OCR in Finance & Accounting

Financial & accounting documents play a critical role in driving business processes. Businesses handle & verify various financial or accounting documents such as invoices, customer orders, receipts or purchase orders as part of their daily workflows. And as businesses grow they have to handle & process a lot of such financial documents.

Organizations tend to have dedicated accounting teams (or outsourced AP teams) to check financial documents, enter the data into accounting software, verify the data against supporting documentation, and finally process transactions if needed.

For example, an organization might need to verify a supplier’s invoice against a purchase order (PO) it had placed, before approving/processing the invoice; this would entail a verification process that matches each line item on the invoice with a corresponding entry in the PO - in other words an end-to-end AP process.

Such elaborate interventions & verifications are mandated by regulatory and ethical requirements. And these are often carried out manually because the various accounting & financial documents are not always machine readable!

Often shared as scans, PDFs or paper, these documents require substantial manual efforts to enter the digital workflows that power businesses today. These manual interventions by finance & accounting personnel tend to be time consuming & error prone (at scale), taking up resources that could be put to better use.

And that’s where OCR, or Optical Character Recognition, can help! (What is OCR? And what is it used for? For a detailed explainer on OCR and its use cases refer this guide.)

OCR in Finance & Accounting

OCR finance or OCR accounting refers to the application of OCR technology to automate the extraction of financial/accounting data from documents - also referred to as financial spreading or accounting cycle automation.

OCR can automatically recognize & extract text, characters, fields or data from scanned documents & images. And since the documents in question mostly present structured data across standard formats, automated OCR finance or OCR accounting could greatly reduce processing times for each document.

For example, an OCR software could extract & present fields (or line items) of interest from related POs, invoices & receipts so that accounting teams can do a quick & efficient 3-way match. Or PDF OCR software could convert bank PDF statements into Excel or CSV for easier downstream processing.

This avoids all the manual effort that would otherwise have been necessary to extract relevant data from these financial documents. Automated OCR software can thus seamlessly connect with accounting or ERP software to create a completely digital workflow.

OCR finance or OCR accounting automation applications allow financial analysts and accountants to focus on higher level, more technical or specialized, tasks that contribute more value to their organizations. OCR also introduces a greater level of accuracy and precision to routine tasks that would otherwise have been carried out manually.

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

Benefits of OCR Finance & OCR Accounting Applications

Analysts & accountants are increasingly leveraging OCR to shift their focus & time from data entry to data review; this improves overall employee efficiency & productivity. Implementing OCR solutions therefore brings its own share of unique benefits:

- Reduce cost - Reduce operational costs by eliminating the inefficient processes of manual data entry and verification. Eliminate related document storage and processing costs.

- Improve processing speed - Automated OCR accounting automation software can extract and verify data in minutes; a task that would otherwise have required many man-hours. OCR can help organizations reduce time spent on manual paperwork by over 75% or more.

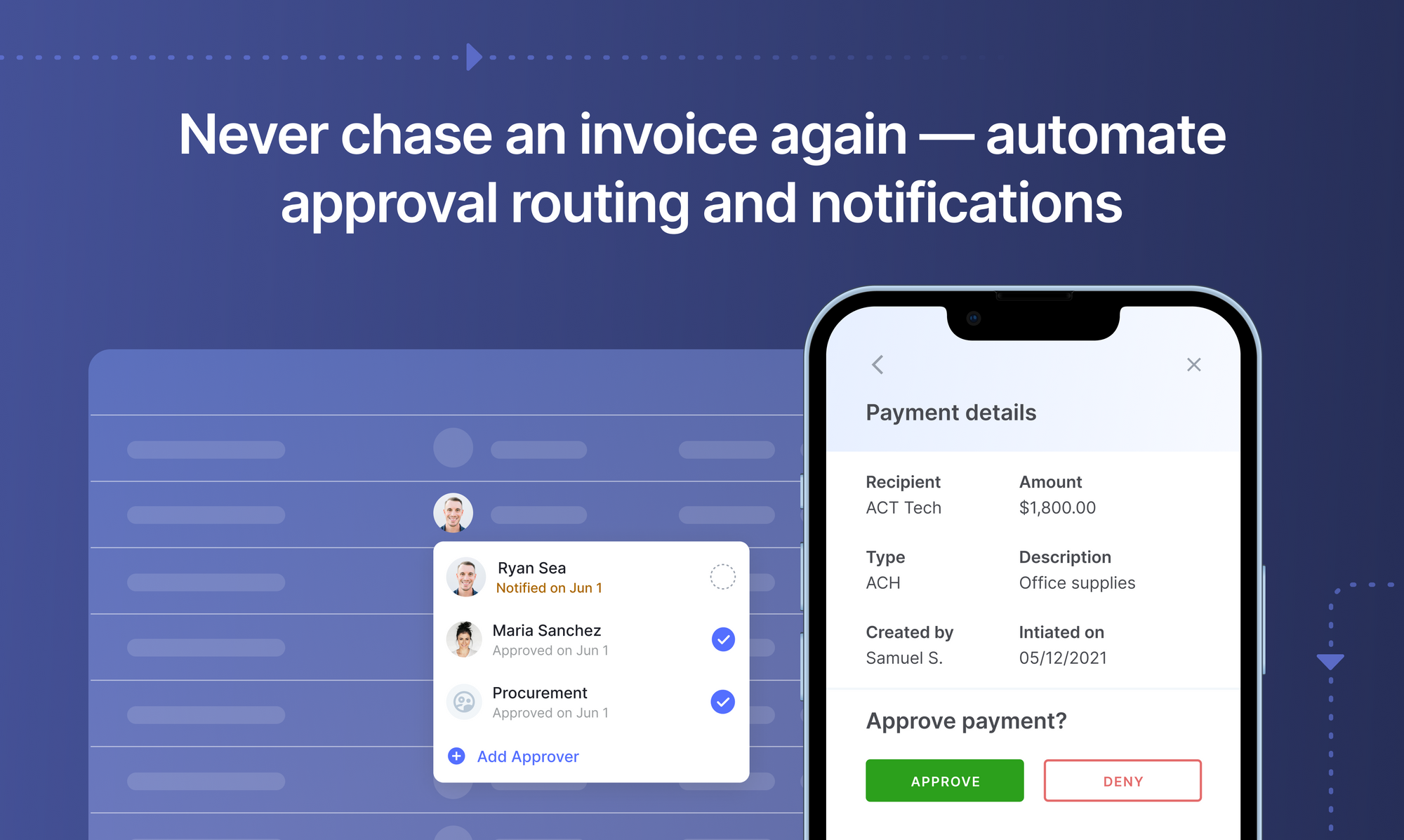

- Streamline payment processing - OCR finance & OCR accounting software (or AP automation software)can help automate or streamline accounts payable (AP), accounts receivable (AR) & check processing among other internal payment processes.

- Process documents intelligently - AI-based OCR software like Nanonets, can classify specific document types from a mixed bunch regardless of the format. Even if presented with a bunch of “unknown” documents, automated OCR software can intelligently classify documents by type (invoice, receipt, bill etc.) or source (supplier, vendor, internal etc.) for further processing & data extraction.

- Improve data accuracy - OCR software leverage AI algorithms & ML capabilities to offer a high degree of accuracy while extracting data from documents. Better accuracy leads to reduced errors and rework which ultimately saves time and money!

- Scale easily - Automated OCR finance software can handle very high volumes of documents quite easily.

- Save the environment - Organizations can reduce the use of paper documents or go paperless as OCR can handle digital document formats.

- Keep employees motivated - Manual processes and paperwork can be extremely boring, especially for accountants & financial analysts. Organizations that adopt OCR use cases, can turn their workforce towards more challenging or engaging tasks.

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

OCR Finance & OCR Accounting Use Cases

OCR finance & OCR accounting have many interesting use cases with respect to document processing workflows. Since accounting & financial documents mostly deal with structured data presented in standardized formats, OCR can handle pretty much any document related to these disciplines.

The most common OCR use cases for financial documents are invoice OCR (also known as invoice scanning & automated invoice processing) & receipt OCR. Extracting relevant fields of data from invoices or receipts can help organizations process transactions more quickly, avoiding delays and potential fines. These OCR use cases typically fall under the category of AP automation, spend management software or expense management.

Here’s a case-study on how Minnesota’s largest construction company improved it’s AP productivity with OCR finance.

The Nanonets Receipt OCR in action

Banking use cases would include processing various applications (for loans, new accounts or check requests) or doing KYC verifications. OCR software can scan application forms, extract relevant fields & populate the same in banking software for faster processing. ID card OCR or identity OCR currently powers most of the mobile-based KYC processes offered by modern banks. These OCR use cases allow banks to fast-track processes that could turn into potential customer pain points. Here’s another case-study on how a KYC platform leveraged OCR to process more than 50,000 Drivers licenses per month.

Insurance companies can similarly automate claims processing with the aid of OCR technology. Insurance OCR can expedite claims verification and claims processing, benefiting consumers and insurance companies alike. Apart from processing insurance-related documents, OCR can also be used to assess physical damage related to insurance claims.

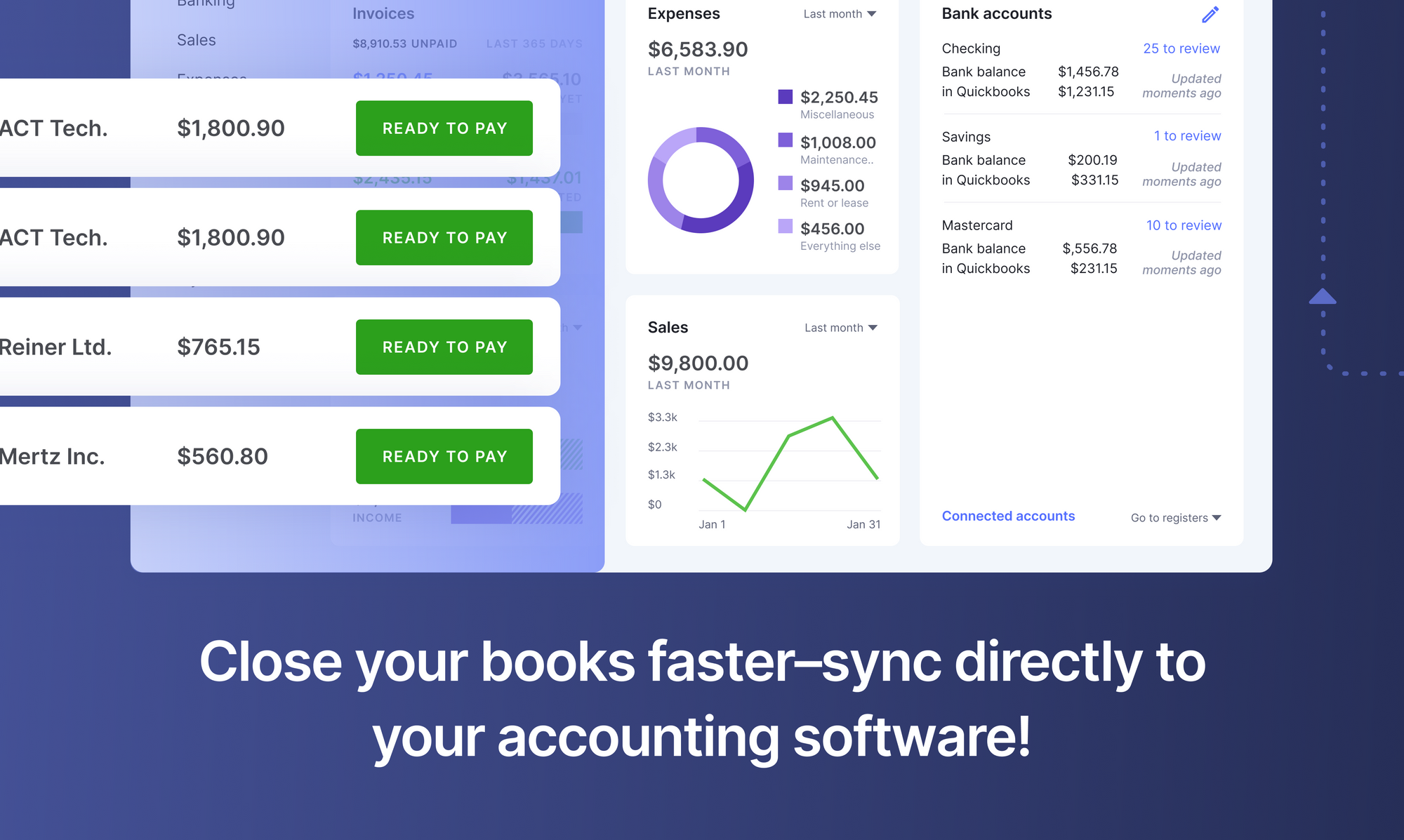

OCR can also be used to simplify accounting related processes by integrating with accounting software. Here’s an interesting case-study on how a business used OCR software to simplify accounting processes related to QuickBooks.

Businesses also use accounting OCR for improving audits and reports on expenses. OCR tools compare and match various document trails to help accountants flag fraudulent charges and business expenses. Here are some examples of potential fraudulent charges that businesses might encounter: blank receipts for non-business transactions, duplicate expense receipts, inflated invoices, or amount mismatches.

Book this 30-min live demo to make this the last time that you'll ever have to manually key in data from invoices or receipts into ERP software.

Nanonets OCR

Nanonets Intro

Nanonets is an AI-based OCR software that is easy to set up and use, offering convenient pre-trained models for popular financial OCR & accounting OCR use cases. Extract financial/accounting data in seconds or train a custom OCR model to meet your specific data extraction needs.

Train your Own Invoice Model with Nanonets

The advantages of using Nanonets over other OCR software parsers (like Power Automate) go far beyond just better financial automation, accuracy & AI/ML capabilities. Here are some of the unique Nanonets benefits:

- Nanonets OCR isn't template-based. Apart from offering pre-trained models for popular use cases, its intelligent document processing algorithm can also handle unseen document types!

- Nanonets handles unstructured data, common data constraints, multi-page documents, tables and multi-line items with ease.

- Nanonets is a no-code intelligent automation platform that can continuously re-train itself and learn from custom data sets. Outputs require almost no post-processing.

- Every aspect of document processing can be customized with Nanonets. Right from document recognition & data extraction to output styles and formats!

- Nanonets was built for hassle-free integration, even with legacy systems. You can also easily integrate Nanonets with most CRM, ERP or RPA software.

Nanonets Documentation

If you’re looking to train your own OCR finance or OCR accounting models, check out the Nanonets API. In the documentation, you will find ready-to-fire code samples in Shell, Ruby, Golang, Java, C#, and Python, as well as detailed API specs for different endpoints.

Update Nov 2022: this post was originally published in March 2020 and has since been updated.

Here's a slide summarizing the findings in this article. Here's an alternate version of this post.