Free Expense Report Template

What is an Expense Report?

The expense report aids in tracking employee expenses for office tasks. The expense report provides visibility into employee spending and acts as a reference point during employee reimbursement processes.

How does expense report work?

Simply put, employees log their expenses along with the receipts in the expense reimbursement form or a templatized expense report for a particular period. The employee forwards the document to the relevant manager and the bookkeeper. Once the manager approves and checks the expenses, the bookkeeper logs the entries into the casebook and passes on information to initiate the payment.

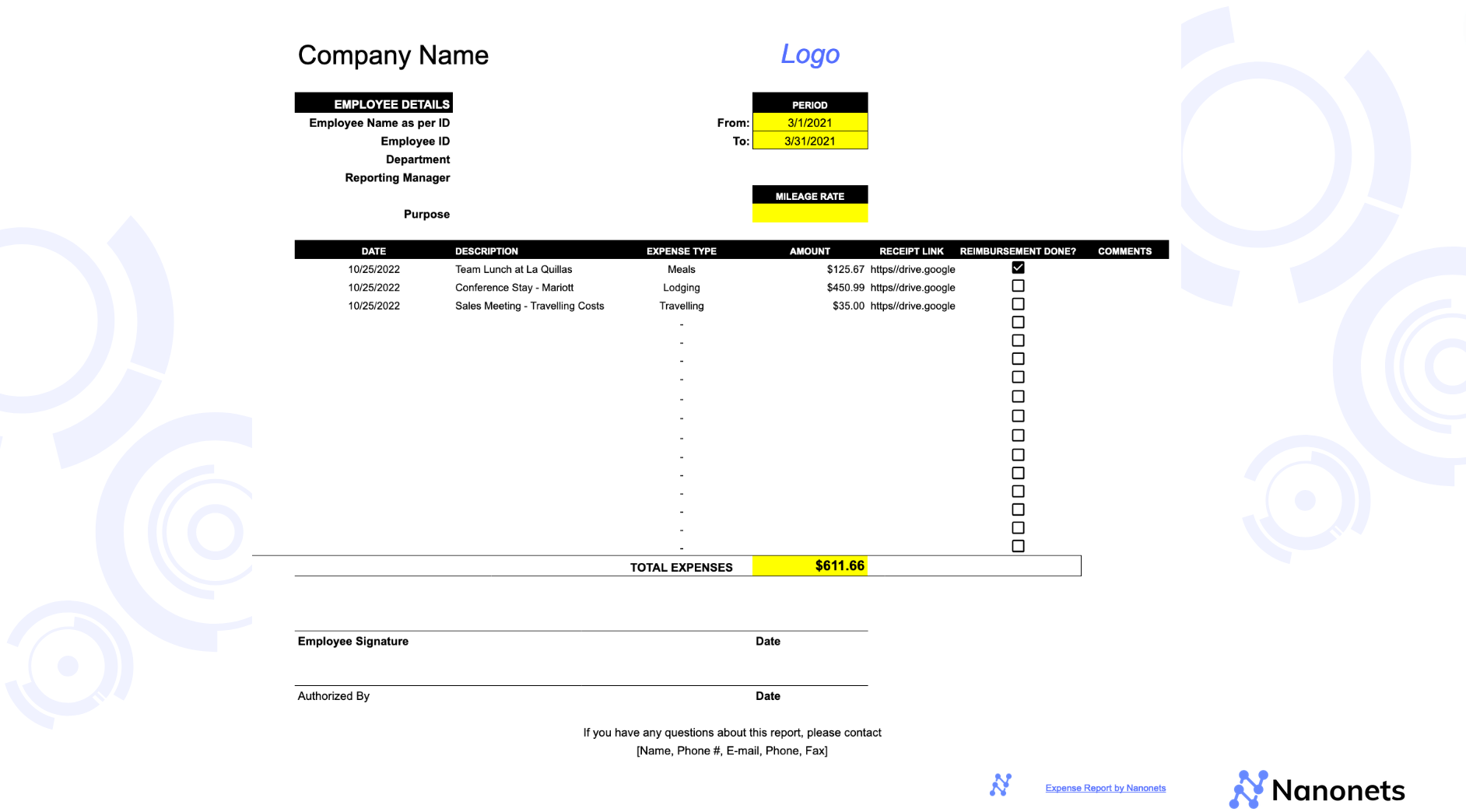

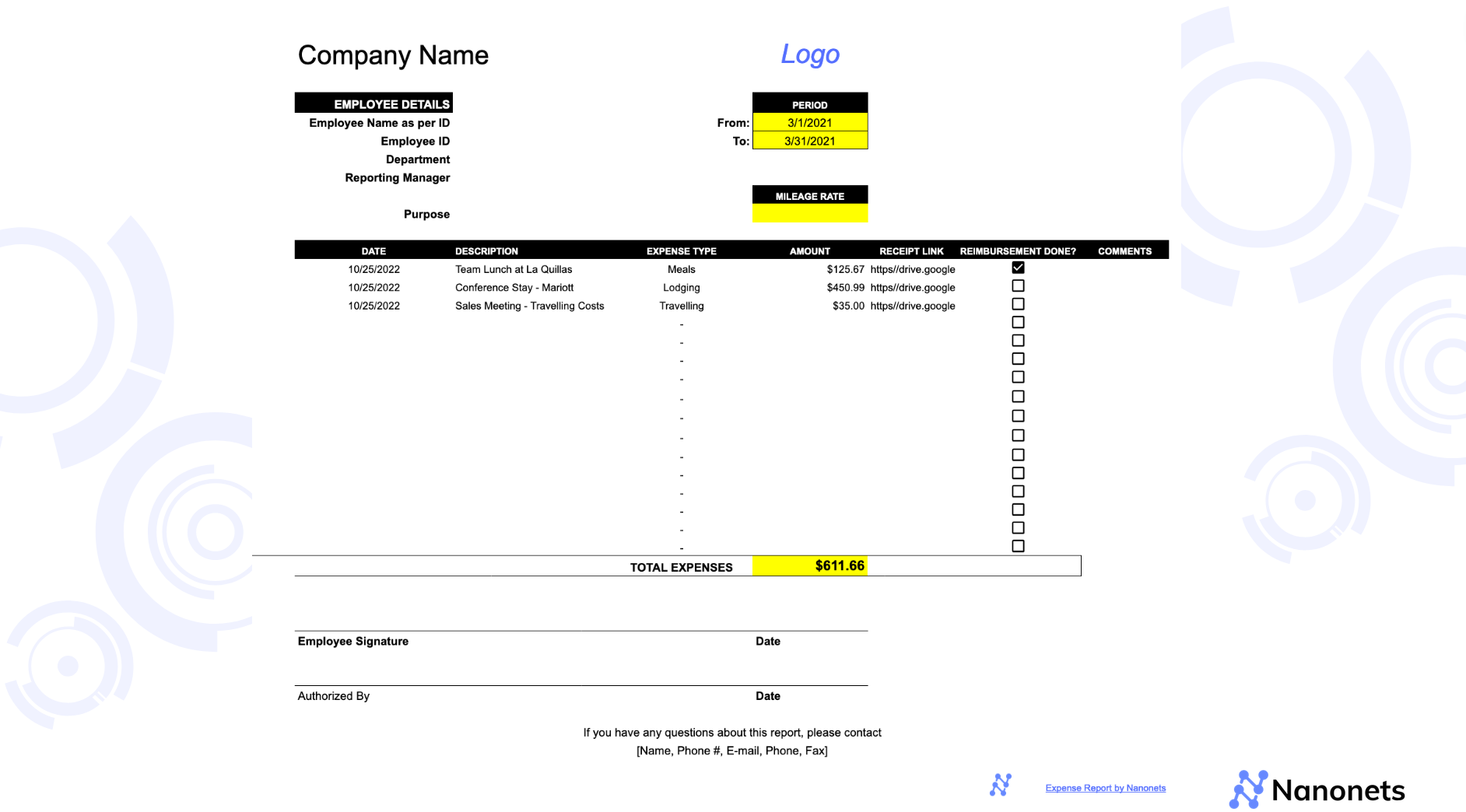

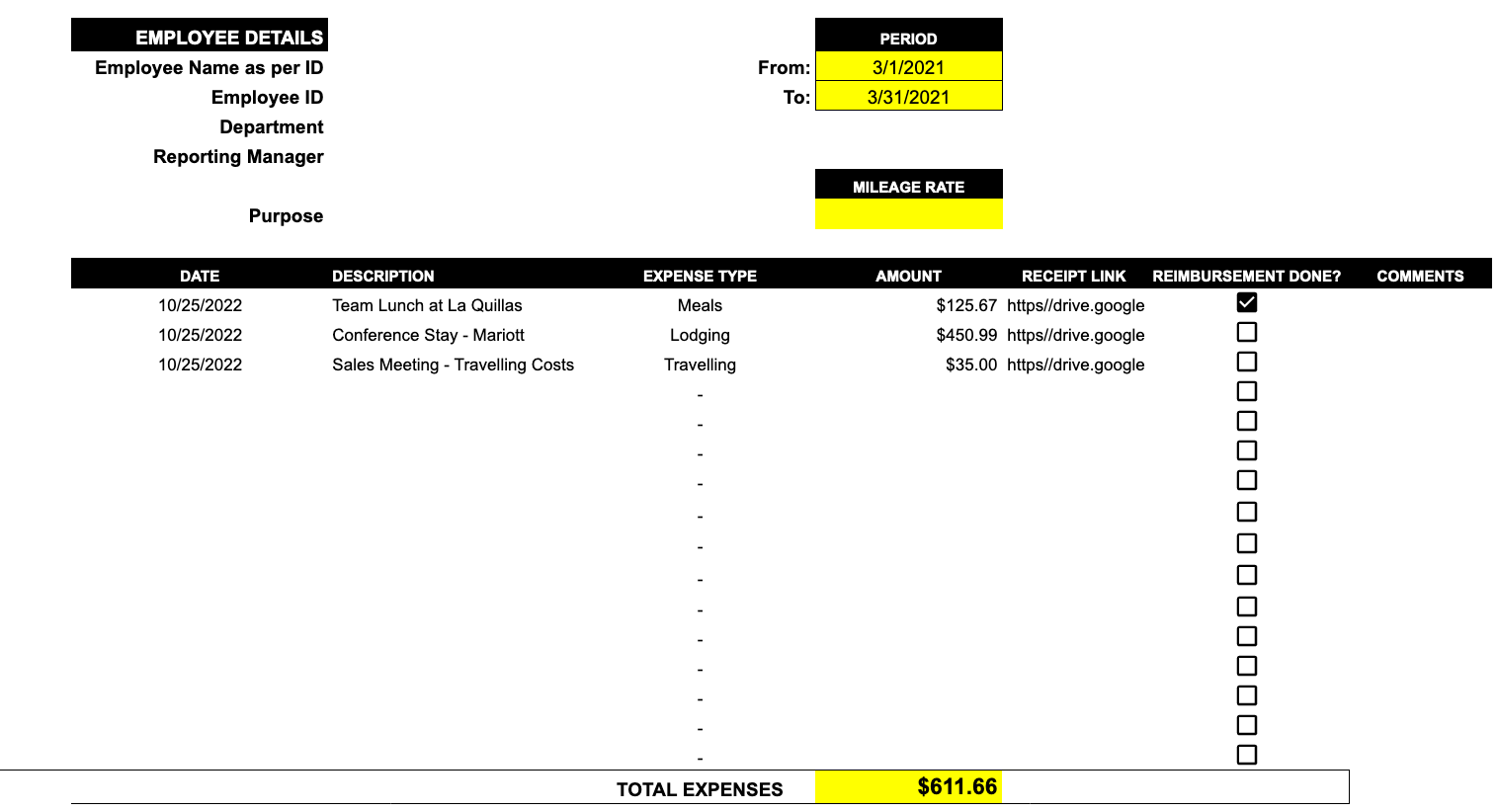

Create professional expense reports with our free expense report template.

What is an Expense Report Used For?

Expense reports help businesses track employee spending in different categories yearly, quarterly, and monthly. Expense reports improve employee spending visibility for travel, meal, lodging, maintenance, and more.

The expense categories vary from company to company. By digitizing or logging them properly using a good expense report template, businesses can work towards reducing excess spending.

How to create an expense report sheet?

Creating expense reports is simple. You need to train your employees to develop accurate employee reimbursement quickly reports for a given period. Here are the steps to create a simple expense report sheet.

- Find an expense report template or use an expense tracking template.

- Customize the line items - add all your expense details correctly.

- Add the receipt links in a proper folder and attach them to relevant entries.

- Double-check all your expenses

- Send them to your manager for approval.

Many small businesses utilize a typical expense report template, such as the one provided by Nanonets. You can also check out expense report templates in excel and word.

You can use Nanonets accounting automation software to extract the information from expense report and log it automatically into the accounting software. Learn more.

How to use the Nanonets expense report template?

Get the Nanonets expense report template.

The Nanonets expense report template is present on Google Sheets. But you can download it and use it in excel. Let’s see how to use the expense report template.

Using the template in Google Sheets

- Open the expense order template in Google Sheets.

- Click on File and Select “Make a Copy” to add the expense report template to your drive.

- Open the template and edit the line items.

- Add your employment details, period, and expense details properly.

- Add your receipt or proof of payment in the line item column itself.

- Delete column J and send the report to your manager for approval.

You can use the Nanonets receipt scanner or our receipt ocr tool to extract information in bulk if you have many receipts.

Using the expense report template in Excel

To use it as an expense report excel template, after making a copy of the document in your drive, select download as “Microsoft Excel (.xlsx).”

How to download the expense report template as a PDF?

Follow these steps to download the expense report as a PDF file from Google sheets.

- Select the expense report template tab.

- Make the relevant changes to the expense report tab.

- Hide the columns on the right with the irrelevant text.

- Select File > Download as > PDF

- Make these selections. Page Orientation - Portrait and Scale - Fit to Page

What needs to be included in an expense report?

The expense report contents can vary due to company requirements. But here, I’ve tried to include the information you must include in your expense report.

- The period for the expense report.

- Company details - like company name and logo

- Employee details - employee name, ID, department and manager.

- Expense details

- Date of expense

- Description of expense

- Expense category

- Expense Amount

- Receipts

- Area for comments in case expense isn’t approved.

- Subtotal of all expenses

- An area for managers to approve and sign off the expenses.

Employees may be asked to attach receipts with mail depending on the company expense policies, specify the mode of payment, or include an explanation for the expense. Study the company expense policy carefully while creating an expense report so you can edit your expense report template properly.

How do I create an expense report in Excel?

You can use excel to manage your expense report easily. Let’s see how you can create an expense report in excel.

- Create a new file in excel.

- Write your company details on the top of the spreadsheet. Use the company logo along with your company name.

- Write your details, department and manager details. Include the period of the expenses boldly in the report.

- Leave a blank row. Now we will create the main expense details area.

- Include headings for every column on the 2nd or 3rd line down from the top. The first line ought to be labeled "Expense." "Type" and "Date" ought to be the following columns. "Amount" should be the column that follows "Date." Regarding these column headings, see the policies of your company. Some businesses insist on a statement that reads "billable or non-billable."

- Start with the first charge displayed under the "Expense" column and enter all of your products in that order. The cost will be identified by the supplier's name or the general service purchased.

- At the bottom of the sheet, put the total amount by using the formula: =Sum(all the amount tabs)

- Then highlight all of the "Amount" boxes, and press "Enter" to give the summation.

- Both the expense sheet and the page with all the receipts attached should be printed out.

- Send the finished expense report to your manager.

Tip.

Instead, you can use a readymade expense report template and download it as an excel spreadsheet.

Different types of expense report templates

Basic Expense Report Template:

- Expense report is used to keep track of expenses over a fixed period. Typically used by employees or independent contractors.

What data is included in the basic expense report template?

- Basic expense report template includes the date, expense description, amount spent, and purpose.

Expense Report with Advance Reimbursement Template:

- Expense report with advance reimbursement tracks expenses before they occur proactively.

- Employees use this expense report template to get advance for their incoming business travel expenses.

What data is included in the expense report with advance reimbursement?

- This king of expense report template includes the date, description of the expense, the amount spent, the amount given to an employee, and the remaining balance.

Project Expense Report Template:

- Project expense report template is used to track project expenses. These are specific expenses only for the project.

- Project expense report template is used by project managers or stakeholders.

What data is included in the project expense report?

- Some of the data points included in the project expense report template are labor costs, materials, and other expenses associated with the project.

- Department: Project Management.

Personal Expense Report Template:

- Personal expense report template is used to track personal tax or reimbursement spending

- This is generally used by self-employed individuals or independent contractors.

What data is included in the personal expense report?

- Some of the data included in the personal expense report template are date periods, expense details, nature of the expense, total amount, tax to be paid, and total amounts.

Weekly Expense Report Template:

- As the name suggests, a weekly expense report tracks weekly expenses by an individual or employee.

- This is typically used by employees or independent contractors.

What data is included in the weekly expense report template?

- It included the same data as the basic expense report template, just that the period is only one week.

- Data included: date, expenses, expense descriptions, the amount spent, and total amounts.

Business Expense Report Template:

- The business expense report template tracks business expenses over a period of time for tax or reimbursement purposes.

- This is used by business accounting departments in the business.

What data is included in the business expense report template?

- Some of the data included in this expense report template are date period, expenses, type of expenses by department, the amount spent, and total amounts.

- Department: Accounting or Finance.

Monthly Expense Report Template:

- Monthly expense report templates are used to keep a track of expenses on a monthly basis.

- It is typically used by employees, business managers, and the accounting department to keep expenses in check.

What data is included in the weekly expense report template?

- The weekly expense report template includes your expenses, their description, payment method, and their subtotals.

- Department: Accounting or Finance.

Small Business Expense Report Template:

- A small business expense report template is used to track expenses incurred by a small business for tax or reimbursement purposes.

- It is used by entrepreneurs of small businesses.

Travel Expense Report Template:

- Employees travel for business reasons and incur expenses. All the travel expenses are reimbursed by the company. In order to avail of the employee reimbursement, the employee has to submit a travel expense report.

- The travel expense report template tracks all travel-related expenses for proper reimbursement.

- Typically used by employees who travel on behalf of the company and need to be reimbursed for their expenses.

What data is included in the travel expense report template?

- The travel expense report template includes expenses incurred during hotel stay, meals, transportation, and other expenses like entry to the venue or conference entry fees.

Construction Expense Report Template:

- Used to track expenses associated with a construction project or initiative.

- Typically used by project managers, stakeholders or accounting departments.

What data is included in the construction expense report template?

- Data included: labor costs, equipment rentals, materials, and other expenses associated with the project.

- Department: Project Management or Accounting.

Also understand the role of account reconciliation in managing expenses efficiently by reading our detailed overview at What is Account Reconciliation?.

FAQ

Why should you use an expense report?

To run a company, there is a need to do some expenses- these expenses are known as business expenses. It could be anything from lunch payments for clients or travel-related expenses. The workers in the company make these expenses, so they have the right to ask them back from the organization. Then, the employees submit an expense report on paper or digitally to the firm. It contains an itemized list of expenses that the employees incur for the benefit of the company. The most important uses of expense reports are outlined below:

Helps in Expense Tracking

The primary use of expense reports is to track where the money is going, which in turn helps control the costs of the organization. It gives a clear picture of how much the employees spend for the organization's benefit. It categorizes the particular expense and then plans on reducing these costs. With the help of an expense report, the company can clearly understand how to spend its funds and how.

Helps with Budgeting

Planning on the budget makes the company ready for its upcoming projects. This, in turn, helps the company to achieve success and grow. With the help of an accurate expense report, the company gets to know the funding or where the money goes. After learning this, the company members can formulate their budget for the organization's future planning. It also helps keep a record of the expenses of all the departments individually, which allows the company to secure the funds and run the business smoothly.

Makes for Detailed And Accurate Reimbursements

As the employees of an organization have incurred expenses for the benefit of the organization, it is the duty of the company to pay them back. With the help of an expense report, the company can make an accurate report on the reimbursements of the employees. In addition, it helps eliminate any kind of confusion. The expense report is made by keeping in mind the company's expense policy with the proof of the payments done by employees so that it is detailed and accurate.

Simplifies Tax Deductions

The expenses made by the employees in the organization could be tax-deductible. But one can't assert deductions for these expenses unless you have them correctly and accurately recorded with proof such as receipt of the payment. With the help of an expense report, this process can be simplified as it helps to keep track of all the deductible expenses during the tax session. Thus the employees of the organization that manages the finance comply with these expenses and put them into tax forms.

What is the purpose of an expense report?

An expense report helps to simplify the accounts payable procedure. It helps track all the business-related expenses incurred by employees for the firm's benefit. The purpose of an expense report includes the following:

Helps To Ensure Money Is Spent Only On Business-Related Work

The most important work of an expense report is to keep a check that the employees are making payments related to the business-related expenses only. If the employee is using the organization's funding for their own personal use, then the company is not liable to pay them back. Thus the company asks for proof of payment made by employees to review where the money has been spent.

Helps to Keep Track of Expenses Of Employees

The organization prepares an expense report to accurately categorize and itemize all expenses. This helps in keeping track of to see if the organization's employees are incurring the costs appropriately. In addition, the company can point out if the employees are using the money inappropriately. It helps to keep a record and use the company's wealth properly. This, in turn, helps the organization to thrive.

It Saves Time and Money

By preparing an expense report, the answer companies can be able to save a lot of time and money. Manually keeping track of money being spent can be extremely time-consuming. But with the help of expense report accounting, the time of the employees can be saved. Moreover, with the help of expense reports, the records can be maintained accurately without any errors. It helps keep a lot of capital for the company and enables it to use this money to do something productive for the organization.

Reduces the Risk of Fraud

Without preparing an expense report, the workers, if any organization, can ask for false reimbursement by presenting fake proof. Thus it is essential to maintain a proper system of expense reports so that the company does not face any fraud. For an accurate expense report, the organizations need the employees to submit proof of the payment being incurred so that false reimbursement can't be made.

Provided a Clear Picture of the Expenses

With the help of an expense report, the company can get a clear and accurate understanding of the company's capital. It tells where the money is going to keep track accurately. It also helps to make a record of the expenses to make the budget for the future effective.

Get more templates:

The Ultimate Bookkeeping Template

Automate approvals with no-code approval workflow template

Keep your books updated with Bank Account Reconciliation template