What is financial data extraction?

Reading information from important financial data is crucial for finance and accounting teams to make effective decisions. Financial data extraction is the key to everything, including reading, understanding, and analyzing such data.

Many companies hire interns for manual data entry or outsource extraction from such important financial data. While widely practiced, this method is challenging, tedious, and sometimes expensive. Not to mention the financial risk involved in inaccuracies or data leaks.

In this article, we’ll learn more about financial data extraction and how to extract data from financial documents.

What is financial data extraction?

Financial data extraction refers to the process of capturing, extracting, and transforming relevant financial information from various sources, such as invoices, receipts, bank statements, financial reports, and other financial documents.

In layman’s terms, it is about making financial data easy to read and analyze.

It involves converting unstructured or semi-structured data into structured data that can be easily analyzed, processed, and utilized for financial analysis, reporting, and decision-making.

Common financial documents to extract data from

Finance and accounting teams process hundreds of financial documents daily.

Let’s look at some common financial documents that are in huge need of data extraction.

- Financial statements include income statements, balance sheets, statements of stakeholders' equity, and cash flow statements.

- Tax forms include IRS notices, individual tax returns, tax return transcripts, etc.

- Bank documents include bank statements, income statements, and credit card statements.

- Expense-related documents include common expense reimbursement forms, expense claims, and receipts.

- Invoices, purchase orders, purchase requisition forms, etc

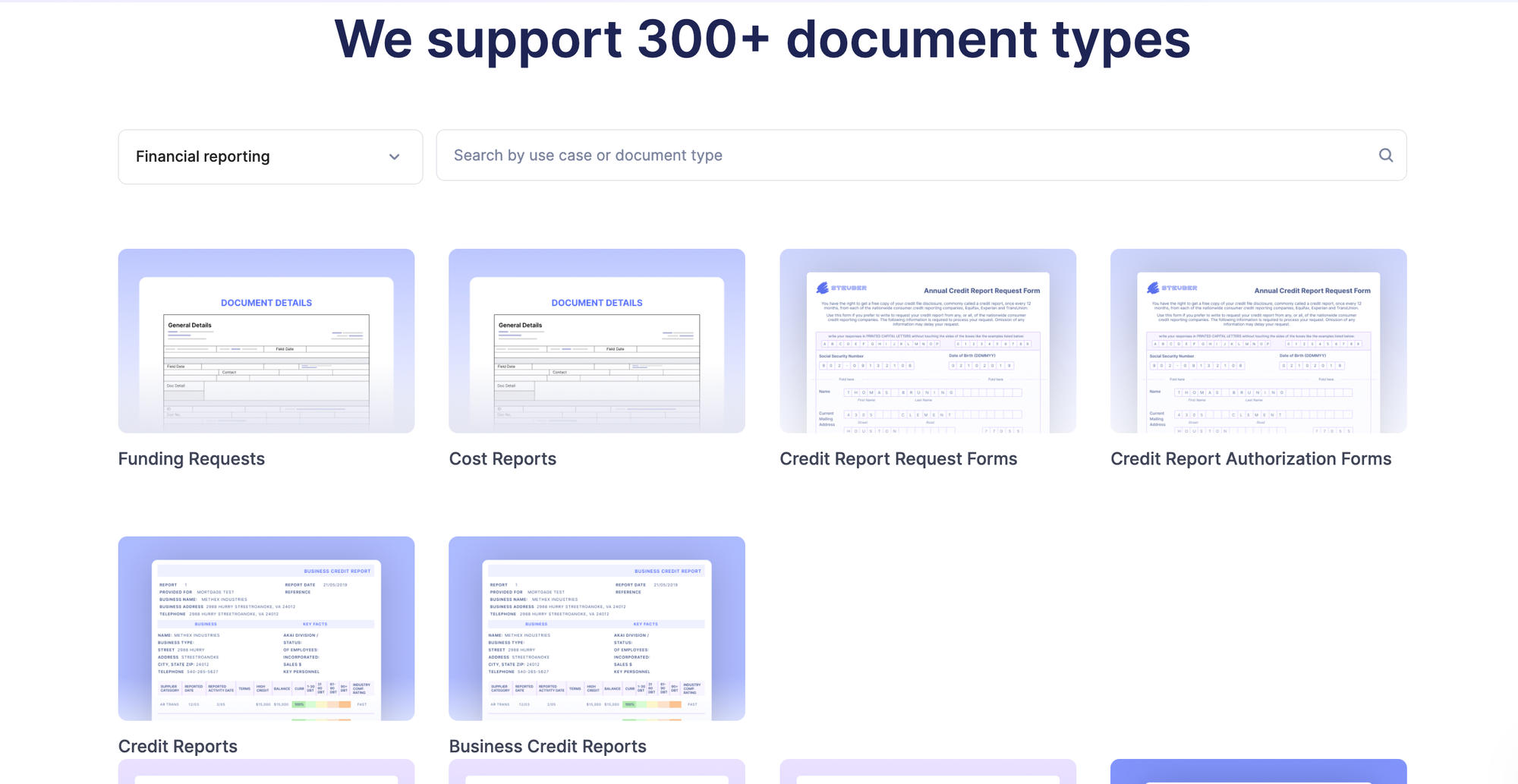

Nanonets supports all the above documents and much more. Find your financial document in this list of 300+ documents, and use Nanonets’ Zero Training Model to extract data from any financial document.

How to extract data from financial statements

The most commonly asked question on the Internet regarding financial data extraction is how to extract data from financial statements.

Financial statements are complex in nature and pose a huge challenge in data extraction. Employees spend valuable hours analyzing such financial statements manually. Unlike receipts and invoices, financial statements are long and take a lot of time to be converted into clean, structured and readable data.

Traditional methods fail when it comes to extracting data from financial statements. Only OCR-based powerful tools are able to extract such rich financial data.

Extracting data from financial statements isn't just about copying tables from a PDF into Excel. Finance teams need to be able to use this data meaningfully. Key information from these statements require additional calculations. Which is why, traditional OCR and outdated data extraction tools which might be able to read simpler financial documents easily, often struggle with intricate financial statements.

Let's have a look at how to extract data from complex financial documents such as financial statements, and annual reports.

How to extract data from complex financial documents using OCR and AI

One can extract data from complex financial documents by using either traditional OCR tools, or AI-based data extraction tools:

Traditional OCR for financial data extraction

While many companies have accepted AI-enabled data extraction today, others still widely use the 20th-century innovation OCR (Optical Character Recognition) in its traditional form to extract data.

A standard OCR tool has been the go-to solution for finance and accounting teams to extract data from financial statements.

However, OCR grapples with constraints tied to background colors, glare, rigid templates, and irregular data structuring. OCR translates scanned images into machine-readable text, excelling with straightforward template-based documents but faltering when faced with layout or template deviations.

OCR scores over manual data entry because it can scan straightforward template-based documents but falters when faced with new layouts or template deviations. Traditional OCR tools struggle with today’s complex financial documents.

Such flaws of standard OCR gave way to Intelligent Document Processing and automated data extraction software.

Automated financial data extraction software/tools

Intelligent Document Processing (IDP) is intelligent because it uses the combined capabilities of OCR, Artificial Intelligence (AI), Natural Language Processing (NLP), and Machine Learning (ML) algorithms for data extraction.

Automated document data extraction tools go beyond simple OCR and use intelligent document processing. Many such tools have widely become popular for extracting data from important documents.

The case for automation

Once you have used AI data extraction tool to read data from any financial document, you won’t be able to return to the boring, old, tedious manual data extraction process.

When financial data is extracted manually, companies waste their employees’ productive hours by manually inputting data from documents into Excel spreadsheets or accounting systems.

While the time lost is only one factor, manual data extraction from such important financial documents is often inaccurate and error-prone.

Imagine an employee dealing with data about transactions worth millions of dollars. One zero is out of place, and it could cost the client or the company a fortune.

Manual data extraction from large volumes of financial documents involves a huge risk of data entry errors, hampers productivity, and limits the ability to leverage data for strategic insights.

With technological advancements, automated solutions using Intelligent Document Processing and AI have emerged, revolutionizing how financial data is extracted.

Why use AI to extract data from financial documents

There are many benefits to automating financial data extraction using AI:

- Cost savings: Manual data extraction is a time-consuming and labor-intensive process. By automating this process, businesses can save on the costs of hiring and training data entry clerks.

- Improved accuracy: Automated data extraction is more accurate than manual data entry. The software can be programmed to identify and extract data consistently and accurately.

- Reduced risk of errors: Manual data entry is prone to errors. Businesses can reduce the risk of errors in their financial data by automating this process.

- Increased efficiency: Automated data extraction can help businesses improve their efficiency by freeing employees to focus on other, more strategic tasks.

- Improved decision-making: Automated data extraction can help businesses make better decisions by providing real-time and accurate data access.

- Compliance: Automated data extraction can help businesses comply with regulations by ensuring their financial data is accurate and up-to-date.

Who should use AI for financial data extraction?

Automated financial data extraction is for businesses of all sizes that need to extract data from financial documents listed earlier.

This includes businesses in the following industries:

- Accounting: Accounting firms use automated data extraction to audit financial statements, prepare tax returns, and manage accounts payable and receivable.

- Banking: Banks use automated financial data extraction to process transactions, manage risk, and comply with regulations.

- Insurance: Insurance companies use AI data extraction to process claims, manage risk, and underwrite policies.

- Investment: Investment firms use automated data extraction to track portfolios, analyze investments, and make trading decisions.

- Manufacturing: Manufacturing companies use automated data extraction to track production data, manage costs, and improve efficiency.

- Retail: Retail companies use automated data extraction to track inventory levels, manage sales data, and make pricing decisions.

- Telecommunications: Telecommunications companies use automated data extraction to manage customer accounts, track usage data, and bill customers.

- Healthcare: Healthcare organizations use AI document processing to track patient records, manage billing, and comply with regulations.

Any business that needs to extract data from financial documents can use AI-based document processing. Its benefits make it a valuable tool for businesses of all sizes.

Top 10 financial data extraction software/tools

A powerful AI-powered platform can help you automate financial data extraction. Here are the most popular automated financial data extraction tools to try:

- Nanonets

- Octoparse

- Highradius

- Docparser

- Xtract.io

- Rossum

- Docparser

- Apify

- Tabula

- Hubdoc

How to extract data from any financial document with Nanonets AI

Here’s how you can extract data from a financial document using Nanonets:

- Sign up on Nanonets app for free

- Import/upload your financial statement file

- Review and customize the extracted fields and line items

- Review the financial statement and export it in formats like CSV, XML, XLSX

You can even set up approval workflows or integrate your accounting software to process the financial document further.

Automating financial data extraction with Nanonets can significantly reduce manual effort, improve data accuracy, and enhance productivity. The streamlined workflow and accurate financial data extraction enable better decision-making, faster processing times, and improved operational efficiency.

Final word

Efficient and accurate data extraction is key to transforming financial processes. With many advanced technologies like OCR and Intelligent Document Processing (IDP), financial data extraction doesn't have to be risky, expensive, and time-consuming.

Frequently Asked Questions (FAQs)

Where can I scrape financial data?

A PDF scraper like Nanonets offers an efficient, powerful, and scalable way to extract large amounts of financial data stored in PDFs and convert them into machine-readable structured data.

How do you analyze financial data?

Different methods are used to analyze financial data, such as horizontal and vertical analysis, ratio analysis, time series analysis, and forecasting.

An AI-powered data extraction platform can simplify and automate financial data analysis by extracting data from multiple sources, including invoices, receipts, and financial statements.

What is financial data extraction?

Financial data extraction involves extracting relevant information from various financial documents, such as invoices, receipts, bank statements, and financial reports.

How do you pull financial data?

You can pull financial data from various sources, such as websites, APIs, and databases.

What are the three types of financial analysis?

The three types of financial analysis are vertical analysis, horizontal analysis, and ratio analysis.

What are the methods of financial data?

Financial data can be obtained through primary sources like financial statements or invoices and secondary sources like academic journals and financial reports.