What is Invoice-to-Pay process? Automate Every Step with AI OCR

What is Invoice-to-Pay?

Invoice-to-Pay is the formal request for payment related to goods or services. Suppliers generate invoices detailing delivered goods or provided services, including the amount owed, and submit the payment request to the buyer for processing and settlement.

The invoice-to-pay process is another name for the procure-to-pay process of a company. It is the most important task of the accounts payable process. With the increase in transaction volumes, and with more emphasis being paid in modern times to paperless and online transactions, the automation of the invoice to pay cycle has assumed importance to businesses.

Let us learn more about the invoice to pay process and its automation.

Table of Contents

- Introduction

- A history of the invoice-to-pay process

- The invoice to pay process

- Automation of the invoice to pay process

- Nanonets for intelligent invoice to payment processes

- Takeaway

A history of the invoice-to-pay process

An invoice is a document sent by a provider/seller/vendor to a client/buyer, itemizing the products or services bought by the latter, along with their monetary value. The invoice payment is the payment made by the buyer to the seller, to settle the invoice issued by the buyer.

It may not be a stretch of the truth to state that human beings may have invented the written word, just to keep track of items they procured or sold. More than four thousand years ago, Sumerian priests seem to have used clay invoices to track and record transactions involving agricultural produce and wine. One can imagine that when the payment was not received on time, it would have been tempting to use the invoices themselves to threaten or inflict harm on the defaulter.

In relatively recent times, Hieronymus Bosch is said to have sent an invoice to King Philip the Handsome, of Castile, in 1504 AD for his painting titled, “The Last Judgment.” Whether King Phillip paid the invoice is not known because of poor invoice management practices in those dark times of financial ignorance.

The invoicing process has become better managed since then with consensus on the simple equation “get invoice - pay invoice”. Today, there’s not a single business that does not deal with invoices and bills, and as the value and volume of transactions expands, entire departments titled Accounts Payable are created to manage the invoice to pay cycle.

Looking to automate the mundane & mechanical Invoice to Pay process? Try Nanonets™ AI-based OCR solution to automate the Invoice to Pay process in your organization!

The invoice to pay process

The invoice to pay process typically starts with the receipt of the invoice from the vendor/seller. Invoices could serve as sales bills as well. Invoices are sent and received in a variety of ways – as a paper copy sent by snail mail (this is fast dying), faxed invoices (43.8 percent of invoices continue to be received by fax today), digitized invoice documents sent by emails, and digitized invoice forms in the supplier’s portals.

The second step in the invoice to pay cycle is checking for the validity of the invoice. An invoice may be connected to a purchase order (PO) issued by the client to the vendor. The data in the invoice, including the type of product/service ordered, price agreed upon, date of delivery, etc., are compared with the original PO. Sometimes, invoices are raised after the delivery of the product/service and in such cases, the invoice details are matched with the details on the delivery receipt.

Any discrepancy in the invoice data is flagged as an exception and there is to-and-fro between the buyer and seller to fix the problem. On the resolution of the exception, the invoice is reissued by the vendor, the invoice is re-recorded and the validation process is repeated.

Depending on the policies of the company, the validation and approval processes may pass through several hierarchical layers. For example, some companies may mandate management-level approvals for invoice values higher than a particular threshold.

Once approved, the invoice is paid following the terms that were negotiated with the vendor. The payment is made in the form of cash, checks, wire transfers, or other methods, as per pre-determined terms & conditions. Although there are no generalized restrictions on how long the invoice payment process should take, many buyers provide the customers with specific details on payment expected. Some typical terms used in the invoice to specify the expected mode of payment are:

PIA – Payment In Advance: A PIA in an invoice indicates that the buyer must fully pay for the product/service before it is delivered.

CIA – Cash In Advance: A subcategory of PIA in which the advance payment must necessarily be in cash.

50 Percent Upfront: The buyer must pay half of the value embodied in the invoice before the service/product is delivered

EOM – End of Month: The buyer must pay by the end of the month in which the invoice was received.

*15 MFI – Month Following Invoice: The buyer must pay on or before the 15th of the month following the invoice date.

NEt 7 (or NEt21, or NEt30): The buyer must pay within 7 (or 21, or 30) days after the invoice arrives.

Once the payment has been made, that particular invoice trail is closed, and the transaction is recorded as complete. The invoice and payment details are archived for future audits.

Many small businesses rely on existing staff to manage invoices, but as the company grows in size, there may arise a need for specialized employees to tackle the invoices from receipt to payment. More and more organizations are now resorting to automated invoice management systems for smooth management of the invoice-to-pay process.

Automation of the invoice to pay process

The digitally enhanced invoice to payment workflow is believed to have started in 1978, with Visical, the first spreadsheet software that could be used for accounts management. This was followed by similar software that could help companies computerize their accounting.

The automation of the invoice-to-pay process removes many of the speed-breaks associated with traditional manual invoice processing. It streamlines the purchase process, reduces paper clutter, enhances the transparency of the invoice route, saves time and money, increases employee productivity, and improves vendor relationships.

Invoice-to-pay automation provides the following benefits to the business:

- Rapid processing of invoices that eliminates delays in payments

- Better vendor-client relationship due to prompt payments

- Prevention of errors and loss of data

- Maintenance of the supply chain movement

- Fraud prevention

- Rerouting of manpower on more rewarding tasks

- Greater visibility, control, and compliance

- Eco-friendliness and avoidance of paper clutter

- Methodical archiving of all purchase documents for audit and taxation purposes

Today, the automation of the invoice to payment process includes invoice data capture, coding invoices with the correct account and cost center, approving invoices, matching invoices to purchase orders, and posting them for payments.

1. Receipt and digitization of the invoice: the invoice may be obtained as an email attachment or as an online form data. In the former case, the email attachments may be in the form of scanned images, PDFs, word processing files, spreadsheets, etc. Automation can help classify these invoices depending on their type, which would help in subsequent data extraction.

2. Extraction of data: This is typically the most common step in which automation is used. Some key fields that must be captured by the OCR from an invoice are:

Vendor details: Seller Name, Seller Address, Seller Phone, Seller Email, Seller bank account details

Invoice details: Invoice number, Invoice date, Invoice amount, Payment due date, Net_D, PO number, Currency

Buyer Details: Buyer Address, Buyer Name

Tax Details: Tax Amount, Tax_ID

Table Details: Product Description, Quantity, Price, Line Amount

Optical Character Recognition (OCR) software recognizes key data fields in the digitized invoice. This recognition is based on their location in the invoice, indicated by rules and templates designed by the developer. Modern tools such as Nanonets use more sophisticated AI-enabled invoice readers to intelligently capture relevant data with minimal errors through a continuous learning process.

3. Validation and approvals: Software can perform automatic three-way matching between the invoice, PO, and receipt by comparing the extracted data and matching it with data from a pre-existing database. The automation tool can also make decisions such as passing the transaction, flagging errors, or raising exceptions. Advanced software, especially those like Nanonets, driven by an AI engine, can reroute flagged invoices for further action.

4. Invoice approval routing: Using invoice management software like the Nanonets, the invoice can be automatically routed from one stage to the next and reminders can be set up for approval. The inclusion of contingencies and reminders into the workflow can eliminate bottlenecks. The integration of electronic signatures and digital forms can enable on-the-go approvals from different participants of the process

5. Payment processing: A completely automated invoice to payment process would also include the payment end wherein an approved invoice is automatically paid digitally. Despite the capability of automatic payment, many companies that use the automated invoice to payment process include a manual intervention step here for the sake of financial security.

6. Storing and archiving of data: A good invoice to payment automation tool would not only store all data in a well-defined database, but can also generate a variety of financial reports including cash flow reports, balance sheets, tax information, inventory, and accounts payable/receivable.

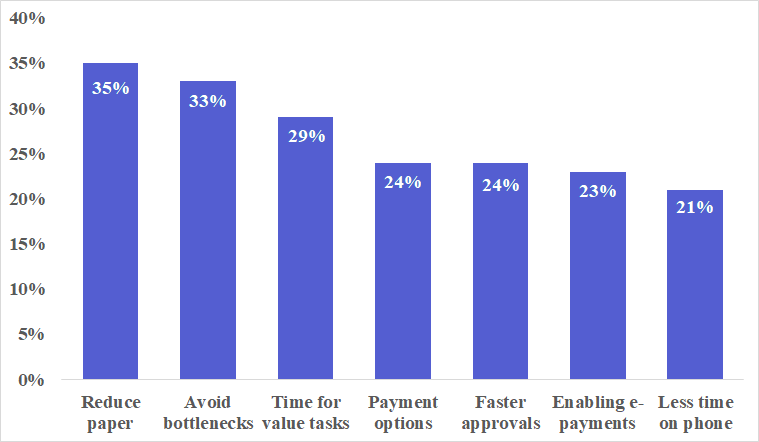

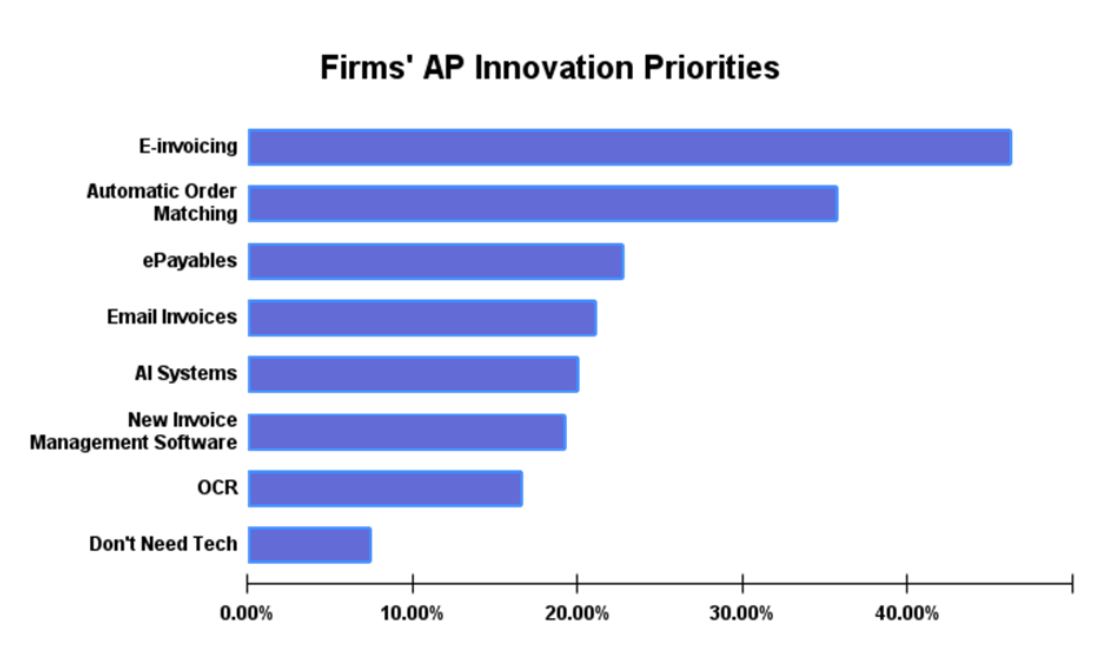

According to a recent survey, here are the top automated invoice processing solutions that many companies would like to implement:

Looking to automate the mundane & mechanical Invoice to Pay process? Try Nanonets™ AI-based OCR solution to automate the Invoice to Pay process in your organization!

Nanonets for intelligent invoice to payment processes

Nanonets is an AI-based software that can be used to automate and streamline the invoice processing steps of your business.

Data can be captured error-free from a variety of invoice file types. The AI engine of Nanonets can be trained with actual invoices, without the need for coding, which makes it customizable to the company.

It also has built-in state-of-art algorithms and a strong infrastructure for multi-step approvals. The Nanonets invoice processing software can be integrated with other systems such as the Mysql database, QuickBooks, or Salesforce and is platform agnostic. It is accurate and scalable, saves time and money for your Accounts Payable Invoice processing team, and enhances productivity.

Some specific features that make Nanonets the ideal solution to the automation of the invoice to payment process are:

- Ability to customize - You can add your data to the pre-trained invoice model and add custom fields to train a model all on the UI

- On-premises - You can run Nanonets on-premises via a docker. Nanonet is GDPR-compliant*

- On-premises - You can run Nanonets on-premises via a docker. Nanonet is GDPR-compliant

- Save time and money - Reduce turnaround time (TAT) from days to minutes & document processing costs by 90%

- Support - On-chat support for real-time query resolution helps users navigate the sometimes complicated world of invoice capture.

- API documentation - In the documentation, you will find ready-to-fire code samples in Shell, Ruby, Golang, Java, C#, and Python, as well as detailed API specs for different endpoints.

The Nanonets invoice capture software can connect data sources like e-mail, Google Drive, etc. with the API that feeds the captured data directly into your CRM/WMS/DB.

Takeaway

The automation of the invoice to payment process comes with compelling benefits such as time and cost savings, streamlined accounts payable process, and ultimately better bottom lines. The choice of an invoice to payment automation tool depends on the level of automation that the business warrants, and the ability of the software to blend with the company’s practices and policies.

The software to be used also depends on the budget allocation of the company, which takes into account, the scale of the business, the bottom line, and the investment potential of the company.

Other factors that must be considered in the choice of an invoice management automation tool are ease of use, tech support, data storage needs of the company, and integration with existing digital tools used by the company.

It must be remembered that any invoice to payment software is a synergistic tool that allows human employees to concentrate on less mundane, higher-value tasks such as business development and other activities that contribute to enterprise value.