10 Benefits of Accounts Payable Workflow Automation

In business, mistakes made by manual processes are difficult to control, leaving businesses of all sizes vulnerable to fraud. Accounts payable (AP) fraud is a growing concern, with over 80% of organizations having fallen prey to it. Even giants such as Google and Facebook have been victims of AP fraud, losing over $100 million.

Having a smooth and effective accounts payable process is critical in establishing strong vendor management relationships, increasing profits, saving time, optimizing AP days and mitigating fraud.

Switching from a manual to an automated AP process can help in making payments on time and to the correct vendors.

With accounts payable workflow automation, a company can avoid late payments, fraudulent payments and clear up delays in processing which can impact bottom lines.

Manual AP workflow vs AP workflow automation

What is a workflow

A workflow is the sequence of steps taken to complete a task from start to finish. In an accounts payable workflow process, the start of the sequence is when the invoice is received, and it ends when payment is made.

Manual AP workflow

In a manual AP workflow, the accounting department receives invoices, which are typed into the system and delivered by hand to the signing authority for AP approval. Once it is approved, a cheque is cut and payment is sent to vendors. In a manual AP workflow, chances of errors occur at all stages from incorrect data entry to approvals getting stuck on the signing authority’s desk.

Accounts Payable workflow automation

Using optical character recognition (OCR), data from the paper invoice is captured and plugged into fields in a digital invoice. The AP automation software checks to make sure all the data entered matches purchase orders and sales receipts, thereby eliminating chances of fraud and mistakes. If a mistake is found, then it is flagged and forwarded to the relevant person for correction/verification. Once the invoice is approved, it gets directed to the company’s enterprise resource planning (ERP) or accounting system, whereupon, payment is made electronically, or a cheque is sent.

Accounts payable workflow automation solutions are often cloud-based. Employees can access the centralized system and view the information to find out what stage the invoice process is at.

Accounting departments no longer need to chase after approvals and the chances of invoices getting stuck on somebody’s desk is eliminated, saving time.

Bottlenecks throughout the workflow can be easily avoided. Invoice matching ensures errors and fraudulent behavior can be flagged/reduced with accounts payable workflow automation.

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Comparison of manual AP vs automated AP workflow

Invoices

Manual AP Workflow - Accounting teams can find it overwhelming with hundreds of paper invoices that need to be checked and entered into the system, leaving room for errors.

Automated AP Workflow - Paper invoices get converted easily using OCR technology, which the accounting team can easily search for and find.

Errors

Manual AP Workflow - Errors in data entry or matching results in wrong payments and fraudulent payments.

Automated AP Workflow - Invoices are automatically matched to purchase orders and sales receipts and any discrepancies found are re-directed electronically to the concerned department or person to review and correct.

Communication

Manual AP Workflow - Accounting teams have to chase down signing authorities for approval. This can lead to paper invoices getting lost or stuck under a pile of paperwork

Automated AP Workflow - Invoice approvals are automatically sent to relevant departments. Reminders can also be sent if there are delays or if clarification is needed.

Financial Fraud

Manual AP Workflow - Human errors are more likely in data entry and invoice/PO matching. Fraudsters can steal information from paper invoices and invoice a company multiple times.

Automated AP Workflow - Can detect trends based on past history and detect duplicate invoices. Vendor names, account info, etc. are reviewed and verified before payment is processed.

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

Benefits of accounts payable workflow automation

1. Prevent Financial Fraud – AP or vendor fraud in businesses is a rising concern that affects companies of all sizes. In a manual account payable workflow, fraud occurs when, for example, vendor X sends an invoice, but vendor X does not exist and payment is made without verification, resulting in the money being lost forever. Fraudulent payments can also occur because of:

- Wrong data entry

- False billing

- Fraudulent cheques

However, with accounts payable workflow automation, fraud can be prevented by:

- 2-way matching, 3-way matching or 4-way matching of purchase orders and sales receipts to invoices with the use of OCR

- Automated invoice approvals

- Audit trail for the accounting team and auditors to follow

2. Avoid overpayment – In a manual AP workflow, errors in checking for duplicate invoices, data entry, vendor verification and supplier changes can easily occur. However, with accounts payable workflow automation, the centralized automated system can eliminate these common errors. This makes it easy for accounting to avoid wrong/overpayments, and retain cash flow needed for day-to-day operations.

3. Improved Audit Process – with a manual account payable workflow process, audits can take weeks or months, with the accounting team going through endless paperwork. With an automated AP audit system, all the data required for the audit process is organized and stored in one place, making audits simpler and saving time.

4. Timely Payments – Human errors cannot be avoided with a traditional account payable workflow process. Missed invoices result in missed or late payments with penalties, which can impact profits and vendor relationships. By switching to an automated process, AP Departments can minimize the mistakes with a centralized system that ensures invoices are matched, verified and approved before making timely payments.

5. Increase Profitability – With an automated AP workflow system in place, businesses can make payments on time, thereby avoiding penalties. When payments are made on time, it can improve relationships with vendors by building a positive relationship. This can result in potential discounts on future orders, which directly saves the company money. Additionally, with OCR technology, fraudulent payments can also be avoided, resulting in revenue being utilized exactly where it’s needed - to improve core business objectives and increase profits.

6. Centralized AP Process – With AP automation, invoice information can be stored in a central database. This will ensure that invoices, purchase orders, approvals and payment information can be easily. Accounting teams no longer need to search for all the paperwork pertaining to a single order, as it can be found easily within the centralized database, thereby saving time. Moreover, a centralized system makes it easy for anyone within the company to check the status of an invoice/payment.

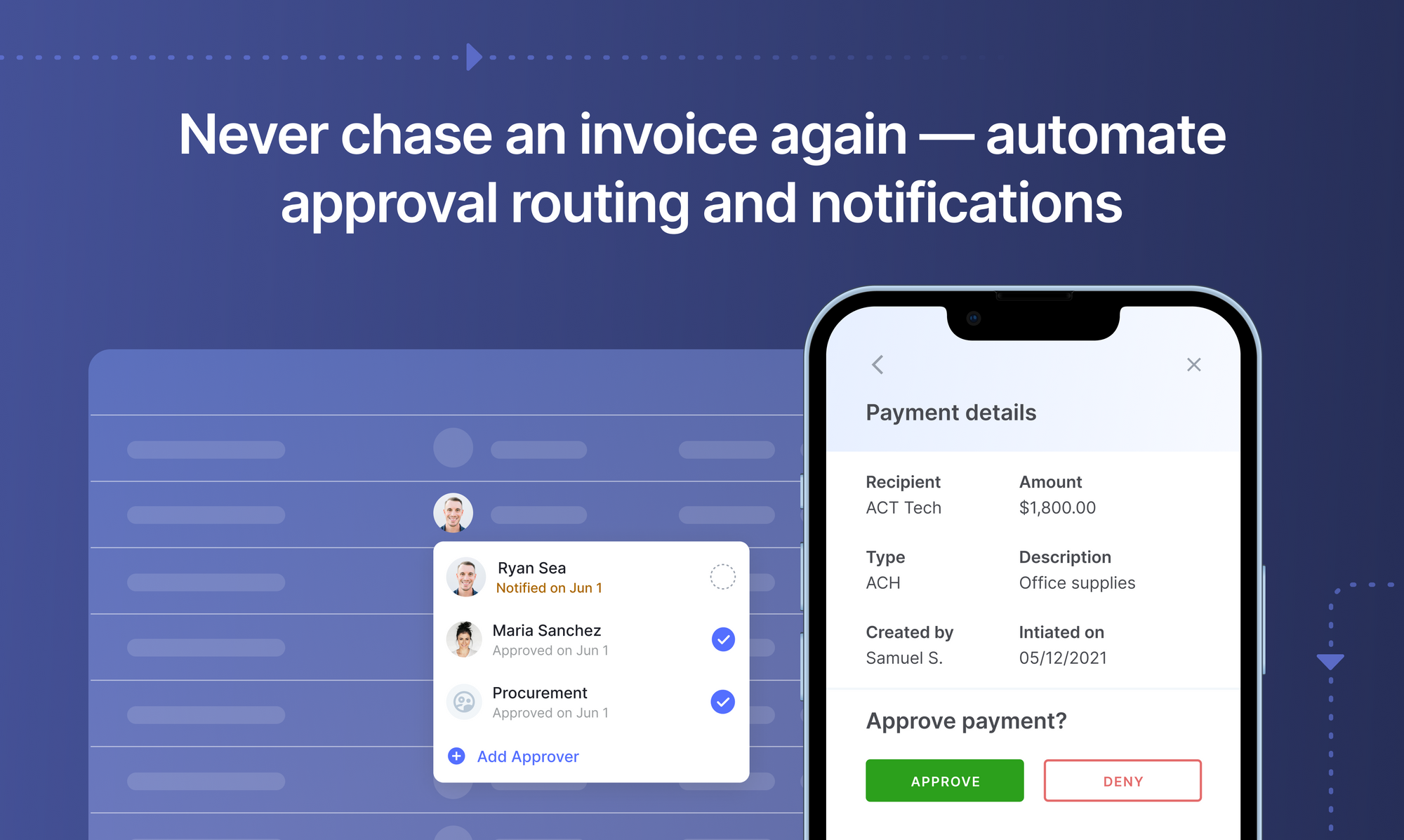

7. Automated Invoice Approvals – Before a purchase can be made, it might require the signature/approval of senior staff/managers. An automated AP system can be customized to ensure that invoices get routed to the proper department, digitally, based on the information entered. This saves the accounting team from having to chase down the signing authority for approvals, reduces paperwork, saves time, and reduces the risk of approvals getting lost in piles of paperwork.

8. No Need for Data Entry - Extracting data from invoices can be a tedious task. Printed, emailed or faxed invoices can come in all formats. Depending on the number of vendors and invoices, this can be very time consuming, which can cause errors in data entry. By automating the process using OCR, the software can extract the required data and plug it into tables, regardless of the format it is sent in. This eliminates human error & expensive/inefficient manual labour, saves time and speeds up payment processing.

9. Improve Employee Morale - A centralized automated system frees up time, which allows a business’s accounting department to better utilize and develop their skills. Unlike a manual AP workflow, which requires employees to spend endless hours tracking down various paperwork, checking data and verifying orders/invoices from each department.

10. Improve Business Credit Score - Making late payments to vendors results in more than just penalties. Payment history can affect a business’s credit score. Having a good credit rating will help when trying to take a business loan, applying for a business credit card and even finding a new vendor. Credit ratings affect funding opportunities and can also affect being qualified for low interest rates on business loans.

Book this 30-min live demo to make this the last time that you'll ever have to manually key in data from invoices or receipts into ERP software.

How to automate accounts payable workflow?

Whenever making any change, it’s best to look at the current process and determine the problem areas and the expectations for the new automated system. The following steps can help in maximizing the benefits of an automated AP process.

Evaluate current accounts payable process

Before changing to an automated system, it is best to evaluate the current process to determine the areas in which the company is losing money, can save time on and can eliminate errors. For example, is human error in matching invoices to purchase orders the most problematic issue? Once the faults of the current system are determined, it is easier to set up a customized automated AP workflow process that is the most effective in fulfilling the needs of the company.

Talk to employees

Switching from a manual to an automated AP process can be tough initially, and can be met with resistance. Therefore, to make the transition smoother, it is best to talk to the employees who will be using the system. Find out which processes are time consuming, causing problems and costing money. Also, ask employees what they expect from the new automated AP workflow. The due diligence carried out in the initial stages will make the transition easier to adopt and be used effectively by the accounting/financial/AP team.

Expectations of new AP workflow

To choose the best automated accounts payable solution, identifying objectives is crucial. Is the new system mostly needed to improve current workflows, reduce costs, save time, eliminate errors or detect fraud?

Choose the best software for the company

After investigating the current AP process and determining which areas need the most improvement, choosing the right software becomes easier. For example, if manual checking of invoices to purchase orders or sales receipts is an area causing the most errors and therefore money, choosing a software that excels in matching invoice data, would be the right choice.

Eliminate use of paper

By switching from paper to electronic invoices, fraudulent payments, mistakes and delays can be reduced/avoided. For example, if order approvals are an area in which bottlenecks frequently occur, the new automated AP system can be designed to route invoices to the right person/department, automatically. This way it can get approved as soon as it is submitted. Moreover, each concerned person can easily access the centralized system to find out what stage the purchase is at. For example, if approval has been cleared, goods/services ordered, invoice paid etc.

By reducing paper usage, invoices will not get lost or get stuck on someone’s desk.

Conclusion

Exercising the right amount of control in business can impact growth and profits. By adopting accounts payable workflow automation, companies can easily track invoices, payments, approvals, etc. from a centralized system.

This provides a level of control that paper invoices cannot, which means the flow of money can be easily monitored, spending patterns analyzed and excess spending reduced, thereby increasing profits.