, predictive analytics tools can help insurance companies identify potential issues and take proactive steps to prevent claims from being rejected.

- Augmented reality for claims inspections: Insurance adjusters can use augmented reality tools to conduct inspections remotely, reducing the need for on-site inspections and speeding up the claims process.

- Blockchain for claims processing: With the help of blockchain technology, insurance companies can automate the claims process and improve transparency, security, and trust in the claims process.

Looking to automate Claims Processing? Look no further! Try Nanonets Claims Processing Automated Workflows for free.

In today's rapidly evolving healthcare industry, claims process automation is no longer just an option, but a necessity. Automating the claims process has numerous benefits, not only for insurance providers, but also for healthcare providers and patients. By reducing administrative burden, improving accuracy and efficiency, and enhancing patient experience, claims process automation is a smart investment for any healthcare or insurance establishment.

One of the main benefits of claims process automation is the reduction of administrative burden. Manual claims processing is often a time-consuming and labor-intensive process, requiring significant resources to manage. Automating the claims process can help streamline administrative tasks, such as data entry and claims adjudication, which in turn can free up valuable time and resources for other tasks, such as patient care.

In addition to reducing administrative burden, automating the claims process can also improve accuracy and efficiency. By removing the potential for human error, automation can help ensure that claims are processed accurately and quickly, reducing the likelihood of costly mistakes and delays. Automation can also help identify fraudulent claims, reducing the risk of fraud and improving overall claim accuracy.

Another benefit of claims process automation is the enhanced patient experience. Automated claims processing can reduce the time it takes for patients to receive reimbursements, which in turn can improve patient satisfaction and loyalty. Automation can also help improve transparency, providing patients with real-time updates on the status of their claims and reducing the need for follow-up inquiries.

Perhaps most importantly, claims process automation can also help improve overall healthcare outcomes. By reducing administrative burden and improving efficiency, automation can help healthcare providers focus more on patient care, leading to better health outcomes for patients. Automation can also help reduce healthcare costs, making healthcare more accessible and affordable for patients.

Despite these benefits, many healthcare and insurance establishments have been slow to adopt claims process automation. One reason for this is the perception that automation is too expensive or too complicated to implement. However, with advances in technology and the availability of cloud-based solutions, automation is now more accessible and affordable than ever before.

Another barrier to adoption of claims process automation is the concern about the complexity of the technology and the potential disruptions that it might cause to established workflows. However, this concern is largely unfounded, as many automation solutions can be seamlessly integrated into existing systems, with minimal disruption to ongoing operations. Moreover, many automation providers offer extensive support and training to help healthcare and insurance establishments navigate the transition to automation and ensure a smooth implementation.

In fact, the benefits of automation far outweigh the potential risks and challenges associated with its adoption. By automating the claims process, healthcare and insurance establishments can not only reduce administrative burden, but also improve the quality of care provided to patients. Automation can help identify patterns and trends in patient data, enabling healthcare providers to make more informed decisions about treatment options and improving patient outcomes. Moreover, automation can help insurance providers better manage risk and reduce fraud, resulting in more affordable and accessible insurance coverage for patients.

In short, claims process automation is a crucial investment for any healthcare or insurance establishment seeking to stay competitive in today's fast-paced healthcare industry. By leveraging automation solutions to streamline administrative tasks, improve accuracy and efficiency, and enhance patient experience and outcomes, healthcare and insurance providers can deliver higher quality care, reduce costs, and ultimately build stronger, more resilient healthcare systems for the benefit of all.

Looking to automate Claims Processing? Look no further! Try Nanonets Claims Processing Automated Workflows for free.